Deck 11: Investment, Strategy, and Economic Rents

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/70

Play

Full screen (f)

Deck 11: Investment, Strategy, and Economic Rents

1

When you are using futures prices to estimate the cash flows of a project the discount rate used is:

I. The cost of capital for the firm

II. The cost of capital for the project

III. The risk free rate

A) I only

B) I and II only

C) III only

D) II only

I. The cost of capital for the firm

II. The cost of capital for the project

III. The risk free rate

A) I only

B) I and II only

C) III only

D) II only

III only

2

Use of certainty-equivalent cash flows is advantageous in the following ways:

I. there is no need to estimate future prices

II. there is no need to estimate the discount rate

III. there may be large errors introduced because prices in a competitive market fluctuate randomly

A) I only

B) II only

C) I and II only

D) I, II and III

I. there is no need to estimate future prices

II. there is no need to estimate the discount rate

III. there may be large errors introduced because prices in a competitive market fluctuate randomly

A) I only

B) II only

C) I and II only

D) I, II and III

I and II only

3

Suppose the current price of gold is $600 per ounce. The price of gold is expected to grow at 4% per year for the foreseeable future. If the appropriate discount rate is 10%, then the current value of gold per ounce is:

A) Less than $600 per ounce

B) $600 per ounce

C) Greater than $600 per ounce

D) Not enough information

A) Less than $600 per ounce

B) $600 per ounce

C) Greater than $600 per ounce

D) Not enough information

$600 per ounce

4

Suppose the current price of gold is $650 per ounce. The price of gold is expected to grow at 5 % per year for foreseeable future. If the appropriate discount rate is 8%, the present value of gold is:

A) Less than $650 per ounce

B) Greater than $650 per ounce

C) $650 per ounce

D) None of the above

A) Less than $650 per ounce

B) Greater than $650 per ounce

C) $650 per ounce

D) None of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

5

The following are some of the competitive advantages that can last longer:

I. patents

II. brand names

III. economies of scale

A) I only

B) II only

C) I and II only

D) I, II and III

I. patents

II. brand names

III. economies of scale

A) I only

B) II only

C) I and II only

D) I, II and III

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

6

When futures prices are used to estimate cash flows, the estimates are:

I. Present value of future cash flows

II. Certainty equivalents

III. Same as the estimates using spot prices

A) I only

B) II only

C) III only

D) I and III only

I. Present value of future cash flows

II. Certainty equivalents

III. Same as the estimates using spot prices

A) I only

B) II only

C) III only

D) I and III only

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

7

A new grocery store cost $50 million in initial investment. It is estimated that the store will generate $5 million after-tax cash flow each year for five years. At the end of 5 years it can be sold for $60 million. What is the NPV of the project at a discount rate of 10%?

A) $2.42 million

B) $10 million

C) $6.21 million

D) None of the above

A) $2.42 million

B) $10 million

C) $6.21 million

D) None of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

8

Investing in gold is like:

I. Investing in a stock that pays quarterly dividends

II. Investing in a stock that pays annual dividends

III. Investing in Treasury bonds

IV. Investing in a stock that pays no dividends

A) I only

B) II only

C) I,II, and III only

D) IV only

I. Investing in a stock that pays quarterly dividends

II. Investing in a stock that pays annual dividends

III. Investing in Treasury bonds

IV. Investing in a stock that pays no dividends

A) I only

B) II only

C) I,II, and III only

D) IV only

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

9

A building is appraised at $1 million. This estimate is based on a forecast of net rent of

$100,000 per year discounted at 10% [PV = 100,000/ 0.1 = 1,000,000]. The rent is the net of repair and maintenance costs and taxes. Suppose the building is currently in disrepair and it takes one year and $250,000 to bring it into rent able condition. How much would you be willing to pay for the building today?

A) $1,000,000

B) $681,818

C) $750,000

D) None of the above

$100,000 per year discounted at 10% [PV = 100,000/ 0.1 = 1,000,000]. The rent is the net of repair and maintenance costs and taxes. Suppose the building is currently in disrepair and it takes one year and $250,000 to bring it into rent able condition. How much would you be willing to pay for the building today?

A) $1,000,000

B) $681,818

C) $750,000

D) None of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

10

A rental property is providing 13% rate of return. Next year's rent is expected to be $1.0 million and is expected to grow at 3% per year forever. What is the current value of the property?

A) $7.7 million

B) $10 million

C) $33.3 million

D) none of the above

A) $7.7 million

B) $10 million

C) $33.3 million

D) none of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

11

The formula Po = Pt/((1 + r)^t) holds good for assets which:

I. Pay no dividends

II. Are traded in a competitive market

III. Cost nothing to hold

A) I only

B) I and II only

C) I,II, and III

D) II and III only

I. Pay no dividends

II. Are traded in a competitive market

III. Cost nothing to hold

A) I only

B) I and II only

C) I,II, and III

D) II and III only

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

12

Goldsmith labs recover gold from printed circuit boards. It has developed new equipment for the purpose. The following data is given.

(1)) Equipment costs $250,000

(2)) It will cost $200,000 per year to run

(3)) It has an economic life of 5 years and is depreciated using straight-line method

(4)) It will recover 300 ounces of gold per year

(5)) The current price of gold is $600 per ounce and it expected to increase at a rate 4% per year for the foreseeable future

(6)) The tax rate is 30%

(7)) The cost of capital is 8% What is NPV of the equipment?

A) $430,400

B) $520,510

C) $470,400

D) None of the above

(1)) Equipment costs $250,000

(2)) It will cost $200,000 per year to run

(3)) It has an economic life of 5 years and is depreciated using straight-line method

(4)) It will recover 300 ounces of gold per year

(5)) The current price of gold is $600 per ounce and it expected to increase at a rate 4% per year for the foreseeable future

(6)) The tax rate is 30%

(7)) The cost of capital is 8% What is NPV of the equipment?

A) $430,400

B) $520,510

C) $470,400

D) None of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

13

A new grocery store cost $50 million in initial investment. It is estimated that the store will generate $5 million after-tax cash flow each year for five years. At the end of 5 years it can be sold for $55 million. What is the NPV of the project at a discount rate of 10%?

A) $2.42 million

B) $5 million

C) $3.1 million

D) None of the above

A) $2.42 million

B) $5 million

C) $3.1 million

D) None of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

14

Economic rents are:

A) Returns that are in excess of the opportunity cost of capital

B) Returns that are equal to the opportunity cost of the capital

C) Returns that are less than the opportunity cost of capital

D) None of the above

A) Returns that are in excess of the opportunity cost of capital

B) Returns that are equal to the opportunity cost of the capital

C) Returns that are less than the opportunity cost of capital

D) None of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is an example of a strategic asset?

A) trucks

B) diesel engine

C) rail road containers

D) rail road lines

A) trucks

B) diesel engine

C) rail road containers

D) rail road lines

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

16

The following are some of the competitive advantages that can last longer:

I. proprietary technology

II. protected markets with high barriers to entry by other firms

III. strategic assets that competitors cannot easily duplicate

A) I only

B) II only

C) I and II only

D) I, II and III

I. proprietary technology

II. protected markets with high barriers to entry by other firms

III. strategic assets that competitors cannot easily duplicate

A) I only

B) II only

C) I and II only

D) I, II and III

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

17

The present value of risky cash flows is calculated as follows:

I. estimate the expected cash flows and discount these at a rate that is consistent with the risk of the cash flows

II. estimate the certainty-equivalent cash flows and discount these at the risk-free rate

III. estimate the expected cash flows and discount these at the risk-free rate

A) I only

B) II only

C) I and II only

D) III only

I. estimate the expected cash flows and discount these at a rate that is consistent with the risk of the cash flows

II. estimate the certainty-equivalent cash flows and discount these at the risk-free rate

III. estimate the expected cash flows and discount these at the risk-free rate

A) I only

B) II only

C) I and II only

D) III only

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

18

One way to uncover forecasting errors in NPV estimates is by looking at:

I. Book values

II. Liquidating values

III. Market values

A) I only

B) II only

C) III only

D) I and II only

I. Book values

II. Liquidating values

III. Market values

A) I only

B) II only

C) III only

D) I and II only

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

19

USGOLD Company has an opportunity to invest in a gold mine. The initial investment is

$250 million. The mine is estimated to produce 100,000 ounces of gold per year for the next ten years. The extraction cost of gold per ounce is $150 and it is expected to remain at that level. The current price of gold is $600 per ounce and it is expected to increase by 4% per year for the next 10 years. What is the NPV of the project at a discount rate of 10%? (Ignore taxes.)

A) $ - 3.8 million.

B) $240.8 million.

C) $257.8 million.

D) None of the above.

$250 million. The mine is estimated to produce 100,000 ounces of gold per year for the next ten years. The extraction cost of gold per ounce is $150 and it is expected to remain at that level. The current price of gold is $600 per ounce and it is expected to increase by 4% per year for the next 10 years. What is the NPV of the project at a discount rate of 10%? (Ignore taxes.)

A) $ - 3.8 million.

B) $240.8 million.

C) $257.8 million.

D) None of the above.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

20

Suppose the current price of gold is $600 per ounce and the price of gold is expected to increase at a rate of 5% per year for the foreseeable future. What is the current value of 0.2 million ounces of gold to be produced each year for the next five years (the discount rate is

8% per year)?

A) $600 million

B) $521.64 million

C) $690.86 million

D) None of the above

8% per year)?

A) $600 million

B) $521.64 million

C) $690.86 million

D) None of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

21

The manufacture of folic acid is a competitive business. A new plant costs $100,000 and lasts for three years. The cash flow from the plant is as follows: Year-1: +43,300, Year-2:

$43,300 and Year-3 = 58,300. (Assume there is no tax.) If the salvage value at the end of year-2 is $60,000, would you scrap the plant at the end of year-2?

A) Yes

B) No

C) Don't know

D) Need more information

$43,300 and Year-3 = 58,300. (Assume there is no tax.) If the salvage value at the end of year-2 is $60,000, would you scrap the plant at the end of year-2?

A) Yes

B) No

C) Don't know

D) Need more information

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

22

The annual demand (in millions) for golf balls is given by the equation: Demand = 6 * (5- price). If the price of a golf ball is $3, what is the demand for golf balls?

A) 8 million

B) 12 million

C) 18 million

D) None of the above

A) 8 million

B) 12 million

C) 18 million

D) None of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

23

A positive NPV for a new project is reliable only if it is based on:

A) forecast of cash flows

B) Michael Porter's theories

C) identifiable sources of economic rents

D) none of the above

A) forecast of cash flows

B) Michael Porter's theories

C) identifiable sources of economic rents

D) none of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

24

You have inherited 100 acres of Iowa farmland. There is an active market in this type of land and other similar properties are selling for $10,000 per acre. If planted with corn, the net cash flows are expected to be $800 per acre forever. If the discount rate is 10%, how much is the land worth per acre?

A) $10,000

B) $8,000

C) $18,000

D) None of the above

A) $10,000

B) $8,000

C) $18,000

D) None of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

25

NPVs can be thought of as the present value of:

A) economic rents

B) profits

C) revenues

D) none of the above

A) economic rents

B) profits

C) revenues

D) none of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

26

The manufacture of herbal health tonic is a competitive industry. The manufacturing facilities have an annual output of 100,000 gallons. Operating costs are $2 per gallon. A

100,000 gallon capacity plant costs $500,000 to build and have an indefinite life, with no salvage value. The cost of capital is 20% (assume no taxes). Your company has discovered a new process that lowers the operating cost per gallon to $1.00. Assuming that the competition will catch up in three years and the market demand is sufficiently high, what is the net present value of building a new plant with new technology?

A) $500,000

B) $210,648

C) +$250,000

D) None of the above

100,000 gallon capacity plant costs $500,000 to build and have an indefinite life, with no salvage value. The cost of capital is 20% (assume no taxes). Your company has discovered a new process that lowers the operating cost per gallon to $1.00. Assuming that the competition will catch up in three years and the market demand is sufficiently high, what is the net present value of building a new plant with new technology?

A) $500,000

B) $210,648

C) +$250,000

D) None of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

27

The strategy of deliberately slowing down the rate at which new products are introduced by well established and technologically advanced firms is:

A) a good strategy that maximizes economic rents

B) a dangerous strategy as it provides opportunities for other firms to introduce new products

C) a good strategy because firms only have a limited number of good projects

D) all of the above

A) a good strategy that maximizes economic rents

B) a dangerous strategy as it provides opportunities for other firms to introduce new products

C) a good strategy because firms only have a limited number of good projects

D) all of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

28

The manufacture of herbal health tonic is a competitive industry. The manufacturing facilities have an annual output of 100,000 gallons. Operating costs are $2 per gallon. A

100,000 gallon capacity plant costs $500,000 to build and have an indefinite life, with no salvage value. The cost of capital is 20% (assume no taxes). Your company has discovered a new process that lowers the operating cost per gallon to $1.50. Assuming that the competition will never catch up and the market demand is sufficiently high, what is the net present value

Of building a new plant with new technology?

A) Zero

B) +$500,000

C) +$250,000

D) +$50,000

100,000 gallon capacity plant costs $500,000 to build and have an indefinite life, with no salvage value. The cost of capital is 20% (assume no taxes). Your company has discovered a new process that lowers the operating cost per gallon to $1.50. Assuming that the competition will never catch up and the market demand is sufficiently high, what is the net present value

Of building a new plant with new technology?

A) Zero

B) +$500,000

C) +$250,000

D) +$50,000

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

29

The annual demand (in millions) for baseballs is given by the equation: Demand = 10 * (4-price). If the price of baseballs is $1.50, what is the demand for baseballs?

A) 10 million

B) 15 million

C) 25 million

D) None of the above

A) 10 million

B) 15 million

C) 25 million

D) None of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

30

The manufacture of folic acid is a competitive business. A new plant costs $100,000 and lasts for three years. The cash flow from the plant is as follows: Year-1: +43,300, Year-2:

$43,300 and Year-3 = 58,300. (Assume there is no tax.) If the salvage value of the plant at the end of year-1 is $80,000, would you scrap the plant at the end of year-1?

A) Yes

B) No

C) Need more information

D) Don't know

$43,300 and Year-3 = 58,300. (Assume there is no tax.) If the salvage value of the plant at the end of year-1 is $80,000, would you scrap the plant at the end of year-1?

A) Yes

B) No

C) Need more information

D) Don't know

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

31

The manufacture of folic acid is a competitive business. A new plant costs $100,000 and lasts for three years. The cash flow from the plant is as follows: Year-1: +43,300, Year-2:

$43,300 and Year-3 = 58,300. (Assume there is no tax.) If the salvage value at the end of year-2 is $40,000, would you scrap the plant at the end of year-2?

A) Yes

B) No

C) Don't know

D) Need more information

$43,300 and Year-3 = 58,300. (Assume there is no tax.) If the salvage value at the end of year-2 is $40,000, would you scrap the plant at the end of year-2?

A) Yes

B) No

C) Don't know

D) Need more information

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

32

In order to better understand a proposed positive net present value project, managers should:

A) Recheck all calculations.

B) Assume there are no forecast errors.

C) Identify sources of economic rent.

D) Evaluate other similar projects the company has undertaken in the past.

A) Recheck all calculations.

B) Assume there are no forecast errors.

C) Identify sources of economic rent.

D) Evaluate other similar projects the company has undertaken in the past.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

33

The manufacture of herbal health tonic is a competitive industry. The manufacturing facilities have an annual output of 100,000 gallons. Operating costs are $2 per gallon. A

100,000 gallon capacity plant costs $500,000 to build and have an indefinite life, with no salvage value. The cost of capital is 20% (assume no taxes). Your company has discovered a new process that lowers the operating cost per gallon to $1.00. Assuming that the competition will catch up in five years and the market demand is sufficiently high, what is the net present value of building a new plant with new technology?

A) $500,000

B) $210,648

C) $299,061

D) None of the above

100,000 gallon capacity plant costs $500,000 to build and have an indefinite life, with no salvage value. The cost of capital is 20% (assume no taxes). Your company has discovered a new process that lowers the operating cost per gallon to $1.00. Assuming that the competition will catch up in five years and the market demand is sufficiently high, what is the net present value of building a new plant with new technology?

A) $500,000

B) $210,648

C) $299,061

D) None of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

34

You have inherited a run-down house in Chicago. There is an active market in properties of this type, and similar properties are selling for $100,000. If rented out, the cash returns are expected to be $12,000 per year forever. If the appropriate discount rate is 15%, how much is the house worth?

A) $80,000

B) $100,000

C) $180,000

D) None of the above

A) $80,000

B) $100,000

C) $180,000

D) None of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

35

The manufacture of folic acid is a competitive business. A new plant costs $100,000 and lasts for three years. The cash flow from the plant is as follows: Year-1: +43,300, Year-2:

$43,300 and Year-3 = 58,300. (Assume there is no tax.) If the salvage value of the plant at the end of year is $66,700, would you scrap the plant at the end of year one?

A) Yes

B) No

C) Depends on the net present value

D) Need more information

$43,300 and Year-3 = 58,300. (Assume there is no tax.) If the salvage value of the plant at the end of year is $66,700, would you scrap the plant at the end of year one?

A) Yes

B) No

C) Depends on the net present value

D) Need more information

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

36

The manufacture of folic acid is a competitive business. A new plant costs $100,000 and lasts for three years. The cash flow from the plant is as follows: Year-1: +43,300, Year-2:

$43,300 and Year-3 = 58,300. (Assume there is no tax.) If the discount rate is 20%, what is the value of the plant at the end of year-2?

A) $48,600

B) $-51,600

C) Zero

D) None of the above

$43,300 and Year-3 = 58,300. (Assume there is no tax.) If the discount rate is 20%, what is the value of the plant at the end of year-2?

A) $48,600

B) $-51,600

C) Zero

D) None of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

37

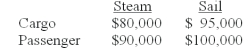

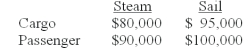

As a 19th century economist, you are faced with the following problem. The world's shipping fleet consists of steamships and sailing ships. Each can be used to carry cargo or passengers. The ships have similar sailing capacities but differ in their annual operating costs as follows:  Assume: (i) Fares are competitively determined, (ii) demand is not expected to change, (

Assume: (i) Fares are competitively determined, (ii) demand is not expected to change, (

III)

Each vessel has a life of 15 years, (

IV) current salvage value of either ship (sailing or steam) is

$114,091, and (v) Cost of capital is 10%, (

VI) no taxes. What is the annual revenue from a cargo ship? (Assume that salvage values are independent of use and there are no taxes.) If the cost of carrying cargo by sailing ship were $70,000 per year, what would be the present value of a steamship?

A) $114,091

B) $152,814

C) $215,000

D) None of the above

Assume: (i) Fares are competitively determined, (ii) demand is not expected to change, (

Assume: (i) Fares are competitively determined, (ii) demand is not expected to change, (III)

Each vessel has a life of 15 years, (

IV) current salvage value of either ship (sailing or steam) is

$114,091, and (v) Cost of capital is 10%, (

VI) no taxes. What is the annual revenue from a cargo ship? (Assume that salvage values are independent of use and there are no taxes.) If the cost of carrying cargo by sailing ship were $70,000 per year, what would be the present value of a steamship?

A) $114,091

B) $152,814

C) $215,000

D) None of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

38

The manufacture of folic acid is a competitive business. A new plant costs $100,000 and lasts for three years. The cash flow from the plant is as follows: Year-1: +43,300, Year-2:

$43,300 and Year-3 = 58,300. (Assume there is no tax.) If the discount rate is 20%, what is the value of the plant at the end of year-1?

A) $76,569

B) -23,400

C) 48,600

D) None of the above

$43,300 and Year-3 = 58,300. (Assume there is no tax.) If the discount rate is 20%, what is the value of the plant at the end of year-1?

A) $76,569

B) -23,400

C) 48,600

D) None of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

39

Allen Technology Company is currently valued at $400 million. It is proposing a new plant with a net present value of $200 million. But the new plant will reduce the value of the existing plant by $50 million. What is the value of the company if it takes up the new plant?

A) $600 million.

B) $200 million.

C) $550 million.

D) None of the above.

A) $600 million.

B) $200 million.

C) $550 million.

D) None of the above.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

40

When the markets become competitive, economic rents:

A) Increase

B) Decrease

C) Remain the same

D) Tend to be zero

A) Increase

B) Decrease

C) Remain the same

D) Tend to be zero

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

41

Price cutting in a competitive market will never lead to the creation of economic rents.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

42

Frequently the financial manager can observe market values for real assets e.g. real estate values, values of precious metals etc. However, they have no place in the capital budgeting analysis. For that purpose discounted cash flow is the only proper tool.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

43

What is the NPV of a project in a perfectly competitive environment?

A) Positive

B) Negative

C) Zero

D) Cannot be determined

A) Positive

B) Negative

C) Zero

D) Cannot be determined

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

44

Since gold is held as an investment but pays no cash dividends, today's price equals the present value of its forecasted future price.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

45

For a stock that pays no dividends, today's price is the present value of next year's price.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

46

Sometimes the losses on existing plants may completely offset the gains from new technology.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

47

In a highly competitive market, how will a firm most likely produce positive economic rents?

A) A new marketing plan that will gain market share from competitors

B) Renegotiation of financing terms with the firm's funding sources

C) The introduction of new technology that creates manufacturing efficiencies

D) All of the above

A) A new marketing plan that will gain market share from competitors

B) Renegotiation of financing terms with the firm's funding sources

C) The introduction of new technology that creates manufacturing efficiencies

D) All of the above

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

48

Briefly explain how investing in gold is like investing in a stock that pays no dividends?

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

49

In order to generate a positive NPV project, a firm must have competitive advantage.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

50

In a competitive market, a firm can earn high economic rents.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

51

According to Michael Porter, managers can secure a competitive advantage for their firm within its industry in three ways. They are: by cost leadership, by product differentiation, and by focusing on a particular market niche.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

52

The total NPV of a new plant is equal to the NPV of the new plant plus the change in the present value of the existing plant.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

53

If a firm expects long-run economic rents from a particular project, the company is considering the effects of competition.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

54

Briefly explain the concept of "economic rent."

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

55

The expected rise in the price of a mineral less extraction costs should equal the cost of capital.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

56

The cash forecasts for positive NPV projects are more reliable, if the managers of the firm are able to identify the economic rents associated with the projects.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

57

Stealing market share is the best way to create economic rents in a competitive market.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

58

The NPV of an investment is the discounted value of the economic rents that it is expected to produce.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

59

If an asset is worth more to others than it is to you, you should always attempt to buy it from them.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

60

In evaluating a project, it is necessary to consider its effect upon the sales of the firm's existing products.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

61

Why are economic rents important to a manager?

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

62

Briefly explain the two ways in which PVs of cash flows can be estimated.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

63

Briefly explain the effect of competition on economic rents

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

64

Explain the economic concept that prevents economic rents from occurring.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

65

Briefly explain the advantage and the disadvantage of a high salvage value for a project.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

66

Briefly explain the effect of building new manufacturing plants on the existing plants.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

67

State the difference between capital budgeting and strategic planning.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

68

What is the total net present value (NPV) of an expansion plan?

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

69

Briefly explain the main difference between the capital budgeting process and the strategic planning process.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

70

Discuss how you would react if you were presented with a project that had a high positive

NPV.

NPV.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck