Deck 12: Tax Administration and Tax Planning

Question

Question

Question

Question

Question

Question

Question

Question

Match between columns

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

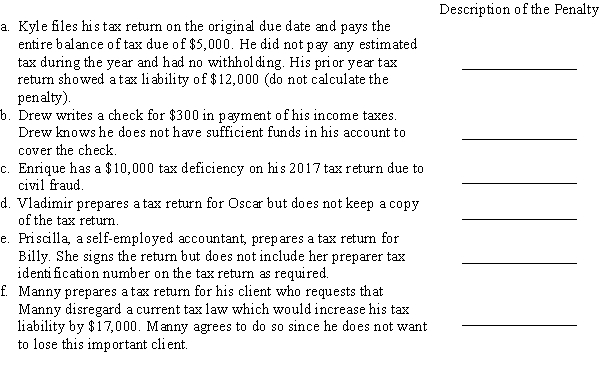

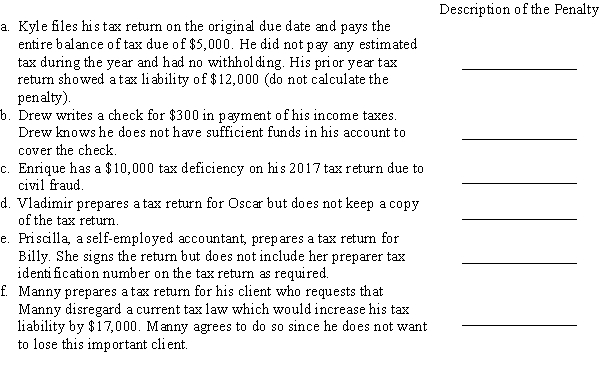

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/62

Play

Full screen (f)

Deck 12: Tax Administration and Tax Planning

1

Which of the following is not a type of IRS audit?

A)Office audit

B)Field audit

C)Correspondence audit

D)Operational audit

E)All of these are types of IRS audits

A)Office audit

B)Field audit

C)Correspondence audit

D)Operational audit

E)All of these are types of IRS audits

D

2

An "office audit" is an audit in which the revenue agent visits the taxpayer's office.

False

3

In the following independent situations, is it better to make an installment agreement with the IRS, an offer in compromise with the IRS, or ask for an extension of time to pay any taxes owed?

a. A taxpayer is unlikely to pay the tax amount they owe.

b. Using monthly payments, a taxpayer can afford to pay off the tax owed within 2 years.

c. A taxpayer can pay off their tax owed when they sell their boat which is up for sale.

a. A taxpayer is unlikely to pay the tax amount they owe.

b. Using monthly payments, a taxpayer can afford to pay off the tax owed within 2 years.

c. A taxpayer can pay off their tax owed when they sell their boat which is up for sale.

a. An offer in compromise

b. Installment agreement

c. Ask for an extension of time to pay the taxes owed

b. Installment agreement

c. Ask for an extension of time to pay the taxes owed

4

Tax returns are processed at the IRS national office in Washington, DC.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

5

At which of the following IRS locations are tax returns processed?

A)Regional offices

B)IRS Campus Processing Sites

C)Local offices

D)National office

E)None of these

A)Regional offices

B)IRS Campus Processing Sites

C)Local offices

D)National office

E)None of these

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following types of audits was suspended due to protests from taxpayers and lawmakers?

A)Discriminant Function System selected audit

B)Taxpayer Compliance Measurement Program selected audit

C)Correspondence audit

D)Office audit

E)None of these

A)Discriminant Function System selected audit

B)Taxpayer Compliance Measurement Program selected audit

C)Correspondence audit

D)Office audit

E)None of these

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

7

Taxpayers who are unable to pay their taxes may enter into a payment plan with the IRS if the amount they owe is within certain limits.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

8

Match between columns

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

9

A "correspondence audit" by the IRS is conducted through the mail.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

10

The Wage and Investment Office of the IRS handles small business taxpayers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

11

Taxpayers are required by law to maintain records to facilitate an IRS audit.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is not a possible result of an audit by the IRS?

A)Payment of a refund to the taxpayer

B)Payment of a deficiency by the taxpayer

C)An appeal

D)No change in the liability

E)All of these are possible results

A)Payment of a refund to the taxpayer

B)Payment of a deficiency by the taxpayer

C)An appeal

D)No change in the liability

E)All of these are possible results

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

13

As a result of an IRS audit, a taxpayer may be required to pay additional taxes, but he or she is never paid a refund.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

14

If a taxpayer makes all of his income from his job and various investments, which office of the IRS would likely investigate his return if it were audited?

A)Wage & Investment Division (W&I)

B)Large & Midsize Business Office

C)Small Business Office

D)Criminal Investigation Office

E)None of these offices would perform the audit

A)Wage & Investment Division (W&I)

B)Large & Midsize Business Office

C)Small Business Office

D)Criminal Investigation Office

E)None of these offices would perform the audit

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

15

The Discriminant Function System is designed to identify tax returns that may contain errors.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

16

Tax returns selected for most audits are selected by the Discriminant Function System.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

17

The IRS may issue summons for a taxpayer's bank account records.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

18

The tax law is administered by the Federal Trade Commission.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is the most common type of audit for an individual taxpayer?

A)Office audit

B)Telephone audit

C)Correspondence audit

D)Field audit

E)None of these

A)Office audit

B)Telephone audit

C)Correspondence audit

D)Field audit

E)None of these

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

20

A tax return with a large casualty loss would be most likely selected for audit through:

A)The Discriminant Function System

B)Information from an informant

C)Information from another governmental agency

D)The Taxpayer Compliance Measurement Program

E)None of these

A)The Discriminant Function System

B)Information from an informant

C)Information from another governmental agency

D)The Taxpayer Compliance Measurement Program

E)None of these

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

21

The tax law contains a penalty for filing a "frivolous" tax return.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

22

A taxpayer made estimated tax payments in excess of the tax due for the year, but failed to file a tax return. Since the taxes were paid in full, would there be a failure-to-file penalty?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

23

Janet did not file her tax return or pay her taxes for 2018 until November of 2019. She paid the following amounts to the IRS related to the late filing and payment of tax:  What amount of the above items may be deducted on Janet's 2019 individual income tax return? Explain.

What amount of the above items may be deducted on Janet's 2019 individual income tax return? Explain.

What amount of the above items may be deducted on Janet's 2019 individual income tax return? Explain.

What amount of the above items may be deducted on Janet's 2019 individual income tax return? Explain.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

24

Craig commits fraud on his tax return. It is found that he was $40,000 deficient in his tax because of the fraud. What would his penalty be?

A)$500

B)$30,000

C)$40,000

D)$0

A)$500

B)$30,000

C)$40,000

D)$0

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

25

If a taxpayer has too much income tax withheld from his salary during the tax year, the IRS will pay interest on the excess amount.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following will not affect the statute of limitations on a tax return?

A)Omission of a significant amount of gross income

B)Mutual consent of the IRS and the taxpayer

C)Failure to pay the tax due with the tax return

D)Failure to file a tax return

E)Filing a fraudulent tax return

A)Omission of a significant amount of gross income

B)Mutual consent of the IRS and the taxpayer

C)Failure to pay the tax due with the tax return

D)Failure to file a tax return

E)Filing a fraudulent tax return

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

27

What type of audit (office, field or correspondence) is demonstrated in the following examples?

a. An IRS agent views Microsoft's books and records at the Microsoft headquarters.

b. Susie receives a letter from the IRS asking her to provide documentation to support her charitable contributions on her tax return filed in the prior year.

c. Mr. and Mrs. John Doe are asked to bring their supporting documents to the downtown IRS office so that an IRS agent may review their tax return which was filed 2 years ago.

a. An IRS agent views Microsoft's books and records at the Microsoft headquarters.

b. Susie receives a letter from the IRS asking her to provide documentation to support her charitable contributions on her tax return filed in the prior year.

c. Mr. and Mrs. John Doe are asked to bring their supporting documents to the downtown IRS office so that an IRS agent may review their tax return which was filed 2 years ago.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

28

Mike deducts a bad debt on his 2019 tax return. How many years is the statute of limitations for the bad debt deduction?

A)Zero

B)3 years

C)6 years

D)7 years

E)No limit

A)Zero

B)3 years

C)6 years

D)7 years

E)No limit

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

29

List three different ways that a tax return may be selected for an audit.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

30

The IRS determined that John underpaid his 2017 tax liability by $6,000 due to negligence. In 2019, John pays $1,000 of interest related to the underpayment and the full amount of any penalties assessed by the IRS.

a.Calculate the amount of the accuracy-related penalty that could be assessed by the IRS in this situation.

b.What part of the deficiency, income taxes, interest, and penalty, is deductible by John on his current tax return? Explain.

a.Calculate the amount of the accuracy-related penalty that could be assessed by the IRS in this situation.

b.What part of the deficiency, income taxes, interest, and penalty, is deductible by John on his current tax return? Explain.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

31

If a calendar year taxpayer's 2019 individual income tax return is mailed on June 15, 2020, the statute of limitations would normally run out on:

A)June 15, 2022

B)June 15, 2023

C)April 15, 2022

D)April 15, 2023

E)None of these

A)June 15, 2022

B)June 15, 2023

C)April 15, 2022

D)April 15, 2023

E)None of these

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is the calculation of the failure-to-file penalties?

A)Half of 1 percent (0.5 percent) of the tax due for each month late, limited to 25 percent of the taxes due

B)5 percent of the tax due for each quarter late, limited to 25 percent of the taxes due

C)5 percent of the tax due for each month or part of the month that it is late, limited to 25 percent of the taxes due

D)20 percent of the tax due

E)5 percent of the tax due

A)Half of 1 percent (0.5 percent) of the tax due for each month late, limited to 25 percent of the taxes due

B)5 percent of the tax due for each quarter late, limited to 25 percent of the taxes due

C)5 percent of the tax due for each month or part of the month that it is late, limited to 25 percent of the taxes due

D)20 percent of the tax due

E)5 percent of the tax due

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

33

Linda filed her individual income tax return on its due date but failed to pay $1,000 in taxes that were due with the return. Linda promptly paid the taxes upon receipt of a notice and demand for payment. If Linda pays the taxes exactly 5 months late, calculate the amount of her failure-to-pay penalty.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is false regarding the return audit process?

A)The higher DIF score a return gets, the higher the likelihood for audit.

B)An office audit is performed at an IRS office.

C)25 percent of taxpayers are audited every year.

D)None of these is false.

A)The higher DIF score a return gets, the higher the likelihood for audit.

B)An office audit is performed at an IRS office.

C)25 percent of taxpayers are audited every year.

D)None of these is false.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

35

The statute of limitations for a tax return generally is 3 years.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

36

For each of the following situations, indicate the nature and amount of the penalty that could be imposed. (The penalties include both tax practitioner penalties and taxpayer penalties).

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

37

The IRS charges a fixed 10 percent interest rate on underpayments of taxes.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

38

Tax penalties are not deductible by taxpayers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

39

Interest paid on an underpayment of taxes (other than an underpayment of estimated taxes) is not subject to the consumer interest limitation.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

40

The statute of limitations for the deduction of a worthless security is 5 years.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

41

All paid tax return preparers must sign up with the IRS and obtain a preparer tax identification number.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

42

Tax return preparers must enter the annual filing season program (AFSP).

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following is the best definition of tax planning?

A)Preparing a client's tax return

B)Planning taxpayers' financial affairs in an effort to minimize tax liability

C)Planning taxpayers' financial affairs to find the best way to avoid tax by successfully bending tax law

D)Researching complex tax issues

E)None of these is considered tax planning

A)Preparing a client's tax return

B)Planning taxpayers' financial affairs in an effort to minimize tax liability

C)Planning taxpayers' financial affairs to find the best way to avoid tax by successfully bending tax law

D)Researching complex tax issues

E)None of these is considered tax planning

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following taxpayers will benefit most in terms of dollars saved as a result of tax planning to reduce taxes?

A)An individual taxpayer who has a marginal tax rate of 32 percent.

B)An individual taxpayer who has an average tax rate of 32 percent.

C)An individual taxpayer who has a marginal tax rate of 24 percent.

D)The taxpayers in a and b will benefit equally.

E)None of these.

A)An individual taxpayer who has a marginal tax rate of 32 percent.

B)An individual taxpayer who has an average tax rate of 32 percent.

C)An individual taxpayer who has a marginal tax rate of 24 percent.

D)The taxpayers in a and b will benefit equally.

E)None of these.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

45

Kendall is considering the purchase of a home. He has saved $22,000 for a down payment on a home and will finance the remainder of the purchase price with a home mortgage loan. Kendall currently rents an apartment for $1,200 per month and does not anticipate an increase in his monthly income. He wants to make sure that the monthly payment on his new home does not exceed $1,200, after-tax. Kendall has a marginal tax rate of 25 percent and an average tax rate of 22 percent. Assuming the monthly mortgage payment (before-tax) will be equal to 1 percent of the initial mortgage balance and the entire amount of each monthly payment will be deductible home mortgage interest, what is the maximum amount that Kendall can spend on a new home?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following statements best describes the purpose of the Taxpayer Bill of Rights?

A)To provide the IRS with additional enforcement powers

B)To grant to taxpayers the right to choose the time and method of payment of delinquent taxes

C)To inform taxpayers of their rights in dealing with the IRS

D)To inform taxpayers of the methods for properly completing their income tax returns

E)None of these

A)To provide the IRS with additional enforcement powers

B)To grant to taxpayers the right to choose the time and method of payment of delinquent taxes

C)To inform taxpayers of their rights in dealing with the IRS

D)To inform taxpayers of the methods for properly completing their income tax returns

E)None of these

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

47

For the following independent situations, list who (the IRS, the taxpayer, the party who initiates the case, or both sides) has the burden of proof in most civil tax cases:

a. The tax case involves a penalty.

b. The tax case involves a trust with net worth of $8.3 million.

c. The taxpayer has credible evidence, maintains records, and cooperates with reasonable IRS requests.

d. The IRS uses statistics to reconstruct an individual's income.

a. The tax case involves a penalty.

b. The tax case involves a trust with net worth of $8.3 million.

c. The taxpayer has credible evidence, maintains records, and cooperates with reasonable IRS requests.

d. The IRS uses statistics to reconstruct an individual's income.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

48

A tax preparer may be subject to a penalty for failing to provide a copy of the taxpayer's tax return to the client.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

49

Patricia has taxable income of $40,000 on which she pays income tax of $4,664. If Patricia's taxable income increases by $2,000, she will pay an additional tax of $440. What is Patricia's marginal tax rate?

A)15.00 percent

B)14.84 percent

C)22.00 percent

D)25.00 percent

E)None of these

A)15.00 percent

B)14.84 percent

C)22.00 percent

D)25.00 percent

E)None of these

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

50

What are the requirements that an unenrolled preparer needs to do in order to participate in the Annual Filing Season Program?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

51

The Taxpayer Bill of Rights is summarized in IRS Publication 1.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

52

A taxpayer with an average tax rate of 20 percent who receives additional income of $20,000 will pay additional taxes of $4,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following statements is the most correct regarding The Taxpayer Bill of Rights?

A)It directs taxpayers to other IRS publications with more details on specific taxpayer rights.

B)It explains the examination, appeal, collection, and refund process.

C)It states that a taxpayer is responsible for payment of only the correct amount of tax due, no more, no less.

D)All of these statements are correct.

E)None of these statements are correct.

A)It directs taxpayers to other IRS publications with more details on specific taxpayer rights.

B)It explains the examination, appeal, collection, and refund process.

C)It states that a taxpayer is responsible for payment of only the correct amount of tax due, no more, no less.

D)All of these statements are correct.

E)None of these statements are correct.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

54

Stephanie has taxable income of $48,200 and a tax liability of $6,468. If Stephanie's income increases by $4,000, her tax liability will be $7,348.

a. What is her average tax rate on the $48,200 of income?

b. What is her marginal tax rate?

a. What is her average tax rate on the $48,200 of income?

b. What is her marginal tax rate?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following statements best describes the process of tax planning?

A)Tax planning is equivalent to tax evasion.

B)Tax planning is the avoidance of "tax traps."

C)Tax planning is the process of arranging one's financial affairs to minimize one's overall tax liability.

D)Tax planning is the deferral of tax on income.

E)Tax planning is the calculation of a taxpayer's marginal rate of tax.

A)Tax planning is equivalent to tax evasion.

B)Tax planning is the avoidance of "tax traps."

C)Tax planning is the process of arranging one's financial affairs to minimize one's overall tax liability.

D)Tax planning is the deferral of tax on income.

E)Tax planning is the calculation of a taxpayer's marginal rate of tax.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following is not a preparer penalty?

A)Tax preparers may be assessed a penalty for failing to give the taxpayer the preparer's workpapers.

B)Tax preparers may be assessed a penalty for failing to keep a copy of the prepared return.

C)Tax preparers may be assessed a penalty for endorsing or cashing a refund check issued to a taxpayer.

D)Tax preparers may be assessed a penalty for failing to sign a tax return.

A)Tax preparers may be assessed a penalty for failing to give the taxpayer the preparer's workpapers.

B)Tax preparers may be assessed a penalty for failing to keep a copy of the prepared return.

C)Tax preparers may be assessed a penalty for endorsing or cashing a refund check issued to a taxpayer.

D)Tax preparers may be assessed a penalty for failing to sign a tax return.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

57

Tax evasion involves the use of illegal methods to reduce or avoid income tax.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

58

Tax practitioners can be assessed a penalty for promoting an abusive tax shelter.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

59

A taxpayer's average tax rate is determined by dividing the total tax paid by the total income of the taxpayer.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

60

Indicate the date that the statute of limitations would run out on the following situations:

a. The IRS assesses additional taxes for a 2017 tax return audit on May 5, 2019. How long does the IRS have to collect the tax?

b. On April 1, 2019, the IRS asks for and the taxpayer agrees to an additional year from April 1, 2019 to complete an audit for a 2015 tax return which was filed on March 9, 2016.

c. Jeremy reported $10,000 of worthless debt on his 2018 tax return which he filed on August 3, 2019.

d. Jenny files her 2019 tax return on February 25, 2020.

e. James omits 7 percent of his income on his 2017 tax return which he filed on July 12, 2018.

a. The IRS assesses additional taxes for a 2017 tax return audit on May 5, 2019. How long does the IRS have to collect the tax?

b. On April 1, 2019, the IRS asks for and the taxpayer agrees to an additional year from April 1, 2019 to complete an audit for a 2015 tax return which was filed on March 9, 2016.

c. Jeremy reported $10,000 of worthless debt on his 2018 tax return which he filed on August 3, 2019.

d. Jenny files her 2019 tax return on February 25, 2020.

e. James omits 7 percent of his income on his 2017 tax return which he filed on July 12, 2018.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following is not a characteristic around which tax planning is organized:

A)Jurisdiction

B)Timing

C)Entity

D)Character

E)All of these

A)Jurisdiction

B)Timing

C)Entity

D)Character

E)All of these

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

62

What is the difference between tax avoidance and tax evasion?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck