Deck 12: Intangible Assets and Goodwill

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/52

Play

Full screen (f)

Deck 12: Intangible Assets and Goodwill

1

The cost of purchasing patent rights for a product that might otherwise have seriously competed with one of the purchaser's patented products should be

A)charged off in the current period.

B)amortized over the legal life of the purchased patent.

C)added to factory overhead and allocated to production of the purchaser's product.

D)amortized over the remaining estimated life of the original patent covering the product whose market would have been impaired by competition from the newly patented product.

A)charged off in the current period.

B)amortized over the legal life of the purchased patent.

C)added to factory overhead and allocated to production of the purchaser's product.

D)amortized over the remaining estimated life of the original patent covering the product whose market would have been impaired by competition from the newly patented product.

D

2

Santo Corporation was granted a patent on a product on January 1, 2010.To protect its patent, the corporation purchased on January 1, 2009 a patent on a competing product which was originally issued on January 10, 2005.Because of its unique plan, Santo Corporation does not feel the competing patent can be used in producing a product.The cost of the competing patent should be

A)amortized over a maximum period of 20 years.

B)amortized over a maximum period of 16 years.

C)amortized over a maximum period of 11 years.

D)expensed in 2009.

A)amortized over a maximum period of 20 years.

B)amortized over a maximum period of 16 years.

C)amortized over a maximum period of 11 years.

D)expensed in 2009.

C

3

The intangible asset goodwill may be

A)capitalized only when purchased.

B)capitalized either when purchased or created internally.

C)capitalized only when created internally.

D)written off directly to retained earnings.

A)capitalized only when purchased.

B)capitalized either when purchased or created internally.

C)capitalized only when created internally.

D)written off directly to retained earnings.

A

4

Which of the following intangible assets should not be amortized?

A)Copyrights

B)Organization costs with limited life

C)Goodwill

D)All of these intangible assets should be amortized.

A)Copyrights

B)Organization costs with limited life

C)Goodwill

D)All of these intangible assets should be amortized.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

5

Purchased goodwill should be

A)written off as soon as possible against retained earnings.

B)written off as soon as possible as an extraordinary item.

C)written off by systematic charges as a regular operating expense over the period

D)not written off but rather reduced only if impairment occurs.

A)written off as soon as possible against retained earnings.

B)written off as soon as possible as an extraordinary item.

C)written off by systematic charges as a regular operating expense over the period

D)not written off but rather reduced only if impairment occurs.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following statements best describes the accounting for intangible assets after acquisition under Private Entity GAAP?

A)They may be accounted for under the cost model or the revaluation model.

B)They should be accounted for under the cost model.

C)They should be accounted for under the revaluation model.

D)None of these.

A)They may be accounted for under the cost model or the revaluation model.

B)They should be accounted for under the cost model.

C)They should be accounted for under the revaluation model.

D)None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

7

When determining whether an internally developed intangible asset should be recognized, the process of generating the intangible is usually broken down into the following parts:

A)The research and financing element.

B)The acquisition and disposal stages.

C)The exploitation and disposal stages.

D)The research and development phase.

A)The research and financing element.

B)The acquisition and disposal stages.

C)The exploitation and disposal stages.

D)The research and development phase.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is not a characteristic of intangible assets? Intangible assets must be

A)Individually identifiable

B)Non-monetary in nature

C)Non-physical in nature

D)Identifiable as part of the business as a whole

A)Individually identifiable

B)Non-monetary in nature

C)Non-physical in nature

D)Identifiable as part of the business as a whole

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements best describes when goodwill should be tested for impairment under IFRS?

A)Goodwill should be tested for impairment when events or changes in circumstance indicate that impairment may have occurred.

B)Goodwill should be tested annually for impairment regardless of the circumstances.

C)Goodwill should be tested for impairment annually and whenever events or changes in circumstance indicate that impairment may have occurred.

D)Goodwill should only be tested for impairment when the company follows a policy to amortize its goodwill.

A)Goodwill should be tested for impairment when events or changes in circumstance indicate that impairment may have occurred.

B)Goodwill should be tested annually for impairment regardless of the circumstances.

C)Goodwill should be tested for impairment annually and whenever events or changes in circumstance indicate that impairment may have occurred.

D)Goodwill should only be tested for impairment when the company follows a policy to amortize its goodwill.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following methods of amortization is normally used for intangible assets?

A)Capital cost allowance

B)Straight-line

C)Activity method

D)Double declining-balance

A)Capital cost allowance

B)Straight-line

C)Activity method

D)Double declining-balance

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

11

A franchise or licence with a limited life is

A)expensed.

B)not amortized.

C)amortized over the lesser of its legal or useful life.

D)amortized over its legal life.

A)expensed.

B)not amortized.

C)amortized over the lesser of its legal or useful life.

D)amortized over its legal life.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

12

Wriglee, Ltd.went to court this year and successfully defended the brand name of its product, "Sweet Gum," from infringement by a competitor.The cost of this defence should be charged to

A)patents and amortized over the legal life of the patent.

B)legal fees and amortized over five years or less.

C)expenses of the period.

D)trademarks and amortized over the same period of time as the "Sweet Gum"

A)patents and amortized over the legal life of the patent.

B)legal fees and amortized over five years or less.

C)expenses of the period.

D)trademarks and amortized over the same period of time as the "Sweet Gum"

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

13

Goodwill was purchased when a business was acquired.When an impairment to the goodwill is determined, the credit is usually made to

A)the Goodwill account.

B)an Accumulated Amortization account.

C)a Deferred Credit account.

D)a shareholders' equity account.

A)the Goodwill account.

B)an Accumulated Amortization account.

C)a Deferred Credit account.

D)a shareholders' equity account.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following statements best describes when previously recognized goodwill impairment may be reversed?

A)Reversals are permitted under both Private Entity GAAP and IFRS.

B)Reversals are permitted under Private Entity GAAP but are not allowed under IFRS

C)Reversals are not permitted under either standard.

D)None of these

A)Reversals are permitted under both Private Entity GAAP and IFRS.

B)Reversals are permitted under Private Entity GAAP but are not allowed under IFRS

C)Reversals are not permitted under either standard.

D)None of these

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is not an intangible asset?

A)Trade name

B)Long-term investment in bonds

C)Franchise

D)Organization costs

A)Trade name

B)Long-term investment in bonds

C)Franchise

D)Organization costs

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

16

If a trademark is developed by the enterprise itself, the costs should be

A)capitalized if future benefits are reasonably assured.

B)capitalized.

C)expensed.

D)expensed if future benefits are reasonably assured.

A)capitalized if future benefits are reasonably assured.

B)capitalized.

C)expensed.

D)expensed if future benefits are reasonably assured.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following statements best describes the accounting for intangible assets after acquisition under IFRS?

A)They may be accounted for under the cost model or the revaluation model.

B)They should be accounted for under the cost model.

C)They should be accounted for under the revaluation model if an active market exists

D)None of these

A)They may be accounted for under the cost model or the revaluation model.

B)They should be accounted for under the cost model.

C)They should be accounted for under the revaluation model if an active market exists

D)None of these

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following statements best describes when goodwill should be tested for impairment under Private Entity GAAP?

A)Goodwill should be tested for impairment when events or changes in circumstances indicate that impairment may have occurred.

B)Goodwill should be tested annually for impairment regardless of the circumstances.

C)Goodwill should be tested for impairment annually and whenever events or changes in circumstance indicate that impairment may have occurred.

D)Goodwill should only be tested for impairment when the company follows a policy to amortize its goodwill.

A)Goodwill should be tested for impairment when events or changes in circumstances indicate that impairment may have occurred.

B)Goodwill should be tested annually for impairment regardless of the circumstances.

C)Goodwill should be tested for impairment annually and whenever events or changes in circumstance indicate that impairment may have occurred.

D)Goodwill should only be tested for impairment when the company follows a policy to amortize its goodwill.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

19

A change in the amortization rate for an intangible asset should be accounted for as a

A)change in accounting principle.

B)change in reporting entity.

C)correction of an error.

D)change in accounting estimate.

A)change in accounting principle.

B)change in reporting entity.

C)correction of an error.

D)change in accounting estimate.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

20

Negative goodwill arises when

A)the book value of identifiable net assets acquired exceeds the purchase price.

B)the fair value of identifiable net assets acquired exceeds the purchase price.

C)the fair value of identifiable net assets acquired is less than the purchase price.

D)the fair value of identifiable net assets acquired exceeds the book value.

A)the book value of identifiable net assets acquired exceeds the purchase price.

B)the fair value of identifiable net assets acquired exceeds the purchase price.

C)the fair value of identifiable net assets acquired is less than the purchase price.

D)the fair value of identifiable net assets acquired exceeds the book value.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

21

In January, 2005, Targa Corporation purchased a patent for a new consumer product for $900,000.At the time of purchase, the patent was valid for fifteen years.Due to the competitive nature of the product, however, the patent was estimated to have a useful life

Of only ten years.During 2010 the product was permanently removed from the market

Under governmental order because of a potential health hazard present in the product.What amount should Targa recognize as an impairment during 2010, assuming amortization is recorded at the end of each year?

A)$600,000.

B)$450,000.

C)$90,000.

D)$60,000.

Of only ten years.During 2010 the product was permanently removed from the market

Under governmental order because of a potential health hazard present in the product.What amount should Targa recognize as an impairment during 2010, assuming amortization is recorded at the end of each year?

A)$600,000.

B)$450,000.

C)$90,000.

D)$60,000.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

22

The owners of Dallas' Electronics Store are contemplating selling the business to new interests.The cumulative earnings for the past 5 years amounted to $900,000 including extraordinary gains of $30,000.The annual earnings based on an average rate of return on investment for this industry would have been $138,000.If excess earnings are to be capitalized at 15%, then implied goodwill should be

A)$210,000.

B)$280,000.

C)$240,000.

D)$870,000.

A)$210,000.

B)$280,000.

C)$240,000.

D)$870,000.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

23

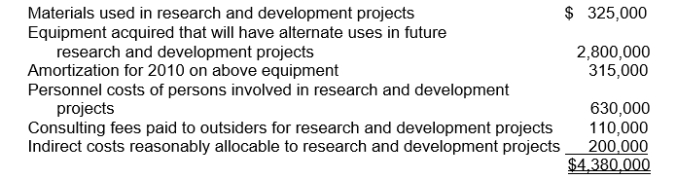

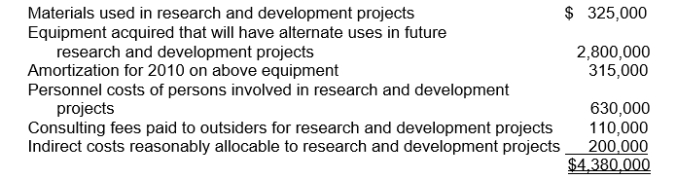

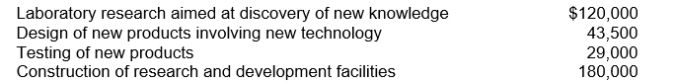

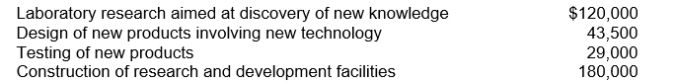

Huber Co.incurred research and development costs in 2010 as follows:  The amount of research and development costs charged to Huber's 2010 income statement or deferred as development costs should be

The amount of research and development costs charged to Huber's 2010 income statement or deferred as development costs should be

A)$3,750,000.

B)$1,580,000.

C)$950,000.

D)$3,435,000

The amount of research and development costs charged to Huber's 2010 income statement or deferred as development costs should be

The amount of research and development costs charged to Huber's 2010 income statement or deferred as development costs should beA)$3,750,000.

B)$1,580,000.

C)$950,000.

D)$3,435,000

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

24

If a company constructs a laboratory building to be used as a research and development facility, the cost of the laboratory building is matched against earnings as

A)research and development expense in the period(s) of construction.

B)amortization deducted as part of research and development costs.

C)amortization or immediate write-off, depending on company policy.

D)an expense at such time as productive research and development has been obtained from the facility.

A)research and development expense in the period(s) of construction.

B)amortization deducted as part of research and development costs.

C)amortization or immediate write-off, depending on company policy.

D)an expense at such time as productive research and development has been obtained from the facility.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is an appropriate method to determine when the development stage is over for an enterprise in the development stage?

A)b, c, and d

B)When significant revenue has been earned.

C)After a specific date.

D)When a specific level of sales has been reached.

A)b, c, and d

B)When significant revenue has been earned.

C)After a specific date.

D)When a specific level of sales has been reached.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

26

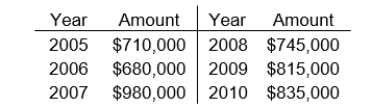

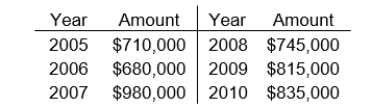

Use the following information for questions

Jeremiah Inc.is being targeted for acquisition by Argo Corporation.As an analyst for

Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction.

The available information relating to Jeremiah includes the following: Current net assets: $5.1 million.

Expected return on net asset for industry: 10%

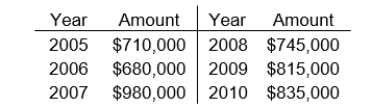

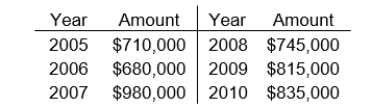

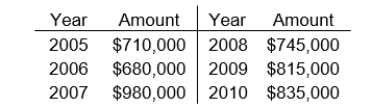

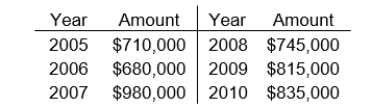

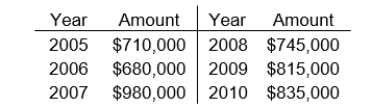

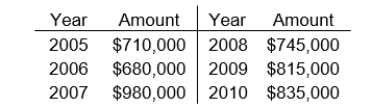

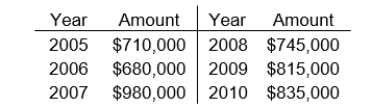

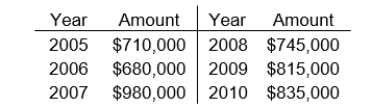

Reported net income for the previous six consecutive years:

The earnings for 2007 included a $200,000 gain from the sale of a discontinued part of its business.

During 2010, Kurz Company purchased the net assets of Sims Corporation for $635,000. On the date of the transaction, Sims had no long-term investments in marketable securities and had $200,000 of liabilities.The fair value of Sims' assets, when acquired were as follows: How should the $365,000 difference between the fair value of the net assets acquired ($1 million) and the cost ($635,000) be accounted for by Kurz?

How should the $365,000 difference between the fair value of the net assets acquired ($1 million) and the cost ($635,000) be accounted for by Kurz?

A)The $365,000 difference should be credited to retained earnings.

B)The noncurrent assets should be recorded at $475,000.

C)The current assets should be recorded at $250,500 and the noncurrent assets should be recorded at $584,500.

D)It is not possible to answer this question until the components of the assets are

Jeremiah Inc.is being targeted for acquisition by Argo Corporation.As an analyst for

Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction.

The available information relating to Jeremiah includes the following: Current net assets: $5.1 million.

Expected return on net asset for industry: 10%

Reported net income for the previous six consecutive years:

The earnings for 2007 included a $200,000 gain from the sale of a discontinued part of its business.

During 2010, Kurz Company purchased the net assets of Sims Corporation for $635,000. On the date of the transaction, Sims had no long-term investments in marketable securities and had $200,000 of liabilities.The fair value of Sims' assets, when acquired were as follows:

How should the $365,000 difference between the fair value of the net assets acquired ($1 million) and the cost ($635,000) be accounted for by Kurz?

How should the $365,000 difference between the fair value of the net assets acquired ($1 million) and the cost ($635,000) be accounted for by Kurz?A)The $365,000 difference should be credited to retained earnings.

B)The noncurrent assets should be recorded at $475,000.

C)The current assets should be recorded at $250,500 and the noncurrent assets should be recorded at $584,500.

D)It is not possible to answer this question until the components of the assets are

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

27

Use the following information for questions

Jeremiah Inc.is being targeted for acquisition by Argo Corporation.As an analyst for

Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction.

The available information relating to Jeremiah includes the following: Current net assets: $5.1 million.

Expected return on net asset for industry: 10%

Reported net income for the previous six consecutive years:

The earnings for 2007 included a $200,000 gain from the sale of a discontinued part of its business.

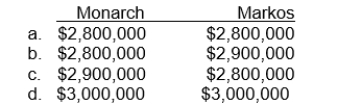

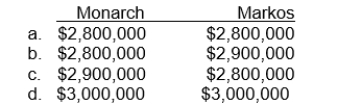

Monarch Football Company had a player contract with Sidka that was recorded in its accounting records at $2.9 million.Markos Football Company had a player contract with Leber that was recorded in its accounting records at $2.8 million.Monarch traded Sidka to Markos for Leber by exchanging each player's contract.The fair value of each contract was $3 million.What amount should be shown in the accounting records after the exchange of player contracts?

Jeremiah Inc.is being targeted for acquisition by Argo Corporation.As an analyst for

Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction.

The available information relating to Jeremiah includes the following: Current net assets: $5.1 million.

Expected return on net asset for industry: 10%

Reported net income for the previous six consecutive years:

The earnings for 2007 included a $200,000 gain from the sale of a discontinued part of its business.

Monarch Football Company had a player contract with Sidka that was recorded in its accounting records at $2.9 million.Markos Football Company had a player contract with Leber that was recorded in its accounting records at $2.8 million.Monarch traded Sidka to Markos for Leber by exchanging each player's contract.The fair value of each contract was $3 million.What amount should be shown in the accounting records after the exchange of player contracts?

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

28

Use the following information for questions

Jeremiah Inc.is being targeted for acquisition by Argo Corporation.As an analyst for

Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction.

The available information relating to Jeremiah includes the following: Current net assets: $5.1 million.

Expected return on net asset for industry: 10%

Reported net income for the previous six consecutive years:

The earnings for 2007 included a $200,000 gain from the sale of a discontinued part of its business.

Estimated goodwill by capitalizing average excess earnings at 14% is

A)$1,791,667

B)$760,833

C)$2,029,762

D)$1,654,331

Jeremiah Inc.is being targeted for acquisition by Argo Corporation.As an analyst for

Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction.

The available information relating to Jeremiah includes the following: Current net assets: $5.1 million.

Expected return on net asset for industry: 10%

Reported net income for the previous six consecutive years:

The earnings for 2007 included a $200,000 gain from the sale of a discontinued part of its business.

Estimated goodwill by capitalizing average excess earnings at 14% is

A)$1,791,667

B)$760,833

C)$2,029,762

D)$1,654,331

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

29

Under private-entity GAAP, to determine if there is an impairment loss:

A)Compare the fair value of the identifiable assets to the book value of the assets

B)Compare the fair value of the reporting unit against the carrying value of the reporting unit

C)Compare the imputed current fair value of goodwill with the carrying value of goodwill

D)Compare the imputed carrying value of the assets with the fair value of the assets

A)Compare the fair value of the identifiable assets to the book value of the assets

B)Compare the fair value of the reporting unit against the carrying value of the reporting unit

C)Compare the imputed current fair value of goodwill with the carrying value of goodwill

D)Compare the imputed carrying value of the assets with the fair value of the assets

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

30

Under IFRS, to determine if there is an impairment loss:

A)Compare the fair value of the identifiable assets to the book value of the assets

B)Compare the fair value of the reporting unit against the carrying value of the reporting unit

C)Compare the imputed current fair value of goodwill with the carrying value of goodwill

D)Compare the carrying amount of the CGU with the recoverable amount

A)Compare the fair value of the identifiable assets to the book value of the assets

B)Compare the fair value of the reporting unit against the carrying value of the reporting unit

C)Compare the imputed current fair value of goodwill with the carrying value of goodwill

D)Compare the carrying amount of the CGU with the recoverable amount

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

31

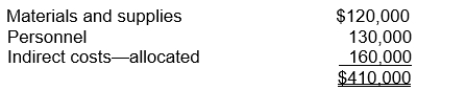

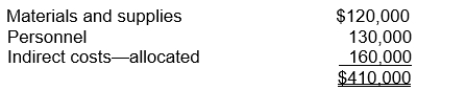

In 2010, Lawrence Corporation incurred development costs as follows:  These costs relate to a product that it expects to market in 2011.It is estimated that these costs will be recouped by December 31, 2013.What is the amount of development costs that could be deferred in 2010, assuming that required conditions for capitalization are met?

These costs relate to a product that it expects to market in 2011.It is estimated that these costs will be recouped by December 31, 2013.What is the amount of development costs that could be deferred in 2010, assuming that required conditions for capitalization are met?

A)$160,000.

B)$250,000.

C)$410,000.

D)$0.

These costs relate to a product that it expects to market in 2011.It is estimated that these costs will be recouped by December 31, 2013.What is the amount of development costs that could be deferred in 2010, assuming that required conditions for capitalization are met?

These costs relate to a product that it expects to market in 2011.It is estimated that these costs will be recouped by December 31, 2013.What is the amount of development costs that could be deferred in 2010, assuming that required conditions for capitalization are met?A)$160,000.

B)$250,000.

C)$410,000.

D)$0.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

32

If the fair value of the net asset acquired is greater than the purchase price the amount is:

A)negative goodwill

B)contributed surplus

C)purchased goodwill

D)organizational costs

A)negative goodwill

B)contributed surplus

C)purchased goodwill

D)organizational costs

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following statements best describes the accounting treatment for pre- opening costs for new businesses?

A)They should always be capitalized.

B)They should always be expensed.

C)Certain cost, such as mail order catalogues, may be capitalized under Private Entity

D)Certain cost, such as mail order catalogues, may be capitalized under IFRS.

A)They should always be capitalized.

B)They should always be expensed.

C)Certain cost, such as mail order catalogues, may be capitalized under Private Entity

D)Certain cost, such as mail order catalogues, may be capitalized under IFRS.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following research and development related costs should be capitalized and amortized over current and future periods?

A)Research and development general laboratory building which can be put to alternative uses in the future

B)Inventory used for a specific research project

C)Administrative salaries allocated to research and development

D)Research findings purchased from another company to aid a particular research project currently in process

A)Research and development general laboratory building which can be put to alternative uses in the future

B)Inventory used for a specific research project

C)Administrative salaries allocated to research and development

D)Research findings purchased from another company to aid a particular research project currently in process

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

35

Decker Inc.incurred the following costs during the year ended December 31, 2010:  The total amount to be classified as development costs in 2010 is

The total amount to be classified as development costs in 2010 is

A)$72,500.

B)$120,000.

C)$300,000

D)$163,500

The total amount to be classified as development costs in 2010 is

The total amount to be classified as development costs in 2010 isA)$72,500.

B)$120,000.

C)$300,000

D)$163,500

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following is not a method of calculating goodwill?

A)Capitalize excess earnings

B)Discount the excess earnings for a limited number of years

C)Capitalize total average earnings and subtract the fair value of net assets

D)All of these are methods of calculating goodwill.

A)Capitalize excess earnings

B)Discount the excess earnings for a limited number of years

C)Capitalize total average earnings and subtract the fair value of net assets

D)All of these are methods of calculating goodwill.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

37

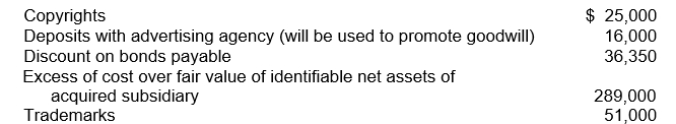

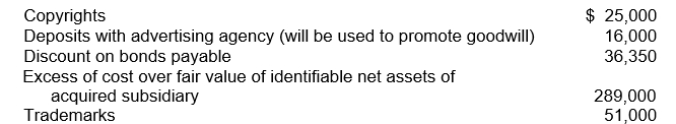

The general ledger of Babcock Corporation as of December 31, 2010, includes the following accounts:  In the preparation of Babcock's balance sheet as of December 31, 2010, what should be reported as total intangible assets, excluding goodwill?

In the preparation of Babcock's balance sheet as of December 31, 2010, what should be reported as total intangible assets, excluding goodwill?

A)$76,000.

B)$365,000.

C)$381,000.

D)$401,350.

In the preparation of Babcock's balance sheet as of December 31, 2010, what should be reported as total intangible assets, excluding goodwill?

In the preparation of Babcock's balance sheet as of December 31, 2010, what should be reported as total intangible assets, excluding goodwill?A)$76,000.

B)$365,000.

C)$381,000.

D)$401,350.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

38

The proper accounting for the costs incurred in creating computer software products that are to be sold, leased, or otherwise marketed to external parties, is to

A)capitalize all costs until the software is sold to external parties.

B)charge research and development expense when incurred until technological feasibility has been established for the product.

C)charge research and development expense only if the computer software has alternative future uses.

D)capitalize all costs as incurred until a detailed program design or working model is

A)capitalize all costs until the software is sold to external parties.

B)charge research and development expense when incurred until technological feasibility has been established for the product.

C)charge research and development expense only if the computer software has alternative future uses.

D)capitalize all costs as incurred until a detailed program design or working model is

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

39

Use the following information for questions

Jeremiah Inc.is being targeted for acquisition by Argo Corporation.As an analyst for

Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction.

The available information relating to Jeremiah includes the following: Current net assets: $5.1 million.

Expected return on net asset for industry: 10%

Reported net income for the previous six consecutive years:

The earnings for 2007 included a $200,000 gain from the sale of a discontinued part of its business.

Assuming that excess earnings are expected to continue for 8 years, and average excess earnings are discounted at 11%, estimated goodwill is (use interest table)

A)$1,784,331

B)$1,661,432

C)$1,462,356

D)$1,290,818

Jeremiah Inc.is being targeted for acquisition by Argo Corporation.As an analyst for

Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction.

The available information relating to Jeremiah includes the following: Current net assets: $5.1 million.

Expected return on net asset for industry: 10%

Reported net income for the previous six consecutive years:

The earnings for 2007 included a $200,000 gain from the sale of a discontinued part of its business.

Assuming that excess earnings are expected to continue for 8 years, and average excess earnings are discounted at 11%, estimated goodwill is (use interest table)

A)$1,784,331

B)$1,661,432

C)$1,462,356

D)$1,290,818

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

40

Use the following information for questions

Jeremiah Inc.is being targeted for acquisition by Argo Corporation.As an analyst for

Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction.

The available information relating to Jeremiah includes the following: Current net assets: $5.1 million.

Expected return on net asset for industry: 10%

Reported net income for the previous six consecutive years:

The earnings for 2007 included a $200,000 gain from the sale of a discontinued part of its business.

Assuming that excess earnings are expected to continue for 8 years, and ignoring the time value of money, estimated goodwill is

A)$2,273,000

B)$2,006,667

C)$1,854,333

D)$1,531,733

Jeremiah Inc.is being targeted for acquisition by Argo Corporation.As an analyst for

Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction.

The available information relating to Jeremiah includes the following: Current net assets: $5.1 million.

Expected return on net asset for industry: 10%

Reported net income for the previous six consecutive years:

The earnings for 2007 included a $200,000 gain from the sale of a discontinued part of its business.

Assuming that excess earnings are expected to continue for 8 years, and ignoring the time value of money, estimated goodwill is

A)$2,273,000

B)$2,006,667

C)$1,854,333

D)$1,531,733

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

41

On June 30, 2010, Rock, Ltd.exchanged 3,000 of Shale Corp.no par value common shares for a patent owned by Iller Co.The Shale shares were acquired in 2008 at a cost of $80,000.At the exchange date, Shale common shares have a fair value of $45 per share, and the patent had a net carrying value of $160,000 on Iller's books.Rock should record the patent at

A)$160,000.

B)$135,000.

C)$90,000.

D)$80,000.

A)$160,000.

B)$135,000.

C)$90,000.

D)$80,000.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

42

Use the following information for questions

Jessup Corp.will acquire a controlling stake in the outstanding shares of Parasol Inc.for

$9.2 million in cash.

Assuming the fair value of Parasol's net-assets is $10.2 million, and Jessup acquired a 75% share, goodwill can be calculated as

A)$1,243,000

B)$1,000,000

C)$1,550,000

D)$750,000

Jessup Corp.will acquire a controlling stake in the outstanding shares of Parasol Inc.for

$9.2 million in cash.

Assuming the fair value of Parasol's net-assets is $10.2 million, and Jessup acquired a 75% share, goodwill can be calculated as

A)$1,243,000

B)$1,000,000

C)$1,550,000

D)$750,000

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

43

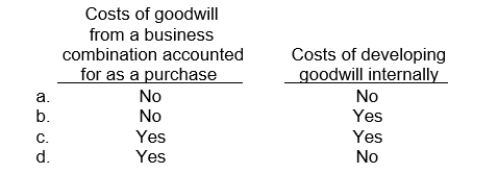

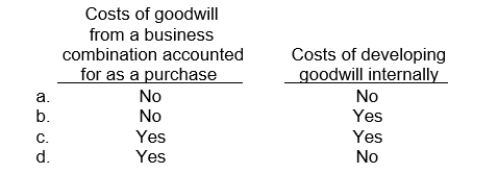

Which of the following costs of goodwill should be capitalized?

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

44

On January 2, 2007, Mortensen, Ltd.purchased a patent for a new consumer product for $90,000.At the time of purchase, the patent was valid for 15 years; however, the patent's useful life was estimated to be only 10 years due to the competitive nature of the product.

On December 31, 2010, the product was permanently withdrawn from sale under

Governmental order because of a potential health hazard in the product.What amount should Mortensen charge against income during 2010, assuming amortization is recorded

At the end of each year?

A)$72,000.

B)$63,000.

C)$54,000.

D)$9,000.

On December 31, 2010, the product was permanently withdrawn from sale under

Governmental order because of a potential health hazard in the product.What amount should Mortensen charge against income during 2010, assuming amortization is recorded

At the end of each year?

A)$72,000.

B)$63,000.

C)$54,000.

D)$9,000.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

45

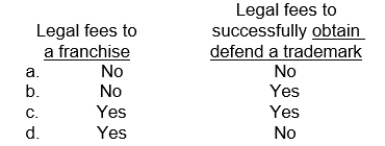

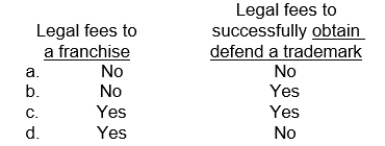

Which of the following legal fees should be capitalized?

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

46

Use the following information for questions

Jessup Corp.will acquire a controlling stake in the outstanding shares of Parasol Inc.for

$9.2 million in cash.

Beasley Corp.incurred $160,000 of basic research and $50,000 of development costs to develop a product for which a patent was granted on January 2, 2005.Legal fees and other costs associated with registration of the patent totalled $60,000.On March 31, 2010, Beasley paid $90,000 for legal fees in a successful defence of the patent.The total amount capitalized for the patent through March 31, 2010 should be

A)$360,000.

B)$270,000.

C)$200,000.

D)$150,000.

Jessup Corp.will acquire a controlling stake in the outstanding shares of Parasol Inc.for

$9.2 million in cash.

Beasley Corp.incurred $160,000 of basic research and $50,000 of development costs to develop a product for which a patent was granted on January 2, 2005.Legal fees and other costs associated with registration of the patent totalled $60,000.On March 31, 2010, Beasley paid $90,000 for legal fees in a successful defence of the patent.The total amount capitalized for the patent through March 31, 2010 should be

A)$360,000.

B)$270,000.

C)$200,000.

D)$150,000.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

47

On May 5, 2010, Mulder Corp.exchanged 5,000 of its common shares for a patent owned by Drucker Co.At May 5, 2010, Mulder's common shares were quoted at $28 per share, and the patent had a carrying value of $130,000 on Drucker's books.Mulder should record the patent at

A)$130,000.

B)$110,000.

C)$140,000.

D)$120,000.

A)$130,000.

B)$110,000.

C)$140,000.

D)$120,000.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

48

Use the following information for questions

Jessup Corp.will acquire a controlling stake in the outstanding shares of Parasol Inc.for

$9.2 million in cash.

Parasol's average annual net income is $75,000 above the average for Parasol's industry. Assuming Jessup estimates goodwill by capitalizing excess earnings at 14%, the estimate of goodwill is

A)nil

B)$1,050,000

C)$535,714

D)$954,333

Jessup Corp.will acquire a controlling stake in the outstanding shares of Parasol Inc.for

$9.2 million in cash.

Parasol's average annual net income is $75,000 above the average for Parasol's industry. Assuming Jessup estimates goodwill by capitalizing excess earnings at 14%, the estimate of goodwill is

A)nil

B)$1,050,000

C)$535,714

D)$954,333

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

49

Use the following information for questions

Jessup Corp.will acquire a controlling stake in the outstanding shares of Parasol Inc.for

$9.2 million in cash.

Mouse Software Company has capitalized computer software costs of $3.6 million related to its spreadsheet product.The software is expected to have a four-year economic life and generate future revenues of $25 million.Revenues generated by this software during 2010 (first year) amounted to $7.5 million.The proper amount of software costs amortized to be recognized by Mouse in 2010 should be

A)$900,000.

B)$3,600,000.

C)$2,812,000.

D)$1,080,000.

Jessup Corp.will acquire a controlling stake in the outstanding shares of Parasol Inc.for

$9.2 million in cash.

Mouse Software Company has capitalized computer software costs of $3.6 million related to its spreadsheet product.The software is expected to have a four-year economic life and generate future revenues of $25 million.Revenues generated by this software during 2010 (first year) amounted to $7.5 million.The proper amount of software costs amortized to be recognized by Mouse in 2010 should be

A)$900,000.

B)$3,600,000.

C)$2,812,000.

D)$1,080,000.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

50

On January 1, 2006, Robson Company purchased a trademark for $400,000, having an estimated useful life of 16 years.In January 2010, Robson paid $60,000 for legal fees in a successful defence of the trademark.Trademark amortization expense for the year ended December 31, 2010, should be

A)$30,000.

B)$28,750.

C)$25,000.

D)$0.

A)$30,000.

B)$28,750.

C)$25,000.

D)$0.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

51

Drip Co.bought a trademark from Gregg Corp.on January 1, 2010, for $163,000.An independent consultant retained by Drip estimated that the remaining useful life is 50 years.Its unamortized cost on Gregg's accounting records was $61,000.Drip decided to write off the trademark over the maximum period allowed.How much should be amortized for the year ended December 31, 2010?

A)$1,220.

B)$3,260.

C)$2,333.

D)$2,700.

A)$1,220.

B)$3,260.

C)$2,333.

D)$2,700.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

52

Use the following information for questions

Jessup Corp.will acquire a controlling stake in the outstanding shares of Parasol Inc.for

$9.2 million in cash.

Assuming the fair value of Parasol's net-assets is $12.5 million, and Jessup acquired a 75% share, goodwill can be calculated as

A)$175,000

B)$175,000 negative

C)$375,000

D)nil

Jessup Corp.will acquire a controlling stake in the outstanding shares of Parasol Inc.for

$9.2 million in cash.

Assuming the fair value of Parasol's net-assets is $12.5 million, and Jessup acquired a 75% share, goodwill can be calculated as

A)$175,000

B)$175,000 negative

C)$375,000

D)nil

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck