Deck 1: The Individual Income Tax Return

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/114

Play

Full screen (f)

Deck 1: The Individual Income Tax Return

1

Married taxpayers may double their standard deduction amount by filing separate returns.

False

2

Which one of the following provisions was passed by Congress to meet a social goal of the tax law?

A)The deduction for job hunting expenses.

B)The charitable deduction.

C)The moving expense deduction for adjusted gross income.

D)The deduction for soil and water conservation costs available to farmers.

E)None of these.

A)The deduction for job hunting expenses.

B)The charitable deduction.

C)The moving expense deduction for adjusted gross income.

D)The deduction for soil and water conservation costs available to farmers.

E)None of these.

B

3

A corporation is a reporting entity but not a tax-paying entity.

False

4

In 2019, Wesley has a fairly simple tax situation with moderate wage income and a modest amount of interest income. Wesley, age 45, wishes to use the easiest possible tax form. He may file:

A)Form 1040EZ

B)Form 1040A

C)Form 1040

D)Form 1065

E)None of these

A)Form 1040EZ

B)Form 1040A

C)Form 1040

D)Form 1065

E)None of these

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is correct?

A)An individual is a reporting entity but not a taxable entity.

B)A partnership is a taxable entity and a reporting entity.

C)A corporation is a reporting entity but not a taxable entity.

D)A partnership is a reporting entity but not a taxable entity.

A)An individual is a reporting entity but not a taxable entity.

B)A partnership is a taxable entity and a reporting entity.

C)A corporation is a reporting entity but not a taxable entity.

D)A partnership is a reporting entity but not a taxable entity.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is not considered one of the five basic taxable or reporting entities?

A)Partnership

B)Corporation

C)Portfolio

D)Individual

E)Trust

A)Partnership

B)Corporation

C)Portfolio

D)Individual

E)Trust

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

7

Mark a "Yes" to each of the following if it is an objective of the tax code. Otherwise mark with a "No."

a. To provide a car to each American.

b. To promote giving to charities.

c. To encourage taxpayers to send their children to college.

d. To raise money to operate the government.

e. To promote the use of solar energy.

a. To provide a car to each American.

b. To promote giving to charities.

c. To encourage taxpayers to send their children to college.

d. To raise money to operate the government.

e. To promote the use of solar energy.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is not a goal of the tax law?

A)Encouraging certain social goals such as contributions to charity.

B)Encouraging certain economic goals such as a thriving business community.

C)Encouraging smaller families.

D)Raising revenue to operate the government.

E)None of these are goals of the tax law.

A)Encouraging certain social goals such as contributions to charity.

B)Encouraging certain economic goals such as a thriving business community.

C)Encouraging smaller families.

D)Raising revenue to operate the government.

E)None of these are goals of the tax law.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

9

List two general objectives of the tax code.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

10

In 2019, Schedule 1 of Form 1040 is used to report:

A)Salary income.

B)Capital gains and losses.

C)Withholding on wages.

D)Unemployment compensation.

A)Salary income.

B)Capital gains and losses.

C)Withholding on wages.

D)Unemployment compensation.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

11

An item is not included in gross income unless the tax law specifies that the item is subject to taxation.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

12

Distinguish between reporting entities and taxable entities and give examples of each.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

13

Partnership income is reported on:

A)Form 1040PTR.

B)Form 1120S.

C)Form 1040X.

D)Form 1065.

A)Form 1040PTR.

B)Form 1120S.

C)Form 1040X.

D)Form 1065.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

14

The US federal tax law's sole purpose is to raise revenue.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following forms may be filed by individual taxpayers?

A)Form 1040

B)Form 1041

C)Form 1065

D)Form 1120

E)None of these

A)Form 1040

B)Form 1041

C)Form 1065

D)Form 1120

E)None of these

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is not a goal of the tax law?

A)Ensuring that all persons pay the same amount of tax.

B)Economic goals such as reduction in unemployment.

C)Social goals such as lowering the cost of adoption.

D)Raise adequate revenue to operate the government.

A)Ensuring that all persons pay the same amount of tax.

B)Economic goals such as reduction in unemployment.

C)Social goals such as lowering the cost of adoption.

D)Raise adequate revenue to operate the government.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

17

Partnership capital gains and losses are allocated separately to each of the partners.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

18

In 2019, depending on the amounts of income and other tax information, some individuals may report their income on:

A)Form 1040A.

B)Form 1065.

C)Form 1120.

D)Form 1041.

E)None of these.

A)Form 1040A.

B)Form 1065.

C)Form 1120.

D)Form 1041.

E)None of these.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

19

For taxpayers who do not itemize deductions, the standard deduction amount is subtracted from the taxpayer's adjusted gross income.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

20

Partnerships:

A)Are not taxable entities.

B)Are taxed in the same manner as individuals.

C)File tax returns on Form 1120.

D)File tax returns on Form 1041.

A)Are not taxable entities.

B)Are taxed in the same manner as individuals.

C)File tax returns on Form 1120.

D)File tax returns on Form 1041.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

21

Eugene and Velma are married. For 2019, Eugene earned $25,000 and Velma earned $30,000. They have decided to file separate returns. They have no deductions for adjusted gross income. Velma's itemized deductions are $14,200 so she is going to itemize. Eugene's itemized deductions are $4,000. Assuming Eugene and Velma do not live in a community property state, what is Eugene's taxable income?

A)$18,000

B)$12,800

C)$21,000

D)$26,000

E)None of these

A)$18,000

B)$12,800

C)$21,000

D)$26,000

E)None of these

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

22

In 2019, Len has a salary of $40,700 from his job. He also has interest income of $400. Len is single and has no dependents. During the year, Len sold stock held as an investment for a $10,000 loss. Calculate the following amounts for Len:

a.Adjusted gross income

b.Standard deduction

c.Taxable income

d.Tax liability

e.Explain the tax treatment of the loss from the stock sale

a.Adjusted gross income

b.Standard deduction

c.Taxable income

d.Tax liability

e.Explain the tax treatment of the loss from the stock sale

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

23

What is the difference between the standard deduction and itemized deductions?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

24

Eugene and Velma are married. For 2019, Eugene earned $25,000 and Velma earned $30,000. They have decided to file separate returns. They have no deductions for adjusted gross income. Eugene's itemized deductions are $14,200 and Velma's are $4,000. Assuming Eugene and Velma do not live in a community property state and Eugene deducts the greater of the standard deduction or itemized deductions, what is Eugene's taxable income?

A)$10,800

B)$18,000

C)$1,000

D)$21,000

E)None of these

A)$10,800

B)$18,000

C)$1,000

D)$21,000

E)None of these

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

25

A single taxpayer, who is not a dependent on another's return, not blind and under age 65, with income of $11,750 must file a tax return.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

26

Hansel and Gretel are married taxpayers who file a joint income tax return for 2019. They have no dependents. On their 2019 income tax return, they have adjusted gross income of $62,000 and total itemized deductions of $4,000. What is their taxable income?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

27

George, age 67, and Linda, age 60, are married taxpayers with three dependent children. Their adjusted gross income for the 2019 tax year is $142,000. They have itemized deductions of $24,600. Determine the following for their joint tax return for 2019:

a.Exemption deduction amount

b.The greater of the amount of their standard deduction or their itemized deductions

c.Taxable income

a.Exemption deduction amount

b.The greater of the amount of their standard deduction or their itemized deductions

c.Taxable income

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

28

Steven, age 35 and single, is a commodities broker. His salary for 2019 is $111,500 and he has taxable interest income of $40,000. He has no deductions for adjusted gross income. His itemized deductions are $31,000. Steven does not have any dependents.

a. What is the amount of his adjusted gross income?

b. What are his allowable itemized deductions?

c. What is his deduction for personal exemptions?

d. What is his taxable income?

e. What is his regular tax liability from the tax rate schedules?

a. What is the amount of his adjusted gross income?

b. What are his allowable itemized deductions?

c. What is his deduction for personal exemptions?

d. What is his taxable income?

e. What is his regular tax liability from the tax rate schedules?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

29

A dependent child with earned income in excess of the available standard deduction amount must file a tax return.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

30

An individual is a head of household. What is her standard deduction?

A)$12,200

B)$24,400

C)$18,350

D)$18,000

E)None of these

A)$12,200

B)$24,400

C)$18,350

D)$18,000

E)None of these

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

31

A taxpayer with self-employment income of $600 must file a tax return.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

32

Nathan is 24 years old, single, and works as an accountant in a salmon cannery in Alaska. His total wages for 2019 were $32,000. Federal income tax of $4,500 was withheld from his wages. His only other income was $260 of interest and he had no deductible expenses.

Calculate the income tax due or income tax refund on Nathan's 2019 individual income tax return. Use the tax formula for individuals and show your work.

Calculate the income tax due or income tax refund on Nathan's 2019 individual income tax return. Use the tax formula for individuals and show your work.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

33

Theodore, age 74, and Maureen, age 59, are married taxpayers with two dependents. Their adjusted gross income for the 2019 tax year is $43,600, and they have itemized deductions of $7,800. Determine the following for Theodore and Maureen's 2019 income tax return:

a.The greater of the amount of their standard deduction or their itemized deductions

b.Their taxable income

a.The greater of the amount of their standard deduction or their itemized deductions

b.Their taxable income

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

34

Roger, age 39, and Lucy, age 37, are married taxpayers who file a joint income tax return for 2019. They have gross income of $26,100. Their deductions for adjusted gross income are $550 and they have itemized deductions of $5,400. If Roger and Lucy have no dependents for 2019, calculate the following amounts:

a.Their adjusted gross income

b.The greater of the amount of their standard deduction or their itemized deductions

c.Their taxable income

a.Their adjusted gross income

b.The greater of the amount of their standard deduction or their itemized deductions

c.Their taxable income

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

35

Oscar and Mary have no dependents and file a joint income tax return for 2019. They have adjusted gross income (all wages) of $140,000 and itemized deductions of $30,000. What is the amount of taxable income that Oscar and Mary must report on their 2019 income tax return?

A)$116,000

B)$93,600

C)$102,000

D)$110,000

E)$140,000

A)$116,000

B)$93,600

C)$102,000

D)$110,000

E)$140,000

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

36

Kenzie is a research scientist in Tallahassee, Florida. Her spouse Gary stays home to take care of their house and two dogs. Kenzie's total wages for 2019 were $60,500 from which $5,900 of federal income tax was withheld.

Calculate the income tax due or income tax refund on Kenzie and Gary's 2019 individual income tax return. Use the tax formula for individuals and show your work.

Calculate the income tax due or income tax refund on Kenzie and Gary's 2019 individual income tax return. Use the tax formula for individuals and show your work.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

37

What is the formula for computing taxable income, as summarized in the text?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

38

Barry is age 45 and a single taxpayer. In 2019, he has gross income of $17,000 and itemized deductions of $6,500. If Barry claims no dependents on his 2019 income tax return, calculate the following amounts:

a.His personal exemption amount

b.Barry's taxable income

a.His personal exemption amount

b.Barry's taxable income

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

39

Rod, age 50, and Ann, age 49, are married taxpayers who file a joint return for 2019. They have gross income of $150,700. Their deductions for adjusted gross income are $5,100 and they have itemized deductions of $18,000, consisting of $10,000 in state income taxes and $8,000 in mortgage interest expense. If they have no dependents for 2019, calculate the following amounts:

a. Their adjusted gross income

b. The greater of the amount of their standard deduction or their itemized deductions

c. Their taxable income

a. Their adjusted gross income

b. The greater of the amount of their standard deduction or their itemized deductions

c. Their taxable income

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

40

Mary is age 33 and a single taxpayer with adjusted gross income for 2019 of $29,400. Mary maintains a home for three dependent children and has itemized deductions of $3,000. Calculate the following amounts for Mary's 2019 income tax return:

a.Mary's standard or itemized deduction amount

b.Mary's taxable income

a.Mary's standard or itemized deduction amount

b.Mary's taxable income

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

41

In which of the following situations is the taxpayer not required to file a 2019 income tax return?

A)When an individual has a current year income tax refund and would like to obtain it.

B)When the taxpayer is a single 67-year-old with wages of $9,800.

C)When the taxpayer is a 35-year-old head of household with wages of $18,900.

D)When the taxpayer is a 69-year-old widow (spouse died 3 years ago) with wages of $16,500 and no dependents.

E)When the taxpayers are a married couple with both spouses under 65 years old with wages of $26,000.

A)When an individual has a current year income tax refund and would like to obtain it.

B)When the taxpayer is a single 67-year-old with wages of $9,800.

C)When the taxpayer is a 35-year-old head of household with wages of $18,900.

D)When the taxpayer is a 69-year-old widow (spouse died 3 years ago) with wages of $16,500 and no dependents.

E)When the taxpayers are a married couple with both spouses under 65 years old with wages of $26,000.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

42

A taxpayer who is living alone, is legally separated from his or her spouse under a separate maintenance decree at year-end, and has no dependents should file as single.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

43

If taxpayers are married and living together at the end of the year, they must file a joint tax return.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

44

Taxpayers who do not qualify for married, head of household, or qualifying widow or widower filing status must file as single.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

45

During 2019, Murray, who is 60 years old and unmarried, provided all of the support of his elderly mother. His mother was a resident of a home for the aged for the entire year and had no income. What is Murray's filing status for 2019, and how many dependents should he report on his tax return?

A)Head of household and 1 dependent

B)Single and 2 dependents

C)Head of household and 2 dependents

D)Single and 1 dependent

E)None of these

A)Head of household and 1 dependent

B)Single and 2 dependents

C)Head of household and 2 dependents

D)Single and 1 dependent

E)None of these

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

46

Taxpayers with self-employment income of $400 or more must file a tax return.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

47

A married person with a dependent child may choose to file as head of household if it reduces his or her tax liability.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

48

Jeri is single and supports her 45-year-old son who has income of $350 from working in a pumpkin patch during October and lives in his own apartment.

a. Can she claim him as a dependent?

b. Can she claim head of household filing status? Why or why not?

a. Can she claim him as a dependent?

b. Can she claim head of household filing status? Why or why not?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

49

Monica is a maid in a San Francisco hotel. Monica received $500 in unreported tips during 2019 and owes Social Security and Medicare taxes on these tips. Her total income for the year, including tips, is $4,500. Is Monica required to file an income tax return for 2019?

Why?

Why?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

50

If a taxpayer is due a refund, it will be mailed to the taxpayer regardless of whether he or she files a tax return.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

51

All taxpayers may use the tax rate schedule to determine their tax liability.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

52

The head of household tax rates are higher than the rates for a single taxpayer.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

53

A taxpayer who maintains a household with an unmarried child may qualify to file as head of household even if the child is not the taxpayer's dependent.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

54

John, 45 years old and unmarried, contributed $1,000 monthly in 2019 to the support of his parents' household. The parents lived alone and their income for 2019 consisted of $500 from dividends and interest. What is John's filing status and how many dependents should he claim on his 2019 tax return?

A)Single and no dependents

B)Head of household and no dependents

C)Single and 2 dependents

D)Head of household and 2 dependents

E)None of these

A)Single and no dependents

B)Head of household and no dependents

C)Single and 2 dependents

D)Head of household and 2 dependents

E)None of these

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following taxpayers does not have to file a tax return for 2019?

A)A single taxpayer who is under age 65, with income of $13,500.

B)Married taxpayers (ages 45 and 50 years), filing jointly, with income of $26,000.

C)A student, age 22, with unearned income of $2,500 who is claimed as a dependent by her parents.

D)A qualifying widow (age 67) with a dependent child and income of $18,800.

E)All of these are correct.

A)A single taxpayer who is under age 65, with income of $13,500.

B)Married taxpayers (ages 45 and 50 years), filing jointly, with income of $26,000.

C)A student, age 22, with unearned income of $2,500 who is claimed as a dependent by her parents.

D)A qualifying widow (age 67) with a dependent child and income of $18,800.

E)All of these are correct.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

56

Most states are community property states.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

57

If an unmarried taxpayer paid more than half the cost of keeping a home which is the principal place of residence of a nephew, who is not her dependent, she may use the head of household filing status.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

58

The maximum official individual income tax rate for 2019 is 39.6 percent, not including the Medicare surtax on net investment income.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

59

If your spouse dies during the tax year and you do not remarry, you must file as single for the year of death.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

60

All of the following factors are important in determining whether an individual is required to file an income tax return, except:

A)The taxpayer's filing status.

B)The taxpayer's gross income.

C)The taxpayer's total itemized deductions.

D)The availability of the additional standard deduction for taxpayers who are elderly.

E)None of these.

A)The taxpayer's filing status.

B)The taxpayer's gross income.

C)The taxpayer's total itemized deductions.

D)The availability of the additional standard deduction for taxpayers who are elderly.

E)None of these.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

61

Match the letter of the filing status to the taxpayers below. Items may be used more than once.

a.Single

b.Married filing a joint return

c.Married filing separate returns

d.Head of household

e.Qualifying widow(er)

f.Married filing joint or married filing separate

The taxpayer is unmarried and is living with his girlfriend.

a.Single

b.Married filing a joint return

c.Married filing separate returns

d.Head of household

e.Qualifying widow(er)

f.Married filing joint or married filing separate

The taxpayer is unmarried and is living with his girlfriend.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

62

Norman and Linda are married taxpayers with taxable income of $126,000 in 2019.

a. When you calculate their tax liability are you required to use the tax tables or the tax rate schedules, or does it matter?

b. What is their tax liability?

a. When you calculate their tax liability are you required to use the tax tables or the tax rate schedules, or does it matter?

b. What is their tax liability?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

63

Match the letter of the filing status to the taxpayers below. Items may be used more than once.

a.Single

b.Married filing a joint return

c.Married filing separate returns

d.Head of household

e.Qualifying widow(er)

f.Married filing joint or married filing separate

The taxpayer's husband died last year. Her 13-year-old dependent daughter lives with her.

a.Single

b.Married filing a joint return

c.Married filing separate returns

d.Head of household

e.Qualifying widow(er)

f.Married filing joint or married filing separate

The taxpayer's husband died last year. Her 13-year-old dependent daughter lives with her.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

64

During 2019, Howard maintained his home in which he and his 16-year-old son resided. The son qualifies as his dependent. Howard's wife died in 2018. What is his filing status for 2019?

A)Single

B)Head of household

C)Married, filing separately

D)Qualifying widow(er)

E)None of these

A)Single

B)Head of household

C)Married, filing separately

D)Qualifying widow(er)

E)None of these

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

65

Alan, whose wife died in 2017, filed a joint tax return for 2017. He did not remarry and continues to maintain his home in which his four dependent children live. In the preparation of his tax return for 2019, Alan should file as:

A)Single

B)Qualifying widow(er)

C)Head of household

D)Married, filing separately

E)None of these

A)Single

B)Qualifying widow(er)

C)Head of household

D)Married, filing separately

E)None of these

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

66

Robert is a single taxpayer who has AGI of $145,000 in 2019; his taxable income is $122,000. What is his federal tax liability for 2019?

A)$18,719.00

B)$9,480.00

C)$23,569.50

D)$23,454.50

E)$29,280.00

A)$18,719.00

B)$9,480.00

C)$23,569.50

D)$23,454.50

E)$29,280.00

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

67

List each alternative filing status available to unmarried individual taxpayers.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

68

Madeline is single and supports her 85-year-old parents who live in a senior home paid for by Madeline and have no income. What is Madeline's filing status and why?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

69

An individual, age 22, enrolled on a full-time basis at a college, is considered a student for purposes of determining whether a dependency exemption is permitted.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

70

Match the letter of the filing status to the taxpayers below. Items may be used more than once.

a.Single

b.Married filing a joint return

c.Married filing separate returns

d.Head of household

e.Qualifying widow(er)

f.Married filing joint or married filing separate

The taxpayer is married, but her husband disappeared with a girlfriend while on vacation in March of the current year. The taxpayer has no dependents.

a.Single

b.Married filing a joint return

c.Married filing separate returns

d.Head of household

e.Qualifying widow(er)

f.Married filing joint or married filing separate

The taxpayer is married, but her husband disappeared with a girlfriend while on vacation in March of the current year. The taxpayer has no dependents.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

71

Irma, widowed in 2018, pays all costs related to the home in which she and her unmarried son live. Her son does not qualify as her dependent. What is her filing status for 2019?

A)Single

B)Married, filing separate

C)Head of household

D)Qualifying widow(er)

E)None of these

A)Single

B)Married, filing separate

C)Head of household

D)Qualifying widow(er)

E)None of these

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

72

Match the letter of the filing status to the taxpayers below. Items may be used more than once.

a.Single

b.Married filing a joint return

c.Married filing separate returns

d.Head of household

e.Qualifying widow(er)

f.Married filing joint or married filing separate

The taxpayer who is unmarried legally adopted a child who lives with her.

a.Single

b.Married filing a joint return

c.Married filing separate returns

d.Head of household

e.Qualifying widow(er)

f.Married filing joint or married filing separate

The taxpayer who is unmarried legally adopted a child who lives with her.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

73

Match the letter of the filing status to the taxpayers below. Items may be used more than once.

a.Single

b.Married filing a joint return

c.Married filing separate returns

d.Head of household

e.Qualifying widow(er)

f.Married filing joint or married filing separate

After living together for 6 months, the couple married on December 31.

a.Single

b.Married filing a joint return

c.Married filing separate returns

d.Head of household

e.Qualifying widow(er)

f.Married filing joint or married filing separate

After living together for 6 months, the couple married on December 31.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

74

A dependent that dies during the tax year may still qualify as a dependent.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

75

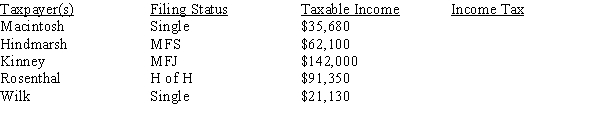

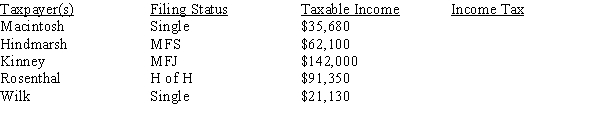

Determine from the tax table or the tax rate schedule, whichever is appropriate, the amount of the income tax for each of the following taxpayers for 2019.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

76

John, age 25, is a full-time student at a state university. John lives with his unmarried sister, Ann, who provides over half of his support. His only income is $4,300 of wages from a part-time job at the college book store. What is Ann's filing status for 2019?

A)Single

B)Head of household

C)Married, filing separately

D)Qualifying widow(er)

E)None of these

A)Single

B)Head of household

C)Married, filing separately

D)Qualifying widow(er)

E)None of these

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

77

An unmarried taxpayer who maintains a household for a dependent child and whose spouse died four years ago should file as:

A)Single

B)Head of household

C)Qualifying widow(er)

D)Married, filing separately

E)None of these

A)Single

B)Head of household

C)Qualifying widow(er)

D)Married, filing separately

E)None of these

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

78

Curt and Linda were married on December 31 of the prior year. What are their options for filing status for their prior year taxes?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

79

William is a divorced taxpayer who provides a home for his dependent child, Edward. What filing status should William indicate on his tax return?

A)Head of household

B)Married, filing separately

C)Single

D)Qualifying widow(er)

E)None of these

A)Head of household

B)Married, filing separately

C)Single

D)Qualifying widow(er)

E)None of these

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

80

Match the letter of the filing status to the taxpayers below. Items may be used more than once.

a.Single

b.Married filing a joint return

c.Married filing separate returns

d.Head of household

e.Qualifying widow(er)

f.Married filing joint or married filing separate

The unmarried taxpayer supports his dependent mother, who lives next door in a separate apartment.

a.Single

b.Married filing a joint return

c.Married filing separate returns

d.Head of household

e.Qualifying widow(er)

f.Married filing joint or married filing separate

The unmarried taxpayer supports his dependent mother, who lives next door in a separate apartment.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck