Deck 13: Planning for Capital Investments

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

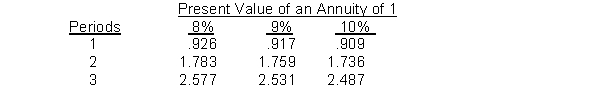

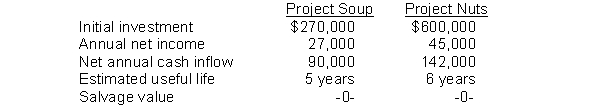

Question

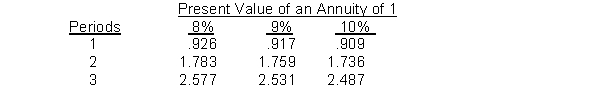

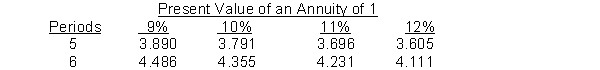

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/100

Play

Full screen (f)

Deck 13: Planning for Capital Investments

1

The profitability index allows comparison of the relative desirability of projects that require differing initial investments.

True

2

The cash payback period is calculated by dividing the cost of the capital investment by the annual cash inflow.

True

3

Sensitivity analysis uses a number of outcome estimates to get a sense of the variability among potential returns.

True

4

By ignoring intangible benefits, capital budgeting techniques might incorrectly eliminate projects that could be beneficial to the company.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

5

A well-run organization should perform an evaluation, called a post-audit, of its investment projects before their completion.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

6

The interest yield of a project is a rate that will cause the present value of the proposed capital expenditure to equal the present value of the expected annual cash inflows.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

7

The cost of capital is a weighted average of the rates paid on borrowed funds, as well as on funds provided by investors in the company's shares.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

8

The net present value method can only be used in capital budgeting if the expected cash flows from a project are an equal amount each year.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

9

The capital budgeting committee ultimately approves the capital expenditure budget for the year.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

10

One way of incorporating intangible benefits into the capital budgeting decision is to project conservative estimates of the value of the intangible benefits and include them in the NPV calculation.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

11

The cash payback method is frequently used as a screening tool but it does not take into consideration the profitability of a project.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

12

Post-audits create an incentive for managers to make accurate estimates, since managers know that their results will be evaluated.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

13

Using the net present value method, a net present value of zero indicates that the project would not be acceptable.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

14

The internal rate of return method is, like the NPV method, a discounted cash flow technique.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

15

The cash payback technique is a quick way to calculate a project's net present value.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

16

The profitability index is calculated by dividing the total cash flows by the initial investment.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

17

Capital budgeting decisions usually involve large investments and often have a significant impact on a company's future profitability.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

18

To avoid accepting projects that actually should be rejected, a company should ignore intangible benefits in calculating net present value.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

19

A post-audit is an evaluation of how well a project's actual performance matches the projections made when the project was proposed.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

20

For purposes of capital budgeting, estimated cash inflows and outflows are preferred for inputs into the capital budgeting decision tools.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following represents a cash outflow?

A)overhaul of equipment

B)increased cash received from customers

C)reduced cash flows for operating costs

D)salvage value of equipment when project is completed

A)overhaul of equipment

B)increased cash received from customers

C)reduced cash flows for operating costs

D)salvage value of equipment when project is completed

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

22

If an asset costs $60,000 and is expected to have a $5,000 salvage value at the end of its nine-year life, and generates annual net cash inflows of $10,000 each year, the cash payback period is

A)6.5 years.

B)6 years.

C)5.5 years.

D)9 years.

A)6.5 years.

B)6 years.

C)5.5 years.

D)9 years.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

23

The higher the risk element in a project, the

A)more attractive the investment.

B)higher the net present value.

C)higher the cost of capital.

D)higher the discount rate.

A)more attractive the investment.

B)higher the net present value.

C)higher the cost of capital.

D)higher the discount rate.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

24

When using the cash payback technique, the payback period is expressed in terms of

A)a percent.

B)dollars.

C)years.

D)months.

A)a percent.

B)dollars.

C)years.

D)months.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

25

The cash payback period is calculated by dividing the cost of the capital investment by the

A)annual net income.

B)net annual cash inflow.

C)present value of the cash inflow.

D)present value of the net income.

A)annual net income.

B)net annual cash inflow.

C)present value of the cash inflow.

D)present value of the net income.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

26

Bark Company is considering buying a machine for $120,000 with an estimated life of ten years and no salvage value.The straight-line method of depreciation will be used.The machine is expected to generate net income of $8,000 each year.The cash payback period on this investment is

A)15 years.

B)10 years.

C)6 years.

D)3 years.

A)15 years.

B)10 years.

C)6 years.

D)3 years.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

27

The capital budgeting decision depends in part on the

A)availability of funds.

B)relationships among proposed projects.

C)risk associated with a particular project.

D)all of these.

A)availability of funds.

B)relationships among proposed projects.

C)risk associated with a particular project.

D)all of these.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

28

The discount rate is referred to by all of the following alternative names except the

A)cost of capital.

B)cutoff rate.

C)hurdle rate.

D)required rate of return.

A)cost of capital.

B)cutoff rate.

C)hurdle rate.

D)required rate of return.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

29

The capital budget for the year is approved by a company's

A)board of directors.

B)capital budgeting committee.

C)officers.

D)shareholders.

A)board of directors.

B)capital budgeting committee.

C)officers.

D)shareholders.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

30

The annual rate of return method requires dividing a project's annual cash inflows by the economic life of the project.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

31

The rate that a company must pay to obtain funds from creditors and shareholders s known as the

A)hurdle rate.

B)cost of capital.

C)cutoff rate.

D)all of these.

A)hurdle rate.

B)cost of capital.

C)cutoff rate.

D)all of these.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following represents a cash inflow?

A)the initial investment

B)sale of old equipment

C)repairs and maintenance

D)increased operating costs

A)the initial investment

B)sale of old equipment

C)repairs and maintenance

D)increased operating costs

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

33

A disadvantage of the cash payback technique is that it

A)ignores obsolescence factors.

B)ignores the cost of an investment.

C)is complicated to use.

D)ignores the time value of money.

A)ignores obsolescence factors.

B)ignores the cost of an investment.

C)is complicated to use.

D)ignores the time value of money.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

34

If a payback period for a project is greater than its expected useful life, the

A)project will always be profitable.

B)entire initial investment will not be recovered.

C)project would only be acceptable if the company's cost of capital was low.

D)project's return will always exceed the company's cost of capital.

A)project will always be profitable.

B)entire initial investment will not be recovered.

C)project would only be acceptable if the company's cost of capital was low.

D)project's return will always exceed the company's cost of capital.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

35

The cash payback technique

A)should be used as a final screening tool.

B)can be the only basis for the capital budgeting decision.

C)is relatively easy to calculate and understand.

D)considers the expected profitability of a project.

A)should be used as a final screening tool.

B)can be the only basis for the capital budgeting decision.

C)is relatively easy to calculate and understand.

D)considers the expected profitability of a project.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

36

A major advantage of the annual rate of return method is that it considers the time value of money.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following describes the capital budgeting evaluation process?

A)The capital budget committee submits its proposals to the officers of the company who choose which projects will be forwarded to the shareholders for ultimate approval.

B)The officiers of the company submit their proposals to the capital budget committee who choose which projects will be forwarded to the shareholders for ultimate approval.

C)The officiers of the company submit their proposals to the capital budget committee who choose which projects will be forwarded to the board of directors for ultimate approval.

D)The capital budget committee submits its proposal to the officers of the company who choose which projects will be forwarded to the board of directors for ultimate approval.

A)The capital budget committee submits its proposals to the officers of the company who choose which projects will be forwarded to the shareholders for ultimate approval.

B)The officiers of the company submit their proposals to the capital budget committee who choose which projects will be forwarded to the shareholders for ultimate approval.

C)The officiers of the company submit their proposals to the capital budget committee who choose which projects will be forwarded to the board of directors for ultimate approval.

D)The capital budget committee submits its proposal to the officers of the company who choose which projects will be forwarded to the board of directors for ultimate approval.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

38

Using the annual rate of return method, a project is acceptable if its rate of return is greater than management's minimum rate of return.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

39

Capital budgeting is the process

A)used in sell or process further decisions.

B)of determining how many common shares to issue.

C)of making capital expenditure decisions.

D)of eliminating unprofitable product lines.

A)used in sell or process further decisions.

B)of determining how many common shares to issue.

C)of making capital expenditure decisions.

D)of eliminating unprofitable product lines.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

40

Using the internal rate of return method, a project is rejected when the rate of return is greater than or equal to the required rate of return.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

41

Post-audits of capital projects

A)are usually foolproof.

B)are done using different evaluation techniques than were used in making the original capital budgeting decision.

C)provide a formal mechanism by which the company can determine whether existing projects should be supported or terminated.

D)all of these.

A)are usually foolproof.

B)are done using different evaluation techniques than were used in making the original capital budgeting decision.

C)provide a formal mechanism by which the company can determine whether existing projects should be supported or terminated.

D)all of these.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

42

In evaluating high-tech projects

A)only tangible benefits should be considered.

B)only intangible benefits should be considered.

C)both tangible and intangible benefits should be considered.

D)neither tangible nor intangible benefits should be considered.

A)only tangible benefits should be considered.

B)only intangible benefits should be considered.

C)both tangible and intangible benefits should be considered.

D)neither tangible nor intangible benefits should be considered.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

43

Intangible benefits in capital budgeting

A)should be ignored because they are difficult to determine.

B)include increased quality or employee loyalty.

C)are not considered because they are usually not relevant to the decision.

D)have a rate of return in excess of the company's cost of capital.

A)should be ignored because they are difficult to determine.

B)include increased quality or employee loyalty.

C)are not considered because they are usually not relevant to the decision.

D)have a rate of return in excess of the company's cost of capital.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

44

Intangible benefits in capital budgeting would include all of the following except increased

A)product quality.

B)employee loyalty.

C)salvage value.

D)product safety.

A)product quality.

B)employee loyalty.

C)salvage value.

D)product safety.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

45

If a company uses a 12% discount rate with the net present value method, and then does the same analysis, but with a 15% discount rate, which of the following is likely to occur?

A)The 12% rate will show the project is more profitable than the 15% rate.

B)The 15% rate will show the project is more profitable than the 12% rate.

C)Both rates will produce the same net present value.

D)The relative profitability of the two studies depends only on the timing of the cash flows, not on the discount rate.

A)The 12% rate will show the project is more profitable than the 15% rate.

B)The 15% rate will show the project is more profitable than the 12% rate.

C)Both rates will produce the same net present value.

D)The relative profitability of the two studies depends only on the timing of the cash flows, not on the discount rate.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

46

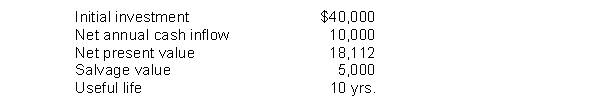

The following information is available for a potential investment for Panda Company:  The potential investment's profitability index is

The potential investment's profitability index is

A)4.00.

B)2.85.

C)2.50.

D)1.45.

The potential investment's profitability index is

The potential investment's profitability index isA)4.00.

B)2.85.

C)2.50.

D)1.45.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

47

The capital budgeting method that takes into account both the size of the original investment and the discounted cash flows is the

A)cash payback method.

B)internal rate of return method.

C)net present value method.

D)profitability index.

A)cash payback method.

B)internal rate of return method.

C)net present value method.

D)profitability index.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

48

An approach that uses a number of outcome estimates to get a sense of the variability among potential returns is

A)the discounted cash flow technique.

B)the net present value method.

C)risk analysis.

D)sensitivity analysis.

A)the discounted cash flow technique.

B)the net present value method.

C)risk analysis.

D)sensitivity analysis.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

49

A post-audit should be performed using

A)a different evaluation technique than that used in making the original decision.

B)the same evaluation technique used in making the original decision.

C)estimated amounts instead of actual figures.

D)an independent advisor.

A)a different evaluation technique than that used in making the original decision.

B)the same evaluation technique used in making the original decision.

C)estimated amounts instead of actual figures.

D)an independent advisor.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

50

The capital budgeting method that allows comparison of the relative desirability of projects that require differing initial investments is the

A)cash payback method.

B)internal rate of return method.

C)net present value method.

D)profitability index.

A)cash payback method.

B)internal rate of return method.

C)net present value method.

D)profitability index.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

51

The profitability index is calculated by dividing the

A)total cash flows by the initial investment.

B)present value of cash flows by the initial investment.

C)initial investment by the total cash flows.

D)initial investment by the present value of cash flows.

A)total cash flows by the initial investment.

B)present value of cash flows by the initial investment.

C)initial investment by the total cash flows.

D)initial investment by the present value of cash flows.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

52

The profitability index

A)does not take into account the discounted cash flows.

B)is calculated by dividing total cash flows by the initial investment.

C)allows comparison of the relative desirability of projects that require differing initial investments.

D)will never be greater than 1.

A)does not take into account the discounted cash flows.

B)is calculated by dividing total cash flows by the initial investment.

C)allows comparison of the relative desirability of projects that require differing initial investments.

D)will never be greater than 1.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

53

If a company's required rate of return is 10% and, in using the net present value method, a project's net present value is zero, this indicates that the

A)project's rate of return exceeds 10%.

B)project's rate of return is less than the minimum rate required.

C)project earns a rate of return of 10%.

D)project earns a rate of return of 0%.

A)project's rate of return exceeds 10%.

B)project's rate of return is less than the minimum rate required.

C)project earns a rate of return of 10%.

D)project earns a rate of return of 0%.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

54

A thorough evaluation of how well a project's actual performance matches the projections made when the project was proposed is called a

A)pre-audit.

B)post-audit.

C)risk analysis.

D)sensitivity analysis.

A)pre-audit.

B)post-audit.

C)risk analysis.

D)sensitivity analysis.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

55

If a company's required rate of return is 9%, and in using the profitability index method, a project's index is greater than 1, this indicates that the project's rate of return is

A)equal to 9%.

B)greater than 9%.

C)less than 9%.

D)unacceptable for investment purposes.

A)equal to 9%.

B)greater than 9%.

C)less than 9%.

D)unacceptable for investment purposes.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

56

All of the following statements about intangible benefits in capital budgeting are correct except that they

A)include increased quality and employee loyalty.

B)are difficult to quantify.

C)are often ignored in capital budgeting decisions.

D)cannot be incorporated into the NPV calculation.

A)include increased quality and employee loyalty.

B)are difficult to quantify.

C)are often ignored in capital budgeting decisions.

D)cannot be incorporated into the NPV calculation.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

57

When the annual cash flows from an investment are unequal, the appropriate table to use is the

A)future value of 1 table.

B)future value of annuity table.

C)present value of 1 table.

D)present value of annuity table.

A)future value of 1 table.

B)future value of annuity table.

C)present value of 1 table.

D)present value of annuity table.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following assumptions is made in order to simplify the net present value method?

A)All cash flows come at the end of the year.

B)All cash flows are immediately reinvested at the best rate available at the time.

C)All cash flows come at the beginning of the year.

D)All cash flows are not reinvested.

A)All cash flows come at the end of the year.

B)All cash flows are immediately reinvested at the best rate available at the time.

C)All cash flows come at the beginning of the year.

D)All cash flows are not reinvested.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

59

Using the profitability index method, the present value of cash inflows for Project Flower is $88,000 and the present value of cash inflows of Project Plant is $48,000.If Project Flower and Project Plant require initial investments of $90,000 and $40,000, respectively, and have the same useful life, the project that should be accepted is

A)Project Flower.

B)Project Plant.

C)Either project may be accepted.

D)Neither project should be accepted.

A)Project Flower.

B)Project Plant.

C)Either project may be accepted.

D)Neither project should be accepted.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

60

Using a number of outcome estimates to get a sense of the variability among potential returns is

A)financial analysis.

B)post-audit analysis.

C)sensitivity analysis.

D)outcome analysis.

A)financial analysis.

B)post-audit analysis.

C)sensitivity analysis.

D)outcome analysis.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

61

All of the following statements about the internal rate of return method are correct except that it

A)recognizes the time value of money.

B)is widely used in practice.

C)is easy to interpret.

D)can be used only when the cash inflows are equal.

A)recognizes the time value of money.

B)is widely used in practice.

C)is easy to interpret.

D)can be used only when the cash inflows are equal.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

62

In using the internal rate of return method, the internal rate of return factor was 4.0 and the equal annual cash inflows were $16,000.The initial investment in the project must have been

A)$8,000.

B)$16,000.

C)$64,000.

D)$32,000.

A)$8,000.

B)$16,000.

C)$64,000.

D)$32,000.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

63

What is the main disadvantage of the annual rate of return method?

A)It is only valid for investments with a one year time perspective.

B)It incorporates depreciation into the calculations, which increases the uncertainty of the calculations associated with estimating the life and salvage value of the investment.

C)No consideration is given as to when the cash inflows occur.

D)It does not consider the time value of money.

A)It is only valid for investments with a one year time perspective.

B)It incorporates depreciation into the calculations, which increases the uncertainty of the calculations associated with estimating the life and salvage value of the investment.

C)No consideration is given as to when the cash inflows occur.

D)It does not consider the time value of money.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

64

The annual rate of return method is also referred to as:

A)simple rate of return method.

B)accounting rate of return method.

C)unadjusted rate of return method.

D)all of the above.

A)simple rate of return method.

B)accounting rate of return method.

C)unadjusted rate of return method.

D)all of the above.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

65

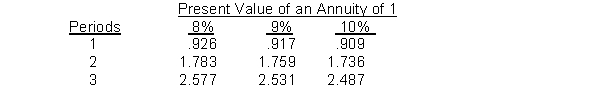

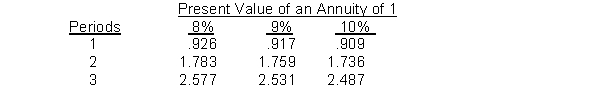

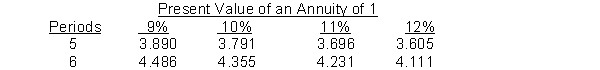

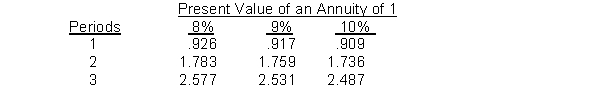

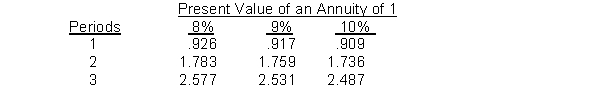

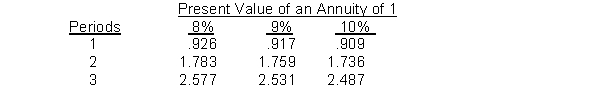

Use the following table for questions .

A company has a minimum required rate of return of 9% and is considering investing in a project that costs $50,000 and is expected to generate cash inflows of $30,000at the end of each year for two years.The net present value of this project is

A)$20,000.

B)$10,000.

C)$6,920.

D)$2,770.

A company has a minimum required rate of return of 9% and is considering investing in a project that costs $50,000 and is expected to generate cash inflows of $30,000at the end of each year for two years.The net present value of this project is

A)$20,000.

B)$10,000.

C)$6,920.

D)$2,770.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

66

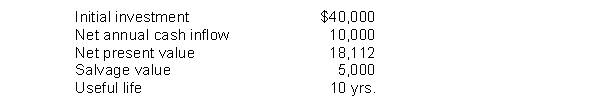

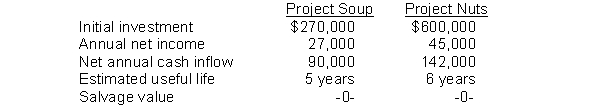

Use the following information for questions

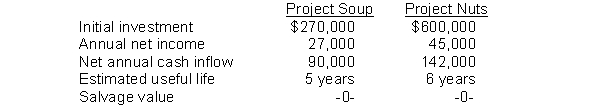

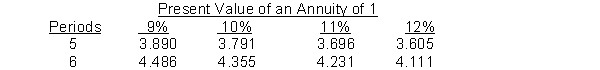

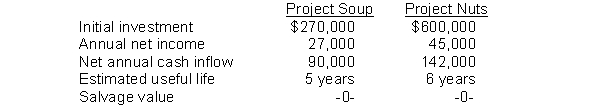

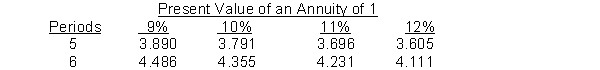

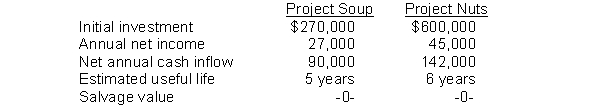

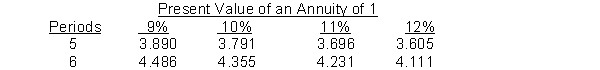

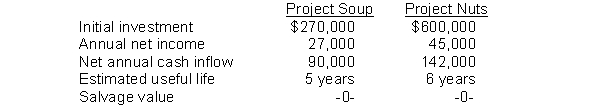

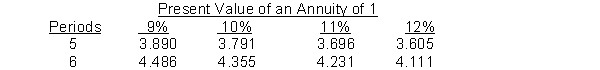

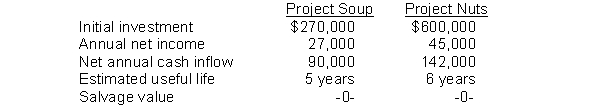

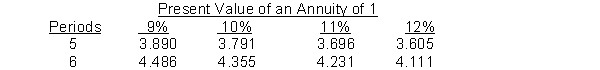

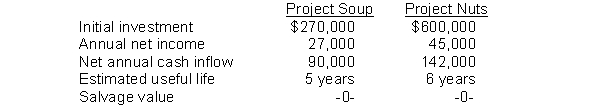

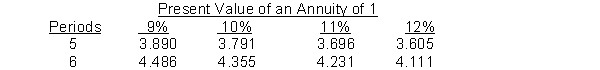

Carr Company is considering two capital investment proposals.Estimates regarding each project are provided below: The company requires a 10% rate of return on all new investments.

The company requires a 10% rate of return on all new investments.

The internal rate of return for Project Nuts is approximately

A)10%.

B)11%.

C)12%.

D)9%.

Carr Company is considering two capital investment proposals.Estimates regarding each project are provided below:

The company requires a 10% rate of return on all new investments.

The company requires a 10% rate of return on all new investments.

The internal rate of return for Project Nuts is approximately

A)10%.

B)11%.

C)12%.

D)9%.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

67

Use the following information for questions

Carr Company is considering two capital investment proposals.Estimates regarding each project are provided below: The company requires a 10% rate of return on all new investments.

The company requires a 10% rate of return on all new investments.

The annual rate of return for Project Soup is

A)13.3%.

B)10%.

C)33.3%.

D)30%.

Carr Company is considering two capital investment proposals.Estimates regarding each project are provided below:

The company requires a 10% rate of return on all new investments.

The company requires a 10% rate of return on all new investments.

The annual rate of return for Project Soup is

A)13.3%.

B)10%.

C)33.3%.

D)30%.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

68

Use the following table for questions .

A company has a minimum required rate of return of 9% and is considering investing in a project that costs $50,000 and is expected to generate cash inflows of $20,000 at the end of each year for three years.The profitability index for this project is

A).99.

B)1.00.

C)1.01.

D)1.20.

A company has a minimum required rate of return of 9% and is considering investing in a project that costs $50,000 and is expected to generate cash inflows of $20,000 at the end of each year for three years.The profitability index for this project is

A).99.

B)1.00.

C)1.01.

D)1.20.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

69

Use the following information for questions

Carr Company is considering two capital investment proposals.Estimates regarding each project are provided below: The company requires a 10% rate of return on all new investments.

The company requires a 10% rate of return on all new investments.

The cash payback period for Project Soup is

A)13.5 years.

B)5 years.

C)3.9 years.

D)3 years.

Carr Company is considering two capital investment proposals.Estimates regarding each project are provided below:

The company requires a 10% rate of return on all new investments.

The company requires a 10% rate of return on all new investments.

The cash payback period for Project Soup is

A)13.5 years.

B)5 years.

C)3.9 years.

D)3 years.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

70

Use the following information for questions

Carr Company is considering two capital investment proposals.Estimates regarding each project are provided below: The company requires a 10% rate of return on all new investments.

The company requires a 10% rate of return on all new investments.

The net present value for Project Nuts is

A)$618,410.

B)$182,912.

C)$100,000.

D)$18,410.

Carr Company is considering two capital investment proposals.Estimates regarding each project are provided below:

The company requires a 10% rate of return on all new investments.

The company requires a 10% rate of return on all new investments.

The net present value for Project Nuts is

A)$618,410.

B)$182,912.

C)$100,000.

D)$18,410.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

71

Performing a post-audit is important because

A)managers will be more likely to submit reasonable data when they make investment proposals if they know their estimates will be compared to actual results.

B)it provides a formal mechanism by which the company can determine whether existing projects should be terminated.

C)it improves the development of future investment proposals because managers improve their estimation techniques by evaluating their past successes and failures.

D)all of these.

A)managers will be more likely to submit reasonable data when they make investment proposals if they know their estimates will be compared to actual results.

B)it provides a formal mechanism by which the company can determine whether existing projects should be terminated.

C)it improves the development of future investment proposals because managers improve their estimation techniques by evaluating their past successes and failures.

D)all of these.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

72

Use the following information for questions

A company projects an increase in net income of $40,000 each year for the next five years if it invests $500,000 in new equipment.The equipment has a five-year life and an estimated salvage value of $50,000.The company uses the straight-line method of depreciation.

What is the net annual cash flow?

A)$40,000

B)$90,000

C)$130,000

D)$140,000

A company projects an increase in net income of $40,000 each year for the next five years if it invests $500,000 in new equipment.The equipment has a five-year life and an estimated salvage value of $50,000.The company uses the straight-line method of depreciation.

What is the net annual cash flow?

A)$40,000

B)$90,000

C)$130,000

D)$140,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

73

Use the following table for questions .

A company has a minimum required rate of return of 10% and is considering investing in a project that requires an investment of $68,000 and is expected to generate cash inflows of $30,000 at the end of each year for 3 years.The present value of future cash inflows for this project is

A)$68,000.

B)$74,610.

C)$7,930.

D)$6,610

A company has a minimum required rate of return of 10% and is considering investing in a project that requires an investment of $68,000 and is expected to generate cash inflows of $30,000 at the end of each year for 3 years.The present value of future cash inflows for this project is

A)$68,000.

B)$74,610.

C)$7,930.

D)$6,610

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

74

A capital budgeting method that takes into consideration the time value of money is the

A)annual rate of return method.

B)return on shareholders' equity method.

C)cash payback technique.

D)internal rate of return method.

A)annual rate of return method.

B)return on shareholders' equity method.

C)cash payback technique.

D)internal rate of return method.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

75

Use the following information for questions

A company is considering purchasing factory equipment that costs $400,000 and is estimated to have no salvage value at the end of its 5-year useful life.If the equipment is purchased, annual revenues are expected to be $150,000 and annual operating expenses exclusive of depreciation expense are expected to be $25,000.The straight-line method of depreciation would be used.

If the equipment is purchased, the annual rate of return expected on this equipment is

A)37.5%.

B)31.25%.

C)11.25%.

D)6.25%.

A company is considering purchasing factory equipment that costs $400,000 and is estimated to have no salvage value at the end of its 5-year useful life.If the equipment is purchased, annual revenues are expected to be $150,000 and annual operating expenses exclusive of depreciation expense are expected to be $25,000.The straight-line method of depreciation would be used.

If the equipment is purchased, the annual rate of return expected on this equipment is

A)37.5%.

B)31.25%.

C)11.25%.

D)6.25%.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

76

The annual rate of return method is based on

A)accounting data.

B)the time value of money data.

C)market values.

D)cash flow data.

A)accounting data.

B)the time value of money data.

C)market values.

D)cash flow data.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

77

The capital budgeting technique that finds the interest yield of the potential investment is the

A)annual rate of return method.

B)internal rate of return method.

C)net present value method.

D)profitability index method.

A)annual rate of return method.

B)internal rate of return method.

C)net present value method.

D)profitability index method.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

78

Use the following information for questions

A company is considering purchasing factory equipment that costs $400,000 and is estimated to have no salvage value at the end of its 5-year useful life.If the equipment is purchased, annual revenues are expected to be $150,000 and annual operating expenses exclusive of depreciation expense are expected to be $25,000.The straight-line method of depreciation would be used.

The cash payback period on the equipment is

A)8.89 years.

B)5.0 years.

C)3.2 years.

D)2.67 years.

A company is considering purchasing factory equipment that costs $400,000 and is estimated to have no salvage value at the end of its 5-year useful life.If the equipment is purchased, annual revenues are expected to be $150,000 and annual operating expenses exclusive of depreciation expense are expected to be $25,000.The straight-line method of depreciation would be used.

The cash payback period on the equipment is

A)8.89 years.

B)5.0 years.

C)3.2 years.

D)2.67 years.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

79

Use the following table for questions .

A company has a minimum required rate of return of 8% and is considering investing in a project that costs $67,145 and is expected to generate cash inflows of $27,000 each year for three years.The approximate internal rate of return on this project is

A)8%.

B)10%.

C)9%.

D)less than the required 8%.

A company has a minimum required rate of return of 8% and is considering investing in a project that costs $67,145 and is expected to generate cash inflows of $27,000 each year for three years.The approximate internal rate of return on this project is

A)8%.

B)10%.

C)9%.

D)less than the required 8%.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

80

The internal rate of return is the interest rate that results in a

A)positive NPV.

B)negative NPV.

C)zero NPV.

D)positive or negative NPV.

A)positive NPV.

B)negative NPV.

C)zero NPV.

D)positive or negative NPV.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck