Deck 4: Reporting Financial Performance

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

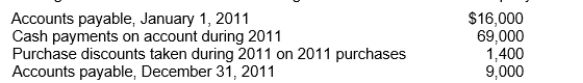

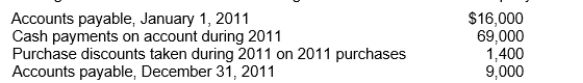

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/61

Play

Full screen (f)

Deck 4: Reporting Financial Performance

1

Irregular or unusual gains or losses that don't relate to discontinued operations

A)may be reported separately if they are material in amount.

B)are generally combined with other gains and losses if they are immaterial.

C)must be shown above "income before discontinued operations" and before the provision for income tax.

D)All of these

A)may be reported separately if they are material in amount.

B)are generally combined with other gains and losses if they are immaterial.

C)must be shown above "income before discontinued operations" and before the provision for income tax.

D)All of these

D

2

The business model may be broken up into three activities:

A)investing, operating, allocating.

B)balance sheet, income statement, cash flow statement.

C)investing, operating, financing.

D)balance sheet, income statement, retained earnings statement.

A)investing, operating, allocating.

B)balance sheet, income statement, cash flow statement.

C)investing, operating, financing.

D)balance sheet, income statement, retained earnings statement.

C

3

Expenses may be presented in the income statement

A)by nature or by function

B)by amount or in alphabetical order

C)by geographical area or by the single-step method

D)by current or non-current

A)by nature or by function

B)by amount or in alphabetical order

C)by geographical area or by the single-step method

D)by current or non-current

A

4

The concept of comprehensive income

A)Is not relevant under IFRS

B)Is not relevant under private entity GAAP

C)Can be replaced with the concept of discontinued operations under private entity

D)None of these

A)Is not relevant under IFRS

B)Is not relevant under private entity GAAP

C)Can be replaced with the concept of discontinued operations under private entity

D)None of these

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

5

Earnings management is

A)the process of managing a business.

B)the process of profit maximization.

C)always fraudulent.

D)manipulating income to meet a targeted earnings level.

A)the process of managing a business.

B)the process of profit maximization.

C)always fraudulent.

D)manipulating income to meet a targeted earnings level.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

6

The major elements of the income statement are

A)revenue, cost of goods sold, selling expenses, and general expense.

B)operating section, non-operating section and discontinued operations.

C)revenues, expenses, gains, and losses.

D)all of these.

A)revenue, cost of goods sold, selling expenses, and general expense.

B)operating section, non-operating section and discontinued operations.

C)revenues, expenses, gains, and losses.

D)all of these.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

7

The occurrence which most likely would have no effect on 2011 net income (assuming that all amounts involved are material) is the

A)sale in 2011 of an office building contributed by a stockholder in 1987.

B)collection in 2011 of a receivable from a customer whose account was written off in 2010 by a charge to the allowance account.

C)settlement based on litigation in 2011 of previously unrecognized damages from a serious accident which occurred in 2008.

D)worthlessness determined in 2011 of stock purchased on a speculative basis in 2007.

A)sale in 2011 of an office building contributed by a stockholder in 1987.

B)collection in 2011 of a receivable from a customer whose account was written off in 2010 by a charge to the allowance account.

C)settlement based on litigation in 2011 of previously unrecognized damages from a serious accident which occurred in 2008.

D)worthlessness determined in 2011 of stock purchased on a speculative basis in 2007.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

8

A company's balance sheet

A)Would never include accumulated other comprehensive income (because it is an income statement item).

B)May include accumulated other comprehensive income if the company follows IFRS

C)May include accumulated other comprehensive income if the company follows private entity GAAP

D)None of these

A)Would never include accumulated other comprehensive income (because it is an income statement item).

B)May include accumulated other comprehensive income if the company follows IFRS

C)May include accumulated other comprehensive income if the company follows private entity GAAP

D)None of these

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

9

The concept of 'soft numbers' reflects that

A)financial statement numbers may be manipulated.

B)sometimes significant measurement uncertainty exists.

C)earnings numbers may not be sustainable.

C)sometimes significant errors exist.

A)financial statement numbers may be manipulated.

B)sometimes significant measurement uncertainty exists.

C)earnings numbers may not be sustainable.

C)sometimes significant errors exist.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

10

The concept of intraperiod tax allocation is used for

A)income from continuing operations

B)income from discontinued operations

C)other comprehensive income

D)All of these

A)income from continuing operations

B)income from discontinued operations

C)other comprehensive income

D)All of these

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

11

The single-step income statement emphasizes

A)the gross profit figure.

B)total revenues and total expenses.

C)extraordinary items and accounting changes more than these are emphasized in the multiple-step income statement.

D)the various components of income from continuing operations.

A)the gross profit figure.

B)total revenues and total expenses.

C)extraordinary items and accounting changes more than these are emphasized in the multiple-step income statement.

D)the various components of income from continuing operations.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is an acceptable method of presenting the income statement?

A)A single-step income statement

B)A multiple-step income statement

C)A consolidated statement of income

D)All of these

A)A single-step income statement

B)A multiple-step income statement

C)A consolidated statement of income

D)All of these

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

13

The income statement strives to capture the

A)financing activities.

B)investing activities.

C)interrelationship between the activities.

D)operating activities.

A)financing activities.

B)investing activities.

C)interrelationship between the activities.

D)operating activities.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

14

The concept of transparency mandates that the financial statements

A)reflect the economic reality of running a business.

B)reflect everything no matter how small.

C)reflect the biases of the managers.

D)all of the above.

A)reflect the economic reality of running a business.

B)reflect everything no matter how small.

C)reflect the biases of the managers.

D)all of the above.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is a required disclosure in the income statement when reporting a change in accounting principle?

A)A per share amount for the cumulative effect of the change.

B)The cumulative effect on prior years net of tax.

C)The cumulative effect should be disclosed immediately after discontinued operations.

D)None of these.

A)A per share amount for the cumulative effect of the change.

B)The cumulative effect on prior years net of tax.

C)The cumulative effect should be disclosed immediately after discontinued operations.

D)None of these.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is not a generally practiced method of presenting the income statement?

A)Including corrections of errors made in a prior period

B)The single-step income statement

C)The consolidated statement of income

D)Including gains and losses from discontinued operations of a segment of a business in determining net income

A)Including corrections of errors made in a prior period

B)The single-step income statement

C)The consolidated statement of income

D)Including gains and losses from discontinued operations of a segment of a business in determining net income

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

17

Information in the income statement helps users to

A)evaluate the past performance of the enterprise.

B)provide a basis for predicting future performance.

C)help assess the risk or uncertainty of achieving future cash flows.

D)all of these.

A)evaluate the past performance of the enterprise.

B)provide a basis for predicting future performance.

C)help assess the risk or uncertainty of achieving future cash flows.

D)all of these.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

18

When expenses are presented by function in the income statement

A)Their breakdown should be disclosed.

B)They should be reported as part of other comprehensive income.

C)Their cash flow predictive value is decreased

D)(a) and (c)

A)Their breakdown should be disclosed.

B)They should be reported as part of other comprehensive income.

C)Their cash flow predictive value is decreased

D)(a) and (c)

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is a change in accounting principle?

A)A change in the estimated service life of machinery

B)A change estimated allowance for bad debts

C)A change in the estimated future warranty expense

D)A change from FIFO to weighted average for inventory

A)A change in the estimated service life of machinery

B)A change estimated allowance for bad debts

C)A change in the estimated future warranty expense

D)A change from FIFO to weighted average for inventory

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

20

Limitations of the income statement include all of the following except

A)items that cannot be measured reliably are not reported.

B)only actual amounts are reported in determining net income.

C)income measurement involves judgement.

D)income numbers are affected by the accounting methods employed.

A)items that cannot be measured reliably are not reported.

B)only actual amounts are reported in determining net income.

C)income measurement involves judgement.

D)income numbers are affected by the accounting methods employed.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

21

A manufacturing firm sold goods during its normal course of business.The pre-tax income attributable to this sale is $137,500.Assuming an income tax rate of 30%, the sale would be reported in the company's income statement as

A)income of $96,250 included in after-tax net income from continuing operations

B)income of $137,500 included in pre-tax income from continuing operations

C)a gain of $137,500 with a separate disclosure of the income tax effect.

D)(a) and (b)

A)income of $96,250 included in after-tax net income from continuing operations

B)income of $137,500 included in pre-tax income from continuing operations

C)a gain of $137,500 with a separate disclosure of the income tax effect.

D)(a) and (b)

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

22

Sure Corporation made a very large arithmetical error in the preparation of its year-end financial statements by improper placement of a decimal point in the calculation of amortization.The error caused the net income to be reported at almost double the proper amount.Correction of the error when discovered in the next year should be treated as

A)an increase in amortization expense for the year in which the error is discovered.

B)a component of income for the year in which the error is discovered, but separately listed on the income statement and fully explained in a note to the financial statements.

C)a gain for the year in which the error was made.

D)an adjustment to beginning retained earnings, net of tax.

A)an increase in amortization expense for the year in which the error is discovered.

B)a component of income for the year in which the error is discovered, but separately listed on the income statement and fully explained in a note to the financial statements.

C)a gain for the year in which the error was made.

D)an adjustment to beginning retained earnings, net of tax.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

23

When a company disposes of a discontinued operation (segment), the transaction should be included in the income statement as a gain or loss on disposal reported as

A)a prior period adjustment.

B)other comprehensive income.

C)an amount after continuing operations.

D)a bulk sale of plant assets included in income from continuing operations.

A)a prior period adjustment.

B)other comprehensive income.

C)an amount after continuing operations.

D)a bulk sale of plant assets included in income from continuing operations.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following items will not appear in the retained earnings statement?

A)Net loss

B)Correction of an error

C)Change in accounting estimates

D)Stock dividends

A)Net loss

B)Correction of an error

C)Change in accounting estimates

D)Stock dividends

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is a required disclosure in the income statement when reporting the disposal of a segment of the business?

A)The gain or loss on disposal should be reported as an extraordinary item.

B)Results of operations of a discontinued segment should be disclosed immediately below other irregular items.

C)Earnings per share from both continuing operations and net income should be

D)The gain or loss on disposal should not be segregated, but should be reported together with the results of continuing operations.

A)The gain or loss on disposal should be reported as an extraordinary item.

B)Results of operations of a discontinued segment should be disclosed immediately below other irregular items.

C)Earnings per share from both continuing operations and net income should be

D)The gain or loss on disposal should not be segregated, but should be reported together with the results of continuing operations.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

26

Comprehensive income includes all changes in equity during a period except

A)gains and losses from discontinued operations.

B)unrealized gains and losses on available for sale securities.

C)those resulting from investments by owners and distributions to owners.

D)gains and losses from irregular items.

A)gains and losses from discontinued operations.

B)unrealized gains and losses on available for sale securities.

C)those resulting from investments by owners and distributions to owners.

D)gains and losses from irregular items.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

27

Pearson Company reported net income of $450,000.This amount included a pre-tax loss of $15,000 that was considered material and pertained to its continuing operations.Assuming an income tax rate of 35%, Pearson's net income without this loss would have been

A)$444,750

B)$435,000

C)$440,250

D)$410,250

A)$444,750

B)$435,000

C)$440,250

D)$410,250

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

28

For purposes of discontinued operations, the key elements in determining that a separate segment exists are

A)the component is a separate business and a separate legal entity.

B)the component is a separate legal entity and generates its own net cash flows.

C)the component is in a separate geographic region and can be sold.

D)the component is a separate business and generates its own cash flow.

A)the component is a separate business and a separate legal entity.

B)the component is a separate legal entity and generates its own net cash flows.

C)the component is in a separate geographic region and can be sold.

D)the component is a separate business and generates its own cash flow.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

29

All-inclusive income includes all of the following except

A)dividend revenue.

B)losses on disposal of assets.

C)investments by owners.

D)gains on the expropriation of property by the government.

A)dividend revenue.

B)losses on disposal of assets.

C)investments by owners.

D)gains on the expropriation of property by the government.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

30

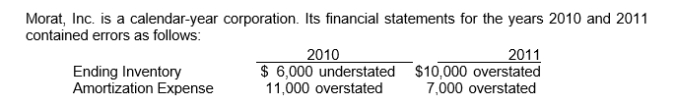

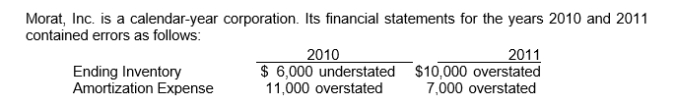

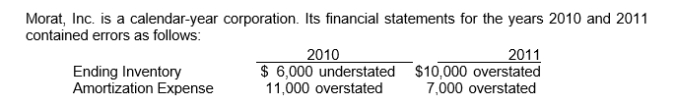

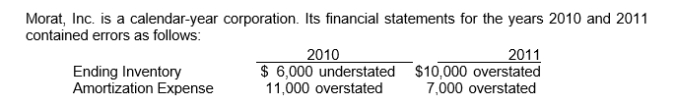

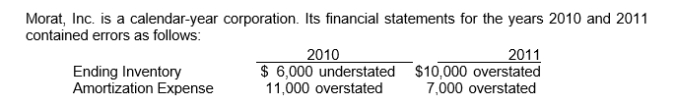

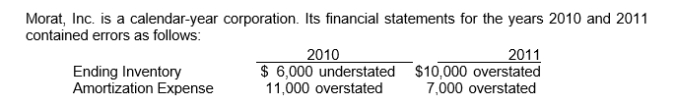

Use the following information for questions

Assuming that none of the errors was detected or corrected, by what amount will 2010 income before taxes be overstated or understated?

A)$2,600 understated

B)$2,600 overstated

C)$7,400 overstated

D)$7,400 understated

Assuming that none of the errors was detected or corrected, by what amount will 2010 income before taxes be overstated or understated?

A)$2,600 understated

B)$2,600 overstated

C)$7,400 overstated

D)$7,400 understated

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

31

The statement of changes in shareholder's equity

A)Is a required statement under IFRS

B)Is a required statement under private entity GAAP

C)Is a required statement under either standard

D)None of these

A)Is a required statement under IFRS

B)Is a required statement under private entity GAAP

C)Is a required statement under either standard

D)None of these

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

32

Lockenberg Company changed the amortization method (a change in accounting principle) for its fleet of delivery trucks.The accumulated net after-tax effect was an increase of prior period's net income by $84,300.This adjustment will have the following effect on Lockenberg's current year net income:

A)Current year's net income will be unaffected

B)Current year's net income will increase by $84,300

C)Current year's net income will increase by $84,300 minus the income tax effect

D)Current year's net income will decrease by $84,300

A)Current year's net income will be unaffected

B)Current year's net income will increase by $84,300

C)Current year's net income will increase by $84,300 minus the income tax effect

D)Current year's net income will decrease by $84,300

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

33

Which one of the following types of losses is excluded from the determination of net income in income statements?

A)Material losses resulting from transactions in the company's investments account.

B)Material losses resulting from unusual sales of assets not acquired for resale.

C)Material losses resulting from the write-off of intangibles.

D)Material losses resulting from correction of errors related to prior periods.

A)Material losses resulting from transactions in the company's investments account.

B)Material losses resulting from unusual sales of assets not acquired for resale.

C)Material losses resulting from the write-off of intangibles.

D)Material losses resulting from correction of errors related to prior periods.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is true about intraperiod tax allocation?

A)It arises because certain revenue and expense items appear in the income statement either before or after they are included in the tax return.

B)It is required for the cumulative effect of changes in accounting principles but not for discontinued operations.

C)Its purpose is to allocate income tax expense evenly over a number of accounting periods.

D)Its purpose is to relate the income tax expense to the items which affect the amount of tax.

A)It arises because certain revenue and expense items appear in the income statement either before or after they are included in the tax return.

B)It is required for the cumulative effect of changes in accounting principles but not for discontinued operations.

C)Its purpose is to allocate income tax expense evenly over a number of accounting periods.

D)Its purpose is to relate the income tax expense to the items which affect the amount of tax.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

35

Other comprehensive income is

A)income from unusual activities.

B)income that is not related to normal earnings activities.

C)income items that bypass the income statement.

D)included in income from continuing operations.

A)income from unusual activities.

B)income that is not related to normal earnings activities.

C)income items that bypass the income statement.

D)included in income from continuing operations.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

36

Income taxes are allocated to

A)correction of errors reported in prior periods.

B)discontinued operations.

C)irregular items.

D)all of these.

A)correction of errors reported in prior periods.

B)discontinued operations.

C)irregular items.

D)all of these.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

37

Accumulated other comprehensive income would be reported

A)in the shareholders' equity section.

B)in the retained earnings section.

C)in net income.

D)in net income from continuing operations.

A)in the shareholders' equity section.

B)in the retained earnings section.

C)in net income.

D)in net income from continuing operations.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

38

The IASB is planning significant changes to the presentation of financial statements. These changes will result in financial statements that are classified according to

A)cash flows from operating, investing and financing activities.

B)business and financing activities.

C)assets, liabilities and equity.

D)the nature and function of expenses.

A)cash flows from operating, investing and financing activities.

B)business and financing activities.

C)assets, liabilities and equity.

D)the nature and function of expenses.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

39

An asset can be classified as held for sale when

A)It is probable that the assets will be sold within one year

B)The sale has been authorized by the company's management

C)The asset is available for immediate sale

D)All of these

A)It is probable that the assets will be sold within one year

B)The sale has been authorized by the company's management

C)The asset is available for immediate sale

D)All of these

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

40

Markete Company has 100,000 common shares outstanding and has a policy of paying a $1.20 dividend for each of these shares.Markete has an income tax rate of 40%.Its retained earnings statement for 2011 had a closing balance of $1,346,000.Assuming an opening balance of zero, dividend payments according to its usual policy and no other adjustments, Markete's 2011 net income was

A)$1,418,000

B)$1,394,000

C)$1,466,000

D)$1,451,000

A)$1,418,000

B)$1,394,000

C)$1,466,000

D)$1,451,000

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

41

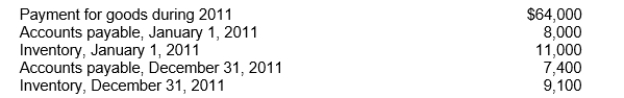

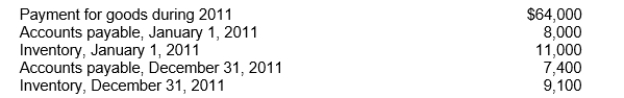

The following information is available for Kress Company:  Cost of goods sold for 2011 is

Cost of goods sold for 2011 is

A)$59,800

B)$60,150

C)$64,320

D)$65,300.

Cost of goods sold for 2011 is

Cost of goods sold for 2011 isA)$59,800

B)$60,150

C)$64,320

D)$65,300.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

42

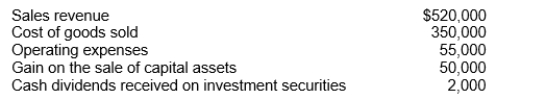

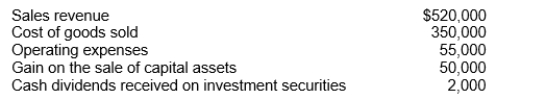

Quorum Company reported the following information for 2011:  For 2011, on a multiple-step income statement, Quorum would report other income of

For 2011, on a multiple-step income statement, Quorum would report other income of

A)$167,000.

B)$165,000.

C)$52,000.

D)$50,000.

For 2011, on a multiple-step income statement, Quorum would report other income of

For 2011, on a multiple-step income statement, Quorum would report other income ofA)$167,000.

B)$165,000.

C)$52,000.

D)$50,000.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

43

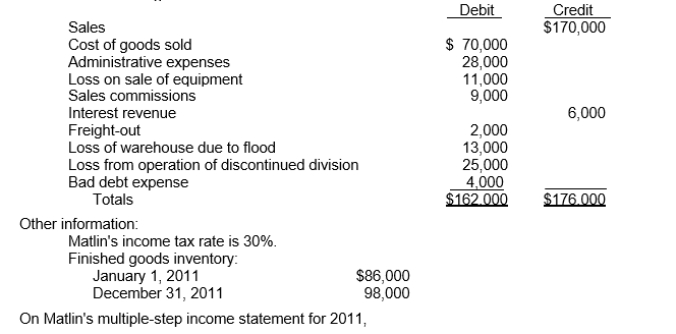

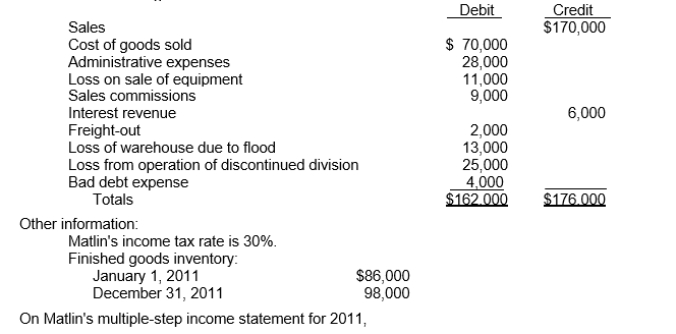

Use the following information for questions

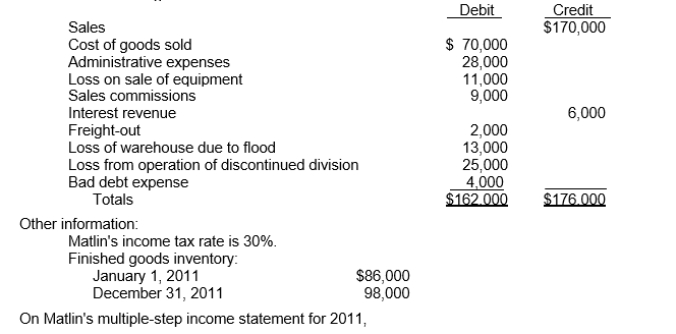

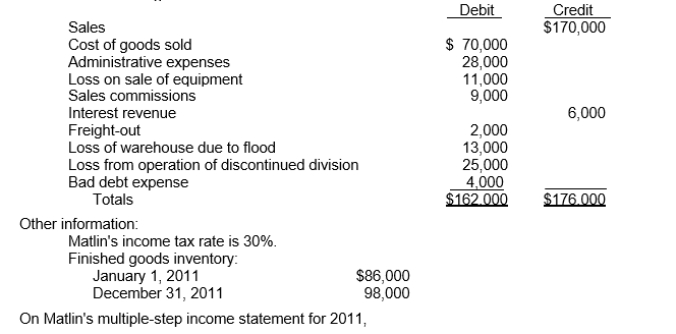

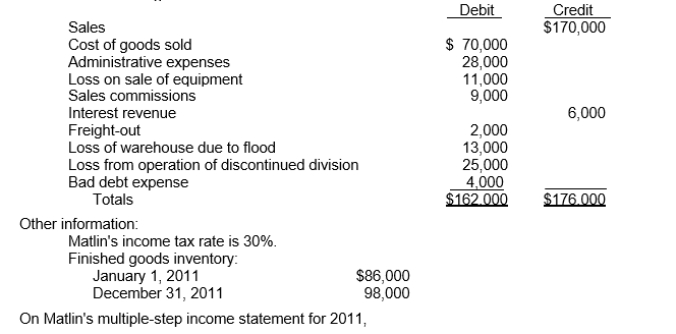

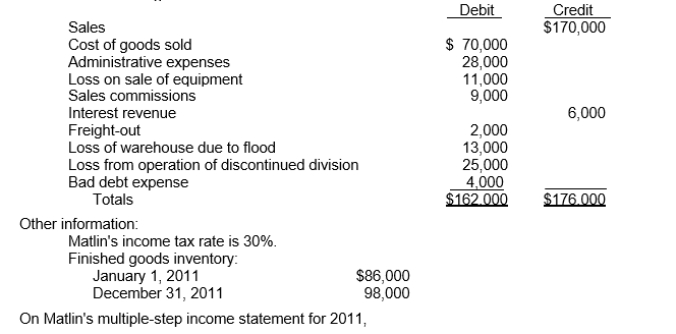

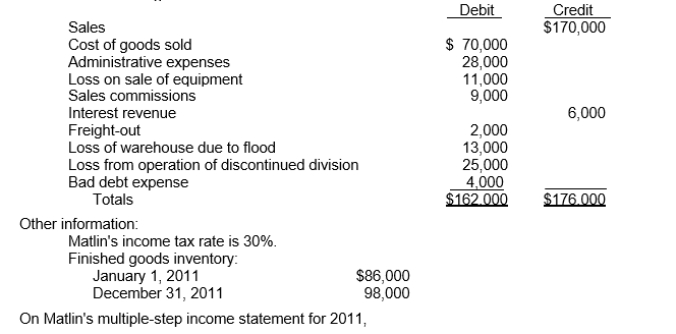

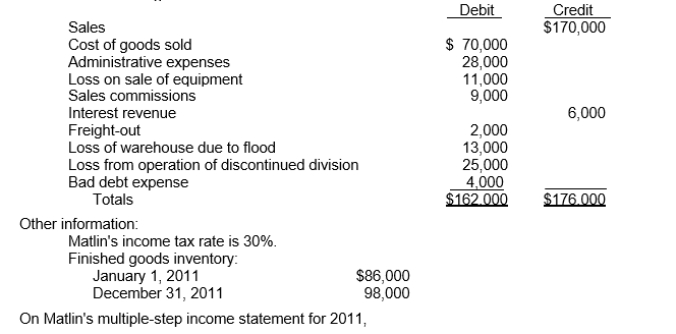

Matlin Corp.'s trial balance of income statement accounts for the year ended December 31, 2011 included the following:

Income from discontinued operations is

A)$10,500.

B)$17,500.

C)$16,800.

D)$24,000.

Matlin Corp.'s trial balance of income statement accounts for the year ended December 31, 2011 included the following:

Income from discontinued operations is

A)$10,500.

B)$17,500.

C)$16,800.

D)$24,000.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

44

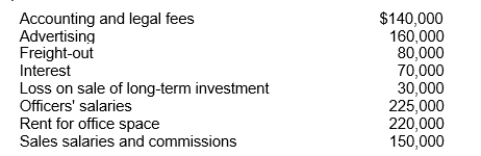

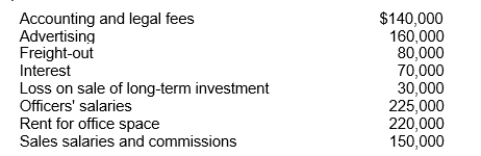

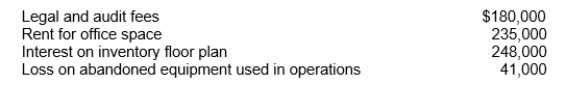

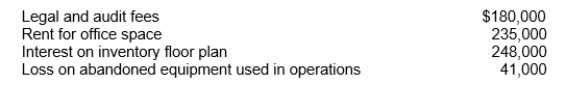

Coil Corp.reports operating expenses in two categories: (1) selling and (2) general and administrative.The adjusted trial balance at December 31, 2011 included the following expense and loss accounts:  One-half of the rented premises is occupied by the sales department.Coil's total selling expenses for 2011 are

One-half of the rented premises is occupied by the sales department.Coil's total selling expenses for 2011 are

A)$500,000.

B)$420,000.

C)$390,000.

D)$350,000.

One-half of the rented premises is occupied by the sales department.Coil's total selling expenses for 2011 are

One-half of the rented premises is occupied by the sales department.Coil's total selling expenses for 2011 areA)$500,000.

B)$420,000.

C)$390,000.

D)$350,000.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

45

In 2011 Roswell Company changed from straight-line to double declining-balance amortization.The total difference in amortization for all years through 2010 was $52,000 and for 2011 the difference was $5,000.The tax rate is 30 percent.The amount that should be reported in the statement of retained earnings for 2011 as a change in accounting principle is

A)$36,400 debit.

B)$36,400 credit.

C)$39,900 debit.

D)$39,900 credit.

A)$36,400 debit.

B)$36,400 credit.

C)$39,900 debit.

D)$39,900 credit.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

46

Use the following information for questions

Assuming that none of the errors was detected or corrected, and that no additional errors were made in 2012, by what amount will current assets at December 31, 2012 be overstated or understated?

A)$10,000 overstated

B)$0

C)$4,000 overstated

D)$10,000 understated

Assuming that none of the errors was detected or corrected, and that no additional errors were made in 2012, by what amount will current assets at December 31, 2012 be overstated or understated?

A)$10,000 overstated

B)$0

C)$4,000 overstated

D)$10,000 understated

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

47

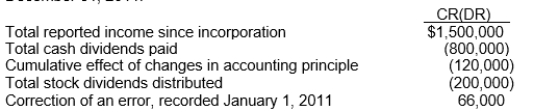

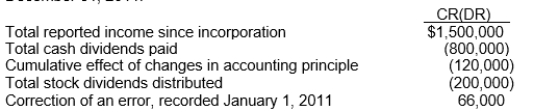

The following information was extracted from the accounts of Colaw Corporation at December 31, 2011:  What should be the balance of retained earnings at December 31, 2011?

What should be the balance of retained earnings at December 31, 2011?

A)$446,000.

B)$500,000.

C)$380,000.

D)$566,000.

What should be the balance of retained earnings at December 31, 2011?

What should be the balance of retained earnings at December 31, 2011?A)$446,000.

B)$500,000.

C)$380,000.

D)$566,000.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

48

Use the following information for questions

Assuming that the errors made in 2010 were corrected, but that the errors made in 2011 were not detected, by what amount will 2011 income before taxes be overstated or understated?

A)$3,000 overstated

B)$10,000 overstated

C)$17,000 overstated

D)$3,000 understated

Assuming that the errors made in 2010 were corrected, but that the errors made in 2011 were not detected, by what amount will 2011 income before taxes be overstated or understated?

A)$3,000 overstated

B)$10,000 overstated

C)$17,000 overstated

D)$3,000 understated

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

49

How much of the expenses listed above should be included in Oskar's general and administrative expenses for 2011?

A)$380,000.

B)$410,000.

C)$440,000.

D)$470,000.

A)$380,000.

B)$410,000.

C)$440,000.

D)$470,000.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

50

The following items were among those that were reported on Gare Co.'s income statement for the year ended December 31, 2011:  The office space is used equally by Gare's sales and accounting departments.What amount of the above-listed items should be classified as general and administrative expenses in Gare's multiple-step income statement?

The office space is used equally by Gare's sales and accounting departments.What amount of the above-listed items should be classified as general and administrative expenses in Gare's multiple-step income statement?

A)$415,000.

B)$160,000.

C)$297,500.

D)$180,000.

The office space is used equally by Gare's sales and accounting departments.What amount of the above-listed items should be classified as general and administrative expenses in Gare's multiple-step income statement?

The office space is used equally by Gare's sales and accounting departments.What amount of the above-listed items should be classified as general and administrative expenses in Gare's multiple-step income statement?A)$415,000.

B)$160,000.

C)$297,500.

D)$180,000.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

51

Use the following information for questions

Assuming that none of the errors was detected or corrected, by what amount will 2011 income before taxes be overstated or understated?

A)$14,300 understated

B)$11,900 understated

C)$6,700 understated

D)$6,700 overstated

Assuming that none of the errors was detected or corrected, by what amount will 2011 income before taxes be overstated or understated?

A)$14,300 understated

B)$11,900 understated

C)$6,700 understated

D)$6,700 overstated

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

52

How much of the expenses listed above should be included in Oskar's selling expenses for 2011?

A)$260,000.

B)$335,000.

C)$340,000.

D)$415,000.

A)$260,000.

B)$335,000.

C)$340,000.

D)$415,000.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

53

The following information is available concerning the accounts of Fischer Company:  Assuming the company records purchases at the gross amounts, the total purchases for 2011 would be

Assuming the company records purchases at the gross amounts, the total purchases for 2011 would be

A)$62,000.

B)$63,400.

C)$58,100.

D)$57,800.

Assuming the company records purchases at the gross amounts, the total purchases for 2011 would be

Assuming the company records purchases at the gross amounts, the total purchases for 2011 would beA)$62,000.

B)$63,400.

C)$58,100.

D)$57,800.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

54

Use the following information for questions

Assuming that none of the errors was detected or corrected, by what amount will retained earnings at December 31, 2011 be overstated or understated?

A)$23,000 understated

B)$17,000 understated

C)$8,000 understated

D)$10,000 overstated

Assuming that none of the errors was detected or corrected, by what amount will retained earnings at December 31, 2011 be overstated or understated?

A)$23,000 understated

B)$17,000 understated

C)$8,000 understated

D)$10,000 overstated

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

55

Use the following information for questions

At Iserlohn Company, events and transactions during 2011 included the following.The tax rate for all items is 30 percent.

(1) Amortization for 2009 was found to be understated by $30,000.

(2) A strike by the employees of a supplier resulted in a loss of $20,000.(3) The inventory at December 31, 2009 was overstated by $40,000.

(4) A flood destroyed a building that had a book value of $400,000.Floods are very uncommon in that area.

The effect of these events and transactions on the beginning balance of 2011 retained earnings would be

A)$14,000.

B)$294,000.

C)$21,000.

D)$343,000.

At Iserlohn Company, events and transactions during 2011 included the following.The tax rate for all items is 30 percent.

(1) Amortization for 2009 was found to be understated by $30,000.

(2) A strike by the employees of a supplier resulted in a loss of $20,000.(3) The inventory at December 31, 2009 was overstated by $40,000.

(4) A flood destroyed a building that had a book value of $400,000.Floods are very uncommon in that area.

The effect of these events and transactions on the beginning balance of 2011 retained earnings would be

A)$14,000.

B)$294,000.

C)$21,000.

D)$343,000.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

56

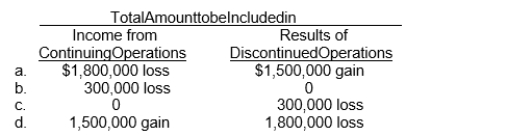

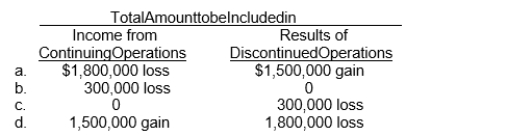

During 2011, Post Corporation disposed of Real Division, a major segment of its business. Post realized a gain of $1,500,000, net of taxes, on the sale of Real's assets.Real's operating losses, net of taxes, were $1,800,000 in 2011.How should these facts be

Reported in Post's income statement for 2011?

Reported in Post's income statement for 2011?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

57

Use the following information for questions

At Iserlohn Company, events and transactions during 2011 included the following.The tax rate for all items is 30 percent.

(1) Amortization for 2009 was found to be understated by $30,000.

(2) A strike by the employees of a supplier resulted in a loss of $20,000.(3) The inventory at December 31, 2009 was overstated by $40,000.

(4) A flood destroyed a building that had a book value of $400,000.Floods are very uncommon in that area.

The effect of these events and transactions on 2011 income from continuing operations net of tax would be

A)$14,000.

B)$35,000.

C)$63,000.

D)$294,000.

At Iserlohn Company, events and transactions during 2011 included the following.The tax rate for all items is 30 percent.

(1) Amortization for 2009 was found to be understated by $30,000.

(2) A strike by the employees of a supplier resulted in a loss of $20,000.(3) The inventory at December 31, 2009 was overstated by $40,000.

(4) A flood destroyed a building that had a book value of $400,000.Floods are very uncommon in that area.

The effect of these events and transactions on 2011 income from continuing operations net of tax would be

A)$14,000.

B)$35,000.

C)$63,000.

D)$294,000.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

58

Stober, Ltd.decided on January 1, 2011 to discontinue its plastic making division.The division, considered a reportable segment, was sold on June 1, 2011.Division assets with a carrying value of $650,000 were sold for $500,000.Operating income from January 1, to May 30, 2011 for the division amounted to $80,000.Ignoring taxes, what amount should be reported on Stober's income statement for the year ended December 31, 2011, under the caption "discontinued operations"?

A)$230,000 gain

B)$80,000 gain

C)$150,000 loss

D)$70,000 loss

A)$230,000 gain

B)$80,000 gain

C)$150,000 loss

D)$70,000 loss

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

59

Use the following information for questions

Matlin Corp.'s trial balance of income statement accounts for the year ended December 31, 2011 included the following:

Cost of goods manufactured is

A)$70,000.

B)$82,000.

C)$53,000.

D)$50,000.

Matlin Corp.'s trial balance of income statement accounts for the year ended December 31, 2011 included the following:

Cost of goods manufactured is

A)$70,000.

B)$82,000.

C)$53,000.

D)$50,000.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

60

Use the following information for questions

Matlin Corp.'s trial balance of income statement accounts for the year ended December 31, 2011 included the following:

Income from continued operations is

A)$17,500.

B)$52,800.

C)$24,500.

D)$27,300.

Matlin Corp.'s trial balance of income statement accounts for the year ended December 31, 2011 included the following:

Income from continued operations is

A)$17,500.

B)$52,800.

C)$24,500.

D)$27,300.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

61

Use the following information for questions

Matlin Corp.'s trial balance of income statement accounts for the year ended December 31, 2011 included the following:

Net income is

A)$9,800.

B)$15,000.

C)$16,800.

D)$24,000.

Matlin Corp.'s trial balance of income statement accounts for the year ended December 31, 2011 included the following:

Net income is

A)$9,800.

B)$15,000.

C)$16,800.

D)$24,000.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck