Deck 10: Certain Business Deductions and Losses

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/52

Play

Full screen (f)

Deck 10: Certain Business Deductions and Losses

1

H's house was flooded this year due to abnormal rainfall.She was forced to stay in a motel while the water subsided.Her motel stay, which cost $300, was not covered by her insurance policy.H may deduct the $300 as part of her casualty loss from the flood.

False

2

Q Corporation uses the cash method of accounting.The corporation manufactures microwave ovens.Two years ago it loaned $50,000 to a supplier who was having difficulties due to an unexpected rise in material prices.This year the debt became worthless.Q may not claim a deduction because it is a cash basis taxpayer and has no basis in the debt.

False

3

B made a $20,000 loan to his good friend C to help his struggling business venture.This year, C filed for bankruptcy.B anticipates receiving $4,000 after the bankruptcy proceedings are complete, probably next year.B may claim a deduction this year.

False

4

N Airlines declared bankruptcy this year.As a result, it was unable to pay many of its employees their salaries which they had earned.For example, S, one of its pilots, worked all of October and did not receive his $5,000 salary for that month.S is not entitled to a bad debt deduction.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

5

Cash basis taxpayers are not allowed a bad debt deduction for worthless accounts receivable arising from routine credit sales.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

6

Colossal Chocolate Company manufactures candy bars.Its gross receipts over the last several years have averaged $5 million.For budgeting and financial reporting purposes, the accounting department prepares financial statements using the variable costing approach.Under this approach, direct materials and labor are capitalized.Indirect costs that vary with production are capitalized, while fixed indirect costs are expensed.Colossal is not allowed to adopt this method of accounting for tax purposes.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

7

Feelwell Corporation manufactures aspirin.Its gross receipts for the last 10 years have averaged just over $1 million.The corporation must capitalize costs of direct materials and direct labor but may expense any indirect costs.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

8

Great Greeting Card Corporation operates a chain of retail card shops.The company's current policy is to capitalize the cost of cards purchased and expense all freight charges.This practice violates the method of accounting for inventory prescribed by the Regulations.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

9

R backed into his neighbor's mailbox, destroying it.R repaired the mailbox and may deduct this cost (subject to limitations) as a casualty loss.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

10

A fire in T's garage destroyed several uninsured items.The items included a moped (cost $400, FMV $300), a lawnmower (cost $95, FMV $75), and an electric table saw (cost $60, FMV $50).Only the value of the moped is potentially deductible, because the other items do not exceed the $100 floor for nonbusiness casualty losses.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

11

This year R opened a retail shoe store, Shoe Jamboree.The business has less than $10 million in gross receipts.Even if the business adopts the cash method of accounting, it is still required to use the accrual method to account for purchases and sales of inventory.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

12

In accordance with generally accepted accounting principles, JKL Manufacturing Corporation uses the reserve method of accounting for bad debts for financial accounting purposes.JKL also must use this method for tax purposes.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

13

In providing the deduction for net operating losses, Congress intended to allow a taxpayer to deduct only his true economic loss or business loss.Accordingly, such nonbusiness expenses as a personal casualty loss do not increase a taxpayer's NOL.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

14

C operates a glass business as a sole proprietorship.The business uses the cash method of accounting.C replaced all of the windows for J Corporation when they were broken by high winds.J Corporation went out of business before C could collect the $3,000 due for the work he performed.C may deduct $3,000 as a bad debt.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

15

Unlimited Appliances Corporation, a retailer, sells home appliances.Its gross receipts for the last 10 years have averaged just over $1 million.The corporation must capitalize the costs of direct material and direct labor but may expense any indirect costs.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

16

Under § 165(c)(3) (deductions for losses related to personal property), X may deduct, subject to limitations, the loss of value in his home when a vacant lot in the adjoining neighborhood is discovered to be a toxic waste dump.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

17

Dr.S has done extremely well financially.Several years ago, his good friend T started a small amusement park with such attractions as a water slide and a miniature golf course.T persuaded S to lend his new business $5,000, which he would repay to S in three years with 15 percent interest annually.The note came due this year and T was unable to repay because his business had failed.In light of the business nature of this debt, Dr.S may treat the bad debt as an ordinary loss.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

18

M and his wife are Kansas wheat farmers.This November he suffered a casualty loss when his entire crop was destroyed by a flash flood, resulting in a $40,000 loss.Thankfully, none of his personal belongings were damaged.In order to help farmers in his area obtain low interest loans and provide them with other relief, the whole town in which he lived, including his farm, was declared a disaster area.M's A.G.I.last year was $30,000 due to the terrible drought.This year he anticipates his A.G.I.to be over $130,000 before the casualty.M should deduct the loss in the prior year.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

19

An individual's nonbusiness bad debt is treated as if it arose from the sale of a capital asset.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

20

E's bake shop business suffered slight property loss due to a recent earthquake.Unfortunately, his insurance policy did not provide coverage for damage caused by an earthquake.Moreover, assuming the damage is less than 10 percent of E's adjusted gross income, he will receive no relief from the tax law for his loss.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

21

In January of this year, B's family automobile was completely destroyed in a collision with an uninsured drunk driver.The car, which originally cost $3,500 and had a fair market value of $2,700 immediately before the accident, was worthless afterwards.B had $250 deductible on his insurance and in June received a $2,450 check from the insurance company.He used the proceeds to purchase a car for $2,000.B itemizes his deductions.Based on these facts, the amount of casualty loss he may claim in computing his taxable income is

A)$150

B)$250

C)$600

D)$950

A)$150

B)$250

C)$600

D)$950

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

22

Z Corporation operates a department store that offers hundreds of different items for sale, from lawn mowers to lollipops.It values its inventory using the lower of cost or market approach.In applying this method, the company can either compare the total cost of the inventory to its total value or compare each item to its market value.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

23

Although financial accounting allows write-downs of inventory to net realizable value, there is nothing comparable in the tax law.The tax law limits the write-down to replacement cost.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

24

J, a cash basis taxpayer, is the general manager of a minor league baseball club.The corporate owner has promised J, in a valid contract, a $5,000 bonus if attendance exceeded 250,000 this year.Attendance was 250,070.The owner reneges on the $5,000 bonus.Upset, J quits and goes to Florida.

A)J can treat the $5,000 that was not paid as a business bad debt.

B)J can treat the $5,000 that was not paid as a nonbusiness bad debt.

C)J cannot deduct the $5,000 that was not paid.

D)None of the above

A)J can treat the $5,000 that was not paid as a business bad debt.

B)J can treat the $5,000 that was not paid as a nonbusiness bad debt.

C)J cannot deduct the $5,000 that was not paid.

D)None of the above

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

25

T's personal boat is damaged in a hurricane.The damage is appraised at $300, and the appraiser charges a $50 fee.T's A.G.I.this year is $100,000.If the insurer reimburses T $250, what amount related to this casualty may be deductible from A.G.I.?

A)$0

B)$50

C)$100

D)$350

A)$0

B)$50

C)$100

D)$350

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

26

Taxpayers may use the lower of cost or market valuation method in conjunction with FIFO.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

27

W is an entrepreneur.He owns numerous companies including Guns Corporation.He also serves as the corporation's chief financial officer.Because of bad publicity relating to assault weapons and fire arms in general, the corporation's sales suffered this year.As a result, W advanced $30,000 to the corporation.No note or other evidence of indebtedness was prepared relating to the advance.Subsequently, legislation was passed which put the corporation out of business and W's loan became worthless.

A)Assuming that the loan was to protect W's investment, he may treat the $30,000 as an ordinary loss.

B)Assuming that the loan was to protect W's employment, he may treat the $30,000 as a short term capital loss.

C)Assuming that the loan was to protect W's employment, he may treat the $30,000 as a business bad debt and deduct it to the extent of his capital gains plus $3,000.

D)Assuming that the loan was to protect W's employment, he may treat the $30,000 as a business bad debt and deduct it as an ordinary loss.

E)The treatment of the $30,000 will be the same regardless of W's motivation for the loan.

A)Assuming that the loan was to protect W's investment, he may treat the $30,000 as an ordinary loss.

B)Assuming that the loan was to protect W's employment, he may treat the $30,000 as a short term capital loss.

C)Assuming that the loan was to protect W's employment, he may treat the $30,000 as a business bad debt and deduct it to the extent of his capital gains plus $3,000.

D)Assuming that the loan was to protect W's employment, he may treat the $30,000 as a business bad debt and deduct it as an ordinary loss.

E)The treatment of the $30,000 will be the same regardless of W's motivation for the loan.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

28

For tax purposes, LIFO inventories must be valued using the lower of cost or market valuation method.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

29

R's personal sailboat is destroyed in a hurricane.The sailboat has a basis of $2,000 and a fair market value of $3,000.If R chooses not to file a claim with the insurer for the loss of the boat, she may deduct what amount of the loss?

A)$0

B)$900

C)$1,900

D)$2,900

A)$0

B)$900

C)$1,900

D)$2,900

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

30

For many years, T Corporation accounted for inventories using FIFO and the lower of cost or market methods.T may switch to LIFO and retain the lower of cost or market valuation method.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

31

F's furniture business suffered a substantial property loss due to a recent earthquake.F's insurance policy did not provide coverage for damage by an earthquake.The property, which was totally worthless after the quake, had been worth $60,000 (basis $20,000).F's A.G.I.this year before the casualty is $90,000.F is provided some relief from his misfortune in that he may deduct

A)$10,900

B)$11,000

C)$20,000

D)$60,000

A)$10,900

B)$11,000

C)$20,000

D)$60,000

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

32

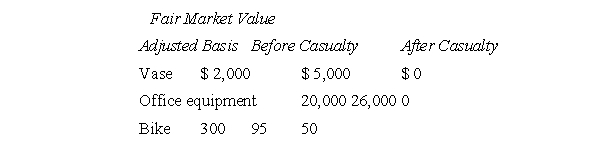

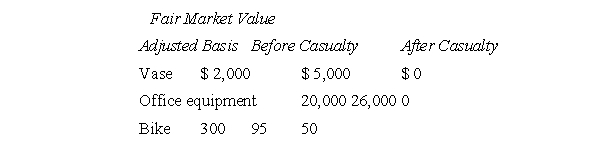

Last year F was accident-prone.He knocked over an expensive vase, shattering it; left an old radio on that caused a fire that destroyed his office equipment; and wrecked his bike.The bases and fair market values of the property are shown below.Assuming F does not elect to replace the vase or bike, and that he receives $5,000 for the vase, $25,000 for the office equipment, and $25 for the bike, what must he report?

A)$7,900 capital gain

B)$8,000 capital gain

C)$8,025 capital gain

D)$7,980 capital gain

E)Some other amount

A)$7,900 capital gain

B)$8,000 capital gain

C)$8,025 capital gain

D)$7,980 capital gain

E)Some other amount

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

33

Taxpayers are not permitted to adopt LIFO for tax purposes if they use FIFO for financial reporting purposes such as reports to shareholders or creditors.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

34

In the past, Zip Corporation has used FIFO and the lower of cost or market valuation method to account for inventories.A switch to LIFO is considered a change in accounting method.However, they may continue to use the same valuation method.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

35

For financial accounting purposes, R uses FIFO and the lower of cost or market to value his inventories.For tax purposes, no deductions may be claimed for any write-downs of inventory to market.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

36

X, a psychiatrist, is a cash-basis taxpayer.He charges Z $100 per session and bills him monthly.When Z declares bankruptcy, he owes X $400.What course of action is open to X?

A)$400 may be currently deducted against ordinary income.

B)$400 may be currently deducted against capital gains.

C)Any deduction is postponed until Z is released.

D)No deduction is allowed.

A)$400 may be currently deducted against ordinary income.

B)$400 may be currently deducted against capital gains.

C)Any deduction is postponed until Z is released.

D)No deduction is allowed.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

37

The management of Mogul Manufacturing has decided to switch from FIFO to LIFO.Because this is a change in accounting method, the company must secure approval from the IRS before it can switch.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

38

In valuing inventories using the lower of cost or market approach, the term market means the price at which the item normally sells in the market that it is normally traded (e.g., retail or wholesale) by the taxpayer.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

39

This year D's hunting cabin worth $5,000 (basis $8,000) was destroyed by fire.The cabin was uninsured.If D's A.G.I.is $40,000 this year, how much of the loss may be claimed as an itemized deduction?

A)$900

B)$4,000

C)$4,900

D)$5,000

E)Some other amount

A)$900

B)$4,000

C)$4,900

D)$5,000

E)Some other amount

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

40

D purchased a personal residence in Los Angeles three years ago for $200,000 and insured it for that amount.Its fair market value this year was $300,000.This year the house burned down.The insurer paid the insured value of $200,000 in full.D's A.G.I.is $25,000.Assuming she has no capital gains or other losses for the year, what amount may she deduct?

A)$0

B)$97,400

C)$99,900

D)$200,000

E)Some other amount

A)$0

B)$97,400

C)$99,900

D)$200,000

E)Some other amount

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

41

H and M, married with two dependent children, operate a piano and organ store.Their records for the current year revealed the following: Gross income from sales

Business operating expenses 250,000

Interest income from inv estment

Interest expense on home mortgage

Long-term capital gain (business)

Long-term capital loss (business) Their net operating loss for the year is

A)$75,000

B)$75,500

C)$78,500

D)$82,000

Business operating expenses 250,000

Interest income from inv estment

Interest expense on home mortgage

Long-term capital gain (business)

Long-term capital loss (business) Their net operating loss for the year is

A)$75,000

B)$75,500

C)$78,500

D)$82,000

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

42

Gizmo Corporation adopted the dollar-value method of accounting for its inventory on January 1, 2011.On that date, its ending inventory was valued at $90,000.On December 31, 2012, ending inventory's value at current prices was $120,000.If the current year index is 120%, the value of Gizmo's ending inventory is

A)$144,000

B)$108,000

C)$120,000

D)$102,000

E)None of the above

A)$144,000

B)$108,000

C)$120,000

D)$102,000

E)None of the above

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

43

B's antique furniture, which cost her $5,000 and was worth $10,000, was completely destroyed by a burglar.She carried no insurance.B's A.G.I.for the year was $20,000.How would this loss affect B's adjusted gross income (A.G.I.)?

A)Decrease A.G.I.by $2,000

B)Decrease A.G.I.by $2,900

C)Decrease A.G.I.by $4,900

D)Decrease A.G.I.by $5,000

A)Decrease A.G.I.by $2,000

B)Decrease A.G.I.by $2,900

C)Decrease A.G.I.by $4,900

D)Decrease A.G.I.by $5,000

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

44

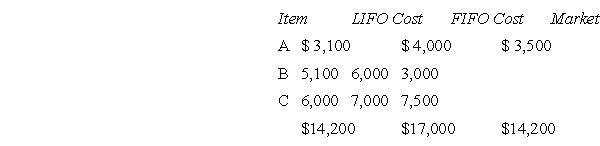

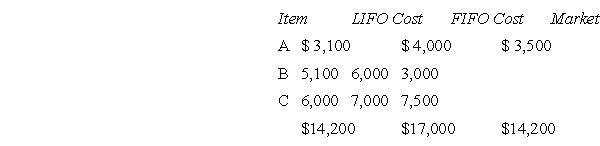

L's inventory records reveal the following information:  Assuming L wishes to value its inventory so as to produce the lowest taxable income for the current year, its ending inventory value would be

Assuming L wishes to value its inventory so as to produce the lowest taxable income for the current year, its ending inventory value would be

A)$14,200

B)$12,100

C)$14,000

D)$17,000

E)Some other amount

Assuming L wishes to value its inventory so as to produce the lowest taxable income for the current year, its ending inventory value would be

Assuming L wishes to value its inventory so as to produce the lowest taxable income for the current year, its ending inventory value would beA)$14,200

B)$12,100

C)$14,000

D)$17,000

E)Some other amount

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

45

Taxpayers who adopt LIFO during periods of rising prices can expect

A)Lower ending inventory, lower costs of goods sold, higher net income, and higher tax liability

B)Higher ending inventory, lower costs of goods sold, higher net income, and higher tax liability

C)Lower ending inventory, higher costs of goods sold, lower net income, and lower tax liability

D)Higher ending inventory, higher costs of goods sold, lower net income, and lower tax liability

A)Lower ending inventory, lower costs of goods sold, higher net income, and higher tax liability

B)Higher ending inventory, lower costs of goods sold, higher net income, and higher tax liability

C)Lower ending inventory, higher costs of goods sold, lower net income, and lower tax liability

D)Higher ending inventory, higher costs of goods sold, lower net income, and lower tax liability

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following can add to or create a net operating loss that can be carried back or forward?

A)Moving expenses

B)Interest and taxes on a personal residence

C)Alimony

D)Contribution to an individual retirement account

E)More than one of the above

A)Moving expenses

B)Interest and taxes on a personal residence

C)Alimony

D)Contribution to an individual retirement account

E)More than one of the above

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

47

T operates a hardware store, selling primarily to the public.The company's average sales are $900,000.Which of the following costs must it capitalize in accounting for its inventory?

A)Freight

B)Utility costs of a warehouse several miles from the retail outlet

C)An allocable portion of general and administrative costs

D)Salary cost of person in charge of purchasing inventory

E)More than one of the above

A)Freight

B)Utility costs of a warehouse several miles from the retail outlet

C)An allocable portion of general and administrative costs

D)Salary cost of person in charge of purchasing inventory

E)More than one of the above

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

48

Y's inventory records reveal the following information: Item Cost Market For financial accounting purposes, Y values its ending inventory using FIFO and the lower of cost or market methods.For tax purposes, the value of Y's ending inventory is

A)$14,200

B)$12,100

C)$14,000

D)Some other amount

A)$14,200

B)$12,100

C)$14,000

D)Some other amount

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

49

In the fall of 2011, a severe storm struck the resort area of South Padre Island.As a result, many people suffered losses due to water damage and subsequent looting.R did not discover that his resort condominium had been burglarized until 2012.Similarly, S did not determine that there had been water damage to his condominium until 2012.

A)R will report his loss on an amended return for 2011.

B)Both R and S will report their losses on their 2012 tax returns.

C)R will report his loss on his 2012 tax return.

D)None of the above

A)R will report his loss on an amended return for 2011.

B)Both R and S will report their losses on their 2012 tax returns.

C)R will report his loss on his 2012 tax return.

D)None of the above

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

50

Dotcom Corporation suffered a net operating loss for 2012.Under the general rules, the corporation

A)May carry back the loss first to 2010, and 2011, and then carry it forward until 2027

B)May elect to forgo the carryback period and carry the loss forward until 2027

C)May carry back the loss first to 2010, and 2011, and then carry it forward until 2032

D)May carry back the loss first to 2009

E)None of the above is correct.

A)May carry back the loss first to 2010, and 2011, and then carry it forward until 2027

B)May elect to forgo the carryback period and carry the loss forward until 2027

C)May carry back the loss first to 2010, and 2011, and then carry it forward until 2032

D)May carry back the loss first to 2009

E)None of the above is correct.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following cannot create a net operating loss that can be carried back or forward?

A)A loss from operating a sole proprietorship

B)A casualty or theft loss to personal-use property

C)A loss attributable to an interest in a partnership

D)A loss attributable to an interest in an S corporation

E)All of the situations above can create an NOL

A)A loss from operating a sole proprietorship

B)A casualty or theft loss to personal-use property

C)A loss attributable to an interest in a partnership

D)A loss attributable to an interest in an S corporation

E)All of the situations above can create an NOL

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following statements is true regarding application of the uniform capitalization rules?

A)The unicap rules apply to all manufacturers.

B)The unicap rules apply to all retailers and wholesalers.

C)The unicap rules do not apply to any taxpayers who have average annual gross receipts for the last three years of less than $10 million.

D)The unicap rules do not apply to taxpayers using the full-absorption method.

A)The unicap rules apply to all manufacturers.

B)The unicap rules apply to all retailers and wholesalers.

C)The unicap rules do not apply to any taxpayers who have average annual gross receipts for the last three years of less than $10 million.

D)The unicap rules do not apply to taxpayers using the full-absorption method.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck