Deck 2: Conceptual Framework Underlying Financial Reporting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/54

Play

Full screen (f)

Deck 2: Conceptual Framework Underlying Financial Reporting

1

A soundly developed conceptual framework of concepts and objectives should

A)increase financial statement users' understanding of and confidence in financial reporting.

B)enhance comparability among companies' financial statements.

C)allow new and emerging practical problems to be more quickly solvable.

D)all of these.

A)increase financial statement users' understanding of and confidence in financial reporting.

B)enhance comparability among companies' financial statements.

C)allow new and emerging practical problems to be more quickly solvable.

D)all of these.

D

2

Which of the following is not an objective of financial reporting?

A)To provide information about an entity's economic resources, obligations and equity/net assets.

B)To provide information that is helpful to investors and creditors and other users in making resource allocation decisions and/or assessing management stewardship.

C)To provide information that is useful in assessing the economic performance of the entity.

D)All of these are objectives of financial reporting.

A)To provide information about an entity's economic resources, obligations and equity/net assets.

B)To provide information that is helpful to investors and creditors and other users in making resource allocation decisions and/or assessing management stewardship.

C)To provide information that is useful in assessing the economic performance of the entity.

D)All of these are objectives of financial reporting.

D

3

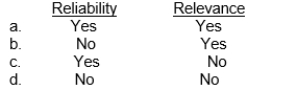

Representational faithfulness is an ingredient of the primary quality of

C

4

Generally accepted accounting principles

A)are fundamental truths or axioms that can be derived from laws of nature.

B)derive their authority from legal court proceedings.

C)derive their credibility and authority from general recognition and acceptance by the

D)have been specified in detail in the CICA conceptual framework.

A)are fundamental truths or axioms that can be derived from laws of nature.

B)derive their authority from legal court proceedings.

C)derive their credibility and authority from general recognition and acceptance by the

D)have been specified in detail in the CICA conceptual framework.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

5

Enhancing qualitative characteristics are an essential part of the conceptual framework of accounting.These include, among others, timeliness.Which of the items below would be most indicative of timeliness?

A)The preparation of quarterly financial statements

B)The preparation of annual financial statements

C)The large volume of data to be included.

D)The choice of the best accounting principle

A)The preparation of quarterly financial statements

B)The preparation of annual financial statements

C)The large volume of data to be included.

D)The choice of the best accounting principle

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following independent business transactions would most likely be recorded as an accounting loss?

A)A decrease in a retail store's sales

B)A decrease of a bank's interest income

C)A decrease in net assets from a company's incidental transactions.

D)All of the above

A)A decrease in a retail store's sales

B)A decrease of a bank's interest income

C)A decrease in net assets from a company's incidental transactions.

D)All of the above

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

7

The adoption of international GAAP can be seen as an application of which of the following quality enhancing characteristics:

A)Verifiability

B)Comparability

C)Understandability

D)Timeliness

A)Verifiability

B)Comparability

C)Understandability

D)Timeliness

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

8

During a major renovation project of its head office, a worker was seriously injured.While the company believes that it was not at fault, it does include the incident in the notes to its financial statements.This is consistent with which of the following principles:

A)Economic entity

B)Control

C)Full disclosure

D)Periodicity

A)Economic entity

B)Control

C)Full disclosure

D)Periodicity

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

9

Decision makers vary widely in the types of decisions they make, the methods of decision making they employ, the information they already possess or can obtain from other sources, and their ability to process information.Consequently, for information to be useful there must be a linkage between these users and the decisions they make.This link is

A)relevance.

B)reliability.

C)understandability.

D)materiality.

A)relevance.

B)reliability.

C)understandability.

D)materiality.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

10

MAX Auto Repair has implemented a policy that requires all expenditures below $10 to be expensed.This is an application of

A)The full disclosure principle

B)The matching principle

C)The materiality constraint

D)Representational faithfulness

A)The full disclosure principle

B)The matching principle

C)The materiality constraint

D)Representational faithfulness

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

11

A severe cold snap may affect this year's crop of Florida's citrus growers.The potentially adverse affect is disclosed in the financial statements of the citrus growers.This practice can be best described as an application of

A)The derecognition of financial statement elements

B)The full disclosure principle

C)The going concern assumption

D)The economic entity assumption

A)The derecognition of financial statement elements

B)The full disclosure principle

C)The going concern assumption

D)The economic entity assumption

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

12

To measure the fair value of an asset, an entity should determine

A)The asset's nature, condition and location

B)The asset's valuation premise

C)The availability of data

D)All of the above

A)The asset's nature, condition and location

B)The asset's valuation premise

C)The availability of data

D)All of the above

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following items below does not meet the definition of an asset?

A)A building owned and used by a company

B)Equipment that is owned and used by a company

C)Publicly available water used by a farm to water its crops

D)None of the above

A)A building owned and used by a company

B)Equipment that is owned and used by a company

C)Publicly available water used by a farm to water its crops

D)None of the above

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

14

Financial information does not demonstrate comparability when

A)firms in the same industry use different accounting methods to account for the same type of transaction.

B)a company changes its estimate of the residual value of a fixed asset.

C)a company fails to adjust its financial statements for changes in the value of the measuring unit.

D)none of these.

A)firms in the same industry use different accounting methods to account for the same type of transaction.

B)a company changes its estimate of the residual value of a fixed asset.

C)a company fails to adjust its financial statements for changes in the value of the measuring unit.

D)none of these.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

15

Financial information exhibits the characteristic of comparability when

A)expenses are reported as charges against revenue in the period in which they are paid.

B)accounting entities give accountable events the same accounting treatment from period to period.

C)extraordinary gains and losses are not included on the income statement.

D)accounting procedures are adopted which give a consistent rate of net income.

A)expenses are reported as charges against revenue in the period in which they are paid.

B)accounting entities give accountable events the same accounting treatment from period to period.

C)extraordinary gains and losses are not included on the income statement.

D)accounting procedures are adopted which give a consistent rate of net income.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

16

The overriding criterion by which accounting information can be judged is that of

A)usefulness for decision making.

B)freedom from bias.

C)timeliness.

D)comparability.

A)usefulness for decision making.

B)freedom from bias.

C)timeliness.

D)comparability.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

17

Accounting information is considered to be relevant when it

A)can be depended on to represent the economic conditions and events that it is intended to represent.

B)is capable of making a difference in a decision.

C)is understandable by reasonably informed users of accounting information.

D)is verifiable and neutral.

A)can be depended on to represent the economic conditions and events that it is intended to represent.

B)is capable of making a difference in a decision.

C)is understandable by reasonably informed users of accounting information.

D)is verifiable and neutral.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

18

Under the currently proposed definition of a liability, what is the most important aspect to consider when deciding whether the item should be recognized as a liability?

A)The item represents an economic obligation for which a present obligation exists

B)The item is shown on the balance sheet

C)The transaction underlying the obligation has occurred

D)The item is measurable

A)The item represents an economic obligation for which a present obligation exists

B)The item is shown on the balance sheet

C)The transaction underlying the obligation has occurred

D)The item is measurable

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

19

A local business man owns several different companies.His accountant prepares separate annual financial statements for each of these businesses.This is an application of which of the following principles:

A)Full disclosure

B)Periodicity

C)Economic entity

D)Matching

A)Full disclosure

B)Periodicity

C)Economic entity

D)Matching

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

20

A principles based approach to financial reporting standards generally does not exhibit ` the following:

A)Specific rules

B)Flexibility

C)General guidance

D)Room for a large degree of professional judgement

A)Specific rules

B)Flexibility

C)General guidance

D)Room for a large degree of professional judgement

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

21

What accounting concept justifies the usage of accruals and deferrals?

A)Going concern assumption

B)Materiality constraint

C)Consistency characteristic

D)Monetary unit assumption

A)Going concern assumption

B)Materiality constraint

C)Consistency characteristic

D)Monetary unit assumption

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

22

During the lifetime of an entity, accountants produce financial statements at arbitrary points in time in accordance with which basic accounting concept?

A)Cost/benefit relationship

B)Periodicity assumption

C)Conservatism constraint

D)Matching principle

A)Cost/benefit relationship

B)Periodicity assumption

C)Conservatism constraint

D)Matching principle

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

23

Proponents of historical cost ordinarily maintain that in comparison with all other valuation alternatives for general purpose financial reporting, statements prepared using historical costs are more:

A)reliable.

B)relevant.

C)indicative of the entity's purchasing power.

D)conservative.

A)reliable.

B)relevant.

C)indicative of the entity's purchasing power.

D)conservative.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

24

The elements of financial statements include investments by owners.These are increases in an entity's net assets resulting from owners'

A)transfers of assets to the entity.

B)rendering services to the entity.

C)satisfaction of liabilities of the entity.

D)all of these.

A)transfers of assets to the entity.

B)rendering services to the entity.

C)satisfaction of liabilities of the entity.

D)all of these.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

25

The assumption that a business enterprise will not be sold or liquidated in the near future is known as the

A)economic entity assumption.

B)monetary unit assumption.

C)conservatism assumption.

D)none of these.

A)economic entity assumption.

B)monetary unit assumption.

C)conservatism assumption.

D)none of these.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

26

Generally, revenue from sales should be recognized at a point when

A)management decides it is appropriate to do so.

B)the product is available for sale to the ultimate consumer.

C)the entire amount receivable has been collected from the customer and there remains no further warranty liability.

D)none of these.

A)management decides it is appropriate to do so.

B)the product is available for sale to the ultimate consumer.

C)the entire amount receivable has been collected from the customer and there remains no further warranty liability.

D)none of these.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

27

One of the principles of the conceptual framework is the matching principle.Which of the following is not a good example of that principle?

A)A machine that produces certain goods is amortized over its useful life.The resulting amortization expense is matched with the proceeds from the sale of those goods.

B)The entire two-year insurance premium is expensed in the first year.

C)The write-off an uncollectible receivable in the year that the sale was made.

D)The recognition of revenue for which associated expenses can not yet be determined is delayed until such determination can be made.

A)A machine that produces certain goods is amortized over its useful life.The resulting amortization expense is matched with the proceeds from the sale of those goods.

B)The entire two-year insurance premium is expensed in the first year.

C)The write-off an uncollectible receivable in the year that the sale was made.

D)The recognition of revenue for which associated expenses can not yet be determined is delayed until such determination can be made.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

28

Under the currently proposed definition of an asset, what is the most important aspect to consider when deciding whether the item should be recognized as an asset?

A)The item represents a present economic resource to which the entity has a right

B)The item is shown on the balance sheet

C)The transaction underlying the resource has occurred

D)The item is measurable

A)The item represents a present economic resource to which the entity has a right

B)The item is shown on the balance sheet

C)The transaction underlying the resource has occurred

D)The item is measurable

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

29

Principles-based GAAP is sometimes criticized for being

A)Too inflexible.

B)Too flexible

C)Too inconsistent

D)None of these

A)Too inflexible.

B)Too flexible

C)Too inconsistent

D)None of these

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is not a time when revenue may be recognized?

A)At time of sale

B)At receipt of cash

C)During production

D)All of these are possible times of revenue recognition.

A)At time of sale

B)At receipt of cash

C)During production

D)All of these are possible times of revenue recognition.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is an implication of the going concern assumption?

A)The historical cost principle is credible.

B)Amortization and amortization policies are justifiable and appropriate.

C)The current-noncurrent classification of assets and liabilities is justifiable and significant.

D)All of these.

A)The historical cost principle is credible.

B)Amortization and amortization policies are justifiable and appropriate.

C)The current-noncurrent classification of assets and liabilities is justifiable and significant.

D)All of these.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

32

Preparation of consolidated financial statements when a parent-subsidiary relationship exists is an example of the

A)economic entity assumption.

B)relevance characteristic.

C)comparability characteristic.

D)neutrality characteristic.

A)economic entity assumption.

B)relevance characteristic.

C)comparability characteristic.

D)neutrality characteristic.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

33

Revenue is generally recognized when performance is achieved and it is measurable and collectible.This statement describes the

A)consistency characteristic.

B)matching principle.

C)revenue recognition principle.

D)relevance characteristic.

A)consistency characteristic.

B)matching principle.

C)revenue recognition principle.

D)relevance characteristic.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

34

In classifying the elements of financial statements, the primary distinction between revenues and gains is

A)the materiality of the amounts involved.

B)the likelihood that the transactions involved will recur in the future.

C)the nature of the activities that gave rise to the transactions involved.

D)the costs versus the benefits of the alternative methods of disclosing the transactions involved.

A)the materiality of the amounts involved.

B)the likelihood that the transactions involved will recur in the future.

C)the nature of the activities that gave rise to the transactions involved.

D)the costs versus the benefits of the alternative methods of disclosing the transactions involved.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

35

The current mixed valuation model primarily ties the basis of valuation to

A)the level of uncertainty.

B)measurement reliability.

C)the age of the asset.

D)management intent with respect to the asset.

A)the level of uncertainty.

B)measurement reliability.

C)the age of the asset.

D)management intent with respect to the asset.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

36

The economic entity assumption

A)is inapplicable to unincorporated businesses.

B)recognizes the legal aspects of business organizations.

C)requires periodic income measurement.

D)is applicable to all forms of business organizations.

A)is inapplicable to unincorporated businesses.

B)recognizes the legal aspects of business organizations.

C)requires periodic income measurement.

D)is applicable to all forms of business organizations.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

37

A decrease in net assets arising from peripheral or incidental transactions is called a(n)

A)capital expenditure.

B)cost.

C)loss.

D)expense.

A)capital expenditure.

B)cost.

C)loss.

D)expense.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following elements of financial statements is not a component of comprehensive income?

A)Revenues

B)Distributions to owners

C)Losses

D)Expenses

A)Revenues

B)Distributions to owners

C)Losses

D)Expenses

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

39

Revenue generally should be recognized

A)at the end of production.

B)at the time of cash collection.

C)when performance is achieved.

D)when performance is achieved and the amount earned is measurable and collectible.

A)at the end of production.

B)at the time of cash collection.

C)when performance is achieved.

D)when performance is achieved and the amount earned is measurable and collectible.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

40

Valuing assets at their liquidation values rather than their cost is inconsistent with the

A)periodicity assumption.

B)matching principle.

C)materiality constraint.

D)historical cost principle.

A)periodicity assumption.

B)matching principle.

C)materiality constraint.

D)historical cost principle.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following best describes the importance of qualitative characteristics as part of the conceptual framework of financial reporting?

A)Relevance and representational faithfulness must always be present.

B)Representational faithfulness may be traded off.

C)Timeliness is a fundamental qualitative characteristic.

D)All of these

A)Relevance and representational faithfulness must always be present.

B)Representational faithfulness may be traded off.

C)Timeliness is a fundamental qualitative characteristic.

D)All of these

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

42

You want to improve the qualitative characteristics of your firm's financial statements. Which of the following options would most likely improve the timeliness of your company's financial statements?

A)To increase the frequency of issue from annually to quarterly

B)To increase the number of disclosures

C)To increase the amortization period for capital assets from 5 to years.

D)To change the timing of when revenues are recognized

A)To increase the frequency of issue from annually to quarterly

B)To increase the number of disclosures

C)To increase the amortization period for capital assets from 5 to years.

D)To change the timing of when revenues are recognized

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following serves as the justification for the periodic recording of amortization expense?

A)Association of efforts (expense) with accomplishments (revenue)

B)Systematic and rational allocation of cost over the periods benefited

C)Immediate recognition of an expense

D)Minimization of income tax liability

A)Association of efforts (expense) with accomplishments (revenue)

B)Systematic and rational allocation of cost over the periods benefited

C)Immediate recognition of an expense

D)Minimization of income tax liability

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

44

Fraudulent financial reporting is a business reality.While it cannot be eliminated, the risk of fraudulent reporting can be decreased.Which of the following considerations is least likely to lessen that risk?

A)An independent audit committee

B)An internal audit function

C)An increased focus on tying bonuses to short-term company performance

D)Vigilant management

A)An independent audit committee

B)An internal audit function

C)An increased focus on tying bonuses to short-term company performance

D)Vigilant management

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

45

Where there is a significant uncertainty with respect to the measurement of an item

A)do not record anything in the financial statements.

B)recognize the item in the financial statements and disclose the measurement uncertainty in the notes to the financial statements.

C)do not record anything in the financial statements and disclose the measurement

D)record the maximum amount in the financial statements.

A)do not record anything in the financial statements.

B)recognize the item in the financial statements and disclose the measurement uncertainty in the notes to the financial statements.

C)do not record anything in the financial statements and disclose the measurement

D)record the maximum amount in the financial statements.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following statements about materiality is not correct?

A)An item must make a difference or it need not be disclosed.

B)Materiality is a matter of relative size or importance.

C)An item is material if its inclusion or omission would influence or change the judgement of a reasonable person.

D)All of these are correct statements about materiality.

A)An item must make a difference or it need not be disclosed.

B)Materiality is a matter of relative size or importance.

C)An item is material if its inclusion or omission would influence or change the judgement of a reasonable person.

D)All of these are correct statements about materiality.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

47

Charging off the cost of a wastebasket with an estimated useful life of 10 years as an expense of the period when purchased is an example of the application of the

A)consistency characteristic.

B)matching principle.

C)materiality constraint.

D)historical cost principle.

A)consistency characteristic.

B)matching principle.

C)materiality constraint.

D)historical cost principle.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

48

The accounting principle of matching is best demonstrated by

A)not recognizing any expense unless some revenue is realized.

B)associating effort (expense) with accomplishment (revenue).

C)recognizing prepaid rent received as revenue.

D)establishing an Appropriation for Contingencies account.

A)not recognizing any expense unless some revenue is realized.

B)associating effort (expense) with accomplishment (revenue).

C)recognizing prepaid rent received as revenue.

D)establishing an Appropriation for Contingencies account.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

49

Schmidt Ltd.aims to improve the qualitative characteristics of its financial statements. Your assistant has presented you with options shown below.Which of those options would most likely improve the comparability of your company's financial statements?

A)The restatement of its financial statements from Canadian GAAP to US GAAP for its American investors

B)The preparation of monthly financial statements

C)The introduction of a policy that specifies how Schmidt's capital assets should be amortized

D)The use of foreign-trained accountants

A)The restatement of its financial statements from Canadian GAAP to US GAAP for its American investors

B)The preparation of monthly financial statements

C)The introduction of a policy that specifies how Schmidt's capital assets should be amortized

D)The use of foreign-trained accountants

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

50

The operations of a resource company's oil sands operations results in environmental damage.While the extent of the damage can not yet be determined, the situation is disclosed in its financial statements.This best demonstrates

A)The application of professional judgement

B)The full disclosure principle

C)Representational faithfulness

D)Good management stewardship

A)The application of professional judgement

B)The full disclosure principle

C)Representational faithfulness

D)Good management stewardship

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

51

Application of the full disclosure principle

A)is theoretically desirable but not practical because the costs of complete disclosure exceed the benefits.

B)is violated when important financial information is buried in the notes to the financial statements.

C)is demonstrated by the inclusion of information such as information about contingencies.

D)requires that the financial statements be consistent and comparable.

A)is theoretically desirable but not practical because the costs of complete disclosure exceed the benefits.

B)is violated when important financial information is buried in the notes to the financial statements.

C)is demonstrated by the inclusion of information such as information about contingencies.

D)requires that the financial statements be consistent and comparable.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

52

Management Discussion and Analysis (MD&A) is

A)notes on meetings between management and auditors.

B)internal documents not released to shareholders.

C)supplementary information included in the annual report.

D)supplementary information included in the notes to the financial statements.

A)notes on meetings between management and auditors.

B)internal documents not released to shareholders.

C)supplementary information included in the annual report.

D)supplementary information included in the notes to the financial statements.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

53

The allowance for doubtful accounts, which appears as a deduction from accounts receivable on a balance sheet and which is based on an estimate of bad debts, is an application of the

A)consistency characteristic.

B)matching principle.

C)materiality constraint.

D)revenue recognition principle.

A)consistency characteristic.

B)matching principle.

C)materiality constraint.

D)revenue recognition principle.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

54

Information that is representationally faithful is

A)Complete

B)Neutral

C)Free from material error or bias

D)All of these

A)Complete

B)Neutral

C)Free from material error or bias

D)All of these

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck