Deck 15: Long-Term Liabilities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/215

Play

Full screen (f)

Deck 15: Long-Term Liabilities

1

If $800,000, 6% bonds are issued on January 1, and pay interest semiannually, the amount of interest paid on July 1 will be $24,000.

True

2

A corporation that issues bonds at a discount will recognize interest expense at a rate which is greater than the market interest rate.

False

3

If bonds sell at a premium, the interest expense recognized each year will be greater than the contractual interest rate.

False

4

Bond interest paid by a corporation is an expense, whereas dividends paid are not an expense of the corporation.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

5

The board of directors may authorize more bonds than are issued.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

6

If $150,000 face value bonds are issued at 103, the proceeds received will be $103,000.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

7

If the market interest rate is greater than the contractual interest rate, bonds will sell at a discount.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

8

If bonds are issued at a discount, the issuing corporation will pay a principal amount less than the face amount of the bonds on the maturity date.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

9

Each bondholder may vote for the board of directors in proportion to the number of bonds held.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

10

The holder of a convertible bond can convert an interest payment received into a cash dividend paid on common stock if the dividend is greater than the interest payment.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

11

The carrying value of bonds is calculated by adding the balance of the Discount on Bonds Payable account to the balance in the Bonds Payable account.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

12

Registered bonds are bonds that are delivered to owners by U.S. registered mail service.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

13

If a corporation issued bonds at an amount less than face value, it indicates that the corporation has a weak credit rating.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

14

A 10% stock dividend is the equivalent of a $1,000 par value bond paying annual interest of 10%.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

15

Discount on bonds is an additional cost of borrowing and should be recorded as interest expense over the life of the bonds.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

16

Neither corporate bond interest nor dividends are deductible for tax purposes.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

17

Bonds are a form of interest-bearing notes payable.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

18

The contractual interest rate is always equal to the market interest rate on the date that bonds are issued.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

19

If bonds are issued at a premium, the carrying value of the bonds will be greater than the face value of the bonds for all periods prior to the bond maturity date.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

20

A debenture bond is an unsecured bond which is issued against the general credit of the borrower.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

21

Premium on Bonds Payable is a contra account to Bonds Payable.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

22

The times interest earned ratio is computed by dividing net income by interest expense.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

23

Under a capital lease, the lease/asset is reported on the balance sheet under plant assets.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

24

Each payment on a mortgage note payable consists of interest on the original balance of the loan and a reduction of the loan principal.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

25

The present value of a bond is a function of two variables: (1) the payment amounts and (2) the interest (discount) rate.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

26

The loss on bond redemption is the difference between the cash paid and the carrying value of the bonds.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

27

A long-term note that pledges title to specific property as security for a loan is known as a mortgage payable.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

28

Generally, convertible bonds do not pay interest.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

29

The terms of the bond issue are set forth in a formal legal document called a bond indenture.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

30

From the standpoint of the issuing company, a disadvantage of using bonds as a means of long-term financing is that

A) bond interest is deductible for tax purposes.

B) interest must be paid on a periodic basis regardless of earnings.

C) income to stockholders may increase as a result of trading on the equity.

D) the bondholders do not have voting rights.

A) bond interest is deductible for tax purposes.

B) interest must be paid on a periodic basis regardless of earnings.

C) income to stockholders may increase as a result of trading on the equity.

D) the bondholders do not have voting rights.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

31

Each of the following is correct regarding bonds except they are

A) a form of interest-bearing notes payable.

B) attractive to many investors.

C) issued by corporations and governmental agencies.

D) sold in large denominations.

A) a form of interest-bearing notes payable.

B) attractive to many investors.

C) issued by corporations and governmental agencies.

D) sold in large denominations.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

32

When bonds are converted into common stock, the carrying value of the bonds is transferred to paid-in capital accounts.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

33

Long-term liabilities are reported in a separate section of the balance sheet immediately following current liabilities.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

34

The carrying value of bonds at maturity should be equal to the face value of the bonds.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

35

Gains and losses are not recognized when convertible bonds are converted into common stock.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

36

Operating leases are leases that the lessee must capitalize on its balance sheet as an asset.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

37

A capital lease requires the lessee to record the lease as a purchase of an asset.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

38

If $500,000 par value bonds with a carrying value of $476,000 are redeemed at 97, a loss on redemption will be recorded.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

39

The effective-interest method of amortization results in varying amounts of amortization and interest expense per period but a constant interest rate.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

40

Bonds that mature at a single specified future date are called term bonds.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

41

Secured bonds are bonds that

A) are in the possession of a bank.

B) are registered in the name of the owner.

C) have specific assets of the issuer pledged as collateral.

D) have detachable interest coupons.

A) are in the possession of a bank.

B) are registered in the name of the owner.

C) have specific assets of the issuer pledged as collateral.

D) have detachable interest coupons.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following statements concerning bonds is not a true statement?

A) Bonds are generally sold through an investment company.

B) The bond indenture is prepared after the bonds are printed.

C) The bond indenture and bond certificate are separate documents.

D) The trustee keeps records of each bondholder.

A) Bonds are generally sold through an investment company.

B) The bond indenture is prepared after the bonds are printed.

C) The bond indenture and bond certificate are separate documents.

D) The trustee keeps records of each bondholder.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

43

A bond trustee does not

A) issue the bonds.

B) keep a record of each bondholder.

C) hold conditional title to pledged property.

D) maintain custody of unsold bonds.

A) issue the bonds.

B) keep a record of each bondholder.

C) hold conditional title to pledged property.

D) maintain custody of unsold bonds.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

44

Bonds that mature at a single specified future date are called

A) coupon bonds.

B) term bonds.

C) serial bonds.

D) debentures.

A) coupon bonds.

B) term bonds.

C) serial bonds.

D) debentures.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

45

Corporations are granted the power to issue bonds through

A) tax laws.

B) state laws.

C) federal security laws.

D) bond debentures.

A) tax laws.

B) state laws.

C) federal security laws.

D) bond debentures.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is not an advantage of issuing bonds instead of common stock?

A) Stockholder control is not affected.

B) Earnings per share on common stock may be lower.

C) Income to common shareholders may increase.

D) Tax savings result.

A) Stockholder control is not affected.

B) Earnings per share on common stock may be lower.

C) Income to common shareholders may increase.

D) Tax savings result.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

47

A bondholder that sends in a coupon to receive interest payments must have a(n)

A) unsecured bond.

B) bearer bond.

C) mortgage bond.

D) serial bond.

A) unsecured bond.

B) bearer bond.

C) mortgage bond.

D) serial bond.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

48

Investors who receive checks in their names for interest paid on bonds must hold

A) registered bonds.

B) coupon bonds.

C) bearer bonds.

D) direct bonds.

A) registered bonds.

B) coupon bonds.

C) bearer bonds.

D) direct bonds.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

49

Bonds will always fall into all but which one of the following categories?

A) Callable or convertible

B) Term or serial

C) Registered or bearer

D) Secured or unsecured

A) Callable or convertible

B) Term or serial

C) Registered or bearer

D) Secured or unsecured

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

50

The party who has the right to exercise a call option on bonds is the

A) investment banker.

B) bondholder.

C) bearer.

D) issuer.

A) investment banker.

B) bondholder.

C) bearer.

D) issuer.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

51

If a corporation issued $3,000,000 in bonds which pay 10% annual interest, what is the annual net cash cost of this borrowing if the income tax rate is 30%?

A) $3,000,000

B) $90,000

C) $300,000

D) $210,000

A) $3,000,000

B) $90,000

C) $300,000

D) $210,000

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

52

The contractual interest rate is always stated as a(n)

A) monthly rate.

B) daily rate.

C) semiannual rate.

D) annual rate.

A) monthly rate.

B) daily rate.

C) semiannual rate.

D) annual rate.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

53

Bonds that are subject to retirement at a stated dollar amount prior to maturity at the option of the issuer are called

A) callable bonds.

B) early retirement bonds.

C) options.

D) debentures.

A) callable bonds.

B) early retirement bonds.

C) options.

D) debentures.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

54

Stockholders of a company may be reluctant to finance expansion through issuing more equity because

A) leveraging with debt is always a better idea.

B) their earnings per share may decrease.

C) the price of the stock will automatically decrease.

D) dividends must be paid on a periodic basis.

A) leveraging with debt is always a better idea.

B) their earnings per share may decrease.

C) the price of the stock will automatically decrease.

D) dividends must be paid on a periodic basis.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

55

A legal document which summarizes the rights and privileges of bondholders as well as the obligations and commitments of the issuing company is called

A) a bond indenture.

B) a bond debenture.

C) trading on the equity.

D) a term bond.

A) a bond indenture.

B) a bond debenture.

C) trading on the equity.

D) a term bond.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

56

Bonds that are not registered are

A) bearer bonds.

B) debentures.

C) registered bonds.

D) transportable bonds.

A) bearer bonds.

B) debentures.

C) registered bonds.

D) transportable bonds.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

57

Bonds that may be exchanged for common stock at the option of the bondholders are called

A) options.

B) stock bonds.

C) convertible bonds.

D) callable bonds.

A) options.

B) stock bonds.

C) convertible bonds.

D) callable bonds.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

58

Bonds that are issued in the name of the owner are

A) coupon bonds.

B) bearer bonds.

C) serial bonds.

D) registered bonds.

A) coupon bonds.

B) bearer bonds.

C) serial bonds.

D) registered bonds.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

59

A major disadvantage resulting from the use of bonds is that

A) earnings per share may be lowered.

B) interest must be paid on a periodic basis.

C) bondholders have voting rights.

D) taxes may increase.

A) earnings per share may be lowered.

B) interest must be paid on a periodic basis.

C) bondholders have voting rights.

D) taxes may increase.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

60

Bonds that are secured by real estate are termed

A) mortgage bonds.

B) serial bonds.

C) debentures.

D) bearer bonds.

A) mortgage bonds.

B) serial bonds.

C) debentures.

D) bearer bonds.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

61

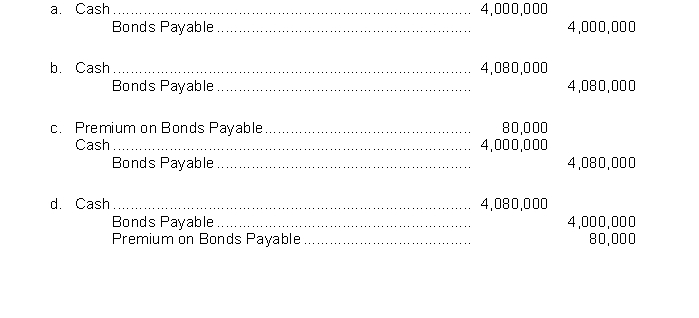

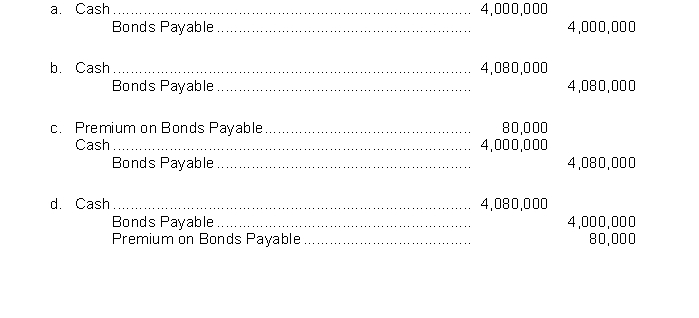

On January 1, 2010, Grant Corporation issued $4,000,000, 10-year, 8% bonds at 102. Interest is payable semiannually on January 1 and July 1. The journal entry to record this transaction on January 1, 2010 is

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

62

A bond with a face value of $200,000 and a quoted price of 102¼ has a selling price of

A) $240,450.

B) $204,050.

C) $200,450.

D) $204,500.

A) $240,450.

B) $204,050.

C) $200,450.

D) $204,500.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

63

If bonds are issued at a discount, it means that the

A) financial strength of the issuer is suspect.

B) market interest rate is higher than the contractual interest rate.

C) market interest rate is lower than the contractual interest rate.

D) bondholder will receive effectively less interest than the contractual interest rate.

A) financial strength of the issuer is suspect.

B) market interest rate is higher than the contractual interest rate.

C) market interest rate is lower than the contractual interest rate.

D) bondholder will receive effectively less interest than the contractual interest rate.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

64

The market interest rate is often called the

A) stated rate.

B) effective rate.

C) coupon rate.

D) contractual rate.

A) stated rate.

B) effective rate.

C) coupon rate.

D) contractual rate.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

65

If the market interest rate is 10%, a $10,000, 12%, 10-year bond, that pays interest semiannually would sell at an amount

A) less than face value.

B) equal to face value.

C) greater than face value.

D) that cannot be determined.

A) less than face value.

B) equal to face value.

C) greater than face value.

D) that cannot be determined.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

66

The carrying value of bonds will equal the market price

A) at the close of every trading day.

B) at the end of the fiscal period.

C) on the date of issuance.

D) every six months on the date interest is paid.

A) at the close of every trading day.

B) at the end of the fiscal period.

C) on the date of issuance.

D) every six months on the date interest is paid.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

67

If the market interest rate is greater than the contractual interest rate, bonds will sell

A) at a premium.

B) at face value.

C) at a discount.

D) only after the stated interest rate is increased.

A) at a premium.

B) at face value.

C) at a discount.

D) only after the stated interest rate is increased.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

68

The total cost of borrowing is increased only if the

A) bonds were issued at a premium.

B) bonds were issued at a discount.

C) bonds were sold at face value.

D) market interest rate is less than the contractual interest rate on that date.

A) bonds were issued at a premium.

B) bonds were issued at a discount.

C) bonds were sold at face value.

D) market interest rate is less than the contractual interest rate on that date.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

69

Premium on Bonds Payable

A) has a debit balance.

B) is a contra account.

C) is considered to be a reduction in the cost of borrowing.

D) is deducted from bonds payable on the balance sheet.

A) has a debit balance.

B) is a contra account.

C) is considered to be a reduction in the cost of borrowing.

D) is deducted from bonds payable on the balance sheet.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

70

When authorizing bonds to be issued, the board of directors does not specify the

A) total number of bonds authorized to be sold.

B) contractual interest rate.

C) selling price.

D) total face value of the bonds.

A) total number of bonds authorized to be sold.

B) contractual interest rate.

C) selling price.

D) total face value of the bonds.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

71

In the balance sheet, the account, Premium on Bonds Payable, is

A) added to bonds payable.

B) deducted from bonds payable.

C) classified as a stockholders' equity account.

D) classified as a revenue account.

A) added to bonds payable.

B) deducted from bonds payable.

C) classified as a stockholders' equity account.

D) classified as a revenue account.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

72

Gomez Corporation issues 2,000, 10-year, 8%, $1,000 bonds dated January 1, 2010, at 98. The journal entry to record the issuance will show a

A) debit to Cash of $2,000,000.

B) credit to Discount on Bonds Payable for $40,000.

C) credit to Bonds Payable for $1,960,000.

D) debit to Cash for $1,960,000.

A) debit to Cash of $2,000,000.

B) credit to Discount on Bonds Payable for $40,000.

C) credit to Bonds Payable for $1,960,000.

D) debit to Cash for $1,960,000.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

73

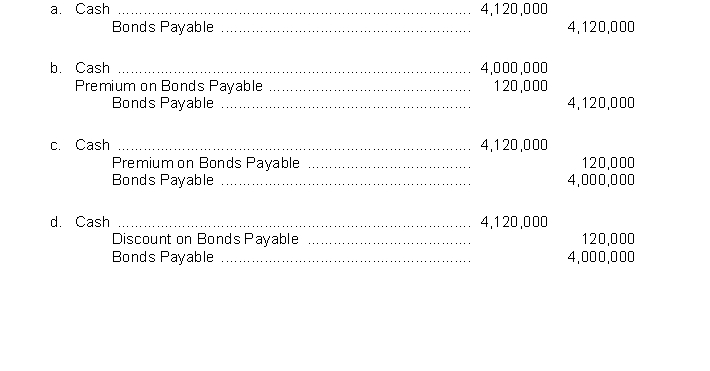

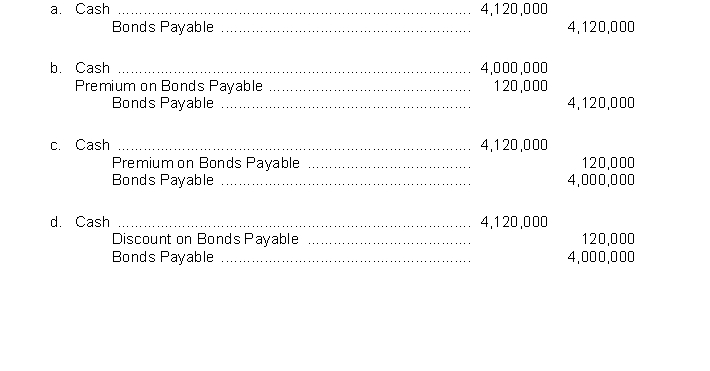

Four thousand bonds with a face value of $1,000 each, are sold at 103. The entry to record the issuance is

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

74

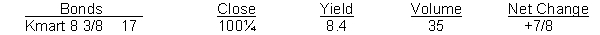

The following exhibit is for Kmart bonds.  The contractual interest rate of the K mart bonds is

The contractual interest rate of the K mart bonds is

A) greater than the market interest rate.

B) less than the market interest rate.

C) equal to the market interest rate.

D) not determinable.

The contractual interest rate of the K mart bonds is

The contractual interest rate of the K mart bonds isA) greater than the market interest rate.

B) less than the market interest rate.

C) equal to the market interest rate.

D) not determinable.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

75

The present value of a $10,000, 5-year bond, will be less than $10,000 if the

A) contractual interest rate is less than the market interest rate.

B) contractual interest rate is greater than the market interest rate.

C) bond is convertible.

D) contractual interest rate is equal to the market interest rate.

A) contractual interest rate is less than the market interest rate.

B) contractual interest rate is greater than the market interest rate.

C) bond is convertible.

D) contractual interest rate is equal to the market interest rate.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

76

A $1,000 face value bond with a quoted price of 97 is selling for

A) $1,000.

B) $970.

C) $907.

D) $97.

A) $1,000.

B) $970.

C) $907.

D) $97.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

77

The statement that "Bond prices vary inversely with changes in the market interest rate" means that if the

A) market interest rate increases, the contractual interest rate will decrease.

B) contractual interest rate increases, then bond prices will go down.

C) market interest rate decreases, then bond prices will go up.

D) contractual interest rate increases, the market interest rate will decrease.

A) market interest rate increases, the contractual interest rate will decrease.

B) contractual interest rate increases, then bond prices will go down.

C) market interest rate decreases, then bond prices will go up.

D) contractual interest rate increases, the market interest rate will decrease.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

78

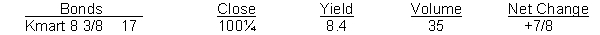

The following exhibit is for Kmart bonds.  On the day of trading referred to above,

On the day of trading referred to above,

A) no Kmart bonds were traded.

B) bonds with market prices of $3,500 were traded.

C) at closing, the selling price of the bond was higher than the previous day's price.

D) the bond sold for $100.25

On the day of trading referred to above,

On the day of trading referred to above,A) no Kmart bonds were traded.

B) bonds with market prices of $3,500 were traded.

C) at closing, the selling price of the bond was higher than the previous day's price.

D) the bond sold for $100.25

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

79

The sale of bonds above face value

A) is a rare occurrence.

B) will cause the total cost of borrowing to be less than the bond interest paid.

C) will cause the total cost of borrowing to be more than the bond interest paid.

D) will have no net effect on Interest Expense by the time the bonds mature.

A) is a rare occurrence.

B) will cause the total cost of borrowing to be less than the bond interest paid.

C) will cause the total cost of borrowing to be more than the bond interest paid.

D) will have no net effect on Interest Expense by the time the bonds mature.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck

80

Each of the following accounts is reported as long-term liabilities except

A) Bond Interest Payable.

B) Bonds Payable.

C) Discount on Bonds Payable.

D) Premium on Bonds Payable.

A) Bond Interest Payable.

B) Bonds Payable.

C) Discount on Bonds Payable.

D) Premium on Bonds Payable.

Unlock Deck

Unlock for access to all 215 flashcards in this deck.

Unlock Deck

k this deck