Deck 3: The Accounting Information System

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/54

Play

Full screen (f)

Deck 3: The Accounting Information System

1

Some events are not recorded in the accounting information system because

A)the amounts are not material.

B)the service has not been provided yet although the cash has been received.

C)the problems measuring them are too complex.

D)all of these.

A)the amounts are not material.

B)the service has not been provided yet although the cash has been received.

C)the problems measuring them are too complex.

D)all of these.

C

2

Which of the following criteria must be met before an event or item should be recorded for accounting purposes?

A)The event or item can be measured objectively in financial terms.

B)The event or item is relevant and reliable.

C)The event or item is an element.

D)All of these must be met.

A)The event or item can be measured objectively in financial terms.

B)The event or item is relevant and reliable.

C)The event or item is an element.

D)All of these must be met.

D

3

The income summary account

A)is used only at year-end.

B)is used to record dividends.

C)is used to bring temporary accounts to zero.

D)is best described by (a) and (c).

A)is used only at year-end.

B)is used to record dividends.

C)is used to bring temporary accounts to zero.

D)is best described by (a) and (c).

D

4

An example of a transaction is

A)the receipt of cash from a customer prior to performing the service.

B)the recording of depreciation.

C)the accrual of salaries owed.

D)all of these.

A)the receipt of cash from a customer prior to performing the service.

B)the recording of depreciation.

C)the accrual of salaries owed.

D)all of these.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

5

Why are certain costs of doing business capitalized when incurred and then amortized over subsequent accounting cycles?

A)To reduce the income tax liability

B)To aid management in cash-flow analysis

C)To match the costs of production with revenues as earned

D)To adhere to the accounting constraint of conservatism

A)To reduce the income tax liability

B)To aid management in cash-flow analysis

C)To match the costs of production with revenues as earned

D)To adhere to the accounting constraint of conservatism

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

6

A trial balance

A)is a list of accounts at a specific point in time.

B)can be used for the preparation of financial statements.

C)is best described by (a.) and (b.)

D)is none of the above.

A)is a list of accounts at a specific point in time.

B)can be used for the preparation of financial statements.

C)is best described by (a.) and (b.)

D)is none of the above.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

7

A trial balance may prove that debits and credits are equal, but

A)an amount could be entered in the wrong account.

B)a transaction could have been entered twice.

C)a transaction could have been omitted.

D)all of these.

A)an amount could be entered in the wrong account.

B)a transaction could have been entered twice.

C)a transaction could have been omitted.

D)all of these.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

8

An accrued expense can best be described as an amount

A)paid and currently matched with earnings.

B)paid and not currently matched with earnings.

C)not paid and not currently matched with earnings.

D)not paid and currently matched with earnings.

A)paid and currently matched with earnings.

B)paid and not currently matched with earnings.

C)not paid and not currently matched with earnings.

D)not paid and currently matched with earnings.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following must be considered in estimating depreciation on an asset for an accounting period?

A)The original cost of the asset

B)Its useful life

C)The decline of its fair market value

D)Both the original cost of the asset and its useful life.

A)The original cost of the asset

B)Its useful life

C)The decline of its fair market value

D)Both the original cost of the asset and its useful life.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

10

If, during an accounting period, an expense item has been incurred and consumed but not yet paid for or recorded, then the end-of-period adjusting entry would involve

A)a liability account and an asset account.

B)an asset or contra-asset and an expense account.

C)a liability account and an expense account.

D)a receivable account and a revenue account.

A)a liability account and an asset account.

B)an asset or contra-asset and an expense account.

C)a liability account and an expense account.

D)a receivable account and a revenue account.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

11

A cheque that is issued would most likely be recorded directly in that company's:

A)expense journal.

B)cash disbursements journal.

C)cash receipts journal.

D)none of the above.

A)expense journal.

B)cash disbursements journal.

C)cash receipts journal.

D)none of the above.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

12

Adjusting entries are necessary to

A)obtain a proper matching of revenue and expense.

B)achieve an accurate statement of assets and equities.

C)adjust assets and liabilities to their fair market value.

D)both a and b

A)obtain a proper matching of revenue and expense.

B)achieve an accurate statement of assets and equities.

C)adjust assets and liabilities to their fair market value.

D)both a and b

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

13

Factors that shape an accounting information system include the

A)nature of the business.

B)size of the firm.

C)volume of data to be handled.

D)all of these.

A)nature of the business.

B)size of the firm.

C)volume of data to be handled.

D)all of these.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

14

Consider a cheque received in payment for revenues that have not yet been earned. Assuming that company uses the cash-basis of accounting, how would that payment be recorded?

A)it would be recorded as unearned revenue until it is actually earned.

B)the entire amount would be recognized as revenue in the current period.

C)it would be recorded as a prepaid expense.

D)none of the above.

A)it would be recorded as unearned revenue until it is actually earned.

B)the entire amount would be recognized as revenue in the current period.

C)it would be recorded as a prepaid expense.

D)none of the above.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following statements best describes the frequency of when financial statements are issued?

A)financial statements should only be issued at the end of the year.

B)financial statements should only be issued quarterly.

C)financial can be issued anytime during the year.

D)none of the above.

A)financial statements should only be issued at the end of the year.

B)financial statements should only be issued quarterly.

C)financial can be issued anytime during the year.

D)none of the above.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

16

The debit and credit analysis of a transaction normally takes place

A)before an entry is recorded in a journal.

B)when the entry is posted to the ledger.

C)when the trial balance is prepared.

D)at some other point in the accounting cycle.

A)before an entry is recorded in a journal.

B)when the entry is posted to the ledger.

C)when the trial balance is prepared.

D)at some other point in the accounting cycle.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

17

A post-closing trial balance.

A)includes temporary accounts only.

B)includes permanent accounts only.

C)includes both temporary and permanent accounts.

D)may include expenses.

A)includes temporary accounts only.

B)includes permanent accounts only.

C)includes both temporary and permanent accounts.

D)may include expenses.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

18

An accounting record into which the essential facts and figures in connection with all transactions are initially recorded is called the

A)ledger.

B)account.

C)trial balance.

D)none of these.

A)ledger.

B)account.

C)trial balance.

D)none of these.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following best describes adjustments:

A)adjustments ensure proper matching.

B)they are used to record external events.

C)(a) and (d).

D)they are usually prepared at the end of the accounting period.

A)adjustments ensure proper matching.

B)they are used to record external events.

C)(a) and (d).

D)they are usually prepared at the end of the accounting period.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

20

A payment that is received would most likely be recorded directly in that company's:

A)general ledger.

B)cash disbursements journal.

C)cash receipts journal.

D)trial balance.

A)general ledger.

B)cash disbursements journal.

C)cash receipts journal.

D)trial balance.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

21

Penny Resources determines that it has not yet recorded the accrual for 2010 interest revenue to be received in 2011.Assuming the amount to be recorded for 2010 is $8,000, the required adjustment on December 31, 2010 is

A)debit interest receivable and credit interest revenue $8,000.

B)debit interest revenue and credit interest receivable $8,000.

C)debit interest payable and credit interest revenue $8,000.

D)no entry required.

A)debit interest receivable and credit interest revenue $8,000.

B)debit interest revenue and credit interest receivable $8,000.

C)debit interest payable and credit interest revenue $8,000.

D)no entry required.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following is a real (permanent) account?

A)Goodwill

B)Sales

C)Accounts Receivable

D)Both Goodwill and Accounts Receivable

A)Goodwill

B)Sales

C)Accounts Receivable

D)Both Goodwill and Accounts Receivable

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

23

Breg Company's account balances at December 31, 2010 for Accounts Receivable and the Allowance for Doubtful Accounts are $860,000 debit and $1,200 credit.Sales during 2010 were $3,000,000.It is estimated that 2 percent of sales will be uncollectible.The adjusting entry would include a credit to the allowance account for

A)$17,176

B)$60,000.

C)$17,200.

D)$18,000.

A)$17,176

B)$60,000.

C)$17,200.

D)$18,000.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

24

Blue Company's account balances at December 31, 2010 for Accounts Receivable and the related Allowance for Doubtful Accounts are $284,000 debit and $1,000 credit, respectively.From an aging of accounts receivable, it is estimated that $10,000 of the December 31 receivables will be uncollectible.The necessary adjusting entry would include a credit to the allowance account for

A)$8,500.

B)$10,000.

C)$9,000.

D)$1,000.

A)$8,500.

B)$10,000.

C)$9,000.

D)$1,000.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

25

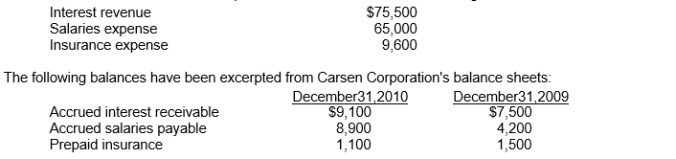

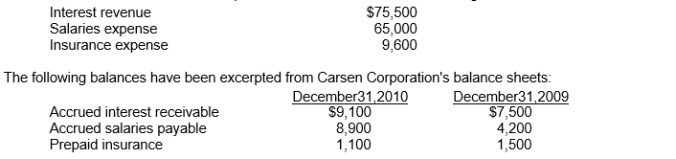

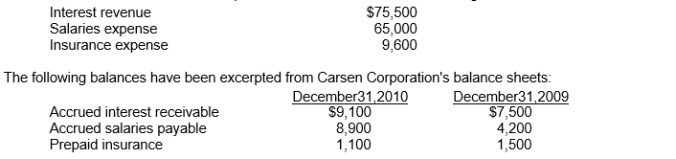

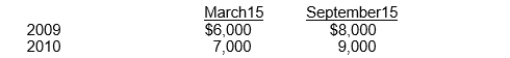

Use the following information for questions

The income statement of Carsen Corporation for 2010 included the following items:

The cash paid for insurance premiums during 2010 was

A)$8,500.

B)$8,100.

C)$10,000.

D)$9,200.

The income statement of Carsen Corporation for 2010 included the following items:

The cash paid for insurance premiums during 2010 was

A)$8,500.

B)$8,100.

C)$10,000.

D)$9,200.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

26

An accrued revenue can best be described as an amount

A)collected and currently matched with expenses.

B)collected and not currently matched with expenses.

C)not collected and currently matched with expenses.

D)not collected and not currently matched with expenses.

A)collected and currently matched with expenses.

B)collected and not currently matched with expenses.

C)not collected and currently matched with expenses.

D)not collected and not currently matched with expenses.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following items should be journalized?

A)a letter advising an employee of a pay raise.

B)a customer's pending bankruptcy (assuming an adequate allowance for doubtful accounts has already been set up).

C)a customer's pending bankruptcy (assuming an adequate allowance for doubtful accounts has not already been set up).

D)(a) and (b).

A)a letter advising an employee of a pay raise.

B)a customer's pending bankruptcy (assuming an adequate allowance for doubtful accounts has already been set up).

C)a customer's pending bankruptcy (assuming an adequate allowance for doubtful accounts has not already been set up).

D)(a) and (b).

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

28

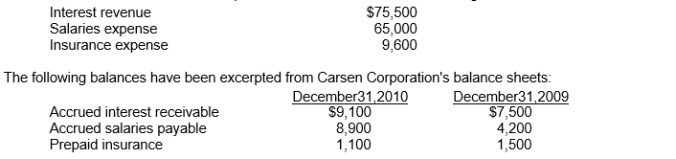

Use the following information for questions

The income statement of Carsen Corporation for 2010 included the following items:

The cash received for interest during 2010 was

A)$66,400.

B)$73,900.

C)$75,500.

D)$77,100.

The income statement of Carsen Corporation for 2010 included the following items:

The cash received for interest during 2010 was

A)$66,400.

B)$73,900.

C)$75,500.

D)$77,100.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

29

Below are several statements about the trial balance.Which of these statements is not correct?

A)debits and credits must balance.

B)the equality of credits and debits ensures that no errors were made.

C)the post-closing trial balance includes temporary accounts only.

D)(b) and (c).

A)debits and credits must balance.

B)the equality of credits and debits ensures that no errors were made.

C)the post-closing trial balance includes temporary accounts only.

D)(b) and (c).

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

30

Adjusting entries that should be reversed include those for prepaid or unearned items that

A)create an asset or a liability account.

B)were originally entered in a revenue or expense account.

C)were originally entered in an asset or liability account.

D)create an asset or a liability account and were originally entered in a revenue or

A)create an asset or a liability account.

B)were originally entered in a revenue or expense account.

C)were originally entered in an asset or liability account.

D)create an asset or a liability account and were originally entered in a revenue or

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

31

Year-end net assets would be overstated and current expenses would be understated as a result of failure to record which of the following adjusting entries?

A)Expiration of prepaid insurance

B)Depreciation of long-lived assets

C)Accrued wages payable

D)All of these

A)Expiration of prepaid insurance

B)Depreciation of long-lived assets

C)Accrued wages payable

D)All of these

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

32

Jackson Company made the annual lease payment of $9,000 for its fleet of delivery trucks.The payment was made on September 1, 2010 and covered the period September 1, 2010 to August 31, 2011.Assuming the entire amount had originally been charged to

Lease expense, the required adjustment on December 31, 2010 is

A)debit lease expense and credit prepaid lease $6,000.

B)debit prepaid lease and credit lease expense $6,000.

C)debit prepaid lease and credit lease expense $9,000.

D)debit lease expense and credit prepaid lease $9,000.

Lease expense, the required adjustment on December 31, 2010 is

A)debit lease expense and credit prepaid lease $6,000.

B)debit prepaid lease and credit lease expense $6,000.

C)debit prepaid lease and credit lease expense $9,000.

D)debit lease expense and credit prepaid lease $9,000.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

33

Perez Corporation received cash of $12,000 on August 1, 2010 for one year's rent in advance and recorded the transaction with a credit to Rent Revenue.The December 31, 2010 adjusting entry is

A)debit Rent Revenue and credit Unearned Rent, $5,000.

B)debit Rent Revenue and credit Unearned Rent, $7,000.

C)debit Unearned Rent and credit Rent Revenue, $5,000.

D)debit Cash and credit Unearned Rent, $7,000.

A)debit Rent Revenue and credit Unearned Rent, $5,000.

B)debit Rent Revenue and credit Unearned Rent, $7,000.

C)debit Unearned Rent and credit Rent Revenue, $5,000.

D)debit Cash and credit Unearned Rent, $7,000.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

34

A prepaid expense can best be described as an amount

A)paid and currently matched with revenues.

B)paid and not currently matched with revenues.

C)not paid and currently matched with revenues.

D)not paid and not currently matched with revenues.

A)paid and currently matched with revenues.

B)paid and not currently matched with revenues.

C)not paid and currently matched with revenues.

D)not paid and not currently matched with revenues.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

35

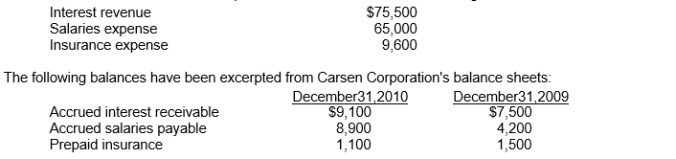

Use the following information for questions

The income statement of Carsen Corporation for 2010 included the following items:

The cash paid for salaries during 2010 was

A)$69,700.

B)$60,300.

C)$60,800.

D)$73,900.

The income statement of Carsen Corporation for 2010 included the following items:

The cash paid for salaries during 2010 was

A)$69,700.

B)$60,300.

C)$60,800.

D)$73,900.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

36

If the inventory account at the end of the year is understated, the effect will be to

A)overstate the gross profit on sales.

B)understate the net purchases.

C)overstate the cost of goods sold.

D)overstate the goods available for sale.

A)overstate the gross profit on sales.

B)understate the net purchases.

C)overstate the cost of goods sold.

D)overstate the goods available for sale.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

37

An unearned revenue can best be described as an amount

A)collected and currently matched with expenses.

B)collected and not currently matched with expenses.

C)not collected and currently matched with expenses.

D)not collected and not currently matched with expenses.

A)collected and currently matched with expenses.

B)collected and not currently matched with expenses.

C)not collected and currently matched with expenses.

D)not collected and not currently matched with expenses.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

38

Adjusting entries that should be reversed include

A)all accrued revenues.

B)all accrued expenses.

C)those that debit an asset or credit a liability.

D)all of these.

A)all accrued revenues.

B)all accrued expenses.

C)those that debit an asset or credit a liability.

D)all of these.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following is a nominal (temporary) account?

A)Unearned Revenue

B)Salary Expense

C)Inventory

D)Retained Earnings

A)Unearned Revenue

B)Salary Expense

C)Inventory

D)Retained Earnings

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

40

Scott Company purchased equipment on November 1, 2010 and gave a 3-month, 9 percent note with a face value of $50,000.The December 31, 2010 adjusting entry is

A)debit Interest Expense and credit Interest Payable, $4,500.

B)debit Interest Expense and credit Interest Payable, $3,750.

C)debit Interest Expense and credit Cash, $750.

D)debit Interest Expense and credit Interest Payable, $750.

A)debit Interest Expense and credit Interest Payable, $4,500.

B)debit Interest Expense and credit Interest Payable, $3,750.

C)debit Interest Expense and credit Cash, $750.

D)debit Interest Expense and credit Interest Payable, $750.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

41

Cole Co.pays all salaried employees on a biweekly basis.Overtime pay, however, is paid in the next biweekly period.Cole accrues salaries expense only at its December 31 year end.Data relating to salaries earned in December 2010 are as follows: Last payroll was paid on Dec/26/2010, for the two-week period ended Dec/26/2010.Overtime pay earned in the two-week period ended Dec/26/2010 was $5,000.

Remaining work days in 2010 were December 29, 30, 31, on which days there was no overtime.

The recurring biweekly salaries total $80,000.Assuming a five-day work week, Cole should record a liability at December 31, 2010 for accrued salaries of

A)$24,000.

B)$29,000.

C)$48,000.

D)$53,000.

Remaining work days in 2010 were December 29, 30, 31, on which days there was no overtime.

The recurring biweekly salaries total $80,000.Assuming a five-day work week, Cole should record a liability at December 31, 2010 for accrued salaries of

A)$24,000.

B)$29,000.

C)$48,000.

D)$53,000.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

42

Perry Corporation loaned $78,000 to another corporation on December 1, 2010 and received a three-month, 9 percent interest-bearing note with a face value of $78,000.What adjusting entry should Rice make on December 31, 2010?

A)Debit Interest Receivable and credit Interest Revenue, $900.

B)Debit Cash and credit Interest Revenue, $585.

C)Debit Interest Receivable and credit Interest Revenue, $585.

D)Debit Cash and credit Interest Receivable, $1,755.

A)Debit Interest Receivable and credit Interest Revenue, $900.

B)Debit Cash and credit Interest Revenue, $585.

C)Debit Interest Receivable and credit Interest Revenue, $585.

D)Debit Cash and credit Interest Receivable, $1,755.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

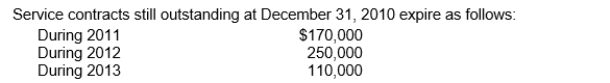

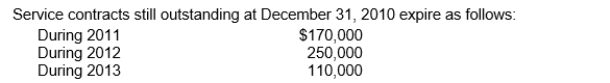

43

Denny Co.sells major household appliance service contracts for cash.The service contracts are for a one-year, two-year, or three-year period.Cash receipts from contracts are credited to Unearned Service Revenues.This account had a balance of $1,100,000 at December 31, 2010 before year-end adjustment.Service contract costs are charged as incurred to the Service Contract Expense account, which had a balance of $325,000 at December 31, 2010.  What amount should be reported as Unearned Service Revenues in Denny's December 31, 2010 balance sheet?

What amount should be reported as Unearned Service Revenues in Denny's December 31, 2010 balance sheet?

A)$775,000.

B)$530,000.

C)$250,000.

D)$325,000.

What amount should be reported as Unearned Service Revenues in Denny's December 31, 2010 balance sheet?

What amount should be reported as Unearned Service Revenues in Denny's December 31, 2010 balance sheet?A)$775,000.

B)$530,000.

C)$250,000.

D)$325,000.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

44

At December 31, 2010, Patula Corporation has not yet received its December invoice for utilities.On December 31, 2010 it accrues an estimate of $10,000.On January 15, 2011 Patula receives the invoice in the amount of $11,000.Assuming the accrual had already been reversed, the entry on January 15, 2011 is

A)debit utilities expense and credit cash $11,000.

B)debit cash and credit utilities expense $11,000.

C)debit utilities expense and credit cash $1,000.

D)debit cash and credit utilities expense $1,000.

A)debit utilities expense and credit cash $11,000.

B)debit cash and credit utilities expense $11,000.

C)debit utilities expense and credit cash $1,000.

D)debit cash and credit utilities expense $1,000.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

45

Fischer Consulting paid $18,000 on December 1, 2010 for a three-year insurance policy (December 1, 2010 to November 30, 2013) and recorded the entire amount as prepaid insurance.The December 31, 2010 adjustment should be recorded as follows:

A)debit prepaid insurance and credit insurance expense $500.

B)debit insurance expense and credit prepaid insurance $500.

C)debit insurance expense and credit prepaid insurance $17,500.

D)debit prepaid insurance and credit insurance expense $17,500.

A)debit prepaid insurance and credit insurance expense $500.

B)debit insurance expense and credit prepaid insurance $500.

C)debit insurance expense and credit prepaid insurance $17,500.

D)debit prepaid insurance and credit insurance expense $17,500.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

46

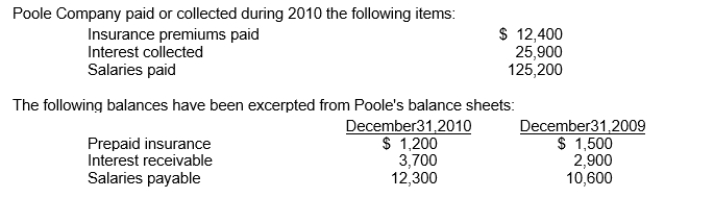

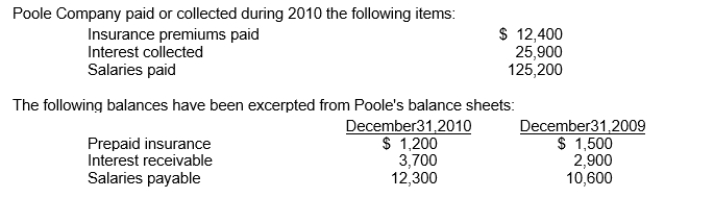

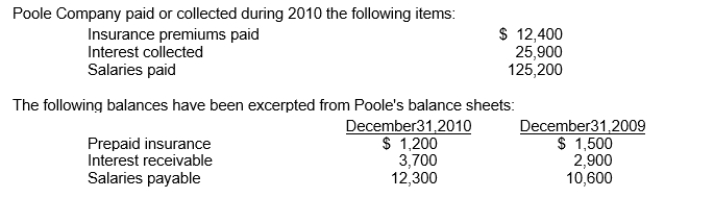

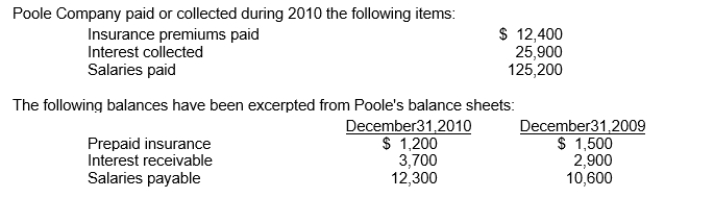

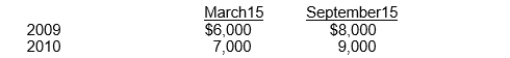

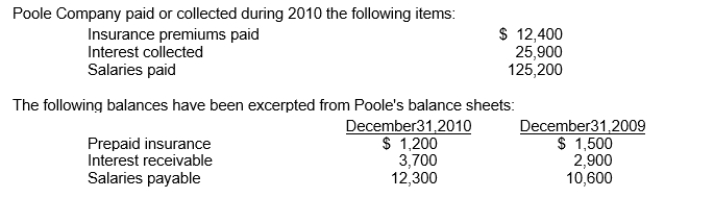

Use the following information for questions

The insurance expense on the income statement for 2010 was

A)$9,700.

B)$12,100.

C)$12,700.

D)$15,100.

The insurance expense on the income statement for 2010 was

A)$9,700.

B)$12,100.

C)$12,700.

D)$15,100.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

47

On June 1, 2010, Mays Corp.loaned Farr $500,000 on a 12% note, payable in five annual instalments of $100,000 beginning January 2, 2011.In connection with this loan, Farr was required to deposit $6,000 in a non-interest-bearing escrow account.The amount held in escrow is to be returned to Farr after all principal and interest payments have been made.Interest on the note is payable on the first day of each month beginning July 1, 2010.Farr made timely payments through November 1, 2010.On January 2, 2011, Mays received payment of the first principal instalment plus all interest due.At December 31, 2010, Mays' interest receivable on the loan to Farr should be

A)$0.

B)$5,000.

C)$10,000.

D)$15,000.

A)$0.

B)$5,000.

C)$10,000.

D)$15,000.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

48

Use the following information for questions

The salary expense on the income statement for 2010 was

A)$102,300.

B)$123,500.

C)$126,900.

D)$148,100.

The salary expense on the income statement for 2010 was

A)$102,300.

B)$123,500.

C)$126,900.

D)$148,100.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

49

Digger Oil & Gas has received its invoice in the amount of $85,000 for property taxes for the year 2010.The invoice was received and paid in June 2010 and the entire amount was debited to property tax expense.Assuming Digger does NOT prepare interim financial statements, the required adjustment on December 31, 2010 is

A)debit property tax expense and credit prepaid property tax $49,583.

B)debit prepaid property tax and credit property tax expense $49,583.

C)debit property tax expense and credit prepaid property tax $35,417.

D)no entry required.

A)debit property tax expense and credit prepaid property tax $49,583.

B)debit prepaid property tax and credit property tax expense $49,583.

C)debit property tax expense and credit prepaid property tax $35,417.

D)no entry required.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

50

Moreno Inc.reviews its December 31, 2010 unadjusted trial balance and determines that a sale in the amount of $15,000 had been incorrectly recorded as a debit to sales and a credit to receivables.The adjusting entry at December 31, 2010 is:

A)debit receivables and credit sales $30,000.

B)credit receivables and debit sales $30,000.

C)debit receivables and credit sales $15,000.

D)credit receivables and debit sales $15,000.

A)debit receivables and credit sales $30,000.

B)credit receivables and debit sales $30,000.

C)debit receivables and credit sales $15,000.

D)credit receivables and debit sales $15,000.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

51

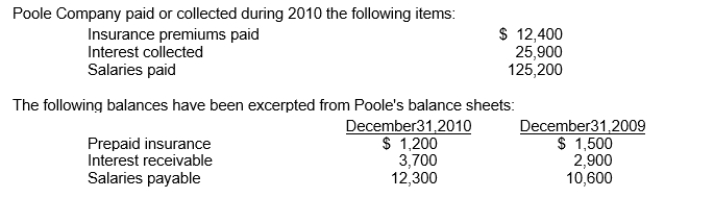

Meswell Corp.'s trademark was licensed to McCall Co.for royalties of 12 percent of sales of the trademarked items.Royalties are payable semi-annually on March 15 for sales in July through December of the prior year, and on September 15 for sales in January through June of the same year.Meswell received the following royalties from McCall:  McCall estimated that sales of the trademarked items would total $75,000 for July through December 2010.In Meswell's 2010 income statement, the royalty revenue should be

McCall estimated that sales of the trademarked items would total $75,000 for July through December 2010.In Meswell's 2010 income statement, the royalty revenue should be

A)$18,000.

B)$16,000.

C)$9,000.

D)$20,000.

McCall estimated that sales of the trademarked items would total $75,000 for July through December 2010.In Meswell's 2010 income statement, the royalty revenue should be

McCall estimated that sales of the trademarked items would total $75,000 for July through December 2010.In Meswell's 2010 income statement, the royalty revenue should beA)$18,000.

B)$16,000.

C)$9,000.

D)$20,000.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

52

On December 10, 2010 Copeta Inc.received a cheque in the amount of $50,000 from a customer for services that Copeta had yet to perform.By December 31, 2010 it had earned $20,000 of that amount.Assuming the appropriate year end adjustments were made, the 2010 balance in Copeta's unearned revenue account will be

A)$30,000.

B)$20,000.

C)$50,000.

D)Zero.

A)$30,000.

B)$20,000.

C)$50,000.

D)Zero.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

53

On September 1, 2009 Calmex Corp.issued a note payable to National Bank in the amount of $900,000, bearing interest at 8 percent, and payable in three equal annual principal payments of $300,000.On this date, the bank's prime rate was 7 percent.The first payment for interest and principal was made on September 1, 2010.At December 31, 2010, Calmex should record accrued interest payable of

A)$24,000.

B)$21,000.

C)$16,000.

D)$14,000.

A)$24,000.

B)$21,000.

C)$16,000.

D)$14,000.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

54

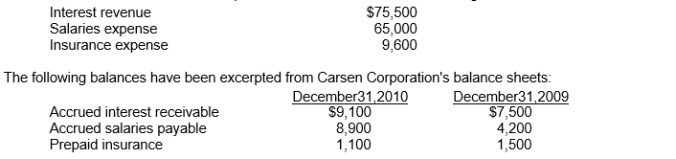

Use the following information for questions

The interest revenue on the income statement for 2010 was

A)$19,300.

B)$25,100.

C)$26,700.

D)$32,500.

The interest revenue on the income statement for 2010 was

A)$19,300.

B)$25,100.

C)$26,700.

D)$32,500.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck