Deck 23: Derivatives and Related Accounting Issues

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/45

Play

Full screen (f)

Deck 23: Derivatives and Related Accounting Issues

1

The underlying amount of a derivative instrument is

A)related to the number of units specified in the derivative and the price that relates to the asset or liability underlying the derivative.

B)the change in the price or rate that relates to the asset or liability underlying the derivative.

C)the price or rate that relates to the asset or liability underlying the derivative.

D)the number of units that is specified in the derivative instrument.

A)related to the number of units specified in the derivative and the price that relates to the asset or liability underlying the derivative.

B)the change in the price or rate that relates to the asset or liability underlying the derivative.

C)the price or rate that relates to the asset or liability underlying the derivative.

D)the number of units that is specified in the derivative instrument.

C

The rates or prices that relate to the asset or liability underlying the derivative are referred to as underlyings.

The rates or prices that relate to the asset or liability underlying the derivative are referred to as underlyings.

2

Which of the following is true about options?

A)Generally, higher volatility of the underlying increases the value of the option.

B)The value of an option is realized only through its being exercised.

C)An American option is exercisable at its maturity date.

D)An option premium is refundable if the option becomes unfavorable.

A)Generally, higher volatility of the underlying increases the value of the option.

B)The value of an option is realized only through its being exercised.

C)An American option is exercisable at its maturity date.

D)An option premium is refundable if the option becomes unfavorable.

A

Underlyings with more price volatility present greater opportunities for gains if the option is in-the-money. Therefore, higher volatility increases the value of an option.

Underlyings with more price volatility present greater opportunities for gains if the option is in-the-money. Therefore, higher volatility increases the value of an option.

3

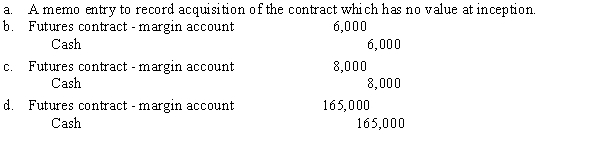

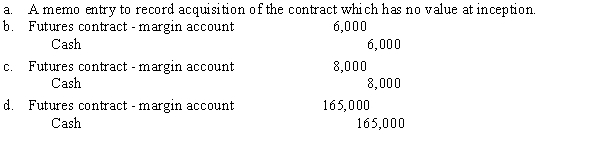

Jenson Company buys 20 contracts on the Chicago Board of Trade to receive October delivery of soybeans to a certified warehouse. Each contract is in units of 3,000 bushels at a futures price of $2.75 per bushel. The owner of the contract requires a margin account with an initial margin of $8,000, with a maintenance margin of $6,000. What entry will Jenson Company make to establish the margin account?

C

An $8,000 payment will be made to establish the margin account, upon which Cash will be credited and a debit will be made to Futures contract - margin account.

An $8,000 payment will be made to establish the margin account, upon which Cash will be credited and a debit will be made to Futures contract - margin account.

4

Based on the relationship between the strike price and the current price, an option may be at-the-money, out-of-the-money or in-the-money. Which of the following statements is true?

A)A Call Option is out-of-the-money when the strike price is greater than the current price.

B)A Put Option is in-the-money when the strike price is greater than the current price.

C)A Put Option is out-of-the-money when the strike price is less than the current price.

D)All of the above are true.

A)A Call Option is out-of-the-money when the strike price is greater than the current price.

B)A Put Option is in-the-money when the strike price is greater than the current price.

C)A Put Option is out-of-the-money when the strike price is less than the current price.

D)All of the above are true.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

5

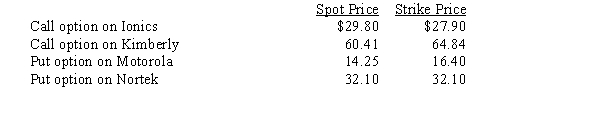

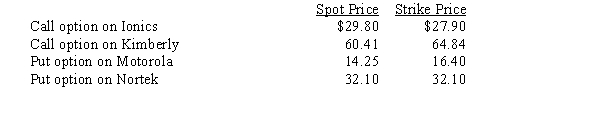

Clark Company holds several options:  The intrinsic value of Clark Company's options is

The intrinsic value of Clark Company's options is

A)$0.38.

B)$4.05.

C)$4.43.

D)$8.48.

The intrinsic value of Clark Company's options is

The intrinsic value of Clark Company's options isA)$0.38.

B)$4.05.

C)$4.43.

D)$8.48.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

6

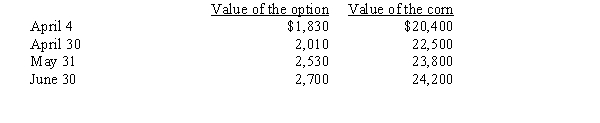

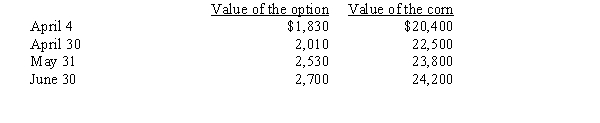

On April 4, Alam Company purchased a call option on 10,000 bushels of corn with delivery on June 30. The strike price is $2.15 per bushel. The value of the option and the market value of the corn are as follows.

A)On April 4, the intrinsic value of the option is $1,100.

B)On April 30, the time value of the option is $1,010.

C)On May 31, the intrinsic value of the option is $230.

D)On June 30, the time value of the option is $2,700.

A)On April 4, the intrinsic value of the option is $1,100.

B)On April 30, the time value of the option is $1,010.

C)On May 31, the intrinsic value of the option is $230.

D)On June 30, the time value of the option is $2,700.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

7

The difference between the strike price of an option and spot price of the item being hedge at any one time represents the option's:

A)time value.

B)intrinsic value.

C)fair value.

D)premium.

A)time value.

B)intrinsic value.

C)fair value.

D)premium.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

8

On September 1st of the current year, Mooney Company writes a contract agreeing to sell to Berry Company 200,000 foreign currency (FC) units at a specific price of $2.14 per FC with delivery in 30 days. The spot rate at the end of 30 days is $2.17. The appropriate discount rate for both Mooney Company and Berry Company is 9%, and Mooney's year end is December 31.

On the settlement of the contract, Mooney would record a

A)gain of $6,000.

B)gain of $5,955.

C)loss of $6,000.

D)loss of $5,955.

On the settlement of the contract, Mooney would record a

A)gain of $6,000.

B)gain of $5,955.

C)loss of $6,000.

D)loss of $5,955.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

9

The total value of a derivative is determined by the

A)number of units specified in the derivative and the price that relates to the asset or liability underlying the derivative.

B)change in the price or rate that relates to the asset or liability underlying the derivative.

C)price or rate that relates to the asset or liability underlying the derivative.

D)number of units that is specified in the derivative instrument.

A)number of units specified in the derivative and the price that relates to the asset or liability underlying the derivative.

B)change in the price or rate that relates to the asset or liability underlying the derivative.

C)price or rate that relates to the asset or liability underlying the derivative.

D)number of units that is specified in the derivative instrument.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

10

A critical characteristic of a derivative is that the instrument

A)derives its value from a related asset or liability.

B)derives its value from changes in value of a related asset or liability.

C)requires that the related asset or liability be sold or bought at settlement.

D)requires the holder of the derivative instrument to make a significant investment.

A)derives its value from a related asset or liability.

B)derives its value from changes in value of a related asset or liability.

C)requires that the related asset or liability be sold or bought at settlement.

D)requires the holder of the derivative instrument to make a significant investment.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

11

A forward contract

A)is not traded on an organized exchange and is customized to meet the needs of the parties.

B)is not traded on an organized exchange and is subject to formal regulation which results in standardized contracts.

C)is traded on an organized exchange and is subject to formal regulation which results in standardized contracts.

D)is traded on an organized exchange and is customized to meet the needs of the parties.

A)is not traded on an organized exchange and is customized to meet the needs of the parties.

B)is not traded on an organized exchange and is subject to formal regulation which results in standardized contracts.

C)is traded on an organized exchange and is subject to formal regulation which results in standardized contracts.

D)is traded on an organized exchange and is customized to meet the needs of the parties.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is not true regarding using an option to hedge financial risks versus a forward contract?

A)An option is a right to buy or sell an underlying, while a forward contract is an obligation.

B)An option requires an initial cash outlay, while a forward contract does not.

C)Both options and forwards are said to have asymmetric or one-sides return profiles.

D)All of the above are true.

A)An option is a right to buy or sell an underlying, while a forward contract is an obligation.

B)An option requires an initial cash outlay, while a forward contract does not.

C)Both options and forwards are said to have asymmetric or one-sides return profiles.

D)All of the above are true.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following statements is true?

A)The ability to settle the derivative by actually buying or selling the related asset is referred to as net settlement.

B)The quantity or number of units specified by a derivative is known as the underlying.

C)A derivative instrument derives its value from a related asset or liability.

D)Usually, a derivative instrument requires little or no initial investment.

A)The ability to settle the derivative by actually buying or selling the related asset is referred to as net settlement.

B)The quantity or number of units specified by a derivative is known as the underlying.

C)A derivative instrument derives its value from a related asset or liability.

D)Usually, a derivative instrument requires little or no initial investment.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

14

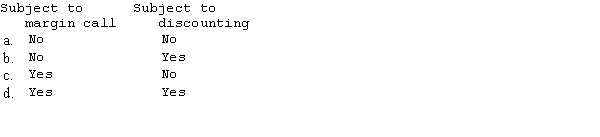

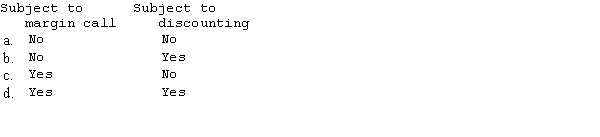

Both forward contracts and futures contracts provide for the receipt or payment of a specific amount of an asset at a specific price with delivery at a specified future point in time. Which combination of characteristics is true for a futures contract?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

15

An option

A)is not traded on an organized exchange and is customized to meet the needs of the parties.

B)is not traded on an organized exchange and is subject to formal regulations which results in standardized contracts

C)is traded on an organized exchange or may be negotiated on a case-by-case basis between counterparties.

D)is traded on an organized exchange and is customized to meet the needs of the parties.

A)is not traded on an organized exchange and is customized to meet the needs of the parties.

B)is not traded on an organized exchange and is subject to formal regulations which results in standardized contracts

C)is traded on an organized exchange or may be negotiated on a case-by-case basis between counterparties.

D)is traded on an organized exchange and is customized to meet the needs of the parties.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

16

Forward contracts are contracts to buy or sell a specified amount of an asset at a specified, fixed price with delivery at a specified future point in time. Which of the following is true about these contracts?

A)The party that agrees to buy the asset is said to be in a short position.

B)The party that agrees to sell the asset is said to be in a long position.

C)The specified, fixed price in the contract is known as the forward rate.

D)A forward contract requires an initial deposit of funds with the transacting broker.

A)The party that agrees to buy the asset is said to be in a short position.

B)The party that agrees to sell the asset is said to be in a long position.

C)The specified, fixed price in the contract is known as the forward rate.

D)A forward contract requires an initial deposit of funds with the transacting broker.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

17

On May 11, McElroy Inc. purchased a call option on 5,000 bushels of wheat with delivery on August 31 for a premium of $750. The strike price is $1.85 per bushel. The values of the option at the end of May and June are $790 and $810, respectively. The option is sold on July 26 for $804. McElroy Inc. prepares quarterly and annual financial statements. Its year end is June 30. McElroy Inc. will

A)recognize a gain on options of $60 on its fourth quarter income statement.

B)recognize a gain on options of $20 on its fourth quarter income statement.

C)recognize a gain on options of $40 on its fourth quarter income statement.

D)record a gain on options of $54 in the July 26 entry to sell the option.

A)recognize a gain on options of $60 on its fourth quarter income statement.

B)recognize a gain on options of $20 on its fourth quarter income statement.

C)recognize a gain on options of $40 on its fourth quarter income statement.

D)record a gain on options of $54 in the July 26 entry to sell the option.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

18

The notional amount of a derivative instrument is

A)related to the number of units specified in the derivative and the price that relates to the asset or liability underlying the derivative.

B)the change in the price or rate that relates to the asset or liability underlying the derivative.

C)the price or rate that relates to the asset or liability underlying the derivative.

D)the number of units that is specified in the derivative instrument.

A)related to the number of units specified in the derivative and the price that relates to the asset or liability underlying the derivative.

B)the change in the price or rate that relates to the asset or liability underlying the derivative.

C)the price or rate that relates to the asset or liability underlying the derivative.

D)the number of units that is specified in the derivative instrument.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

19

A futures contract

A)is not traded on an organized exchange and is customized to meet the needs of the parties.

B)is not traded on an organized exchange and is subject to formal regulations which results in standardized contrasts.

C)is traded on an organized exchange and is subject to formal regulations which results in standardized contrasts.

D)is traded on an organized exchange and is customized to meet the needs of the parties.

A)is not traded on an organized exchange and is customized to meet the needs of the parties.

B)is not traded on an organized exchange and is subject to formal regulations which results in standardized contrasts.

C)is traded on an organized exchange and is subject to formal regulations which results in standardized contrasts.

D)is traded on an organized exchange and is customized to meet the needs of the parties.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

20

On May 1 of the current year, Orr Company purchases a call option on 15,000 bushels of corn with delivery in July for a premium of $1,200 and a strike price of $3.05 per bushel. The values of the option at the end of May and June are $1,125 and $1,007, respectively. The option is sold on July 7th for $1,133. Orr Company prepares monthly financial statements.

A)On May 1, Orr Company records a memo entry to record acquisition of the contract which has no value.

B)For May, Orr Company records a gain on the contract of $75.

C)For June, Orr Company records a loss of $193.

D)At the sale of the option contract on July 7, Orr Company records a gain of $126.

A)On May 1, Orr Company records a memo entry to record acquisition of the contract which has no value.

B)For May, Orr Company records a gain on the contract of $75.

C)For June, Orr Company records a loss of $193.

D)At the sale of the option contract on July 7, Orr Company records a gain of $126.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

21

A hedge to avoid the potential unfavorable effects of changing prices associated with all of the following would qualify for special fair value hedge accounting except:

A)debt instruments held in a trading portfolio.

B)equity and debt instruments held in an available-for-sale portfolio.

C)a firm commitment to acquire crude oil.

D)a farmer's inventory of hogs.

A)debt instruments held in a trading portfolio.

B)equity and debt instruments held in an available-for-sale portfolio.

C)a firm commitment to acquire crude oil.

D)a farmer's inventory of hogs.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following has an asymmetric return profile?

A)Forward contracts

B)Futures contracts

C)Options

D)Swaps

A)Forward contracts

B)Futures contracts

C)Options

D)Swaps

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

23

All of the following are examples of cash flow hedges except:

A)a hedge against a price increase in a raw material expected to be purchased in 60 days.

B)a hedge against a fixed interest note payable using an interest rate swap.

C)a hedge against a variable interest note payable using an interest rate swap.

D)All of the above are examples of cash flow hedges.

A)a hedge against a price increase in a raw material expected to be purchased in 60 days.

B)a hedge against a fixed interest note payable using an interest rate swap.

C)a hedge against a variable interest note payable using an interest rate swap.

D)All of the above are examples of cash flow hedges.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

24

With respect to derivative instruments that are designated as hedges, the FASB calls for which of the following general disclosures?

A)The objective of using hedging instruments.

B)Description of the various types of hedges.

C)A description of the types of transactions that are hedged

D)All of the above.

A)The objective of using hedging instruments.

B)Description of the various types of hedges.

C)A description of the types of transactions that are hedged

D)All of the above.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

25

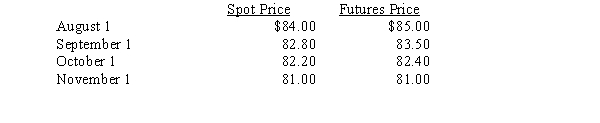

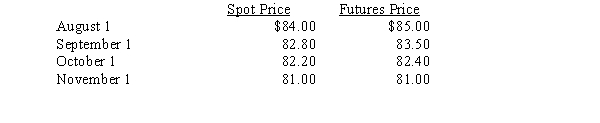

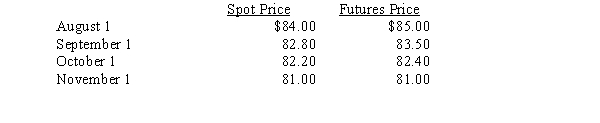

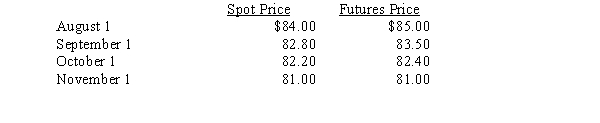

On August 1, an oil producer decided to hedge the fair value of its inventory by acquiring a futures contract to sell 100,000 barrels of oil on November 1 for $85.00 each. Price data follow:  What was the fair value of the contract on October 1?

What was the fair value of the contract on October 1?

A)$280,000

B)$110,000

C)$260,000

D)$20,000

What was the fair value of the contract on October 1?

What was the fair value of the contract on October 1?A)$280,000

B)$110,000

C)$260,000

D)$20,000

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

26

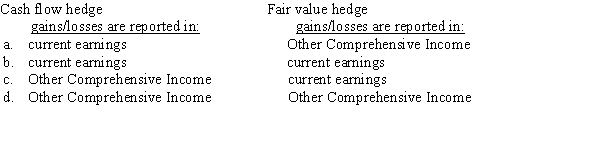

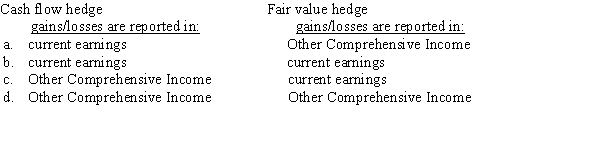

Which of the following is true of the financial statement presentation of gains/losses from cash flow hedges and fair value hedges?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

27

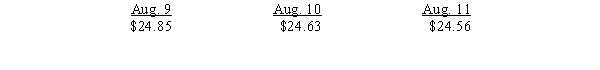

On August 9, Jacobs Company buys 25 contracts on Nymex to receive December delivery of Brent Crude Oil. Each contract is in units of 1,000 bbls at a futures price of $24.85 per bbl. The initial margin on the contract is set at $25,000, with a maintenance margin of $19,000. The futures prices are as follows:

Required:

a.Journalize the entries for Jacobs Company for the first three days of the contract.

b.Why are forward prices discounted and future prices are not discounted?

Required:

a.Journalize the entries for Jacobs Company for the first three days of the contract.

b.Why are forward prices discounted and future prices are not discounted?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

28

On February 1, Durham Company writes a forward contract to sell Rubright Company 3,000,000 yen at a specific, fixed price of $0.00875 per yen with delivery in 60 days. The spot rate at the end of the 60 days is $0.00913 per yen. The following is the forward rates information throughout the 60-day term.

Assume the discount rate is 7%.

Required:

a.Compute the gain or loss for Rubright Company over the life of the contract.

b.Assume the contract is settled at the end of the 60 days, prepare the journal entries to account for this contract on Rubright's books.

Assume the discount rate is 7%.

Required:

a.Compute the gain or loss for Rubright Company over the life of the contract.

b.Assume the contract is settled at the end of the 60 days, prepare the journal entries to account for this contract on Rubright's books.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

29

An advantage of a fair value hedge is that:

A)gains or losses on the derivative hedging instrument and the offsetting gains or losses on the hedged items are both recognized currently in earnings.

B)gains or losses on hedges of firm commitments are reported in other comprehensive income because the anticipated cash flows have not been recognized in earnings.

C)documentation is not necessary for fair value hedges.

D)a bank may use a fair value hedge to hedge the risk that a customer's loan will be prepaid.

A)gains or losses on the derivative hedging instrument and the offsetting gains or losses on the hedged items are both recognized currently in earnings.

B)gains or losses on hedges of firm commitments are reported in other comprehensive income because the anticipated cash flows have not been recognized in earnings.

C)documentation is not necessary for fair value hedges.

D)a bank may use a fair value hedge to hedge the risk that a customer's loan will be prepaid.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

30

At the beginning of 20X5, a derivative loss associated with a forecasted purchase of equipment will plus the expected cost of the equipment is $211,000. The fair value of the equipment is $199,000. The equipment has a useful life of 5 years.

A)$12,000 should be included in Other Comprehensive Income in 20X5.

B)$2,400 should be included in Other Comprehensive Income each year from 20X5 to 20X9.

C)$12,000 should be included in Income in 20X5.

D)$2,400 should be included in Income each year from 20X5 to 20X9.

A)$12,000 should be included in Other Comprehensive Income in 20X5.

B)$2,400 should be included in Other Comprehensive Income each year from 20X5 to 20X9.

C)$12,000 should be included in Income in 20X5.

D)$2,400 should be included in Income each year from 20X5 to 20X9.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

31

Interest rate swaps

A)are a type of Futures Contract.

B)are traded on the over-the-counter market.

C)required an initial cash flow in the form of a margin.

D)are customized to meet the needs of the specific parties.

A)are a type of Futures Contract.

B)are traded on the over-the-counter market.

C)required an initial cash flow in the form of a margin.

D)are customized to meet the needs of the specific parties.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

32

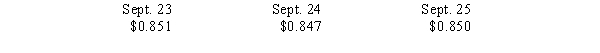

On September 23, Gensil Company buys 40 contracts on the Chicago Board of Trade to deliver orange juice to a certified warehouse in November. Each contract is in units of 15,000 pounds at a futures price of $0.851 per pound. The initial margin on the contract is set at $18,000, with a maintenance margin of $14,000. The futures prices are as follows:

Required:

a.Journalize the entries for Gensil Company for the first three days of the contract.

b.What is meant by the maintenance margin and how could it affect Gensil Company?

Required:

a.Journalize the entries for Gensil Company for the first three days of the contract.

b.What is meant by the maintenance margin and how could it affect Gensil Company?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

33

On August 1, an oil producer decided to hedge the fair value of its inventory by acquiring a futures contract to sell 100,000 barrels of oil on November 1 for $85.00 each. Price data follow:  What is the current period change in time value that would be recognized in earnings as of October 1?

What is the current period change in time value that would be recognized in earnings as of October 1?

A)$260,000

B)$110,000

C)$50,000

D)$60,000

What is the current period change in time value that would be recognized in earnings as of October 1?

What is the current period change in time value that would be recognized in earnings as of October 1?A)$260,000

B)$110,000

C)$50,000

D)$60,000

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

34

Under special accounting treatment for cash flow hedge of a forecasted transaction, the relationship between the change in value of a derivative instrument and the change in value of the forecasted transaction affects the amount of gain(loss) that should be in Other Comprehensive Income (OCI). If the amount of gain on derivatives that is classified as OCI is $17,500 and the cumulative loss on the remaining forecasted transaction is ($13,200), the amount of OCI to be reclassified as a component of current earnings is

A)$4,300.

B)$13,200.

C)$17,500.

D)not applicable.

A)$4,300.

B)$13,200.

C)$17,500.

D)not applicable.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

35

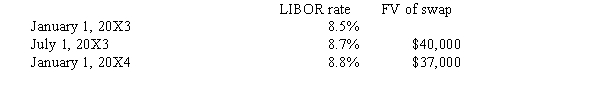

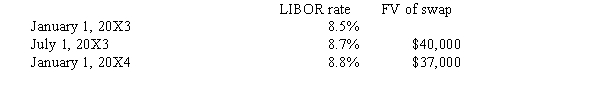

On January 1, 20X3, Shuey Company borrowed $1,000,000 at a variable rate based on LIBOR + 1.5% for 10 years with interest payable semi-annually. Shuey anticipates that interest rates will rise and has also arranged to receive a variable rate based on LIBOR + 1.5% in exchange for the payment of a 10% rate of interest. LIBOR rates were as follows on the reset dates:  How much interest expense is recognized for the six months ended December 31, 20X3?

How much interest expense is recognized for the six months ended December 31, 20X3?

A)$51,500

B)$50,000

C)$51,000

D)$51,200

How much interest expense is recognized for the six months ended December 31, 20X3?

How much interest expense is recognized for the six months ended December 31, 20X3?A)$51,500

B)$50,000

C)$51,000

D)$51,200

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

36

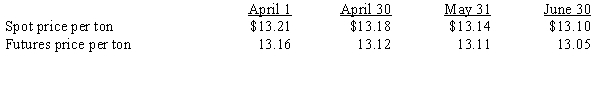

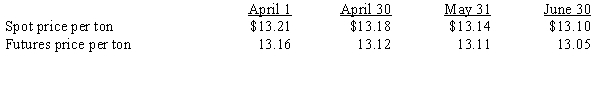

During the second quarter of 20X5, Bertke Company entered into a futures contract that calls for the sale of 2,500 tons of soybean meal in July at a future price of $13.26 per ton. Bertke Company designated the contract as a hedge on a forecasted sale of soybean meal. The changed in the time value of the futures contract is excluded from the assessment of hedge effectiveness. The information regarding the contract and soybean meal is as follows:

Required:

Prepare a schedule to show the effect of this hedge on current earnings of Bertke Company.

Required:

Prepare a schedule to show the effect of this hedge on current earnings of Bertke Company.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

37

A swap

A)is not traded on an organized exchange and is customized to meet the needs of the parties.

B)is not traded on an organized exchange and is subject to formal regulations which results in standardized contrasts

C)is traded on an organized exchange and is subject to formal regulations which results in standardized contrasts.

D)is traded on an organized exchange and is customized to meet the needs of the parties.

A)is not traded on an organized exchange and is customized to meet the needs of the parties.

B)is not traded on an organized exchange and is subject to formal regulations which results in standardized contrasts

C)is traded on an organized exchange and is subject to formal regulations which results in standardized contrasts.

D)is traded on an organized exchange and is customized to meet the needs of the parties.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

38

On January 1, 20X3, Shuey Company borrowed $1,000,000 at the fixed rate of 10% for 10 years with interest payable semi-annually. Shuey anticipates that interest rates will fall and has also arranged to receive a 10% rate of interest in exchange for the payment of variable rates based on LIBOR + 1.5%. LIBOR rates were as follows on the reset dates:  How much interest expense is recognized for the six months ended December 31, 20X3?

How much interest expense is recognized for the six months ended December 31, 20X3?

A)$49,000

B)$50,000

C)$41,900

D)$48,500

How much interest expense is recognized for the six months ended December 31, 20X3?

How much interest expense is recognized for the six months ended December 31, 20X3?A)$49,000

B)$50,000

C)$41,900

D)$48,500

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

39

A fair value hedge may be used for all of the following except:

A)a purchase order.

B)inventory of corn.

C)long-term debt.

D)anticipated sales of aluminum.

A)a purchase order.

B)inventory of corn.

C)long-term debt.

D)anticipated sales of aluminum.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

40

In order for a fair value hedge to receive special accounting treatment, the

A)derivative instrument must be held until it expires or is exercised.

B)criteria necessary for special accounting treatment must only be met at the inception of the hedge.

C)entity may designate the derivative instrument as a fair value hedge when it is determined the hedge is effective.

D)hedging relationship must be considered highly effective.

A)derivative instrument must be held until it expires or is exercised.

B)criteria necessary for special accounting treatment must only be met at the inception of the hedge.

C)entity may designate the derivative instrument as a fair value hedge when it is determined the hedge is effective.

D)hedging relationship must be considered highly effective.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

41

Identify the various types of information that should be included in disclosures regarding derivative instruments and hedging.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

42

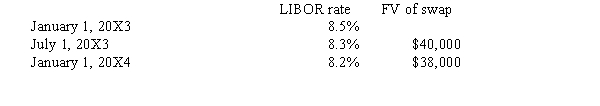

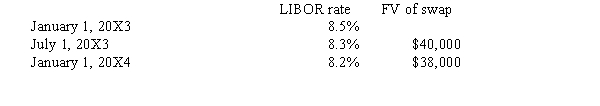

On July 1, 20X1, Littleton Inc. loaned a key supplier of raw material $2,000,000 to construct a new processing facility. The loan is due on July 1, 20X3 and pays interest each December 31 and June 30. The supplier insisted on a variable rate loan. Charles Upton, controller of Littleton Inc., wants to avoid the risk of variable interest rate fluctuations. As a result, Littleton Inc. entered into an interest rate swap in which it will pay the variable rate on $2,000,000 in exchange for a fixed interest rate of 8.3%. The swap is settled on the interest payment dates. Variable interest rates and the value of the swap on selected dates are as follows:

Required:

Prepare all entries to record this hedge through December 31, 20X1.

Required:

Prepare all entries to record this hedge through December 31, 20X1.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

43

Explain how a derivative instrument may be used to reduce or avoid the exposure to risk associated with other transactions.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

44

On January 3, 20X4, Realto Company issued a $5,400,000, 3-year note payable with a fixed interest rate of 8% payable semiannually. By the end of June 20X5, Realto's controller, believed that interest rate would fall over the next year. On July 3, 20X5, Realto Company entered into an interest rate swap with the First Columbia Bank. The bank required a premium of $10,400. The swap had a notional amount of $5,400,000 and called for the payment of a variable interest rate in exchange for the 8% fixed rate. The variable rates are reset semiannually beginning on July 1, 20X5, in order to determine the next interest payment. Differences between rates on the swap will be settled on a semiannual basis. Variable interest rates and the value of the swap on selected dates are as follows:

Required:

For December 31, 20X5, determine:

a.The net interest expense.

b.The carrying value of the note payable.

Required:

For December 31, 20X5, determine:

a.The net interest expense.

b.The carrying value of the note payable.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

45

Jensen Company forecasts a need for 200,000 pounds of cotton in May. On April 11, the company acquires a call option to buy 200,000 pounds of cotton in May at a strike price of $0.3765 per pound for a premium of $814. Spot prices and options values at selected dates follow:

Jensen Company settled the option on May 3 and purchased 200,000 pounds of cotton on May 17 at a spot price of $0.3840 per pound. During the last half of May and the beginning of June the cotton was used to produce cloth. One third of the cloth was sold in June. The change in the option's time value is excluded from the assessment of hedge effectiveness.

Required:

a.Prepare all journal entries necessary through June to record the above transactions and events.

b.What would the effect on earnings have been if the forecasted purchase were not hedged?

Jensen Company settled the option on May 3 and purchased 200,000 pounds of cotton on May 17 at a spot price of $0.3840 per pound. During the last half of May and the beginning of June the cotton was used to produce cloth. One third of the cloth was sold in June. The change in the option's time value is excluded from the assessment of hedge effectiveness.

Required:

a.Prepare all journal entries necessary through June to record the above transactions and events.

b.What would the effect on earnings have been if the forecasted purchase were not hedged?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck