Deck 2: Financial Statements, Cash Flow, and Taxes

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/86

Play

Full screen (f)

Deck 2: Financial Statements, Cash Flow, and Taxes

1

Net operating profit after taxes (NOPAT) is the amount of net income a company would generate from its operations if it had no interest income or interest expense.

True

2

If the tax laws were changed so that $0.50 out of every $1.00 of interest paid by a corporation was allowed as a tax-deductible expense, this would probably encourage companies to use more debt financing than they currently do, other things held constant.

False

3

Total net operating capital is equal to net fixed assets.

False

4

Interest paid by a corporation is a tax deduction for the paying corporation, but dividends paid are not deductible. This treatment, other things held constant, tends to encourage the use of debt financing by corporations.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

5

On the balance sheet, total assets must always equal total liabilities plus equity.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

6

In Canada, amortization is a similar concept as depreciation and can be applied to both tangible and intangible assets.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

7

The current cash flow from existing assets is highly relevant to the investor. However, since the value of the firm depends primarily upon its growth opportunities, profit projections from those opportunities are the only relevant future flows with which investors are concerned.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

8

The primary reason the annual report is important in finance is that it is used by investors when they form expectations about the firm's future earnings and dividends, and the riskiness of those cash flows.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

9

The interest and dividends paid by a corporation are considered to be deductible operating expenses;

hence, they decrease the firm's tax liability.

hence, they decrease the firm's tax liability.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

10

Since investors use net income to value the firm, cash flow becomes a secondary consideration simply because cash is for operation only.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

11

Income statements must be prepared only on an annual basis.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

12

The balance sheet is a financial statement that measures the flow of funds into and out of various accounts over time, while the income statement measures the firm's financial position at a point in time.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

13

Retained earnings are the existing shareholders' reinvested profit and do not represent cash.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

14

The fact that interest income received by a corporation is 50% taxable encourages firms to use more debt financing than equity financing.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

15

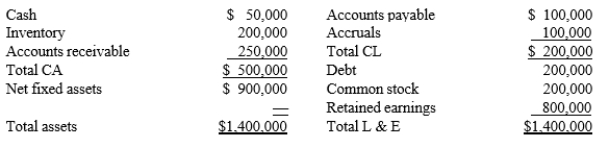

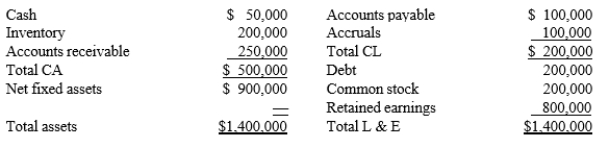

Consider the balance sheet of Wilkes Industries as shown below. Because Wilkes has $800,000 of retained earnings, the company would be able to pay cash to buy an asset with a cost of $200,000.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

16

The value of goodwill on intangible assets is calculated according to the impairment rule instead of a fixed annual charge.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

17

The FIFO method leads to a higher balance sheet inventory value, but a lower cost of goods sold in the income statement.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

18

To estimate the cash flow from operations, depreciation must be added back to net income because it is a non-cash charge that has been deducted from revenue.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

19

The income statement shows the difference between a firm's income and its costs-i.e., its profits- during a specified period of time. However, not all reported income comes in the form or cash, and reported costs likewise may not correctly reflect cash outlays. Therefore, there may be a substantial difference between a firm's reported profits and its actual cash flow for the same period.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

20

The annual report contains four basic financial statements: the income statement, balance sheet, statement of cash flows, and statement of retained earnings.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following statements best describes the income statement?

A) The focal point of the income statement is the cash account, because that account cannot be manipulated by "accounting tricks."

B) EBITDA is a truer measure of financial strength than are net income and free cash flow.

C) If a firm follows the International Financial Reporting Standard (IFRS), its reported net income and net cash flow will be the same.

D) The income statement for a given year is designed to give us an idea of how much the firm earned during that year.

A) The focal point of the income statement is the cash account, because that account cannot be manipulated by "accounting tricks."

B) EBITDA is a truer measure of financial strength than are net income and free cash flow.

C) If a firm follows the International Financial Reporting Standard (IFRS), its reported net income and net cash flow will be the same.

D) The income statement for a given year is designed to give us an idea of how much the firm earned during that year.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following statements best describes the financial statements?

A) The balance sheet gives us a picture of the firm's financial position at a point in time.

B) The income statement gives us a picture of the firm's financial position at a point in time.

C) The statement of cash flows tells us how much cash the firm has in the form of currency and demand deposits.

D) The statement of cash needs tells us how much cash the firm will require during some future period, generally a month or a year.

A) The balance sheet gives us a picture of the firm's financial position at a point in time.

B) The income statement gives us a picture of the firm's financial position at a point in time.

C) The statement of cash flows tells us how much cash the firm has in the form of currency and demand deposits.

D) The statement of cash needs tells us how much cash the firm will require during some future period, generally a month or a year.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following statements is correct?

A) Typically, a firm's DPS should exceed its EPS.

B) Typically, a firm's EBIT should exceed its EBITDA.

C) With an excellent profit record, a firm stock price exceeds its book value per share.

D) The more depreciation a firm has in a given year, the higher its EPS, other things held constant.

A) Typically, a firm's DPS should exceed its EPS.

B) Typically, a firm's EBIT should exceed its EBITDA.

C) With an excellent profit record, a firm stock price exceeds its book value per share.

D) The more depreciation a firm has in a given year, the higher its EPS, other things held constant.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following statements best describes depreciation?

A) The more depreciation a firm reports, the higher its tax bill, other things held constant.

B) Depreciation reduces a firm's cash balance, so an increase in depreciation would normally lead to a reduction in the firm's net cash flow.

C) Net Cash Flow = Net Income + Depreciation and Amortization Charges.

D) Depreciation and amortization are not cash charges, so neither of them has an effect on a firm's reported profits.

A) The more depreciation a firm reports, the higher its tax bill, other things held constant.

B) Depreciation reduces a firm's cash balance, so an increase in depreciation would normally lead to a reduction in the firm's net cash flow.

C) Net Cash Flow = Net Income + Depreciation and Amortization Charges.

D) Depreciation and amortization are not cash charges, so neither of them has an effect on a firm's reported profits.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

25

On its 2009 balance sheet, Barngrover Books showed $510 million of retained earnings, and exactly that same amount was shown the following year. Assuming that no earnings restatements were issued, which of the following statements is correct?

A) Although the company lost money in 2009, it must have paid dividends.

B) The company must have had zero net income in 2009.

C) The company must have paid no dividends in 2009.

D) Dividends could have been paid in 2009, with amounts equal to the earnings for the year.

A) Although the company lost money in 2009, it must have paid dividends.

B) The company must have had zero net income in 2009.

C) The company must have paid no dividends in 2009.

D) Dividends could have been paid in 2009, with amounts equal to the earnings for the year.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following items is NOT included in current assets?

A) accounts receivable

B) inventory

C) bonds

D) cash

A) accounts receivable

B) inventory

C) bonds

D) cash

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following would be most likely to occur in the year when companies have to depreciate equipment over longer lives? Assume that sales, other operating costs, and tax rates are not affected, and the same depreciation method is used for tax and shareholder reporting purposes.

A) Companies' NOPAT would decline.

B) Companies' physical stocks of fixed assets would increase.

C) Companies' net cash flows would increase.

D) Companies' cash positions would decline.

A) Companies' NOPAT would decline.

B) Companies' physical stocks of fixed assets would increase.

C) Companies' net cash flows would increase.

D) Companies' cash positions would decline.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following statements best describes the statement of cash flows?

A) In the statement of cash flows, a DECREASE in accounts receivable is reported as a use of cash.

B) In the statement of cash flows, a DECREASE in accounts payable is reported as a use of cash.

C) In the statement of cash flows, depreciation charges are reported as a use of cash.

D) In the statement of cash flows, a DECREASE in inventories is reported as a use of cash.

A) In the statement of cash flows, a DECREASE in accounts receivable is reported as a use of cash.

B) In the statement of cash flows, a DECREASE in accounts payable is reported as a use of cash.

C) In the statement of cash flows, depreciation charges are reported as a use of cash.

D) In the statement of cash flows, a DECREASE in inventories is reported as a use of cash.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following statements best describes the balance sheet?

A) The balance sheet for a given year is designed to give us an idea of what happened to the firm during that year.

B) The balance sheet for a given year tells us how much money the company earned during that year.

C) For most companies, the market value of the stock equals the book value of the stock as reported on the balance sheet.

D) A balance sheet lists the assets that will be converted to cash first, and then goes on down to list the longest-lived ones last.

A) The balance sheet for a given year is designed to give us an idea of what happened to the firm during that year.

B) The balance sheet for a given year tells us how much money the company earned during that year.

C) For most companies, the market value of the stock equals the book value of the stock as reported on the balance sheet.

D) A balance sheet lists the assets that will be converted to cash first, and then goes on down to list the longest-lived ones last.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

30

Aubey Aircraft recently announced that its net income increased sharply from the previous year, yet its net cash flow from operations declined. Which of the following could explain this performance?

A) The company's operating income declined.

B) The company's expenditures on fixed assets declined.

C) The company's cost of goods sold increased.

D) The company's depreciation and amortization expenses declined.

A) The company's operating income declined.

B) The company's expenditures on fixed assets declined.

C) The company's cost of goods sold increased.

D) The company's depreciation and amortization expenses declined.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following items cannot be found on a firm's balance sheet under current liabilities?

A) accounts payable

B) short-term notes payable to the bank

C) accrued wages

D) cost of goods sold

A) accounts payable

B) short-term notes payable to the bank

C) accrued wages

D) cost of goods sold

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following statements best describes the statement of cash flows?

A) The statement of cash flows reflects cash flows from operations, but it does not reflect the effects of buying or selling fixed assets.

B) The statement of cash flows reflects cash flows from continuing operations, but it does not reflect the effects of changes in working capital.

C) The statement of cash flows reflects cash flows from operations and from borrowings, but it does not reflect cash obtained by selling new common stock.

D) The statement of cash flows shows how much the firm's cash--the total of currency, bank deposits, and short-term liquid securities (or cash equivalents)- increased or decreased during a given year.

A) The statement of cash flows reflects cash flows from operations, but it does not reflect the effects of buying or selling fixed assets.

B) The statement of cash flows reflects cash flows from continuing operations, but it does not reflect the effects of changes in working capital.

C) The statement of cash flows reflects cash flows from operations and from borrowings, but it does not reflect cash obtained by selling new common stock.

D) The statement of cash flows shows how much the firm's cash--the total of currency, bank deposits, and short-term liquid securities (or cash equivalents)- increased or decreased during a given year.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

33

Below is the common equity section (in millions) of Teweles Technology's last two year-end balance sheets:  Teweles has never paid a dividend to its common shareholders. Which of the following statements is correct?

Teweles has never paid a dividend to its common shareholders. Which of the following statements is correct?

A) The company's net income in 2009 was higher than in 2008.

B) Teweles issued common stock in 2006.

C) The market price of Teweles's stock doubled in 2009.

D) The company has more equity than debt on its balance sheet.

Teweles has never paid a dividend to its common shareholders. Which of the following statements is correct?

Teweles has never paid a dividend to its common shareholders. Which of the following statements is correct?A) The company's net income in 2009 was higher than in 2008.

B) Teweles issued common stock in 2006.

C) The market price of Teweles's stock doubled in 2009.

D) The company has more equity than debt on its balance sheet.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

34

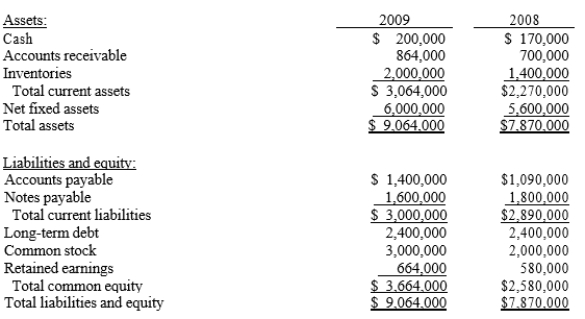

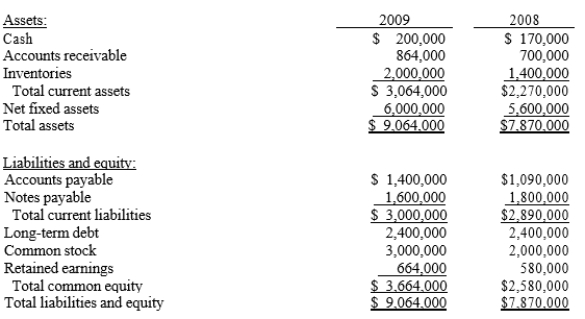

Below are the 2008 and 2009 year-end balance sheets for Wolken Enterprises:  D Wolken has never paid a dividend on its common share, and it issued $2,400,000 of 10-year non- callable, long-term debt in 2008. As of the end of 2009, none of the principal on this debt had been repaid. Assume that the company's sales in 2008 and 2009 were the same. Which of the following statements must be correct?

D Wolken has never paid a dividend on its common share, and it issued $2,400,000 of 10-year non- callable, long-term debt in 2008. As of the end of 2009, none of the principal on this debt had been repaid. Assume that the company's sales in 2008 and 2009 were the same. Which of the following statements must be correct?

A) Wolken increased its short-term bank debt in 2009.

B) Wolken issued long-term debt in 2009.

C) Wolken issued new common shares in 2009.

D) Wolken repurchased some common shares in 2009.

D Wolken has never paid a dividend on its common share, and it issued $2,400,000 of 10-year non- callable, long-term debt in 2008. As of the end of 2009, none of the principal on this debt had been repaid. Assume that the company's sales in 2008 and 2009 were the same. Which of the following statements must be correct?

D Wolken has never paid a dividend on its common share, and it issued $2,400,000 of 10-year non- callable, long-term debt in 2008. As of the end of 2009, none of the principal on this debt had been repaid. Assume that the company's sales in 2008 and 2009 were the same. Which of the following statements must be correct?A) Wolken increased its short-term bank debt in 2009.

B) Wolken issued long-term debt in 2009.

C) Wolken issued new common shares in 2009.

D) Wolken repurchased some common shares in 2009.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

35

A security analyst obtained the following information from Prestopino Products' financial statements: - Retained earnings at the end of 2008 were $700,000, but retained earnings at the end of 2009 had declined to $320,000.

- The company does not pay dividends.

- The company's depreciation expense is its only non-cash expense; it has no amortization charges.

- The company has no non-cash revenues.

- The company's net cash flow (NCF) for 2009 was $150,000.

On the basis of this information, which of the following statements is correct?

A) Prestopino had negative net income in 2009.

B) Prestopino's depreciation expense in 2009 was less than $150,000.

C) Prestopino had positive net income in 2009, but its income was less than its 2008 income.

D) Prestopino's NCF in 2009 must be higher than its NCF in 2008.

- The company does not pay dividends.

- The company's depreciation expense is its only non-cash expense; it has no amortization charges.

- The company has no non-cash revenues.

- The company's net cash flow (NCF) for 2009 was $150,000.

On the basis of this information, which of the following statements is correct?

A) Prestopino had negative net income in 2009.

B) Prestopino's depreciation expense in 2009 was less than $150,000.

C) Prestopino had positive net income in 2009, but its income was less than its 2008 income.

D) Prestopino's NCF in 2009 must be higher than its NCF in 2008.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following factors could explain why Dellva Energy had a negative net cash flow last year, even though the cash on its balance sheet increased?

A) The company sold a new issue of bonds.

B) The company made a large investment in new plant and equipment.

C) The company paid a large dividend.

D) The company had high amortization expenses.

A) The company sold a new issue of bonds.

B) The company made a large investment in new plant and equipment.

C) The company paid a large dividend.

D) The company had high amortization expenses.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

37

The standard financial statements prepared by accountants have to be modified for managerial purposes. Related to these modifications, which of the following statements is correct?

A) The standard statements make adjustments to reflect the effects of inflation on asset values, and these adjustments are normally carried into any adjustment that managers make to the standard statements.

B) The standard statements focus on accounting income for the entire corporation, not cash flows, and the two can be quite different during any given accounting period. However, for valuation purposes we need to discount cash flows, not accounting income. Moreover, since many firms have a number of separate divisions, and since division managers should be compensated on their divisions' performance, not that of the entire firm, information that focuses on the divisions is needed. These factors have led to the development of information that is focused on cash flows and the operations of individual units.

C) The standard statements provide useful information on the firm's individual operating units, but management needs more information on the firm's overall operations than the standard statements provide.

D) The standard statements focus on cash flows, but managers are less concerned with cash flows than with accounting income as defined by GAAP.

A) The standard statements make adjustments to reflect the effects of inflation on asset values, and these adjustments are normally carried into any adjustment that managers make to the standard statements.

B) The standard statements focus on accounting income for the entire corporation, not cash flows, and the two can be quite different during any given accounting period. However, for valuation purposes we need to discount cash flows, not accounting income. Moreover, since many firms have a number of separate divisions, and since division managers should be compensated on their divisions' performance, not that of the entire firm, information that focuses on the divisions is needed. These factors have led to the development of information that is focused on cash flows and the operations of individual units.

C) The standard statements provide useful information on the firm's individual operating units, but management needs more information on the firm's overall operations than the standard statements provide.

D) The standard statements focus on cash flows, but managers are less concerned with cash flows than with accounting income as defined by GAAP.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

38

Analysts who follow Howe Industries recently noted that, relative to the previous year, the company's operating net cash flow INCREASED, yet cash as reported on the balance sheet DECREASED. Which of the following factors could explain this situation?

A) The company cut its dividend.

B) The company made a large investment in a profitable new plant.

C) The company sold a division and received cash in return.

D) The company issued new long-term debt.

A) The company cut its dividend.

B) The company made a large investment in a profitable new plant.

C) The company sold a division and received cash in return.

D) The company issued new long-term debt.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

39

Other things held constant, which of the following actions would increase the amount of cash on a company's balance sheet?

A) The company purchases a new piece of equipment.

B) The company pays a dividend.

C) The company issues new common stock.

D) The company gives customers more time to pay their bills.

A) The company purchases a new piece of equipment.

B) The company pays a dividend.

C) The company issues new common stock.

D) The company gives customers more time to pay their bills.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

40

The time dimension is important in financial statement analysis. The balance sheet shows the firm's financial position at a given point in time, the income statement shows results over a period of time, and the statement of cash flows reflects changes in the firm's accounts over that period of time.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

41

Hunter Manufacturing Inc.'s December 31, 2008 balance sheet showed total common equity of $2,050,000 and 100,000 shares of stock outstanding. During 2009, Hunter had $250,000 of net income, and it paid out $100,000 as dividends. What was the book value per share at 12/31/09, assuming that Hunter neither issued nor retired any common stock during 2009?

A) $20.90

B) $22.00

C) $23.10

D) $24.26

A) $20.90

B) $22.00

C) $23.10

D) $24.26

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

42

Assume that Pappas Company commenced operations on January 1, 2008, and it was granted permission to use the same depreciation calculations for shareholder reporting and income tax purposes. The company planned to depreciate its fixed assets over 15 years, but in December 2008 management realized that the assets would last for only 10 years. The firm's accountants plan to report the 2008 financial statements based on this new information. How would the new depreciation assumption affect the company's financial statements?

A) The firm's reported net fixed assets would increase.

B) The firm's EBIT would increase.

C) The firm's reported 2008 earnings per share would increase.

D) The firm's cash position in 2008 and 2009 would increase.

A) The firm's reported net fixed assets would increase.

B) The firm's EBIT would increase.

C) The firm's reported 2008 earnings per share would increase.

D) The firm's cash position in 2008 and 2009 would increase.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following statements best describes the tax system?

A) Since companies can deduct dividends paid but not interest paid, such a tax system favours the use of equity financing over debt financing.

B) Interest paid to an individual is counted as income for tax purposes and taxed at the individual's regular tax rate.

C) The maximum federal personal tax rate in 2009 is 35%.

D) Ordinary corporate operating losses can be carried back to each of the preceding 10 years and forward for the next 3 years and used to offset taxable income in those years.

A) Since companies can deduct dividends paid but not interest paid, such a tax system favours the use of equity financing over debt financing.

B) Interest paid to an individual is counted as income for tax purposes and taxed at the individual's regular tax rate.

C) The maximum federal personal tax rate in 2009 is 35%.

D) Ordinary corporate operating losses can be carried back to each of the preceding 10 years and forward for the next 3 years and used to offset taxable income in those years.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

44

Companies generate income from their "regular" operations and from other sources such as interest earned on the securities they hold, which is called non-operating income. Lindley Textiles recently reported $12,500 of sales, $7,250 of operating costs other than depreciation, and $1,000 of depreciation. The company had no amortization charges and no non-operating income. It had $8,000 of bonds outstanding that carry a 7.5% interest rate, and its combined federal and provincial income tax rate was 40%. How much was Lindley's operating income, or EBIT?

A) $3,644

B) $3,836

C) $4,038

D) $4,250

A) $3,644

B) $3,836

C) $4,038

D) $4,250

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following statements best describes retained earnings?

A) Since depreciation is a source of funds, the more depreciation a company has, the larger its retained earnings will be, other things held constant.

B) A firm can show a large amount of retained earnings on its balance sheet yet need to borrow cash to make required payments.

C) The retained earnings account as shown on the balance sheet shows the amount of cash that is available for paying dividends.

D) If a firm reports a loss on its income statement, then the retained earnings account as shown on the balance sheet will be negative.

A) Since depreciation is a source of funds, the more depreciation a company has, the larger its retained earnings will be, other things held constant.

B) A firm can show a large amount of retained earnings on its balance sheet yet need to borrow cash to make required payments.

C) The retained earnings account as shown on the balance sheet shows the amount of cash that is available for paying dividends.

D) If a firm reports a loss on its income statement, then the retained earnings account as shown on the balance sheet will be negative.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

46

The CFO of Shalit Industries plans to have the company issue $300 million of new common stock and use the proceeds to pay off some of its outstanding bonds. Assume that the company, which does not pay any dividends, takes this action, and that total assets, operating income (EBIT), and its tax rate all remain constant. Which of the following would occur?

A) The company's taxable income would fall.

B) The company would have less common equity than before.

C) The company's net income would increase.

D) The company would have to pay less taxes.

A) The company's taxable income would fall.

B) The company would have less common equity than before.

C) The company's net income would increase.

D) The company would have to pay less taxes.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

47

JBS Inc. recently reported net income of $4,750 and depreciation of $885. How much was its net cash flow, assuming it had no amortization expense and sold none of its fixed assets?

A) $4,831.31

B) $5,085.59

C) $5,353.25

D) $5,635.00

A) $4,831.31

B) $5,085.59

C) $5,353.25

D) $5,635.00

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

48

Last year, Tucker Technologies had (1) a negative net cash flow from operations, (2) a negative free cash flow, and (3) an increase in cash as reported on its balance sheet. Which of the following factors could explain this situation?

A) The company had a sharp increase in its inventories.

B) The company had a sharp increase in its accrued liabilities.

C) The company sold a new issue of common stock.

D) The company made a large capital investment early in the year.

A) The company had a sharp increase in its inventories.

B) The company had a sharp increase in its accrued liabilities.

C) The company sold a new issue of common stock.

D) The company made a large capital investment early in the year.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

49

Assume that Bev's Beverages Inc. (BBI) can double its depreciation expense for the upcoming year while sales revenue and tax rate remain. Prior to the change, BBI's net income after taxes was forecasted to be $4 million. Which of the following best describes the impact on BBI's financial statements versus the statements before the change? Assume that the company uses the same depreciation method for tax and shareholder reporting purposes.

A) The provision will reduce the company's net cash flow.

B) The provision will increase the company's tax payments.

C) Net fixed assets on the balance sheet will increase.

D) Net fixed assets on the balance sheet will decrease.

A) The provision will reduce the company's net cash flow.

B) The provision will increase the company's tax payments.

C) Net fixed assets on the balance sheet will increase.

D) Net fixed assets on the balance sheet will decrease.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

50

A start-up firm is making an initial investment in new plant and equipment. Assume that currently its equipment must be depreciated on a straight-line basis over 10 years, but now the company is allowed to depreciate the equipment over 7 years. Which of the following would occur in the year following the change?

A) The firm's operating income (EBIT) would increase.

B) The firm's net cash flow would increase.

C) The firm's tax payments would increase.

D) The firm's reported net income would increase.

A) The firm's operating income (EBIT) would increase.

B) The firm's net cash flow would increase.

C) The firm's tax payments would increase.

D) The firm's reported net income would increase.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

51

Tucker Electronic System's current balance sheet shows total common equity of $3,125,000. The company has 125,000 shares of stock outstanding, and they sell at a price of $52.50 per share. By how much do the firm's market and book values per share differ?

A) $27.50

B) $28.88

C) $30.32

D) $31.83

A) $27.50

B) $28.88

C) $30.32

D) $31.83

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following statements best describes the tax system?

A) For small Canadian-controlled private corporations, income less than $400,000 is exempt from taxes. Thus, government receives no tax revenue from these businesses.

B) All businesses, regardless of their legal form of organization, are taxed by the Canada Revenue Agency (CRA).

C) Corporate income taxes are influenced by the size and location of the companies and their income types.

D) All corporations other than nonprofit corporations are subject to corporate income taxes, which are 29% for the lowest amounts of income and 35% for the highest amounts of income.

A) For small Canadian-controlled private corporations, income less than $400,000 is exempt from taxes. Thus, government receives no tax revenue from these businesses.

B) All businesses, regardless of their legal form of organization, are taxed by the Canada Revenue Agency (CRA).

C) Corporate income taxes are influenced by the size and location of the companies and their income types.

D) All corporations other than nonprofit corporations are subject to corporate income taxes, which are 29% for the lowest amounts of income and 35% for the highest amounts of income.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

53

The Nantell Corporation just purchased an expensive piece of equipment. Originally, the firm planned to depreciate the equipment over 5 years on a straight-line basis, but now wants to depreciate the equipment on a straight-line basis over 7 years. Other things held constant, which of the following will occur as a result of this change? Assume that the company uses the same depreciation method for tax and stockholder reporting purposes.

A) Nantell's taxable income will be lower.

B) Nantell's net fixed assets as shown on the balance sheet will be higher at the end of the year.

C) Nantell's cash position will improve (increase).

D) Nantell's tax liability for the year will be lower.

A) Nantell's taxable income will be lower.

B) Nantell's net fixed assets as shown on the balance sheet will be higher at the end of the year.

C) Nantell's cash position will improve (increase).

D) Nantell's tax liability for the year will be lower.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following statements is correct?

A) MVA gives us an idea about how much value a firm's management has added during the last year.

B) MVA stands for market value added, and it is defined as follows: MVA = (Shares outstanding) × (Stock price) + Book value of common equity

C) EVA stands for economic value added, and it is defined as follows: EVA = (Operating capita) × (ROIC - WACC)

D) EVA gives us an idea about how much value a firm's management has added over the firm's life.

A) MVA gives us an idea about how much value a firm's management has added during the last year.

B) MVA stands for market value added, and it is defined as follows: MVA = (Shares outstanding) × (Stock price) + Book value of common equity

C) EVA stands for economic value added, and it is defined as follows: EVA = (Operating capita) × (ROIC - WACC)

D) EVA gives us an idea about how much value a firm's management has added over the firm's life.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following statements best describes EVA?

A) One way to increase EVA is to achieve the same level of operating income but with more investor-supplied capital.

B) If a firm reports positive net income, its EVA must also be positive.

C) One drawback of EVA as a performance measure is that it mistakenly assumes that equity capital is free.

D) One way to increase EVA is to generate the same level of operating income but with less investor-supplied capital.

A) One way to increase EVA is to achieve the same level of operating income but with more investor-supplied capital.

B) If a firm reports positive net income, its EVA must also be positive.

C) One drawback of EVA as a performance measure is that it mistakenly assumes that equity capital is free.

D) One way to increase EVA is to generate the same level of operating income but with less investor-supplied capital.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following statements best describes the financial statements?

A) Dividends paid reduce the net income that is reported on a company's income statement.

B) If a company uses some of its bank deposits to buy short-term, highly liquid marketable securities, this will cause a decline in its current assets as shown on the balance sheet.

C) If a company issues new long-term bonds during the current year, this will increase its reported current liabilities at the end of the year.

D) If a company pays more in dividends than it generates in net income, its retained earnings as reported on the balance sheet will decline from the previous year's balance.

A) Dividends paid reduce the net income that is reported on a company's income statement.

B) If a company uses some of its bank deposits to buy short-term, highly liquid marketable securities, this will cause a decline in its current assets as shown on the balance sheet.

C) If a company issues new long-term bonds during the current year, this will increase its reported current liabilities at the end of the year.

D) If a company pays more in dividends than it generates in net income, its retained earnings as reported on the balance sheet will decline from the previous year's balance.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

57

Frederickson Office Supplies recently reported $12,500 of sales, $7,250 of operating costs other than depreciation, and $1,250 of depreciation. The company had no amortization or depreciation charges and no non-operating income. It had $8,000 of bonds outstanding that carry a 7.5% interest rate, and its combined federal and provincial income tax rate was 40%. How much was the firm's taxable income, or earnings before taxes (EBT)?

A) $3,230.00

B) $3,400.00

C) $3,570.00

D) $3,748.50

A) $3,230.00

B) $3,400.00

C) $3,570.00

D) $3,748.50

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following statements is correct?

A) Changes in working capital have no effect on free cash flow.

B) Free cash flow (FCF) is defined as follows: FCF = EBIT(1 - T)

+ Depreciation and Amortization

- Capital expenditures required to sustain operations

- Required changes in net operating working capital

C) Free cash flow (FCF) is defined as follows: FCF = EBIT(1 - T) + Depreciation and Amortization + Capital expenditures

D) Operating cash flow is the same as free cash flow (FCF).

A) Changes in working capital have no effect on free cash flow.

B) Free cash flow (FCF) is defined as follows: FCF = EBIT(1 - T)

+ Depreciation and Amortization

- Capital expenditures required to sustain operations

- Required changes in net operating working capital

C) Free cash flow (FCF) is defined as follows: FCF = EBIT(1 - T) + Depreciation and Amortization + Capital expenditures

D) Operating cash flow is the same as free cash flow (FCF).

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

59

Last year Roussakis Company's operations provided a negative net cash flow, yet the cash shown on its balance sheet increased. Which of the following statements could explain the increase in cash, assuming the company's financial statements were prepared under generally accepted accounting principles?

A) The company repurchased some of its common stock.

B) The company retired a large amount of its long-term debt.

C) The company sold some of its fixed assets.

D) The company had high depreciation expenses.

A) The company repurchased some of its common stock.

B) The company retired a large amount of its long-term debt.

C) The company sold some of its fixed assets.

D) The company had high depreciation expenses.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

60

Swinnerton Clothing Company's balance sheet showed total current assets of $2,250, all of which were required in operations. Its current liabilities consisted of $575 of accounts payable, $300 of 6% short-term notes payable to the bank, and $145 of accrued wages and taxes. What was its net operating working capital that was financed by investors?

A) $1,454

B) $1,530

C) $1,607

D) $1,771

A) $1,454

B) $1,530

C) $1,607

D) $1,771

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

61

In 2009, XYZ Inc. located in Ontario had income from operation of $3,850,000, received interest of $150,000, paid $200,000 in interest, received dividends from another Canadian corporation of

$100,000, and paid $400,000 in dividends to its common shareholders. If the applicable income tax rate is 33%, what is the corporation's tax liability?

A) $1,155,000

B) $1,254,000

C) $1,287,000

D) $1,353,000

$100,000, and paid $400,000 in dividends to its common shareholders. If the applicable income tax rate is 33%, what is the corporation's tax liability?

A) $1,155,000

B) $1,254,000

C) $1,287,000

D) $1,353,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

62

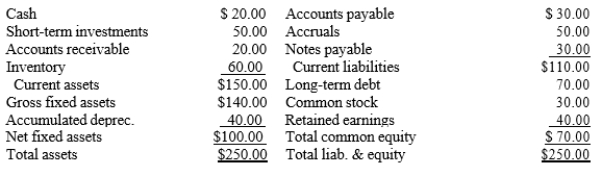

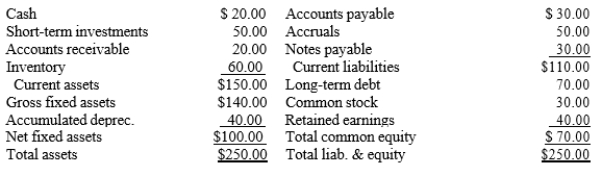

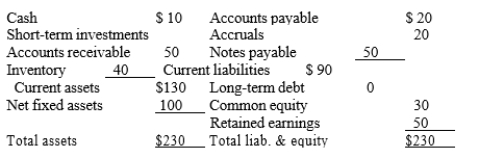

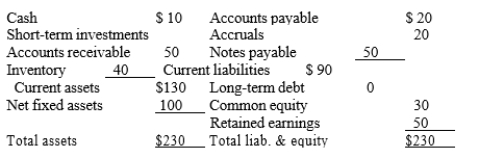

Zumbahlen Inc. has the following balance sheet. How much total operating capital does the firm have?

A) $114.00

B) $120.00

C) $126.00

D) $132.30

A) $114.00

B) $120.00

C) $126.00

D) $132.30

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

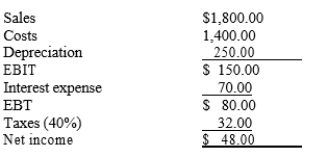

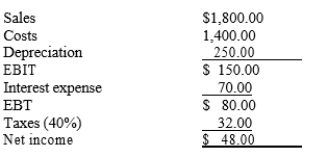

63

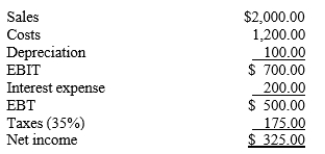

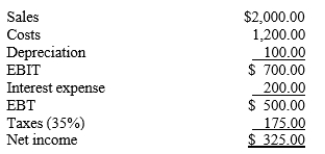

EP Enterprises has the following income statement. How much net operating profit after taxes (NOPAT) does the firm have?

A) $81.23

B) $85.50

C) $90.00

D) $94.50

A) $81.23

B) $85.50

C) $90.00

D) $94.50

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

64

Rao Corporation has the following balance sheet. How much net operating working capital does the firm have?

A) $54.00

B) $60.00

C) $66.00

D) $72.60

A) $54.00

B) $60.00

C) $66.00

D) $72.60

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

65

When the tax rules come into effect in 2011, an income trust purchases corporate bonds having a before-tax interest yield of 16%. If the marginal tax rate is 31.5%, what is the after-tax interest yield?

A) 5.04%

B) 5.48%

C) 10.96%

D) 16.00%

A) 5.04%

B) 5.48%

C) 10.96%

D) 16.00%

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

66

Calculate the tax liability for a small Canadian-controlled private corporation (CCPC) located in British Columbia having earnings before taxes (EBT) of $480,000. The relevant combined federal and provincial corporate income tax rates are 15.5% for taxable income up to $400,000 and 18.6% for the amount exceeding $400,000.

A) $53,400.00

B) $58,280.00

C) $64,800.00

D) $70,200.00

A) $53,400.00

B) $58,280.00

C) $64,800.00

D) $70,200.00

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

67

Bae Inc. has the following income statement. How much net operating profit after taxes (NOPAT) does the firm have?

A) $390.11

B) $410.64

C) $432.25

D) $455.00

A) $390.11

B) $410.64

C) $432.25

D) $455.00

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

68

Meric Mining Inc. recently reported $15,000 of sales, $7,500 of operating costs other than depreciation, and $1,200 of depreciation. The company had no amortization charges, it had outstanding $6,500 of bonds that carry a 6.25% interest rate, and its combined federal and provincial income tax rate was 35%. How much was the firm's net income after taxes? Meric uses the same depreciation expense for tax and shareholder reporting purposes.

A) $3,284.55

B) $3,457.42

C) $3,639.39

D) $3,830.94

A) $3,284.55

B) $3,457.42

C) $3,639.39

D) $3,830.94

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

69

NNR Inc.'s balance sheet showed total current assets of $1,875,000 plus $4,225,000 of net fixed assets. All of these assets were required in operations. The firm's current liabilities consisted of $475,000 of accounts payable, $375,000 of 6% short-term notes payable to the bank, and $150,000 of accrued wages and taxes. Its remaining capital consisted of long-term debt and common equity. What was NNR's total investor-provided operating capital?

A) $4,694,128

B) $4,941,188

C) $5,201,250

D) $5,475,000

A) $4,694,128

B) $4,941,188

C) $5,201,250

D) $5,475,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

70

Tibbs Inc. had the following data for the year ending 12/31/06: Net income = $300; Net operating profit after taxes (NOPAT) = $400; Total assets = $2,500; Short-term investments = $200; Shareholders' equity = $1,800; Total debt = $700; and Total operating capital = $2,300. What was its return on invested capital (ROIC)?

A) 14.91%

B) 15.70%

C) 16.52%

D) 17.39%

A) 14.91%

B) 15.70%

C) 16.52%

D) 17.39%

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

71

TSW Inc. had the following data for last year: Net income = $800; Net operating profit after taxes (NOPAT) = $700; Total assets = $3,000; and Total operating capital = $2,000. Information for the just-completed year is as follows: Net income = $1,000; Net operating profit after taxes (NOPAT) = $925; Total assets = $2,600; and Total operating capital = $2,500. How much free cash flow did the firm generate during the just-completed year?

A) $383

B) $425

C) $468

D) $514

A) $383

B) $425

C) $468

D) $514

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

72

Formed in 2005, ABC Ltd. had taxable income of $95,000 in 2005; $70,000 in 2006; $55,000 in 2007; $80,000 in 2008, and -$150,000 in 2009. What is the adjusted corporate tax payment in 2009? Assume that ABC is a CCPC in Manitoba with a combined federal and provincial corporate income tax rate of

13%)

A) $17,150.00

B) $18,100.00

C) $19,500.00

D) $20,550.00

13%)

A) $17,150.00

B) $18,100.00

C) $19,500.00

D) $20,550.00

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

73

An individual made $48,000 last year paying $12,480 in taxes. What is the taxpayer's average tax rate?

A) 17.4%

B) 22.1%

C) 26.0%

D) 30.9%

A) 17.4%

B) 22.1%

C) 26.0%

D) 30.9%

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

74

On 12/31/09, Heaton Industries Inc. reported retained earnings of $675,000 on its balance sheet, and it reported that it had $172,500 of net income during the year. On its previous balance sheet, at 12/31/08, the company had reported $555,000 of retained earnings. No shares were repurchased during 2009. How much in dividends did Heaton pay during 2009?

A) $47,381

B) $49,875

C) $52,500

D) $55,125

A) $47,381

B) $49,875

C) $52,500

D) $55,125

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

75

Over the years, Janjigian Corporation's shareholders have provided $15,250 of capital, part when they purchased new issues of stock and part when they allowed management to retain some of the firm's earnings. The firm now has 1,000 shares of common share outstanding, and it sells at a price of $42.00 per share. How much value has Janjigian's management added to stockholder wealth over the years, i.e., what is Janjigian's MVA?

A) $22,935

B) $24,142

C) $25,413

D) $26,750

A) $22,935

B) $24,142

C) $25,413

D) $26,750

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

76

Last year Tiemann Technologies reported $10,500 of sales, $6,250 of operating costs other than depreciation, and $1,300 of depreciation. The company had no amortization charges, it had $5,000 of bonds that carry a 6.5% interest rate, and its combined federal and provincial income tax rate was 35%. This year's data are expected to remain unchanged except for one item, depreciation, which is expected to increase by $750. By how much will net after-tax income change as a result of the change in depreciation? The company uses the same depreciation calculations for tax and stockholder reporting purposes.

A) -463.13

B) -487.50

C) -511.88

D) -537.47

A) -463.13

B) -487.50

C) -511.88

D) -537.47

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

77

If a local Firm X owns 35% of the shares of a Canadian-owned Firm Y, and Y pays dividends to all of its shareholders, what percent of the dividends received by X can be exempted from its taxable income?

A) 0

B) 35%

C) 65%

D) 100%

A) 0

B) 35%

C) 65%

D) 100%

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

78

During 2009, Bascom Bakery Inc. paid out $21,750 of common dividends. It ended the year with $187,500 of retained earnings versus the prior year's retained earnings of $132,250. How much net income did the firm earn during the year?

A) $77,000

B) $80,850

C) $84,893

D) $89,137

A) $77,000

B) $80,850

C) $84,893

D) $89,137

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

79

Barnes' Brothers has the following data for the year ending 12/31/07: Net income = $600; Net operating profit after taxes (NOPAT) = $700; Total assets = $2,500; Short-term investments = $200; Stockholders' equity = $1,800; Total debt = $700; and Total operating capital = $2,100. Barnes' weighted average cost of capital is 10%. What is its economic value added (EVA)?

A) $420.11

B) $442.23

C) $465.50

D) $490.00

A) $420.11

B) $442.23

C) $465.50

D) $490.00

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

80

Formed in 2009, the ABC Ltd. had an operating loss of $95,000, with projected taxable income of $70,000 in 2010, $55,000 in 2011, and $80,000 in 2012. What will be the corporate tax liability in

2012? Assume that ABC is a CCPC in Quebec with a combined federal and provincial corporate income tax rate of 19%.

A) $15,200.00

B) $16,250.00

C) $17,700.00

D) $18,500.00

2012? Assume that ABC is a CCPC in Quebec with a combined federal and provincial corporate income tax rate of 19%.

A) $15,200.00

B) $16,250.00

C) $17,700.00

D) $18,500.00

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck