Deck 20: Leases

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/69

Play

Full screen (f)

Deck 20: Leases

1

In calculating depreciation of a leased asset, the lessee should subtract a(n)

A)guaranteed residual value and depreciate over the term of the lease.

B)unguaranteed residual value and depreciate over the term of the lease.

C)guaranteed residual value and depreciate over the economic life of the asset.

D)unguaranteed residual value and depreciate over the economic life of the asset.

A)guaranteed residual value and depreciate over the term of the lease.

B)unguaranteed residual value and depreciate over the term of the lease.

C)guaranteed residual value and depreciate over the economic life of the asset.

D)unguaranteed residual value and depreciate over the economic life of the asset.

A

2

Which of the following best describes current standards in accounting for leases?

A)Leases are not capitalized.

B)Leases similar to instalment purchases are capitalized.

C)Only long-term leases are capitalized.

D)All leases are capitalized.

A)Leases are not capitalized.

B)Leases similar to instalment purchases are capitalized.

C)Only long-term leases are capitalized.

D)All leases are capitalized.

B

3

Regarding a basic capital (finance)lease for a lessee, which of the following statements is INCORRECT?

A)The lessee records the leased asset at the lower of the minimum lease payments and the fair value of the asset at the lease's inception.

B)The lessee accounts for the lease as if an asset is purchased and a long-term obligation is entered into.

C)The lessor uses the lease as a source of funding.

D)The lessee uses the lease as a source of funding.

A)The lessee records the leased asset at the lower of the minimum lease payments and the fair value of the asset at the lease's inception.

B)The lessee accounts for the lease as if an asset is purchased and a long-term obligation is entered into.

C)The lessor uses the lease as a source of funding.

D)The lessee uses the lease as a source of funding.

C

4

For a lessee, the minimum lease payments may include

A)the minimum rental payments and a guaranteed residual value only.

B)the minimum rental payments and a bargain purchase option only.

C)a bargain purchase option and a guaranteed residual value.

D)the minimum rental payments, a bargain purchase option, and a guaranteed residual value.

A)the minimum rental payments and a guaranteed residual value only.

B)the minimum rental payments and a bargain purchase option only.

C)a bargain purchase option and a guaranteed residual value.

D)the minimum rental payments, a bargain purchase option, and a guaranteed residual value.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

5

An essential element in a lease agreement is that the

A)lessee transfers less than the total interest in the property.

B)lessor transfers less than the total interest in the property.

C)lease must contain a bargain purchase option.

D)rental (lease)payments must be constant for the duration of the lease.

A)lessee transfers less than the total interest in the property.

B)lessor transfers less than the total interest in the property.

C)lease must contain a bargain purchase option.

D)rental (lease)payments must be constant for the duration of the lease.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

6

Accounting for leases is important to all EXCEPT the following:

A)U.S.Congress.

B)leasing companies.

C)financial institutions.

D)companies who purchase assets outright.

A)U.S.Congress.

B)leasing companies.

C)financial institutions.

D)companies who purchase assets outright.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is NOT a criteria to determine a capital lease under ASPE?

A)There is a bargain purchase option included in the lease.

B)The implicit interest rate in the lease is greater than the incremental borrowing rate.

C)The lease term is 75% or more of the leased property's economic life.

D)The present value of the minimum lease payments is equal to 90% or more of the fair value of the leased asset.

A)There is a bargain purchase option included in the lease.

B)The implicit interest rate in the lease is greater than the incremental borrowing rate.

C)The lease term is 75% or more of the leased property's economic life.

D)The present value of the minimum lease payments is equal to 90% or more of the fair value of the leased asset.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is NOT a potential advantage of leasing?

A)no tax advantages for the lessor

B)cheaper financing

C)100% financing at fixed rates

D)protection against obsolescence

A)no tax advantages for the lessor

B)cheaper financing

C)100% financing at fixed rates

D)protection against obsolescence

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

9

What type of lease is EXCLUDED from being recognized as a finance lease under IFRS 16?

A)short-term leases

B)vehicle leases

C)significant value leases

D)leases including bargain purchase options

A)short-term leases

B)vehicle leases

C)significant value leases

D)leases including bargain purchase options

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

10

The lease liability under IFRS 16 is amortized using

A)the straight-line amortization method.

B)the discounted amortization method.

C)the present value interest method.

D)the effect interest method.

A)the straight-line amortization method.

B)the discounted amortization method.

C)the present value interest method.

D)the effect interest method.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

11

When a lessee is accounting for a capital (finance)lease

A)a guaranteed residual value is excluded from the "minimum lease payments."

B)an unguaranteed residual value is excluded from the "minimum lease payments."

C)a guaranteed residual value is basically an additional lease payment due at the end of the lease.

D)the present value of any guaranteed residual is deducted from the leased asset cost in determining the depreciable amount.

A)a guaranteed residual value is excluded from the "minimum lease payments."

B)an unguaranteed residual value is excluded from the "minimum lease payments."

C)a guaranteed residual value is basically an additional lease payment due at the end of the lease.

D)the present value of any guaranteed residual is deducted from the leased asset cost in determining the depreciable amount.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

12

The journal entries for Capital (ASPE)or Finance (IFRS)leases for the lessee include entries for all EXCEPT

A)rent expense.

B)setting up the lease asset and liability.

C)depreciation of the asset.

D)interest paid on the lease.

A)rent expense.

B)setting up the lease asset and liability.

C)depreciation of the asset.

D)interest paid on the lease.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

13

Why has accounting for leases been controversial?

A)Leasing is uncommon.

B)Companies have structured leases in a way that the lease liabilities remain "off-balance sheet".

C)All leases are structured the same way and treated the same way.

D)Most leases are immaterial.

A)Leasing is uncommon.

B)Companies have structured leases in a way that the lease liabilities remain "off-balance sheet".

C)All leases are structured the same way and treated the same way.

D)Most leases are immaterial.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

14

In calculating the present value of the minimum lease payments, IFRS requires the lessee should

A)use its incremental borrowing rate in all cases.

B)use either its incremental borrowing rate or the interest rate implicit in the lease, whichever is higher.

C)use either its incremental borrowing rate or the interest rate implicit in the lease, whichever is lower.

D)use the interest rate implicit in the lease whenever this is reasonably determinable, otherwise use the lessee's incremental borrowing rate.

A)use its incremental borrowing rate in all cases.

B)use either its incremental borrowing rate or the interest rate implicit in the lease, whichever is higher.

C)use either its incremental borrowing rate or the interest rate implicit in the lease, whichever is lower.

D)use the interest rate implicit in the lease whenever this is reasonably determinable, otherwise use the lessee's incremental borrowing rate.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

15

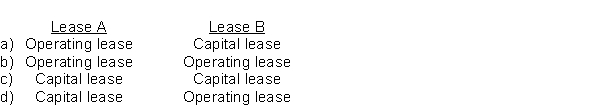

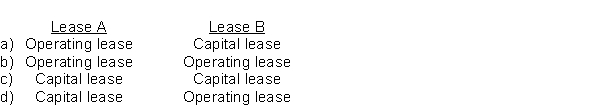

Lease A does not contain a bargain purchase option, but the lease term is equal to 90% of the estimated economic life of the leased property.Lease B does not transfer ownership of the property to the lessee by the end of the lease term, but the lease term is equal to 85% of the estimated economic life of the leased property.Using ASPE criteria, how should the lessee classify these leases?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

16

In Canada, lessors are usually these following types of companies, EXCEPT for:

A)manufacturer finance companies.

B)independent finance companies.

C)crown financings corporations.

D)traditional financial institutions.

A)manufacturer finance companies.

B)independent finance companies.

C)crown financings corporations.

D)traditional financial institutions.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

17

What is NOT a key variable considered in deciding on the on the rate of return?

A)the lessee's credit standing

B)the length of the lease

C)the status of the residual value (guaranteed or unguaranteed)

D)the type of asset being leased

A)the lessee's credit standing

B)the length of the lease

C)the status of the residual value (guaranteed or unguaranteed)

D)the type of asset being leased

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

18

Which item is NOT included in amount of the lease payment under IFRS 16?

A)Guaranteed residual values

B)Renewal or purchase options

C)Executory costs

D)Contingent rentals

A)Guaranteed residual values

B)Renewal or purchase options

C)Executory costs

D)Contingent rentals

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

19

Executory costs include

A)maintenance, interest and property taxes.

B)interest, property taxes and depreciation.

C)insurance, maintenance and property taxes.

D)maintenance, insurance and income taxes.

A)maintenance, interest and property taxes.

B)interest, property taxes and depreciation.

C)insurance, maintenance and property taxes.

D)maintenance, insurance and income taxes.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following is a correct statement regarding one of the ASPE capitalization criteria?

A)The lease transfers ownership of the property to the lessor.

B)The lease must contain a bargain purchase option.

C)The lease term is 75% or more of the leased property's estimated economic life.

D)The fair value of the minimum lease payments is equal to 90% or more of the present value of the leased asset.

A)The lease transfers ownership of the property to the lessor.

B)The lease must contain a bargain purchase option.

C)The lease term is 75% or more of the leased property's estimated economic life.

D)The fair value of the minimum lease payments is equal to 90% or more of the present value of the leased asset.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

21

A capital lease, as compared to an operating lease, has a higher likelihood which of the following?

A)default payment

B)violation of loan covenants

C)stronger ratios

D)higher overall expenses

A)default payment

B)violation of loan covenants

C)stronger ratios

D)higher overall expenses

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

22

In the earlier years of a lease, from the lessee's perspective, accounting for a leased asset as

A)a capital lease will enable the lessee to report higher income in the earlier years, compared to accounting for it as an operating lease.

B)a capital lease will cause debt to increase, compared to accounting for it as an operating lease.

C)an operating lease will cause income to decrease in the earlier years, compared to accounting for it as a finance lease.

D)an operating lease will cause debt to increase, compared to accounting for it as a finance lease.

A)a capital lease will enable the lessee to report higher income in the earlier years, compared to accounting for it as an operating lease.

B)a capital lease will cause debt to increase, compared to accounting for it as an operating lease.

C)an operating lease will cause income to decrease in the earlier years, compared to accounting for it as a finance lease.

D)an operating lease will cause debt to increase, compared to accounting for it as a finance lease.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

23

For the lessor, what is included in the Unearned Interest Income account?

A)the difference between the lease receivable and the fair value of the leased property

B)the lease receivable plus the fair value of the leased property

C)the difference between the lease receivable and the interest expected to be earned

D)the lease receivable plus the interest expected to be earned

A)the difference between the lease receivable and the fair value of the leased property

B)the lease receivable plus the fair value of the leased property

C)the difference between the lease receivable and the interest expected to be earned

D)the lease receivable plus the interest expected to be earned

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

24

Obligations under leases should be disclosed as

A)all current liabilities.

B)all noncurrent liabilities.

C)the current portion in current liabilities and the remainder in noncurrent liabilities.

D)deferred credits.

A)all current liabilities.

B)all noncurrent liabilities.

C)the current portion in current liabilities and the remainder in noncurrent liabilities.

D)deferred credits.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

25

Under IFRS 16, the right-of-use lease requires similar disclosure to which statement of financial position items?

A)Long-term liabilities

B)Common shares

C)Investments

D)Interest payable

A)Long-term liabilities

B)Common shares

C)Investments

D)Interest payable

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

26

For companies engaged in direct financing leases (ASPE)or finance leases (IFRS),

A)they are generally manufacturers or retail stores.

B)their profits are derived from leasing their inventory at a profit.

C)their objective is to earn interest income on the financing arrangement with the lessee.

D)such leases are frequently operating leases.

A)they are generally manufacturers or retail stores.

B)their profits are derived from leasing their inventory at a profit.

C)their objective is to earn interest income on the financing arrangement with the lessee.

D)such leases are frequently operating leases.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

27

When is a lease recognized as an operating lease under ASPE?

A)if it is of low-value to the corporation

B)if it is less than one year

C)if it doesn't meet the criteria of an capital lease

D)if the company elects to record as an operating lease

A)if it is of low-value to the corporation

B)if it is less than one year

C)if it doesn't meet the criteria of an capital lease

D)if the company elects to record as an operating lease

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

28

For a sales-type lease (ASPE)or manufacturer or dealer lease (IFRS),

A)the sales price and cost of goods sold are only recognized for the portion of the asset that is sure to be realized.

B)the sales price and cost of goods sold are recognized on the entire asset including unguaranteed residuals.

C)the present value of the guaranteed residual value is deducted to determine the cost of goods sold.

D)the present value of the guaranteed residual value is added to determine the cost of goods sold.

A)the sales price and cost of goods sold are only recognized for the portion of the asset that is sure to be realized.

B)the sales price and cost of goods sold are recognized on the entire asset including unguaranteed residuals.

C)the present value of the guaranteed residual value is deducted to determine the cost of goods sold.

D)the present value of the guaranteed residual value is added to determine the cost of goods sold.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

29

When is a lease recognized as an operating lease under IFRS?

A)if it is deemed so by the lessor

B)if it is less than one year

C)if it doesn't meet the criteria of an operating lease

D)if the company elects to record as an operating lease

A)if it is deemed so by the lessor

B)if it is less than one year

C)if it doesn't meet the criteria of an operating lease

D)if the company elects to record as an operating lease

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

30

A lessee reported a ten-year capital lease requiring equal annual payments.The reduction of the lease liability in year 2 should equal

A)the current liability shown for the lease at the end of year 1.

B)the current liability shown for the lease at the end of year 2.

C)the reduction of the lease obligation in year 1.

D)one-tenth of the original lease liability.

A)the current liability shown for the lease at the end of year 1.

B)the current liability shown for the lease at the end of year 2.

C)the reduction of the lease obligation in year 1.

D)one-tenth of the original lease liability.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

31

Initial direct costs are

A)costs incurred by a lessee that are directly associated with negotiating and arranging a lease.

B)expensed in the year of incurrence by the lessor in a financing-type lease.

C)spread over the term of a sales-type lease by the lessee.

D)deferred and allocated over the term of an operating lease in proportion to the amount of rental (lease)income that is recognized.

A)costs incurred by a lessee that are directly associated with negotiating and arranging a lease.

B)expensed in the year of incurrence by the lessor in a financing-type lease.

C)spread over the term of a sales-type lease by the lessee.

D)deferred and allocated over the term of an operating lease in proportion to the amount of rental (lease)income that is recognized.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

32

For a sales-type lease (ASPE)or manufacturer or dealer lease (IFRS),

A)the sales price includes the present value of the unguaranteed residual value.

B)the present value of the guaranteed residual value is deducted to determine the cost of goods sold.

C)the gross profit will be the same whether the residual value is guaranteed or unguaranteed.

D)cost of goods sold is not recognized.

A)the sales price includes the present value of the unguaranteed residual value.

B)the present value of the guaranteed residual value is deducted to determine the cost of goods sold.

C)the gross profit will be the same whether the residual value is guaranteed or unguaranteed.

D)cost of goods sold is not recognized.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

33

For the lessor, what is included in the lease receivable account?

A)the discounted lease payments less any guaranteed or unguaranteed residual value or any bargain purchase option

B)the discounted lease payments plus any guaranteed or unguaranteed residual value or any bargain purchase option

C)the undiscounted lease payments minus any guaranteed or unguaranteed residual value or any bargain purchase option

D)the undiscounted lease payments plus any guaranteed or unguaranteed residual value or any bargain purchase option

A)the discounted lease payments less any guaranteed or unguaranteed residual value or any bargain purchase option

B)the discounted lease payments plus any guaranteed or unguaranteed residual value or any bargain purchase option

C)the undiscounted lease payments minus any guaranteed or unguaranteed residual value or any bargain purchase option

D)the undiscounted lease payments plus any guaranteed or unguaranteed residual value or any bargain purchase option

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

34

Under ASPE, a lease in which the lessor wants to include a profit in the rental amount as well as the asset cost is called a

A)sales-type lease.

B)manufacturer lease.

C)direct financing lease.

D)finance lease.

A)sales-type lease.

B)manufacturer lease.

C)direct financing lease.

D)finance lease.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

35

For a sales-type lease (ASPE)or manufacturer or dealer lease (IFRS),

A)direct costs are recognized over the term of the lease.

B)direct costs are recognized as an expense in the year they are incurred.

C)direct costs are treated identically under ASPE and IFRS.

D)direct costs treatment does not apply the matching concept.

A)direct costs are recognized over the term of the lease.

B)direct costs are recognized as an expense in the year they are incurred.

C)direct costs are treated identically under ASPE and IFRS.

D)direct costs treatment does not apply the matching concept.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

36

Which statement is correct in comparing capital leases to operating leases?

A)A capital lease will have a higher asset turnover compared to an operating lease.

B)A capital lease will increase the return on total assets compared to an operating lease.

C)A capital lease will have a lower debt-to-equity ratio compared to an operating lease.

D)A capital lease will have a higher debt-to-equity ratio compared to an operating lease.

A)A capital lease will have a higher asset turnover compared to an operating lease.

B)A capital lease will increase the return on total assets compared to an operating lease.

C)A capital lease will have a lower debt-to-equity ratio compared to an operating lease.

D)A capital lease will have a higher debt-to-equity ratio compared to an operating lease.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

37

For a lessor, which of the following would NOT be included in the Gross Investment in Lease (Lease Receivable)?

A)guaranteed residual value

B)unguaranteed residual value

C)bargain purchase option

D)executory costs

A)guaranteed residual value

B)unguaranteed residual value

C)bargain purchase option

D)executory costs

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

38

Under IFRS 16, a lease in which the lessor is involved in mostly financing operations, such as lease-finance companies is called a

A)sales-type lease.

B)manufacturer lease.

C)direct financing lease.

D)finance lease.

A)sales-type lease.

B)manufacturer lease.

C)direct financing lease.

D)finance lease.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

39

In a lease that is appropriately recorded as a direct financing lease (ASPE)or finance lease (IFRS)by the lessor, the unearned interest income is

A)amortized and taken into income over the lease term using the effective interest method.

B)amortized and taken into income over the lease term using the straight-line method.

C)taken into income at the inception of the lease.

D)taken into income at the end of the lease.

A)amortized and taken into income over the lease term using the effective interest method.

B)amortized and taken into income over the lease term using the straight-line method.

C)taken into income at the inception of the lease.

D)taken into income at the end of the lease.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

40

How many years do companies have to disclose the minimum lease payments in the leases note disclosure?

A)1

B)2

C)5

D)10

A)1

B)2

C)5

D)10

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

41

Rabbit Inc.has an asset with a fair market value of $450,000 that it wants to lease.Rabbit's wants to recover its net investment in the leased asset and earn an 8%.The asset will revert back to Rabbit's at the end of a 5-year lease term and it is expected that the residual value of the asset will be $20,000 at the end of the lease.If Rabbit wants to charge rent semi-annually starting at the beginning of the lease, what amount should the lease payments be (rounded to whole dollars)?

A)$60,817

B)$62,096

C)$101,200

D)$104,367

A)$60,817

B)$62,096

C)$101,200

D)$104,367

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

42

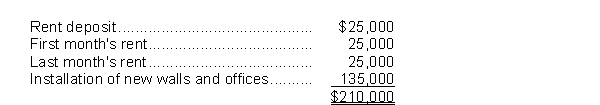

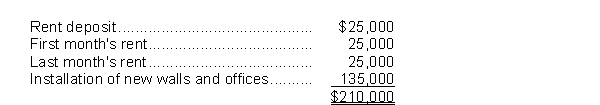

On December 1, 2017, Quincannon Corp.leased office space for 10 years at a monthly rental of $25,000, under an operating lease.On that date Quincannon paid the landlord the following amounts:  Quincannon debited the entire $210,000 payment to Prepaid Rent.

Quincannon debited the entire $210,000 payment to Prepaid Rent.

How much should Quincannon recognize as rent expense for the year ended December 31, 2017?

A)$25,000

B)$26,125

C)$51,125

D)$137,500

Quincannon debited the entire $210,000 payment to Prepaid Rent.

Quincannon debited the entire $210,000 payment to Prepaid Rent.How much should Quincannon recognize as rent expense for the year ended December 31, 2017?

A)$25,000

B)$26,125

C)$51,125

D)$137,500

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

43

Assume Sunny Corp.(a company reporting under IFRS)wants to earn an 8% return on its investment of $1,200,000 in an asset that is to be leased to Cloudy Corp.for ten years with an annual rental due in advance each year.How much should Sunny charge for annual rental assuming there is no purchase option that is reasonably certain to be exercised by Cloudy Corp.?

A)$120,000

B)$165,588

C)$178,835

D)$216,000

A)$120,000

B)$165,588

C)$178,835

D)$216,000

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

44

Use the following information for questions.

On January 2, 2017, Cambridge Ltd.signed a ten-year non-cancellable lease for a heavy-duty drill press.The lease required annual payments of $35,000, starting December 31, 2017, with title passing to Cambridge at the end of the lease.Cambridge is accounting for this lease as a capital (finance)lease.The drill press has an estimated useful life of 20 years, with no residual value.Cambridge uses straight-line depreciation for all its plant assets.The lease payments were determined to have a present value of $215,000, based on an implicit interest rate of 10%.

On their 2017 income statement, how much interest expense should Cambridge report in connection with this lease?

A)$0

B)$13,125

C)$17,500

D)$21,500

On January 2, 2017, Cambridge Ltd.signed a ten-year non-cancellable lease for a heavy-duty drill press.The lease required annual payments of $35,000, starting December 31, 2017, with title passing to Cambridge at the end of the lease.Cambridge is accounting for this lease as a capital (finance)lease.The drill press has an estimated useful life of 20 years, with no residual value.Cambridge uses straight-line depreciation for all its plant assets.The lease payments were determined to have a present value of $215,000, based on an implicit interest rate of 10%.

On their 2017 income statement, how much interest expense should Cambridge report in connection with this lease?

A)$0

B)$13,125

C)$17,500

D)$21,500

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

45

Use the following information for questions.

On January 2, 2017, Cambridge Ltd.signed a ten-year non-cancellable lease for a heavy-duty drill press.The lease required annual payments of $35,000, starting December 31, 2017, with title passing to Cambridge at the end of the lease.Cambridge is accounting for this lease as a capital (finance)lease.The drill press has an estimated useful life of 20 years, with no residual value.Cambridge uses straight-line depreciation for all its plant assets.The lease payments were determined to have a present value of $215,000, based on an implicit interest rate of 10%.

On their 2017 income statement, how much depreciation expense should Cambridge report in connection with this lease?

A)$10,750

B)$17,500

C)$21,500

D)$35,000

On January 2, 2017, Cambridge Ltd.signed a ten-year non-cancellable lease for a heavy-duty drill press.The lease required annual payments of $35,000, starting December 31, 2017, with title passing to Cambridge at the end of the lease.Cambridge is accounting for this lease as a capital (finance)lease.The drill press has an estimated useful life of 20 years, with no residual value.Cambridge uses straight-line depreciation for all its plant assets.The lease payments were determined to have a present value of $215,000, based on an implicit interest rate of 10%.

On their 2017 income statement, how much depreciation expense should Cambridge report in connection with this lease?

A)$10,750

B)$17,500

C)$21,500

D)$35,000

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

46

Laurel Ltd.leased an office building to Hardy Inc.for a three year, non-renewable term.This was properly classified as an operating lease by both parties.The monthly rental is set at $12,000 per month.However, as an added inducement, Laurel agreed to grant Hardy a four-month rent-free period at the beginning of the lease, and a further two-month rent-free period at the end of the lease.How much rent expense should Hardy record each month during the three year period?

A)$12,000

B)$11,250

C)$10,667

D)$10,000

A)$12,000

B)$11,250

C)$10,667

D)$10,000

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

47

Under IAS 17 when should a company classify its leases as finance leases?

A)when the risks and rewards of ownership are transferred to the lessee

B)all leases are finance leases

C)all leases are finance leases except for leases of low-value assets and short-term leases

D)when it is a sale-leaseback lease

A)when the risks and rewards of ownership are transferred to the lessee

B)all leases are finance leases

C)all leases are finance leases except for leases of low-value assets and short-term leases

D)when it is a sale-leaseback lease

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

48

Under IFRS 16, the lessee uses the rate implicit in the lease to calculate leases; under ASPE,

A)the same treatment is used.

B)the lower of the lessee's incremental borrowing rate and the rate implicit in the lease is used.

C)the higher of the lessee's incremental borrowing rate and the rate implicit in the lease is used.

D)the incremental borrowing rate is used.

A)the same treatment is used.

B)the lower of the lessee's incremental borrowing rate and the rate implicit in the lease is used.

C)the higher of the lessee's incremental borrowing rate and the rate implicit in the lease is used.

D)the incremental borrowing rate is used.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

49

Madrigal Corp.sold its headquarters building at a gain, and simultaneously leased back the building from the buyer.The lease was reported as a capital (finance)lease.At the time of the sale, the gain should be reported as

A)operating income.

B)other comprehensive income.

C)a separate component of shareholders' equity.

D)a deferred gain.

A)operating income.

B)other comprehensive income.

C)a separate component of shareholders' equity.

D)a deferred gain.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

50

On December 31, 2016, Northern Skies Corp.leased a machine from Eastern Star Ltd.for a five-year period.Annual lease payments are $315,000 (including $15,000 annual executory costs), due on December 31 each year.The first payment was made on December 31, 2016, and the second payment on December 31, 2017.The appropriate interest rate for this type of lease is 10%.The present value of the minimum lease payments at the inception of the lease (before the first payment)was $1,251,000.The lease is being accounted for as a finance lease by Northern Skies.On its December 31, 2017 statement of financial position, Northern Skies should report a lease liability of

A)$951,000.

B)$936,000.

C)$855,900.

D)$746,100.

A)$951,000.

B)$936,000.

C)$855,900.

D)$746,100.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

51

Under ASPE, if land is the sole property being leased, and title does NOT transfer at the end of the lease, it should be accounted for as a(n)

A)operating lease.

B)capital lease.

C)sales-type lease.

D)direct-financing lease.

A)operating lease.

B)capital lease.

C)sales-type lease.

D)direct-financing lease.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

52

Under ASPE, leases are either capital or an operating lease to a lessee; under IFRS 16,

A)leases are treated the same as under ASPE.

B)leases are treated the same as under IAS 17.

C)all leases are considered capital.

D)all leases are considered capital except for short-term leases and leases of low-value assets.

A)leases are treated the same as under ASPE.

B)leases are treated the same as under IAS 17.

C)all leases are considered capital.

D)all leases are considered capital except for short-term leases and leases of low-value assets.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

53

Rounded to the nearest dollar, the amount of the total annual lease payment is

A)$56,471.

B)$143,471.

C)$146,471.

D)$149,471.

A)$56,471.

B)$143,471.

C)$146,471.

D)$149,471.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

54

On January 1, 2017, X-Man Corp.signed a ten-year non-cancellable lease for new machinery.The terms of the lease called for X-Man to make annual payments of $100,000 at the end of each year for ten years, with title to pass to X-Man at the end of the lease period.X-Man accordingly accounted for this lease transaction as a finance lease.The machinery has an estimated useful life of 15 years and no residual value.X-Man uses straight-line depreciation for all of its property, plant and equipment.The lease payments were determined to have a present value of $671,008 at an effective interest rate of 8%.It was also determined that the fair value of the machinery on January 1, 2017 was $674,000.

With respect to this lease, for the year ending December 31, 2017, X-Man should report (rounded to the nearest dollar)

A)lease expense of $100,000, and depreciation expense of $44,734.

B)interest expense of $53,681 and depreciation expense of $67,101.

C)interest expense of $53,681 and depreciation expense of $44,734.

D)interest expense of $53,920 and depreciation expense of $44,933.

With respect to this lease, for the year ending December 31, 2017, X-Man should report (rounded to the nearest dollar)

A)lease expense of $100,000, and depreciation expense of $44,734.

B)interest expense of $53,681 and depreciation expense of $67,101.

C)interest expense of $53,681 and depreciation expense of $44,734.

D)interest expense of $53,920 and depreciation expense of $44,933.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

55

A sale-leaseback transaction is

A)a lease that has a profit component that is recognized as sales revenue.

B)when a company buys an asset and then leases it to someone else other than the seller.

C)a transaction in which a property owner sells a property to another party and, and at the same time leases a similar asset.

D)a transaction in which a property owner sells a property to another party and, at the same time, leases the same asset back from the new owner.

A)a lease that has a profit component that is recognized as sales revenue.

B)when a company buys an asset and then leases it to someone else other than the seller.

C)a transaction in which a property owner sells a property to another party and, and at the same time leases a similar asset.

D)a transaction in which a property owner sells a property to another party and, at the same time, leases the same asset back from the new owner.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

56

Frank Corporation has an asset with a fair market value of $200,000 that it wants to lease.Frank's wants to recover its net investment in the leased asset and earn a 10% return.The asset will revert back to Frank's at the end of a 6-year lease term.If Frank's charges rent annually at the beginning of the year, what should amount should the annual rent be (rounded to whole dollars)?

A)$18,817

B)$33,333

C)$41,747

D)$53,333

A)$18,817

B)$33,333

C)$41,747

D)$53,333

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

57

On July 1, 2017, Justin Ltd., a dealer in machinery and equipment, leased equipment to Trudeau Inc.The lease is for ten years, and at the end of the lease period, title will pass to Trudeau.Justin requires ten equal annual payments of $62,100 on July 1 of each year, and Trudeau made the first payment on July 1, 2017.Justin had purchased the equipment for $390,000 on January 1, 2017, and established a selling price of $500,000 (which was fair value at July 1, 2017).Assume that, at July 1, 2017, the present value of the rent payments over the lease term discounted at 8% (the appropriate interest rate)was $450,000.The useful life of the equipment is 12 years.

For the year ended December 31, 2017, and assuming that Trudeau uses straight-line depreciation, how much depreciation and interest expense should Trudeau record?

A)$18,750 and $15,516

B)$18,750 and $24,840

C)$22,500 and $15,516

D)$22,500 and $24,840

For the year ended December 31, 2017, and assuming that Trudeau uses straight-line depreciation, how much depreciation and interest expense should Trudeau record?

A)$18,750 and $15,516

B)$18,750 and $24,840

C)$22,500 and $15,516

D)$22,500 and $24,840

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

58

On December 31, 2017, Eastern Inc.leased machinery with a fair value of $420,000 from Northern Rentals.The agreement is a six-year non-cancellable lease requiring annual payments of $80,000 beginning December 31, 2017.The lease is appropriately accounted for by Eastern as a finance lease.Eastern's incremental borrowing rate is 11%; however, they also know that the interest rate implicit in the lease payments is 10%.Eastern adheres to IFRS.

The present value of an annuity due for 6 years at 10% is 4.7908.

The present value of an annuity due for 6 years at 11% is 4.6959.

On its December 31, 2017 statement of financial position, Eastern should report a lease liability of (rounded to the nearest dollar)

A)$303,264.

B)$340,000.

C)$375,672.

D)$383,264.

The present value of an annuity due for 6 years at 10% is 4.7908.

The present value of an annuity due for 6 years at 11% is 4.6959.

On its December 31, 2017 statement of financial position, Eastern should report a lease liability of (rounded to the nearest dollar)

A)$303,264.

B)$340,000.

C)$375,672.

D)$383,264.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

59

If a corporation adhering to IFRS sells machinery at fair value and then leases it back (sale-leaseback)as a finance lease, any gain on the sale should be

A)recognized in the year of "sale."

B)recorded as other comprehensive income.

C)deferred and amortized to income over the term of the lease.

D)deferred and recognized as income at the end of the lease.

A)recognized in the year of "sale."

B)recorded as other comprehensive income.

C)deferred and amortized to income over the term of the lease.

D)deferred and recognized as income at the end of the lease.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

60

Under IFRS, if land is the sole property being leased, and title does transfer at the end of the lease, it should be accounted for as a(n)

A)operating lease.

B)capital lease.

C)sales-type lease or financing lease.

D)rental agreement.

A)operating lease.

B)capital lease.

C)sales-type lease or financing lease.

D)rental agreement.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

61

Use the following information for questions.

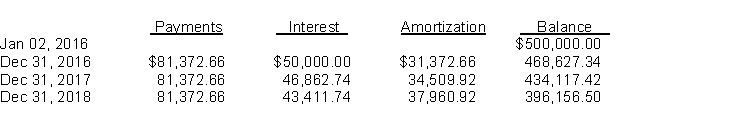

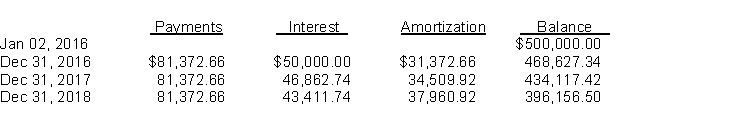

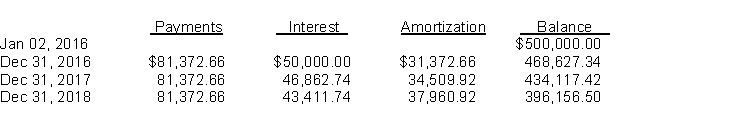

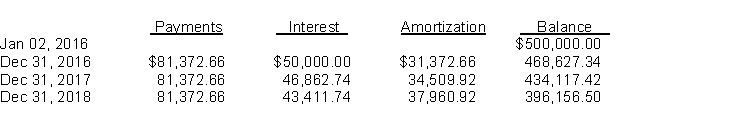

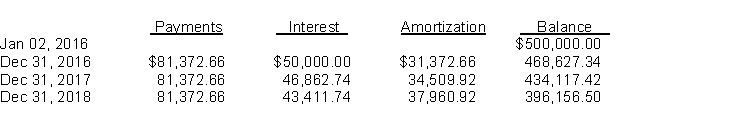

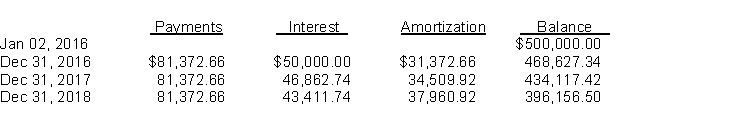

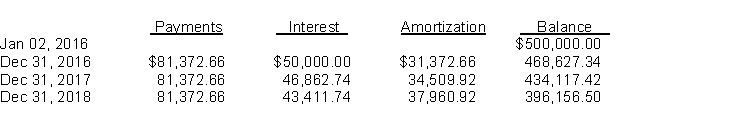

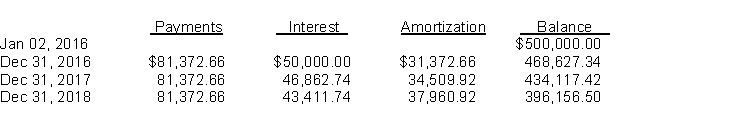

Ball Ltd.purchased land and constructed a service station, at a total cost of $450,000.On January 2, 2016, when construction was completed, Ball sold the service station and land to a major oil company for $500,000, and immediately leased it back from the oil company.Fair value of the land at the time of the sale was $50,000.The lease is a 10-year, non-cancellable lease.Ball uses straight-line amortization for its other assets.The economic life of the station is 15 years with zero residual value.Title to the property will revert back to Ball at the end of the lease.A partial amortization schedule for this lease follows:

The total lease-related income recognized by the lessee during 2017 is

A)$0.

B)$3,333.

C)$5,000.

D)$50,000.

Ball Ltd.purchased land and constructed a service station, at a total cost of $450,000.On January 2, 2016, when construction was completed, Ball sold the service station and land to a major oil company for $500,000, and immediately leased it back from the oil company.Fair value of the land at the time of the sale was $50,000.The lease is a 10-year, non-cancellable lease.Ball uses straight-line amortization for its other assets.The economic life of the station is 15 years with zero residual value.Title to the property will revert back to Ball at the end of the lease.A partial amortization schedule for this lease follows:

The total lease-related income recognized by the lessee during 2017 is

A)$0.

B)$3,333.

C)$5,000.

D)$50,000.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

62

On May 1, 2017, Charles Corp.leased equipment to Darwin Inc.for one year under an operating lease.Instead of leasing it, Darwin could have bought the equipment from Charles for $800,000 cash.At this time, Charles's accounting records showed a book value for the equipment of $700,000.Depreciation on the equipment in 2017 was $90,000.During 2017, Darwin paid $22,500 per month rent to Charles for the 8-month period, and Charles incurred maintenance and other related costs under the terms of the lease of $16,000.

The pre-tax expense reported by Darwin from this lease for the year ended December 31, 2017, should be

A)$74,000.

B)$90,000.

C)$164,000.

D)$180,000.

The pre-tax expense reported by Darwin from this lease for the year ended December 31, 2017, should be

A)$74,000.

B)$90,000.

C)$164,000.

D)$180,000.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

63

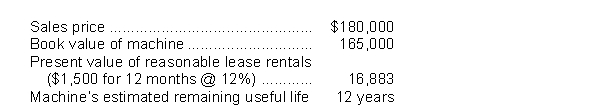

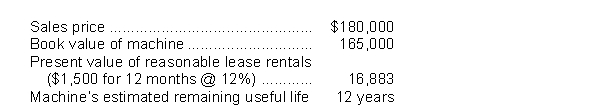

On December 31, 2017, Lewis Ltd.sold a machine to Martin Inc.and simultaneously leased it back for one year.Pertinent information at this date follows:  On Lewis's December 31, 2017 statement of financial position, the deferred profit from the sale of this machine should be reported as

On Lewis's December 31, 2017 statement of financial position, the deferred profit from the sale of this machine should be reported as

A)$17,000.

B)$15,000.

C)$2,000.

D)$0.

On Lewis's December 31, 2017 statement of financial position, the deferred profit from the sale of this machine should be reported as

On Lewis's December 31, 2017 statement of financial position, the deferred profit from the sale of this machine should be reported asA)$17,000.

B)$15,000.

C)$2,000.

D)$0.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

64

Sukwinder Corp.manufactures equipment for sale or lease.On December 31, 2017, Sukwinder leased equipment to Pattar Sales Inc.for five years, with ownership of the equipment being transferred to Pattar at the end of the lease.Annual lease payments are $126,000 (including $6,000 executory costs)and are due on December 31 of each year.The first payment was made on December 31, 2017.Collectibility of the remaining lease payments is reasonably assured, and there are no additional costs (other than executory costs)to be incurred by Sukwinder.The normal sales price of the equipment (fair value)is $462,000, and Sukwinder's cost is $360,000.

For the year ended December 31, 2017, what amount of income should Sukwinder report from this lease?

A)$102,000

B)$132,000

C)$138,000

D)$198,000

For the year ended December 31, 2017, what amount of income should Sukwinder report from this lease?

A)$102,000

B)$132,000

C)$138,000

D)$198,000

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

65

Use the following information for questions.

Ball Ltd.purchased land and constructed a service station, at a total cost of $450,000.On January 2, 2016, when construction was completed, Ball sold the service station and land to a major oil company for $500,000, and immediately leased it back from the oil company.Fair value of the land at the time of the sale was $50,000.The lease is a 10-year, non-cancellable lease.Ball uses straight-line amortization for its other assets.The economic life of the station is 15 years with zero residual value.Title to the property will revert back to Ball at the end of the lease.A partial amortization schedule for this lease follows:

What is the interest rate implicit in the amortization schedule presented above?

A)12%

B)10%

C)8%

D)6%

Ball Ltd.purchased land and constructed a service station, at a total cost of $450,000.On January 2, 2016, when construction was completed, Ball sold the service station and land to a major oil company for $500,000, and immediately leased it back from the oil company.Fair value of the land at the time of the sale was $50,000.The lease is a 10-year, non-cancellable lease.Ball uses straight-line amortization for its other assets.The economic life of the station is 15 years with zero residual value.Title to the property will revert back to Ball at the end of the lease.A partial amortization schedule for this lease follows:

What is the interest rate implicit in the amortization schedule presented above?

A)12%

B)10%

C)8%

D)6%

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

66

On May 1, 2017, Charles Corp.leased equipment to Darwin Inc.for one year under an operating lease.Instead of leasing it, Darwin could have bought the equipment from Charles for $800,000 cash.At this time, Charles's accounting records showed a book value for the equipment of $700,000.Depreciation on the equipment in 2017 was $90,000.During 2017, Darwin paid $22,500 per month rent to Charles for the 8-month period, and Charles incurred maintenance and other related costs under the terms of the lease of $16,000.

The net income before income taxes reported by Charles from this lease for the year ended December 31, 2017, should be

A)$74,000.

B)$90,000.

C)$164,000.

D)$180,000.

The net income before income taxes reported by Charles from this lease for the year ended December 31, 2017, should be

A)$74,000.

B)$90,000.

C)$164,000.

D)$180,000.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

67

Use the following information for questions.

Ball Ltd.purchased land and constructed a service station, at a total cost of $450,000.On January 2, 2016, when construction was completed, Ball sold the service station and land to a major oil company for $500,000, and immediately leased it back from the oil company.Fair value of the land at the time of the sale was $50,000.The lease is a 10-year, non-cancellable lease.Ball uses straight-line amortization for its other assets.The economic life of the station is 15 years with zero residual value.Title to the property will revert back to Ball at the end of the lease.A partial amortization schedule for this lease follows:

The total lease-related expenses recognized by the lessee during 2017 are (rounded to the nearest dollar)

A)$76,863.

B)$80,000.

C)$81,373.

D)$91,863.

Ball Ltd.purchased land and constructed a service station, at a total cost of $450,000.On January 2, 2016, when construction was completed, Ball sold the service station and land to a major oil company for $500,000, and immediately leased it back from the oil company.Fair value of the land at the time of the sale was $50,000.The lease is a 10-year, non-cancellable lease.Ball uses straight-line amortization for its other assets.The economic life of the station is 15 years with zero residual value.Title to the property will revert back to Ball at the end of the lease.A partial amortization schedule for this lease follows:

The total lease-related expenses recognized by the lessee during 2017 are (rounded to the nearest dollar)

A)$76,863.

B)$80,000.

C)$81,373.

D)$91,863.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

68

Use the following information for questions.

Ball Ltd.purchased land and constructed a service station, at a total cost of $450,000.On January 2, 2016, when construction was completed, Ball sold the service station and land to a major oil company for $500,000, and immediately leased it back from the oil company.Fair value of the land at the time of the sale was $50,000.The lease is a 10-year, non-cancellable lease.Ball uses straight-line amortization for its other assets.The economic life of the station is 15 years with zero residual value.Title to the property will revert back to Ball at the end of the lease.A partial amortization schedule for this lease follows:

What is the amount of the lessee's obligation to the lessor after the December 31, 2018 payment? (Round to the nearest dollar.)

A)$500,000

B)$468,627

C)$434,117

D)$396,157

Ball Ltd.purchased land and constructed a service station, at a total cost of $450,000.On January 2, 2016, when construction was completed, Ball sold the service station and land to a major oil company for $500,000, and immediately leased it back from the oil company.Fair value of the land at the time of the sale was $50,000.The lease is a 10-year, non-cancellable lease.Ball uses straight-line amortization for its other assets.The economic life of the station is 15 years with zero residual value.Title to the property will revert back to Ball at the end of the lease.A partial amortization schedule for this lease follows:

What is the amount of the lessee's obligation to the lessor after the December 31, 2018 payment? (Round to the nearest dollar.)

A)$500,000

B)$468,627

C)$434,117

D)$396,157

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

69

On June 30, 2017, Sharma Corp.sold equipment for $300,000.The equipment had a book value of $500,000 and a remaining useful life of 10 years.The same day, Sharma leased back the equipment at $6,000 per month for 5 years with no option to renew the lease or repurchase the equipment.

Sharma's equipment rent expense for this equipment for the year ended December 31, 2017, should be

A)$72,000.

B)$36,000.

C)$30,000.

D)$24,000.

Sharma's equipment rent expense for this equipment for the year ended December 31, 2017, should be

A)$72,000.

B)$36,000.

C)$30,000.

D)$24,000.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck