Deck 10: Property, Plant, and Equipment: Accounting Model Basics

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

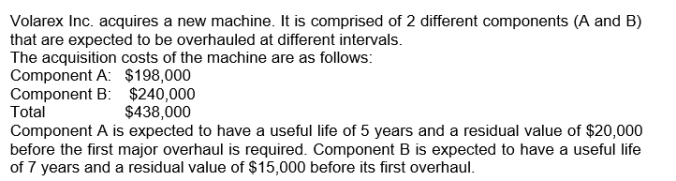

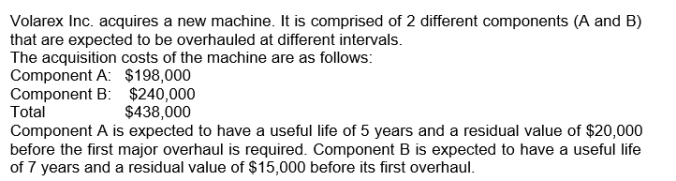

Question

Question

Question

Question

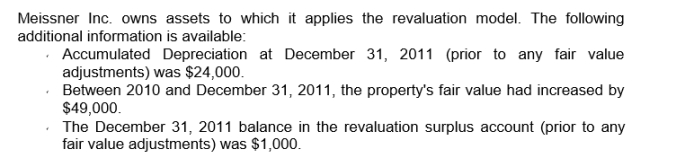

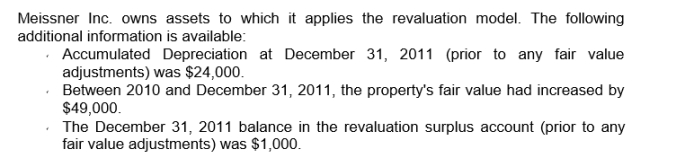

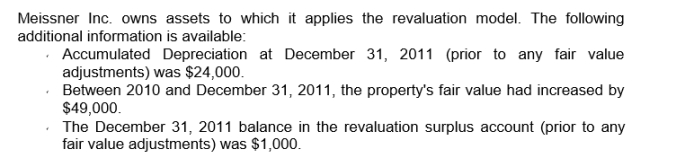

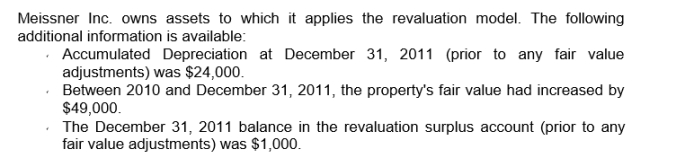

Question

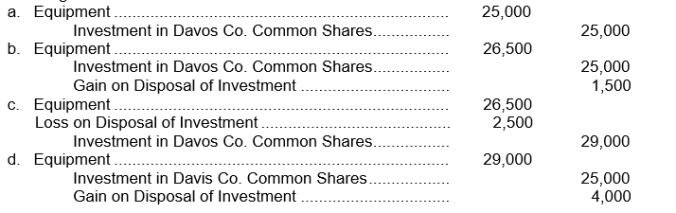

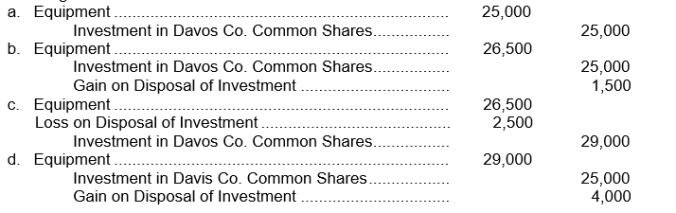

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/63

Play

Full screen (f)

Deck 10: Property, Plant, and Equipment: Accounting Model Basics

1

Land is generally included in property, plant and equipment except when

A)It is not yet ready for use

B)It is held for resale by land developers

C)It includes a building that must be demolished

D)All of the above

A)It is not yet ready for use

B)It is held for resale by land developers

C)It includes a building that must be demolished

D)All of the above

B

2

When a plant asset is acquired by the issuance of a public company's common shares, the cost of the plant asset is properly measured by the

A)no par value of the shares.

B)stated value of the shares.

C)book value of the shares.

D)market value of the shares.

A)no par value of the shares.

B)stated value of the shares.

C)book value of the shares.

D)market value of the shares.

D

3

The debit for a sales tax properly levied and paid on the purchase of machinery preferably would be a charge to

A)the machinery account.

B)a separate deferred charge account.

C)miscellaneous tax expense (which includes all taxes other than those on income).

D)Accumulated Depreciation-Machinery.

A)the machinery account.

B)a separate deferred charge account.

C)miscellaneous tax expense (which includes all taxes other than those on income).

D)Accumulated Depreciation-Machinery.

A

4

The revaluation model of accounting for PP&E assets

A)May be applied to all classes of PP&E including investment property.

B)Uses a revaluation surplus account to hold net increases in the asset's fair value.

C)Should not be applied to investment property.

D)(b) and (c) only

A)May be applied to all classes of PP&E including investment property.

B)Uses a revaluation surplus account to hold net increases in the asset's fair value.

C)Should not be applied to investment property.

D)(b) and (c) only

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

5

Costa Company purchased a large area of land with the intention to transform it into a banana plantation.Before the new seedlings can be planted, the site, which is prone to flooding, must be drained.The cost of the draining should be

A)Capitalized as part of the cost of the land.

B)Expensed only after the first crop of bananas has been harvested.

C)Expensed immediately

D)Reported as loss from discontinued operations

A)Capitalized as part of the cost of the land.

B)Expensed only after the first crop of bananas has been harvested.

C)Expensed immediately

D)Reported as loss from discontinued operations

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

6

Property, plant, and equipment assets purchased on long-term credit contracts should be accounted for at

A)the total value of the future payments.

B)the future amount of the future payments.

C)the present value of the future payments.

D)none of these.

A)the total value of the future payments.

B)the future amount of the future payments.

C)the present value of the future payments.

D)none of these.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

7

If a corporation purchases a lot and building and subsequently tears down the building and uses the property as a parking lot, the proper accounting treatment of the cost of the building would depend on

A)the significance of the cost allocated to the building in relation to the combined cost of the lot and building.

B)the length of time for which the building was held prior to its demolition.

C)the contemplated future use of the parking lot.

D)the intention of management for the property when the building was acquired.

A)the significance of the cost allocated to the building in relation to the combined cost of the lot and building.

B)the length of time for which the building was held prior to its demolition.

C)the contemplated future use of the parking lot.

D)the intention of management for the property when the building was acquired.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

8

The costs of land improvements with limited lives are

A)Added to the land account

B)Recorded in a separate account

C)Amortized over their useful lives.

D)(b) and (c) only

A)Added to the land account

B)Recorded in a separate account

C)Amortized over their useful lives.

D)(b) and (c) only

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

9

Construction of a qualifying asset is started on April 1 and finished on December 1.The fraction used to multiply an expenditure made on April 1 to find weighted-average accumulated expenditures is

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

10

Borrowing costs incurred for the acquisition of assets may be capitalized if certain conditions are met.Which of the following issues is irrelevant in making that determination?

A)The capitalization period

B)The avoidable borrowing costs

C)Whether the asset is are already being used

D)The depreciation period

A)The capitalization period

B)The avoidable borrowing costs

C)Whether the asset is are already being used

D)The depreciation period

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

11

Small tools and containers used repeatedly for more than a year are classified on the balance sheet as

A)current assets.

B)fixed assets.

C)deferred charges.

D)investments.

A)current assets.

B)fixed assets.

C)deferred charges.

D)investments.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

12

Under Private Entity GAAP, the cost for environmental clean-up costs at the end of an asset's useful life are

A)Expensed as incurred

B)Recognized only if they represent a legal obligation.

C)Are capitalized once they have become apparent.

D)None of the above

A)Expensed as incurred

B)Recognized only if they represent a legal obligation.

C)Are capitalized once they have become apparent.

D)None of the above

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

13

The fair value model of accounting for PP&E assets

A)Should be applied to investment property only.

B)Recognizes changes in the asset's fair value in other comprehensive income.

C)Once chosen for one investment property does not have to be applied to all investment property.

D)(a) and (c) only

A)Should be applied to investment property only.

B)Recognizes changes in the asset's fair value in other comprehensive income.

C)Once chosen for one investment property does not have to be applied to all investment property.

D)(a) and (c) only

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

14

Borrowing cost that are capitalized should

A)be written off over the remaining term of the debt.

B)be accumulated in a separate deferred charge account and written off equally over a 40-year period.

C)not be written off until the related asset is fully amortized or disposed of.

D)none of these.

A)be written off over the remaining term of the debt.

B)be accumulated in a separate deferred charge account and written off equally over a 40-year period.

C)not be written off until the related asset is fully amortized or disposed of.

D)none of these.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

15

Property, plant, and equipment assets may properly include

A)deposits on machinery not yet received.

B)idle equipment awaiting sale.

C)land held for possible use as a future plant site.

D)none of these.

A)deposits on machinery not yet received.

B)idle equipment awaiting sale.

C)land held for possible use as a future plant site.

D)none of these.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is not a major characteristic of a property, plant, and equipment asset?

A)Possesses physical substance

B)Acquired for resale

C)Acquired for use

D)Yields services over a number of years

A)Possesses physical substance

B)Acquired for resale

C)Acquired for use

D)Yields services over a number of years

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

17

Which of these is not a major characteristic of a property, plant, and equipment asset?

A)Possesses physical substance

B)Acquired for use in operations

C)Yields services over a number of years

D)All of these are major characteristics of a property, plant, and equipment asset.

A)Possesses physical substance

B)Acquired for use in operations

C)Yields services over a number of years

D)All of these are major characteristics of a property, plant, and equipment asset.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

18

The cost model of accounting for PP&E assets

A)Should be applied to investment property only

B)Should be applied to other PP&E assets only

C)Can be applied to all classes of PP&E including investment property.

D)Is not appropriate under current Canadian GAAP

A)Should be applied to investment property only

B)Should be applied to other PP&E assets only

C)Can be applied to all classes of PP&E including investment property.

D)Is not appropriate under current Canadian GAAP

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

19

Kirk Co.exchanged merchandise that cost $19,000 and normally sold for $27,000 for a new delivery truck with a list price of $31,000.The delivery truck should be recorded on Kirk's books at

A)$19,000

B)$27,000

C)$31,000

D)$12,000

A)$19,000

B)$27,000

C)$31,000

D)$12,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

20

The capitalization of borrowing costs for the purchase of assets

A)Can have a significant impact on a company's earnings

B)Must be disclosed in the notes to the financial statements

C)Is allowed under both private entities GAAP and international GAAP.

D)All of the above

A)Can have a significant impact on a company's earnings

B)Must be disclosed in the notes to the financial statements

C)Is allowed under both private entities GAAP and international GAAP.

D)All of the above

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

21

When an enterprise is the recipient of a donated asset, the account credited may be a

A)paid-in capital account.

B)revenue account.

C)deferred revenue account.

D)all of these.

A)paid-in capital account.

B)revenue account.

C)deferred revenue account.

D)all of these.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

22

Use the following information for questions

On March 1, 2010, Beck Company purchased land for an office site by paying $270,000 cash.Beck began construction on the office building on March 1.The following expenditures were incurred for construction:

The office was completed and ready for occupancy on July 1.To help pay for construction,

$360,000 was borrowed on March 1, 2010 on a nine percent, three-year note payable.Other than the construction note, the only debt outstanding during 2010 was a $150,000, 10%, six-year note

payable dated January 1, 2010.

Assume the weighted-average accumulated expenditures for the construction project are $435,000.The amount of interest cost to be capitalized during 2010 is

A)$39,150.

B)$41,400.

C)$39,900.

D)$50,400.

On March 1, 2010, Beck Company purchased land for an office site by paying $270,000 cash.Beck began construction on the office building on March 1.The following expenditures were incurred for construction:

The office was completed and ready for occupancy on July 1.To help pay for construction,

$360,000 was borrowed on March 1, 2010 on a nine percent, three-year note payable.Other than the construction note, the only debt outstanding during 2010 was a $150,000, 10%, six-year note

payable dated January 1, 2010.

Assume the weighted-average accumulated expenditures for the construction project are $435,000.The amount of interest cost to be capitalized during 2010 is

A)$39,150.

B)$41,400.

C)$39,900.

D)$50,400.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

23

On May 1, 2010, Lloyd Company began construction of a building.Expenditures of $75,000 were incurred monthly for five months beginning on May 1.The building was completed and ready for occupancy on September 1, 2010.For the purpose of

Determining the amount of interest cost to be capitalized, the average accumulated

Expenditures on the building during 2010 were

A)$60,000

B)$62,500

C)$75,000

D)$290,000

Determining the amount of interest cost to be capitalized, the average accumulated

Expenditures on the building during 2010 were

A)$60,000

B)$62,500

C)$75,000

D)$290,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

24

Use the following information for questions

On March 1, 2010, Beck Company purchased land for an office site by paying $270,000 cash.Beck began construction on the office building on March 1.The following expenditures were incurred for construction:

The office was completed and ready for occupancy on July 1.To help pay for construction,

$360,000 was borrowed on March 1, 2010 on a nine percent, three-year note payable.Other than the construction note, the only debt outstanding during 2010 was a $150,000, 10%, six-year note

payable dated January 1, 2010.

The weighted-average accumulated expenditures on the construction project during 2010 were

A)$258,000.

B)$1,467,000.

C)$156,000.

D)$348,000.

On March 1, 2010, Beck Company purchased land for an office site by paying $270,000 cash.Beck began construction on the office building on March 1.The following expenditures were incurred for construction:

The office was completed and ready for occupancy on July 1.To help pay for construction,

$360,000 was borrowed on March 1, 2010 on a nine percent, three-year note payable.Other than the construction note, the only debt outstanding during 2010 was a $150,000, 10%, six-year note

payable dated January 1, 2010.

The weighted-average accumulated expenditures on the construction project during 2010 were

A)$258,000.

B)$1,467,000.

C)$156,000.

D)$348,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

25

Use the following information for questions

On March 1, 2010, Beck Company purchased land for an office site by paying $270,000 cash.Beck began construction on the office building on March 1.The following expenditures were incurred for construction:

The office was completed and ready for occupancy on July 1.To help pay for construction,

$360,000 was borrowed on March 1, 2010 on a nine percent, three-year note payable.Other than the construction note, the only debt outstanding during 2010 was a $150,000, 10%, six-year note

payable dated January 1, 2010.

A company owns assets that qualify as investment property and applies the fair value model for all such property.Assuming the assets are expected to be used for 10 years and have a year-1 book value of $100,000, depreciation expense for that year is:

A)$10,000

B)nil

C)$15,000

D)$9,000

On March 1, 2010, Beck Company purchased land for an office site by paying $270,000 cash.Beck began construction on the office building on March 1.The following expenditures were incurred for construction:

The office was completed and ready for occupancy on July 1.To help pay for construction,

$360,000 was borrowed on March 1, 2010 on a nine percent, three-year note payable.Other than the construction note, the only debt outstanding during 2010 was a $150,000, 10%, six-year note

payable dated January 1, 2010.

A company owns assets that qualify as investment property and applies the fair value model for all such property.Assuming the assets are expected to be used for 10 years and have a year-1 book value of $100,000, depreciation expense for that year is:

A)$10,000

B)nil

C)$15,000

D)$9,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

26

On March 1, Mega Co.began construction of a small building.Payments of $50,000 were made monthly for four months beginning March 1.The building was completed and ready for occupancy on June 1.In determining the amount of interest cost to be capitalized, the weighted-average accumulated expenditures are

A)$50,000

B)$25,000

C)$150,000

D)$140,000

A)$50,000

B)$25,000

C)$150,000

D)$140,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

27

When a closely held corporation issues preferred shares for land, the land should be recorded at the

A)total no par value of the shares issued.

B)total book value of the shares issued.

C)total liquidating value of the shares issued.

D)fair market value of the land.

A)total no par value of the shares issued.

B)total book value of the shares issued.

C)total liquidating value of the shares issued.

D)fair market value of the land.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

28

For a nonmonetary exchange of plant assets, accounting recognition should not be given to

A)a loss when the assets exchanged are similar.

B)a gain when the assets exchanged are dissimilar.

C)part of a gain when the assets exchanged are similar and cash is paid.

D)part of a gain when the assets exchanged are similar and cash is received.

A)a loss when the assets exchanged are similar.

B)a gain when the assets exchanged are dissimilar.

C)part of a gain when the assets exchanged are similar and cash is paid.

D)part of a gain when the assets exchanged are similar and cash is received.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

29

Use the following information for questions

On March 1, 2010, Beck Company purchased land for an office site by paying $270,000 cash.Beck began construction on the office building on March 1.The following expenditures were incurred for construction:

The office was completed and ready for occupancy on July 1.To help pay for construction,

$360,000 was borrowed on March 1, 2010 on a nine percent, three-year note payable.Other than the construction note, the only debt outstanding during 2010 was a $150,000, 10%, six-year note

payable dated January 1, 2010.

Jakob Corporation uses the fair value model of accounting for its investment property.The fair values of its property were $124,000 and $129,000 at December 2011 and and December 2012 respectively.At December 2012 Jakob should

A)Recognize a gain of $5,000 in income

B)Report a gain of $5,000 in other comprehensive income

C)Defer the gain until realized

D)none of the above

On March 1, 2010, Beck Company purchased land for an office site by paying $270,000 cash.Beck began construction on the office building on March 1.The following expenditures were incurred for construction:

The office was completed and ready for occupancy on July 1.To help pay for construction,

$360,000 was borrowed on March 1, 2010 on a nine percent, three-year note payable.Other than the construction note, the only debt outstanding during 2010 was a $150,000, 10%, six-year note

payable dated January 1, 2010.

Jakob Corporation uses the fair value model of accounting for its investment property.The fair values of its property were $124,000 and $129,000 at December 2011 and and December 2012 respectively.At December 2012 Jakob should

A)Recognize a gain of $5,000 in income

B)Report a gain of $5,000 in other comprehensive income

C)Defer the gain until realized

D)none of the above

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

30

During 2010, Weber Co.incurred average accumulated expenditures of $500,000 during construction of assets that qualified for capitalization of interest.The only debt outstanding during 2010 was a $600,000, 8%, five-year note payable dated January 1, 2008.What is the amount of interest that should be capitalized by Weber during 2010?

A)$40,000

B)$0

C)$20,000

D)$30,000

A)$40,000

B)$0

C)$20,000

D)$30,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

31

On March 1, Delta Co.began construction of a small building.Payments of $150,000 were made monthly for three months beginning March 1.The building was completed and ready for occupancy on June 1.In determining the amount of interest cost to be capitalized, the weighted-average accumulated expenditures are

A)$0

B)$450,000

C)$150,000

D)$75,000

A)$0

B)$450,000

C)$150,000

D)$75,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

32

Use the following information for questions

On March 1, 2010, Beck Company purchased land for an office site by paying $270,000 cash.Beck began construction on the office building on March 1.The following expenditures were incurred for construction:

The office was completed and ready for occupancy on July 1.To help pay for construction,

$360,000 was borrowed on March 1, 2010 on a nine percent, three-year note payable.Other than the construction note, the only debt outstanding during 2010 was a $150,000, 10%, six-year note

payable dated January 1, 2010.

The actual interest cost incurred during 2010 was

A)$45,000.

B)$50,400.

C)$25,200.

D)$42,000.

On March 1, 2010, Beck Company purchased land for an office site by paying $270,000 cash.Beck began construction on the office building on March 1.The following expenditures were incurred for construction:

The office was completed and ready for occupancy on July 1.To help pay for construction,

$360,000 was borrowed on March 1, 2010 on a nine percent, three-year note payable.Other than the construction note, the only debt outstanding during 2010 was a $150,000, 10%, six-year note

payable dated January 1, 2010.

The actual interest cost incurred during 2010 was

A)$45,000.

B)$50,400.

C)$25,200.

D)$42,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

33

A major overhaul made to a machine increased its fair market value and its production capacity by 25% without extending the machine's useful life.The cost of the improvement should be

A)expensed.

B)debited to accumulated depreciation.

C)capitalized in the machine account.

D)allocated between accumulated depreciation and the machine account.

A)expensed.

B)debited to accumulated depreciation.

C)capitalized in the machine account.

D)allocated between accumulated depreciation and the machine account.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

34

Use the following information for questions

Parry Co.purchased land as a factory site for $500,000.Parry paid $20,000 to tear down two buildings on the land.Salvage was sold for $2,700.Legal fees of $1,740 were paid for title investigation and making the purchase.Architect's fees were $20,600.Title insurance cost

$1,200, and liability insurance during construction cost $1,300.Excavation cost $5,220.The contractor was paid $1,200,000.An assessment made by the city for pavement was $3,200.Interest costs during construction were $85,000.

The cost of the land that should be recorded by Parry Co.is

A)$520,240.

B)$523,440.

C)$524,940.

D)$528,140.

Parry Co.purchased land as a factory site for $500,000.Parry paid $20,000 to tear down two buildings on the land.Salvage was sold for $2,700.Legal fees of $1,740 were paid for title investigation and making the purchase.Architect's fees were $20,600.Title insurance cost

$1,200, and liability insurance during construction cost $1,300.Excavation cost $5,220.The contractor was paid $1,200,000.An assessment made by the city for pavement was $3,200.Interest costs during construction were $85,000.

The cost of the land that should be recorded by Parry Co.is

A)$520,240.

B)$523,440.

C)$524,940.

D)$528,140.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

35

Use the following information for questions

Parry Co.purchased land as a factory site for $500,000.Parry paid $20,000 to tear down two buildings on the land.Salvage was sold for $2,700.Legal fees of $1,740 were paid for title investigation and making the purchase.Architect's fees were $20,600.Title insurance cost

$1,200, and liability insurance during construction cost $1,300.Excavation cost $5,220.The contractor was paid $1,200,000.An assessment made by the city for pavement was $3,200.Interest costs during construction were $85,000.

The cost of the building that should be recorded by Parry Co.is

A)$1,306,900.

B)$1,307,420.

C)$1,311,600.

D)$1,312,120.

Parry Co.purchased land as a factory site for $500,000.Parry paid $20,000 to tear down two buildings on the land.Salvage was sold for $2,700.Legal fees of $1,740 were paid for title investigation and making the purchase.Architect's fees were $20,600.Title insurance cost

$1,200, and liability insurance during construction cost $1,300.Excavation cost $5,220.The contractor was paid $1,200,000.An assessment made by the city for pavement was $3,200.Interest costs during construction were $85,000.

The cost of the building that should be recorded by Parry Co.is

A)$1,306,900.

B)$1,307,420.

C)$1,311,600.

D)$1,312,120.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

36

A plant site donated by a township to a manufacturer that plans to open a new factory should be recorded on the manufacturer's books at

A)the nominal cost of taking title to it.

B)its market value.

C)one dollar (since the site cost nothing but should be included in the balance sheet).

D)the value assigned to it by the company's directors.

A)the nominal cost of taking title to it.

B)its market value.

C)one dollar (since the site cost nothing but should be included in the balance sheet).

D)the value assigned to it by the company's directors.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

37

In order for a cost to be capitalized (capital expenditure), the following must be present:

A)The useful life of an asset must be increased.

B)The quantity of assets must be increased.

C)The quality of assets must be increased.

D)Any one of these.

A)The useful life of an asset must be increased.

B)The quantity of assets must be increased.

C)The quality of assets must be increased.

D)Any one of these.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

38

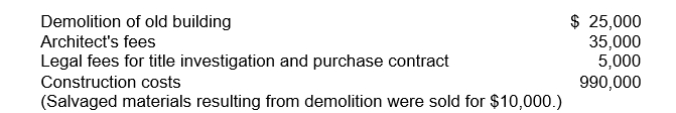

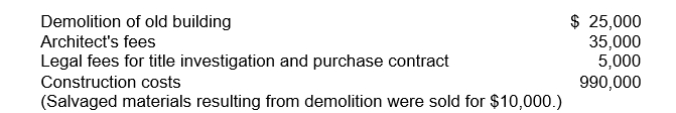

On February 1, 2010, Sarazin Corporation purchased a parcel of land as a factory site for $300,000.An old building on the property was demolished, and construction began on a new building which was completed on November 1, 2010.Costs incurred during this period are listed below:  Sarazin should record the cost of the land and new building, respectively as

Sarazin should record the cost of the land and new building, respectively as

A)$330,000 and $1,015,000.

B)$315,000 and $1,030,000.

C)$315,000 and $1,025,000.

D)$320,000 and $1,025,000.

Sarazin should record the cost of the land and new building, respectively as

Sarazin should record the cost of the land and new building, respectively asA)$330,000 and $1,015,000.

B)$315,000 and $1,030,000.

C)$315,000 and $1,025,000.

D)$320,000 and $1,025,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

39

Accounting recognition should be given to some or all of the gain realized on a nonmonetary exchange of plant assets except where the assets exchanged are

A)similar and additional cash (less than 10%) is paid.

B)similar and additional cash (greater than 10%) is received.

C)dissimilar and additional cash (less than 10%) is paid.

D)dissimilar and additional cash (greater than 10%) is received.

A)similar and additional cash (less than 10%) is paid.

B)similar and additional cash (greater than 10%) is received.

C)dissimilar and additional cash (less than 10%) is paid.

D)dissimilar and additional cash (greater than 10%) is received.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

40

On December 1, Lambert Corporation exchanged 2,000 shares of its no par value common shares for a parcel of land to be held for a future plant site.The book value of the shares is currently $45 per share, and their market value is $55 per share.Lambert received $15,000 for selling scrap when an existing building on the property was removed from the site.Based on these facts, the land should be capitalized at

A)$120,000

B)$75,000

C)$110,000

D)$95,000

A)$120,000

B)$75,000

C)$110,000

D)$95,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

41

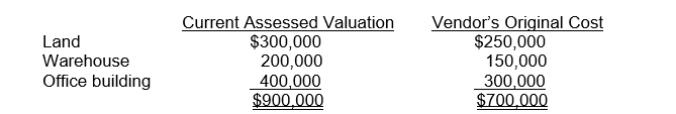

On April 1, Lagos Corporation purchased for $765,000 a tract of land on which was located a warehouse and office building.The following data were collected concerning the property:  What are the appropriate amounts that Lagos should record for the land, warehouse, and office building, respectively?

What are the appropriate amounts that Lagos should record for the land, warehouse, and office building, respectively?

A)Land, $250,000; warehouse, $150,000; office building, $300,000.

B)Land, $300,000; warehouse, $200,000; office building, $400,000.

C)Land, $273,214; warehouse, $163,929; office building, $327,857.

D)Land, $255,000; warehouse, $170,000; office building, $340,000.

What are the appropriate amounts that Lagos should record for the land, warehouse, and office building, respectively?

What are the appropriate amounts that Lagos should record for the land, warehouse, and office building, respectively?A)Land, $250,000; warehouse, $150,000; office building, $300,000.

B)Land, $300,000; warehouse, $200,000; office building, $400,000.

C)Land, $273,214; warehouse, $163,929; office building, $327,857.

D)Land, $255,000; warehouse, $170,000; office building, $340,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

42

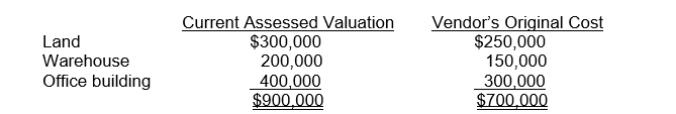

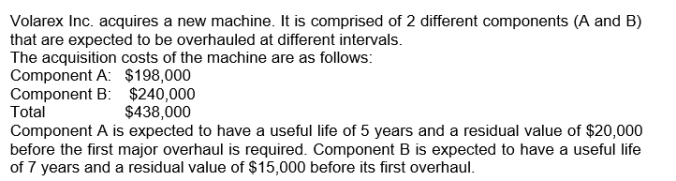

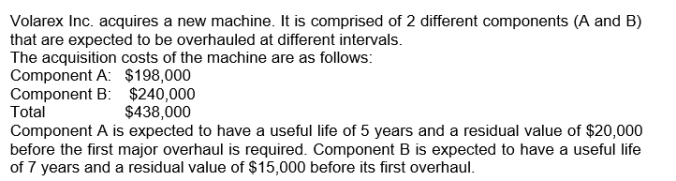

Use the following information for questions

Abcor Corporation uses the cost model to account for its PP&E assets.The assets were acquired on January 1, 2010.The following additional information is available: Assuming Abcor did not experience any impairment losses, the 2011 net carrying value of the assets is

Assuming Abcor did not experience any impairment losses, the 2011 net carrying value of the assets is

A)$87,500

B)$78,750

C)$70,000

D)$68,000

Abcor Corporation uses the cost model to account for its PP&E assets.The assets were acquired on January 1, 2010.The following additional information is available:

Assuming Abcor did not experience any impairment losses, the 2011 net carrying value of the assets is

Assuming Abcor did not experience any impairment losses, the 2011 net carrying value of the assets isA)$87,500

B)$78,750

C)$70,000

D)$68,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

43

Lamont Company buys a lift truck with a list price of $20,000.The dealer grants a 15% reduction in list price and an additional two percent cash discount on the net price if payment is made in 30 days.Sales taxes amount to $250 and the company paid an extra $200 to have a special horn installed.What should be the recorded cost of the truck?

A)$16,660.

B)$17,080.

C)$17,110.

D)$16,910.

A)$16,660.

B)$17,080.

C)$17,110.

D)$16,910.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

44

On August 1, 2010, Volmar Corporation purchased a new machine on a deferred payment basis.A down payment of $4,000 was made and four annual instalments of $6,000 each are to be made beginning on September 1, 2010.The cash equivalent price of the machine was $25,000.Due to an employee strike, Volmar could not install the machine immediately, and thus incurred $300 of storage costs.Costs of installation (excluding the storage costs) amounted to $800.The amount to be capitalized as the cost of the machine is

A)$25,000.

B)$25,800.

C)$26,100.

D)$28,000.

A)$25,000.

B)$25,800.

C)$26,100.

D)$28,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

45

Laroche Co.exchanged similar nonmonetary assets with Karr Co.No cash was exchanged.The carrying amount of the asset surrendered by Laroche exceeded both the fair value of the asset received and Karr's carrying amount of that asset.Laroche should recognize the difference between the carrying amount of the asset it surrendered and

A)the fair value of the asset it received as a loss.

B)the fair value of the asset it received as a gain.

C)Karr's carrying amount of the asset it received as a loss.

D)Karr's carrying amount of the asset it received as a gain.

A)the fair value of the asset it received as a loss.

B)the fair value of the asset it received as a gain.

C)Karr's carrying amount of the asset it received as a loss.

D)Karr's carrying amount of the asset it received as a gain.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

46

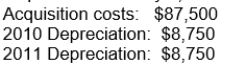

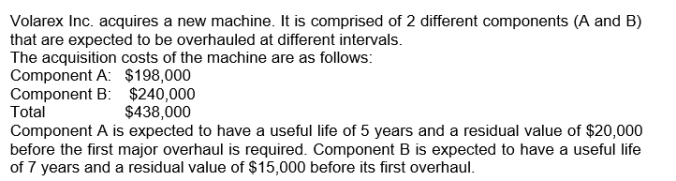

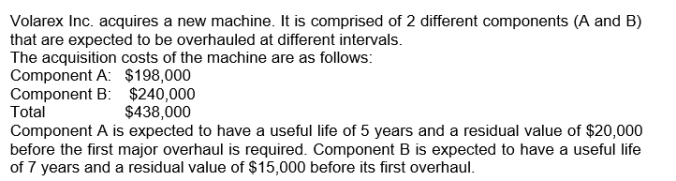

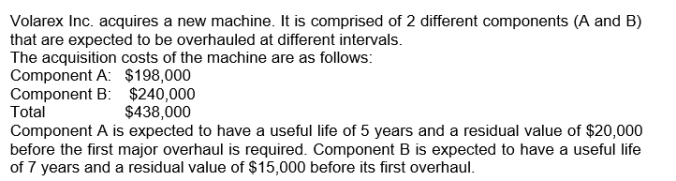

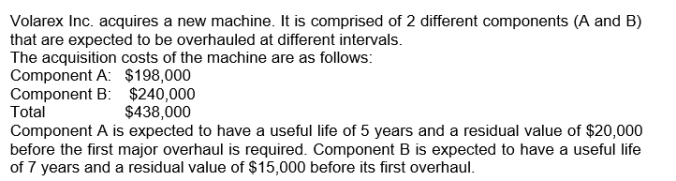

Use the following information for questions

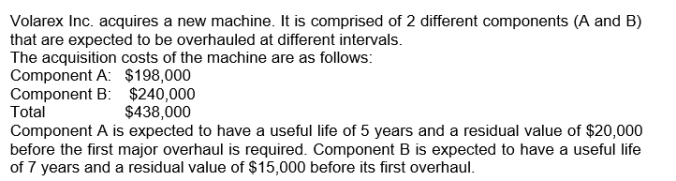

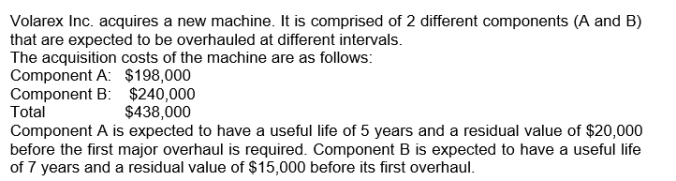

Assuming, the double declining balance is used, what will be the net book value of component B at the end of year 1?

A)$205,714

B)$34,286

C)$80,000

D)$171,429

Assuming, the double declining balance is used, what will be the net book value of component B at the end of year 1?

A)$205,714

B)$34,286

C)$80,000

D)$171,429

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

47

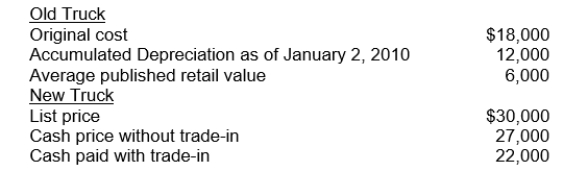

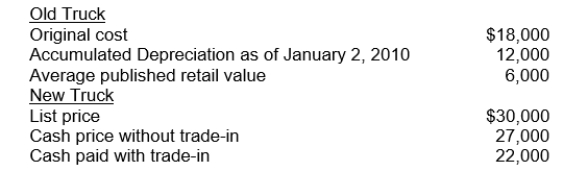

On January 2, 2010, Mack Delivery Company traded in an old delivery truck for a newer model.Data relative to the old and new trucks follow:  What should be the cost of the new truck for financial accounting purposes?

What should be the cost of the new truck for financial accounting purposes?

A)$22,000.

B)$27,000.

C)$28,000.

D)$30,000.

What should be the cost of the new truck for financial accounting purposes?

What should be the cost of the new truck for financial accounting purposes?A)$22,000.

B)$27,000.

C)$28,000.

D)$30,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

48

Use the following information for questions

At the beginning of year 6, component A undergoes a major overhaul at a cost of 100,000. The work is expected to extend its life by 3 years with a residual value of zero.Volarex uses the straight-line method to depreciate this asset.What will be the net book value of

Component A one year after the overhaul?

A)$66,667

B)$40,000

C)$80,000

D)$120,000

At the beginning of year 6, component A undergoes a major overhaul at a cost of 100,000. The work is expected to extend its life by 3 years with a residual value of zero.Volarex uses the straight-line method to depreciate this asset.What will be the net book value of

Component A one year after the overhaul?

A)$66,667

B)$40,000

C)$80,000

D)$120,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

49

On August 1, 2010, Danube Corporation purchased a new machine on a deferred payment basis.A down payment of $2,000 was made and four monthly instalments of $3,000 each are to be made beginning on September 1, 2010.The cash equivalent price of the machine was $12,000.Danube incurred and paid installation costs amounting to

$1,000.The amount to be capitalized as the cost of the machine is

A)$13,000

B)$3,000

C)$12,000

D)$14,000

$1,000.The amount to be capitalized as the cost of the machine is

A)$13,000

B)$3,000

C)$12,000

D)$14,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

50

Use the following information for questions

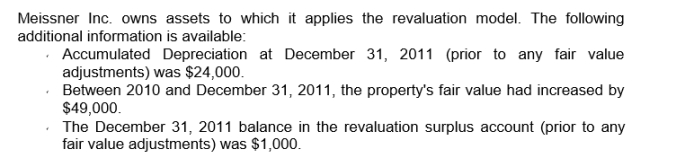

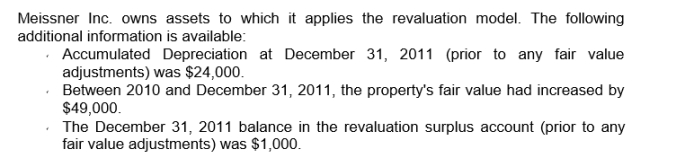

The adjusted 2011 year-end balance in Meissner's revaluation surplus account will be

A)nil

B)$49,000

C)$48,000

D)$50,000

The adjusted 2011 year-end balance in Meissner's revaluation surplus account will be

A)nil

B)$49,000

C)$48,000

D)$50,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

51

Bliss Company exchanged 500 common shares of Davos Company, which Bliss was holding as an investment, for equipment from East Company.The Davos Company common shares, which had been purchased by Bliss for $50 per share, had a quoted market value of $58 per share at the date of exchange.The equipment had a recorded amount on East's books of $26,500.What journal entry should Bliss make to record this exchange?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

52

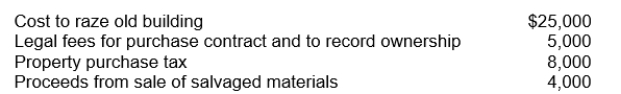

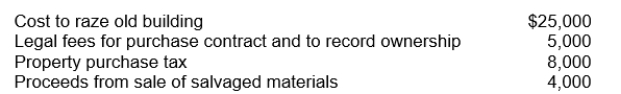

On December 1, 2010, Moik Co.purchased a tract of land as a factory site for $500,000. The old building on the property was razed, and salvaged materials resulting from demolition were sold.Additional costs incurred and salvage proceeds realized during

December 2010 were as follows: In Moik's December 31, 2010 balance sheet, what amount should be reported as land?

In Moik's December 31, 2010 balance sheet, what amount should be reported as land?

A)$513,000.

B)$521,000.

C)$534,000.

D)$538,000.

December 2010 were as follows:

In Moik's December 31, 2010 balance sheet, what amount should be reported as land?

In Moik's December 31, 2010 balance sheet, what amount should be reported as land?A)$513,000.

B)$521,000.

C)$534,000.

D)$538,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

53

Use the following information for questions

In 2004, Miles Company purchased a tract of land as a possible future plant site.In January, 2010, valuable sulphur deposits were discovered on adjoining property and Minton Company immediately began explorations on its property.In December, 2010, after incurring $500,000 in exploration costs that were accumulated in an expense account, Miles discovered sulphur deposits appraised at $2.5 million more than the value of the land.To record the discovery of the deposits, Miles should

A)make no entry.

B)debit $500,000 to an asset account.

C)debit $2,500,000 to an asset account.

D)debit $3,000,000 to an asset account.

In 2004, Miles Company purchased a tract of land as a possible future plant site.In January, 2010, valuable sulphur deposits were discovered on adjoining property and Minton Company immediately began explorations on its property.In December, 2010, after incurring $500,000 in exploration costs that were accumulated in an expense account, Miles discovered sulphur deposits appraised at $2.5 million more than the value of the land.To record the discovery of the deposits, Miles should

A)make no entry.

B)debit $500,000 to an asset account.

C)debit $2,500,000 to an asset account.

D)debit $3,000,000 to an asset account.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

54

Use the following information for questions

Assuming straight-line depreciation, what will be the net book value of component A after 5 years?

A)$19,000

B)$20,000

C)$55,600

D)nil

Assuming straight-line depreciation, what will be the net book value of component A after 5 years?

A)$19,000

B)$20,000

C)$55,600

D)nil

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

55

On December 1, 2010, Lear Company acquired a new delivery truck in exchange for an old delivery truck that it had acquired in 2007.The old truck was purchased for $20,000 and had a book value of $7,600.On the date of the exchange, the old truck had a market value of $8,000.In addition, Lear paid $26,000 cash for the new truck, which had a list price of $36,000.At what amount should Lear record the new truck for financial accounting purposes?

A)$26,000.

B)$33,600.

C)$34,000.

D)$36,000.

A)$26,000.

B)$33,600.

C)$34,000.

D)$36,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

56

A company is constructing an asset for its own use.Construction began in 2010.The asset is being financed entirely with a specific new borrowing.Construction expenditures were made in 2010 and 2011 at the end of each quarter.The total amount of interest cost capitalized in 2011 should be determined by applying the interest rate on the specific new borrowing to the

A)total accumulated expenditures for the asset in 2011 and 2011.

B)average accumulated expenditures for the asset in 2010 and 2011.

C)average expenditures for the asset in 2011.

D)total expenditures for the asset in 2011.

A)total accumulated expenditures for the asset in 2011 and 2011.

B)average accumulated expenditures for the asset in 2010 and 2011.

C)average expenditures for the asset in 2011.

D)total expenditures for the asset in 2011.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

57

Land was purchased to be used as the site for the construction of a plant.A building on the property was sold and removed by the buyer so that construction on the plant could begin.The proceeds from the sale of the building should be

A)classified as other income.

B)deducted from the cost of the land.

C)netted against the costs to clear the land and expensed as incurred.

D)netted against the costs to clear the land and amortized over the life of the plant.

A)classified as other income.

B)deducted from the cost of the land.

C)netted against the costs to clear the land and expensed as incurred.

D)netted against the costs to clear the land and amortized over the life of the plant.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

58

Use the following information for questions

The adjusted 2011 year-end balance in Meissner's accumulated depreciation account will be

A)$24,000

B)nil

C)$23,000

D)$25,000

The adjusted 2011 year-end balance in Meissner's accumulated depreciation account will be

A)$24,000

B)nil

C)$23,000

D)$25,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

59

Use the following information for questions

Assume the same facts as indicated above, except that, between 2010 and December 31, 2011, the property's fair value had decreased by $10,000.As a result, Meissner's 2011 income statement will include a

A)$9,000 loss

B)$9,000 gain (other comprehensive income)

C)$10,000 loss

D)$1,000 loss

Assume the same facts as indicated above, except that, between 2010 and December 31, 2011, the property's fair value had decreased by $10,000.As a result, Meissner's 2011 income statement will include a

A)$9,000 loss

B)$9,000 gain (other comprehensive income)

C)$10,000 loss

D)$1,000 loss

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

60

Jasper Football Co.had a player contract with Larsen that is recorded in its books at $600,000 on July 1, 2010.Tex Football Co.had a player contract with Muller that is recorded in its books at $750,000 on July 1, 2010.On this date, Jasper traded Larsen to

Tex for Muller and paid a cash difference of $75,000.The fair value of the Muller contract was $900,000 on the exchange date.After the exchange, the Muller contract should be

Recorded in Jasper's books at

A)$675,000.

B)$750,000.

C)$825,000.

D)$900,000.

Tex for Muller and paid a cash difference of $75,000.The fair value of the Muller contract was $900,000 on the exchange date.After the exchange, the Muller contract should be

Recorded in Jasper's books at

A)$675,000.

B)$750,000.

C)$825,000.

D)$900,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

61

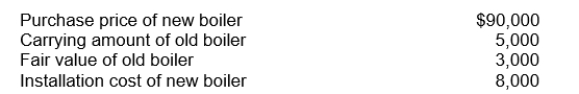

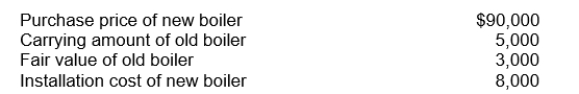

On January 2, 2010, Bork Corp.replaced its boiler with a more efficient one.The following information was available on that date:  The old boiler was sold for $3,000.What amount should Ross capitalize as the cost of the new boiler?

The old boiler was sold for $3,000.What amount should Ross capitalize as the cost of the new boiler?

A)$98,000.

B)$92,000.

C)$95,000.

D)$97,000.

The old boiler was sold for $3,000.What amount should Ross capitalize as the cost of the new boiler?

The old boiler was sold for $3,000.What amount should Ross capitalize as the cost of the new boiler?A)$98,000.

B)$92,000.

C)$95,000.

D)$97,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

62

Modesto City owned an idle parcel of real estate consisting of land and a factory building. Modesto gave title to this realty to Mission Co.as an incentive for Mission to establish manufacturing operations in the city.Mission paid nothing for this realty, which had a fair market value of $250,000 at the date of the grant.Mission should record this nonmonetary transaction as a

A)memo entry only.

B)credit to Contribution Revenue for $250,000.

C)credit to extraordinary income for $250,000.

D)credit to Donated Capital for $250,000.

A)memo entry only.

B)credit to Contribution Revenue for $250,000.

C)credit to extraordinary income for $250,000.

D)credit to Donated Capital for $250,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

63

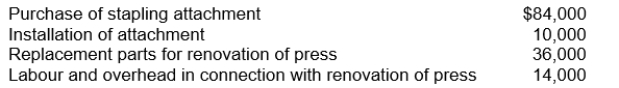

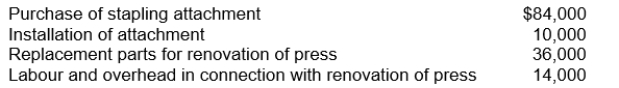

On September 10, 2010, Linx Co.incurred the following costs for one of its printing presses:  Neither the attachment nor the renovation increased the estimated useful life of the press.However, the renovation resulted in significantly increased productivity.What amount of the costs should be capitalized?

Neither the attachment nor the renovation increased the estimated useful life of the press.However, the renovation resulted in significantly increased productivity.What amount of the costs should be capitalized?

A)$0.

B)$108,000.

C)$130,000.

D)$144,000.

Neither the attachment nor the renovation increased the estimated useful life of the press.However, the renovation resulted in significantly increased productivity.What amount of the costs should be capitalized?

Neither the attachment nor the renovation increased the estimated useful life of the press.However, the renovation resulted in significantly increased productivity.What amount of the costs should be capitalized?A)$0.

B)$108,000.

C)$130,000.

D)$144,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck