Deck 5: Financial Position and Cash Flows

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/49

Play

Full screen (f)

Deck 5: Financial Position and Cash Flows

1

A company that follows private entity GAAP

A)must not disclose the cash flow per share

B)can disclose the cash flow per share

C)can disclose the cash flow per share if it makes a special election to do so

D)None of these

A)must not disclose the cash flow per share

B)can disclose the cash flow per share

C)can disclose the cash flow per share if it makes a special election to do so

D)None of these

A

2

The basis for classifying assets as current or noncurrent is the period of time normally required by the accounting entity to convert cash invested in

A)inventory back into cash, or twelve months, whichever is shorter.

B)receivables back into cash, or twelve months, whichever is longer.

C)tangible fixed assets back into cash, or twelve months, whichever is longer.

D)inventory back into cash, or twelve months, whichever is longer.

A)inventory back into cash, or twelve months, whichever is shorter.

B)receivables back into cash, or twelve months, whichever is longer.

C)tangible fixed assets back into cash, or twelve months, whichever is longer.

D)inventory back into cash, or twelve months, whichever is longer.

D

3

Monetary assets are defined as assets that are convertible to

A)known amounts of cash.

B)cash within one operating cycle.

C)cash within twelve months.

D)cash within three months

A)known amounts of cash.

B)cash within one operating cycle.

C)cash within twelve months.

D)cash within three months

A

4

Which of the following should be excluded from long-term liabilities?

A)Obligations payable at some date beyond the operating cycle

B)Most pension obligations

C)Long-term liabilities that mature within the operating cycle and will be paid from a sinking fund

D)None of these

A)Obligations payable at some date beyond the operating cycle

B)Most pension obligations

C)Long-term liabilities that mature within the operating cycle and will be paid from a sinking fund

D)None of these

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is a current asset?

A)Cash surrender value of a life insurance policy of which the company is the beneficiary.

B)Investment in equity securities for the purpose of controlling the issuing company.

C)Cash designated for the purchase of tangible fixed assets.

D)Trade instalment receivables normally collectible in eighteen months.

A)Cash surrender value of a life insurance policy of which the company is the beneficiary.

B)Investment in equity securities for the purpose of controlling the issuing company.

C)Cash designated for the purchase of tangible fixed assets.

D)Trade instalment receivables normally collectible in eighteen months.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

6

Which item below is not a current liability?

A)Unearned revenue

B)Stock dividends distributable

C)The currently maturing portion of long-term debt

D)Trade accounts payable

A)Unearned revenue

B)Stock dividends distributable

C)The currently maturing portion of long-term debt

D)Trade accounts payable

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

7

When current debt is refinanced by the issue date of financial statements, it may generally be presented as non-current

A)if the company follows IFRS

B)under either private entity GAAP or IFRS

C)if the company follows private entity GAAP

D)None of these

A)if the company follows IFRS

B)under either private entity GAAP or IFRS

C)if the company follows private entity GAAP

D)None of these

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

8

The balance sheet is useful for analysing all of the following except

A)liquidity.

B)solvency.

C)profitability.

D)financial flexibility.

A)liquidity.

B)solvency.

C)profitability.

D)financial flexibility.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

9

The basis for classifying assets as current or noncurrent is conversion to cash within

A)the accounting cycle or one year, whichever is shorter.

B)the operating cycle or one year, whichever is longer.

C)the accounting cycle or one year, whichever is longer.

D)the operating cycle or one year, whichever is shorter.

A)the accounting cycle or one year, whichever is shorter.

B)the operating cycle or one year, whichever is longer.

C)the accounting cycle or one year, whichever is longer.

D)the operating cycle or one year, whichever is shorter.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

10

A company that follows IFRS

A)can disclose the cash flow per share if it makes a special election to do so

B)must not disclose the cash flow per share

C)is generally allowed to disclose the cash flow per share

D)None of these

A)can disclose the cash flow per share if it makes a special election to do so

B)must not disclose the cash flow per share

C)is generally allowed to disclose the cash flow per share

D)None of these

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

11

Significant changes to the presentation of financial statements are currently being developed by the IASB and FASB.Which of the following statements best describes the focus of these changes?

A)To better highlight the company's assets, liabilities and equity

B)To segregate the company's operating, financing and investing activities

C)To highlight the company's major business and financing activities.

D)To increase the number of notes to be attached to the company's financial statements.

A)To better highlight the company's assets, liabilities and equity

B)To segregate the company's operating, financing and investing activities

C)To highlight the company's major business and financing activities.

D)To increase the number of notes to be attached to the company's financial statements.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

12

An example of an item which is not an element of working capital is

A)accrued interest on notes receivable.

B)goodwill.

C)goods in process.

D)short-term investments.

A)accrued interest on notes receivable.

B)goodwill.

C)goods in process.

D)short-term investments.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is a limitation of the balance sheet?

A)Many items that are of financial value are omitted.

B)Judgements and estimates are used.

C)Current fair value is not reported.

D)All of these

A)Many items that are of financial value are omitted.

B)Judgements and estimates are used.

C)Current fair value is not reported.

D)All of these

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

14

Treasury stock should be reported as a(n)

A)current asset.

B)investment.

C)other asset.

D)reduction of shareholders' equity.

A)current asset.

B)investment.

C)other asset.

D)reduction of shareholders' equity.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following should not be considered as a current asset in the balance sheet?

A)Instalment notes receivable due over eighteen months in accordance with normal trade practice.

B)Prepaid taxes which cover assessments of the following operating cycle of the business.

C)Equity or debt securities purchased with cash available for current operations.

D)The cash surrender value of a life insurance policy carried by a corporation, the beneficiary, on its president.

A)Instalment notes receivable due over eighteen months in accordance with normal trade practice.

B)Prepaid taxes which cover assessments of the following operating cycle of the business.

C)Equity or debt securities purchased with cash available for current operations.

D)The cash surrender value of a life insurance policy carried by a corporation, the beneficiary, on its president.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

16

Working capital is

A)capital which has been reinvested in the business.

B)unappropriated retained earnings.

C)cash and receivables less current liabilities.

D)none of these.

A)capital which has been reinvested in the business.

B)unappropriated retained earnings.

C)cash and receivables less current liabilities.

D)none of these.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

17

Long-term liabilities include

A)obligations not expected to be liquidated within the operating cycle.

B)obligations payable at some date beyond the operating cycle.

C)future income taxes and most lease obligations.

D)all of these.

A)obligations not expected to be liquidated within the operating cycle.

B)obligations payable at some date beyond the operating cycle.

C)future income taxes and most lease obligations.

D)all of these.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following items would require special disclosure under IFRS?

A)Investment property

B)Biological assets

C)Provisions

D)All of these

A)Investment property

B)Biological assets

C)Provisions

D)All of these

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

19

Disclosure of the date that financial statements are authorized for issue is

A)mandatory if the company follows private entity GAAP

B)mandatory if the company follows IFRS

C)mandatory under either private entity GAAP or IFRS

D)None of these

A)mandatory if the company follows private entity GAAP

B)mandatory if the company follows IFRS

C)mandatory under either private entity GAAP or IFRS

D)None of these

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

20

Equity or debt securities held to finance future construction of additional plants should be classified on a balance sheet as

A)current assets.

B)property, plant, and equipment.

C)intangible assets.

D)long-term investments.

A)current assets.

B)property, plant, and equipment.

C)intangible assets.

D)long-term investments.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

21

A company's petty cash fund of $450 would generally be

A)included as part of cash

B)would not qualify as a current asset because the amount is below $1,000

C)a current asset

D)(a) and (c)

A)included as part of cash

B)would not qualify as a current asset because the amount is below $1,000

C)a current asset

D)(a) and (c)

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following is not a method of disclosing pertinent information?

A)Supporting schedules

B)Parenthetical explanations

C)Cross reference and contra items

D)All of these are methods of disclosing pertinent information.

A)Supporting schedules

B)Parenthetical explanations

C)Cross reference and contra items

D)All of these are methods of disclosing pertinent information.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

23

In preparing a statement of cash flows, cash flows from operating activities

A)are always equal to accrual accounting income.

B)are calculated as the difference between revenues and expenses.

C)can be calculated by appropriately adding to or deducting from net income those items in the income statement that do not affect cash.

D)can be calculated by appropriately adding to or deducting from net income those items

A)are always equal to accrual accounting income.

B)are calculated as the difference between revenues and expenses.

C)can be calculated by appropriately adding to or deducting from net income those items in the income statement that do not affect cash.

D)can be calculated by appropriately adding to or deducting from net income those items

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

24

Preparing the statement of cash flows involves all of the following except determining the

A)cash provided by operations.

B)cash provided by or used in investing and financing activities.

C)change in cash during the period.

D)cash collections from customers during the period.

A)cash provided by operations.

B)cash provided by or used in investing and financing activities.

C)change in cash during the period.

D)cash collections from customers during the period.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

25

The cash debt coverage ratio is computed by dividing net cash provided by operating activities by

A)average long-term liabilities.

B)average total liabilities.

C)ending long-term liabilities.

D)ending total liabilities.

A)average long-term liabilities.

B)average total liabilities.

C)ending long-term liabilities.

D)ending total liabilities.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following would be classified in a different major section of a balance sheet from the others?

A)Capital stock

B)Common stock subscribed

C)Stock dividend distributable

D)Stock investment in affiliate

A)Capital stock

B)Common stock subscribed

C)Stock dividend distributable

D)Stock investment in affiliate

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

27

The current cash debt coverage ratio is often used to assess

A)financial flexibility.

B)liquidity.

C)profitability.

D)solvency.

A)financial flexibility.

B)liquidity.

C)profitability.

D)solvency.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

28

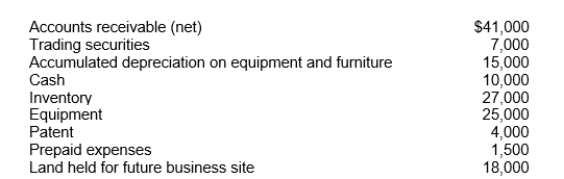

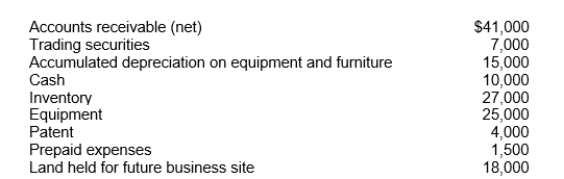

Wolanski Corp.'s trial balance reflected the following account balances at December 31, 2010:  In Wolanski's December 31, 2010 balance sheet, the current assets total is

In Wolanski's December 31, 2010 balance sheet, the current assets total is

A)$104,500.

B)$90,500.

C)$86,500.

D)$73,500.

In Wolanski's December 31, 2010 balance sheet, the current assets total is

In Wolanski's December 31, 2010 balance sheet, the current assets total isA)$104,500.

B)$90,500.

C)$86,500.

D)$73,500.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

29

Making and collecting loans and disposing of property, plant, and equipment are

A)operating activities.

B)investing activities.

C)financing activities.

D)liquidity activities.

A)operating activities.

B)investing activities.

C)financing activities.

D)liquidity activities.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

30

The standards for private entity GAAP and IFRS include numerous differences.Which of the following statements best describes the requirements for the preparation and presentation of the cash flow statement?

A)Both standards allow the use of the indirect or direct method

B)Private entity GAAP permits the use of the direct method only

C)IFRS permits the use of the single-step method only

D)(b) and (c)

A)Both standards allow the use of the indirect or direct method

B)Private entity GAAP permits the use of the direct method only

C)IFRS permits the use of the single-step method only

D)(b) and (c)

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

31

A measure of a company's financial flexibility is the

A)cash debt coverage ratio.

B)current cash debt coverage ratio.

C)free cash flow.

D)cash debt coverage ratio and free cash flow.

A)cash debt coverage ratio.

B)current cash debt coverage ratio.

C)free cash flow.

D)cash debt coverage ratio and free cash flow.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

32

A cash flow statement that is prepared under the direct method starts with:

A)Net income

B)Gross Profit

C)None of these

D)Income from operations

A)Net income

B)Gross Profit

C)None of these

D)Income from operations

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

33

Free cash flow is calculated as net cash provided by operating activities less

A)capital expenditures.

B)dividends.

C)capital expenditures and dividends.

D)capital expenditures and amortization.

A)capital expenditures.

B)dividends.

C)capital expenditures and dividends.

D)capital expenditures and amortization.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

34

In preparing a statement of cash flows, repurchase of a company's own shares at an amount greater than cost would be classified as a(n)

A)operating activity.

B)financing activity.

C)extraordinary activity.

D)investing activity.

A)operating activity.

B)financing activity.

C)extraordinary activity.

D)investing activity.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following best describes a liability?

A)Any obligation, whether enforceable or not, is a liability

B)A liability is an enforceable economic burden or obligation

C)A liability is a legal economic benefit

D)None of these

A)Any obligation, whether enforceable or not, is a liability

B)A liability is an enforceable economic burden or obligation

C)A liability is a legal economic benefit

D)None of these

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

36

The financial statement which summarizes operating, investing, and financing activities of an entity for a period of time is the

A)retained earnings statement.

B)income statement.

C)statement of cash flows.

D)statement of financial position.

A)retained earnings statement.

B)income statement.

C)statement of cash flows.

D)statement of financial position.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

37

The shareholders' equity section is usually divided into what four parts?

A)Preferred stock, common stock, treasury stock, contributed surplus

B)Preferred stock, common stock, retained earnings, other comprehensive income

C)Capital shares, contributed surplus, retained earnings, accumulated other comprehensive income

D)Capital stock, appropriated retained earnings, unappropriated retained earnings, contributed surplus

A)Preferred stock, common stock, treasury stock, contributed surplus

B)Preferred stock, common stock, retained earnings, other comprehensive income

C)Capital shares, contributed surplus, retained earnings, accumulated other comprehensive income

D)Capital stock, appropriated retained earnings, unappropriated retained earnings, contributed surplus

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

38

A cash flow statement that is prepared under the indirect method adds and subtracts certain items to the base number.How would decreases in unearned revenues be shown? They would be shown as

A)a deduction from net income

B)an addition to net income

C)a deduction from sales

D)an addition to sales

A)a deduction from net income

B)an addition to net income

C)a deduction from sales

D)an addition to sales

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

39

In preparing a statement of cash flows, which of the following transactions would be considered an investing activity?

A)Sale of equipment at book value

B)Sale of merchandise on credit

C)Declaration of a cash dividend

D)Issuance of bonds payable at a discount

A)Sale of equipment at book value

B)Sale of merchandise on credit

C)Declaration of a cash dividend

D)Issuance of bonds payable at a discount

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following should be reported for capital shares?

A)The shares authorized

B)The shares issued

C)The shares outstanding

D)All of these

A)The shares authorized

B)The shares issued

C)The shares outstanding

D)All of these

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

41

In a statement of cash flows, receipts from sales of property, plant, and equipment and other productive assets should generally be classified as cash inflows from

A)operating activities.

B)financing activities.

C)investing activities.

D)selling activities.

A)operating activities.

B)financing activities.

C)investing activities.

D)selling activities.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

42

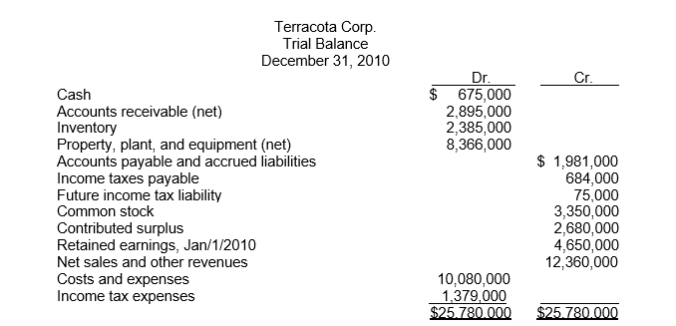

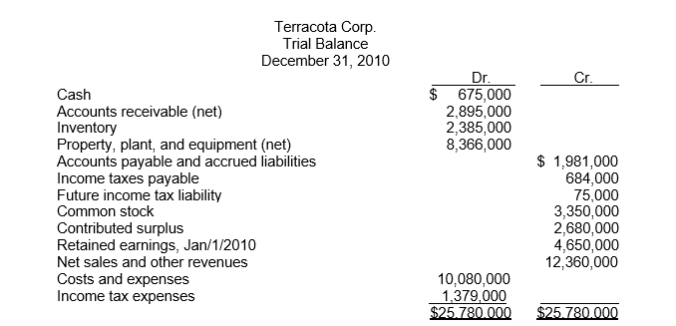

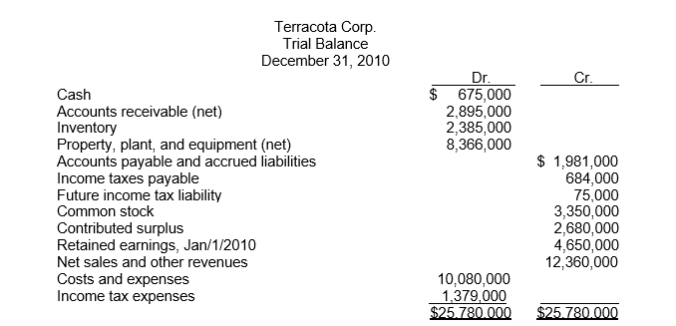

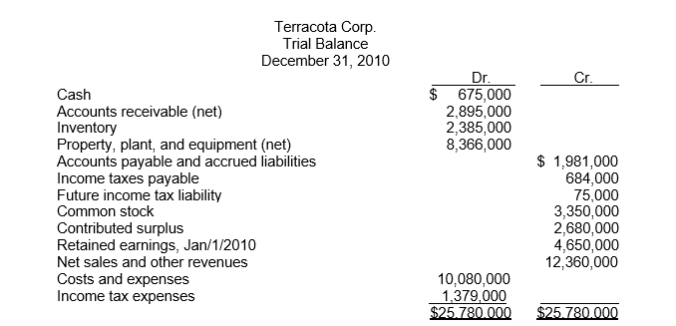

Use the following information for questions

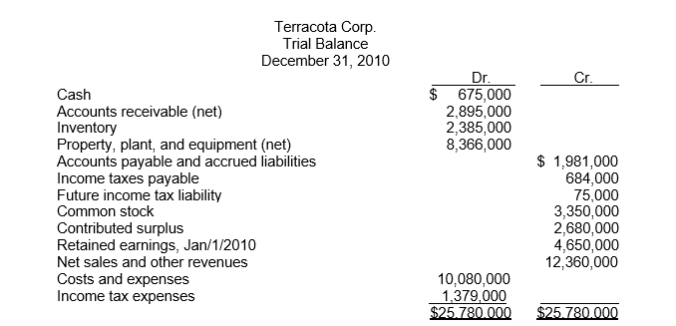

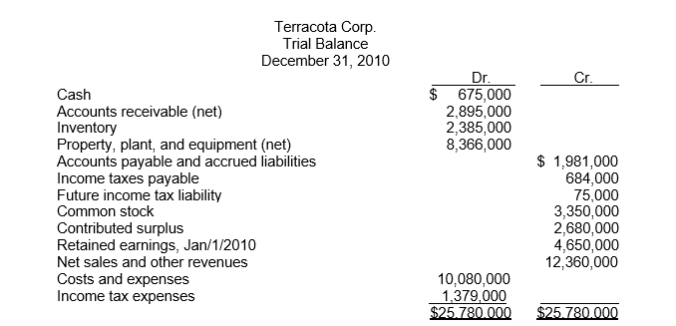

The following trial balance of Terracota Corp.at December 31, 2010 has been properly adjusted except for the income tax expense adjustment.

Other financial data for the year ended December 31, 2010:

Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2012.

The balance in the Future Income Tax Liability account pertains to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability.

During the year, estimated tax payments of $465,000 were charged to income tax expense.

The current and future tax rate on all types of income is 35 percent.In Terracota's December 31, 2010 balance sheet,

The final retained earnings balance is

A)$5,551,000.

B)$6,016,000

C)$5,135,000.

D)$6,431,000.

The following trial balance of Terracota Corp.at December 31, 2010 has been properly adjusted except for the income tax expense adjustment.

Other financial data for the year ended December 31, 2010:

Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2012.

The balance in the Future Income Tax Liability account pertains to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability.

During the year, estimated tax payments of $465,000 were charged to income tax expense.

The current and future tax rate on all types of income is 35 percent.In Terracota's December 31, 2010 balance sheet,

The final retained earnings balance is

A)$5,551,000.

B)$6,016,000

C)$5,135,000.

D)$6,431,000.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

43

Use the following information for questions

The following trial balance of Terracota Corp.at December 31, 2010 has been properly adjusted except for the income tax expense adjustment.

Other financial data for the year ended December 31, 2010:

Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2012.

The balance in the Future Income Tax Liability account pertains to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability.

During the year, estimated tax payments of $465,000 were charged to income tax expense.

The current and future tax rate on all types of income is 35 percent.In Terracota's December 31, 2010 balance sheet,

The current liabilities total is

A)$2,435,000.

B)$2,695,000.

C)$2,200,000.

D)$2,230,000.

The following trial balance of Terracota Corp.at December 31, 2010 has been properly adjusted except for the income tax expense adjustment.

Other financial data for the year ended December 31, 2010:

Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2012.

The balance in the Future Income Tax Liability account pertains to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability.

During the year, estimated tax payments of $465,000 were charged to income tax expense.

The current and future tax rate on all types of income is 35 percent.In Terracota's December 31, 2010 balance sheet,

The current liabilities total is

A)$2,435,000.

B)$2,695,000.

C)$2,200,000.

D)$2,230,000.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

44

In a statement of cash flows, payments to acquire debt instruments of other entities (other than cash equivalents) should be classified as cash outflows for

A)operating activities.

B)investing activities.

C)financing activities.

D)lending activities.

A)operating activities.

B)investing activities.

C)financing activities.

D)lending activities.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

45

In a statement of cash flows, interest payments to lenders and other creditors should be classified as cash outflows for

A)operating activities.

B)borrowing activities.

C)lending activities.

D)financing activities.

A)operating activities.

B)borrowing activities.

C)lending activities.

D)financing activities.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

46

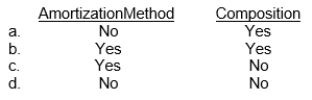

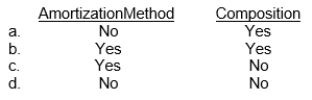

Which of the following facts concerning depreciable assets should be included in the summary of significant accounting policies?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

47

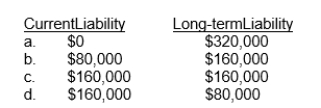

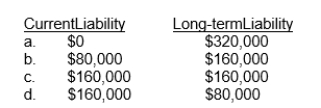

On January 1, 2010, Kapp Co.leased a building to Duerr Corp.for a ten-year term at an annual rental of $80,000.At inception of the lease, Kapp received $320,000 covering the first two years' rent of $160,000 and a security deposit of $160,000.This deposit will not be returned to Duerr upon expiration of the lease but will be applied to payment of rent for the last two years of the lease.What portion of the $320,000 should be shown as a current and long-term liability in Kapp's December 31, 2010 balance sheet?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

48

Use the following information for questions

The following trial balance of Terracota Corp.at December 31, 2010 has been properly adjusted except for the income tax expense adjustment.

Other financial data for the year ended December 31, 2010:

Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2012.

The balance in the Future Income Tax Liability account pertains to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability.

During the year, estimated tax payments of $465,000 were charged to income tax expense.

The current and future tax rate on all types of income is 35 percent.In Terracota's December 31, 2010 balance sheet,

The current assets total is

A)$5,955,000.

B)$5,595,000.

C)$3,060,000.

D)$4,495,000.

The following trial balance of Terracota Corp.at December 31, 2010 has been properly adjusted except for the income tax expense adjustment.

Other financial data for the year ended December 31, 2010:

Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2012.

The balance in the Future Income Tax Liability account pertains to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability.

During the year, estimated tax payments of $465,000 were charged to income tax expense.

The current and future tax rate on all types of income is 35 percent.In Terracota's December 31, 2010 balance sheet,

The current assets total is

A)$5,955,000.

B)$5,595,000.

C)$3,060,000.

D)$4,495,000.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

49

In a statement of cash flows, proceeds from issuing equity instruments should be classified as cash inflows from

A)lending activities.

B)operating activities.

C)investing activities.

D)financing activities.

A)lending activities.

B)operating activities.

C)investing activities.

D)financing activities.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck