Deck 18: Option Valuation and Strategiesprivate

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/42

Play

Full screen (f)

Deck 18: Option Valuation and Strategiesprivate

1

Selling a call and purchasing a treasury bill produces the same returns as buying a stock.

False

2

The hedge ratio is one piece of information given by

the Black/Scholes option valuation model.

the Black/Scholes option valuation model.

True

3

Writing both a put and a call at the same strike price and expiration date is an illustration of a straddle.

True

4

An investor cannot buy and sell two different call options with the same expiration dates.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

5

The hedge ratio indicates the number of call options that is necessary to offset price movements in the underlying stock.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

6

An investor buys a straddle in anticipation of stable

stock prices.

stock prices.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

7

According to put-call parity, if a stock is overpriced, the investor should sell the stock short, sell the put, buy the call, and buy the bond.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

8

Buying a call and a treasury bill produces similar results as buying a stock and a put.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

9

According to the Black/Scholes option valuation model, the value of a call option rises as it approaches expiration.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

10

Bull and Bear spreads require taking a long position in one option and a short position in another option with a different strike price.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

11

The Black/Scholes option valuation model divides the

option's strike price by the probability that the option will be exercised.

option's strike price by the probability that the option will be exercised.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

12

To construct a bear spread, the investor buys a call option and shorts the stock.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

13

According to the Black/Scholes option valuation model, the value of a call option rises as interest rates increase.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

14

Put-call parity suggests that the sum of the prices of a stock, a call and a put on that stock, and a debt instrument maturing at the expiration of the options must equal zero.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

15

If the hedge ratio is 0.7, the number of call options

necessary to offset a long position in a stock is 7.0.

necessary to offset a long position in a stock is 7.0.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

16

The "collar strategy" is used to lock-in profits from an increase in the price of a stock.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

17

If investors believe that a stock's price will

fluctuate but they are not certain as to the direction, these investors may buy a straddle.

fluctuate but they are not certain as to the direction, these investors may buy a straddle.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

18

The protective call strategy is an illustration of a

short position.

short position.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

19

Put-call parity explains why a change in interest rates by the Federal Reserve affects stock and option prices.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

20

If an individual sells a stock short, that investor is protected from a large increase in the price of the stock by selling a call option.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

21

If the investor anticipates that the price of stock

Will be stable, he or she may

A) sell a straddle

B) buy a straddle

C) buy a call

D) buy a put

Will be stable, he or she may

A) sell a straddle

B) buy a straddle

C) buy a call

D) buy a put

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

22

If the investor buys a bull spread, the individual

Anticipates

A) higher call price

B) higher stock prices

C) lower stock prices

D) lower call prices

Anticipates

A) higher call price

B) higher stock prices

C) lower stock prices

D) lower call prices

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

23

If the investor buys a bear spread, the individual

Anticipates

A) higher interest rates

B) higher option prices

C) lower stock prices

D) lower put prices

Anticipates

A) higher interest rates

B) higher option prices

C) lower stock prices

D) lower put prices

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

24

According to the Black/Scholes option valuation

Model, the value of a call option increases if

A) the option approaches expiration

B) the return on the stock is more certain

C) interest rates on a discounted bond decline

D) the standard deviation of the stock's return increases

Model, the value of a call option increases if

A) the option approaches expiration

B) the return on the stock is more certain

C) interest rates on a discounted bond decline

D) the standard deviation of the stock's return increases

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

25

According to the Black/Scholes option valuation

Model, a call option's value increases if

A) stock prices increase and interest rates decrease

B) the time to expiration decreases and interest rates increase

C) the variability of the stock's return increases and stock prices increase

D) interest rates decrease and the variability of the stock's return increases

Model, a call option's value increases if

A) stock prices increase and interest rates decrease

B) the time to expiration decreases and interest rates increase

C) the variability of the stock's return increases and stock prices increase

D) interest rates decrease and the variability of the stock's return increases

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

26

To acquire a straddle, the investor

A) buys stock and a call

B) buys two calls with different strike prices

C) buys a put and sells a call with the same strike price

E) buys a put and buys a call with the same strike price

A) buys stock and a call

B) buys two calls with different strike prices

C) buys a put and sells a call with the same strike price

E) buys a put and buys a call with the same strike price

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

27

The VIX is

A) an index of option prices

B) an index of Black/Scholes option values

C) positively correlated with the S&P 500

D) a measure of investor sentiment

A) an index of option prices

B) an index of Black/Scholes option values

C) positively correlated with the S&P 500

D) a measure of investor sentiment

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

28

If the investor anticipates that the price of a

Stock will fluctuate, this individual may

A) sell a call and sell a put

B) buy a call and buy a put

C) buy a call and sell a put

D) sell a call and buy a put

Stock will fluctuate, this individual may

A) sell a call and sell a put

B) buy a call and buy a put

C) buy a call and sell a put

D) sell a call and buy a put

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

29

If a stock is selling for $33 and you expect the price not to fluctuate, what are the potential profits and losses from writing a straddle if a call option at $35 sells for $3 and the put option at $35 sells for $4?

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

30

The price of a stock is $46 and the prices of call options to buy the stock at $45 and $50 are $6 and $3, respectively. What are the potential profits and losses when the price of the stock is $40, $45, $50, and $55 if the investor buys the call at $45 and sells the call at $50?

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

31

A call option is the right to buy stock at $25 a share. According to the Black/Scholes option valuation model, what is the value of the call

a. if the price of the stock is $25, the interest rate is 8 percent, the option expires in three months, and the standard deviation of the stock's return is 0.20 (20 percent)?

b. if the price of the stock is $25, the interest rate is 6 percent, the option expires in three months, and the standard deviation of the stock's return is 0.20 (20 percent)?

c. if the price of the stock is $27, the interest rate is 8 percent, the option expires in three months, and the standard deviation of the stock's return is 0.20 (20 percent)?

a. if the price of the stock is $25, the interest rate is 8 percent, the option expires in three months, and the standard deviation of the stock's return is 0.20 (20 percent)?

b. if the price of the stock is $25, the interest rate is 6 percent, the option expires in three months, and the standard deviation of the stock's return is 0.20 (20 percent)?

c. if the price of the stock is $27, the interest rate is 8 percent, the option expires in three months, and the standard deviation of the stock's return is 0.20 (20 percent)?

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

32

If the price of a stock is $100 while the price of a call option at $100 is $3, the price of the put option is $2, and the rate of interest is 10 percent so the investor can purchase a $100 discounted note for $90.90 . what should you do and verify the potential losses and profits from the position.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

33

If an investor sells a stock short, that individual

Reduces the risk of loss by

A) buying a put

B) buying a call

C) entering a limit order to sell the stock if its price declines

D) increasing the collateral with the broker

Reduces the risk of loss by

A) buying a put

B) buying a call

C) entering a limit order to sell the stock if its price declines

D) increasing the collateral with the broker

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

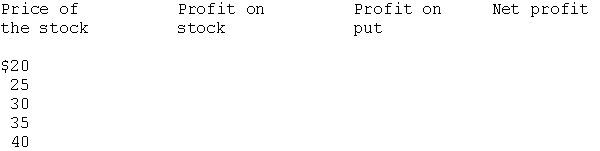

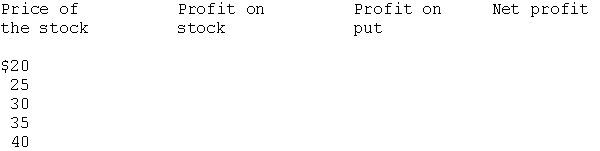

34

A put and a call have the following terms:

Call: strike price $30

term three months

price $3

Put: strike price $30

term three months

price $4

The price of the stock is currently $29. You sell the stock short and purchase the call. Complete the following table and answer the questions.

a. What is the maximum possible profit on the position?

b. What is the maximum possible loss on the position?

c. What is the range of stock prices that generates a profit?

d. What advantage does this position offer?

Call: strike price $30

term three months

price $3

Put: strike price $30

term three months

price $4

The price of the stock is currently $29. You sell the stock short and purchase the call. Complete the following table and answer the questions.

a. What is the maximum possible profit on the position?

b. What is the maximum possible loss on the position?

c. What is the range of stock prices that generates a profit?

d. What advantage does this position offer?

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

35

According to the Black/Scholes option valuation

Model, a call option's value decreases if

A) interest rates increase as the option approaches expiration

B) the variability of the stock's return declines and the interest rate decreases

C) an increase in the price of the stock results in a two for one stock split

D the option is exercised

Model, a call option's value decreases if

A) interest rates increase as the option approaches expiration

B) the variability of the stock's return declines and the interest rate decreases

C) an increase in the price of the stock results in a two for one stock split

D the option is exercised

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

36

If a call is overvalued, put-call parity suggests

That the investor should

A) sell the call and the stock and buy the put and the bond

B) sell the call and the bond and buy the put and the stock

C) sell the bond and the put and buy the stock and the call

D) sell the stock and the put and buy the call and the bond

That the investor should

A) sell the call and the stock and buy the put and the bond

B) sell the call and the bond and buy the put and the stock

C) sell the bond and the put and buy the stock and the call

D) sell the stock and the put and buy the call and the bond

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

37

Put-call parity suggests that

A) the sum of the prices of a stock and a call equal zero

B) the sum of the prices of a put and a call equal zero

C) sum of the prices of a stock and a put must equal the sum of the prices of a call and a discounted bond with the maturity date as the expiration date of the options

C) the sum of the prices of a stock, a call, a put, and a bond equal zero

A) the sum of the prices of a stock and a call equal zero

B) the sum of the prices of a put and a call equal zero

C) sum of the prices of a stock and a put must equal the sum of the prices of a call and a discounted bond with the maturity date as the expiration date of the options

C) the sum of the prices of a stock, a call, a put, and a bond equal zero

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

38

An increase in the VIX is associated with

A) increased stock returns

B) increased stock market volatility

C) increased interest rates

D) increased market complacency

PROBLEMS

A) increased stock returns

B) increased stock market volatility

C) increased interest rates

D) increased market complacency

PROBLEMS

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

39

The investor owns 1,000 shares of stock but anticipates its price may decline. To reduce the risk of loss, how many call options must be sold if the hedge ratio is 0.7?

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

40

The hedge ratio determines

A) the number of call options to offset movements in the price of the stock

B) the number of call options to offset a straddle

C) the number of put options to offset movements in the price of a call option

D) the number of call options to offset the impact of changes in interest rates

A) the number of call options to offset movements in the price of the stock

B) the number of call options to offset a straddle

C) the number of put options to offset movements in the price of a call option

D) the number of call options to offset the impact of changes in interest rates

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

41

Put-call parity asserts that a combination of a long position in the stock and the put produces the same return as a comparable position in a call and a risk-free bond. If not, at least one market is in disequilibrium. The resulting arbitrage alters the securities' prices until the value of the stock plus the put equals the prices of the call and the bond. The successful use of arbitrage assumes the investor of a profit no matter what happens to the price of the stock.

Put-call parity also asserts that if an arbitrage opportunity does not exist, then a combination of the stock and the put produces the same return as the comparable position in the call and the risk-free bond. Currently, the price of a stock is $70 while the price of a call option at $70 is $6; the price of the put option at $70 is $2, and the price of a discounted bond is $66. Verify that a long position in the stock and the put produces the same performance as a long position in the call and the bond for the following prices of the stock: $60, 65, 70, 75, and 80.

SOLUTIONS TO PROBLEMS

Put-call parity also asserts that if an arbitrage opportunity does not exist, then a combination of the stock and the put produces the same return as the comparable position in the call and the risk-free bond. Currently, the price of a stock is $70 while the price of a call option at $70 is $6; the price of the put option at $70 is $2, and the price of a discounted bond is $66. Verify that a long position in the stock and the put produces the same performance as a long position in the call and the bond for the following prices of the stock: $60, 65, 70, 75, and 80.

SOLUTIONS TO PROBLEMS

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

42

Put-call parity basically says that combination of a put, a call, and a risk-free bond must be the same value as the underlying stock. If not, at least one market is in disequilibrium. The resulting arbitrage alters the securities' prices until the value of the call plus the bond is equal to the prices of the put plus the stock. Currently, the price of a stock is $100 while the price of a call option at $100 is $10; the price of the put option is $4.59, and the rate of interest is 8 percent, so that the investor may purchase a $100 discounted note for $92.59.

a. Do these prices indicate that the financial markets are in equilibrium? Show me how you derived your answer.

b. An arbitrage opportunity should exist, but if you set up the position incorrectly, you will always sustain losses. Verify to me that if you do set up an incorrect arbitrage, you will always sustain a loss. Please use prices of the stock at $80, $100, and $120 as of the expiration date of the options.

a. Do these prices indicate that the financial markets are in equilibrium? Show me how you derived your answer.

b. An arbitrage opportunity should exist, but if you set up the position incorrectly, you will always sustain losses. Verify to me that if you do set up an incorrect arbitrage, you will always sustain a loss. Please use prices of the stock at $80, $100, and $120 as of the expiration date of the options.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck