Deck 9: Capital Recovery: Depreciation, Amortization, and Depletion

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/48

Play

Full screen (f)

Deck 9: Capital Recovery: Depreciation, Amortization, and Depletion

1

Sellers prefer allocating a portion of their sales price to goodwill rather than a covenant not to compete even though a buyer is generally indifferent.

True

2

Property used in an income-producing activity that is neither a trade nor a business may be depreciated.

True

3

Taxpayers may use component depreciation to depreciate the various components (e.g., plumbing, electrical) of a building under MACRS.

False

4

A deduction for percentage depletion is allowed even though the entire cost of the asset has been recovered (i.e., the basis of the asset is zero).

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

5

Capitalizing an expenditure for research and experimentation decreases the basis of the property to which the expense relates.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

6

A covenant not to compete may be amortized over the period of the covenant.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

7

A depreciation deduction may be claimed for a decline in value that occurred while an item of property was held for personal purposes.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

8

Livestock owned by ranchers and farmers and held for resale may be depreciated as a capital expenditure.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

9

During 2004, Y purchased a new warehouse, which he sold on June 10, 2013.In 2013, Y may claim depreciation equal to 6/12 of the MACRS statutory percentage.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

10

The use of MACRS is precluded for property placed in service prior to the enactment of either version of MACRS, unless the property is transferred in a transaction where both the owner and the user change.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

11

Expenditures for research and experimentation that are deferred must be amortized ratably over a period of 17 years.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

12

All methods of depreciation permitted by the IRS prior to the 1981 introduction of ACRS provided taxpayers the opportunity to manipulate the depreciation deduction by underestimating the useful lives of their property.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

13

Auto leasing for business purposes yields the same tax advantage as auto ownership despite the limitations applied to depreciation of automobiles.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

14

In computing depreciation using MACRS, a taxpayer who elects to expense all or a portion of an asset must adjust the basis of the asset.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

15

The straight-line method must be used for amortizing intangible property such as copyrights.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

16

All depreciable property is eligible to be depreciated by means of at least one straight-line method.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

17

Farmers may deduct expenditures for ponds and drainage ditches rather than capitalize them.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

18

Taxpayer N purchased numerous tax texts totaling $1,000 while obtaining his master's degree in taxation.This year he began teaching taxation when the books were valued at $700.Assuming he uses the texts as references in his profession, he may compute depreciation using a basis of $1,000.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

19

The entire cost of recovery property that constitutes a research and experimental expenditure can be expensed entirely in the year of acquisition.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

20

The facts-and-circumstances approach to determining the useful life of an asset remains permitted under some circumstances.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

21

Which property is depreciable using MACRS?

A)Manufacturing equipment purchased new

B)Automobiles used in a business

C)Apartment building purchased from a previous, unrelated owner

D)Computers used in a business

E)All of the above are depreciable using MACRS.

A)Manufacturing equipment purchased new

B)Automobiles used in a business

C)Apartment building purchased from a previous, unrelated owner

D)Computers used in a business

E)All of the above are depreciable using MACRS.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

22

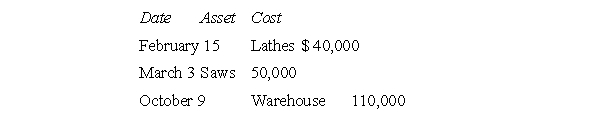

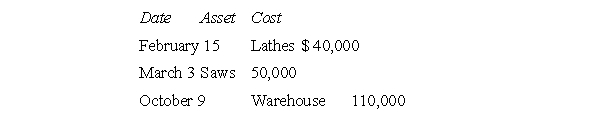

During the year, Fine Furnishings, a manufacturer of furniture, purchased the following assets:  In computing depreciation of these assets, which of the following conventions will be used?

In computing depreciation of these assets, which of the following conventions will be used?

A)Half-year, mid-month

B)Mid-quarter, mid-month

C)Half-year, mid-quarter, mid-month

D)Mid-quarter

E)Some combination other than those given above

In computing depreciation of these assets, which of the following conventions will be used?

In computing depreciation of these assets, which of the following conventions will be used?A)Half-year, mid-month

B)Mid-quarter, mid-month

C)Half-year, mid-quarter, mid-month

D)Mid-quarter

E)Some combination other than those given above

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

23

In 2012, B purchased a crane to be used entirely for business.He spent a total of $475,000.He decided to use the limited-expensing election.What is the total depreciable basis for the mini-computer?

A)$500,000

B)$475,000

C)$0

D)$350,000

E)None of the above

A)$500,000

B)$475,000

C)$0

D)$350,000

E)None of the above

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

24

MACRS prescribes rates of depreciation determined by three criteria.What are they?

A)Useful life, property classification, and recovery period

B)Accounting convention, useful life, and property classification

C)Accounting convention, useful life, and recovery period

D)Accounting convention, property classification, and recovery period

A)Useful life, property classification, and recovery period

B)Accounting convention, useful life, and property classification

C)Accounting convention, useful life, and recovery period

D)Accounting convention, property classification, and recovery period

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

25

Company G, a calendar year taxpayer, purchased a five-story building on April 2 of the current year for $1 million.The building, which has no historical or architectural significance, was constructed in 1946 by the previous owner, who had fully depreciated it before selling it to Company G.The first floor is occupied by shops and restaurants, the other four by apartments.Income will be $50,000 from commercial rents and $150,000 from residential rents.The deduction for depreciation that the company may claim for the building is about

A)$0

B)$18,162

C)$19,231

D)$25,104

E)$25,758

A)$0

B)$18,162

C)$19,231

D)$25,104

E)$25,758

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

26

In November of this year, Creative Corn Products, a calendar year taxpayer, placed in service its only equipment purchased during the year.The equipment cost $700,000.All of the equipment qualified as five-year property under MACRS.Ignore bonus depreciation.The maximum deduction that the taxpayer may claim with respect to the equipment is

A)$35,000

B)$87,500

C)$125,000

D)$240,000

E)$140,000

A)$35,000

B)$87,500

C)$125,000

D)$240,000

E)$140,000

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

27

During the year, T purchased the items shown below.Indicate which item qualifies for both § 179 limited expensing and bonus depreciation.

A)A new computer used to monitor his investments

B)A new office building to be used in his business

C)A truck purchased from XYZ Corporation, which had used it in its sand and gravel business

D)New office furniture for the new office building

E)None of the above

A)A new computer used to monitor his investments

B)A new office building to be used in his business

C)A truck purchased from XYZ Corporation, which had used it in its sand and gravel business

D)New office furniture for the new office building

E)None of the above

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

28

Personal property is

A)Not depreciable

B)Depreciable using the 150 percent declining-balance and 200 percent declining-balance methods only

C)Depreciable using the 150 percent declining-balance, 200 percent declining-balance, and straight-line methods

D)Depreciable using only those methods available for real property

A)Not depreciable

B)Depreciable using the 150 percent declining-balance and 200 percent declining-balance methods only

C)Depreciable using the 150 percent declining-balance, 200 percent declining-balance, and straight-line methods

D)Depreciable using only those methods available for real property

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

29

Placid Places Incorporated, a calendar year taxpayer, purchased an apartment building on October 1 of the current year for $1,200,000, of which $200,000 was allocable to the land.The corporation's depreciation for the building for the year will be the product of the building's basis and

A)1/27.5 and 2.5/12

B)1/27.5 and 9.5/12

C)1/39 and 2..5/12

D)1/39 and ½

E)1/39 and 9..5/12

A)1/27.5 and 2.5/12

B)1/27.5 and 9.5/12

C)1/39 and 2..5/12

D)1/39 and ½

E)1/39 and 9..5/12

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

30

Which statement concerning depreciation is not true?

A)Only property that has a determinable life is depreciable.

B)Deductions for depreciation must be claimed for the year when the depreciation occurred or they will be forfeited.

C)Personal property converted to business use is not depreciable since it was once used for personal purposes.

D)Land is not depreciable.

A)Only property that has a determinable life is depreciable.

B)Deductions for depreciation must be claimed for the year when the depreciation occurred or they will be forfeited.

C)Personal property converted to business use is not depreciable since it was once used for personal purposes.

D)Land is not depreciable.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

31

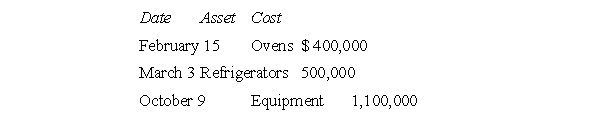

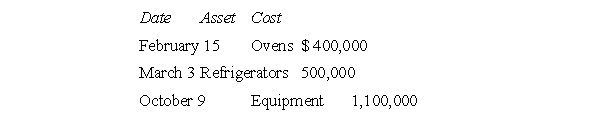

During the year a calendar year taxpayer, Heavenly Hamhocks, a chain of specialty food shops, purchased equipment as follows:  Assuming the property is all seven-year property, depreciation for the assets this year would be

Assuming the property is all seven-year property, depreciation for the assets this year would be

A)$71,400

B)$264,270

C)$285,800

D)$500,000

E)None of the above

Assuming the property is all seven-year property, depreciation for the assets this year would be

Assuming the property is all seven-year property, depreciation for the assets this year would beA)$71,400

B)$264,270

C)$285,800

D)$500,000

E)None of the above

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

32

Which is not depreciable under the Modified Accelerated Cost Recovery System (MACRS)?

A)New buildings

B)Used buildings

C)Used machinery

D)Patents

A)New buildings

B)Used buildings

C)Used machinery

D)Patents

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following is not considered eligible property for limited expensing under § 179?

A)Automobile used by a salesman

B)Warehouse purchased by XYZ Corporation to store inventory

C)Computer used by Nick Knight to do the accounting for his video tape rental business

D)Equipment used by Serendipity Tea Company in its operations

E)All of the above are eligible.

A)Automobile used by a salesman

B)Warehouse purchased by XYZ Corporation to store inventory

C)Computer used by Nick Knight to do the accounting for his video tape rental business

D)Equipment used by Serendipity Tea Company in its operations

E)All of the above are eligible.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

34

In 2012, Ozzie Ostentatious purchased a new Porsche convertible for $80,000 to be used in his business, Tract Homes Are Us.Ozzie drove the car 80 percent of the time for business.The maximum amount of the car's cost that Ozzie may deduct this year (ignoring bonus depreciation) is

A)$3,160

B)$1,775

C)$64,000

D)$2,528

E)None of the above

A)$3,160

B)$1,775

C)$64,000

D)$2,528

E)None of the above

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

35

Which statement is not true of straight-line depreciation under MACRS?

A)Each of the three accounting conventions (half-year, mid-month, and mid-quarter) are eligible for MACRS straight-line depreciation.

B)MACRS straight-line depreciation is required for real property.

C)MACRS straight-line depreciation must be used for either all or none of the assets of a given class placed in service during a given year.

D)The class life of an asset is used as its recovery period.

A)Each of the three accounting conventions (half-year, mid-month, and mid-quarter) are eligible for MACRS straight-line depreciation.

B)MACRS straight-line depreciation is required for real property.

C)MACRS straight-line depreciation must be used for either all or none of the assets of a given class placed in service during a given year.

D)The class life of an asset is used as its recovery period.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

36

In 2012 Kay Smart operates a cosmetic manufacturing business.During the year, the business placed in service $560,000 of five-year property eligible for limited expensing under § 179.Ms.Smart wisely elected § 179.The maximum amount that she can expense under § 179 is

A)$0

B)$65,000

C)$125,000

D)$500,000

E)None of the above

A)$0

B)$65,000

C)$125,000

D)$500,000

E)None of the above

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

37

Riverview Incorporated, a calendar year taxpayer, purchased an apartment building on June 1 last year for $1,200,000, of which $200,000 was allocable to the land.The corporation sold the property on June 27 of the current year.The corporation's depreciation for the building for the current year will be approximately

A)$0

B)$16,665

C)$18,180

D)$36,360

E)None of the above

A)$0

B)$16,665

C)$18,180

D)$36,360

E)None of the above

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

38

S purchased a used automobile to be used in his sole proprietorship.For the year, S's business mileage was 20,000 miles, while his personal mileage was 30,000 miles.S may

A)Claim no depreciation because the car was used predominantly for personal purposes

B)Elect limited expensing under § 179

C)Deduct a maximum of $3,160 (2012) of depreciation

D)Claim depreciation using the straight-line method

E)More than one of the above statements are true

A)Claim no depreciation because the car was used predominantly for personal purposes

B)Elect limited expensing under § 179

C)Deduct a maximum of $3,160 (2012) of depreciation

D)Claim depreciation using the straight-line method

E)More than one of the above statements are true

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

39

Which statement concerning class life and recovery period is not true?

A)The class life of an asset and its recovery period under the Alternative Depreciation System (ADS) are generally the same.

B)Except for very short-lived property, the recovery period of an asset under MACRS is generally less than its class life.

C)A class life has been assigned by the IRS to each asset to which a recovery period has been assigned.

D)The class life of an asset is constant, regardless of which straight-line method is used to calculate its depreciation.

A)The class life of an asset and its recovery period under the Alternative Depreciation System (ADS) are generally the same.

B)Except for very short-lived property, the recovery period of an asset under MACRS is generally less than its class life.

C)A class life has been assigned by the IRS to each asset to which a recovery period has been assigned.

D)The class life of an asset is constant, regardless of which straight-line method is used to calculate its depreciation.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

40

During the year, R purchased two items of machinery.One item is five-year property and the other is seven-year property.Which of the following statements is true regarding his options for depreciation?

A)If R elects to depreciate the five-year property using the straight-line method alternative, he may adopt any other method under MACRS for the seven-year property.

B)If R elects the straight-line method alternative for a particular asset, he must depreciate all other assets placed into service during the year under the straight-line method.

C)If R elects the straight-line method alternative for the five-year property, he may still use accelerated MACRS percentages for the other assets in that property class.

D)None of the above is true.

A)If R elects to depreciate the five-year property using the straight-line method alternative, he may adopt any other method under MACRS for the seven-year property.

B)If R elects the straight-line method alternative for a particular asset, he must depreciate all other assets placed into service during the year under the straight-line method.

C)If R elects the straight-line method alternative for the five-year property, he may still use accelerated MACRS percentages for the other assets in that property class.

D)None of the above is true.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

41

Taxpayer K purchased a used stereo system for $12,000 in May.K uses the system 20 hours each week for her business as a music critic, and she and her family use it 30 hours each week for educational and personal purposes.How much may K claim in deductions for depreciation and current expenses associated with the system? (Assume that stereo equipment has a recovery period of five years, regardless of the depreciation method employed.)

A)$0 depreciation, $0 expensed

B)$80 depreciation, $4,000 expensed

C)$0 depreciation, $4,800 expensed

D)$480 depreciation, $0 expensed

E)$960 depreciation, $0 expensed

A)$0 depreciation, $0 expensed

B)$80 depreciation, $4,000 expensed

C)$0 depreciation, $4,800 expensed

D)$480 depreciation, $0 expensed

E)$960 depreciation, $0 expensed

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

42

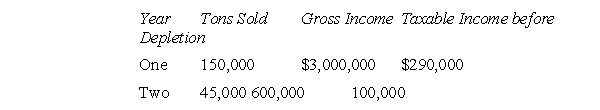

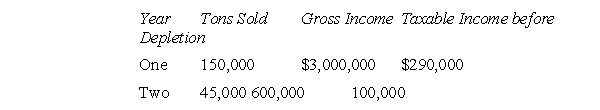

The Bloomingulch Company mines limestone.During the year the company purchased property south of town for $180,000.Engineers estimate that 200,000 tons of limestone are recoverable from the property.Given the following information, compute the company's depletion deduction for year two.Assume the depletion rate is 5 percent.

A)$30,000

B)$31,500

C)$40,500

D)$50,000

E)None of the above

A)$30,000

B)$31,500

C)$40,500

D)$50,000

E)None of the above

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

43

What conditions are necessary and sufficient to demonstrate that the use of personal use property is qualified business use? I.Use is for the convenience of the employer.

II)Use is for a business or trade.

III)Use is required as a condition of employment.

A)I.only

B)II only

C)III.only

D)I.and II.only

E)I., II.and III.

II)Use is for a business or trade.

III)Use is required as a condition of employment.

A)I.only

B)II only

C)III.only

D)I.and II.only

E)I., II.and III.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

44

The keeping of records required for listed property is extensive but not limitless.What is not required to substantiate the use of listed property?

A)The date of use

B)The amount of each business use

C)The amount of each nonbusiness use

D)The amount of total use

E)The amount of each expenditure related to the property

A)The date of use

B)The amount of each business use

C)The amount of each nonbusiness use

D)The amount of total use

E)The amount of each expenditure related to the property

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

45

Last year, Taxpayer N purchased a car for $12,000 and used it entirely for his construction business.Depreciation that year was $2,400.N hired his son T in February of the current year and allowed him to put the car to personal use on weekends.The value of T's personal use of the car was included as part of his income.If T's personal use of the car this year represented 60 percent of its total use, what income and depreciation expense related to the car should N include on the tax return for his business?

A)$0 income, $960 depreciation

B)$0 income, $1,920 depreciation

C)$1,200 income, $960 depreciation

D)$1,200 income, $1,920 depreciation

E)$2,400 income, $0 depreciation

A)$0 income, $960 depreciation

B)$0 income, $1,920 depreciation

C)$1,200 income, $960 depreciation

D)$1,200 income, $1,920 depreciation

E)$2,400 income, $0 depreciation

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

46

Due to the ceiling on the amount of first-year expensing and depreciation deductions that may be claimed for automobiles, the basis of a car

A)Is fully recovered in less time than is that of a car costing less

B)Is fully recovered in the same amount of time as that of a car costing less

C)Is fully recovered in more time than is that of a car costing less

D)Is never fully recovered

A)Is fully recovered in less time than is that of a car costing less

B)Is fully recovered in the same amount of time as that of a car costing less

C)Is fully recovered in more time than is that of a car costing less

D)Is never fully recovered

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

47

Ageless Oil Corporation is still eligible to use percentage depletion.During the year its only well produced 6,000 barrels of oil at a cost of $6 per barrel.The corporation subsequently sold all of their production for $8 per barrel.Assuming that the production and sale of oil represented all revenues and expenses for the year, the corporation's deduction for percentage depletion would be (assume the statutory depletion rate for oil is 22%)

A)$3,950

B)$10,560

C)$30,000

D)$6,000

E)None of the above

A)$3,950

B)$10,560

C)$30,000

D)$6,000

E)None of the above

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

48

Certain "listed property" is subject to limitations regarding capital recovery if it is not used more than 50 percent for business.What category below is not a kind of listed property?

A)Computer equipment not used exclusively at a regular business establishment

B)Passenger automobiles

C)Motorcycles

D)Photographic equipment

E)Furniture

A)Computer equipment not used exclusively at a regular business establishment

B)Passenger automobiles

C)Motorcycles

D)Photographic equipment

E)Furniture

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck