Deck 4: Recognizing Revenues in Governmental Funds

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

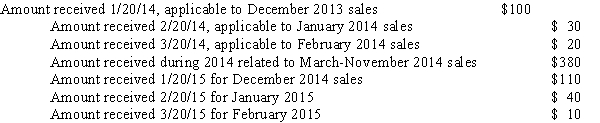

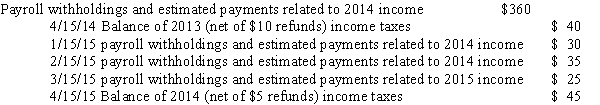

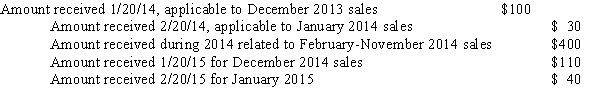

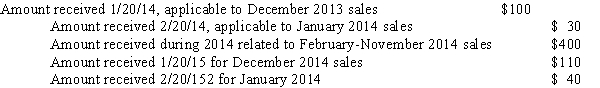

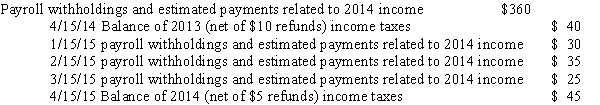

Question

Question

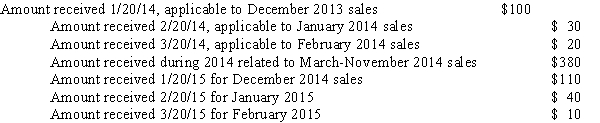

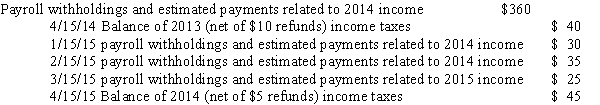

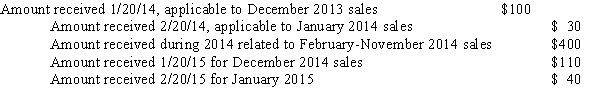

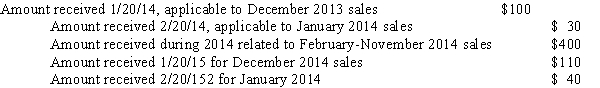

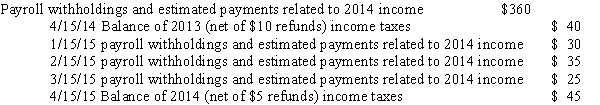

Question

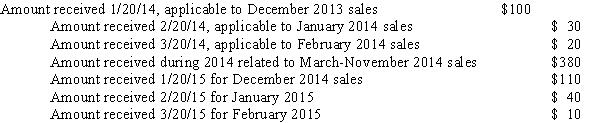

Question

Question

Question

Question

Question

Question

Question

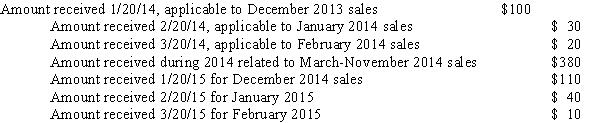

Question

Question

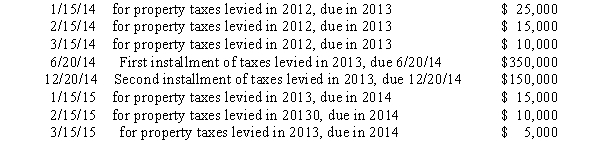

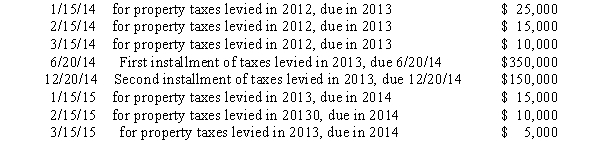

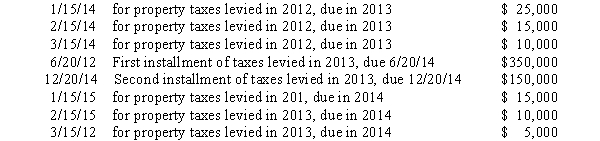

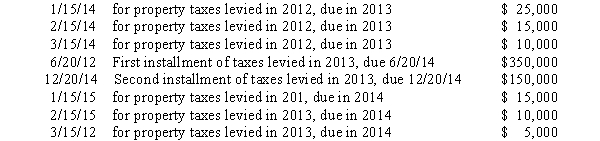

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/62

Play

Full screen (f)

Deck 4: Recognizing Revenues in Governmental Funds

1

The revenue-recognition issues facing governments are generally focused on the exchange transaction earning process, similar to those of businesses.

False

2

The modified accrual basis of accounting is used in presenting the fund financial statements of the governmental funds because

A)it is the superior method of accounting for the economic resources of any entity.

B)it provides information as to the extent the entity achieved interperiod equity.

C)it is budget oriented while facilitating comparisons among entities.

D)it results in accounting measurements based on the substance of transactions.

A)it is the superior method of accounting for the economic resources of any entity.

B)it provides information as to the extent the entity achieved interperiod equity.

C)it is budget oriented while facilitating comparisons among entities.

D)it results in accounting measurements based on the substance of transactions.

C

3

Governmental activities tend to derive the majority of their revenues from exchange transactions.

False

4

Under the modified accrual basis of accounting, the amount of property tax revenues that should be recognized by a government in the current year related to the current-year levy will be

A)the total amount of the levy.

B)the expected collectible portion of the levy.

C)the portion of the levy collected.

D)the portion of the levy collected in the current year or within sixty days after the end of the fiscal period.

A)the total amount of the levy.

B)the expected collectible portion of the levy.

C)the portion of the levy collected.

D)the portion of the levy collected in the current year or within sixty days after the end of the fiscal period.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

5

As used in governmental accounting, interperiod equity refers to a concept of

A)providing the same level of services to citizens each year.

B)measuring whether current year revenues are sufficient to pay for current year services.

C)levying property taxes at the same rate each year.

D)requiring that general fund budgets be balanced each year.

A)providing the same level of services to citizens each year.

B)measuring whether current year revenues are sufficient to pay for current year services.

C)levying property taxes at the same rate each year.

D)requiring that general fund budgets be balanced each year.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

6

As used in defining the modified accrual basis of accounting, the term "available" means

A)received in cash.

B)will be received in cash within 60 days after year-end.

C)collection in cash is reasonably assured.

D)collected within the current period or expected to be collected soon enough thereafter to be used to pay liabilities of the current period.

A)received in cash.

B)will be received in cash within 60 days after year-end.

C)collection in cash is reasonably assured.

D)collected within the current period or expected to be collected soon enough thereafter to be used to pay liabilities of the current period.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

7

Ad valorem taxes are taxes that are based on value.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

8

For fund financial statements, the measurement focus and basis of accounting used by governmental fund types are

A)current financial resources and modified accrual accounting.

B)economic resources and modified accrual accounting.

C)financial resources and full accrual accounting.

D)economic resources and full accrual accounting.

A)current financial resources and modified accrual accounting.

B)economic resources and modified accrual accounting.

C)financial resources and full accrual accounting.

D)economic resources and full accrual accounting.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

9

The budgetary measurement focus of governments is determined by applicable state or local laws.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

10

Taxes that are imposed on the reporting government's citizens are considered general revenues, even if they are restricted to specific programs.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

11

Sales taxes are taxpayer assessed, that is, parties other than the beneficiary government determine the tax base.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

12

If an entity elects to focus on all economic resources, then it should adopt a modified accrual basis of accounting.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

13

Under the modified accrual basis of accounting, investment revenues for the current period should include

A)only interest and dividends received.

B)all interest and dividends received during the period plus all accruals of interest and dividends earned.

C)all interest and dividends received plus gains and losses on securities that were sold during the period.

D)all interest and dividends received, all gains and losses on securities sold, and all changes in market values on securities held in the portfolio at year-end.

A)only interest and dividends received.

B)all interest and dividends received during the period plus all accruals of interest and dividends earned.

C)all interest and dividends received plus gains and losses on securities that were sold during the period.

D)all interest and dividends received, all gains and losses on securities sold, and all changes in market values on securities held in the portfolio at year-end.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

14

Under the modified accrual basis, revenues are "available" if they are collected within the current period or are expected to be collected soon enough after the end of the period to be used to pay liabilities of the current period.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

15

Revenues that cannot be classified as general revenues are by default considered program revenues.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

16

Current financial resources include cash and receivables but not investments.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

17

Income taxes are classified as ad valorem taxes.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

18

Under the modified accrual basis of accounting, derived nonexchange revenues are recognized when

A)they are earned.

B)they are measurable and available to finance the expenditures of the current period.

C)the underlying exchange transaction occurs.

D)the underlying exchange transaction occurs and they are measurable and available to finance the expenditures of the current period.

A)they are earned.

B)they are measurable and available to finance the expenditures of the current period.

C)the underlying exchange transaction occurs.

D)the underlying exchange transaction occurs and they are measurable and available to finance the expenditures of the current period.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

19

Under the accrual basis of accounting, property tax revenues are recognized

A)when they are received in cash.

B)in the year for which they were levied.

C)in the year for which they were levied and when collection in cash is reasonably assured.

D)when they are available to finance expenditures of the fiscal period.

A)when they are received in cash.

B)in the year for which they were levied.

C)in the year for which they were levied and when collection in cash is reasonably assured.

D)when they are available to finance expenditures of the fiscal period.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

20

In accounting for property taxes, under the modified accrual basis, existing standards provide that, except in unusual circumstances, revenues should be recognized only if cash is expected to be collected within sixty days after year-end.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

21

Under the accrual basis of accounting, imposed nonexchange revenues (such as fines)should be recognized

A)when assessed.

B)when the government has an enforceable legal claim.

C)when collected.

D)when the government has an enforceable legal claim and when collected within the current period or soon enough thereafter to be used to pay the liabilities of the current period

A)when assessed.

B)when the government has an enforceable legal claim.

C)when collected.

D)when the government has an enforceable legal claim and when collected within the current period or soon enough thereafter to be used to pay the liabilities of the current period

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

22

Under the modified accrual basis of accounting, license fees, permits, and other miscellaneous revenue are generally recognized for practical purposes

A)when cash is received.

B)when the exchange takes place.

C)over the period during which the government obtains an enforceable legal claim.

D)when related expenditures are incurred.

A)when cash is received.

B)when the exchange takes place.

C)over the period during which the government obtains an enforceable legal claim.

D)when related expenditures are incurred.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

23

Under GAAP, property taxes levied in one fiscal period to finance the activities of the following fiscal period are recognized as revenue in the government-wide financial statements

A)in the year levied.

B)in the year for which they are intended to finance the activities.

C)when collected, regardless of when levied.

D)in the year for which they are intended to finance the activities, if collected within that period or within a period no greater than 60 days after the close of the fiscal year.

A)in the year levied.

B)in the year for which they are intended to finance the activities.

C)when collected, regardless of when levied.

D)in the year for which they are intended to finance the activities, if collected within that period or within a period no greater than 60 days after the close of the fiscal year.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

24

Under the modified accrual basis of accounting, imposed nonexchange revenues (such as fines)should be recognized

A)when assessed.

B)when the government has an enforceable legal claim.

C)when collected.

D)when the government has an enforceable legal claim and when collected within the current period or soon enough thereafter to be used to pay the liabilities of the current period.

A)when assessed.

B)when the government has an enforceable legal claim.

C)when collected.

D)when the government has an enforceable legal claim and when collected within the current period or soon enough thereafter to be used to pay the liabilities of the current period.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

25

Under GAAP, property taxes levied in one fiscal period to finance the activities of the following fiscal period are recognized as revenue in the governmental fund financial statements

A)in the year levied.

B)in the year for which they are intended to finance the activities.

C)when collected, regardless of when levied.

D)in the year for which they are intended to finance the activities, if collected within that period or within a period no greater than 60 days after the close of the fiscal year.

A)in the year levied.

B)in the year for which they are intended to finance the activities.

C)when collected, regardless of when levied.

D)in the year for which they are intended to finance the activities, if collected within that period or within a period no greater than 60 days after the close of the fiscal year.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

26

A city levies a 2 percent sales tax that is collected for them by the state.Sales taxes must be remitted by the merchants to the state by the 20th day of the month following the month in which the sale occurred.The state has a policy of remitting sales taxes to the city within 30 days of collection by the state.Cash received by the state related to sales taxes is as follows:  Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its governmental fund financial statements for the fiscal year ended 12/31/14?

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its governmental fund financial statements for the fiscal year ended 12/31/14?

A)$430.

B)$530.

C)$540.

D)$550.

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its governmental fund financial statements for the fiscal year ended 12/31/14?

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its governmental fund financial statements for the fiscal year ended 12/31/14?A)$430.

B)$530.

C)$540.

D)$550.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

27

A city that has a 12/31 fiscal year end has adopted a policy of recognizing the maximum amount of property tax revenue allowable under GAAP.Property taxes of $720,000 (of which 10 percent are estimated to be uncollectible)are levied in October 2013 to finance the activities of the fiscal year 2014.During 2014, cash collections related to property taxes levied in October 2013 were $600,000.In 2015 the following amounts related to the property taxes levied in October 2013 were collected: January $30,000; March, $6,000.For the fiscal year ended 12/31/14, what amount should be recognized as property tax revenues related to the 2013 levy on the governmental fund financial statements?

A)$720,000.

B)$648,000.

C)$630,000.

E)$600,000.

A)$720,000.

B)$648,000.

C)$630,000.

E)$600,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

28

During 2014, a state has the following cash collections related to state income taxes  Assuming that the state defines "available" as the maximum period allowable for property taxes, what is the amount of revenue that will be recognized in the 2014 governmental fund financial statements related to state income taxes?

Assuming that the state defines "available" as the maximum period allowable for property taxes, what is the amount of revenue that will be recognized in the 2014 governmental fund financial statements related to state income taxes?

A)$400.

B)$405.

C)$430.

D)$465.

Assuming that the state defines "available" as the maximum period allowable for property taxes, what is the amount of revenue that will be recognized in the 2014 governmental fund financial statements related to state income taxes?

Assuming that the state defines "available" as the maximum period allowable for property taxes, what is the amount of revenue that will be recognized in the 2014 governmental fund financial statements related to state income taxes?A)$400.

B)$405.

C)$430.

D)$465.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

29

A city levies a 2 percent sales tax.Sales taxes must be remitted by the merchants to the city by the twentieth day of the month following the month in which the sale occurred.Cash received by the city related to sales taxes is as follows:  Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize in the government-wide financial statements as sales tax revenue for the fiscal year ended 12/31/14?

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize in the government-wide financial statements as sales tax revenue for the fiscal year ended 12/31/14?

A)$430.

B)$530.

C)$540.

D)$550.

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize in the government-wide financial statements as sales tax revenue for the fiscal year ended 12/31/14?

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize in the government-wide financial statements as sales tax revenue for the fiscal year ended 12/31/14?A)$430.

B)$530.

C)$540.

D)$550.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

30

A city levies a 2 percent sales tax that is collected for them by the state.Sales taxes must be remitted by the merchants to the state by the twentieth day of the month following the month in which the sale occurred.The state has a policy of remitting sales taxes to the city within 30 days of collection by the state.Cash received by the state related to sales taxes is as follows:  Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its government-wide financial statements for the fiscal year ended 12/31/14?

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its government-wide financial statements for the fiscal year ended 12/31/14?

A)$430.

B)$530.

C)$540.

D)$550.

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its government-wide financial statements for the fiscal year ended 12/31/14?

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its government-wide financial statements for the fiscal year ended 12/31/14?A)$430.

B)$530.

C)$540.

D)$550.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

31

Under the modified accrual basis of accounting, gains and losses on disposal of capital assets

A)are not recognized.

B)are recognized when the proceeds (cash)of the sale are received (on the installment basis).

C)are recognized only if there is a gain.

D)are recognized when the sale occurs, regardless of when the cash is collected.

A)are not recognized.

B)are recognized when the proceeds (cash)of the sale are received (on the installment basis).

C)are recognized only if there is a gain.

D)are recognized when the sale occurs, regardless of when the cash is collected.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

32

Under the accrual basis of accounting, gains and losses on disposal of capital assets

A)are not recognized.

B)are recognized when the proceeds (cash)of the sale are received (on the installment basis).

C)are recognized only if there is a gain.

D)are recognized when the sale occurs, regardless of when the cash is collected.

A)are not recognized.

B)are recognized when the proceeds (cash)of the sale are received (on the installment basis).

C)are recognized only if there is a gain.

D)are recognized when the sale occurs, regardless of when the cash is collected.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

33

Under GAAP, income tax revenues should be recognized in the governmental fund financial statements in the accounting period

A)when collected in cash by the taxing authority.

B)in which the underlying income was earned, regardless of when collected.

C)in which the underlying income was earned, if collected in the current period or soon enough thereafter to pay liabilities of the current period.

D)when earned.

A)when collected in cash by the taxing authority.

B)in which the underlying income was earned, regardless of when collected.

C)in which the underlying income was earned, if collected in the current period or soon enough thereafter to pay liabilities of the current period.

D)when earned.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

34

A city levies a 2 percent sales tax.Sales taxes must be remitted by the merchants to the City by the twentieth day of the month following the month in which the sale occurred.Cash received by the city related to sales taxes is as follows:  Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize in the governmental fund financial statements as sales tax revenue for the fiscal year ended 12/31/14?

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize in the governmental fund financial statements as sales tax revenue for the fiscal year ended 12/31/14?

A)$430.

B)$530.

C)$540.

D)$550.

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize in the governmental fund financial statements as sales tax revenue for the fiscal year ended 12/31/14?

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize in the governmental fund financial statements as sales tax revenue for the fiscal year ended 12/31/14?A)$430.

B)$530.

C)$540.

D)$550.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

35

Ideally, under the accrual basis of accounting, license fees, permits, and other miscellaneous revenue should be recognized

A)when cash is received.

B)when the exchange takes place.

C)over the period during which the government obtains an enforceable legal claim.

D)when related expenditures are incurred.

A)when cash is received.

B)when the exchange takes place.

C)over the period during which the government obtains an enforceable legal claim.

D)when related expenditures are incurred.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

36

During 2014, a state has the following cash collections related to state income taxes  Assuming that the state defines "available" as the maximum period allowable for property taxes, what is the amount of revenue that will be recognized in the 2014 government-wide financial statements related to state income taxes?

Assuming that the state defines "available" as the maximum period allowable for property taxes, what is the amount of revenue that will be recognized in the 2014 government-wide financial statements related to state income taxes?

A)$400.

B)$475.

C)$430.

D)$465.

Assuming that the state defines "available" as the maximum period allowable for property taxes, what is the amount of revenue that will be recognized in the 2014 government-wide financial statements related to state income taxes?

Assuming that the state defines "available" as the maximum period allowable for property taxes, what is the amount of revenue that will be recognized in the 2014 government-wide financial statements related to state income taxes?A)$400.

B)$475.

C)$430.

D)$465.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

37

A city that has a 12/31 fiscal year end has adopted a policy of recognizing the maximum amount of property tax revenue allowable under GAAP.Property taxes of $720,000 (of which 10 percent are estimated to be uncollectible)are levied in October 2013 to finance the activities of the fiscal year 2014.During 2014, cash collections related to property taxes levied in October 2013 were $600,000.In 2015the following amounts related to the property taxes levied in October 2013 were collected: January $30,000; March $6,000.For the fiscal year ended 12/31/14, what amount should be recognized as property tax revenues related to the 2013 levy on the government-wide financial statements?

A)$720,000.

B)$648,000.

C)$630,000.

D)$600,000.

A)$720,000.

B)$648,000.

C)$630,000.

D)$600,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

38

A city that has a 12/31 fiscal year end has adopted a policy of recognizing property tax revenue consistent with the 60-day rule allowable period under GAAP.Property taxes of $600,000 (of which none are estimated to be uncollectible)are levied in October 2013 to finance the activities of fiscal year 2014.Property taxes are due in two installments June 20 and December 20.Cash collections related to property taxes are as follows:  The total amount of property tax revenue that should be recognized in the governmental fund financial statements in 2014 is:

The total amount of property tax revenue that should be recognized in the governmental fund financial statements in 2014 is:

A)$600,000.

B)$575,000.

C)$535,000.

D)$525,000.

The total amount of property tax revenue that should be recognized in the governmental fund financial statements in 2014 is:

The total amount of property tax revenue that should be recognized in the governmental fund financial statements in 2014 is:A)$600,000.

B)$575,000.

C)$535,000.

D)$525,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

39

A city that has a 12/31 fiscal year end has adopted a policy of recognizing property tax revenue consistent with the 60-day rule allowable period under GAAP.Property taxes of $600,000 (of which none are estimated to be uncollectible)are levied in October 2013 to finance the activities of fiscal year 2014.Property taxes are due in two installments June 20 and December 20.Cash collections related to property taxes are as follows:  The total amount of property tax revenue that will be recognized in the government-wide financial statements in 2014 is:

The total amount of property tax revenue that will be recognized in the government-wide financial statements in 2014 is:

A)$600,000.

B)$575,000.

C)$535,000.

D)$525,000.

The total amount of property tax revenue that will be recognized in the government-wide financial statements in 2014 is:

The total amount of property tax revenue that will be recognized in the government-wide financial statements in 2014 is:A)$600,000.

B)$575,000.

C)$535,000.

D)$525,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

40

Under the accrual basis of accounting used by governments, investment revenues for the current period should include

A)only interest and dividends received.

B)all interest and dividends received during the period plus all accruals of interest and dividends earned.

C)all interest and dividends received plus gains and losses on securities that were sold during the period.

D)all interest and dividends received, all gains and losses on securities sold, and all changes in market values on securities held in the portfolio at year-end.

A)only interest and dividends received.

B)all interest and dividends received during the period plus all accruals of interest and dividends earned.

C)all interest and dividends received plus gains and losses on securities that were sold during the period.

D)all interest and dividends received, all gains and losses on securities sold, and all changes in market values on securities held in the portfolio at year-end.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

41

Under GAAP, income tax revenues should be recognized in the government-wide financial statements in the accounting period

A)when collected in cash by the taxing authority.

B)in which the underlying income was earned, regardless of when collected.

C)in which the underlying income was earned, if collected in the current period or soon enough thereafter to pay liabilities of the current period.

D)when earned.

A)when collected in cash by the taxing authority.

B)in which the underlying income was earned, regardless of when collected.

C)in which the underlying income was earned, if collected in the current period or soon enough thereafter to pay liabilities of the current period.

D)when earned.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

42

Unrestricted grant revenues with a time requirement should be recognized

A)when the award is announced.

B)when the cash is received.

C)in the period in which the grant is required to be used.

D)when expenditures are recognized on grant-related activities.

A)when the award is announced.

B)when the cash is received.

C)in the period in which the grant is required to be used.

D)when expenditures are recognized on grant-related activities.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

43

Payments made to a state pension plan by the state government on behalf of a local government should

A)not be displayed or disclosed in the local government financial statements.

B)be displayed as a revenue in the local government financial statements.

C)be displayed as both a revenue and an expenditure in the local government financial statements.

D)be disclosed, but not displayed, in the local government financial statements.

A)not be displayed or disclosed in the local government financial statements.

B)be displayed as a revenue in the local government financial statements.

C)be displayed as both a revenue and an expenditure in the local government financial statements.

D)be disclosed, but not displayed, in the local government financial statements.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

44

State governments should recognize food stamp revenue

A)when they receive the food stamps.

B)when food stamps are distributed by the state to eligible recipients.

C)when the recipient uses the food stamps

D)never.Food stamps are not financial resources.

A)when they receive the food stamps.

B)when food stamps are distributed by the state to eligible recipients.

C)when the recipient uses the food stamps

D)never.Food stamps are not financial resources.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

45

Endowments are provided to governments with the specification that only the revenues generated from-not the contributed assets-may be used to finance specific programs.A government should recognize revenue from the initial endowment when

A)it receives the assets (cash).

B)when it receives the pledge.

C)ratably over 30 years.

D)never.The contributions themselves cannot be used to support the government's programs.

A)it receives the assets (cash).

B)when it receives the pledge.

C)ratably over 30 years.

D)never.The contributions themselves cannot be used to support the government's programs.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

46

A local government began the year with a portfolio of securities with an historical cost of $1,200 and a fair value of $1,240.During the year the government acquired an additional security at a cost of $260 and sold for $200 a security that had an historical cost of $172 and a fair value at the beginning of the year of $190.At the end of the year, the securities portfolio had a fair value of $1,330.The amount that should be recognized on the financial statements for the year as investment income is

A)$10.

B)$20.

C)$28.

D)$30.

A)$10.

B)$20.

C)$28.

D)$30.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

47

Governments should recognize revenue from donated capital assets that will be sold to support the government's programs at which amount in their government-wide financial statements?

A)historical cost to the donor.

B)book value in the hands of the donor.

C)fair value of the donated assets.

D)zero.

A)historical cost to the donor.

B)book value in the hands of the donor.

C)fair value of the donated assets.

D)zero.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following are not characterized as non-exchange revenues?

A)Sales taxes.

B)Property taxes.

C)Fines and forfeits.

D)Charges for services.

A)Sales taxes.

B)Property taxes.

C)Fines and forfeits.

D)Charges for services.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

49

A government is the recipient of a bequest of a multi-story office building that the government intends to use as a new city hall.The building has a historical cost of $850,000; a book value in the hands of the benefactor of $700,000; and a fair value of $1,050,000.The city should recognize on its governmental fund financial statements donations revenue of

A)$-0-.

B)$700,000.

C)$850,000.

D)$1,050,000.

A)$-0-.

B)$700,000.

C)$850,000.

D)$1,050,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

50

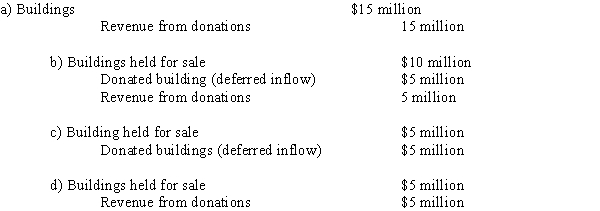

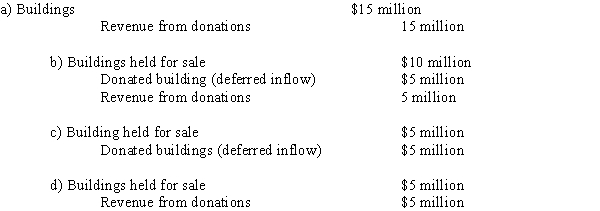

A wealthy philanthropist donates three buildings to H-Town.Each building has a fair market value of $5 million.The town plans to use Building 1 as a new fire station and sell Buildings 2 and 3. Building 2 is sold after year-end, but within the availability period.Building 3 fails to sell by the time the town issues the financial statements.Which of the following correctly records revenue from these donations in the governmental fund financial statements?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

51

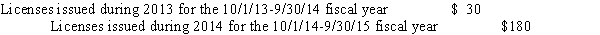

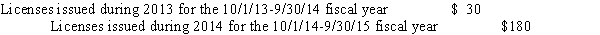

A city with a 12/31 fiscal year-end requires that restaurants buy a license, renewable yearly.Proceeds of the license fees are intended to pay the salaries of inspectors in the health department.Licenses are issued for a fiscal year from October 1 to September 30.During 2014, cash collections related to licenses were as follows  It is anticipated that during 2015 the amount collected on licenses for the 10/1/14-9/30/15 fiscal year will be $45.In September 2013 the amount collected related to 10/1/13-9/30/14 licenses was $144.What amount should be recognized as revenue in the fund financial statements for the fiscal year ended 12/31/14?

It is anticipated that during 2015 the amount collected on licenses for the 10/1/14-9/30/15 fiscal year will be $45.In September 2013 the amount collected related to 10/1/13-9/30/14 licenses was $144.What amount should be recognized as revenue in the fund financial statements for the fiscal year ended 12/31/14?

A)$180.

B)$183.

C)$210.

D)$225.

It is anticipated that during 2015 the amount collected on licenses for the 10/1/14-9/30/15 fiscal year will be $45.In September 2013 the amount collected related to 10/1/13-9/30/14 licenses was $144.What amount should be recognized as revenue in the fund financial statements for the fiscal year ended 12/31/14?

It is anticipated that during 2015 the amount collected on licenses for the 10/1/14-9/30/15 fiscal year will be $45.In September 2013 the amount collected related to 10/1/13-9/30/14 licenses was $144.What amount should be recognized as revenue in the fund financial statements for the fiscal year ended 12/31/14?A)$180.

B)$183.

C)$210.

D)$225.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

52

At the beginning of its fiscal year, a local government owned an investment with a historical cost of $85 and a fair value of $95.During the year, dividends of $2 were received.At the end of the year, the investment had a fair value of $100.The amount that should be recognized on the governmental fund financial statements for the year as investment income is

A)$-0-.

B)$7.

C)$15.

D)$17.

A)$-0-.

B)$7.

C)$15.

D)$17.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

53

Under GAAP, investment income for governments must include

A)only dividends and interest received during the period.

B)only dividends and interest earned during the period.

C)only realized gains and losses.

D)dividends and interest received during the period and both realized and unrealized gains and losses

A)only dividends and interest received during the period.

B)only dividends and interest earned during the period.

C)only realized gains and losses.

D)dividends and interest received during the period and both realized and unrealized gains and losses

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

54

A government is the recipient of a bequest of a multi-story office building that the government intends to sell to support program activities.The building has a historical cost of $850,000, a book value in the hands of the benefactor of $700,000, and a fair value of $1,050,000.The city had not yet begun to try to sell the building when its annual financial statements were issued.The city should recognize on its governmental fund financial statements, donations revenue of

A)$-0-.

B)$700,000.

C)$850,000.

D)$1,050,000.

A)$-0-.

B)$700,000.

C)$850,000.

D)$1,050,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

55

During 2014, the city issued $300 in fines for failure to keep real property in 'acceptable' condition.During that period the city spent $200 to mow and clean up the unoccupied properties for which the fines were assessed.The city estimates that $30 of the fines issued in 2014 will be uncollectible.During 2014 the city collected $230 related to 2014 fines and $20 related to 2013 fines.The amount of revenue that the city should recognize in its 2014 governmental fund financial statements related to fines is

A)$230.

B)$250.

C)$270.

D)$300.

A)$230.

B)$250.

C)$270.

D)$300.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

56

Last year a city received notice of a $150,000 grant from the state to purchase vehicles to transport physically challenged individuals.During the current year the city received the entire $150,000, purchased a bus for $65,000, and issued a purchase order for a van for $60,000.The grant revenue that the city should recognize on the government-wide financial statements in the current year is

A)$-0-.

B)$ 65,000.

C)$125,000.

D)$150,000.

A)$-0-.

B)$ 65,000.

C)$125,000.

D)$150,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following are derived tax revenues? a.Income taxes.

B)Sales taxes.

C)Both of the above.

D)Neither of the above

B)Sales taxes.

C)Both of the above.

D)Neither of the above

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

58

A city receives notice of a $150,000 grant from the state to purchase vans to transport physically challenged individuals.Although the city did not receive any of the grant funds during the current year, the city purchased a bus for $65,000 and issued a purchase order for a van for $60,000.The grant revenue that the city should recognize in the government-wide financial statements in the current year is

A)$-0-.

B)$ 65,000.

C)$125,000.

D)$150,000.

A)$-0-.

B)$ 65,000.

C)$125,000.

D)$150,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

59

Reimbursement-type grant revenues are recognized in the accounting period in which

A)the award is made.

B)the cash is received.

C)the grantee is notified of the award.

D)expenditures are recorded on grant-related activities.

A)the award is made.

B)the cash is received.

C)the grantee is notified of the award.

D)expenditures are recorded on grant-related activities.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

60

A city is the recipient of a cash bequest of $500,000 that must be used to plant flowers and shrubs in the city parks.During the year only $200,000 is actually received from the bequest and $150,000 is spent on shrubs.The amount that should be recognized as revenue by the city in its government-wide financial statements in the current year is

A)$-0-.

B)$150,000.

C)$200,000.

D)$500,000.

A)$-0-.

B)$150,000.

C)$200,000.

D)$500,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

61

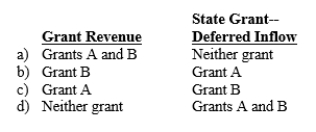

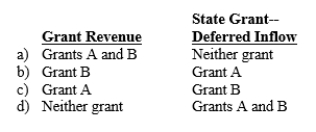

Paul City received payment of two grants from the state during its fiscal year ending September 30, 2013.Grant A can be used to cover any operating expenses incurred during fiscal 2014.Grant B can be used at any time to acquire equipment for the city's fire department.Should the city report these grants as grant revenues or deferred inflows in its government-wide financial statements for fiscal 2013?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

62

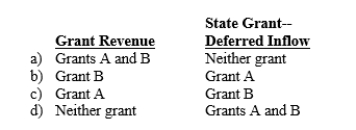

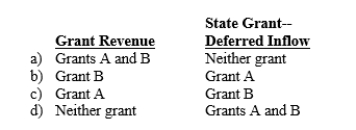

Paul City received payment of two grants from the state during its fiscal year ending September 30, 2013.Grant A can be used to cover any operating expenses incurred during fiscal 2014.Grant B can be used at any time to acquire equipment for the city's fire department.Should the city report these grants as grant revenues or deferred inflows in its governmental fund financial statements for fiscal 2013?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck