Deck 12: Investments

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/148

Play

Full screen (f)

Deck 12: Investments

1

For available-for-sale securities, the unrealized gain or loss account is carried forward to future periods.

True

2

The accounting for short-term debt investments and for long-term debt investments is similar.

True

3

In accordance with the historical cost principle, brokerage fees should be added to the cost of an investment.

True

4

The valuation of available-for-sale securities is similar to the procedures followed for trading securities, except that changes in fair value are not recognized in current income.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

5

The Stock Investments account is debited at acquisition under both the equity method and cost method of accounting for investments in common stock.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

6

A reason some companies purchase investments is because they generate a significant portion of their earnings from investment income.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

7

Under the equity method, the receipt of dividends from the investee company results in an increase in the Stock Investments account.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

8

When debt investments are sold, the gain or loss is the difference between the net proceeds from the sale and the fair value of the bonds.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

9

A decline in the fair value of a trading security is recorded by debiting an unrealized loss account and crediting the Fair Value Adjustment account.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

10

Under the equity method, the investment in common stock is initially recorded at cost, and the Stock Investments account is adjusted annually.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

11

In accordance with the historical cost principle, the cost of debt investments includes brokerage fees and accrued interest.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

12

An unrealized gain or loss on trading securities is reported as a separate component of stockholders' equity.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

13

Consolidated financial statements are appropriate when an investor controls an investee by ownership of more than 50% of the investee's common stock.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

14

Consolidated financial statements are prepared in place of the financial statements for the parent and subsidiary companies.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

15

In accounting for stock investments of less than 20%, the equity method is used.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

16

Consolidated financial statements should be prepared only when a subsidiary company has a controlling interest in the parent company.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

17

Dividends received on stock investments of less than 20% should be credited to the Stock Investments account.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

18

Debt investments are investments in government and corporation bonds.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

19

Corporations purchase investments in debt or stock securities generally for one of two reasons.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

20

If an investor owns between 20% and 50% of an investee's common stock, it is presumed that the investor has significant influence on the investee.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

21

The Fair Value Adjustment account can only have a credit balance or a zero balance.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

22

One of the reasons a corporation may purchase investments is that it has excess cash.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

23

When recording bond interest, Interest Receivable is reported as a fixed asset in the balance sheet.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

24

When a parent company acquires a wholly owned subsidiary for an amount in excess of the book value of the net assets acquired, the excess is always allocated to goodwill.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

25

"Intent to convert" does not include an investment used as a resource that will be used whenever the need for cash arises.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

26

To be classified as a short-term investment, the investment must be readily marketable and intended to be converted into cash within the next year or operating cycle.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

27

A company may purchase a noncontrolling interest in another firm in a related industry

A) to house excess cash until needed.

B) to generate earnings.

C) for strategic reasons.

D) for speculative reasons.

A) to house excess cash until needed.

B) to generate earnings.

C) for strategic reasons.

D) for speculative reasons.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

28

A typical investment to house excess cash until needed is

A) stocks of companies in a related industry.

B) debt securities.

C) low-risk, highly liquid securities.

D) stock securities.

A) stocks of companies in a related industry.

B) debt securities.

C) low-risk, highly liquid securities.

D) stock securities.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

29

Under the cost method, the investment is recorded at cost and revenue is recognized only when cash dividends are received.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

30

Stocks traded on the New York Stock Exchange are considered readily marketable.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

31

A consolidated income statement will reflect only revenue and expense transactions between the consolidated entity and parties outside the affiliated group.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

32

Consolidated financial statements present a condensed version of the financial statements so investors will not experience information overload.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

33

An investment is readily marketable if it is management's intent to sell the investment.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

34

Corporations invest in other companies for all of the following reasons except to

A) house excess cash until needed.

B) generate earnings.

C) meet strategic goals.

D) increase trading of the other companies' stock.

A) house excess cash until needed.

B) generate earnings.

C) meet strategic goals.

D) increase trading of the other companies' stock.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

35

If the fair value of an available-for-sale security exceeds its cost, the security should be written up to fair value and a realized gain should be recognized.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

36

The process of excluding intercompany transactions in preparing consolidated statements is referred to as intercompany eliminations.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

37

At the time of acquisition of a debt investment,

A) no journal entry is required.

B) the historical cost principle applies.

C) the Stock Investments account is debited when bonds are purchased.

D) the Investment account is credited for its cost plus brokerage fees.

A) no journal entry is required.

B) the historical cost principle applies.

C) the Stock Investments account is debited when bonds are purchased.

D) the Investment account is credited for its cost plus brokerage fees.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

38

Pension funds and mutual funds regularly invest in debt and stock securities to

A) generate earnings.

B) house excess cash until needed.

C) meet strategic goals.

D) control the company in which they invest.

A) generate earnings.

B) house excess cash until needed.

C) meet strategic goals.

D) control the company in which they invest.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

39

Available-for-sale securities are securities bought and held primarily for sale in the near term to generate income on short-term price differences.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

40

Corporations invest excess cash for short periods of time in each of the following except

A) equity securities.

B) highly liquid securities.

C) low-risk securities.

D) government securities.

A) equity securities.

B) highly liquid securities.

C) low-risk securities.

D) government securities.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

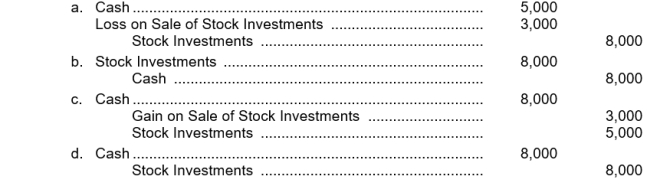

41

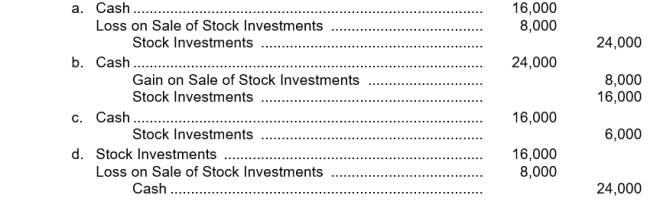

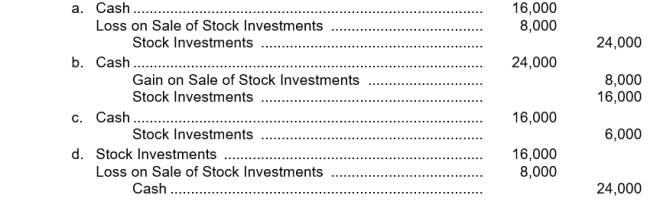

Yeloe Corporation sells 400 shares of common stock being held as an investment. The shares were acquired six months ago at a cost of $60 a share. Yeloe sold the shares for $40 a share. The entry to record the sale is

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following is not a true statement about the accounting for debt investments?

A) At acquisition, the historical cost principle applies.

B) The cost includes any brokerage fees.

C) Debt investments include investments in government and corporation bonds.

D) The cost includes any accrued interest.

A) At acquisition, the historical cost principle applies.

B) The cost includes any brokerage fees.

C) Debt investments include investments in government and corporation bonds.

D) The cost includes any accrued interest.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

43

The cost of debt investments includes each of the following except

A) brokerage fees.

B) commissions.

C) accrued interest.

D) the price paid.

A) brokerage fees.

B) commissions.

C) accrued interest.

D) the price paid.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

44

Blaine Company had these transactions pertaining to stock investments: Feb. 1 Purchased 2,000 shares of Horton Company for cash. June 1 Received cash dividends of per share on Horton stock. Oct. 1 Sold 1,200 shares of Horton stock for . The entry to record the purchase of the Horton stock would include a

A) debit to Stock Investments for $45,900.

B) credit to Cash for $45,900.

C) debit to Stock Investments for $51,000.

D) debit to Investment Expense for $5,100.

A) debit to Stock Investments for $45,900.

B) credit to Cash for $45,900.

C) debit to Stock Investments for $51,000.

D) debit to Investment Expense for $5,100.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

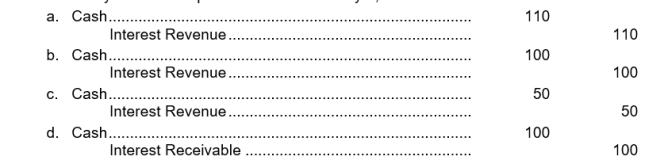

45

On January 1, Skills Company purchased as a short-term investment a $1,000, 6% bond for $1,000. The bond pays interest on January 1. The bond is sold on July 1 for $1,200 plus accrued interest. Interest has not been accrued since the last interest payment date. What is the entry to record the cash proceeds at the time the bond is sold?

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

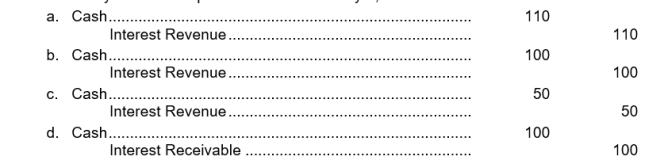

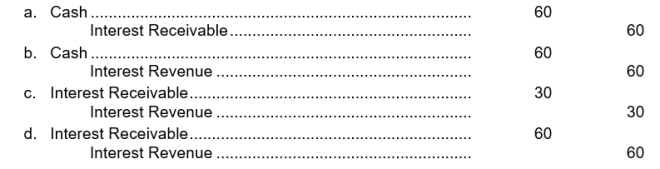

46

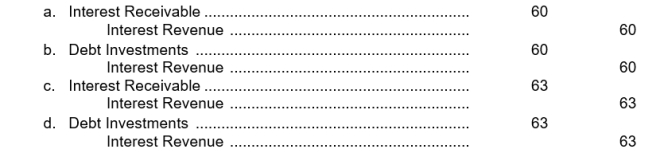

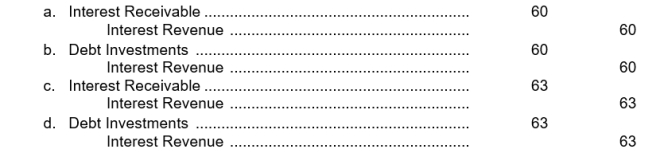

On January 1, Hamm Company purchased as an investment a $1,000, 6% bond for $1,050. The bond pays interest on January 1. What is the entry to record the interest accrual on December 31?

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

47

On January 1, 2014, Brenner Company purchased at face value, a $1,000, 10% bond that pays interest on January 1. Brenner Company has a calendar year end. The entry for the receipt of interest on January 1, 2015 is

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

48

Bay Company acquires 60, 8%, 5 year, $1,000 Community bonds on January 1, 2014 for $60,000. The journal entry to record this investment includes a debit to

A) Debt Investments for $64,800.

B) Debt Investments for $60,000.

C) Cash for $60,000.

D) Stock Investments for $60,000.

A) Debt Investments for $64,800.

B) Debt Investments for $60,000.

C) Cash for $60,000.

D) Stock Investments for $60,000.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

49

If a short-term debt investment is sold, the Investment account is

A) debited for the fair value of the bonds at the sale date.

B) credited for the cost of the bonds at the sale date.

C) credited for the fair value of the bonds at the sale date.

D) debited for the cost of the bonds at the sale date.

A) debited for the fair value of the bonds at the sale date.

B) credited for the cost of the bonds at the sale date.

C) credited for the fair value of the bonds at the sale date.

D) debited for the cost of the bonds at the sale date.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

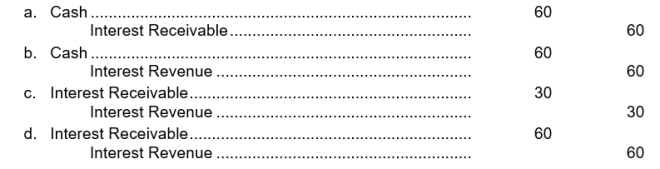

50

On January 1, 2014, Brenner Company purchased at face value, a $1,000, 8% bond that pays interest on January 1. Brenner Company has a calendar year end. The adjusting entry on December 31, 2014, is

A) not required.

A) not required.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

51

In accounting for debt investments, entries are made for each of the following except the

A) acquisition.

B) interest revenue.

C) sale.

D) entries are made for each answer choice.

A) acquisition.

B) interest revenue.

C) sale.

D) entries are made for each answer choice.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

52

Bay Company acquires 60, 8%, 5 year, $1,000 Community bonds on January 1, 2014 for $60,000. Assume Community pays interest on January 1. The journal entry at December 31, 2014 would include a credit to

A) Interest Receivable for $2,400.

B) Interest Receivable for $4,800.

C) Accrued Expense for $4,800.

D) Interest Revenue for $4,800.

A) Interest Receivable for $2,400.

B) Interest Receivable for $4,800.

C) Accrued Expense for $4,800.

D) Interest Revenue for $4,800.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

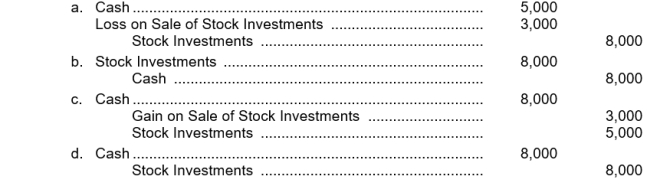

53

Beak Corporation sells 200 shares of common stock being held as an investment. The shares were acquired six months ago at a cost of $25 a share. Beak sold the shares for $40 a share. The entry to record the sale is

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

54

Tempest Co. purchased 60, 6% Urich Company bonds for $60,000 cash. Interest is payable annually on January 1. If 30 of the securities are sold on January 1 for $32,000, the entry would include a credit to Gain on Sale of Debt Investments for

A) $1,600.

B) $1,750.

C) $1,800.

D) $2,000.

A) $1,600.

B) $1,750.

C) $1,800.

D) $2,000.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following is not a true statement regarding short-term debt investments?

A) The securities usually pay interest.

B) Investments are frequently government or corporate bonds.

C) This type of investment must be currently traded in the securities market.

D) Debt investments are recorded at the price paid less brokerage fees.

A) The securities usually pay interest.

B) Investments are frequently government or corporate bonds.

C) This type of investment must be currently traded in the securities market.

D) Debt investments are recorded at the price paid less brokerage fees.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

56

Ban Co. purchased 50, 5% Waylan Company bonds on January 1, 2014 for $50,500 cash. Interest is payable annually on January 1. The entry to record the December 31, 2015 interest accrual would include a

A) debit to Interest Receivable for $2,500.

B) debit to Interest Revenue for $2,500.

C) credit to Interest Revenue for $2,525.

D) debit to Debt Investments for $2,525.

A) debit to Interest Receivable for $2,500.

B) debit to Interest Revenue for $2,500.

C) credit to Interest Revenue for $2,525.

D) debit to Debt Investments for $2,525.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

57

Blaine Company had these transactions pertaining to stock investments: Feb. 1 Purchased 2,000 shares of Horton Company (10%) for $51,000 cash.

June 1 Received cash dividends of $3 per share on Horton stock.

Oct) 1 Sold 1,200 shares of Horton stock for $32,400.

The entry to record the receipt of the dividends on June 1 would include a

A) debit to Stock Investments for $6,000.

B) credit to Dividend Revenue for $6,000.

C) debit to Dividend Revenue for $6,000.

D) credit to Stock Investments for $6,000.

June 1 Received cash dividends of $3 per share on Horton stock.

Oct) 1 Sold 1,200 shares of Horton stock for $32,400.

The entry to record the receipt of the dividends on June 1 would include a

A) debit to Stock Investments for $6,000.

B) credit to Dividend Revenue for $6,000.

C) debit to Dividend Revenue for $6,000.

D) credit to Stock Investments for $6,000.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

58

On January 1, 2014, Brenner Company purchased at face value, a $1,000, 6% bond that pays interest on January 1. Brenner Company has a calendar year end. The entry for the receipt of interest on January 1, 2015, is

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

59

Ban Co. purchased 50, 5% Waylan Company bonds on January 1, 2014 for $50,500 cash. Interest is payable annually on January 1. The entry to record the January 1, 2015 annual interest payment would include a

A) debit to Interest Revenue for $2,500.

B) credit to Interest Receivable for $2,500.

C) credit to Interest Revenue for $2,525.

D) credit to Debt Investments for $2,525.

A) debit to Interest Revenue for $2,500.

B) credit to Interest Receivable for $2,500.

C) credit to Interest Revenue for $2,525.

D) credit to Debt Investments for $2,525.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

60

Bay Company acquires 60, 8%, 5 year, $1,000 Community bonds on January 1, 2014 for $60,000. If Bay sells all of its Community bonds for $64,500, what gain or loss is recognized?

A) Loss of $9,300

B) Loss of $4,500

C) Gain of $9,300

D) Gain of $4,500

A) Loss of $9,300

B) Loss of $4,500

C) Gain of $9,300

D) Gain of $4,500

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

61

When a company holds stock of several different corporations, the group of securities is identified as a(n)

A) affiliated investment.

B) consolidated portfolio.

C) investment portfolio.

D) controlling interest.

A) affiliated investment.

B) consolidated portfolio.

C) investment portfolio.

D) controlling interest.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

62

For accounting purposes, the method used to account for long-term investments in common stock is determined by

A) the amount paid for the stock by the investor.

B) the extent of an investor's influence on the operating and financial affairs of the investee.

C) whether the stock has paid dividends in past years.

D) whether the acquisition of the stock by the investor was "friendly" or "hostile."

A) the amount paid for the stock by the investor.

B) the extent of an investor's influence on the operating and financial affairs of the investee.

C) whether the stock has paid dividends in past years.

D) whether the acquisition of the stock by the investor was "friendly" or "hostile."

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

63

Under the equity method of accounting for long-term investments in common stock, when a dividend is received from the investee company,

A) the Dividend Revenue account is credited.

B) the Stock Investments account is increased.

C) the Stock Investments account is decreased.

D) no entry is necessary.

A) the Dividend Revenue account is credited.

B) the Stock Investments account is increased.

C) the Stock Investments account is decreased.

D) no entry is necessary.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

64

In accounting for stock investments between 20% and 50%, the _______ method is used.

A) consolidated statements

B) controlling interest

C) cost

D) equity

A) consolidated statements

B) controlling interest

C) cost

D) equity

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

65

Penny Company owns 20% interest in the stock of Lynn Corporation. During the year, Lynn pays $25,000 in dividends, and reports $200,000 in net income. Penny Company's investment in Lynn will increase by

A) $25,000.

B) $40,000.

C) $45,000.

D) $35,000.

A) $25,000.

B) $40,000.

C) $45,000.

D) $35,000.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

66

Mize Company owns 30% interest in the stock of Lyte Corporation. During the year, Lyte pays $20,000 in dividends to Mize, and reports $300,000 in net income. Mize Company's investment in Lyte will increase Mize s net income by

A) $6,000.

B) $90,000.

C) $96,000.

D) $10,000.

A) $6,000.

B) $90,000.

C) $96,000.

D) $10,000.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

67

If the cost method is used to account for a long-term investment in common stock, dividends received should be

A) credited to the Stock Investments account.

B) credited to the Dividend Revenue account.

C) debited to the Stock Investments account.

D) recorded only when 20% or more of the stock is owned.

A) credited to the Stock Investments account.

B) credited to the Dividend Revenue account.

C) debited to the Stock Investments account.

D) recorded only when 20% or more of the stock is owned.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

68

Alistair Corporation sells 500 shares of common stock being held as a short-term investment. The shares were acquired six months ago at a cost of $55 a share. Alistair sold the shares for $40 a share. The entry to record the sale is

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

69

The cost method of accounting for long-term investments in stock should be employed when the

A) investor owns more than 50% of the investee's stock.

B) investor has significant influence on the investee and the stock held by the investor are marketable equity securities.

C) market value of the shares held is greater than their historical cost.

D) investor's influence on the investee is insignificant.

A) investor owns more than 50% of the investee's stock.

B) investor has significant influence on the investee and the stock held by the investor are marketable equity securities.

C) market value of the shares held is greater than their historical cost.

D) investor's influence on the investee is insignificant.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following would not be considered a motive for making a stock investment in another corporation?

A) Appreciation in the market value of the stock investment

B) Use of the investment for expanding its own operations

C) Use of the investment to diversify its own operations

D) An increase in the amount of interest revenue from the stock investment

A) Appreciation in the market value of the stock investment

B) Use of the investment for expanding its own operations

C) Use of the investment to diversify its own operations

D) An increase in the amount of interest revenue from the stock investment

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

71

The account, Stock Investments, is

A) a subsidiary ledger account.

B) a long-term liability account.

C) a long-term investment account.

D) another name for Debt Investments.

A) a subsidiary ledger account.

B) a long-term liability account.

C) a long-term investment account.

D) another name for Debt Investments.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

72

Roxy Corporation makes a short-term investment in 180 shares of Sager Company's common stock. The stock is purchased for $53 a share. The entry for the purchase is

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

73

When an investor owns between 20% and 50% of the common stock of a corporation, it is generally presumed that the investor

A) has insignificant influence on the investee and that the cost method should be used to account for the investment.

B) should apply the cost method in accounting for the investment.

C) will prepare consolidated financial statements.

D) has significant influence on the investee and that the equity method should be used to account for the investment.

A) has insignificant influence on the investee and that the cost method should be used to account for the investment.

B) should apply the cost method in accounting for the investment.

C) will prepare consolidated financial statements.

D) has significant influence on the investee and that the equity method should be used to account for the investment.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

74

Gayton Corporation purchased 1,000 shares of Smart common stock ($50 par) at $80 per share as a short-term investment. The shares were subsequently sold at $78 per share. The cost of the securities purchased and gain or loss on the sale were

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

75

If 10% of the common stock of an investee company is purchased as a long-term investment, the appropriate method of accounting for the investment is

A) the cost method.

B) the equity method.

C) the preparation of consolidated financial statements.

D) determined by agreement with whomever owns the remaining 90% of the stock.

A) the cost method.

B) the equity method.

C) the preparation of consolidated financial statements.

D) determined by agreement with whomever owns the remaining 90% of the stock.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

76

Blaine Company had these transactions pertaining to stock investments: Feb. 1 Purchased 2,000 shares of Norton Company for . June 1 Received cash dividends of per share on Horton stock. Oct. 1 Sold 1,200 shares of Horton stock for . The entry to record the sale of the stock would include a

A) debit to Cash for $30,600.

B) credit to Gain on Sale of Stock Investments for $1,200.

C) debit to Stock Investments for $30,600.

D) credit to Gain on Sale of Stock Investments for $1,800.

A) debit to Cash for $30,600.

B) credit to Gain on Sale of Stock Investments for $1,200.

C) debit to Stock Investments for $30,600.

D) credit to Gain on Sale of Stock Investments for $1,800.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

77

Under the equity method, the Stock Investments account is increased when the

A) investee company reports net income.

B) investee company pays a dividend.

C) investee company reports a loss.

D) stock investment is sold at a gain.

A) investee company reports net income.

B) investee company pays a dividend.

C) investee company reports a loss.

D) stock investment is sold at a gain.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

78

On January 1, 2014, Lark Corporation purchased 35% of the common stock outstanding of Dinc Corporation for $700,000. During 2014, Dinc Corporation reported net income of $200,000 and paid cash dividends of $100,000. The balance of the Stock Investments-Dinc account on the books of Lark Corporation at December 31, 2014 is

A) $700,000.

B) $735,000.

C) $770,000.

D) $665,000.

A) $700,000.

B) $735,000.

C) $770,000.

D) $665,000.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

79

On January 1, 2014, Grgante Corporation purchased 25% of the common stock outstanding of Long Corporation for $270,000. During 2014, Long Corporation reported net income of $80,000 and paid cash dividends of $40,000. The balance of the Stock Investments-Long account on the books of Grgante Corporation at December 31, 2014 is

A) $270,000.

B) $310,000.

C) $350,000.

D) $280,000.

A) $270,000.

B) $310,000.

C) $350,000.

D) $280,000.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

80

If an investor owns less than 20% of the common stock of another corporation as a long-term investment,

A) the equity method of accounting for the investment should be employed.

B) no dividends can be expected.

C) it is presumed that the investor has relatively little influence on the investee.

D) it is presumed that the investor has significant influence on the investee.

A) the equity method of accounting for the investment should be employed.

B) no dividends can be expected.

C) it is presumed that the investor has relatively little influence on the investee.

D) it is presumed that the investor has significant influence on the investee.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck