Deck 1: Business Decisions and Financial Accounting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/135

Play

Full screen (f)

Deck 1: Business Decisions and Financial Accounting

1

Stockholders are creditors of a company.

False

2

For a new business, the beginning balance of Retained Earnings is zero.

True

3

The Securities and Exchange Commission (SEC) is the government agency that has jurisdiction over public companies in the United States.

True

4

In the United States, generally accepted accounting principles (GAAP) are established by the PCAOB (Public Company Accounting Oversight Board).

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

5

Accounts payable and accounts receivable are reported on the income statement.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

6

Daily activities involved in running a business such as buying supplies and paying wages are operating activities.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

7

Revenue is reported on the income statement only if cash was received at the point of sale.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

8

All corporations acquire financing by issuing shares of ownership (called stock certificates) for sale on public stock exchanges.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

9

The stockholders' equity of a company is the difference between assets and liabilities.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

10

You paid $10,000 to buy 1% of the stock in a corporation that has now gone bankrupt. The company owes

$10 million dollars to creditors. As a result of the bankruptcy, you will lose $100,000.

$10 million dollars to creditors. As a result of the bankruptcy, you will lose $100,000.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

11

A company owes $200,000 on a bank loan. If this loan is documented using a formal written debt contract, it will be reported as a liability called Notes Payable.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

12

The accounting decisions that were made when preparing a company's financial statements are explained in the auditor's report.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

13

Contributed Capital is an asset on the balance sheet.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

14

Building a new warehouse is an operating activity.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

15

The payment of dividends is a financing activity.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

16

Financing activities include borrowing money from a financial institution and obtaining money by issuing shares of ownership (called stock certificates).

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

17

Expenses are the costs incurred in doing business which are necessary to earn revenue.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

18

If a company reports net income on the income statement, then the statement of cash flows must show an increase in cash flows from operating activities for the period.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

19

Accounts payable, notes payable and wages payable are examples of liabilities.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

20

The Sarbanes-Oxley Act (SOX) requires top management of companies to sign a report certifying their responsibilities for financial statements.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

21

Financing that individuals or institutions have provided to a company is

A) always classified as liabilities.

B) classified as liabilities when provided by creditors and stockholders' equity when provided by owners.

C) always classified as equity.

D) classified as stockholders' equity when provided by creditors and liabilities when provided by owners.

A) always classified as liabilities.

B) classified as liabilities when provided by creditors and stockholders' equity when provided by owners.

C) always classified as equity.

D) classified as stockholders' equity when provided by creditors and liabilities when provided by owners.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

22

The separate entity assumption means:

A) a company's financial statements reflect only the business activities of that company.

B) each separate owner's finances must be revealed in the financial statements.

C) each separate entity that has a claim on a company's assets must be shown in the financial statements.

D) if the business is a sole proprietorship, the owners' personal activities are included in the company's financial statements.

A) a company's financial statements reflect only the business activities of that company.

B) each separate owner's finances must be revealed in the financial statements.

C) each separate entity that has a claim on a company's assets must be shown in the financial statements.

D) if the business is a sole proprietorship, the owners' personal activities are included in the company's financial statements.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

23

Cash flow from investing activities includes

A) money received from a company's stockholders for the sale of stock.

B) money received from the sale of the company's office building.

C) money paid for dividends to the company's stockholders.

D) money paid for salaries of employees.

A) money received from a company's stockholders for the sale of stock.

B) money received from the sale of the company's office building.

C) money paid for dividends to the company's stockholders.

D) money paid for salaries of employees.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

24

What is the missing amount for Notes Payable?

A) $207,100

B) $437,800

C) $1,439,200

D) $3,347,700

A) $207,100

B) $437,800

C) $1,439,200

D) $3,347,700

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

25

Financial statements are most commonly prepared:

A) semi-monthly.

B) monthly, quarterly and annually.

C) whenever management feels like it.

D) weekly.

A) semi-monthly.

B) monthly, quarterly and annually.

C) whenever management feels like it.

D) weekly.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following would not represent a financing activity?

A) Paying dividends to stockholders.

B) An investment of financial capital by the owners.

C) Borrowing money from a bank to finance the purchase of new equipment.

D) Collecting cash from customers.

A) Paying dividends to stockholders.

B) An investment of financial capital by the owners.

C) Borrowing money from a bank to finance the purchase of new equipment.

D) Collecting cash from customers.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

27

How many of the following statements regarding the balance sheet for Anonymous Inc. are true?

The $207,100 shown on the balance sheet has been distributed to stockholders as dividends.

Retained Earnings is misclassified. It should be reported as an Asset.

Anonymous, Inc., is owed $310,500 from customers who have purchased goods or services from the company, but have not yet paid for them.

A) None

B) One

C) Two

D) Three

The $207,100 shown on the balance sheet has been distributed to stockholders as dividends.

Retained Earnings is misclassified. It should be reported as an Asset.

Anonymous, Inc., is owed $310,500 from customers who have purchased goods or services from the company, but have not yet paid for them.

A) None

B) One

C) Two

D) Three

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

28

Creditors are:

A) people or organizations who owe money to a business.

B) people or organizations to whom a business owes money.

C) stockholders of a business.

D) customers of a business.

A) people or organizations who owe money to a business.

B) people or organizations to whom a business owes money.

C) stockholders of a business.

D) customers of a business.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is true?

A) Companies can choose to end their fiscal year on any date they feel is most relevant.

B) Companies must end their fiscal year on March 31, June 30, September 30, or December 31.

C) Companies can select any date except a holiday to end their fiscal year.

D) Companies must end their fiscal year on December 31.

A) Companies can choose to end their fiscal year on any date they feel is most relevant.

B) Companies must end their fiscal year on March 31, June 30, September 30, or December 31.

C) Companies can select any date except a holiday to end their fiscal year.

D) Companies must end their fiscal year on December 31.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

30

As of September 30, 2010, which source provided more financing for Anonymous, Inc.?

A) owners

B) creditors

C) both provided equal financing

D) neither provided any financing

A) owners

B) creditors

C) both provided equal financing

D) neither provided any financing

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

31

Accounting information systems:

A) are summarized by reports that are published to the public.

B) capture and report the results of a business's operating, investing, and financing activities.

C) monitor business activities only in financial terms.

D) capture only the information that is needed by the owners of the company.

A) are summarized by reports that are published to the public.

B) capture and report the results of a business's operating, investing, and financing activities.

C) monitor business activities only in financial terms.

D) capture only the information that is needed by the owners of the company.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following would represent an operating activity?

A) Purchasing equipment with money borrowed from creditors.

B) An investment of financial capital by the owners.

C) Buying the company's office supplies.

D) Repaying a loan the company had taken out.

A) Purchasing equipment with money borrowed from creditors.

B) An investment of financial capital by the owners.

C) Buying the company's office supplies.

D) Repaying a loan the company had taken out.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

33

What is the missing amount for Total Liabilities?

A) $3,347,700

B) $1,439,200

C) $1,470,700

D) $1,877,000

A) $3,347,700

B) $1,439,200

C) $1,470,700

D) $1,877,000

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

34

Investing activities:

A) involve day to day events like selling goods and services, which occur when running a business.

B) involve the buying or selling of land, buildings, equipment, and other long-term investments.

C) involve the receipt of interest from short-term investments such as certificates of deposits (CD's).

D) involve the payment of wages, rent and other costs of running a business.

A) involve day to day events like selling goods and services, which occur when running a business.

B) involve the buying or selling of land, buildings, equipment, and other long-term investments.

C) involve the receipt of interest from short-term investments such as certificates of deposits (CD's).

D) involve the payment of wages, rent and other costs of running a business.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

35

Operating activities:

A) involve day to day events related to production and sales.

B) relate to the acquisition or sale of long-term assets.

C) only involve financial exchanges.

D) involve the payment of dividends to owners.

A) involve day to day events related to production and sales.

B) relate to the acquisition or sale of long-term assets.

C) only involve financial exchanges.

D) involve the payment of dividends to owners.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

36

Expenses are shown

A) on the income statement in the time period in which they are paid.

B) on the income statement in the time period in which they are incurred.

C) on the balance sheet in the time period in which they are paid.

D) on the balance sheet in the time period in which they are incurred.

A) on the income statement in the time period in which they are paid.

B) on the income statement in the time period in which they are incurred.

C) on the balance sheet in the time period in which they are paid.

D) on the balance sheet in the time period in which they are incurred.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following would represent an investing activity?

A) Purchasing equipment.

B) An investment of financial capital by the owners.

C) Borrowing money from a bank.

D) Repaying a loan the company had taken out.

A) Purchasing equipment.

B) An investment of financial capital by the owners.

C) Borrowing money from a bank.

D) Repaying a loan the company had taken out.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

38

The three main types of business activities measured by financial statements are:

A) selling goods, selling services, and obtaining financing.

B) operating activities, investing activities, and financing activities.

C) hiring, producing, and advertising.

D) generating revenues, paying expenses, and paying dividends.

A) selling goods, selling services, and obtaining financing.

B) operating activities, investing activities, and financing activities.

C) hiring, producing, and advertising.

D) generating revenues, paying expenses, and paying dividends.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

39

Net Income is

A) the amount the company earned after expenses and dividends are subtracted from revenue.

B) the amount by which assets exceed expenses.

C) the amount by which assets exceed liabilities.

D) the amount by which revenues exceed expenses.

A) the amount the company earned after expenses and dividends are subtracted from revenue.

B) the amount by which assets exceed expenses.

C) the amount by which assets exceed liabilities.

D) the amount by which revenues exceed expenses.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

40

Public corporations:

A) are businesses owned by two or more people, each of whom is personally liable for the debts of the business.

B) are businesses whose stock is bought and sold on a stock exchange.

C) are businesses whose stock is bought and sold privately.

D) are businesses where stock is not used as evidence of ownership.

A) are businesses owned by two or more people, each of whom is personally liable for the debts of the business.

B) are businesses whose stock is bought and sold on a stock exchange.

C) are businesses whose stock is bought and sold privately.

D) are businesses where stock is not used as evidence of ownership.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following would affect stockholders' equity?

A) A company borrows $100 million and buys $100 million in equipment.

B) A company pays $100 million to stockholders as a dividend.

C) A company sells $100 million in assets for $100 million cash.

D) A company receives payment for $100 million in accounts receivable.

A) A company borrows $100 million and buys $100 million in equipment.

B) A company pays $100 million to stockholders as a dividend.

C) A company sells $100 million in assets for $100 million cash.

D) A company receives payment for $100 million in accounts receivable.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following would be reported on the income statement for 2010?

A) Supplies that were purchased and used in 2009 but paid for in 2010.

B) Dividends that were paid in 2010.

C) Supplies that were purchased, used, and paid for in 2010.

D) Supplies that were purchased in 2009 and paid for in 2010 but have not been used.

A) Supplies that were purchased and used in 2009 but paid for in 2010.

B) Dividends that were paid in 2010.

C) Supplies that were purchased, used, and paid for in 2010.

D) Supplies that were purchased in 2009 and paid for in 2010 but have not been used.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following is true about the format of financial statements?

A) A double underline is drawn below the subtotal for total liabilities on the balance sheet.

B) Dollar signs are omitted if the heading states that amounts are reported in U.S. dollars.

C) Dividends are reported in parenthesis on the statement of retained earnings.

D) The heading of each financial statement indicates who, when, and what in that particular order.

A) A double underline is drawn below the subtotal for total liabilities on the balance sheet.

B) Dollar signs are omitted if the heading states that amounts are reported in U.S. dollars.

C) Dividends are reported in parenthesis on the statement of retained earnings.

D) The heading of each financial statement indicates who, when, and what in that particular order.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

44

The Don't Bite Me Pest Control Company has 10,000 gallons of insecticide supplies on hand that cost $300,000; a bill from the vendor for $100,000 of these supplies has not yet been paid. The company expects to earn $800,000 for its services when it uses the insecticide supplies. The company would report a supplies asset in the amount of

A) $10,000

B) $200,000.

C) $300,000

D) $800,000

A) $10,000

B) $200,000.

C) $300,000

D) $800,000

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following statements is true?

A) The "net change in cash" reported on the statement of cash flows is also reported on the statement of retained earnings.

B) Both the income statement and the statement of cash flows show the result of a company's operating activities.

C) The statement of cash flows is for a period of time while the income statement is at a point in time.

D) The statement of cash flows is at a point of time while the income statement is for a period of time.

A) The "net change in cash" reported on the statement of cash flows is also reported on the statement of retained earnings.

B) Both the income statement and the statement of cash flows show the result of a company's operating activities.

C) The statement of cash flows is for a period of time while the income statement is at a point in time.

D) The statement of cash flows is at a point of time while the income statement is for a period of time.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

46

The purpose of a statement of retained earnings is to:

A) estimate the current value of a company's assets.

B) report how the profits of a company have been distributed to stockholders or retained in the business.

C) show where the money is flowing into and out of a company.

D) explain the specific revenues and expenses arising during the period.

A) estimate the current value of a company's assets.

B) report how the profits of a company have been distributed to stockholders or retained in the business.

C) show where the money is flowing into and out of a company.

D) explain the specific revenues and expenses arising during the period.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

47

The Publish or Perish Printing Company paid a dividend to stockholders. This will be reported on the:

A) audit report.

B) income statement.

C) balance sheet.

D) statement of retained earnings.

A) audit report.

B) income statement.

C) balance sheet.

D) statement of retained earnings.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following are the three basic elements of the balance sheet?

A) assets, liabilities, and retained earnings.

B) assets, liabilities, and contributed capital.

C) assets, liabilities, and revenues.

D) assets, liabilities, and stockholders' equit y.

A) assets, liabilities, and retained earnings.

B) assets, liabilities, and contributed capital.

C) assets, liabilities, and revenues.

D) assets, liabilities, and stockholders' equit y.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

49

In the U.S., public companies have to be audited by independent auditors using rules approved by the:

A) 1933 Securities Act.

B) Public Company Accounting Oversight Board (PCAOB).

C) Financial Accounting Standards Board (FASB).

D) American Institute of Certified Public Accountants (AICPA).

A) 1933 Securities Act.

B) Public Company Accounting Oversight Board (PCAOB).

C) Financial Accounting Standards Board (FASB).

D) American Institute of Certified Public Accountants (AICPA).

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

50

Dividends are reported on the:

A) Income statement.

B) Balance sheet.

C) Statement of retained earnings.

D) Income statement and balance sheet.

A) Income statement.

B) Balance sheet.

C) Statement of retained earnings.

D) Income statement and balance sheet.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

51

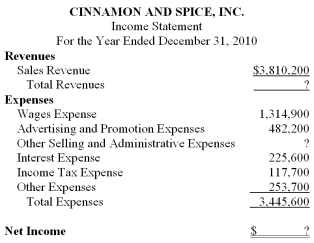

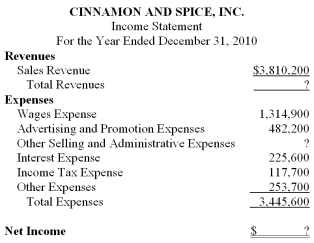

Find the missing data.

A) Total revenues are $3,810,200, other selling and administrative expenses are $1,051,500, and net income is $364,600.

B) Total revenues are $2,495,300, other selling and administrative expenses are $1,051,500, and net income is ($950,300).

C) Total revenues are $364,600, other selling and administrative expenses are $3,081,000, and net income is $7,255,800.

D) Total revenues are $3,810,200, other selling and administrative expenses are $364,600, and net income is

A) Total revenues are $3,810,200, other selling and administrative expenses are $1,051,500, and net income is $364,600.

B) Total revenues are $2,495,300, other selling and administrative expenses are $1,051,500, and net income is ($950,300).

C) Total revenues are $364,600, other selling and administrative expenses are $3,081,000, and net income is $7,255,800.

D) Total revenues are $3,810,200, other selling and administrative expenses are $364,600, and net income is

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

52

The Whackem-Smackem Software Company sold $11 million of computer games in its first year of operations. The company received payments of $7.5 million for these computer games. The company's income statement would report:

A) sales revenue of $7.5 million.

B) accounts receivable of $3.5 million.

C) expenses of $3.5 million.

D) sales revenue of $11 million.

A) sales revenue of $7.5 million.

B) accounts receivable of $3.5 million.

C) expenses of $3.5 million.

D) sales revenue of $11 million.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following is a true statement?

A) The SEC approves the rules used by the auditors in determining whether a public company's financial statements are in conformity with GAAP.

B) The PCAOB and the SEC were both created by the FASB.

C) The SEC was created by the PCAOB.

D) The PCAOB approves the rules used by auditors in determining whether a public company's financial

A) The SEC approves the rules used by the auditors in determining whether a public company's financial statements are in conformity with GAAP.

B) The PCAOB and the SEC were both created by the FASB.

C) The SEC was created by the PCAOB.

D) The PCAOB approves the rules used by auditors in determining whether a public company's financial

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

54

At the end of last year, the company's assets totaled $860,000 and its liabilities totaled $740,000. During the current year, the company's total assets increased by $58,000 and its total liabilities increased by $24,000. At the end of the current year, stockholders' equity was

A) $154,000.

B) $120,000.

C) $34,000.

D) $178,000.

A) $154,000.

B) $120,000.

C) $34,000.

D) $178,000.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following would not affect a company's net income?

A) A change in the company's income taxes.

B) Changing the selling price of a company's product.

C) Paying a dividend to stockholders.

D) Advertising a new product.

A) A change in the company's income taxes.

B) Changing the selling price of a company's product.

C) Paying a dividend to stockholders.

D) Advertising a new product.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

56

If a company uses $50,000 of its cash to buy an asset then:

A) assets and liabilities will be unchanged.

B) assets will rise $50,000 as will liabilities.

C) assets will rise $50,000 as will stockholders' equity.

D) assets will fall $50,000 and liabilities will rise $50,000.

A) assets and liabilities will be unchanged.

B) assets will rise $50,000 as will liabilities.

C) assets will rise $50,000 as will stockholders' equity.

D) assets will fall $50,000 and liabilities will rise $50,000.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following is not true?

A) Assets = Liabilities + Stockholders' Equity

B) Liabilities = Assets - Stockholders' Equity

C) Stockholders' Equity + Liabilities - Assets = 0

D) Liabilities - Stockholders' Equity = Assets

A) Assets = Liabilities + Stockholders' Equity

B) Liabilities = Assets - Stockholders' Equity

C) Stockholders' Equity + Liabilities - Assets = 0

D) Liabilities - Stockholders' Equity = Assets

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

58

If XYZ Company had $12 million in revenue and net income of $3 million then its:

A) expenses must have been $15 million.

B) expenses must have been $9 million.

C) assets must have been $12 million.

D) assets must have been $3 million.

A) expenses must have been $15 million.

B) expenses must have been $9 million.

C) assets must have been $12 million.

D) assets must have been $3 million.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

59

In the statement of cash flows, the company's payment of a $1,900 electric bill would be classified as:

A) an operating cash outflow.

B) a financing cash outflow.

C) an investing cash inflow.

D) an investing and a financing cash flow.

A) an operating cash outflow.

B) a financing cash outflow.

C) an investing cash inflow.

D) an investing and a financing cash flow.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

60

Assets:

A) represent the amounts earned by a company.

B) must equal the liabilities of a company.

C) must equal the stockholders' equity of the company.

D) represent the resources owned by a company.

A) represent the amounts earned by a company.

B) must equal the liabilities of a company.

C) must equal the stockholders' equity of the company.

D) represent the resources owned by a company.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following statements is false?

A) When choosing between a company that pays steady dividends and one that retains its earnings to support future growth, investors will always choose the company that pays steady dividends.

B) Companies can develop reputations for honest financial reporting even when conveying bad news.

C) Trends in a company's net income from year to year can provide clues about its future earnings, which can help investors to decide whether to buy stock in the company.

D) Information in the notes to the financial statements can influence a user's interpretation of balance sheet and income statement information.

A) When choosing between a company that pays steady dividends and one that retains its earnings to support future growth, investors will always choose the company that pays steady dividends.

B) Companies can develop reputations for honest financial reporting even when conveying bad news.

C) Trends in a company's net income from year to year can provide clues about its future earnings, which can help investors to decide whether to buy stock in the company.

D) Information in the notes to the financial statements can influence a user's interpretation of balance sheet and income statement information.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

62

An investor might look at a company's financial statements to determine:

A) if competitors' earnings are rising or falling.

B) if the company's stock is likely to fall, signaling a good time to sell.

C) if the company's creditors are having a good year.

D) if the company's owners are financially sound.

A) if competitors' earnings are rising or falling.

B) if the company's stock is likely to fall, signaling a good time to sell.

C) if the company's creditors are having a good year.

D) if the company's owners are financially sound.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

63

To determine whether generally accepted accounting principles (GAAP) were followed in the preparation of financial statements, an examination of:

A) tax documents would be performed by the IRS.

B) the annual report would be performed by the SEC.

C) the financial statements and related documents would be performed by an independent auditor.

D) the financial statements and related documents would be performed by the FASB.

A) tax documents would be performed by the IRS.

B) the annual report would be performed by the SEC.

C) the financial statements and related documents would be performed by an independent auditor.

D) the financial statements and related documents would be performed by the FASB.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

64

The amount of Assets at the end of the year is

A) $105,000.

B) $108,000.

C) $104,000.

D) $107,000.

A) $105,000.

B) $108,000.

C) $104,000.

D) $107,000.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

65

Generally accepted accounting principles (GAAP) were (are) established by:

A) an Italian monk in 1494.

B) the U.S. Congress in 1933.

C) the PCAOB in 2004.

D) the FASB.

A) an Italian monk in 1494.

B) the U.S. Congress in 1933.

C) the PCAOB in 2004.

D) the FASB.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following is not a difference between notes payable and accounts payable?

A) Notes payable are not interest free while accounts payable may be interest free.

B) Notes payable can remain unpaid longer than accounts payable.

C) Notes payable are documented using formal written debt contracts while accounts payable are generally informal.

D) Notes payable are not reported as liabilities on the balance sheet while accounts payable are reported as

A) Notes payable are not interest free while accounts payable may be interest free.

B) Notes payable can remain unpaid longer than accounts payable.

C) Notes payable are documented using formal written debt contracts while accounts payable are generally informal.

D) Notes payable are not reported as liabilities on the balance sheet while accounts payable are reported as

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following statements is not true concerning the notes to the financial statements?

A) Notes to the financial statements explain what policies were used to prepare the financial statements.

B) Notes to the financial statements provide additional information about what is included in the financial statements.

C) Notes to the financial statements provide additional information about financial matters that are not included in the financial statements.

D) Notes to the financial statements provide financial information about the owners of the business.

A) Notes to the financial statements explain what policies were used to prepare the financial statements.

B) Notes to the financial statements provide additional information about what is included in the financial statements.

C) Notes to the financial statements provide additional information about financial matters that are not included in the financial statements.

D) Notes to the financial statements provide financial information about the owners of the business.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

68

Every financial statement should have "who, what, and when" in its heading. These are:

A) the name of the person preparing the statement, the type of financial statement, and when the financial statement was reported to the SEC.

B) the name of the person preparing the statement, the name of the company, and the date the statement was prepared.

C) the name of the company, the type of financial statement, and the time period or date from which the data were taken.

D) the name of the company, the purpose of the statement, and when the financial statement was reported to the

A) the name of the person preparing the statement, the type of financial statement, and when the financial statement was reported to the SEC.

B) the name of the person preparing the statement, the name of the company, and the date the statement was prepared.

C) the name of the company, the type of financial statement, and the time period or date from which the data were taken.

D) the name of the company, the purpose of the statement, and when the financial statement was reported to the

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

69

The amount of liabilities at the end of the year is

A) $30,000.

B) $33,000.

C) $28,000.

D) $32,000.

A) $30,000.

B) $33,000.

C) $28,000.

D) $32,000.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

70

Investors and creditors look at the balance sheet to see whether the company

A) is profitable.

B) owns enough assets to pay what it owes to creditors.

C) has had a positive cash flow from operations.

D) is paying sufficient dividends to stockholders.

A) is profitable.

B) owns enough assets to pay what it owes to creditors.

C) has had a positive cash flow from operations.

D) is paying sufficient dividends to stockholders.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

71

A company's quarterly income statements show that in the last three quarters both sales revenue and net income have been falling. Which of the following conclusions drawn by users are valid, given this information?

A) Creditors are likely to conclude that the risk of lending to the company is falling and might be willing to accept a lower interest rate on loans.

B) Investors are likely to conclude that the stock price is likely to rise, making the company more attractive as a potential investment.

C) Investors are likely to conclude that the company is more attractive as a potential investment.

D) Owners may conclude that the company will be less likely to distribute dividends.

A) Creditors are likely to conclude that the risk of lending to the company is falling and might be willing to accept a lower interest rate on loans.

B) Investors are likely to conclude that the stock price is likely to rise, making the company more attractive as a potential investment.

C) Investors are likely to conclude that the company is more attractive as a potential investment.

D) Owners may conclude that the company will be less likely to distribute dividends.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

72

Investors are often interested in the amount of net income distributed as dividends. In which section of the financial statements would investors look to find this amount?

A) Statement of retained earnings.

B) Balance sheet.

C) Notes to the financial statements.

D) Income statement.

A) Statement of retained earnings.

B) Balance sheet.

C) Notes to the financial statements.

D) Income statement.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

73

The WC Company borrowed $26,500 from a bank during 2010.

A) This would be listed as ($26,500) under investing activities on the statement of cash flows.

B) This would be listed as ($26,500) under operating activities on the statement of cash flows.

C) This would be listed as $26,500 under investing activities on the statement of cash flows.

D) This would be listed as $26,500 under financing activities on the statement of cash flows.

A) This would be listed as ($26,500) under investing activities on the statement of cash flows.

B) This would be listed as ($26,500) under operating activities on the statement of cash flows.

C) This would be listed as $26,500 under investing activities on the statement of cash flows.

D) This would be listed as $26,500 under financing activities on the statement of cash flows.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

74

Internal users of financial data include:

A) investors.

B) creditors.

C) management.

D) regulatory authorities.

A) investors.

B) creditors.

C) management.

D) regulatory authorities.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

75

What was the amount of net income for the year?

A) $2,000

B) $1,000

C) $3,000

D) $5,000

A) $2,000

B) $1,000

C) $3,000

D) $5,000

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

76

A creditor might look at a company's financial statements to determine if the:

A) company is likely to have the resources to repay its debts.

B) company's stock is likely to fall, signaling a good time to sell.

C) company's stock is likely to rise, signaling a good time to buy.

D) company's stock is likely to vary up and down.

A) company is likely to have the resources to repay its debts.

B) company's stock is likely to fall, signaling a good time to sell.

C) company's stock is likely to rise, signaling a good time to buy.

D) company's stock is likely to vary up and down.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

77

What would a financial statement user learn from reading the auditors' report?

A) Whether the financial statements present a fair picture of the company's financial results and are prepared in accordance with GAAP.

B) Whether or not it is a good time to purchase the stock.

C) What the company plans to distribute as dividends.

D) Whether or not the company has plans for future expansion.

A) Whether the financial statements present a fair picture of the company's financial results and are prepared in accordance with GAAP.

B) Whether or not it is a good time to purchase the stock.

C) What the company plans to distribute as dividends.

D) Whether or not the company has plans for future expansion.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following business organizations has only one owner?

A) A corporation.

B) A sole proprietorship.

C) A public company.

D) A partnership.

A) A corporation.

B) A sole proprietorship.

C) A public company.

D) A partnership.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

79

During 2010, a company's assets rise $56,000 and its liabilities rise $38,000. If no dividend is paid and no further capital is contributed, net income for 2010 was:

A) $56,000.

B) $18,000.

C) $94,000.

D) $38,000

A) $56,000.

B) $18,000.

C) $94,000.

D) $38,000

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

80

The amount of Retained Earnings at the end of the year is

A) $15,000.

B) $11,000.

C) $12,000.

D) $1,000.

A) $15,000.

B) $11,000.

C) $12,000.

D) $1,000.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck