Deck 21: Accounting for Leases

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

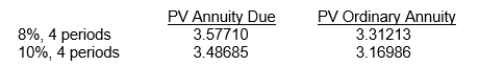

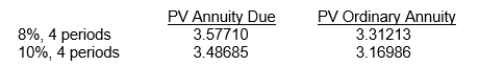

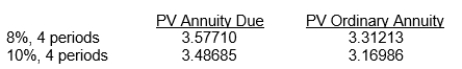

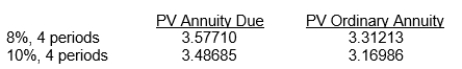

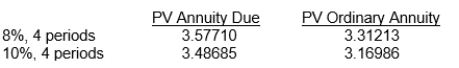

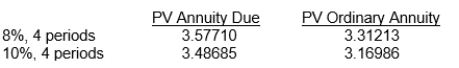

Question

Question

Question

Question

Question

Question

Question

Question

Question

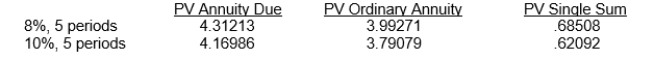

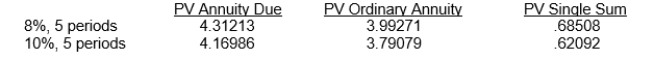

Question

Question

Question

Question

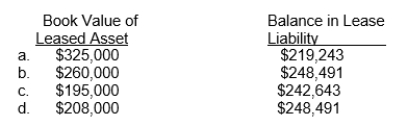

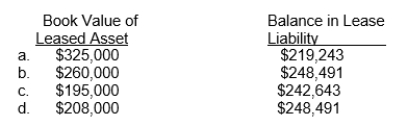

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/105

Play

Full screen (f)

Deck 21: Accounting for Leases

1

IFRS requires that lessees use the incremental rate to record a lease, unless it is impratical to determine it.

False

2

The distinction between a direct-financing lease and a sales-type lease is the presence or absence of a transfer of title.

False

3

In computing the annual lease payments, the lessor deducts only a guaranteed residual value from the fair value of a leased asset.

False

4

A benefit of leasing to the lessor is the return of the leased property at the end of the lease term.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

5

Lessors classify and account for all leases that don't qualify as sales-type leases as operating leases.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

6

A lessee records interest expense in both a finance lease and an operating lease.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

7

When the lessee agrees to make up any deficiency below a stated amount that the lessor realizes in residual value, that stated amount is the guaranteed residual value.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

8

Under the operating method, the lessor records each rental receipt as part interest revenue and part rental revenue.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

9

Direct-financing leases are in substance the financing of an asset purchase by the lessee.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

10

Leasing equipment reduces the risk of obsolescence to the lessee, and passes the risk of residual value to the lessor.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

11

Executory costs should be excluded by the lessee in computing the present value of the minimum lease payments.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

12

U.S.GAAP and IFRS for leasing are very different in their accounting because both the FASB and the IASB have decided that the existing accounting does not provide the most usefull, transparent, and complete information about leasing transactions that should be provided in the financial statements.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

13

A lease that contains a purchase option must be capitalized by the lessee.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

14

The use of on un realistically low discount rate could lead to a lessee recording a leased asset at an amount exceeding the fair value of the equipment, which is generally prohibited in IFRS.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

15

Only the lessor makes the distinction of classifying leases as operating or finance leases.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

16

Both a guaranteed and an unguaranteed residual value affect the lessee's computation of amounts capitalized as a leased asset.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

17

The IASB agrees with the capitalization approach and requires companies to capitalize all long-term leases.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

18

From the lessee's viewpoint, an unguaranteed residual value is the same as no residual value in terms of computing the minimum lease payments.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

19

Lessors classify and account for all leases that do not quqlify as direct-financing or sales-type leases as operating leases.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

20

A capitalized leased asset is always depreciated over the term of the lease by the lessee.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following best describes current practice in accounting for leases?

A)Leases are not capitalized.

B)Leases similar to installment purchases are capitalized.

C)All long-term leases are capitalized.

D)All leases are capitalized.

A)Leases are not capitalized.

B)Leases similar to installment purchases are capitalized.

C)All long-term leases are capitalized.

D)All leases are capitalized.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

22

In computing the present value of the minimum lease payments, the lessee should

A)use its incremental borrowing rate in all cases.

B)use either its incremental borrowing rate or the implicit rate of the lessor, whichever is higher, assuming that the implicit rate is known to the lessee.

C)use either its incremental borrowing rate or the implicit rate of the lessor, whichever is lower, assuming that the implicit rate is known to the lessee.

D)none of these.

A)use its incremental borrowing rate in all cases.

B)use either its incremental borrowing rate or the implicit rate of the lessor, whichever is higher, assuming that the implicit rate is known to the lessee.

C)use either its incremental borrowing rate or the implicit rate of the lessor, whichever is lower, assuming that the implicit rate is known to the lessee.

D)none of these.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

23

The methods of accounting for a lease by the lessee are

A)operating and finance lease methods.

B)operating, sales, and finance lease methods.

C)operating and leveraged lease methods.

D)none of these.

A)operating and finance lease methods.

B)operating, sales, and finance lease methods.

C)operating and leveraged lease methods.

D)none of these.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

24

U.S.GAAP for accounting for leases is more general in its treatment than IFRS.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

25

In accounting for the intial direct costs for a sales-type lease, the lessor adds intial direct costs to the net investment in the lease and amortizes them over the life of the lease as a yield adjustment.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

26

After the lessor establishes the payment, there is a difference in the investment that the lessor records from an accounting point of view about whether the residual value is guaranteed or unguaranteed.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

27

A common method of measuring the current liability portion in ordinary annuity leases is the change-in-the-present-value method.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

28

Mika company leases telecommunication equipment.Assume the following data for equipment leased from phlash company.The lease term is 5 year and requires equal rental payment of ¥3,150,000 at the beginning of each year.the present value of the payment was ¥13,135,059.The equipment has a fair value at the inception of the lease of ¥13,900,000, an estimated useful life of 8 year, and no residual value.mika pays all executory costs directly to third parties.Phlash set the annual rental to earn a rate of return of 10%, and this fact is known to mika.The lease does not transfer title or contain a bargain-purchase option.based on this information, which of the following statement is true?.

A)The lease should be classified as an operating lease.

B)The lease meets the economic life test to be classified as a finance lease.

C)The lease should be classified as a finance lease based on passing the recovery of investment test

D)The lease is classified as an operating lease for Mika and a finance lease for Phlash.

A)The lease should be classified as an operating lease.

B)The lease meets the economic life test to be classified as a finance lease.

C)The lease should be classified as a finance lease based on passing the recovery of investment test

D)The lease is classified as an operating lease for Mika and a finance lease for Phlash.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is an advantage of leasing?

A)Off-balance-sheet financing

B)Less costly financing

C)100% financing at fixed rates

D)All of these

A)Off-balance-sheet financing

B)Less costly financing

C)100% financing at fixed rates

D)All of these

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is a correct statement of one of the capitalization criteria?

A)The lease transfers ownership of the property to the lessor.

B)The lease contains a purchase option.

C)The lease term is equal to or more than 75% of the estimated economic life of the leased property.

D)The minimum lease payments (excluding executory costs) equal or exceed 90% of the fair value of the leased property.

A)The lease transfers ownership of the property to the lessor.

B)The lease contains a purchase option.

C)The lease term is equal to or more than 75% of the estimated economic life of the leased property.

D)The minimum lease payments (excluding executory costs) equal or exceed 90% of the fair value of the leased property.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

31

Minimum lease payments may include a

A)penalty for failure to renew.

B)bargain purchase option.

C)guaranteed residual value.

D)any of these.

A)penalty for failure to renew.

B)bargain purchase option.

C)guaranteed residual value.

D)any of these.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

32

The gross profit amount in a sales-type lease is greater when a guaranteed residual value exists.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

33

The lessor will recover a greater net investment if the residual value is guaranteed instead of unguaranteed.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

34

The primary difference between a direct-financing lease and a sales-type lease is the manufacturer's or dealer's gross profit.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

35

Major reasons why a company may become involved in leasing to other companies is (are)

A)interest revenue.

B)high residual values.

C)tax incentives.

D)all of these.

A)interest revenue.

B)high residual values.

C)tax incentives.

D)all of these.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

36

Companies must periodically review the estimated unguaranteed residual value in a sales-type lease.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

37

Together the FASB and IASB hope to craft a new lease accounting standard that will eliminate the notion of the operating lease.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

38

In computing depreciation of a leased asset, the lessee should subtract

A)a guaranteed residual value and depreciate over the term of the lease.

B)an unguaranteed residual value and depreciate over the term of the lease.

C)a guaranteed residual value and depreciate over the life of the asset.

D)an unguaranteed residual value and depreciate over the life of the asset.

A)a guaranteed residual value and depreciate over the term of the lease.

B)an unguaranteed residual value and depreciate over the term of the lease.

C)a guaranteed residual value and depreciate over the life of the asset.

D)an unguaranteed residual value and depreciate over the life of the asset.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

39

Executory costs include

A)maintenance.

B)property taxes.

C)insurance.

D)all of these.

A)maintenance.

B)property taxes.

C)insurance.

D)all of these.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

40

The IASB requires lessees and lessors to disclose certain information about leases in their financial statements or in the notes.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

41

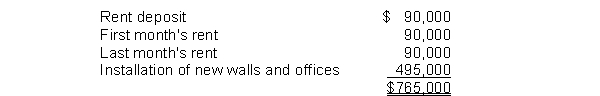

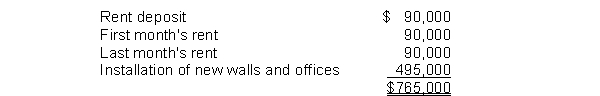

On December 1, 2011, Goetz Corporation leased office space for 10 years at a monthly rental of $90,000.On that date Perez paid the landlord the following amounts:

The entire amount of $765,000 was charged to rent expense in 2011.What amount should Goetz have charged to expense for the year ended December 31, 2011?

A)$90,000

B)$94,125

C)$184,125

D)$495,000

The entire amount of $765,000 was charged to rent expense in 2011.What amount should Goetz have charged to expense for the year ended December 31, 2011?

A)$90,000

B)$94,125

C)$184,125

D)$495,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

42

All of the followings are ways in which companies avoid leased assets capitalization in devising lease agreements, except:

A)Ensure that the lease does not specify the transfer of title of the property to the lassee.

B)Do not write in a bargain-purchase option.

C)Arrange for the present value of the minimum lease payments to be sufficiently more than the fair value of the leased property.

D)Set the lease term sufficiently below the estimated economic life of the leased property such that the economic life test is not met.

A)Ensure that the lease does not specify the transfer of title of the property to the lassee.

B)Do not write in a bargain-purchase option.

C)Arrange for the present value of the minimum lease payments to be sufficiently more than the fair value of the leased property.

D)Set the lease term sufficiently below the estimated economic life of the leased property such that the economic life test is not met.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following would not be included in the Lease Receivable account?

A)Guaranteed residual value

B)Unguaranteed residual value

C)A bargain purchase option

D)All would be included

A)Guaranteed residual value

B)Unguaranteed residual value

C)A bargain purchase option

D)All would be included

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

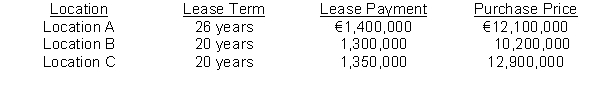

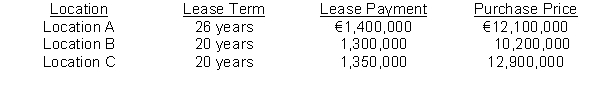

44

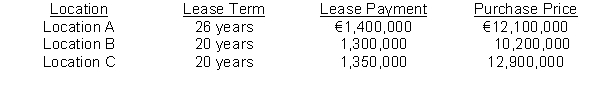

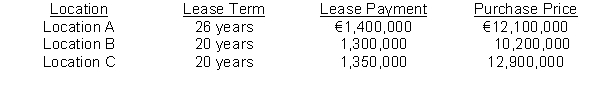

Use the following information for questions.

Yueve's Company is negotiating three leases for store locations Yueve's incremental borrowing rate is 12 percent and the lessor's implicit rate is unkown (it is impracticable to determine)

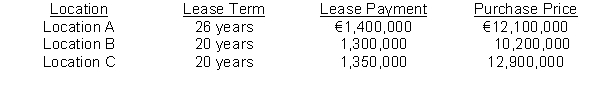

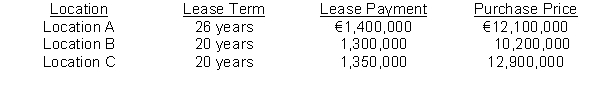

Each store will have an economic useful life of 30 years.lease payments will be made at the end of each year.Based on the data below properly classify each of the leases as an operating lease or a finance lease.The purchase price for each property is listed as an alternative to leasing.

Based on this information, which test(s) does Location B pass for classifying the lease as a finance lease.

Yueve's Company is negotiating three leases for store locations Yueve's incremental borrowing rate is 12 percent and the lessor's implicit rate is unkown (it is impracticable to determine)

Each store will have an economic useful life of 30 years.lease payments will be made at the end of each year.Based on the data below properly classify each of the leases as an operating lease or a finance lease.The purchase price for each property is listed as an alternative to leasing.

Based on this information, which test(s) does Location B pass for classifying the lease as a finance lease.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

45

All of the following statements are true regarding the circumvention of accounting rules for leases when determaining whether a lease qualifies as an operating or capital lease?

A)The residual value guarantee is a device used by lessees and lessors by transferring some of the risk to a third party to convert financing leases to operating leases.

B)The lessee who does not know exactly the lessor`s implicit interest rate might use a different (higher) incremental borrowing rate.

C)Lessors typically try to avoid having lease arrangement classified as operating leases.

D)Lessors typically try to avoid having lease arrangement classified as operating leases.

A)The residual value guarantee is a device used by lessees and lessors by transferring some of the risk to a third party to convert financing leases to operating leases.

B)The lessee who does not know exactly the lessor`s implicit interest rate might use a different (higher) incremental borrowing rate.

C)Lessors typically try to avoid having lease arrangement classified as operating leases.

D)Lessors typically try to avoid having lease arrangement classified as operating leases.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is true regarding the deferral of sale profits on a sale-leaseback using IFRS?

A)Both profits and losses on a sale followed by an operating lease leaseback are recognized immediately if the transaction is established at fair value

B)Profit from the sale should be amortized in proportion to the rental payments it an operating lease results from the sale-leaseback.

C)Any profit on a sale-leaseback resulting in an operating lease is deferred and recognized over the subsequent lease period, whereas any loss is recognized immediately.

D)Profit from the sale should be deferred and amortized in proportion to the amortization of the leased asset if a capital lease results from the sale-leaseback.

A)Both profits and losses on a sale followed by an operating lease leaseback are recognized immediately if the transaction is established at fair value

B)Profit from the sale should be amortized in proportion to the rental payments it an operating lease results from the sale-leaseback.

C)Any profit on a sale-leaseback resulting in an operating lease is deferred and recognized over the subsequent lease period, whereas any loss is recognized immediately.

D)Profit from the sale should be deferred and amortized in proportion to the amortization of the leased asset if a capital lease results from the sale-leaseback.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

47

On January 1, 2011, Dean Corporation signed a ten-year noncancelable lease for certain machinery.The terms of the lease called for Dean to make annual payments of $100,000 at the end of each year for ten years with title to pass to Dean at the end of this period.The machinery has an estimated useful life of 15 years and no residual value.Dean uses the straight-line method of depreciation for all of its fixed assets.Dean accordingly accounted for this lease transaction as a finance lease.The lease payments were determined to have a present value of $671,008 at an effective interest rate of 8%.With respect to this capitalized lease, Dean should record for 2011

A)lease expense of $100,000.

B)interest expense of $44,734 and depreciation expense of $38,068.

C)interest expense of $53,681 and depreciation expense of $44,734.

D)interest expense of $45,681 and depreciation expense of $67,101.

A)lease expense of $100,000.

B)interest expense of $44,734 and depreciation expense of $38,068.

C)interest expense of $53,681 and depreciation expense of $44,734.

D)interest expense of $45,681 and depreciation expense of $67,101.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

48

All of the following statements are true with regard to how the statement of financial position will be similarly affected by leasing the assets as opposed to issuing bonds and purchasing the assets, except which statement?

A)since a long-term non-cancelable lease which is used as a financing device generally results in the capitalization of the leased assets and recognition of the lease commitment in the statement of financial position, the comparative effect is not very different from purchase and ownership.

B)Assets leased under finance leases would be capitalized at the present value of the future lease payment, which is somewhat equivalent to the purchase price of the assets.

C)Bonds sold at par would be nearly equivalent to the present value of the future lease payments.

D)The specific accounts affected by the transactions would be the same.

A)since a long-term non-cancelable lease which is used as a financing device generally results in the capitalization of the leased assets and recognition of the lease commitment in the statement of financial position, the comparative effect is not very different from purchase and ownership.

B)Assets leased under finance leases would be capitalized at the present value of the future lease payment, which is somewhat equivalent to the purchase price of the assets.

C)Bonds sold at par would be nearly equivalent to the present value of the future lease payments.

D)The specific accounts affected by the transactions would be the same.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

49

For a sales-type lease,

A)the sales price includes the present value of the unguaranteed residual value.

B)the present value of the guaranteed residual value is deducted to determine the cost of goods sold.

C)the gross profit will be the same whether the residual value is guaranteed or unguaranteed.

D)none of these.

A)the sales price includes the present value of the unguaranteed residual value.

B)the present value of the guaranteed residual value is deducted to determine the cost of goods sold.

C)the gross profit will be the same whether the residual value is guaranteed or unguaranteed.

D)none of these.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

50

The Lease Liability account should be disclosed as

A)all current liabilities.

B)all non-current liabilities.

C)current portions in current liabilities and the remainder in non-current liabilities.

D)deferred credits.

A)all current liabilities.

B)all non-current liabilities.

C)current portions in current liabilities and the remainder in non-current liabilities.

D)deferred credits.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

51

If companies want to disqualify a lease as a finance lease to the lessee, while having the same lease qualify as a finance (sales or financing) lease to the lessor, which of the following are true?

A)It cannot be done

B)They must make information about the implicit rate unavailable to the lessee and use of the incremental borrowing rate by the lessee when it is higher than the implicit interast rate of the lessor.

C)they must include a bargain purchase option.

D)they must specify the transfer of the property to the lessee.

A)It cannot be done

B)They must make information about the implicit rate unavailable to the lessee and use of the incremental borrowing rate by the lessee when it is higher than the implicit interast rate of the lessor.

C)they must include a bargain purchase option.

D)they must specify the transfer of the property to the lessee.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

52

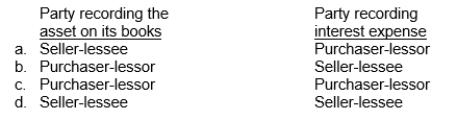

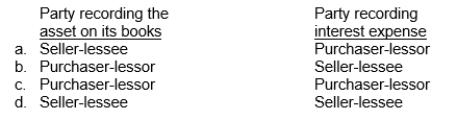

If the lease in a sale-leaseback transaction meets one of the four leasing criteria and is therefore accounted for as a finance lease, who records the asset on its books and which party records interest expense during the lease period?

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

53

Use the following information for questions.

Yueve's Company is negotiating three leases for store locations Yueve's incremental borrowing rate is 12 percent and the lessor's implicit rate is unkown (it is impracticable to determine)

Each store will have an economic useful life of 30 years.lease payments will be made at the end of each year.Based on the data below properly classify each of the leases as an operating lease or a finance lease.The purchase price for each property is listed as an alternative to leasing.

Based on this information, which test(s) does Location A pass for classifying the lease as a finance lease.

Yueve's Company is negotiating three leases for store locations Yueve's incremental borrowing rate is 12 percent and the lessor's implicit rate is unkown (it is impracticable to determine)

Each store will have an economic useful life of 30 years.lease payments will be made at the end of each year.Based on the data below properly classify each of the leases as an operating lease or a finance lease.The purchase price for each property is listed as an alternative to leasing.

Based on this information, which test(s) does Location A pass for classifying the lease as a finance lease.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

54

In a sale-leaseback transaction where none of the four leasing criteria are satisfied, which of the following is false?

A)The seller-lessee removes the asset from its books.

B)The purchaser-lessor records a gain.

C)The seller-lessee records the lease as an operating lease.

D)All of the above are false statements.

A)The seller-lessee removes the asset from its books.

B)The purchaser-lessor records a gain.

C)The seller-lessee records the lease as an operating lease.

D)All of the above are false statements.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

55

When a company sells property and then leases it back, any gain on the sale should usually be

A)recognized in the current year.

B)recognized as a prior period adjustment.

C)recognized at the end of the lease.

D)deferred and recognized as income over the term of the lease.

A)recognized in the current year.

B)recognized as a prior period adjustment.

C)recognized at the end of the lease.

D)deferred and recognized as income over the term of the lease.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

56

To avoid leased asset capitalization, companies can devise lease agreements that fail to satisfy any of the four leasing criteria.Which of the following is not one of the ways to accomplish this goal?

A)Lessee uses a higher interest rate than that used by lessor.

B)Set the lease term at something less than 75% of the estimated useful life of the property.

C)Write in a bargain purchase option.

D)Use a third party to guarantee the asset's residual value.

A)Lessee uses a higher interest rate than that used by lessor.

B)Set the lease term at something less than 75% of the estimated useful life of the property.

C)Write in a bargain purchase option.

D)Use a third party to guarantee the asset's residual value.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following statements is correct?

A)In a direct-financing lease, initial direct costs are added to the net investment in the lease.

B)In a sales-type lease, initial direct costs are expensed in the year of incurrence.

C)For operating leases, initial direct costs are deferred and allocated over the lease term.

D)All of these.

A)In a direct-financing lease, initial direct costs are added to the net investment in the lease.

B)In a sales-type lease, initial direct costs are expensed in the year of incurrence.

C)For operating leases, initial direct costs are deferred and allocated over the lease term.

D)All of these.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

58

When lessors account for residual values related to leased assets, they

A)always include the residual value because they always assume the residual value will be realized.

B)include the unguaranteed residual value in sales revenue.

C)recognize more gross profit on a sales-type lease with a guaranteed residual value than on a sales-type lease with an unguaranteed residual value.

D)All of the above are true with regard to lessors and residual values.

A)always include the residual value because they always assume the residual value will be realized.

B)include the unguaranteed residual value in sales revenue.

C)recognize more gross profit on a sales-type lease with a guaranteed residual value than on a sales-type lease with an unguaranteed residual value.

D)All of the above are true with regard to lessors and residual values.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following is true regarding footnote disclosure of operating lease payments under IFRS and U.S.GAAP?

A)U.S.GAAP does not require as much detail as IFRS.

B)It is more difficult to estimate the impact of the off-balance sheet liabilities for companies that use U.S.GAAP, as compared with IFRS companies.

C)Extensive disclosure of future noncancelable lease payment is required for the next five years and the years thereafter under IFRS.

D)IFRS typically has no detail on the year-by-year breakout of lease payment due.

A)U.S.GAAP does not require as much detail as IFRS.

B)It is more difficult to estimate the impact of the off-balance sheet liabilities for companies that use U.S.GAAP, as compared with IFRS companies.

C)Extensive disclosure of future noncancelable lease payment is required for the next five years and the years thereafter under IFRS.

D)IFRS typically has no detail on the year-by-year breakout of lease payment due.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

60

Use the following information for questions.

Yueve's Company is negotiating three leases for store locations Yueve's incremental borrowing rate is 12 percent and the lessor's implicit rate is unkown (it is impracticable to determine)

Each store will have an economic useful life of 30 years.lease payments will be made at the end of each year.Based on the data below properly classify each of the leases as an operating lease or a finance lease.The purchase price for each property is listed as an alternative to leasing.

Based on this information, which test(s) does Location B pass for classifying the lease as a finance lease.

Yueve's Company is negotiating three leases for store locations Yueve's incremental borrowing rate is 12 percent and the lessor's implicit rate is unkown (it is impracticable to determine)

Each store will have an economic useful life of 30 years.lease payments will be made at the end of each year.Based on the data below properly classify each of the leases as an operating lease or a finance lease.The purchase price for each property is listed as an alternative to leasing.

Based on this information, which test(s) does Location B pass for classifying the lease as a finance lease.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

61

Use the following information for questions.

On January 1, 2011, Yancey, Inc.signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company.The following information pertains to this lease agreement.

(a) The agreement requires equal rental payments at the end of each year.

(b) The fair value of the building on January 1, 2011 is $3,000,000; however, the book value to Holt is $2,500,000.

(c) The building has an estimated economic life of 10 years, with no residual value.Yancey depreciates similar buildings on the straight-line method.

(d) At the termination of the lease, the title to the building will be transferred to the lessee.

(e) Yancey's incremental borrowing rate is 11% per year.Holt Warehouse Co.set the annual rental to insure a 10% rate of return.The implicit rate of the lessor is known by Yancey, Inc.

(f) The yearly rental payment includes $10,000 of executory costs related to taxes on the property.

Yancey, Inc.would record depreciation expense on this storage building in 2011 of (Rounded to the nearest dollar.)

A)$0.

B)$250,000.

C)$300,000.

D)$488,237.

On January 1, 2011, Yancey, Inc.signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company.The following information pertains to this lease agreement.

(a) The agreement requires equal rental payments at the end of each year.

(b) The fair value of the building on January 1, 2011 is $3,000,000; however, the book value to Holt is $2,500,000.

(c) The building has an estimated economic life of 10 years, with no residual value.Yancey depreciates similar buildings on the straight-line method.

(d) At the termination of the lease, the title to the building will be transferred to the lessee.

(e) Yancey's incremental borrowing rate is 11% per year.Holt Warehouse Co.set the annual rental to insure a 10% rate of return.The implicit rate of the lessor is known by Yancey, Inc.

(f) The yearly rental payment includes $10,000 of executory costs related to taxes on the property.

Yancey, Inc.would record depreciation expense on this storage building in 2011 of (Rounded to the nearest dollar.)

A)$0.

B)$250,000.

C)$300,000.

D)$488,237.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

62

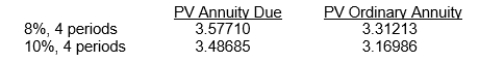

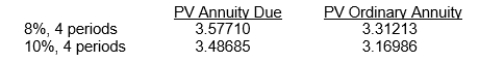

Pisa, Inc.leased equipment from Tower Company under a four-year lease requiring equal annual payments of $86,038, with the first payment due at lease inception.The lease does not transfer ownership, nor is there a bargain purchase option.The equipment has a 4-year useful life and no residual value.If Pisa, Inc.'s incremental borrowing rate is 10% and the rate implicit in the lease (which is known by Pisa, Inc.) is 8%, what is the amount recorded for the leased asset at the lease inception?

A)$307,767

B)$272,728

C)$284,969

D)$300,000

A)$307,767

B)$272,728

C)$284,969

D)$300,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

63

Haystack, Inc.manufactures machinery used in the mining industry.On January 2, 2011 it leased equipment with a cost of $200,000 to Silver Point Co.The 5-year lease calls for a 10% down payment and equal annual payments at the end of each year.The equipment has an expected useful life of 5 years.Silver Point's incremental borrowing rate is 10%, and it depreciates similar equipment using the double-declining balance method.The selling price of the equipment is $325,000, and the rate implicit in the lease is 8%, which is known to Silver Point Co.What is the amount of interest expense recorded by Silver Point Co.for the year ended December 31, 2011?

A)$29,250

B)$23,400

C)$26,000

D)$32,500

A)$29,250

B)$23,400

C)$26,000

D)$32,500

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

64

Use the following information for questions.

On January 1, 2011, Sauder Corporation signed a five-year noncancelable lease for equipment.The terms of the lease called for Sauder to make annual payments of $50,000 at the beginning of each year for five years with title to pass to Sauder at the end of this period.The equipment has an estimated useful life of 7 years and no residual value.Sauder uses the straight-line method of depreciation for all of its fixed assets.Sauder accordingly accounts for this lease transaction as a finance lease.The minimum lease payments were determined to have a present value of $208,493 at an effective interest rate of 10%.

In 2012, Sauder should record interest expense of

A)$10,849.

B)$12,434.

C)$15,849.

D)$17,434.

On January 1, 2011, Sauder Corporation signed a five-year noncancelable lease for equipment.The terms of the lease called for Sauder to make annual payments of $50,000 at the beginning of each year for five years with title to pass to Sauder at the end of this period.The equipment has an estimated useful life of 7 years and no residual value.Sauder uses the straight-line method of depreciation for all of its fixed assets.Sauder accordingly accounts for this lease transaction as a finance lease.The minimum lease payments were determined to have a present value of $208,493 at an effective interest rate of 10%.

In 2012, Sauder should record interest expense of

A)$10,849.

B)$12,434.

C)$15,849.

D)$17,434.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

65

Use the following information for questions.

On January 1, 2011, Ogleby Corporation signed a five-year noncancelable lease for equipment.The terms of the lease called for Ogleby to make annual payments of $60,000 at the end of each year for five years with title to pass to Ogleby at the end of this period.The equipment has an estimated useful life of 7 years and no residual value.Ogleby uses the straight-line method of depreciation for all of its fixed assets.Ogleby accordingly accounts for this lease transaction as a finance lease.The minimum lease payments were determined to have a present value of $227,448 at an effective interest rate of 10%.

With respect to this capitalized lease, for 2011 Ogleby should record

A)rent expense of $60,000.

B)interest expense of $22,745 and depreciation expense of $45,489.

C)interest expense of $22,745 and depreciation expense of $32,493.

D)interest expense of $30,000 and depreciation expense of $45,489.

On January 1, 2011, Ogleby Corporation signed a five-year noncancelable lease for equipment.The terms of the lease called for Ogleby to make annual payments of $60,000 at the end of each year for five years with title to pass to Ogleby at the end of this period.The equipment has an estimated useful life of 7 years and no residual value.Ogleby uses the straight-line method of depreciation for all of its fixed assets.Ogleby accordingly accounts for this lease transaction as a finance lease.The minimum lease payments were determined to have a present value of $227,448 at an effective interest rate of 10%.

With respect to this capitalized lease, for 2011 Ogleby should record

A)rent expense of $60,000.

B)interest expense of $22,745 and depreciation expense of $45,489.

C)interest expense of $22,745 and depreciation expense of $32,493.

D)interest expense of $30,000 and depreciation expense of $45,489.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

66

On December 31, 2011, Lang Corporation leased a ship from Fort Company for an eight-year period expiring December 30, 2019.Equal annual payments of $200,000 are due on December 31 of each year, beginning with December 31, 2011.The lease is properly classified as a finance lease on Lang 's books.The present value at December 31, 2011 of the eight lease payments over the lease term discounted at 10% is $1,173,685.Assuming all payments are made on time, the amount that should be reported by Lang Corporation as the total lease liability on its December 31, 2012 statement of financial position.

A)$1,091,054.

B)$1,000,159.

C)$871,054.

D)$1,200,000.

A)$1,091,054.

B)$1,000,159.

C)$871,054.

D)$1,200,000.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

67

Use the following information for questions.

On January 1, 2011, Sauder Corporation signed a five-year noncancelable lease for equipment.The terms of the lease called for Sauder to make annual payments of $50,000 at the beginning of each year for five years with title to pass to Sauder at the end of this period.The equipment has an estimated useful life of 7 years and no residual value.Sauder uses the straight-line method of depreciation for all of its fixed assets.Sauder accordingly accounts for this lease transaction as a finance lease.The minimum lease payments were determined to have a present value of $208,493 at an effective interest rate of 10%.

In 2011, Sauder should record interest expense of

A)$15,849.

B)$29,151.

C)$20,849.

D)$34,151.

On January 1, 2011, Sauder Corporation signed a five-year noncancelable lease for equipment.The terms of the lease called for Sauder to make annual payments of $50,000 at the beginning of each year for five years with title to pass to Sauder at the end of this period.The equipment has an estimated useful life of 7 years and no residual value.Sauder uses the straight-line method of depreciation for all of its fixed assets.Sauder accordingly accounts for this lease transaction as a finance lease.The minimum lease payments were determined to have a present value of $208,493 at an effective interest rate of 10%.

In 2011, Sauder should record interest expense of

A)$15,849.

B)$29,151.

C)$20,849.

D)$34,151.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

68

Use the following information for questions.

On January 1, 2011, Yancey, Inc.signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company.The following information pertains to this lease agreement.

(a) The agreement requires equal rental payments at the end of each year.

(b) The fair value of the building on January 1, 2011 is $3,000,000; however, the book value to Holt is $2,500,000.

(c) The building has an estimated economic life of 10 years, with no residual value.Yancey depreciates similar buildings on the straight-line method.

(d) At the termination of the lease, the title to the building will be transferred to the lessee.

(e) Yancey's incremental borrowing rate is 11% per year.Holt Warehouse Co.set the annual rental to insure a 10% rate of return.The implicit rate of the lessor is known by Yancey, Inc.

(f) The yearly rental payment includes $10,000 of executory costs related to taxes on the property.

From the lessee's viewpoint, what type of lease exists in this case?

A)Sales-type lease

B)Sale-leaseback

C)Finance lease

D)Operating lease

On January 1, 2011, Yancey, Inc.signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company.The following information pertains to this lease agreement.

(a) The agreement requires equal rental payments at the end of each year.

(b) The fair value of the building on January 1, 2011 is $3,000,000; however, the book value to Holt is $2,500,000.

(c) The building has an estimated economic life of 10 years, with no residual value.Yancey depreciates similar buildings on the straight-line method.

(d) At the termination of the lease, the title to the building will be transferred to the lessee.

(e) Yancey's incremental borrowing rate is 11% per year.Holt Warehouse Co.set the annual rental to insure a 10% rate of return.The implicit rate of the lessor is known by Yancey, Inc.

(f) The yearly rental payment includes $10,000 of executory costs related to taxes on the property.

From the lessee's viewpoint, what type of lease exists in this case?

A)Sales-type lease

B)Sale-leaseback

C)Finance lease

D)Operating lease

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

69

Use the following information for questions.

On January 1, 2011, Ogleby Corporation signed a five-year noncancelable lease for equipment.The terms of the lease called for Ogleby to make annual payments of $60,000 at the end of each year for five years with title to pass to Ogleby at the end of this period.The equipment has an estimated useful life of 7 years and no residual value.Ogleby uses the straight-line method of depreciation for all of its fixed assets.Ogleby accordingly accounts for this lease transaction as a finance lease.The minimum lease payments were determined to have a present value of $227,448 at an effective interest rate of 10%.

With respect to this capitalized lease, for 2012 Ogleby should record

A)interest expense of $22,745 and depreciation expense of $32,493.

B)interest expense of $20,469 and depreciation expense of $32,493.

C)interest expense of $19,019 and depreciation expense of $32,493.

D)interest expense of $14,469 and depreciation expense of $32,493.

On January 1, 2011, Ogleby Corporation signed a five-year noncancelable lease for equipment.The terms of the lease called for Ogleby to make annual payments of $60,000 at the end of each year for five years with title to pass to Ogleby at the end of this period.The equipment has an estimated useful life of 7 years and no residual value.Ogleby uses the straight-line method of depreciation for all of its fixed assets.Ogleby accordingly accounts for this lease transaction as a finance lease.The minimum lease payments were determined to have a present value of $227,448 at an effective interest rate of 10%.

With respect to this capitalized lease, for 2012 Ogleby should record

A)interest expense of $22,745 and depreciation expense of $32,493.

B)interest expense of $20,469 and depreciation expense of $32,493.

C)interest expense of $19,019 and depreciation expense of $32,493.

D)interest expense of $14,469 and depreciation expense of $32,493.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

70

Pisa, Inc.leased equipment from Tower Company under a four-year lease requiring equal annual payments of $86,038, with the first payment due at lease inception.The lease does not transfer ownership, nor is there a bargain purchase option.The equipment has a 4-year useful life and no residual value.Pisa, Inc.'s incremental borrowing rate is 10% and the rate implicit in the lease (which is known by Pisa, Inc.) is 8%.Assuming that this lease is properly classified as a finance lease, what is the amount of interest expense recorded by Pisa, Inc.in the first year of the asset's life?

A)$0

B)$24,621

C)$17,738

D)$22,798

A)$0

B)$24,621

C)$17,738

D)$22,798

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

71

Metcalf Company leases a machine from Vollmer Corp.under an agreement which meets the criteria to be a finance lease for Metcalf.The six-year lease requires payment of $102,000 at the beginning of each year, including $15,000 per year for maintenance, insurance, and taxes.The incremental borrowing rate for the lessee is 10%; the lessor's implicit rate is 8% and is known by the lessee.The present value of an annuity due of 1 for six years at 10% is 4.79079.The present value of an annuity due of 1 for six years at 8% is 4.99271.Metcalf should record the leased asset at

A)$509,256.

B)$488,661.

C)$434,366.

D)$416,799.

A)$509,256.

B)$488,661.

C)$434,366.

D)$416,799.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

72

Use the following information for questions.

On January 1, 2011, Yancey, Inc.signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company.The following information pertains to this lease agreement.

(a) The agreement requires equal rental payments at the end of each year.

(b) The fair value of the building on January 1, 2011 is $3,000,000; however, the book value to Holt is $2,500,000.

(c) The building has an estimated economic life of 10 years, with no residual value.Yancey depreciates similar buildings on the straight-line method.

(d) At the termination of the lease, the title to the building will be transferred to the lessee.

(e) Yancey's incremental borrowing rate is 11% per year.Holt Warehouse Co.set the annual rental to insure a 10% rate of return.The implicit rate of the lessor is known by Yancey, Inc.

(f) The yearly rental payment includes $10,000 of executory costs related to taxes on the property.

What is the amount of the minimum annual lease payment? (Rounded to the nearest dollar.)

A)$188,237

B)$478,236

C)$488,236

D)$498,236

On January 1, 2011, Yancey, Inc.signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company.The following information pertains to this lease agreement.

(a) The agreement requires equal rental payments at the end of each year.

(b) The fair value of the building on January 1, 2011 is $3,000,000; however, the book value to Holt is $2,500,000.

(c) The building has an estimated economic life of 10 years, with no residual value.Yancey depreciates similar buildings on the straight-line method.

(d) At the termination of the lease, the title to the building will be transferred to the lessee.

(e) Yancey's incremental borrowing rate is 11% per year.Holt Warehouse Co.set the annual rental to insure a 10% rate of return.The implicit rate of the lessor is known by Yancey, Inc.

(f) The yearly rental payment includes $10,000 of executory costs related to taxes on the property.

What is the amount of the minimum annual lease payment? (Rounded to the nearest dollar.)

A)$188,237

B)$478,236

C)$488,236

D)$498,236

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

73

Use the following information for questions.

On January 1, 2011, Sauder Corporation signed a five-year noncancelable lease for equipment.The terms of the lease called for Sauder to make annual payments of $50,000 at the beginning of each year for five years with title to pass to Sauder at the end of this period.The equipment has an estimated useful life of 7 years and no residual value.Sauder uses the straight-line method of depreciation for all of its fixed assets.Sauder accordingly accounts for this lease transaction as a finance lease.The minimum lease payments were determined to have a present value of $208,493 at an effective interest rate of 10%.

On December 31, 2011, Kuhn Corporation leased a plane from Bell Company for an eight-year period expiring December 30, 2019.Equal annual payments of $150,000 are due on December 31 of each year, beginning with December 31, 2011.The lease is properly classified as a Finance lease on Kuhn's books.The present value at December 31, 2011 of the eight lease payments over the lease term discounted at 10% is $880,264.Assuming the first payment is made on time, the amount that should be reported by Kuhn Corporation as the lease liability on its December 31, 2011 statement of financial position is

A)$880,264.

B)$818,290.

C)$792,238.

D)$730,264.

On January 1, 2011, Sauder Corporation signed a five-year noncancelable lease for equipment.The terms of the lease called for Sauder to make annual payments of $50,000 at the beginning of each year for five years with title to pass to Sauder at the end of this period.The equipment has an estimated useful life of 7 years and no residual value.Sauder uses the straight-line method of depreciation for all of its fixed assets.Sauder accordingly accounts for this lease transaction as a finance lease.The minimum lease payments were determined to have a present value of $208,493 at an effective interest rate of 10%.

On December 31, 2011, Kuhn Corporation leased a plane from Bell Company for an eight-year period expiring December 30, 2019.Equal annual payments of $150,000 are due on December 31 of each year, beginning with December 31, 2011.The lease is properly classified as a Finance lease on Kuhn's books.The present value at December 31, 2011 of the eight lease payments over the lease term discounted at 10% is $880,264.Assuming the first payment is made on time, the amount that should be reported by Kuhn Corporation as the lease liability on its December 31, 2011 statement of financial position is

A)$880,264.

B)$818,290.

C)$792,238.

D)$730,264.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

74

Use the following information for questions.

On January 1, 2011, Yancey, Inc.signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company.The following information pertains to this lease agreement.

(a) The agreement requires equal rental payments at the end of each year.

(b) The fair value of the building on January 1, 2011 is $3,000,000; however, the book value to Holt is $2,500,000.

(c) The building has an estimated economic life of 10 years, with no residual value.Yancey depreciates similar buildings on the straight-line method.

(d) At the termination of the lease, the title to the building will be transferred to the lessee.

(e) Yancey's incremental borrowing rate is 11% per year.Holt Warehouse Co.set the annual rental to insure a 10% rate of return.The implicit rate of the lessor is known by Yancey, Inc.

(f) The yearly rental payment includes $10,000 of executory costs related to taxes on the property.

If the lease were nonrenewable, there was no purchase option, title to the building does not pass to the lessee at termination of the lease and the lease were only for eight years, what type of lease would this be for the lessee?

A)Sales-type lease

B)Direct-financing lease

C)Operating lease

D)Finance lease

On January 1, 2011, Yancey, Inc.signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company.The following information pertains to this lease agreement.

(a) The agreement requires equal rental payments at the end of each year.

(b) The fair value of the building on January 1, 2011 is $3,000,000; however, the book value to Holt is $2,500,000.

(c) The building has an estimated economic life of 10 years, with no residual value.Yancey depreciates similar buildings on the straight-line method.

(d) At the termination of the lease, the title to the building will be transferred to the lessee.

(e) Yancey's incremental borrowing rate is 11% per year.Holt Warehouse Co.set the annual rental to insure a 10% rate of return.The implicit rate of the lessor is known by Yancey, Inc.

(f) The yearly rental payment includes $10,000 of executory costs related to taxes on the property.

If the lease were nonrenewable, there was no purchase option, title to the building does not pass to the lessee at termination of the lease and the lease were only for eight years, what type of lease would this be for the lessee?

A)Sales-type lease

B)Direct-financing lease

C)Operating lease

D)Finance lease

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

75

Haystack, Inc.manufactures machinery used in the mining industry.On January 2, 2011 it leased equipment with a cost of $200,000 to Silver Point Co.The 5-year lease calls for a 10% down payment and equal annual payments of $73,259 at the end of each year.The equipment has an expected useful life of 5 years.Silver Point's incremental borrowing rate is 10%, and it depreciates similar equipment using the double-declining balance method.The selling price of the equipment is $325,000, and the rate implicit in the lease is 8%, which is known to Silver Point Co.What is the book value of the leased asset at December 31, 2011, and what is the balance in the Lease Liability account?

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

76

Pisa, Inc.leased equipment from Tower Company under a four-year lease requiring equal annual payments of $86,038, with the first payment due at lease inception.The lease does not transfer ownership, nor is there a bargain purchase option.The equipment has a 4-year useful life and no residual value.Pisa, Inc.'s incremental borrowing rate is 10% and the rate implicit in the lease (which is known by Pisa, Inc.) is 8%.Pisa, Inc.uses the straight-line method to depreciate similar assets.What is the amount of depreciation expense recorded by Pisa, Inc.in the first year of the asset's life?

A)$0 because the asset is depreciated by Tower Company.

B)$71,242

C)$76,942

D)$75,000

A)$0 because the asset is depreciated by Tower Company.

B)$71,242

C)$76,942

D)$75,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

77

Use the following information for questions.

On January 1, 2011, Yancey, Inc.signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company.The following information pertains to this lease agreement.

(a) The agreement requires equal rental payments at the end of each year.

(b) The fair value of the building on January 1, 2011 is $3,000,000; however, the book value to Holt is $2,500,000.

(c) The building has an estimated economic life of 10 years, with no residual value.Yancey depreciates similar buildings on the straight-line method.

(d) At the termination of the lease, the title to the building will be transferred to the lessee.

(e) Yancey's incremental borrowing rate is 11% per year.Holt Warehouse Co.set the annual rental to insure a 10% rate of return.The implicit rate of the lessor is known by Yancey, Inc.

(f) The yearly rental payment includes $10,000 of executory costs related to taxes on the property.

What is the amount of the total annual lease payment?

A)$188,237

B)$478,237

C)$488,237

D)$498,237

On January 1, 2011, Yancey, Inc.signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company.The following information pertains to this lease agreement.

(a) The agreement requires equal rental payments at the end of each year.

(b) The fair value of the building on January 1, 2011 is $3,000,000; however, the book value to Holt is $2,500,000.

(c) The building has an estimated economic life of 10 years, with no residual value.Yancey depreciates similar buildings on the straight-line method.

(d) At the termination of the lease, the title to the building will be transferred to the lessee.

(e) Yancey's incremental borrowing rate is 11% per year.Holt Warehouse Co.set the annual rental to insure a 10% rate of return.The implicit rate of the lessor is known by Yancey, Inc.

(f) The yearly rental payment includes $10,000 of executory costs related to taxes on the property.

What is the amount of the total annual lease payment?

A)$188,237

B)$478,237

C)$488,237

D)$498,237

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

78

Pisa, Inc.leased equipment from Tower Company under a four-year lease requiring equal annual payments of $86,038, with the first payment due at lease inception.The lease does not transfer ownership, nor is there a bargain purchase option.The equipment has a 4 year useful life and no residual value.Pisa, Inc.'s incremental borrowing rate is 10% and the rate implicit in the lease (which is known by Pisa, Inc.) is 8%.Assuming that this lease is properly classified as a finance lease, what is the amount of principal reduction recorded when the second lease payment is made in Year 2?

A)$86,038

B)$61,417

C)$63,240

D)$68,300

A)$86,038

B)$61,417

C)$63,240

D)$68,300

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

79

Emporia Corporation is a lessee with a finance lease.The asset is recorded at $450,000 and has an economic life of 8 years.The lease term is 5 years.The asset is expected to have a fair value of $150,000 at the end of 5 years, and a fair value of $50,000 at the end of 8 years.The lease agreement provides for the transfer of title of the asset to the lessee at the end of the lease term.What amount of depreciation expense would the lessee record for the first year of the lease?

A)$90,000

B)$80,000

C)$60,000

D)$50,000

A)$90,000

B)$80,000

C)$60,000

D)$50,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

80

Use the following information for questions.

On January 1, 2011, Yancey, Inc.signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company.The following information pertains to this lease agreement.

(a) The agreement requires equal rental payments at the end of each year.

(b) The fair value of the building on January 1, 2011 is $3,000,000; however, the book value to Holt is $2,500,000.

(c) The building has an estimated economic life of 10 years, with no residual value.Yancey depreciates similar buildings on the straight-line method.

(d) At the termination of the lease, the title to the building will be transferred to the lessee.

(e) Yancey's incremental borrowing rate is 11% per year.Holt Warehouse Co.set the annual rental to insure a 10% rate of return.The implicit rate of the lessor is known by Yancey, Inc.

(f) The yearly rental payment includes $10,000 of executory costs related to taxes on the property.

From the lessor's viewpoint, what type of lease is involved?

A)Sales-type lease

B)Sale-leaseback

C)Direct-financing lease

D)Operating lease

On January 1, 2011, Yancey, Inc.signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company.The following information pertains to this lease agreement.

(a) The agreement requires equal rental payments at the end of each year.

(b) The fair value of the building on January 1, 2011 is $3,000,000; however, the book value to Holt is $2,500,000.

(c) The building has an estimated economic life of 10 years, with no residual value.Yancey depreciates similar buildings on the straight-line method.

(d) At the termination of the lease, the title to the building will be transferred to the lessee.

(e) Yancey's incremental borrowing rate is 11% per year.Holt Warehouse Co.set the annual rental to insure a 10% rate of return.The implicit rate of the lessor is known by Yancey, Inc.

(f) The yearly rental payment includes $10,000 of executory costs related to taxes on the property.

From the lessor's viewpoint, what type of lease is involved?

A)Sales-type lease

B)Sale-leaseback

C)Direct-financing lease

D)Operating lease

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck