Deck 6: Revenue Recognition

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/63

Play

Full screen (f)

Deck 6: Revenue Recognition

1

If a company sells its product but gives the buyer the right to return the product, revenue from the sales transaction should be recognized at the time of sale under the earnings approach if

A)the market for returnable goods is untested.

B)the amount of goods returned is high.

C)there is a transfer of the risks and rewards of ownership.

D)the amount of future returns can be reasonably estimated.

A)the market for returnable goods is untested.

B)the amount of goods returned is high.

C)there is a transfer of the risks and rewards of ownership.

D)the amount of future returns can be reasonably estimated.

D

2

When the entity has substantially accomplished what it must do to be entitled to the benefits represented by the revenues, revenues are

A)earned.

B)realized.

C)recognized.

D)all of these.

A)earned.

B)realized.

C)recognized.

D)all of these.

A

3

Cost estimates at the end of the second year indicate a loss will result on completion of the entire contract.Which of the following statements is correct?

A)Under the completed-contract method, the loss is not recognized until the year the construction is completed.

B)Under the percentage-of-completion method, the gross profit recognized in the first year must not be changed.

C)Under the completed-contract method, when the billings exceed the accumulated costs, the amount of the estimated loss is reported as a current liability.

D)Under the completed-contract method, when the Construction in Process balance

A)Under the completed-contract method, the loss is not recognized until the year the construction is completed.

B)Under the percentage-of-completion method, the gross profit recognized in the first year must not be changed.

C)Under the completed-contract method, when the billings exceed the accumulated costs, the amount of the estimated loss is reported as a current liability.

D)Under the completed-contract method, when the Construction in Process balance

C

4

The principal disadvantage of using the percentage-of-completion method of recognizing revenue from long-term contracts is that it

A)is unacceptable for income tax purposes.

B)gives results based upon estimates which may be subject to considerable uncertainty.

C)is likely to assign a small amount of revenue to a period during which much revenue

D)none of these.

A)is unacceptable for income tax purposes.

B)gives results based upon estimates which may be subject to considerable uncertainty.

C)is likely to assign a small amount of revenue to a period during which much revenue

D)none of these.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

5

In selecting an accounting method for a newly contracted long-term construction project under private entity GAAP, the principal factor to be considered should be

A)the terms of payment in the contract.

B)the degree to which a reliable estimate of the costs to complete and extent of progress toward completion is practicable.

C)the method commonly used by the contractor to account for other long-term construction contracts.

D)the inherent nature of the contractor's technical facilities used in construction.

A)the terms of payment in the contract.

B)the degree to which a reliable estimate of the costs to complete and extent of progress toward completion is practicable.

C)the method commonly used by the contractor to account for other long-term construction contracts.

D)the inherent nature of the contractor's technical facilities used in construction.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is not a reason why revenue is recognized at time of sale under the earnings approach?

A)The earning process is substantially complete.

B)The amount is reasonably measured.

C)Title legally passes from seller to buyer.

D)All of these are reasons to recognize revenue at time of sale.

A)The earning process is substantially complete.

B)The amount is reasonably measured.

C)Title legally passes from seller to buyer.

D)All of these are reasons to recognize revenue at time of sale.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

7

When work to be done and costs to be incurred on a long-term contract can be estimated dependably, which of the following methods of revenue recognition is preferable under private entity GAAP?

A)Instalment method

B)Percentage-of-completion method

C)Completed-contract method

D)None of these

A)Instalment method

B)Percentage-of-completion method

C)Completed-contract method

D)None of these

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

8

Under a consignment sales arrangement,

A)the consignor receives the merchandise to sell.

B)the consignor retains legal title.

C)the consignee ships the merchandise to the consignor.

D)the consignee retains legal title.

A)the consignor receives the merchandise to sell.

B)the consignor retains legal title.

C)the consignee ships the merchandise to the consignor.

D)the consignee retains legal title.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

9

Under the earnings approach, a sale should not be recognized as revenue by the seller at the time of sale if

A)payment was made by cheque.

B)the selling price is less than the normal selling price.

C)the buyer has a right to return the product and the amount of future returns cannot be reasonably estimated.

D)none of these.

A)payment was made by cheque.

B)the selling price is less than the normal selling price.

C)the buyer has a right to return the product and the amount of future returns cannot be reasonably estimated.

D)none of these.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

10

Under private entity GAAP, the profession requires that the percentage-of-completion method be used when certain conditions exist.Which of the following is not one of those necessary conditions?

A)Estimates of progress toward completion, revenues, and costs are reasonably dependable.

B)The contractor can be expected to perform the contractual obligation.

C)The buyer can be expected to satisfy some of the obligations under the contract.

D)The contract clearly specifies the enforceable rights of the parties, the consideration to be exchanged, and the manner and terms of settlement.

A)Estimates of progress toward completion, revenues, and costs are reasonably dependable.

B)The contractor can be expected to perform the contractual obligation.

C)The buyer can be expected to satisfy some of the obligations under the contract.

D)The contract clearly specifies the enforceable rights of the parties, the consideration to be exchanged, and the manner and terms of settlement.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

11

Under the earnings approach in accounting for a long-term construction-type contract using the percentage-of-completion method, the gross profit recognized during the first year would be the estimated total gross profit from the contract, multiplied by the percentage of the costs incurred during the year to the

A)total costs incurred to date.

B)total estimated cost.

C)unbilled portion of the contract price.

D)total contract price.

A)total costs incurred to date.

B)total estimated cost.

C)unbilled portion of the contract price.

D)total contract price.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

12

Under the earnings approach, how should the balances of progress billings and construction in process be shown at reporting dates prior to the completion of a long-term contract?

A)Progress billings as deferred income, construction in progress as a deferred expense.

B)Progress billings as income, construction in process as inventory.

C)Net, as a current asset if debit balance and current liability if credit balance.

D)Net, as income from construction if credit balance, and loss from construction if debit balance.

A)Progress billings as deferred income, construction in progress as a deferred expense.

B)Progress billings as income, construction in process as inventory.

C)Net, as a current asset if debit balance and current liability if credit balance.

D)Net, as income from construction if credit balance, and loss from construction if debit balance.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

13

An alternative available when the seller is exposed to continued risks of ownership through return of the product is

A)recording the sale, and accounting for returns as they occur in future periods.

B)not recording a sale until all return privileges have expired.

C)recording the sale, but reducing sales by an estimate of future returns.

D)all of these.

A)recording the sale, and accounting for returns as they occur in future periods.

B)not recording a sale until all return privileges have expired.

C)recording the sale, but reducing sales by an estimate of future returns.

D)all of these.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

14

Under the earnings approach, how should earned but unbilled revenues at the balance sheet date on a long-term construction contract be disclosed if the percentage-of- completion method of revenue recognition is used?

A)As construction in process in the current asset section of the balance sheet.

B)As construction in process in the noncurrent asset section of the balance sheet.

C)As a receivable in the noncurrent asset section of the balance sheet.

D)In a note to the financial statements until the customer is formally billed for the portion

A)As construction in process in the current asset section of the balance sheet.

B)As construction in process in the noncurrent asset section of the balance sheet.

C)As a receivable in the noncurrent asset section of the balance sheet.

D)In a note to the financial statements until the customer is formally billed for the portion

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

15

The criteria for recognition of revenue at completion of production of precious metals and farm products include

A)an established market with quoted prices.

B)low additional costs of completion and selling.

C)units are interchangeable.

D)all of these.

A)an established market with quoted prices.

B)low additional costs of completion and selling.

C)units are interchangeable.

D)all of these.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

16

Under the completed-contract method,

A)revenue, cost, and gross profit are recognized during the production cycle.

B)revenue and cost are recognized during the production cycle, but gross profit recognition is deferred until the contract is completed.

C)the contract-based approach to recognizing revenues would not be allowed.

D)none of these.

A)revenue, cost, and gross profit are recognized during the production cycle.

B)revenue and cost are recognized during the production cycle, but gross profit recognition is deferred until the contract is completed.

C)the contract-based approach to recognizing revenues would not be allowed.

D)none of these.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

17

The earnings approach to accounting for revenues provides that

A)performance is achieved.

B)the amount earned is reasonably measurable.

C)collectibility is reasonably assured.

D)all of these.

A)performance is achieved.

B)the amount earned is reasonably measurable.

C)collectibility is reasonably assured.

D)all of these.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

18

Under the earnings approach, when goods or services are exchanged for cash or claims to cash (receivables), revenues are

A)earned.

B)realized.

C)recognized.

D)all of these.

A)earned.

B)realized.

C)recognized.

D)all of these.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

19

Under a consignment sales arrangement, revenue is recognized under the earnings approach

A)upon shipment of the merchandise to the consignee.

B)upon receipt of the merchandise by the consignee.

C)upon sale by the consignee.

D)upon receipt by the consignor of notification of the sale.

A)upon shipment of the merchandise to the consignee.

B)upon receipt of the merchandise by the consignee.

C)upon sale by the consignee.

D)upon receipt by the consignor of notification of the sale.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

20

Cost estimates on a long-term contract may indicate that a loss will result on completion of the entire contract.In this case, the entire expected loss should be

A)recognized in the current period, regardless of whether the percentage-of-completion or completed-contract method is employed.

B)recognized in the current period under the percentage-of-completion method, but the completed-contract method should defer recognition of the loss to the time when the contract is completed.

C)recognized in the current period under the completed-contract method, but the percentage-of-completion method should defer the loss until the contract is completed.

D)deferred and recognized when the contract is completed, regardless of whether the

A)recognized in the current period, regardless of whether the percentage-of-completion or completed-contract method is employed.

B)recognized in the current period under the percentage-of-completion method, but the completed-contract method should defer recognition of the loss to the time when the contract is completed.

C)recognized in the current period under the completed-contract method, but the percentage-of-completion method should defer the loss until the contract is completed.

D)deferred and recognized when the contract is completed, regardless of whether the

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

21

In certain cases revenue is recognized at the completion of production even though no sale has been made.Which of the following statements is not true?

A)Examples involve precious metals or farm equipment.

B)The products possess immediate marketability at quoted prices.

C)No significant costs are involved in selling the product.

D)All of these statements are true.

A)Examples involve precious metals or farm equipment.

B)The products possess immediate marketability at quoted prices.

C)No significant costs are involved in selling the product.

D)All of these statements are true.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

22

Under the earnings approach, revenue is recognized by the consignor when the

A)goods are shipped to the consignee.

B)consignee receives the goods.

C)consignor receives an advance from the consignee.

D)consignor receives an account sales from the consignee.

A)goods are shipped to the consignee.

B)consignee receives the goods.

C)consignor receives an advance from the consignee.

D)consignor receives an account sales from the consignee.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

23

Losses in long-term construction projects

A)are recognized immediately under the completed-contract method

B)are recognized immediately under the percentage-of-completion method

C)are generally deferred

D)(a) and (b)

A)are recognized immediately under the completed-contract method

B)are recognized immediately under the percentage-of-completion method

C)are generally deferred

D)(a) and (b)

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

24

The actions a company takes to add value are referred to as

A)The point of delivery

B)The critical event

C)The earnings process

D)None of these

A)The point of delivery

B)The critical event

C)The earnings process

D)None of these

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

25

Under an earnings approach to accounting for revenues, the main focus is placed on

A)the creation of contractual rights of the underlying sales agreement.

B)the adherence to relevant contractual obligations.

C)the earnings process itself and how value is added.

D)the presentation on the financial statements.

A)the creation of contractual rights of the underlying sales agreement.

B)the adherence to relevant contractual obligations.

C)the earnings process itself and how value is added.

D)the presentation on the financial statements.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

26

The concept of commercial substance in purchase and sales transactions means that

A)The transaction is a bona fide purchase and sale

B)The entity's cash flows are expected to change

C)The transaction must involve tangible assets

D)(a) and (b)

A)The transaction is a bona fide purchase and sale

B)The entity's cash flows are expected to change

C)The transaction must involve tangible assets

D)(a) and (b)

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following statements does not describe a long term construction project that is accounted for under the completed contract method?

A)Revenues are recognized evenly throughout the contract.

B)Revenues are recognized at the end of the project.

C)Losses are recognized immediately

D)None of these

A)Revenues are recognized evenly throughout the contract.

B)Revenues are recognized at the end of the project.

C)Losses are recognized immediately

D)None of these

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following types of analyses would show a company's year-to year changes in revenue?

A)Ratio analysis

B)Trend analysis

C)Regression analysis

D)None of these

A)Ratio analysis

B)Trend analysis

C)Regression analysis

D)None of these

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

29

The journal entries to recognize the revenue from a consignment sale would likely be identical under the earnings and the contract-based approaches assuming

A)the contract is entered into at the same time as when control over the goods is passed to the customer.

B)the underlying goods or services are valued under the residual value method

C)the completed contract method is used

D)the percentage-of-completion method is used.

A)the contract is entered into at the same time as when control over the goods is passed to the customer.

B)the underlying goods or services are valued under the residual value method

C)the completed contract method is used

D)the percentage-of-completion method is used.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

30

The new revenue recognition model currently studied by the IASB and FASB

A)is the contract-based approach

B)is the earnings approach

C)the percentage of completion method

D)the completed contract method

A)is the contract-based approach

B)is the earnings approach

C)the percentage of completion method

D)the completed contract method

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

31

The concept of a constructive obligation in business law refers to an obligation

A)that may not be explicitly stated in the contract

B)that may have been created through past practice

C)that may be enforceable under common law

D)All of these

A)that may not be explicitly stated in the contract

B)that may have been created through past practice

C)that may be enforceable under common law

D)All of these

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

32

A credit that is realized through an entity's ordinary activities would be treated as

A)gain

B)revenue

C)income

D)none of these

A)gain

B)revenue

C)income

D)none of these

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

33

A sale that requires the customer to pay the purchase price in instalments

A)should always be recognized under the contract-based view as the contract has already established the customer's obligation to pay.

B)should only be recognized upon receipt of the last instalment payment.

C)may be recognized under the earnings approach if measurement and collectability issues do not exist.

D)None of these.

A)should always be recognized under the contract-based view as the contract has already established the customer's obligation to pay.

B)should only be recognized upon receipt of the last instalment payment.

C)may be recognized under the earnings approach if measurement and collectability issues do not exist.

D)None of these.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

34

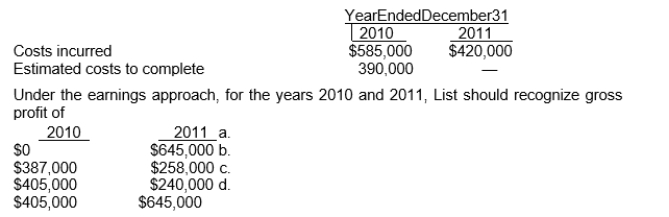

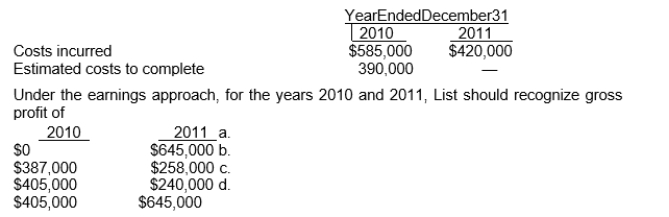

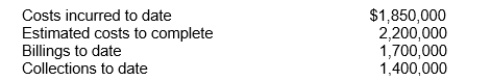

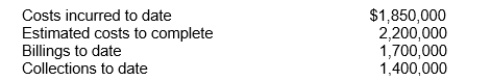

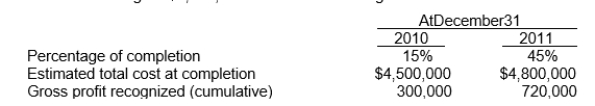

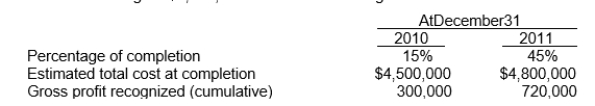

Molder Construction Company uses the percentage-of-completion method of accounting. In 2010, Molder began work on a contract it had received which provided for a contract price of $7,400,000.Other details follow:  Under the earnings approach, what should be the gross profit recognized in 2010?

Under the earnings approach, what should be the gross profit recognized in 2010?

A)$300,000.

B)$4,440,000.

C)$840,000.

D)$1,400,000.

Under the earnings approach, what should be the gross profit recognized in 2010?

Under the earnings approach, what should be the gross profit recognized in 2010?A)$300,000.

B)$4,440,000.

C)$840,000.

D)$1,400,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

35

Kehl Construction Corporation contracted to construct a building for $1,500,000. Construction began in 2010 and was completed in 2011.Data relating to the contract are summarized below:  Kehl uses the percentage-of-completion method and the earnings approach as the basis for income recognition.For the years ended December 31, 2010, and 2011, respectively, Kehl should report gross profit of

Kehl uses the percentage-of-completion method and the earnings approach as the basis for income recognition.For the years ended December 31, 2010, and 2011, respectively, Kehl should report gross profit of

A)$270,000 and $170,000.

B)$900,000 and $600,000.

C)$300,000 and $140,000.

D)$0 and $440,000.

Kehl uses the percentage-of-completion method and the earnings approach as the basis for income recognition.For the years ended December 31, 2010, and 2011, respectively, Kehl should report gross profit of

Kehl uses the percentage-of-completion method and the earnings approach as the basis for income recognition.For the years ended December 31, 2010, and 2011, respectively, Kehl should report gross profit ofA)$270,000 and $170,000.

B)$900,000 and $600,000.

C)$300,000 and $140,000.

D)$0 and $440,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

36

Under both private entity GAAP and IFRS,

A)the earnings approach to revenue recognition is followed.

B)all of these

C)the percentage of completion methods are allowed.

D)warranty costs are accrued.

A)the earnings approach to revenue recognition is followed.

B)all of these

C)the percentage of completion methods are allowed.

D)warranty costs are accrued.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

37

The completed contract method for accounting for long-term construction projects

A)requires that no revenue is recognized until the project is completed.

B)requires that costs are accumulated and revenue is recognized in proportion to cash collected.

C)is not compatible with the contract-based approach to revenue recognition

D)(a) and (c)

A)requires that no revenue is recognized until the project is completed.

B)requires that costs are accumulated and revenue is recognized in proportion to cash collected.

C)is not compatible with the contract-based approach to revenue recognition

D)(a) and (c)

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following concepts is not relevant for understanding the economics of business transactions?

A)Their reciprocal nature.

B)Their physical nature.

C)All of these are relevant

D)The presence of concessionary terms

A)Their reciprocal nature.

B)Their physical nature.

C)All of these are relevant

D)The presence of concessionary terms

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

39

When a sale involves goods and services, the selling price should not be

A)allocated to each of these parts

B)allocated only to the part with the higher value

C)allocated using the relative fair value method

D)allocated using the residual method

A)allocated to each of these parts

B)allocated only to the part with the higher value

C)allocated using the relative fair value method

D)allocated using the residual method

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following would normally be considered as a problem associated with the earnings approach to revenue recognition?

A)This approach may be subject to a considerable degree of subjective judgement.

B)The existence of multiple and sometimes conflicting guidelines

C)The difficulties arising from the split of risks and rewards between buyer and seller.

D)All of these

A)This approach may be subject to a considerable degree of subjective judgement.

B)The existence of multiple and sometimes conflicting guidelines

C)The difficulties arising from the split of risks and rewards between buyer and seller.

D)All of these

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

41

Use the following information for questions

If Frey uses the completed-contract method, the gross profit to be recognized in 2011 under the earnings approach is

A)$800,000.

B)$750,000.

C)$2,000,000.

D)$1,700,000.

If Frey uses the completed-contract method, the gross profit to be recognized in 2011 under the earnings approach is

A)$800,000.

B)$750,000.

C)$2,000,000.

D)$1,700,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

42

Moor Company sold some machinery to Gale Company on January 1, 2010.The cash selling price would have been $284,310.Gale entered into an instalment sales contract which required annual payments of $75,000, including interest at 10 percent, over five years.The first payment was due on December 31, 2010.The collection of the payments is reasonably assured and measurement is not an issue.What amount of interest income should be included in Moor's 2011 income statement (the second year of the contract)?

A)$7,500.

B)$23,774.

C)$15,000.

D)$28,431.

A)$7,500.

B)$23,774.

C)$15,000.

D)$28,431.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

43

Lear Constructors, Ltd.has consistently used the percentage-of-completion method of recognizing income.In 2010, Lear started work on a $7,000,000 construction contract that was completed in 2011.The following information was taken from Lear's 2010 accounting records:  Under the earnings approach, what amount of gross profit should Lear have recognized in 2010 on this contract?

Under the earnings approach, what amount of gross profit should Lear have recognized in 2010 on this contract?

A)$700,000.

B)$466,667.

C)$350,000.

D)$233,333.

Under the earnings approach, what amount of gross profit should Lear have recognized in 2010 on this contract?

Under the earnings approach, what amount of gross profit should Lear have recognized in 2010 on this contract?A)$700,000.

B)$466,667.

C)$350,000.

D)$233,333.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

44

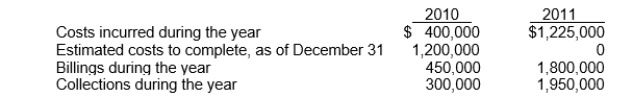

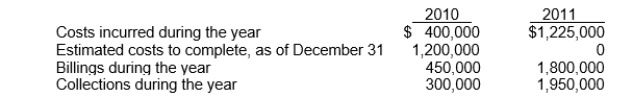

List Construction Co.uses the percentage-of-completion method.In 2010, List began work on a contract for $1,650,000 and it was completed in 2011.Data on the costs are:  Use the following information for questions 44 and 45: Spark Ltd.began work in 2010 on contract #731 which provided for a contract price of

Use the following information for questions 44 and 45: Spark Ltd.began work in 2010 on contract #731 which provided for a contract price of

$2,400,000.Other details follow:

Use the following information for questions 44 and 45: Spark Ltd.began work in 2010 on contract #731 which provided for a contract price of

Use the following information for questions 44 and 45: Spark Ltd.began work in 2010 on contract #731 which provided for a contract price of$2,400,000.Other details follow:

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

45

Assume that Spark uses the completed-contract method of accounting.The portion of the total gross profit to be recognized as income in 2011 is

A)$300,000.

B)$450,000.

C)$775,000.

D)$2,400,000.

A)$300,000.

B)$450,000.

C)$775,000.

D)$2,400,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

46

Consider a project that was correctly accounted for under the percentage-of-completion method.At the end of the project, the construction in process account includes total debits and credits of $3.5 Mill.Assuming that gross profit of $1.2 Mill.was recognized throughout the contract, total constructions costs were:

A)$2.3 Mill.

B)$3.5 Mill.

C)$2.1 Mill.

D)$4.6 Mill.

A)$2.3 Mill.

B)$3.5 Mill.

C)$2.1 Mill.

D)$4.6 Mill.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

47

Kohlman Co.has made a sale to a customer valued at $1.5 Mill.The associated expenses are $0.3 Mill.Some aspects of this sale have created an element of measurement uncertainty.Assuming that this element of uncertainty can be reasonably estimated at $0.45 Mill.Kohlman should

A)Reduce revenues by $0.45 Mill

B)Increase expenses by $0.45 Mill

C)None of these

D)(a) or (b)

A)Reduce revenues by $0.45 Mill

B)Increase expenses by $0.45 Mill

C)None of these

D)(a) or (b)

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

48

At the end of year 2, the accounting records for a multi-year construction project indicate actual costs incurred to-date, and most recent estimate of total cost of $3.2 Mill and $9.5 Mill respectively.Assuming the percentage-of completion method is used, at the end of year 2 the project is

A)33.7% complete

B)31.2% complete

C)26.1% complete

D)none of these

A)33.7% complete

B)31.2% complete

C)26.1% complete

D)none of these

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

49

Use the following information for questions

If Frey uses the percentage-of-completion method, the gross profit to be recognized in 2010 under the earnings approach is

A)$400,000.

B)$420,000.

C)$900,000.

D)$200,000.

If Frey uses the percentage-of-completion method, the gross profit to be recognized in 2010 under the earnings approach is

A)$400,000.

B)$420,000.

C)$900,000.

D)$200,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

50

Beaver Builders, Ltd.is using the completed-contract method for a $4,100,000 contract that will take two years to complete.Data at December 31, 2010, the end of the first year, are:  The gross profit or loss that should be recognized for 2010 under the earnings approach is

The gross profit or loss that should be recognized for 2010 under the earnings approach is

A)$0.

B)a $50,000 loss

C)a $50,000 gross profit

D)a $100,000 gross profit

The gross profit or loss that should be recognized for 2010 under the earnings approach is

The gross profit or loss that should be recognized for 2010 under the earnings approach isA)$0.

B)a $50,000 loss

C)a $50,000 gross profit

D)a $100,000 gross profit

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

51

Use the following information for questions

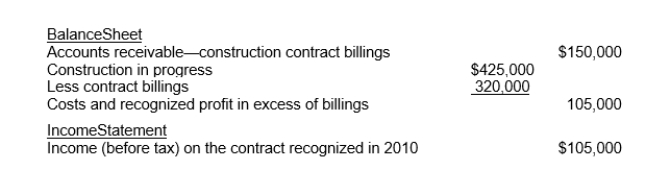

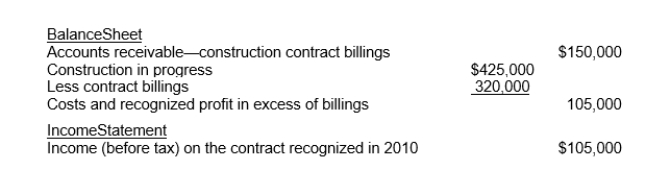

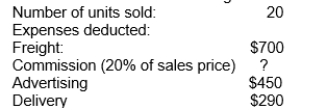

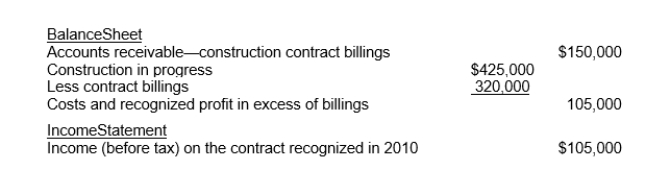

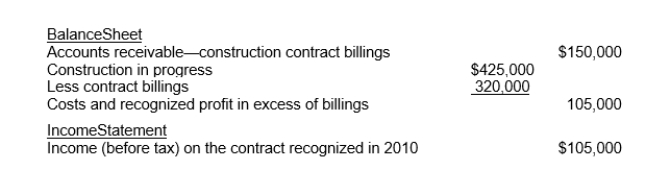

In 2010, Rupp Corporation began construction work under a three-year contract.The contract price is $3,500,000.Rupp uses the percentage-of-completion method for financial accounting purposes.The income to be recognized each year is based on the proportion of costs incurred to total estimated costs for completing the contract.The financial statement presentations relating to this contract at December 31, 2010, follow:

How much cash was collected in 2010 on this contract?

A)$170,000.

B)$200,000.

C)$25,000.

D)$300,000.

In 2010, Rupp Corporation began construction work under a three-year contract.The contract price is $3,500,000.Rupp uses the percentage-of-completion method for financial accounting purposes.The income to be recognized each year is based on the proportion of costs incurred to total estimated costs for completing the contract.The financial statement presentations relating to this contract at December 31, 2010, follow:

How much cash was collected in 2010 on this contract?

A)$170,000.

B)$200,000.

C)$25,000.

D)$300,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

52

Shore Construction Co.has consistently used the percentage-of-completion method of recognizing revenue.During 2010, Shore entered into a fixed-price contract to construct an office building for $6,000,000.Information relating to the contract is as follows:  Under the earnings approach, contract costs incurred during 2011 were

Under the earnings approach, contract costs incurred during 2011 were

A)$1,440,000.

B)$1,485,000.

C)$1,575,000.

D)$2,160,000.

Under the earnings approach, contract costs incurred during 2011 were

Under the earnings approach, contract costs incurred during 2011 wereA)$1,440,000.

B)$1,485,000.

C)$1,575,000.

D)$2,160,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

53

Use the following information for questions

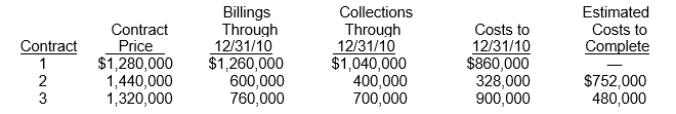

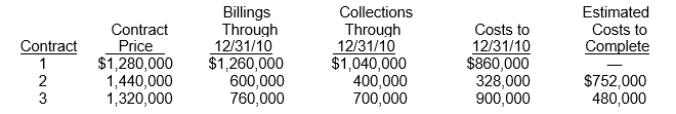

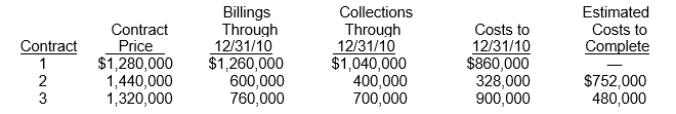

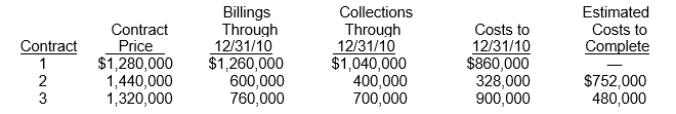

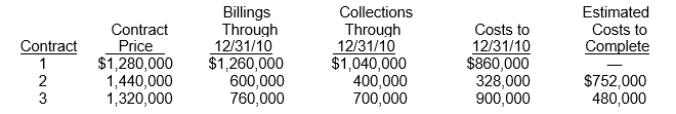

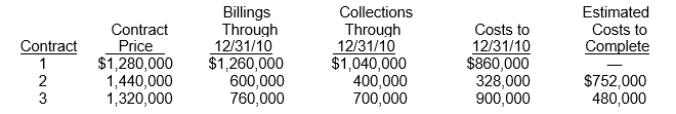

Peske Construction Co.began operations in 2010.Construction activity for 2010 is shown below.Peske uses the completed-contract method.

Which of the following should be shown on the income statement for 2010 related to Contract 1?

A)Gross profit, $180,000.

B)Gross profit, $400,000.

C)Gross profit, $420,000.

D)Gross profit, $240,000.

Peske Construction Co.began operations in 2010.Construction activity for 2010 is shown below.Peske uses the completed-contract method.

Which of the following should be shown on the income statement for 2010 related to Contract 1?

A)Gross profit, $180,000.

B)Gross profit, $400,000.

C)Gross profit, $420,000.

D)Gross profit, $240,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

54

Use the following information for questions

Peske Construction Co.began operations in 2010.Construction activity for 2010 is shown below.Peske uses the completed-contract method.

Which of the following should be shown on the balance sheet at December 31, 2010 related to Contract 2?

A)Inventory, $272,000.

B)Inventory, $328,000.

C)Current liability, $272,000.

D)Current liability, $600,000.

Peske Construction Co.began operations in 2010.Construction activity for 2010 is shown below.Peske uses the completed-contract method.

Which of the following should be shown on the balance sheet at December 31, 2010 related to Contract 2?

A)Inventory, $272,000.

B)Inventory, $328,000.

C)Current liability, $272,000.

D)Current liability, $600,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

55

Use the following information for questions

Peske Construction Co.began operations in 2010.Construction activity for 2010 is shown below.Peske uses the completed-contract method.

Which of the following should be shown on the balance sheet at December 31, 2010 related to Contract 3?

A)Inventory, $80,000.

B)Inventory, $140,000.

C)Inventory, $840,000.

D)Inventory, $900,000.

Peske Construction Co.began operations in 2010.Construction activity for 2010 is shown below.Peske uses the completed-contract method.

Which of the following should be shown on the balance sheet at December 31, 2010 related to Contract 3?

A)Inventory, $80,000.

B)Inventory, $140,000.

C)Inventory, $840,000.

D)Inventory, $900,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

56

Berlak Company entered into a contract with Charles Corporation.Berlak agreed to provide Charles with building supplies.Charles agreed to pay a total of $18,000 at delivery.Under the contract-based view, Berlak's net contract position can be assumed to be

A)nil

B)$18,000

C)$9,000

D)$4,500

A)nil

B)$18,000

C)$9,000

D)$4,500

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

57

On January 1, 2010, Bissel Co.sold land that cost $90,000 for $120,000, receiving a note bearing interest at 10 percent.The note will be paid in three annual instalments of $48,255 starting on December 31, 2010.Assuming that collection of the note is very uncertain, how much revenue from this sale should Bissel recognize in 2010?

A)$0.

B)$9,000.

C)$12,000.

D)$30,000.

A)$0.

B)$9,000.

C)$12,000.

D)$30,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

58

Assume that Spark uses the percentage-of-completion method of accounting.Under the earnings approach, the portion of the total gross profit to be recognized as income in 2010 is

A)$150,000.

B)$200,000.

C)$600,000.

D)$800,000.

A)$150,000.

B)$200,000.

C)$600,000.

D)$800,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

59

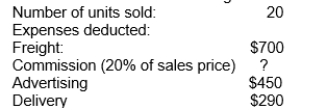

On April 1, 2010, Green Co.consigned 50 handcrafted garden benches to Garden Co. The per unit cost of the benches was $350 and total freight was $700 (the freight was paid by Garden).On August 1, Green received a cheque in the amount of $14,100 from Garden which included the following information:  Under the earnings approach, total sales were

Under the earnings approach, total sales were

A)$15,540

B)$19,425

C)$18,550

D)$19,060

Under the earnings approach, total sales were

Under the earnings approach, total sales wereA)$15,540

B)$19,425

C)$18,550

D)$19,060

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

60

Use the following information for questions

In 2010, Rupp Corporation began construction work under a three-year contract.The contract price is $3,500,000.Rupp uses the percentage-of-completion method for financial accounting purposes.The income to be recognized each year is based on the proportion of costs incurred to total estimated costs for completing the contract.The financial statement presentations relating to this contract at December 31, 2010, follow:

What was the initial estimated total income before tax on this contract?

A)$381,430.

B)$405,231.

C)$864,706.

D)$650,204.

In 2010, Rupp Corporation began construction work under a three-year contract.The contract price is $3,500,000.Rupp uses the percentage-of-completion method for financial accounting purposes.The income to be recognized each year is based on the proportion of costs incurred to total estimated costs for completing the contract.The financial statement presentations relating to this contract at December 31, 2010, follow:

What was the initial estimated total income before tax on this contract?

A)$381,430.

B)$405,231.

C)$864,706.

D)$650,204.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

61

Malek Inc.is a retailer of home appliances and offers a service contract on each appliance sold.Elton sells appliances on instalment contracts, but all service contracts must be paid in full at the time of sale.Collections received for service contracts should be recorded as an increase in a

A)deferred revenue account.

B)sales contracts receivable valuation account.

C)shareholders' valuation account.

D)service revenue account.

A)deferred revenue account.

B)sales contracts receivable valuation account.

C)shareholders' valuation account.

D)service revenue account.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

62

During 2010, Moss Corp.started a construction job with a total contract price of $1.4 million. The job was completed on December 15, 2011.Additional data are as follows:  Under the completed-contract method, what amount should Moss recognize as gross profit for 2011?

Under the completed-contract method, what amount should Moss recognize as gross profit for 2011?

A)$90,000.

B)$125,000.

C)$190,000.

D)$250,000.

Under the completed-contract method, what amount should Moss recognize as gross profit for 2011?

Under the completed-contract method, what amount should Moss recognize as gross profit for 2011?A)$90,000.

B)$125,000.

C)$190,000.

D)$250,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

63

Toledo Farms produced 180 tonnes of wheat during the 2010 season.Toledo sells all of its wheat to Pool Elevators, which has agreed to purchase Toledo's entire production at the prevailing market price.Recent legislation assures that the market price will not fall below $132 per tonne during the next two years.Toledo's costs of selling and distributing the wheat are immaterial and can be reasonably estimated.Toledo reports its inventory at expected exit value.During 2010, Toledo sold and delivered to Pool Elevators 150 tonnes at the market price of $135 per tonne.Toledo sold the remaining 30 tonnes during 2011 at the market price of $138 per tonne.Under the earnings approach, what amount of revenue should Toledo recognize in 2010?

A)$20,250.

B)$23,760.

C)$24,210.

D)$24,300.

A)$20,250.

B)$23,760.

C)$24,210.

D)$24,300.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck