Deck 14: Investment, Time, and Insurance

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/77

Play

Full screen (f)

Deck 14: Investment, Time, and Insurance

1

Suppose that you deposit $2,828 in your savings account, which pays 4% interest annually. What is your account balance at the end of four years?

A) $3,308.36

B) $2,417.39

C) $3,100.12

D) $2,988.44

A) $3,308.36

B) $2,417.39

C) $3,100.12

D) $2,988.44

A

2

For calculating net present value (NPV), the interest rate represents the _____ of investing, so a higher interest rate _____ the NPV.

A) opportunity cost; increases

B) opportunity cost; reduces

C) benefit; increases

D) benefit; reduces

A) opportunity cost; increases

B) opportunity cost; reduces

C) benefit; increases

D) benefit; reduces

B

3

Use the following to answer question:

Table 14.2

Period

Costs

Benefits

0

$2,000

$ 0

1

0

800

2

0

500

3

0

1,000

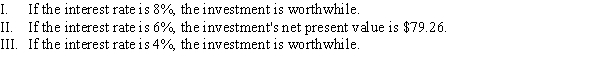

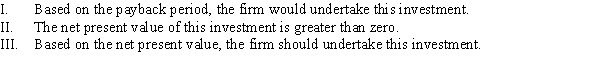

(Table 14.2) The table depicts the costs and benefits of an investment. Which of the following statements is (are) TRUE?

A) II and III

B) I, II, and III

C) II

D) III

Table 14.2

Period

Costs

Benefits

0

$2,000

$ 0

1

0

800

2

0

500

3

0

1,000

(Table 14.2) The table depicts the costs and benefits of an investment. Which of the following statements is (are) TRUE?

A) II and III

B) I, II, and III

C) II

D) III

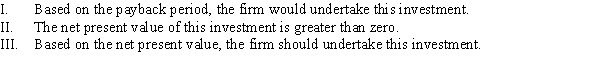

D

4

Use the following to answer question:

Table 14.1

Time Period (years)

Cash Flow

0

$800

1

200

2

200

3

200

(Table 14.1) At a 7% annual interest rate, what is the present discounted value of the cash flows?

A) $1,688.08

B) $1,324.86

C) $1,275.33

D) $1,109.70

Table 14.1

Time Period (years)

Cash Flow

0

$800

1

200

2

200

3

200

(Table 14.1) At a 7% annual interest rate, what is the present discounted value of the cash flows?

A) $1,688.08

B) $1,324.86

C) $1,275.33

D) $1,109.70

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

5

The Rule of 72 states that it will take _____ years for a savings account to double at a 9% annual interest rate.

A) 8

B) 9

C) 6.5

D) 6.1

A) 8

B) 9

C) 6.5

D) 6.1

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

6

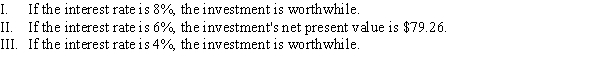

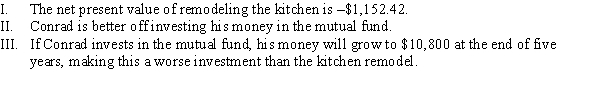

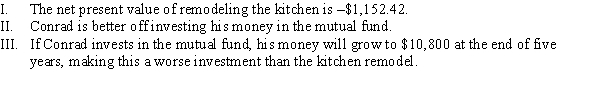

Conrad has $10,000; he is considering whether to (1) invest in a mutual fund with an 8% annual interest rate or (2) remodel his kitchen. If he remodels the kitchen, he will be able to sell his home for an additional $13,000 when he moves at the end of five years. Which of the following statements is (are) TRUE?

A) II

B) I

C) I and II

D) I and III

A) II

B) I

C) I and II

D) I and III

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

7

Tankim has $4,000 in his savings account, which pays an annual interest rate of 2%. The value of his account at the end of eight years is:

A) $4,200.

B) $4,686.64.

C) $4,640.

D) $4,808.16.

A) $4,200.

B) $4,686.64.

C) $4,640.

D) $4,808.16.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

8

Mark is considering spending $25,000 on a farm tractor that will increase his crop yield and bring additional revenues of $4,000 for each of the next 7 years. Mark should:

A) buy the tractor because its benefits of $28,000 outweigh its costs of $25,000.

B) buy the tractor because inflation will reduce the value of future cash flows.

C) use present discounted value analysis to decide whether the tractor is a good investment.

D) not buy the tractor because the payback period extends beyond three years.

A) buy the tractor because its benefits of $28,000 outweigh its costs of $25,000.

B) buy the tractor because inflation will reduce the value of future cash flows.

C) use present discounted value analysis to decide whether the tractor is a good investment.

D) not buy the tractor because the payback period extends beyond three years.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

9

Suppose that a bond with a $1,000 face value matures in one year and pays a 10% coupon rate. It is selling for $1,025. What interest rate would make a person indifferent between the selling price of $1,025 and the bond payment (face value and coupon) one year from now?

A) 9.8%

B) 7.3%

C) 11.1%

D) 10.2%

A) 9.8%

B) 7.3%

C) 11.1%

D) 10.2%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

10

If principal is invested at a constant interest rate, the value of the account will increase:

A) at an increasing rate over time.

B) at a constant rate over time.

C) at a decreasing rate over time.

D) at a linear rate over time.

A) at an increasing rate over time.

B) at a constant rate over time.

C) at a decreasing rate over time.

D) at a linear rate over time.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

11

If Vincent puts $344 into his saving account, his account will have grown to $379.26 by the end of two years. What is the interest rate earned on Vincent's savings account?

A) 3.5%

B) 4.2%

C) 5%

D) 7%

A) 3.5%

B) 4.2%

C) 5%

D) 7%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

12

Suppose that a bond with a face value of $10,000 and coupon rate of 7% matures a year from now. It is selling for $9,880. What interest rate would make a person indifferent between the selling price of $9,880 and the bond payment (face value and coupon) one year from now?

A) 7%

B) 5.7%

C) 1.3%

D) 8.3%

A) 7%

B) 5.7%

C) 1.3%

D) 8.3%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

13

Todd, who just started college, is promised $10,000 by his grandmother at the end of four years if he graduates with honors. What is the present discounted value of this payment at a 6% interest rate?

A) $9,400.68

B) $8,180.26

C) $6,000.32

D) $7,920.94

A) $9,400.68

B) $8,180.26

C) $6,000.32

D) $7,920.94

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

14

Suppose that a firm generates $40,000 of profit per year, and this profit will continue forever. At a 10% interest rate, what is the present discounted value of the firm's profit?

A) $400,000

B) $4 million

C) $4.4 million

D) $360,000

A) $400,000

B) $4 million

C) $4.4 million

D) $360,000

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

15

Donna purchased property and must make an annual mortgage payment of $6,000 for the next 30 years. What is the present discounted value of the payment stream at a 5% interest rate?

A) $88,450.42

B) $110,682.21

C) $92,234.71

D) $105,320.57

A) $88,450.42

B) $110,682.21

C) $92,234.71

D) $105,320.57

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

16

A corporate bond has a $10,000 face value, five-year maturity, and an 8% annual coupon rate. If interest rates are 6%, what is the present discounted value of the bond?

A) $10,540.18

B) $9,805.25

C) $10,842.47

D) $11,220.82

A) $10,540.18

B) $9,805.25

C) $10,842.47

D) $11,220.82

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

17

A company is considering extracting natural gas from one of its properties. The initial extraction cost is $8 million, and all of the gas will be extracted in two years. The profits from selling the natural gas will be $6 million in year 1 and $5 million in year 2. What is the net present value of this investment at 12%?

A) $2.5 million

B) $1,343,112

C) $800,780

D) $1,020,645

A) $2.5 million

B) $1,343,112

C) $800,780

D) $1,020,645

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

18

What interest rate would make a person indifferent between receiving $1,250 today and $1,500 at the end of one year?

A) 16.7%

B) 12.5%

C) 24%

D) 20%

A) 16.7%

B) 12.5%

C) 24%

D) 20%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following statements is TRUE?

A) The present discounted value of future cash flows rises as the time to payoff increases.

B) The present discounted value of future cash flows rises with the interest rate.

C) The present discounted value of future cash flows falls when the interest rate rises.

D) The present discounted value of future cash flows remains constant as the time to payoff decreases.

A) The present discounted value of future cash flows rises as the time to payoff increases.

B) The present discounted value of future cash flows rises with the interest rate.

C) The present discounted value of future cash flows falls when the interest rate rises.

D) The present discounted value of future cash flows remains constant as the time to payoff decreases.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

20

Davey has the opportunity to buy an investment that pays $500 at the end of each of the next two years. If interest rates are 6.5%, what is the maximum price that Davey should pay for this investment?

A) $910.31

B) $889.23

C) $777.20

D) $686.40

A) $910.31

B) $889.23

C) $777.20

D) $686.40

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

21

A drug company is considering investing $100 million today to bring a weight loss pill to the market. At the end of one year, the firm will know the payoff: there is a 0.50 probability that the pill will sell at a high price and generate $37 million dollars per year of profit forever and a 0.50 probability that the pill will sell at a low price and generate $1 million per year of profit forever. The interest rate is 10%. Suppose the firm decides to wait one year to determine whether the pill will sell at a high price or a low price. The firm will not invest if it learns that the pill will sell at a low price. What is the option value of waiting one year to make the investment?

A) $10 million

B) $46.4 million

C) $17.44 million

D) $8.1 million

A) $10 million

B) $46.4 million

C) $17.44 million

D) $8.1 million

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

22

Let = inflation rate, r = real interest rate, and i = nominal interest rate. Which of the following statements is (are) TRUE?

A) = (r)(i)

B) = i + r

C) r = i -

D) i = r -

A) = (r)(i)

B) = i + r

C) r = i -

D) i = r -

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

23

The demand and supply of capital are given by QD = 50 - 8r and QS = 4r - 10, where Q is the quantity of capital in millions of dollars and r is the interest rate measured as a percentage. What is the equilibrium quantity of capital?

A) $5 million

B) $60 million

C) $10 million

D) $12 million

A) $5 million

B) $60 million

C) $10 million

D) $12 million

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

24

Use the following to answer question:

Table 14.4

Year

Investment I

Benefits and Costs

r = 0.10

Investment II

Benefits and Costs

r = 0.10

Investment III

Benefits and Costs

r = 0.08

0

-800

-800

-800

1

1,000

200

800

2

200

200

300

3

200

1,000

250

(Table 14.4) Which of the following lists the investments in order from highest to lowest net present value?

A) I, II, III

B) III, II, I

C) III, I, II

D) I, III, II

Table 14.4

Year

Investment I

Benefits and Costs

r = 0.10

Investment II

Benefits and Costs

r = 0.10

Investment III

Benefits and Costs

r = 0.08

0

-800

-800

-800

1

1,000

200

800

2

200

200

300

3

200

1,000

250

(Table 14.4) Which of the following lists the investments in order from highest to lowest net present value?

A) I, II, III

B) III, II, I

C) III, I, II

D) I, III, II

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

25

A change in household tastes and preferences reduces the rate of saving. The market interest rate _____ and the quantity of capital _____.

A) increases; increases

B) increases; decreases

C) decreases; decreases

D) decreases; increases

A) increases; increases

B) increases; decreases

C) decreases; decreases

D) decreases; increases

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

26

Jasmine is considering buying a 1954 Chevy, restoring it, and selling it. She calculates a 0.2 probability that she will gain 25% from the project, a 0.3 probability that she will gain 10%, and a 0.5 probability that she will gain 5%. What is Jasmine's expected return?

A) 18%

B) 10.5%

C) 7%

D) 12%

A) 18%

B) 10.5%

C) 7%

D) 12%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

27

A drug company is considering investing $100 million today to bring a weight loss pill to the market. At the end of one year, the firm will know the payoff: there is a 0.50 probability that the pill will sell at a high price and generate $37 million per year of profit forever and a 0.50 probability that the pill will sell at a low price and generate $1 million per year of profit forever. The interest rate is 10%. Suppose the firm decides to wait one year to determine whether the pill will sell at a high or low price. The firm will not invest if it learns that the pill will sell at a low price. What is the net present value of waiting one year to make the investment?

A) $107.44 million

B) $88 million

C) $201.22 million

D) $64.5 million

A) $107.44 million

B) $88 million

C) $201.22 million

D) $64.5 million

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

28

The demand and supply of capital are given by QD = 200 - 60r and QS = 20r - 40, where Q is the quantity of capital in millions of dollars and r is the interest rate measured as a percentage. What is the equilibrium interest rate?

A) 5%

B) 2%

C) 8%

D) 3%

A) 5%

B) 2%

C) 8%

D) 3%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

29

An increase in business confidence leads many firms to expand their factories, which causes the _____ capital to increase and interest rates to _____.

A) demand for; rise

B) demand for; fall

C) supply of; rise

D) supply of; fall

A) demand for; rise

B) demand for; fall

C) supply of; rise

D) supply of; fall

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

30

Use the following to answer question:

Table 14.7

Benefit Payout

Probability of Payout

-$2 million

0.3

1 million

0.4

4 million

0.3

(Table 14.7) What is the expected value of the benefit payout?

A) $1.33 million

B) $1 million

C) $2.2 million

D) $2.5 million

Table 14.7

Benefit Payout

Probability of Payout

-$2 million

0.3

1 million

0.4

4 million

0.3

(Table 14.7) What is the expected value of the benefit payout?

A) $1.33 million

B) $1 million

C) $2.2 million

D) $2.5 million

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

31

Use the following to answer question:

Table 14.6

Year

Costs

Benefits

0

$400

$ 0

1

0

50

2

0

50

3

0

400

(Table 14.6) Suppose that the interest rate is 9% and the firm requires a payback period of three years. Which of the following statements is (are) TRUE?

A) I, II, and III

B) II and III

C) I

D) I and III

Table 14.6

Year

Costs

Benefits

0

$400

$ 0

1

0

50

2

0

50

3

0

400

(Table 14.6) Suppose that the interest rate is 9% and the firm requires a payback period of three years. Which of the following statements is (are) TRUE?

A) I, II, and III

B) II and III

C) I

D) I and III

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

32

A drug company is considering investing $100 million today to bring a weight loss pill to the market. At the end of one year, the firm will know the payoff: there is a 0.50 probability that the pill will sell at a high price and generate $37 million per year of profit forever and a 0.50 probability that the pill will sell at a low price and generate $1 million per year of profit forever. The interest rate is 10%. What is the expected net present value of this investment?

A) $280 million

B) $112 million

C) $44 million

D) $90 million

A) $280 million

B) $112 million

C) $44 million

D) $90 million

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

33

What is the option value of waiting?

A) the increase in the net present value from postponing an investment until uncertainty about the investment returns is reduced

B) the use of a risk-free discount rate for the evaluation of risky investments

C) the difference between the present discounted value calculated from using the nominal interest rate and the real interest rate

D) the interest rate that causes the net present value of an investment to equal zero

A) the increase in the net present value from postponing an investment until uncertainty about the investment returns is reduced

B) the use of a risk-free discount rate for the evaluation of risky investments

C) the difference between the present discounted value calculated from using the nominal interest rate and the real interest rate

D) the interest rate that causes the net present value of an investment to equal zero

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

34

In the market for capital, the discovery of new productive technologies increases the profitability of investments. The market interest rate _____, and the quantity of capital _____.

A) increases; increases

B) increases; decreases

C) decrease; decreases

D) decreases; increases

A) increases; increases

B) increases; decreases

C) decrease; decreases

D) decreases; increases

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

35

The real interest rate is the rate:

A) advertised in capital markets; it does not account for changes in the price level.

B) expressed in terms of purchasing power.

C) that measures the return in numbers of dollars.

D) that removes the distortionary effects of compounding.

A) advertised in capital markets; it does not account for changes in the price level.

B) expressed in terms of purchasing power.

C) that measures the return in numbers of dollars.

D) that removes the distortionary effects of compounding.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

36

Use the following to answer question:

Table 14.5

Year

Costs

Benefits

0

$1,200

$ 0

1

400

2

400

3

200

4

200

5

200

(Table 14.5) What is the payback period of the investment?

A) five years

B) four years

C) three years

D) It depends on the interest rate.

Table 14.5

Year

Costs

Benefits

0

$1,200

$ 0

1

400

2

400

3

200

4

200

5

200

(Table 14.5) What is the payback period of the investment?

A) five years

B) four years

C) three years

D) It depends on the interest rate.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

37

Use the following to answer question:

Table 14.3

Year

Costs if Hybrid Bought

Costs if Standard Bought

0

-$27,000

-$22,500

1

-2,000

-2,890

2

-2,000

-2,890

3

-2,000

-2,890

4

-2,000

-2,890

5

-2,000

-2,890

6

-2,000

-2,890

(Table 14.3) The table shows the initial cost outlays of two versions of the Ford Escape and their estimated annual fuel costs. Stu is not sure whether he wants the hybrid or standard model. Although more expensive, the hybrid model has better gas mileage and would save $890 of gas per year. Assume both cars are worthless after six years. At a 7% interest rate, what is the net present value of the net cost difference between the hybrid and the standard model?

A) $450.10

B) -$257.78

C) -$48.23

D) $175.96

Table 14.3

Year

Costs if Hybrid Bought

Costs if Standard Bought

0

-$27,000

-$22,500

1

-2,000

-2,890

2

-2,000

-2,890

3

-2,000

-2,890

4

-2,000

-2,890

5

-2,000

-2,890

6

-2,000

-2,890

(Table 14.3) The table shows the initial cost outlays of two versions of the Ford Escape and their estimated annual fuel costs. Stu is not sure whether he wants the hybrid or standard model. Although more expensive, the hybrid model has better gas mileage and would save $890 of gas per year. Assume both cars are worthless after six years. At a 7% interest rate, what is the net present value of the net cost difference between the hybrid and the standard model?

A) $450.10

B) -$257.78

C) -$48.23

D) $175.96

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

38

A firm is considering an investment project that today would cost $20,000. At the end of one year, there is a 70% probability that the investment will pay out $28,000 and a 30% probability that it will pay out $16,000. Using a 10% interest rate, what is the expected net present value of this investment?

A) -$670.85

B) $483.14

C) $2,181.82

D) $4,020.19

A) -$670.85

B) $483.14

C) $2,181.82

D) $4,020.19

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following statements is (are) TRUE?

A) If the real interest rate is 3% and the nominal rate is 5%, the inflation rate is 8%.

B) If the nominal interest rate is 5% and inflation is 2.5%, the real interest rate is 2.5%.

C) If the nominal interest rate is 5% and inflation is 4%, the real interest rate is 9%.

D) If the real interest rate is 3% and inflation is 5%, the nominal interest rate is 2%.

A) If the real interest rate is 3% and the nominal rate is 5%, the inflation rate is 8%.

B) If the nominal interest rate is 5% and inflation is 2.5%, the real interest rate is 2.5%.

C) If the nominal interest rate is 5% and inflation is 4%, the real interest rate is 9%.

D) If the real interest rate is 3% and inflation is 5%, the nominal interest rate is 2%.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

40

Reed is interested in purchasing a hydrographics machine for $10,000. The machine would be used for three years and generate $4,000 per year of cash flow. After three years, the machine could be sold for $3,000. What is the net present value of the machine at 12%?

A) $1,742.67

B) $3,200.23

C) $2,012.18

D) $4,158.40

A) $1,742.67

B) $3,200.23

C) $2,012.18

D) $4,158.40

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

41

Karen would like to save for a car that will cost her $20,000 in five years. If the current interest rate is 6%, how much will she need to set aside, assuming monthly compounding?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

42

A timber rancher is considering harvesting a stand of trees. The wood from the trees would sell today for $70,000. If the timber rancher allows the trees to grow for two more years, he can sell more wood and earn $79,000. At an interest rate of 8%, should the timber rancher harvest the trees today or wait two years before harvesting?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

43

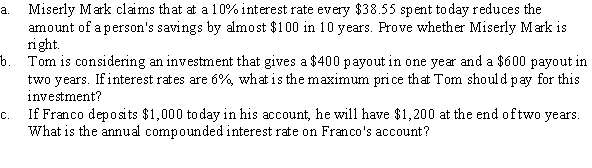

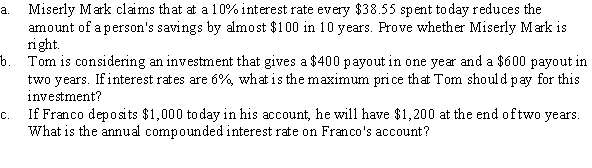

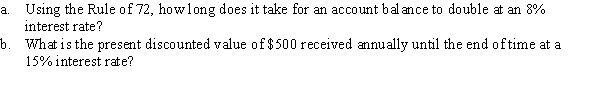

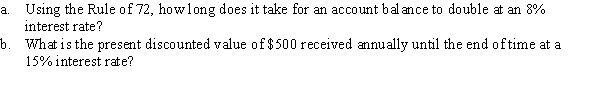

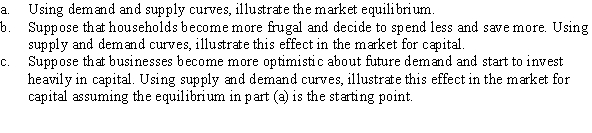

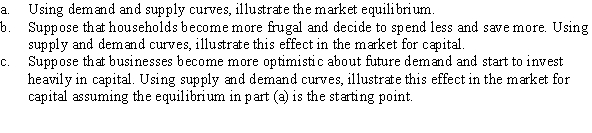

Answer the following questions.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

44

Darlene can buy one of two investments. The first pays $1,000 at the end of 3 years. The second pays $400 at the end of each of the next two years and $200 in the final year. Each investment costs $800. If interest rates are 4%, which investment should Darlene buy?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

45

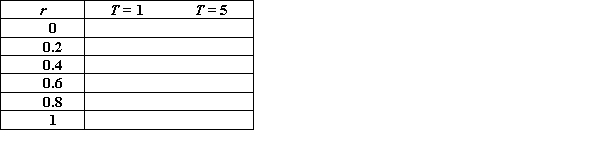

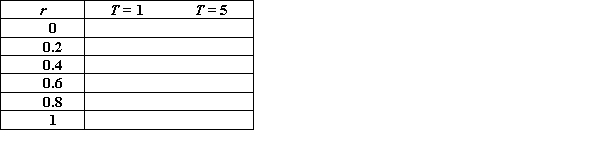

Complete the table and graph, assuming a future payment of $10,000. What is the relationship between present value and the interest rate, holding time constant? What is the relationship between present value and time, holding the interest rate constant?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

46

Adam has wealth of $40,000 as long as his business does not burn down. However, there is a 50% probability that his business will burn down and cause a $30,000 loss, leaving him with $10,000 of wealth. Adam's utility function is given by U = W0.5, where W is wealth. What is the maximum price that Adam would pay for full insurance that covers the potential $30,000 loss? (Hint: The maximum price equals the actuarially fair premium plus the risk premium.)

A) $17,500

B) $12,500

C) $15,500

D) $22,500

A) $17,500

B) $12,500

C) $15,500

D) $22,500

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

47

Answer the following questions.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

48

Use the following to answer question:

Table 14.8

Health Status

Income

Probability

Well

$90,000

0.90

Sick

0

0.10

(Table 14.8) Suppose the person's utility function is given by U = I0.5, where I is income. What is the person's expected utility?

A) 270

B) 45

C) 184

D) 81

Table 14.8

Health Status

Income

Probability

Well

$90,000

0.90

Sick

0

0.10

(Table 14.8) Suppose the person's utility function is given by U = I0.5, where I is income. What is the person's expected utility?

A) 270

B) 45

C) 184

D) 81

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

49

Use the following to answer question:

Table 14.9

Gamble A

Gamble B

Payoff

Probability

Payoff

Probability

$500

1

$1,000

0.5

0

0

0

0.5

(Table 14.9) A _____ person prefers gamble _____ to gamble _____.

A) risk-averse; B; A

B) risk-averse; A; B

C) risk-neutral; A; B

D) risk-neutral; B; A

Table 14.9

Gamble A

Gamble B

Payoff

Probability

Payoff

Probability

$500

1

$1,000

0.5

0

0

0

0.5

(Table 14.9) A _____ person prefers gamble _____ to gamble _____.

A) risk-averse; B; A

B) risk-averse; A; B

C) risk-neutral; A; B

D) risk-neutral; B; A

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

50

There is an 80% probability that Tom will be in good health during the year and incur only $200 in medical expenses, but there is a 20% probability that he will be ill and incur $20,000 in medical expenses. If an insurance company charged Tom an actuarially fair premium, how much would Tom pay for health insurance?

A) $3,840

B) $4,000

C) $4,160

D) $3,460

A) $3,840

B) $4,000

C) $4,160

D) $3,460

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

51

You've won a radio contest that gives you $500 of free gas per year for the next 20 years. What is the value of this prize at a 6% interest rate? Would this prize be more or less valuable at a 10% interest rate?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

52

Abby's parents have decided to save for her college education. They estimate they will need $100,000 18 years from now to pay for it. If the interest rate remains fixed at 5% over this period, how much money will Abby's parents have to put into savings today to meet their goal?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

53

Use the following to answer question:

Table 14.10

Business Fire

Income

Probability

Yes

$160,000

0.10

No

490,000

0.90

(Table 14.10) Suppose the person's utility function is given by U = I0.5, where I is income. What guaranteed income level would offer the same expected utility level as that from the uncertain income (i.e., find the certainty equivalent)?

A) $432,600

B) $464,400

C) $448,900

D) $457,000

Table 14.10

Business Fire

Income

Probability

Yes

$160,000

0.10

No

490,000

0.90

(Table 14.10) Suppose the person's utility function is given by U = I0.5, where I is income. What guaranteed income level would offer the same expected utility level as that from the uncertain income (i.e., find the certainty equivalent)?

A) $432,600

B) $464,400

C) $448,900

D) $457,000

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

54

Benny was seriously injured at his place of employment and can no longer work. If Benny hadn't been injured, he would have worked five more years and would have earned $60,000 each year. What is the present discounted value of Benny's lost earnings at a 5% interest rate?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

55

Adam has wealth of $40,000 as long as his business does not burn down. However, there is a 50% probability that his business will burn down, causing a loss of $30,000 and leaving him with $10,000 of wealth. Adam's utility function is given by U = W0.5, where W is wealth. Suppose Adam purchases insurance to cover the potential $30,000 loss. If the insurance premium is actuarially fair, Adam's utility with insurance is:

A) 100.40.

B) 145.23.

C) 158.11.

D) 161.51.

A) 100.40.

B) 145.23.

C) 158.11.

D) 161.51.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

56

Use the following to answer question:

Table 14.11

Income

Clipper's Total Utility

Prince's Total Utility

$ 0

0

0

20,000

100

200

40,000

195

300

60,000

285

350

80,000

370

375

100,000

450

387

(Table 14.11) Because Clipper is _____ risk averse than Prince, Prince will pay the _____ risk premium.

A) more; larger

B) less; larger

C) less; smaller

D) more; smaller

Table 14.11

Income

Clipper's Total Utility

Prince's Total Utility

$ 0

0

0

20,000

100

200

40,000

195

300

60,000

285

350

80,000

370

375

100,000

450

387

(Table 14.11) Because Clipper is _____ risk averse than Prince, Prince will pay the _____ risk premium.

A) more; larger

B) less; larger

C) less; smaller

D) more; smaller

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

57

Use the following to answer question:

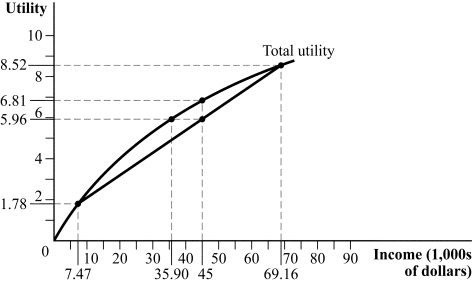

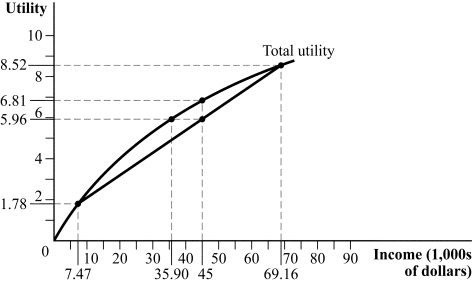

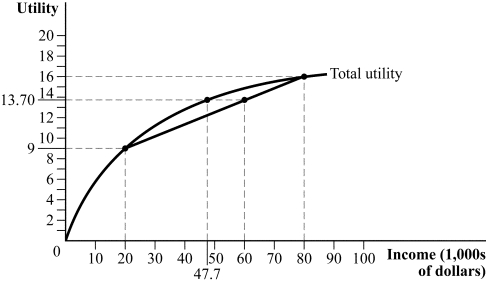

Figure 14.1

(Figure 14.1) The risk premium is:

A) $24,160.

B) $9,100.

C) $45,000.

D) $35,900.

Figure 14.1

(Figure 14.1) The risk premium is:

A) $24,160.

B) $9,100.

C) $45,000.

D) $35,900.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

58

Use the following to answer question:

Table 14.12

Year

Savings Account Balance (interest rate = 10%)

Savings Account Balance (interest rate = 5%)

0

$10,000

$10,000

5

10

15

20

(Table 14.12) Complete the table.

Table 14.12

Year

Savings Account Balance (interest rate = 10%)

Savings Account Balance (interest rate = 5%)

0

$10,000

$10,000

5

10

15

20

(Table 14.12) Complete the table.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

59

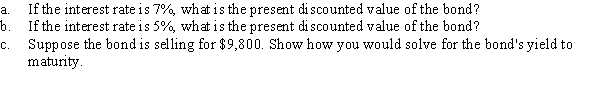

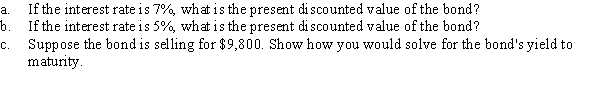

A corporate bond has a $10,000 face value and offers a 7% coupon rate. The bond matures at the end of three years.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

60

Adam has wealth of $40,000 as long as his business does not burn down. However, there is a 50% probability that his business will burn down, causing a loss of $30,000 and leaving him with $10,000 of wealth. Adam's utility function is given by U = W0.5, where W is wealth. What is Adam's expected utility?

A) 150

B) 48

C) 66

D) 120

A) 150

B) 48

C) 66

D) 120

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

61

The market for capital is in equilibrium at an interest rate of 3% and a quantity of $10 million.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

62

A restaurant owner is considering refurbishing his restaurant at a cost of $40,000 to generate increased sales. There is a 50% probability that the refurbished restaurant will increase profits by $26,000 each year for the next two years and a 50% probability that profits will increase by only $18,000 each year for the next two years. Calculate the expected net present value of refurbishing the restaurant at an interest rate of 8%. Do you advise the restaurant owner to refurbish the restaurant?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

63

The demand for capital is QD = 46 - 10r and the supply of capital is QS = 2r - 2, where r is the interest rate (measured as a percentage) and Q measures the quantity of capital in millions of dollars. What are the equilibrium interest rate and quantity of capital?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

64

Suppose a real estate agent's utility function is given by U = I0.5, where I is income. The agent has uncertain income, such that this year she has a 20% chance of earning $62,500 and an 80% chance of earning $160,000. The income level that would offer the same expected utility is $136,900. What is this agent's risk premium?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

65

Gabe has wealth of $100,000 and faces a 5% probability that he will get sick and lose $40,000.

a. What is Gabe's expected wealth?

b. What is Gabe's expected loss?

c. What price would Gabe pay for an actuarially fair insurance policy that would reimburse him the full value of his loss?

d. Suppose that Gabe's certainty equivalent is $97,000. What is Gabe's risk premium?

a. What is Gabe's expected wealth?

b. What is Gabe's expected loss?

c. What price would Gabe pay for an actuarially fair insurance policy that would reimburse him the full value of his loss?

d. Suppose that Gabe's certainty equivalent is $97,000. What is Gabe's risk premium?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

66

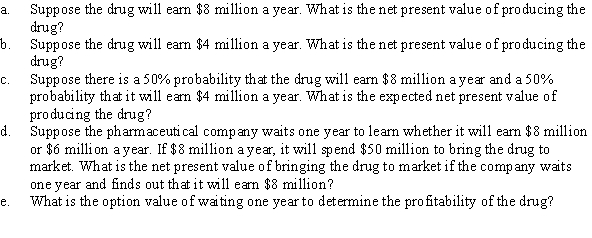

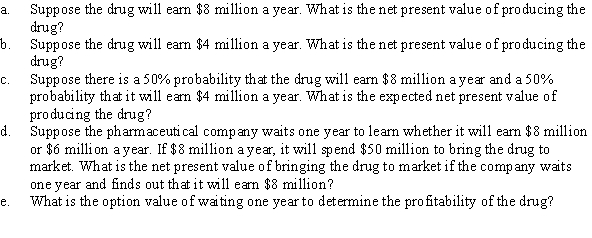

A pharmaceutical company is considering producing a generic drug. If it spent $50 million today, the pharmaceutical company could begin selling its drug in one year. The interest rate is 10% and all returns last until the end of time.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

67

Suppose that Stimpy's utility function U is given by U = w0.5, where w is wealth measured in thousands of dollars. Stimpy has wealth of $20,000 but faces a probability of getting ill and losing $10,000. He has an 80% probability of being well and a 20% probability of being ill.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

68

Jerome operates a car repair shop and is considering whether to purchase a computer diagnostic tool for Korean automobiles. The tool, which costs $4,000, will enable Jerome to service Korean automobiles. This added business will give Jerome additional income of $2,000 in each of the next three years. What is the net present value of the tool at 5.5%? Should Jerome buy it?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

69

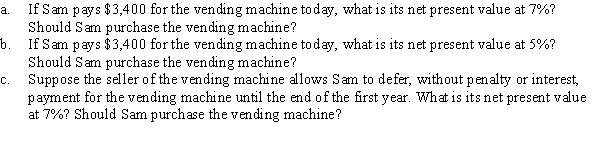

Sam is considering purchase of a vending machine to sell sodas. The cost of the vending machine is $3,400. Sam estimates that the vending machine will last for five years and will provide net income of $800 each year for its lifetime.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

70

A beef processing firm is considering whether to upgrade its plant at a cost of $200,000 or invest in an account that earns 12% annual interest. If it upgrades its plant, the firm will generate an additional $70,000 of profit each year for the next three years. Should the firm upgrade its plant?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

71

Tarek is considering buying a house to renovate and flip (resell). He calculates a 0.3 probability that he will gain a 32% return from the project, a 0.3 probability that he will gain a 21% return, and a 0.4 probability that he will gain a 15% return. Tarek expects a return of _____ from this project.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

72

Richard fixes up old cars and sells them to supplement his retirement income. Richard came across a beat-up 1955 Corvette that he is considering rebuilding and selling. He estimates a 0.2 probability that he will gain 15% on the deal, a 0.2 probability that he will gain 10%, and a 0.6 probability that he will gain 5%. What is Richard's expected return for fixing up and selling the Corvette?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

73

The demand for capital is QD = 100 - 20r, and the supply of capital is QS = 12r - 28, where r is the interest rate and Q is the quantity of capital in millions of dollars. Assume that households increase savings such that households save $20 million more at every interest rate level. What are the new equilibrium interest rate and quantity of capital?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

74

The demand for capital is QD = 100 - 20r, and the supply of capital is QS = 12r - 28, where r is the interest rate and Q is the quantity of capital in millions of dollars. What are the equilibrium interest rate and quantity of capital?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

75

The demand for capital is QD = 80 - 15r, and the supply of capital is QS = 20r - 60, where r is the interest rate and Q is the quantity of capital in millions of dollars. Businesses become more optimistic about the business environment and borrow $70 million more capital at each interest rate level. What happens to the equilibrium interest rate and quantity of capital as a result of this newfound optimism?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

76

George and his coworkers like to bet each year on who will win the NCAA basketball tournament. Each person pays $50 to be part of the pool. George estimates that he has a 10% chance of winning the pot, equal to $1,000, paid half now and the other half at the start of the same tournament next year. What is George's expected present value of playing if the interest rate is 2.5%?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

77

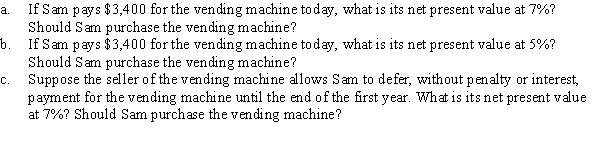

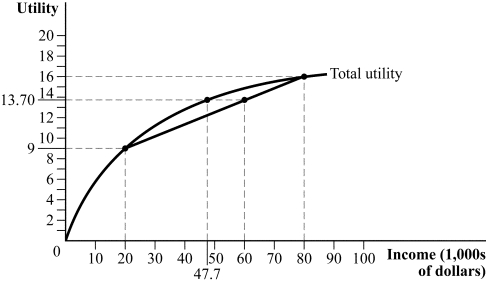

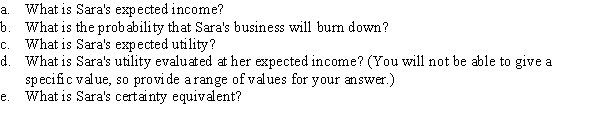

Use the following to answer question:

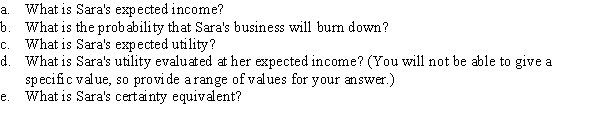

Figure 14.2

(Figure 14.2) Suppose that Sara has an income of $80,000, but if her business burns down, her income drops to $20,000.

Figure 14.2

(Figure 14.2) Suppose that Sara has an income of $80,000, but if her business burns down, her income drops to $20,000.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck