Deck 17: Financial Reporting Issues

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/29

Play

Full screen (f)

Deck 17: Financial Reporting Issues

1

The GASB Statement No. 34 reporting model includes, but is not limited to which of the following reports?

A)Government-wide financial statements

B)a management discussion and analysis section

C)funds based financial statements

D)all of the above

A)Government-wide financial statements

B)a management discussion and analysis section

C)funds based financial statements

D)all of the above

D

A complete set of general purpose financial statements include:

1) Management's discussion and analysis statement

2) Separate fund financial statements for governmental, proprietary and fiduciary funds

3) Government-wide financial statements presenting the entire government

4) Notes to financial statements

5) Required supplementary information

A complete set of general purpose financial statements include:

1) Management's discussion and analysis statement

2) Separate fund financial statements for governmental, proprietary and fiduciary funds

3) Government-wide financial statements presenting the entire government

4) Notes to financial statements

5) Required supplementary information

2

Which of the following could be considered a component unit of a primary government unit?

A)water utility enterprise

B)chamber of commerce

C)pension plan

D)affiliated booster club

A)water utility enterprise

B)chamber of commerce

C)pension plan

D)affiliated booster club

C

A component unit is a legally separate organization for which the elected officials of the primary government are financially accountable or for which the nature and significance of the relationship with the primary government is such that exclusion would cause the financial statements of the primary government to be misleading or incomplete. Examples include authorities, commissions, boards, pension plans, development corporation, hospitals and school districts.

A component unit is a legally separate organization for which the elected officials of the primary government are financially accountable or for which the nature and significance of the relationship with the primary government is such that exclusion would cause the financial statements of the primary government to be misleading or incomplete. Examples include authorities, commissions, boards, pension plans, development corporation, hospitals and school districts.

3

Which of the following statements relating to the requirements for financial reporting is not true?

A)General purpose financial statements include the notes to the financial statements

B)General purpose financial statements provide the minimum financial reporting necessary for fair representation of government activity

C)General purpose financial statements are part of the financial section of a comprehensive annual financial report

D)General purpose financial statements are part of required supplementary information

A)General purpose financial statements include the notes to the financial statements

B)General purpose financial statements provide the minimum financial reporting necessary for fair representation of government activity

C)General purpose financial statements are part of the financial section of a comprehensive annual financial report

D)General purpose financial statements are part of required supplementary information

D

The supplementary information is a required part of the general purpose financial statements.

The supplementary information is a required part of the general purpose financial statements.

4

In order to convert the governmental fund statement of revenues, expenditures, and changes in fund balances to a government wide statement of activities, which of the following activities is necessary?

1)Eliminate capital outlay expenditures

2)Reclassify revenues between program revenues and general revenues

3)Record bad debt expenses

4)Convert revenues from the economic flow of resources accrual basis to the current financial resources modified accrual basis

A)1, 3, 4

B)1, 2, 3

C)1, 2, 3, 4

D)1, 2, 4

1)Eliminate capital outlay expenditures

2)Reclassify revenues between program revenues and general revenues

3)Record bad debt expenses

4)Convert revenues from the economic flow of resources accrual basis to the current financial resources modified accrual basis

A)1, 3, 4

B)1, 2, 3

C)1, 2, 3, 4

D)1, 2, 4

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

5

The most common difference between funds-based and government-wide financial statements is

A)government-wide statements of activities show operating data by function

B)government-wide statements of activities use a format that differs from proprietary funds statements of revenues

C)interfund payables and receivables must be eliminated in the preparation of the statement of activities

D)all of the above

A)government-wide statements of activities show operating data by function

B)government-wide statements of activities use a format that differs from proprietary funds statements of revenues

C)interfund payables and receivables must be eliminated in the preparation of the statement of activities

D)all of the above

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

6

Converting the governmental fund balance sheet to a government-wide statement of net assets requires which of the following activities?

1)Add general fixed assets, net of accumulated depreciation

2)Add general long-term debt, using the effective interest method

3)Eliminate the assets and liabilities of most internal service funds (those whose primary customer is the general government)

4)Eliminate the fund balance and classify the net assets into invested in capital assets, restricted net assets, and unrestricted net assets

A)1, 2, 3, 4

B)1, 3

C)1, 2, 4

D)3, 4

1)Add general fixed assets, net of accumulated depreciation

2)Add general long-term debt, using the effective interest method

3)Eliminate the assets and liabilities of most internal service funds (those whose primary customer is the general government)

4)Eliminate the fund balance and classify the net assets into invested in capital assets, restricted net assets, and unrestricted net assets

A)1, 2, 3, 4

B)1, 3

C)1, 2, 4

D)3, 4

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

7

The purpose of the Management Discussion and Analysis section is

A)to give a concise overview and analysis of the financial statements

B)to provide detailed cost information relating to providing services to citizens

C)pension cost calculations for the governmental unit

D)detailed information about short term spending and fiscal compliance

A)to give a concise overview and analysis of the financial statements

B)to provide detailed cost information relating to providing services to citizens

C)pension cost calculations for the governmental unit

D)detailed information about short term spending and fiscal compliance

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

8

GASB Statement No. 34 requirements for the reporting for general fixed assets include

A)the use of account groups

B)reporting general fixed assets as a major fund

C)general fixed assets will be included only in the government wide financial statements

D)report general fixed assets as a component unit

A)the use of account groups

B)reporting general fixed assets as a major fund

C)general fixed assets will be included only in the government wide financial statements

D)report general fixed assets as a component unit

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

9

Major funds are described as

A)the general fund and enterprise funds

B)at least 5% of all government and enterprise funds combined

C)those in which assets, liabilities, revenues, or expenditures are at least 10% of all funds in that type.

D)all of the above

A)the general fund and enterprise funds

B)at least 5% of all government and enterprise funds combined

C)those in which assets, liabilities, revenues, or expenditures are at least 10% of all funds in that type.

D)all of the above

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

10

Required supplementary information includes all of the following except for:

A)A budgetary comparison statement or schedule

B)Management discussion and analysis

C)pension related information

D)information about the condition of infrastructure assets

A)A budgetary comparison statement or schedule

B)Management discussion and analysis

C)pension related information

D)information about the condition of infrastructure assets

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

11

When operations of component units of government are blended with the primary government unit, they are reported by

A)a separate column on the General Purpose Financial Statements of the primary governmental unit

B)a disclosure in a footnote to the primary government unit General Purpose Financial Statements

C)Not reported or disclosed separately from the primary governmental unit

D)a separate set of general purpose financial statements

A)a separate column on the General Purpose Financial Statements of the primary governmental unit

B)a disclosure in a footnote to the primary government unit General Purpose Financial Statements

C)Not reported or disclosed separately from the primary governmental unit

D)a separate set of general purpose financial statements

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is not a classification of the net asset accounts of a proprietary fund?

A)Invested in capital assets, net of related debt

B)Restricted both externally and internally

C)Encumbrances

D)Unrestricted

A)Invested in capital assets, net of related debt

B)Restricted both externally and internally

C)Encumbrances

D)Unrestricted

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

13

Reciprocal interfund activities include all but which of the following?

A)interfund loans

B)interfund services between government and proprietary funds

C)advances to/from other funds

D)interfund reimbursements

A)interfund loans

B)interfund services between government and proprietary funds

C)advances to/from other funds

D)interfund reimbursements

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is/are reporting requirements in funds-based statements under GASB Statement No.34?

A)the statements highlight major funds and aggregate non major funds into one column

B)provide detailed information about short term spending and fiscal compliance

C)separate funds based statements are required for governmental, proprietary, and fiduciary funds

D)All of the above

A)the statements highlight major funds and aggregate non major funds into one column

B)provide detailed information about short term spending and fiscal compliance

C)separate funds based statements are required for governmental, proprietary, and fiduciary funds

D)All of the above

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

15

GASB Statement No.34 requires the reporting for infrastructure assets. Special provisions for reporting include

A)mandatory straight line depreciation on all infrastructure assets

B)depreciation should not be recorded on any infrastructure assets

C)small government units do not have to report on infrastructure assets now or in the future

D)allowing various approaches to estimating infrastructure costs

A)mandatory straight line depreciation on all infrastructure assets

B)depreciation should not be recorded on any infrastructure assets

C)small government units do not have to report on infrastructure assets now or in the future

D)allowing various approaches to estimating infrastructure costs

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

16

GASB Statement No. 34 requires the reporting for internal service funds by

A)combining income statement results with general fund activities

B)requiring internal service funds to be reported separately as major funds

C)classifying internal service funds as proprietary funds, labeled as government activities

D)All of the above

A)combining income statement results with general fund activities

B)requiring internal service funds to be reported separately as major funds

C)classifying internal service funds as proprietary funds, labeled as government activities

D)All of the above

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

17

Key characteristics of the statement of net assets include all of the following except:

A)general long-term liabilities at face value only

B)all capital assets

C)depreciation on capital assets except for certain infrastructure exceptions

D)interfund payables and receivables between governmental funds are eliminated

A)general long-term liabilities at face value only

B)all capital assets

C)depreciation on capital assets except for certain infrastructure exceptions

D)interfund payables and receivables between governmental funds are eliminated

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

18

Under the requirements for a Statement of Cash Flow, what sections must be included in the statement?

1)Operating cash flows

2)Cash Flows from noncapital financing

3)Capital and related financing cash flows

4)Investing cash flows

A)1, 2, 4, and interfund transfers in

B)1, 2, 3, 4

C)2, 3, 4, and cash receipts from taxes

D)1, 2, 3, and cash receipts from taxes

1)Operating cash flows

2)Cash Flows from noncapital financing

3)Capital and related financing cash flows

4)Investing cash flows

A)1, 2, 4, and interfund transfers in

B)1, 2, 3, 4

C)2, 3, 4, and cash receipts from taxes

D)1, 2, 3, and cash receipts from taxes

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

19

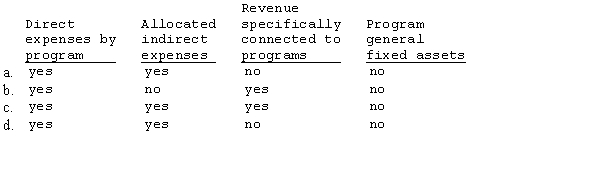

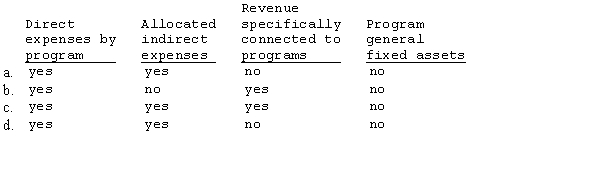

Which of the following combination of items reported is included on the statement of activities?

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following were innovations in financial reporting introduced by GASB Statement No. 34?

A)An introductory narrative section

B)An overall view of the government in government wide statements

C)Comprehensive information about the cost of delivering services to citizens

D)all of the above

A)An introductory narrative section

B)An overall view of the government in government wide statements

C)Comprehensive information about the cost of delivering services to citizens

D)all of the above

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

21

Governmental entities are required to present fund financial statements for the governmental funds based on the modified accrual basis of accounting and government-wide financial statements where all funds, included the governmental funds, are presented using the accrual basis of accounting. Explain the required reconciliations and describe the major reconciling items.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

22

The Single Audit Act requires that a governmental unit have a single audit if they

A)receive any Federal Funds even on a pass-through basis.

B)are not in compliance with the Federal grant conditions.

C)receive more than $300,000 in Federal funds annually.

D)only receive one Federal grant.

A)receive any Federal Funds even on a pass-through basis.

B)are not in compliance with the Federal grant conditions.

C)receive more than $300,000 in Federal funds annually.

D)only receive one Federal grant.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

23

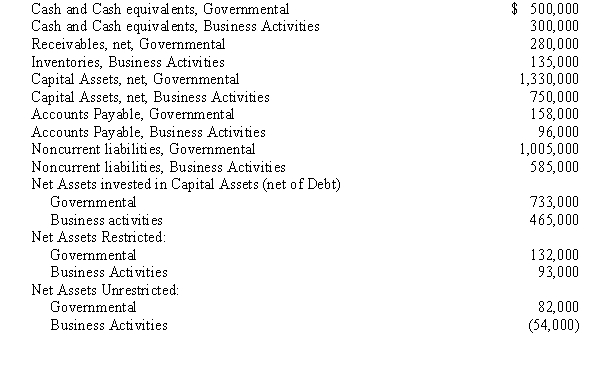

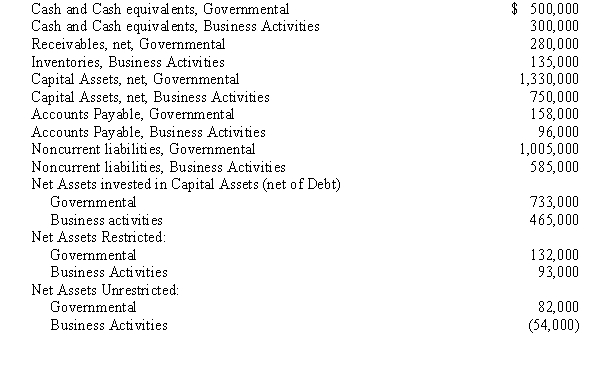

From the following information, prepare a statement of net assets for the city of Franklin as of June 30, 20X3:

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

24

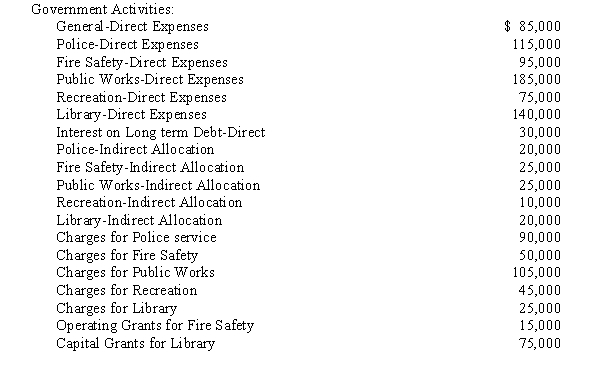

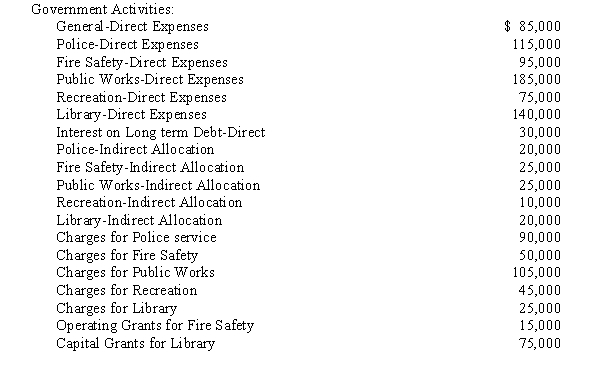

The City of Terrytown reports the following information:

There are no business type activities for this city or other component units. Taxes raised for general revenues equal $200,000 and taxes raised for debt service equal $25,000. Other general revenues were generated through fines, fees, and permits that total $100,000. The city also sold a plot of land for a gain of $10,000. The beginning of the year net assets totaled $155,000.

Required:

Prepare a statement of activities schedule for the city.

There are no business type activities for this city or other component units. Taxes raised for general revenues equal $200,000 and taxes raised for debt service equal $25,000. Other general revenues were generated through fines, fees, and permits that total $100,000. The city also sold a plot of land for a gain of $10,000. The beginning of the year net assets totaled $155,000.

Required:

Prepare a statement of activities schedule for the city.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

25

GASB Statement No. 34 requires a separate set of financial statements for each of the three categories of funds. Prepare an analysis of the basic types of fund categories, what the measurement focus is and the basis of accounting, and which basic financial statements are needed.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

26

Briefly discuss the minimum requirements of the Management Discussion and Analysis section in the comprehensive annual financial report.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

27

Audit reports prepared under the Single Audit Act include which of the following?

A)a report on compliance with laws and regulations

B)a report on the study of the internal control systems

C)an opinion on the fairness of financial statement presentation

D)all of the above

A)a report on compliance with laws and regulations

B)a report on the study of the internal control systems

C)an opinion on the fairness of financial statement presentation

D)all of the above

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following is not a purpose of the financial audit that accompanies statements?

A)ensuring compliance with fiscal requirements

B)render an opinion about whether the statements present fairly the financial position, results of operation, and cash flows of the government

C)to comment on the economy, efficiency or program results of a governmental unit

D)statements have been prepared in accordance with GAAP, GASB, and state, municipal, and federal laws

A)ensuring compliance with fiscal requirements

B)render an opinion about whether the statements present fairly the financial position, results of operation, and cash flows of the government

C)to comment on the economy, efficiency or program results of a governmental unit

D)statements have been prepared in accordance with GAAP, GASB, and state, municipal, and federal laws

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is not a category included in the statistical section of government's audit report?

A)Revenue capacity information.

B)Asset capacity information.

C)Demographic and economic information.

D)Financial trends information.

A)Revenue capacity information.

B)Asset capacity information.

C)Demographic and economic information.

D)Financial trends information.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck