Deck 11: Current Liabilities and Payroll Accounting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

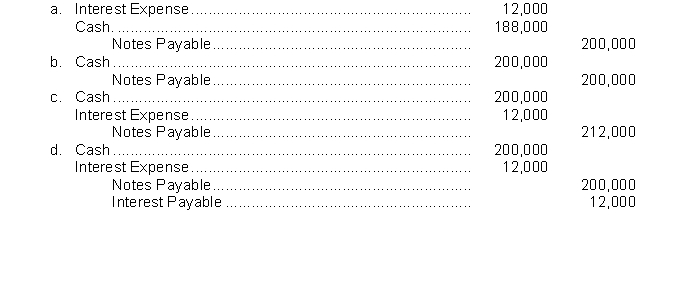

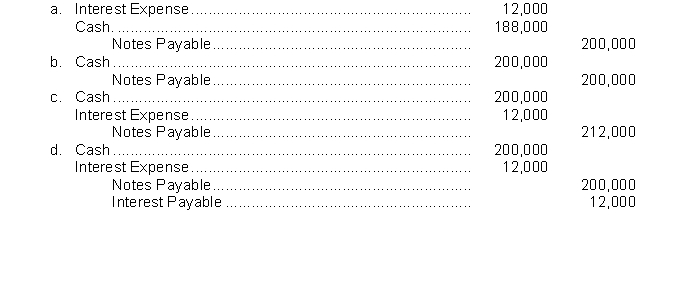

Question

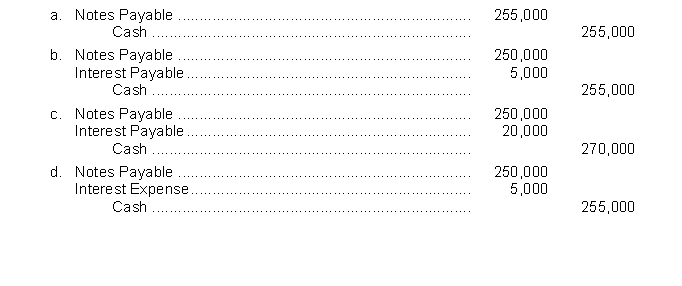

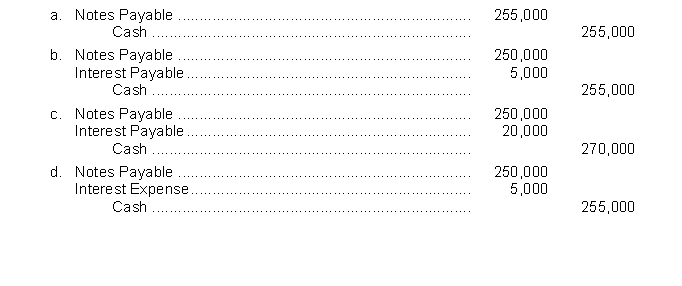

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/207

Play

Full screen (f)

Deck 11: Current Liabilities and Payroll Accounting

1

Unearned revenues should be classified as Other Revenues and Gains on the Income Statement.

False

2

Interest expense on a note payable is only recorded at maturity.

False

3

Current maturities of long-term debt refers to the amount of interest on a note payable that must be paid in the current year.

False

4

A company whose current liabilities exceed its current assets may have a liquidity problem.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

5

A $30,000, 8%, 9-month note payable requires an interest payment of $1,800 at maturity.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

6

Working capital is current assets divided by current liabilities.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

7

The relationship between current liabilities and current assets is important in evaluating a company's ability to pay off its long-term debt.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

8

Current liabilities are expected to be paid within one year or the operating cycle, whichever is longer.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

9

Notes payable are often used instead of accounts payable.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

10

A current liability must be paid out of current earnings.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

11

Interest expense is reported under Other Expenses and Losses in the income statement.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

12

During the month, a company sells goods for a total of $108,000, which includes sales taxes of $8,000; therefore, the company should recognize $100,000 in Sales Revenues and $8,000 in Sales Tax Expense.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

13

The current ratio permits analysts to compare the liquidity of different sized companies.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

14

Most notes are not interest bearing.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

15

Metropolitan Symphony sells 200 season tickets for $60,000 that represents a five concert season. The amount of Unearned Ticket Revenue after the second concert is $24,000.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

16

The higher the sales tax rate, the more profit a retailer can earn.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

17

With an interest-bearing note, the amount of cash received upon issuance of the note generally exceeds the note's face value.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

18

Contingent liabilities should be recorded in the accounts if there is a remote possibility that the contingency will actually occur.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

19

A note payable must always be paid before an account payable.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

20

Notes payable usually require the borrower to pay interest.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

21

Internal control over payroll is not necessary because employees will complain if they do not receive the correct amount on their payroll checks.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

22

A debt that is expected to be paid within one year through the creation of long-term debt is a current liability.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

23

Notes payable usually are issued to meet long-term financing needs.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

24

The timekeeping function includes supervisors monitoring hours worked through time cards and time reports.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

25

When a company gives employees rights to receive compensation for absences and the payment for such absences is probable and the amount can be reasonably estimated, the company should accrue a liability.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

26

FICA taxes are a voluntary deduction from employee earnings.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

27

The employer incurs a payroll tax expense equal to the amount withheld from the employees' wages for federal income taxes.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

28

FICA taxes withheld and federal income taxes withheld are mandatory payroll deductions.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

29

Payroll activities involve three functions: hiring employees, preparing the payroll, and paying the payroll.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

30

The human resources department documents and authorizes employment of new employees.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

31

Post-retirement benefits consist of payments by employers to retired employees for health care, life insurance, and pensions.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

32

FICA taxes are a deduction from employee earnings and are also imposed upon employers as an expense.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

33

All of the following are reported as current liabilities except

A) accounts payable.

B) bonds payable.

C) notes payable.

D) unearned revenues.

A) accounts payable.

B) bonds payable.

C) notes payable.

D) unearned revenues.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

34

The relationship between current liabilities and current assets is

A) useful in determining income.

B) useful in evaluating a company's liquidity.

C) called the matching principle.

D) useful in determining the amount of a company's long-term debt.

A) useful in determining income.

B) useful in evaluating a company's liquidity.

C) called the matching principle.

D) useful in determining the amount of a company's long-term debt.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

35

FICA taxes and federal income taxes are levied on employees' earnings without limit.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

36

Current maturities of long-term debt are often identified as long-term debt due within one year on the balance sheet.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

37

In concept, the estimating of Warranty Expense when products are sold under warranty is similar to the estimating of Bad Debts Expense based on credit sales.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

38

A contingent liability is a liability that may occur if some future event takes place.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

39

The objectives of internal accounting control for payrolls are (a) to safeguard company assets from unauthorized payments of payrolls and (b) to assure accuracy and reliability of the accounting records pertaining to payroll.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

40

In a given year, total warranty expense is the sum of actual warranty costs incurred on units sold plus the estimated cost of servicing those units in the future.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

41

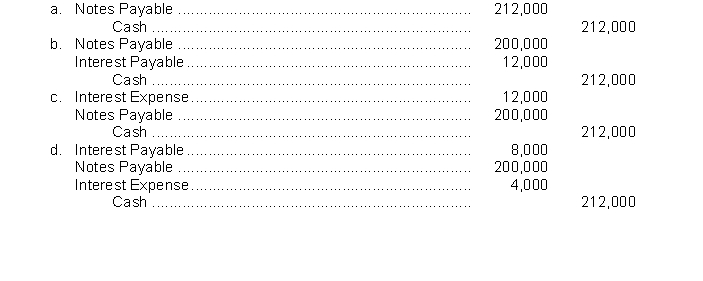

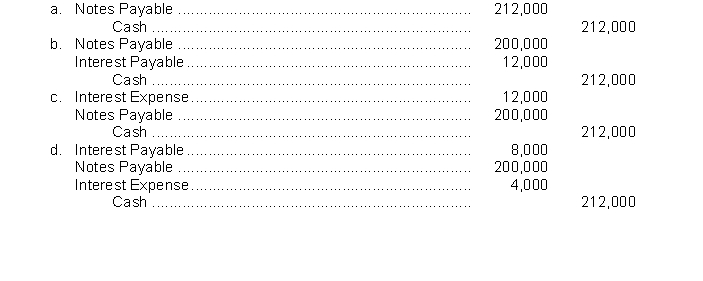

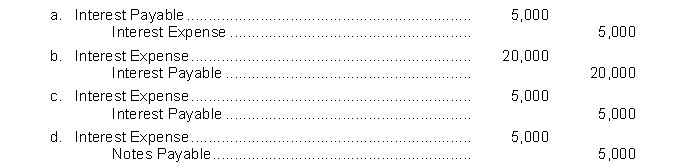

Admire County Bank agrees to lend Givens Brick Company $200,000 on January 1. Givens Brick Company signs a $200,000, 8%, 9-month note. What entry will Givens Brick Company make to pay off the note and interest at maturity assuming that interest has been accrued to September 30?

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

42

The relationship of current assets to current liabilities is used in evaluating a company's

A) operating cycle.

B) revenue-producing ability.

C) short-term debt paying ability.

D) long-range solvency.

A) operating cycle.

B) revenue-producing ability.

C) short-term debt paying ability.

D) long-range solvency.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following is usually not an accrued liability?

A) Interest payable

B) Wages payable

C) Taxes payable

D) Notes payable

A) Interest payable

B) Wages payable

C) Taxes payable

D) Notes payable

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

44

From a liquidity standpoint, it is more desirable for a company to have current

A) assets equal current liabilities.

B) liabilities exceed current assets.

C) assets exceed current liabilities.

D) liabilities exceed long-term liabilities.

A) assets equal current liabilities.

B) liabilities exceed current assets.

C) assets exceed current liabilities.

D) liabilities exceed long-term liabilities.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

45

Interest expense on an interest-bearing note is

A) always equal to zero.

B) accrued over the life of the note.

C) only recorded at the time the note is issued.

D) only recorded at maturity when the note is paid.

A) always equal to zero.

B) accrued over the life of the note.

C) only recorded at the time the note is issued.

D) only recorded at maturity when the note is paid.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

46

When an interest-bearing note matures, the balance in the Notes Payable account is

A) less than the total amount repaid by the borrower.

B) the difference between the maturity value of the note and the face value of the note.

C) equal to the total amount repaid by the borrower.

D) greater than the total amount repaid by the borrower.

A) less than the total amount repaid by the borrower.

B) the difference between the maturity value of the note and the face value of the note.

C) equal to the total amount repaid by the borrower.

D) greater than the total amount repaid by the borrower.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

47

The entry to record the proceeds upon issuing an interest-bearing note is

A) Interest Expense Cash

Notes Payable

B) Cash Notes Payable

C) Notes Payable Cash

D) Cash Notes Payable

Interest Payable

A) Interest Expense Cash

Notes Payable

B) Cash Notes Payable

C) Notes Payable Cash

D) Cash Notes Payable

Interest Payable

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

48

As interest is recorded on an interest-bearing note, the Interest Expense account is

A) increased; the Notes Payable account is increased.

B) increased; the Notes Payable account is decreased.

C) increased; the Interest Payable account is increased.

D) decreased; the Interest Payable account is increased.

A) increased; the Notes Payable account is increased.

B) increased; the Notes Payable account is decreased.

C) increased; the Interest Payable account is increased.

D) decreased; the Interest Payable account is increased.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

49

Most companies pay current liabilities

A) out of current assets.

B) by issuing interest-bearing notes payable.

C) by issuing stock.

D) by creating long-term liabilities.

A) out of current assets.

B) by issuing interest-bearing notes payable.

C) by issuing stock.

D) by creating long-term liabilities.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

50

With an interest-bearing note, the amount of assets received upon issuance of the note is generally

A) equal to the note's face value.

B) greater than the note's face value.

C) less than the note's face value.

D) equal to the note's maturity value.

A) equal to the note's face value.

B) greater than the note's face value.

C) less than the note's face value.

D) equal to the note's maturity value.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

51

A note payable is in the form of

A) a contingency that is reasonably likely to occur.

B) a written promissory note.

C) an oral agreement.

D) a standing agreement.

A) a contingency that is reasonably likely to occur.

B) a written promissory note.

C) an oral agreement.

D) a standing agreement.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

52

Liabilities are classified on the balance sheet as current or

A) deferred.

B) unearned.

C) long-term.

D) accrued.

A) deferred.

B) unearned.

C) long-term.

D) accrued.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

53

In most companies, current liabilities are paid within

A) one year through the creation of other current liabilities.

B) the operating cycle through the creation of other current liabilities.

C) one year out of current assets.

D) the operating cycle out of current assets.

A) one year through the creation of other current liabilities.

B) the operating cycle through the creation of other current liabilities.

C) one year out of current assets.

D) the operating cycle out of current assets.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

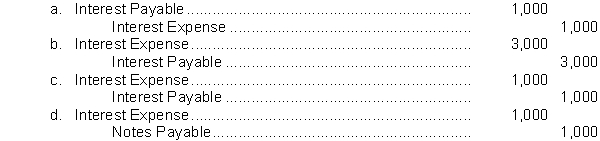

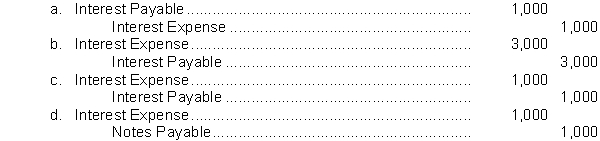

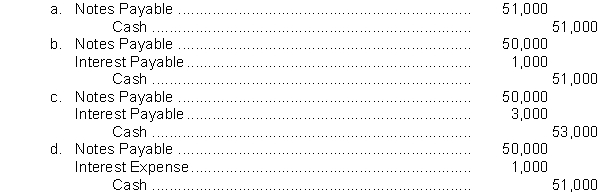

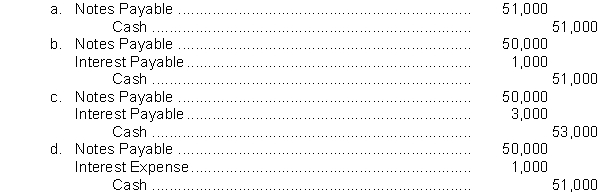

54

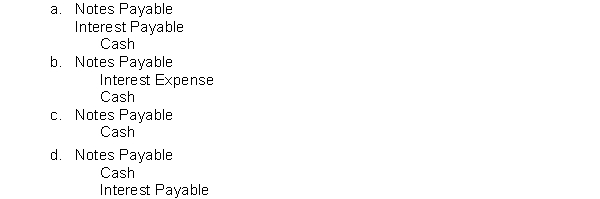

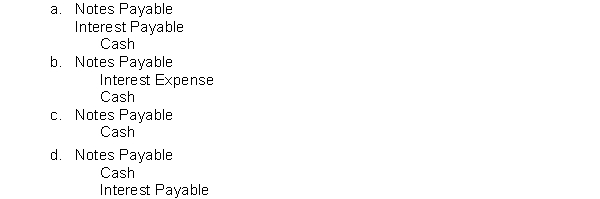

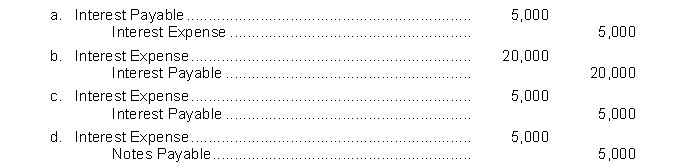

The entry to record the payment of an interest-bearing note at maturity after all interest expense has been recognized is

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

55

Admire County Bank agrees to lend Givens Brick Company $200,000 on January 1. Givens Brick Company signs a $200,000, 8%, 9-month note. The entry made by Givens Brick Company on January 1 to record the proceeds and issuance of the note is

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

56

On October 1, Steve's Carpet Service borrows $250,000 from First National Bank on a 3-month, $250,000, 8% note. The entry by Steve's Carpet Service to record payment of the note and accrued interest on January 1 is

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

57

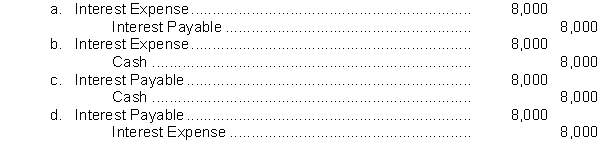

On October 1, Steve's Carpet Service borrows $250,000 from First National Bank on a 3-month, $250,000, 8% note. What entry must Steve's Carpet Service make on December 31 before financial statements are prepared?

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

58

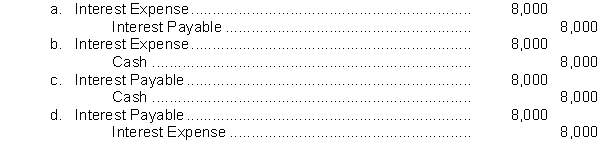

Admire County Bank agrees to lend Givens Brick Company $200,000 on January 1. Givens Brick Company signs a $200,000, 8%, 9-month note. What is the adjusting entry required if Givens Brick Company prepares financial statements on June 30?

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

59

A current liability is a debt that can reasonably be expected to be paid

A) within one year.

B) between 6 months and 18 months.

C) out of currently recognized revenues.

D) out of cash currently on hand.

A) within one year.

B) between 6 months and 18 months.

C) out of currently recognized revenues.

D) out of cash currently on hand.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

60

The entry to record the issuance of an interest-bearing note credits Notes Payable for the note's

A) maturity value.

B) market value.

C) face value.

D) cash realizable value.

A) maturity value.

B) market value.

C) face value.

D) cash realizable value.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

61

The interest charged on a $50,000 note payable, at the rate of 8%, on a 3-month note would be

A) $4,000.

B) $2,000.

C) $1,000.

D) $667.

A) $4,000.

B) $2,000.

C) $1,000.

D) $667.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

62

On October 1, 2010, Pennington Company issued a $40,000, 10%, nine-month interest-bearing note. Assuming interest was accrued in June 30, 2011, the entry to record the payment of the note on July 1, 2011, will include a:

A) debit to Interest Expense of $1,000.

B) credit to Cash of $40,000

C) debit to Interest Payable of $3,000.

D) debit to Notes Payable of $43,000.

A) debit to Interest Expense of $1,000.

B) credit to Cash of $40,000

C) debit to Interest Payable of $3,000.

D) debit to Notes Payable of $43,000.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

63

A company receives $132, of which $12 is for sales tax. The journal entry to record the sale would include a

A) debit to Sales Tax Expense for $12.

B) credit to Sales Tax Payable for $12.

C) debit to Sales for $132.

D) debit to Cash for $120.

A) debit to Sales Tax Expense for $12.

B) credit to Sales Tax Payable for $12.

C) debit to Sales for $132.

D) debit to Cash for $120.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

64

On January 1, 2010, Howard Company, a calendar-year company, issued $600,000 of notes payable, of which $150,000 is due on January 1 for each of the next four years. The proper balance sheet presentation on December 31, 2010, is

A) Current Liabilities, $600,000.

B) Long-term Debt, $600,000.

C) Current Liabilities, $300,000; Long-term Debt, $300,000.

D) Current Liabilities, $150,000; Long-term Debt, $450,000.

A) Current Liabilities, $600,000.

B) Long-term Debt, $600,000.

C) Current Liabilities, $300,000; Long-term Debt, $300,000.

D) Current Liabilities, $150,000; Long-term Debt, $450,000.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

65

Unearned Rental Revenue is

A) a contra account to Rental Revenue.

B) a revenue account.

C) reported as a current liability.

D) debited when rent is received in advance.

A) a contra account to Rental Revenue.

B) a revenue account.

C) reported as a current liability.

D) debited when rent is received in advance.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

66

Reliable Insurance Company collected a premium of $15,000 for a 1-year insurance policy on May 1. What amount should Reliable report as a current liability for Unearned Insurance Premiums at December 31?

A) $0.

B) $5,000.

C) $10,000.

D) $15,000.

A) $0.

B) $5,000.

C) $10,000.

D) $15,000.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

67

The interest charged on a $50,000 note payable, at the rate of 6%, on a 2-month note would be

A) $3,000.

B) $1,500.

C) $750.

D) $500.

A) $3,000.

B) $1,500.

C) $750.

D) $500.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

68

The interest charged on a $100,000 note payable, at the rate of 8%, on a 90-day note would be

A) $8,000.

B) $4,444.

C) $2,000.

D) $667.

A) $8,000.

B) $4,444.

C) $2,000.

D) $667.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

69

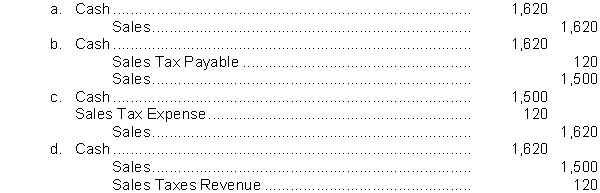

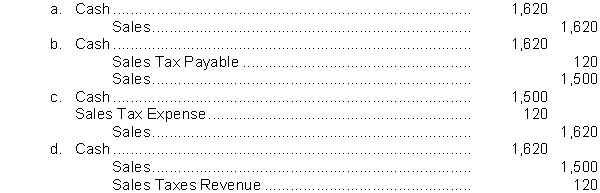

A cash register tape shows cash sales of $1,500 and sales taxes of $120. The journal entry to record this information is

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

70

On September 1, Joe's Painting Service borrows $50,000 from National Bank on a 4-month, $50,000, 6% note. What entry must Joe's Painting Service make on December 31 before financial statements are prepared?

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

71

On September 1, Joe's Painting Service borrows $50,000 from National Bank on a 4-month, $50,000, 6% note. The entry by Joe's Painting Service to record payment of the note and accrued interest on January 1 is

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

72

A retail store credited the Sales account for the sales price and the amount of sales tax on sales. If the sales tax rate is 5% and the balance in the Sales account amounted to $315,000, what is the amount of the sales taxes owed to the taxing agency?

A) $300,000

B) $315,000

C) $15,750

D) $15,000

A) $300,000

B) $315,000

C) $15,750

D) $15,000

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

73

Sales taxes collected by a retailer are recorded by

A) crediting Sales Taxes Revenue.

B) debiting Sales Taxes Expense.

C) crediting Sales Taxes Payable.

D) debiting Sales Taxes Payable.

A) crediting Sales Taxes Revenue.

B) debiting Sales Taxes Expense.

C) crediting Sales Taxes Payable.

D) debiting Sales Taxes Payable.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

74

On January 1, 2010, Donahue Company, a calendar-year company, issued $400,000 of notes payable, of which $100,000 is due on January 1 for each of the next four years. The proper balance sheet presentation on December 31, 2010, is

A) Current Liabilities, $400,000.

B) Long-term Debt , $400,000.

C) Current Liabilities, $100,000; Long-term Debt, $300,000.

D) Current Liabilities, $300,000; Long-term Debt, $100,000.

A) Current Liabilities, $400,000.

B) Long-term Debt , $400,000.

C) Current Liabilities, $100,000; Long-term Debt, $300,000.

D) Current Liabilities, $300,000; Long-term Debt, $100,000.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

75

Crawford Company has total proceeds (before segregation of sales taxes) from sales of $4,770. If the sales tax is 6%, the amount to be credited to the account Sales is:

A) $4,770.

B) $4,484.

C) $5,056.

D) $4,500.

A) $4,770.

B) $4,484.

C) $5,056.

D) $4,500.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

76

On October 1, 2010, Pennington Company issued a $40,000, 10%, nine-month interest-bearing note. If the Pennington Company is preparing financial statements at December 31, 2010, the adjusting entry for accrued interest will include a:

A) credit to Notes Payable of $1,000.

B) debit to Interest Expense of $1,000

C) credit to Interest Payable of $2,000.

D) debit to Interest Expense of $1,500.

A) credit to Notes Payable of $1,000.

B) debit to Interest Expense of $1,000

C) credit to Interest Payable of $2,000.

D) debit to Interest Expense of $1,500.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

77

Sales taxes collected by the retailer are recorded as a(n)

A) revenue.

B) liability.

C) expense.

D) asset.

A) revenue.

B) liability.

C) expense.

D) asset.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

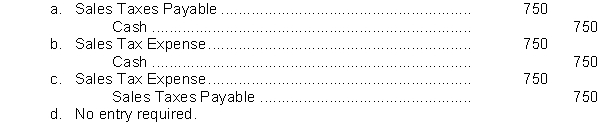

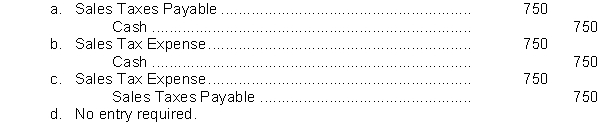

78

Ed's Bookstore has collected $750 in sales taxes during April. If sales taxes must be remitted to the state government monthly, what entry will Ed's Bookstore make to show the April remittance?

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

79

The interest charged on a $100,000 note payable, at the rate of 6%, on a 60-day note would be

A) $6,000.

B) $3,333.

C) $1,500.

D) $1,000.

A) $6,000.

B) $3,333.

C) $1,500.

D) $1,000.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

80

A company receives $174, of which $14 is for sales tax. The journal entry to record the sale would include a

A debit to Sales Tax Expense for $14.

B) debit to Sales Tax Payable for $14.

C) debit to Sales for $174.

D) debit to Cash for $174.

A debit to Sales Tax Expense for $14.

B) debit to Sales Tax Payable for $14.

C) debit to Sales for $174.

D) debit to Cash for $174.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck