Deck 10: Statement of Cash Flows

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/82

Play

Full screen (f)

Deck 10: Statement of Cash Flows

1

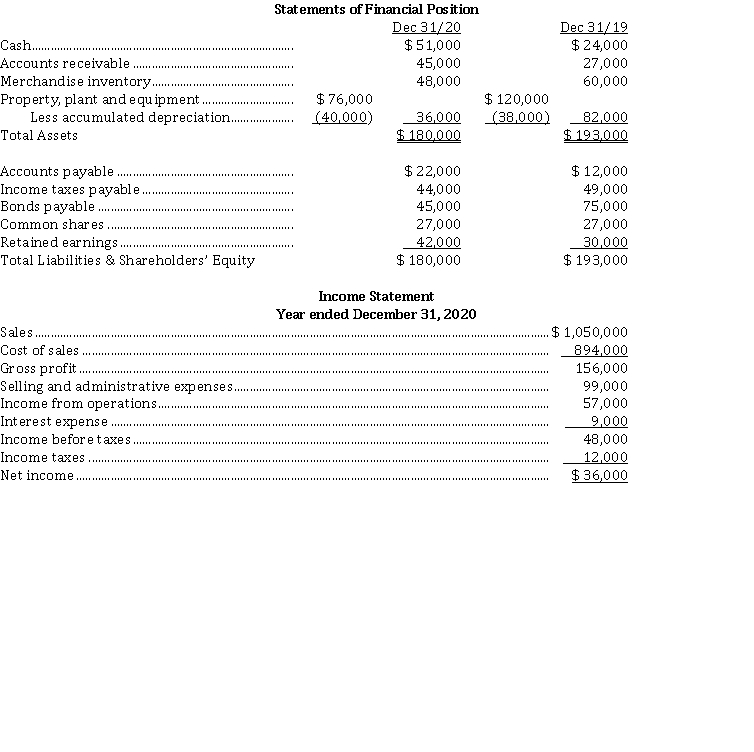

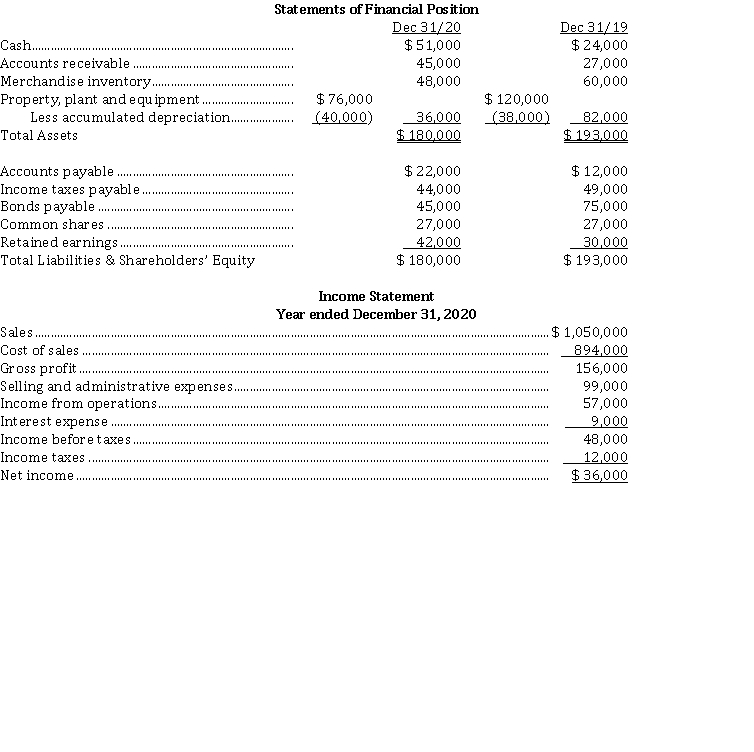

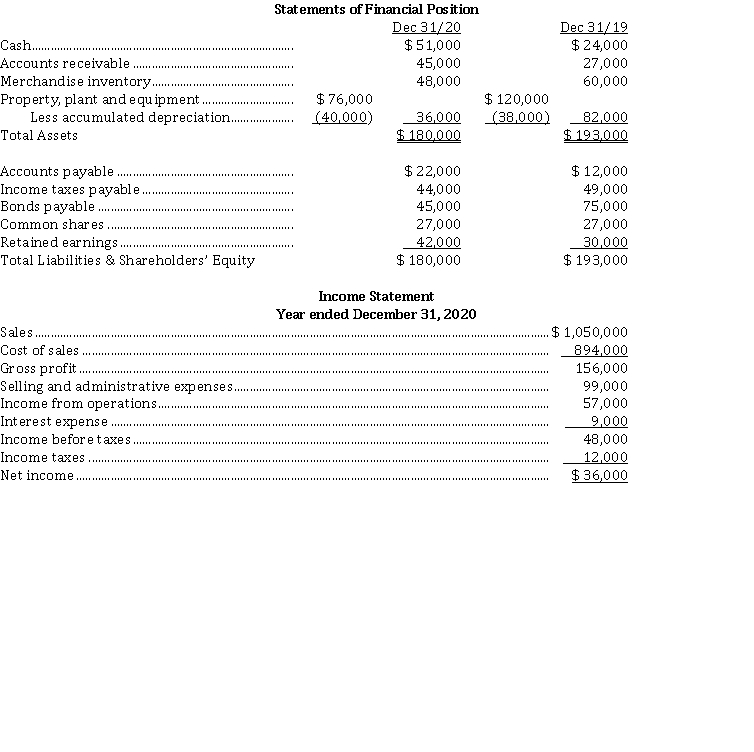

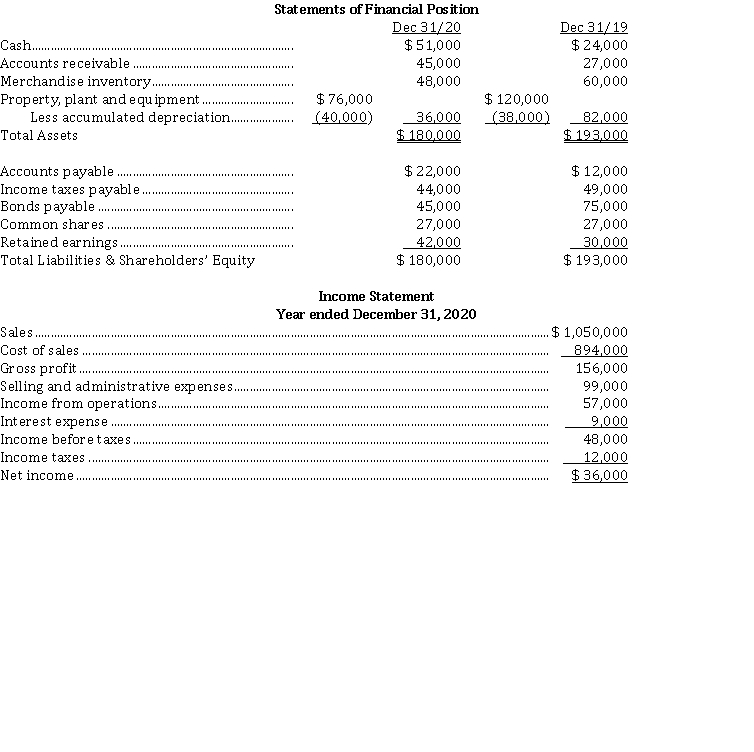

Use the following information for questions 12-13.

Fables Corp. provided the following information for calendar 2020: Fables adheres to ASPE.

-The cash provided by (used in) investing activities during 2020 is

A) $ 60,000.

B) $ (360,000).

C) $ (600,000).

D) $ (660,000).

Fables Corp. provided the following information for calendar 2020: Fables adheres to ASPE.

-The cash provided by (used in) investing activities during 2020 is

A) $ 60,000.

B) $ (360,000).

C) $ (600,000).

D) $ (660,000).

$ (360,000).

2

Selected information from Hatian Corp.'s 2020 accounting records is as follows: Hatian adheres to ASPE.

Based on the above information, the cash provided by (used in) financing activities for calendar 2020 is

A) $ 80,000.

B) $ 90,000.

C) $ (110,000).

D) $ 740,000.

Based on the above information, the cash provided by (used in) financing activities for calendar 2020 is

A) $ 80,000.

B) $ 90,000.

C) $ (110,000).

D) $ 740,000.

$ 740,000.

3

Use the following information for questions 12-13.

Fables Corp. provided the following information for calendar 2020: Fables adheres to ASPE.

-The cash provided by financing activities during 2020 is

A) $ 540,000.

B) $ 480,000.

C) $ 390,000.

D) $ 330,000.

Fables Corp. provided the following information for calendar 2020: Fables adheres to ASPE.

-The cash provided by financing activities during 2020 is

A) $ 540,000.

B) $ 480,000.

C) $ 390,000.

D) $ 330,000.

$ 390,000.

4

The primary purpose of the statement of cash flows is to provide information

A) about an entity's operating, investing, and financing activities during a period.

B) that is useful in assessing cash flow prospects.

C) about an entity's cash receipts and cash payments during a period.

D) about an entity's ability to meet its obligations, its ability to pay dividends, and its needs for external financing.

A) about an entity's operating, investing, and financing activities during a period.

B) that is useful in assessing cash flow prospects.

C) about an entity's cash receipts and cash payments during a period.

D) about an entity's ability to meet its obligations, its ability to pay dividends, and its needs for external financing.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

5

In a statement of cash flows, which of the following would be reported in the cash flows from investing activities section?

A) issuance of common shares in exchange for a factory building

B) stock dividends received

C) development costs incurred (intangible asset)

D) declaration of cash dividends

A) issuance of common shares in exchange for a factory building

B) stock dividends received

C) development costs incurred (intangible asset)

D) declaration of cash dividends

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

6

Use the following information for questions 10-11.

Duncan Corp. purchased a building, paying part of the purchase price in cash and issuing a mortgage note payable to the seller for the balance.

In a statement of cash flows, what amount is included in investing activities for the above transaction?

A) the cash payment

B) the full purchase price

C) zero (but disclosed in the notes)

D) the amount mortgaged

Duncan Corp. purchased a building, paying part of the purchase price in cash and issuing a mortgage note payable to the seller for the balance.

In a statement of cash flows, what amount is included in investing activities for the above transaction?

A) the cash payment

B) the full purchase price

C) zero (but disclosed in the notes)

D) the amount mortgaged

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

7

Use the following information for questions 18-19.

The statements of financial position for King Lear Corp. at the end of 2020 and 2019 are as follows:

During 2020, land was acquired in exchange for common shares (which had a market value of $ 150,000 at the time). All equipment purchased was for cash. Equipment costing $ 15,000 was sold for $ 6,000 cash; book value of the equipment at the time of sale was $ 12,000, and the loss was included in net income. Cash dividends of $ 30,000 were declared and paid during the year. King adheres to ASPE and uses the indirect method when preparing the statement of cash flows.

-The cash provided by (used in) financing activities was

A) $ 90,000.

B) $ (30,000).

C) $ (60,000).

D) $ 0.

The statements of financial position for King Lear Corp. at the end of 2020 and 2019 are as follows:

During 2020, land was acquired in exchange for common shares (which had a market value of $ 150,000 at the time). All equipment purchased was for cash. Equipment costing $ 15,000 was sold for $ 6,000 cash; book value of the equipment at the time of sale was $ 12,000, and the loss was included in net income. Cash dividends of $ 30,000 were declared and paid during the year. King adheres to ASPE and uses the indirect method when preparing the statement of cash flows.

-The cash provided by (used in) financing activities was

A) $ 90,000.

B) $ (30,000).

C) $ (60,000).

D) $ 0.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

8

Cash equivalents include

A) treasury bills, equity investments and long-term bonds.

B) non-equity investments with short maturities and bank overdrafts repayable on demand.

C) treasury bills, commercial paper and all equity investments.

D) treasury bills, commercial paper, and money market funds purchased with excess cash.

A) treasury bills, equity investments and long-term bonds.

B) non-equity investments with short maturities and bank overdrafts repayable on demand.

C) treasury bills, commercial paper and all equity investments.

D) treasury bills, commercial paper, and money market funds purchased with excess cash.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

9

Use the following information for questions 18-19.

The statements of financial position for King Lear Corp. at the end of 2020 and 2019 are as follows:

During 2020, land was acquired in exchange for common shares (which had a market value of $ 150,000 at the time). All equipment purchased was for cash. Equipment costing $ 15,000 was sold for $ 6,000 cash; book value of the equipment at the time of sale was $ 12,000, and the loss was included in net income. Cash dividends of $ 30,000 were declared and paid during the year. King adheres to ASPE and uses the indirect method when preparing the statement of cash flows.

-The cash provided by (used in) investing activities was

A) $ 39,000.

B) $ (54,000).

C) $ (60,000).

D) $ (204,000).

The statements of financial position for King Lear Corp. at the end of 2020 and 2019 are as follows:

During 2020, land was acquired in exchange for common shares (which had a market value of $ 150,000 at the time). All equipment purchased was for cash. Equipment costing $ 15,000 was sold for $ 6,000 cash; book value of the equipment at the time of sale was $ 12,000, and the loss was included in net income. Cash dividends of $ 30,000 were declared and paid during the year. King adheres to ASPE and uses the indirect method when preparing the statement of cash flows.

-The cash provided by (used in) investing activities was

A) $ 39,000.

B) $ (54,000).

C) $ (60,000).

D) $ (204,000).

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

10

Selected information from Regan Ltd.'s 2020 accounting records is as follows:

Based on the above information, the cash provided by investing activities for calendar 2020 is

A) $ 20,000.

B) $ 200,000.

C) $ 320,000.

D) $ 400,000.

Based on the above information, the cash provided by investing activities for calendar 2020 is

A) $ 20,000.

B) $ 200,000.

C) $ 320,000.

D) $ 400,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

11

Use the following information for questions 16-17.

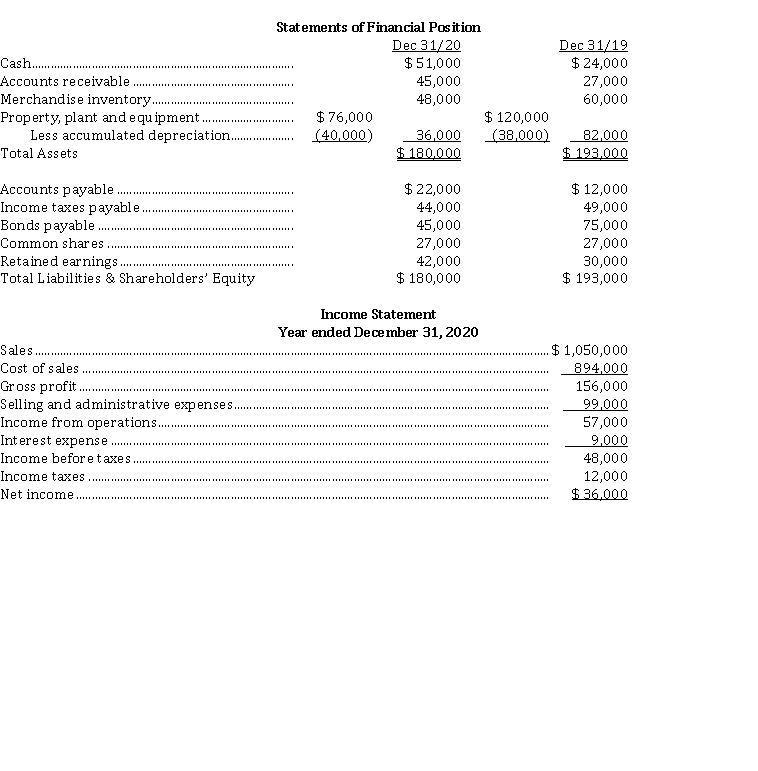

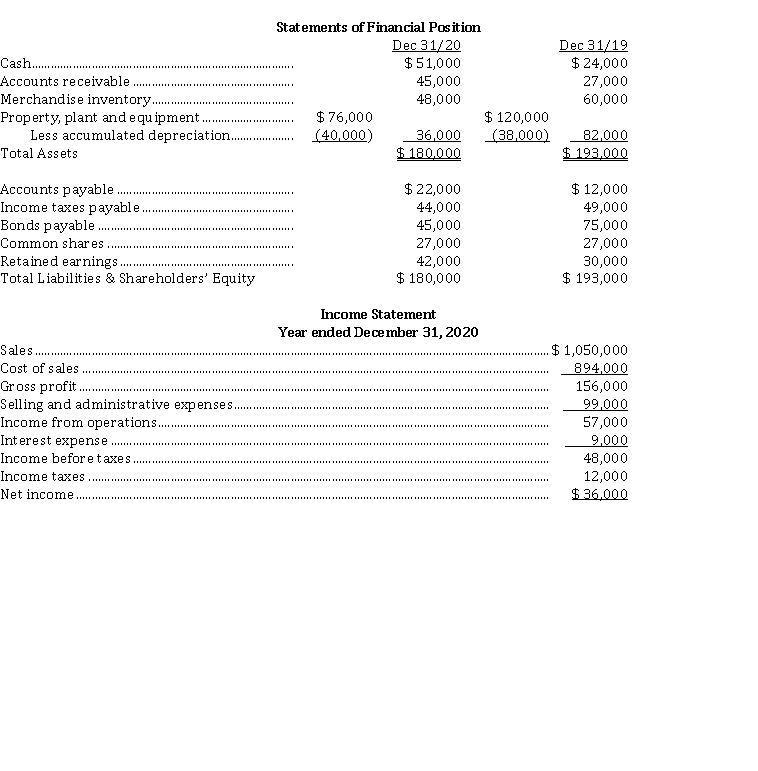

Oswald Ltd. has recently decided to go public and has hired you as their independent accountant. They wish to adhere to IFRS and know that they must prepare a statement of cash flows. Their financial statements for 2020 and 2019 are provided below: The following additional data were provided for calendar 2020:

The following additional data were provided for calendar 2020:

1. Dividends declared and paid were $ 24,000.

2. Equipment was sold for $ 30,000. This equipment originally cost $ 44,000, and had a book value of $ 36,000 at the time of sale. The loss on sale was included in "selling and administrative expenses," as was the depreciation expense for the year.

3. Bonds were retired during the year at par .

-On a statement of cash flows for calendar 2020, the cash provided by (used in) by financing activities is

A) $ 6,000.

B) $ 24,000.

C) $ (54,000).

D) $ (30,000).

Oswald Ltd. has recently decided to go public and has hired you as their independent accountant. They wish to adhere to IFRS and know that they must prepare a statement of cash flows. Their financial statements for 2020 and 2019 are provided below:

The following additional data were provided for calendar 2020:

The following additional data were provided for calendar 2020:1. Dividends declared and paid were $ 24,000.

2. Equipment was sold for $ 30,000. This equipment originally cost $ 44,000, and had a book value of $ 36,000 at the time of sale. The loss on sale was included in "selling and administrative expenses," as was the depreciation expense for the year.

3. Bonds were retired during the year at par .

-On a statement of cash flows for calendar 2020, the cash provided by (used in) by financing activities is

A) $ 6,000.

B) $ 24,000.

C) $ (54,000).

D) $ (30,000).

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

12

Use the following information for questions 20-21.

Casio adheres to ASPE. Casio Corp.'s transactions for the year ended December 31, 2020 included the following:

1. Purchased land for $ 275,000 cash.

2. Borrowed $ 275,000 from the bank on a long-term note.

3. Sold long-term investments for $ 250,000.

4. Accounts receivable decreased by $ 50,000.

5. Paid cash dividends of $ 300,000.

6. Issued 1,000 common shares for $ 125,000.

7. Purchased machinery and equipment for $ 62,500 cash.

8. Accounts payable increased by $ 100,000.

The cash used in investing activities for 2020 was

A) $ (337,500).

B) $ (187,500).

C) $ (87,500).

D) $ (25,000).

Casio adheres to ASPE. Casio Corp.'s transactions for the year ended December 31, 2020 included the following:

1. Purchased land for $ 275,000 cash.

2. Borrowed $ 275,000 from the bank on a long-term note.

3. Sold long-term investments for $ 250,000.

4. Accounts receivable decreased by $ 50,000.

5. Paid cash dividends of $ 300,000.

6. Issued 1,000 common shares for $ 125,000.

7. Purchased machinery and equipment for $ 62,500 cash.

8. Accounts payable increased by $ 100,000.

The cash used in investing activities for 2020 was

A) $ (337,500).

B) $ (187,500).

C) $ (87,500).

D) $ (25,000).

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

13

The statement of cash flows is required to be included

A) only for financial statements prepared under IFRS.

B) only for financial statements prepared under ASPE.

C) for both financial statements prepared under IFRS and under ASPE.

D) for financial statements prepared under IFRS, but is optional under ASPE.

A) only for financial statements prepared under IFRS.

B) only for financial statements prepared under ASPE.

C) for both financial statements prepared under IFRS and under ASPE.

D) for financial statements prepared under IFRS, but is optional under ASPE.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

14

A statement of cash flows generally would NOT include the effects of

A) common shares issued at an amount greater than par value.

B) the purchase of treasury shares.

C) cash dividends paid.

D) stock dividends declared and issued.

A) common shares issued at an amount greater than par value.

B) the purchase of treasury shares.

C) cash dividends paid.

D) stock dividends declared and issued.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

15

The information in a statement of cash flows enables stakeholders to assess the

A) amounts, timing and certainty of future cash flows.

B) liquidity and solvency of an entity.

C) change in working capital during the period.

D) reason(s) for the difference between net income and cash flows from financing activities.

A) amounts, timing and certainty of future cash flows.

B) liquidity and solvency of an entity.

C) change in working capital during the period.

D) reason(s) for the difference between net income and cash flows from financing activities.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

16

On a statement of cash flows, additional cash invested by a sole proprietor would be disclosed in

A) operating activities.

B) investing activities.

C) financing activities.

D) both operating and financing activities.

A) operating activities.

B) investing activities.

C) financing activities.

D) both operating and financing activities.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

17

Use the following information for questions 16-17.

Oswald Ltd. has recently decided to go public and has hired you as their independent accountant. They wish to adhere to IFRS and know that they must prepare a statement of cash flows. Their financial statements for 2020 and 2019 are provided below: The following additional data were provided for calendar 2020:

The following additional data were provided for calendar 2020:

1. Dividends declared and paid were $ 24,000.

2. Equipment was sold for $ 30,000. This equipment originally cost $ 44,000, and had a book value of $ 36,000 at the time of sale. The loss on sale was included in "selling and administrative expenses," as was the depreciation expense for the year.

3. Bonds were retired during the year at par .

-On a statement of cash flows for calendar 2020, the cash provided by (used in) investing activities is

A) $ 6,000.

B) $ 30,000.

C) $ (36,000).

D) $ (44,000).

Oswald Ltd. has recently decided to go public and has hired you as their independent accountant. They wish to adhere to IFRS and know that they must prepare a statement of cash flows. Their financial statements for 2020 and 2019 are provided below:

The following additional data were provided for calendar 2020:

The following additional data were provided for calendar 2020:1. Dividends declared and paid were $ 24,000.

2. Equipment was sold for $ 30,000. This equipment originally cost $ 44,000, and had a book value of $ 36,000 at the time of sale. The loss on sale was included in "selling and administrative expenses," as was the depreciation expense for the year.

3. Bonds were retired during the year at par .

-On a statement of cash flows for calendar 2020, the cash provided by (used in) investing activities is

A) $ 6,000.

B) $ 30,000.

C) $ (36,000).

D) $ (44,000).

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

18

A successful company's major source of cash should be

A) operating activities.

B) investing activities.

C) financing activities.

D) both operating activities and investing activities.

A) operating activities.

B) investing activities.

C) financing activities.

D) both operating activities and investing activities.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

19

Use the following information for questions 10-11.

Duncan Corp. purchased a building, paying part of the purchase price in cash and issuing a mortgage note payable to the seller for the balance.

In a statement of cash flows, what amount is included in financing activities for the above transaction?

A) the cash payment

B) the full purchase price

C) zero (but disclosed in the notes)

D) the amount mortgaged

Duncan Corp. purchased a building, paying part of the purchase price in cash and issuing a mortgage note payable to the seller for the balance.

In a statement of cash flows, what amount is included in financing activities for the above transaction?

A) the cash payment

B) the full purchase price

C) zero (but disclosed in the notes)

D) the amount mortgaged

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following is NOT a significant non-cash transaction?

A) capital (finance) lease obligations

B) conversion of preferred shares to common shares

C) exchange of non-monetary assets

D) purchasing a building with a 10% cash down payment and mortgaging the balance

A) capital (finance) lease obligations

B) conversion of preferred shares to common shares

C) exchange of non-monetary assets

D) purchasing a building with a 10% cash down payment and mortgaging the balance

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

21

Using the indirect method, an increase in inventory would be reported in a statement of cash flows as a(n)

A) addition to net income in calculating cash flows from operating activities.

B) deduction from net income in calculating cash flows from operating activities.

C) cash flow from investing activities.

D) cash flow from financing activities.

A) addition to net income in calculating cash flows from operating activities.

B) deduction from net income in calculating cash flows from operating activities.

C) cash flow from investing activities.

D) cash flow from financing activities.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

22

Use the following information for questions 20-21.

Casio adheres to ASPE. Casio Corp.'s transactions for the year ended December 31, 2020 included the following:

1. Purchased land for $ 275,000 cash.

2. Borrowed $ 275,000 from the bank on a long-term note.

3. Sold long-term investments for $ 250,000.

4. Accounts receivable decreased by $ 50,000.

5. Paid cash dividends of $ 300,000.

6. Issued 1,000 common shares for $ 125,000.

7. Purchased machinery and equipment for $ 62,500 cash.

8. Accounts payable increased by $ 100,000.

The cash provided by (used in) financing activities for 2020 was

A) $ 12,500.

B) $ 100,000.

C) $ (225,000).

D) $ (250,000).

Casio adheres to ASPE. Casio Corp.'s transactions for the year ended December 31, 2020 included the following:

1. Purchased land for $ 275,000 cash.

2. Borrowed $ 275,000 from the bank on a long-term note.

3. Sold long-term investments for $ 250,000.

4. Accounts receivable decreased by $ 50,000.

5. Paid cash dividends of $ 300,000.

6. Issued 1,000 common shares for $ 125,000.

7. Purchased machinery and equipment for $ 62,500 cash.

8. Accounts payable increased by $ 100,000.

The cash provided by (used in) financing activities for 2020 was

A) $ 12,500.

B) $ 100,000.

C) $ (225,000).

D) $ (250,000).

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

23

Use the following information for questions 24-25.

Malcolm Corp.'s statements of financial position at December 31, 2020 and 2019 and information relating to 2020 activities are presented below: Other information relating to 2020 activities:

1. Net income was $ 375,000.

2. Cash dividends of $ 150,000 were declared and paid.

3. Equipment costing $ 250,000, with a book value of $ 80,000, was sold for $ 90,000.

4. A long-term investment was sold for $ 80,000. There were no other transactions affecting long-term investments.

5. 5,000 common shares were issued for $ 25 a share.

6. Temporary investments consist of treasury bills maturing on June 30, 2021.

-The cash provided by financing activities in 2020 was

A) $ 420,000.

B) $ 270,000.

C) $ 130,000.

D) $ 120,000.

Malcolm Corp.'s statements of financial position at December 31, 2020 and 2019 and information relating to 2020 activities are presented below: Other information relating to 2020 activities:

1. Net income was $ 375,000.

2. Cash dividends of $ 150,000 were declared and paid.

3. Equipment costing $ 250,000, with a book value of $ 80,000, was sold for $ 90,000.

4. A long-term investment was sold for $ 80,000. There were no other transactions affecting long-term investments.

5. 5,000 common shares were issued for $ 25 a share.

6. Temporary investments consist of treasury bills maturing on June 30, 2021.

-The cash provided by financing activities in 2020 was

A) $ 420,000.

B) $ 270,000.

C) $ 130,000.

D) $ 120,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

24

A fire damaged Francisco Corp.'s office building. The company received $ 600,000 as a settlement from their insurance company, which was $ 180,000 less than the book value of the building. Their income tax rate is 25%. On the statement of cash flows (indirect method), the receipt from the insurance company should

A) be shown as an addition to net income of $ 420,000.

B) be shown as an inflow from investing activities of $ 420,000.

C) be shown as an inflow from investing activities of $ 600,000.

D) be shown as an inflow from investing activities of $ 450,000.

A) be shown as an addition to net income of $ 420,000.

B) be shown as an inflow from investing activities of $ 420,000.

C) be shown as an inflow from investing activities of $ 600,000.

D) be shown as an inflow from investing activities of $ 450,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

25

Tampa Ltd.'s prepaid insurance balance was $ 20,000 at December 31, 2020 and $ 10,000 at December 31, 2019. Insurance expense was $ 8,000 for 2020 and $ 6,000 for 2019. How much cash paid for insurance would be reported in Tampa 2020 statement of cash flows prepared using the direct method?

A) $ 22,000

B) $ 18,000

C) $ 12,000

D) $ 8,000

A) $ 22,000

B) $ 18,000

C) $ 12,000

D) $ 8,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

26

Use the following information for questions 22-23.

ecaHecaRoss Corp.'s transactions for calendar 2020 included the following:

1. Acquired 50% of Lennox Ltd.'s common shares for $ 90,000 cash.

2. Issued 5,000 preferred shares in exchange for land with a fair value of $ 160,000.

3. Issued 11% bonds, par value $ 200,000, due 2020, for $ 196,000 cash.

4. Purchased a patent for $ 110,000 cash.

5. Borrowed $ 90,000 from Bank A.

6. Paid $ 60,000 toward a bank loan with Bank B.

7. Sold long-term investments for $ 398,000.

The cash provided by investing activities in 2020 was

A) $ 148,000.

B) $ 198,000.

C) $ 238,000.

D) $ 308,000.

ecaHecaRoss Corp.'s transactions for calendar 2020 included the following:

1. Acquired 50% of Lennox Ltd.'s common shares for $ 90,000 cash.

2. Issued 5,000 preferred shares in exchange for land with a fair value of $ 160,000.

3. Issued 11% bonds, par value $ 200,000, due 2020, for $ 196,000 cash.

4. Purchased a patent for $ 110,000 cash.

5. Borrowed $ 90,000 from Bank A.

6. Paid $ 60,000 toward a bank loan with Bank B.

7. Sold long-term investments for $ 398,000.

The cash provided by investing activities in 2020 was

A) $ 148,000.

B) $ 198,000.

C) $ 238,000.

D) $ 308,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

27

When preparing a statement of cash flows, a decrease in prepaid insurance during a period would require which of the following adjustments in determining cash flows from operating activities?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

28

In calculating cash flows from operating activities, a decrease in accounts payable during a period

A) means that accrual basis income is less than cash basis income.

B) requires an addition to net income under the indirect method.

C) requires an increase to cost of goods sold under the direct method.

D) requires a decrease to cost of goods sold under the direct method.

A) means that accrual basis income is less than cash basis income.

B) requires an addition to net income under the indirect method.

C) requires an increase to cost of goods sold under the direct method.

D) requires a decrease to cost of goods sold under the direct method.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

29

When preparing a statement of cash flows (indirect method), which of the following is NOT an adjustment to reconcile net income to cash flows from operating activities?

A) an increase in prepaid expenses

B) an increase in bonds payable

C) a decrease in income taxes payable

D) depreciation expense

A) an increase in prepaid expenses

B) an increase in bonds payable

C) a decrease in income taxes payable

D) depreciation expense

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

30

When preparing a statement of cash flows, an increase in accounts payable during a period would require which of the following adjustments in determining cash flows from operating activities?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

31

Use the following information for questions 24-25.

Malcolm Corp.'s statements of financial position at December 31, 2020 and 2019 and information relating to 2020 activities are presented below: Other information relating to 2020 activities:

1. Net income was $ 375,000.

2. Cash dividends of $ 150,000 were declared and paid.

3. Equipment costing $ 250,000, with a book value of $ 80,000, was sold for $ 90,000.

4. A long-term investment was sold for $ 80,000. There were no other transactions affecting long-term investments.

5. 5,000 common shares were issued for $ 25 a share.

6. Temporary investments consist of treasury bills maturing on June 30, 2021.

-The cash used in investing activities in 2020 was

A) $ 580,000.

B) $ 455,000.

C) $ 430,000.

D) $ 420,000.

Malcolm Corp.'s statements of financial position at December 31, 2020 and 2019 and information relating to 2020 activities are presented below: Other information relating to 2020 activities:

1. Net income was $ 375,000.

2. Cash dividends of $ 150,000 were declared and paid.

3. Equipment costing $ 250,000, with a book value of $ 80,000, was sold for $ 90,000.

4. A long-term investment was sold for $ 80,000. There were no other transactions affecting long-term investments.

5. 5,000 common shares were issued for $ 25 a share.

6. Temporary investments consist of treasury bills maturing on June 30, 2021.

-The cash used in investing activities in 2020 was

A) $ 580,000.

B) $ 455,000.

C) $ 430,000.

D) $ 420,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

32

Use the following information for questions 22-23.

ecaHecaRoss Corp.'s transactions for calendar 2020 included the following:

1. Acquired 50% of Lennox Ltd.'s common shares for $ 90,000 cash.

2. Issued 5,000 preferred shares in exchange for land with a fair value of $ 160,000.

3. Issued 11% bonds, par value $ 200,000, due 2020, for $ 196,000 cash.

4. Purchased a patent for $ 110,000 cash.

5. Borrowed $ 90,000 from Bank A.

6. Paid $ 60,000 toward a bank loan with Bank B.

7. Sold long-term investments for $ 398,000.

The cash provided by financing activities in 2020 was

A) $ 136,000.

B) $ 226,000.

C) $ 286,000.

D) $ 296,000.

ecaHecaRoss Corp.'s transactions for calendar 2020 included the following:

1. Acquired 50% of Lennox Ltd.'s common shares for $ 90,000 cash.

2. Issued 5,000 preferred shares in exchange for land with a fair value of $ 160,000.

3. Issued 11% bonds, par value $ 200,000, due 2020, for $ 196,000 cash.

4. Purchased a patent for $ 110,000 cash.

5. Borrowed $ 90,000 from Bank A.

6. Paid $ 60,000 toward a bank loan with Bank B.

7. Sold long-term investments for $ 398,000.

The cash provided by financing activities in 2020 was

A) $ 136,000.

B) $ 226,000.

C) $ 286,000.

D) $ 296,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

33

When preparing a statement of cash flows, a decrease in accounts receivable during a period would cause which one of the following adjustments in calculating cash flows from operating activities?

Direct Method Indirect Method

A) increase decrease

B) decrease increase

C) increase increase

D) decrease decrease

Direct Method Indirect Method

A) increase decrease

B) decrease increase

C) increase increase

D) decrease decrease

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

34

Oyster Corp. reports its income from investments by the equity method and recognized income of $ 25,000 from its investment in Pearl Ltd. during the current year, even though no dividends were declared or paid by Pearl during the year. On Oyster's statement of cash flows (indirect method), the $ 25,000 should

A) not be shown.

B) be shown as cash inflow from investing activities.

C) be shown as cash outflow from financing activities.

D) be shown as a deduction from net income in the cash flows from operating activities section.

A) not be shown.

B) be shown as cash inflow from investing activities.

C) be shown as cash outflow from financing activities.

D) be shown as a deduction from net income in the cash flows from operating activities section.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

35

When preparing a statement of cash flows using the direct method, a net loss reported on the income statement will

A) automatically result in a cash outflow from operating activities.

B) be included in financing activities.

C) be disclosed as a note to the statement of cash flows.

D) not be included on the statement at all.

A) automatically result in a cash outflow from operating activities.

B) be included in financing activities.

C) be disclosed as a note to the statement of cash flows.

D) not be included on the statement at all.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

36

When preparing a statement of cash flows (indirect method), an increase in ending inventory over beginning inventory will result in an adjustment to net income because

A) cash was increased while cost of goods sold was decreased.

B) acquisition of inventory is an investment activity.

C) inventory purchased during the period was less than inventory sold, resulting in a net cash increase.

D) cost of goods sold on an accrual basis is lower than on a cash basis.

A) cash was increased while cost of goods sold was decreased.

B) acquisition of inventory is an investment activity.

C) inventory purchased during the period was less than inventory sold, resulting in a net cash increase.

D) cost of goods sold on an accrual basis is lower than on a cash basis.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

37

Use the following information for questions 32-33.

Oswald Ltd. has recently decided to go public and has hired you as their independent accountant. They wish to adhere to IFRS and know that they must prepare a statement of cash flows. Their financial statements for 2020 and 2019 are provided below:

The following additional data were provided for calendar 2020:

1. Dividends declared and paid were $ 24,000.

2. Equipment was sold for $ 30,000. This equipment originally cost $ 44,000, and had a book value of $ 36,000 at the time of sale. The loss on sale was included in "selling and administrative expenses," as was the depreciation expense for the year.

3. Bonds were retired during the year at par.

-On a statement of cash flows for calendar 2020, the cash received from customers is

A) $ 1,068,000.

B) $ 1,055,000.

C) $ 1,050,000.

D) $ 1,032,000.

Oswald Ltd. has recently decided to go public and has hired you as their independent accountant. They wish to adhere to IFRS and know that they must prepare a statement of cash flows. Their financial statements for 2020 and 2019 are provided below:

The following additional data were provided for calendar 2020:

1. Dividends declared and paid were $ 24,000.

2. Equipment was sold for $ 30,000. This equipment originally cost $ 44,000, and had a book value of $ 36,000 at the time of sale. The loss on sale was included in "selling and administrative expenses," as was the depreciation expense for the year.

3. Bonds were retired during the year at par.

-On a statement of cash flows for calendar 2020, the cash received from customers is

A) $ 1,068,000.

B) $ 1,055,000.

C) $ 1,050,000.

D) $ 1,032,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

38

Use the following information for questions 32-33.

Oswald Ltd. has recently decided to go public and has hired you as their independent accountant. They wish to adhere to IFRS and know that they must prepare a statement of cash flows. Their financial statements for 2020 and 2019 are provided below:

The following additional data were provided for calendar 2020:

1. Dividends declared and paid were $ 24,000.

2. Equipment was sold for $ 30,000. This equipment originally cost $ 44,000, and had a book value of $ 36,000 at the time of sale. The loss on sale was included in "selling and administrative expenses," as was the depreciation expense for the year.

3. Bonds were retired during the year at par.

-On a statement of cash flows for calendar 2020, the cash paid for income taxes is

A) $ 17,000.

B) $ 12,000.

C) $ 7,000.

D) $ 5,000.

Oswald Ltd. has recently decided to go public and has hired you as their independent accountant. They wish to adhere to IFRS and know that they must prepare a statement of cash flows. Their financial statements for 2020 and 2019 are provided below:

The following additional data were provided for calendar 2020:

1. Dividends declared and paid were $ 24,000.

2. Equipment was sold for $ 30,000. This equipment originally cost $ 44,000, and had a book value of $ 36,000 at the time of sale. The loss on sale was included in "selling and administrative expenses," as was the depreciation expense for the year.

3. Bonds were retired during the year at par.

-On a statement of cash flows for calendar 2020, the cash paid for income taxes is

A) $ 17,000.

B) $ 12,000.

C) $ 7,000.

D) $ 5,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

39

An analysis of the machinery accounts of Polonius Ltd. during 2020 follows:

The information concerning Polonius's machinery accounts should be shown in their statement of cash flows (indirect method) for the year ended December 31, 2020, as a(n)

A) subtraction from net income of $ 100,000 and a $ 200,000 decrease in cash flows from financing activities.

B) addition to net income of $ 100,000 and a $ 200,000 decrease in cash flows from investing activities.

C) $ 100,000 increase in cash flows from financing activities.

D) $ 200,000 decrease in cash flows from investing activities.

The information concerning Polonius's machinery accounts should be shown in their statement of cash flows (indirect method) for the year ended December 31, 2020, as a(n)

A) subtraction from net income of $ 100,000 and a $ 200,000 decrease in cash flows from financing activities.

B) addition to net income of $ 100,000 and a $ 200,000 decrease in cash flows from investing activities.

C) $ 100,000 increase in cash flows from financing activities.

D) $ 200,000 decrease in cash flows from investing activities.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

40

Noah Inc., a service organization, reports the following for calendar 2020:

Noah adheres to ASPE. Based on the above information, and using the direct method, the cash provided by (used in) operating activities to be reported on Noah's 2020 statement of cash flows is

A) $ 48,000.

B) $ 60,000.

C) $ 105,000.

D) $ (135,000).

Noah adheres to ASPE. Based on the above information, and using the direct method, the cash provided by (used in) operating activities to be reported on Noah's 2020 statement of cash flows is

A) $ 48,000.

B) $ 60,000.

C) $ 105,000.

D) $ (135,000).

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

41

With regard to disclosures required under IFRS and ASPE, which of the following statements is INCORRECT?

A) IFRS requires separate disclosure of taxes on income.

B) IFRS requires separate disclosure of interest received and paid and dividends received and paid.

C) ASPE does not require reporting and explanation of the amount of cash and cash equivalents that have restrictions on their use.

D) ASPE does not require separate disclosure of taxes on income.

A) IFRS requires separate disclosure of taxes on income.

B) IFRS requires separate disclosure of interest received and paid and dividends received and paid.

C) ASPE does not require reporting and explanation of the amount of cash and cash equivalents that have restrictions on their use.

D) ASPE does not require separate disclosure of taxes on income.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

42

Use the following information for questions.

Financial statements for Bernard Corp. are presented below: \text{ } \\

BERNARD CORP. Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

-The book value of the buildings and equipment at December 31, 2020 was

A) $ 508,000.

B) $ 520,000.

C) $ 588,000.

D) $ 712,000.

Financial statements for Bernard Corp. are presented below: \text{ } \\

BERNARD CORP.

Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.-The book value of the buildings and equipment at December 31, 2020 was

A) $ 508,000.

B) $ 520,000.

C) $ 588,000.

D) $ 712,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

43

Ophelia Ltd. reported retained earnings at December 31, 2019 of $ 270,000, and at December 31, 2020, $ 218,000. Net income for calendar 2020 was $ 187,500. During 2020, a stock dividend was declared and distributed, which increased the common shares account by $ 116,500. As well, a cash dividend was declared and paid during the year. The stock dividend should be reported on the statement of cash flows as

A) an outflow from operating activities of $ 116,500.

B) an outflow from financing activities of $ 116,500.

C) an outflow from investing activities of $ 116,500.

D) Stock dividends are not shown on a statement of cash flows.

A) an outflow from operating activities of $ 116,500.

B) an outflow from financing activities of $ 116,500.

C) an outflow from investing activities of $ 116,500.

D) Stock dividends are not shown on a statement of cash flows.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

44

Use the following information for questions.

Financial statements for Bernard Corp. are presented below: \text{ } \\

BERNARD CORP. Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

-The balance in the Common Shares account at December 31, 2020 was

A) $ 260,000.

B) $ 400,000.

C) $ 460,000.

D) $ 620,000.

Financial statements for Bernard Corp. are presented below: \text{ } \\

BERNARD CORP.

Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.-The balance in the Common Shares account at December 31, 2020 was

A) $ 260,000.

B) $ 400,000.

C) $ 460,000.

D) $ 620,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

45

The statements of financial position for King Lear Corp. at the end of 2020 and 2019 are as follows:

During 2020, land was acquired in exchange for common shares (which had a market value of $ 150,000 at the time). All equipment purchased was for cash. Equipment costing $ 15,000 was sold for $ 6,000 cash; book value of the equipment at the time of sale was $ 12,000, and the loss was included in net income. Cash dividends of $ 30,000 were declared and paid during the year. King adheres to ASPE and uses the indirect method when preparing the statement of cash flows. The cash provided by operating activities for calendar 2020 was

A) $ 72,000.

B) $ 78,000.

C) $ 84,000.

D) $ 99,000.

During 2020, land was acquired in exchange for common shares (which had a market value of $ 150,000 at the time). All equipment purchased was for cash. Equipment costing $ 15,000 was sold for $ 6,000 cash; book value of the equipment at the time of sale was $ 12,000, and the loss was included in net income. Cash dividends of $ 30,000 were declared and paid during the year. King adheres to ASPE and uses the indirect method when preparing the statement of cash flows. The cash provided by operating activities for calendar 2020 was

A) $ 72,000.

B) $ 78,000.

C) $ 84,000.

D) $ 99,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

46

During 2020, Olivier Corp., which uses the allowance method of accounting for doubtful accounts, recorded bad debts expense of $ 25,000. As well, the corporation wrote off uncollectible accounts receivable of $ 9,000. As a result of these transactions, their cash flows from operating activities would be calculated (indirect method) by adjusting net income with a

A) $ 25,000 increase.

B) $ 9,000 increase.

C) $ 16,000 increase.

D) $ 34,000 decrease.

A) $ 25,000 increase.

B) $ 9,000 increase.

C) $ 16,000 increase.

D) $ 34,000 decrease.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

47

Free cash flow is

A) the cash flows from operating activities reported on the statement of cash flows.

B) the discretionary cash that an entity has available for increasing capacity, acquiring new investments, paying dividends, and retiring debt.

C) the discretionary cash that an entity has available for increasing capacity, selling off investments, paying dividends, and incurring new debt.

D) the cash flows from operating activities reported on the statement of cash flows increased by the capital expenditures that are needed to sustain the current level of operations.

A) the cash flows from operating activities reported on the statement of cash flows.

B) the discretionary cash that an entity has available for increasing capacity, acquiring new investments, paying dividends, and retiring debt.

C) the discretionary cash that an entity has available for increasing capacity, selling off investments, paying dividends, and incurring new debt.

D) the cash flows from operating activities reported on the statement of cash flows increased by the capital expenditures that are needed to sustain the current level of operations.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

48

Macbeth Corp.'s comparative statements of financial position at December 31, 2020 and 2019 reported accumulated depreciation balances of $ 960,000 and $ 720,000, respectively. Equipment with a cost of $ 60,000 and a book value of $ 48,000 was the only equipment sold in 2020. Therefore, the depreciation expense for 2020 was

A) $ 228,000.

B) $ 240,000.

C) $ 252,000.

D) $ 264,000.

A) $ 228,000.

B) $ 240,000.

C) $ 252,000.

D) $ 264,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

49

Hamlet Ltd. adheres to ASPE. On Hamlet Ltd.'s statement of cash flows (indirect method) for calendar 2020, cash flows from operating activities were reported at $ 154,000. The statement included the following items: depreciation on plant assets of $ 60,000; impairment of goodwill of $ 10,000; and cash dividends paid of $ 72,000. Based only on the information given above, Hamlet's net income for 2020 was

A) $ 12,000.

B) $ 84,000.

C) $ 154,000.

D) $ 214,000.

A) $ 12,000.

B) $ 84,000.

C) $ 154,000.

D) $ 214,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

50

During calendar 2020, Marcellus Inc. sold equipment for $ 168,000. The equipment had cost $ 252,000 and had a book value of $ 144,000 at the time of sale. Accumulated Depreciation-Equipment was $ 688,000 at Dec 31, 2019 and $ 736,000 at Dec 31, 2020. Therefore, Depreciation Expense (Equipment) for 2020 was

A) $ 60,000.

B) $ 96,000.

C) $ 156,000.

D) $ 192,000.

A) $ 60,000.

B) $ 96,000.

C) $ 156,000.

D) $ 192,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

51

Use the following information for questions.

Financial statements for Bernard Corp. are presented below: \text{ } \\

BERNARD CORP. Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

-When the equipment was sold, the Buildings and Equipment account was credited with

A) $ 48,000.

B) $ 56,000.

C) $ 80,000.

D) $ 104,000.

Financial statements for Bernard Corp. are presented below: \text{ } \\

BERNARD CORP.

Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.-When the equipment was sold, the Buildings and Equipment account was credited with

A) $ 48,000.

B) $ 56,000.

C) $ 80,000.

D) $ 104,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

52

Downsview Corp. reported net income for calendar 2020 of $ 375,000. Additional information follows: Based on the above information, the cash provided by operating activities (indirect method) for calendar 2020 is

A) $ 706,250.

B) $ 737,500.

C) $ 756,250.

D) $ 787,500.

A) $ 706,250.

B) $ 737,500.

C) $ 756,250.

D) $ 787,500.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

53

Use the following information for questions.

During calendar 2020, Laertes Corp. sold equipment for $ 70,000. The equipment had cost $ 100,000 and had a book value of $ 52,000 at the time of sale. Data from their comparative statements of financial position are:

-Depreciation expense for 2020 was

A) $ 86,000.

B) $ 68,000.

C) $ 18,000.

D) $ 12,000.

During calendar 2020, Laertes Corp. sold equipment for $ 70,000. The equipment had cost $ 100,000 and had a book value of $ 52,000 at the time of sale. Data from their comparative statements of financial position are:

-Depreciation expense for 2020 was

A) $ 86,000.

B) $ 68,000.

C) $ 18,000.

D) $ 12,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

54

Use the following information for questions.

Financial statements for Bernard Corp. are presented below: \text{ } \\

BERNARD CORP. Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

-The balance in the Accounts Payable account at December 31, 2020 was

A) $ 148,000.

B) $ 108,000.

C) $ 44,000.

D) $ 32,000.

Financial statements for Bernard Corp. are presented below: \text{ } \\

BERNARD CORP.

Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.-The balance in the Accounts Payable account at December 31, 2020 was

A) $ 148,000.

B) $ 108,000.

C) $ 44,000.

D) $ 32,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

55

Horatio Corp. sold some of its plant assets during calendar 2020 for $ 21,000 cash. The original cost of the assets was $ 150,000, and the accumulated depreciation to the date of sale was $ 140,000. This transaction should be shown on Horatio's 2020 statement of cash flows (indirect method) as a(n)

A) deduction from net income of $ 11,000 and a $ 10,000 cash inflow from financing activities.

B) addition to net income of $ 11,000 and a $ 21,000 cash inflow from investing activities.

C) deduction from net income of $ 11,000 and a $ 21,000 cash inflow from investing activities.

D) addition to net income of $ 21,000.

A) deduction from net income of $ 11,000 and a $ 10,000 cash inflow from financing activities.

B) addition to net income of $ 11,000 and a $ 21,000 cash inflow from investing activities.

C) deduction from net income of $ 11,000 and a $ 21,000 cash inflow from investing activities.

D) addition to net income of $ 21,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

56

Marcus Ltd. sold equipment during calendar 2020 for $ 28,500 cash. The original cost of the equipment was $ 69,000, and the accumulated depreciation to the date of sale was $ 36,750. This transaction should be shown on Marcus' 2020 statement of cash flows (indirect method) as a(n)

A) addition to net income of $ 3,750 and a $ 28,500 cash inflow from investing activities.

B) deduction from net income of $ 3,750 and a $ 32,250 cash inflow from investing activities.

C) deduction from net income of $ 3,750 and a $ 28,500 cash inflow from investing activities.

D) addition to net income of $ 3,750 and a $ 28,500 cash inflow from financing activities.

A) addition to net income of $ 3,750 and a $ 28,500 cash inflow from investing activities.

B) deduction from net income of $ 3,750 and a $ 32,250 cash inflow from investing activities.

C) deduction from net income of $ 3,750 and a $ 28,500 cash inflow from investing activities.

D) addition to net income of $ 3,750 and a $ 28,500 cash inflow from financing activities.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

57

Use the following information for questions.

Financial statements for Bernard Corp. are presented below: \text{ } \\

BERNARD CORP. Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

-The balance in the Retained Earnings account at December 31, 2020 was

A) $ 500,000.

B) $ 440,000.

C) $ 380,000.

D) $ 180,000.

Financial statements for Bernard Corp. are presented below: \text{ } \\

BERNARD CORP.

Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.-The balance in the Retained Earnings account at December 31, 2020 was

A) $ 500,000.

B) $ 440,000.

C) $ 380,000.

D) $ 180,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

58

Edgar Inc. reported net income for calendar 2020 of $ 3,500,000. Additional information follows: Based on the above information, the cash provided by operating activities (indirect method) for calendar 2020 is

A) $ 4,750,000.

B) $ 4,730,000.

C) $ 4,715,000.

D) $ 4,660,000.

A) $ 4,750,000.

B) $ 4,730,000.

C) $ 4,715,000.

D) $ 4,660,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

59

Oswald Ltd. has recently decided to go public and has hired you as their independent accountant. They wish to adhere to IFRS and know that they must prepare a statement of cash flows. Their financial statements for 2020 and 2019 are provided below:

The following additional data were provided for calendar 2020:

1) Dividends declared and paid were $ 24,000.

2) Equipment was sold for $ 30,000. This equipment originally cost $ 44,000, and had a book value of $ 36,000 at the time of sale. The loss on sale was included in "selling and administrative expenses," as was the depreciation expense for the year.

3) Bonds were retired during the year at par.

For a statement of cash flows for calendar 2020, using the indirect method, the cash provided by operating activities is

A) $ 51,000.

B) $ 36,000.

C) $ 30,000.

D) $ 25,000.

The following additional data were provided for calendar 2020:

1) Dividends declared and paid were $ 24,000.

2) Equipment was sold for $ 30,000. This equipment originally cost $ 44,000, and had a book value of $ 36,000 at the time of sale. The loss on sale was included in "selling and administrative expenses," as was the depreciation expense for the year.

3) Bonds were retired during the year at par.

For a statement of cash flows for calendar 2020, using the indirect method, the cash provided by operating activities is

A) $ 51,000.

B) $ 36,000.

C) $ 30,000.

D) $ 25,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

60

Use the following information for questions.

During calendar 2020, Laertes Corp. sold equipment for $ 70,000. The equipment had cost $ 100,000 and had a book value of $ 52,000 at the time of sale. Data from their comparative statements of financial position are:

-Equipment purchased during 2020 was

A) $ 170,000.

B) $ 100,000.

C) $ 70,000.

D) $ 30,000.

During calendar 2020, Laertes Corp. sold equipment for $ 70,000. The equipment had cost $ 100,000 and had a book value of $ 52,000 at the time of sale. Data from their comparative statements of financial position are:

-Equipment purchased during 2020 was

A) $ 170,000.

B) $ 100,000.

C) $ 70,000.

D) $ 30,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

61

Advantages and disadvantages of the direct and indirect methods

Discuss the advantages and disadvantages of the direct and indirect methods of preparing a statement of cash flows.

Discuss the advantages and disadvantages of the direct and indirect methods of preparing a statement of cash flows.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

62

the purpose of the statement of cash flow.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

63

Effects of transactions on the statement of cash flows (indirect method)

Any given transaction may affect a statement of cash flows (using the indirect method) in one or more of the following ways:

Cash flows from operating activities

A. Net income will be increased or adjusted upward.

B. Net income will be decreased or adjusted downward.

Cash flows from investing activities

C. Increase as a result of cash inflows.

D. Decrease as a result of cash outflows.

Cash flows from financing activities

E. Increase as a result of cash inflows.

F. Decrease as a result of cash outflows.

The statement of cash flows is not affected

G. Not required to be reported on the statement.

Instructions

For each transaction listed below, list the letter or letters from above that describe(s) the effect of the transaction on a statement of cash flows (indirect method) assuming the company follows ASPE. Ignore any income tax effects.

1. Redeemed preferred shares with a carrying value of $ 44,000 for $ 50,000.

2. Wrote off uncollectible accounts receivable of $ 3,000 against the allowance for doubtful accounts balance of $ 12,200.

3. Sold machinery that originally cost $ 3,000, with a book value of $ 1,800, for $ 5,000.

4. Acquired land through the issuance of bonds payable.

5. Sold 1,000 common shares for $ 25 per share.

6. Sold treasury shares at their carrying value.

7. Paid cash dividends of $ 8,000.

8. Purchased a patent for $ 20,000.

____ 9. Recorded depreciation expense of $ 150,000 for the year.

Any given transaction may affect a statement of cash flows (using the indirect method) in one or more of the following ways:

Cash flows from operating activities

A. Net income will be increased or adjusted upward.

B. Net income will be decreased or adjusted downward.

Cash flows from investing activities

C. Increase as a result of cash inflows.

D. Decrease as a result of cash outflows.

Cash flows from financing activities

E. Increase as a result of cash inflows.

F. Decrease as a result of cash outflows.

The statement of cash flows is not affected

G. Not required to be reported on the statement.

Instructions

For each transaction listed below, list the letter or letters from above that describe(s) the effect of the transaction on a statement of cash flows (indirect method) assuming the company follows ASPE. Ignore any income tax effects.

1. Redeemed preferred shares with a carrying value of $ 44,000 for $ 50,000.

2. Wrote off uncollectible accounts receivable of $ 3,000 against the allowance for doubtful accounts balance of $ 12,200.

3. Sold machinery that originally cost $ 3,000, with a book value of $ 1,800, for $ 5,000.

4. Acquired land through the issuance of bonds payable.

5. Sold 1,000 common shares for $ 25 per share.

6. Sold treasury shares at their carrying value.

7. Paid cash dividends of $ 8,000.

8. Purchased a patent for $ 20,000.

____ 9. Recorded depreciation expense of $ 150,000 for the year.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

64

As part of the IASB's Disclosure Initiative "Amendments to IAS 7 - Statement of Cash Flows", explain what companies are encouraged, but not required, to do in terms of changes in liabilities arising from financing activities.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

65

Cash flows from operating activities (indirect and direct methods)

Presented below is the latest income statement of Oxford Ltd.: In addition, the following information related to net changes in working capital is available: Oxford Ltd. also reports that depreciation expense for the year was $ 13,700 and that the deferred tax liability account increased $ 2,600.

Instructions

Prepare a schedule calculating the net cash flow from operating activities that would be shown on a statement of cash flows:

a) using the indirect method.

b) using the direct method.

Presented below is the latest income statement of Oxford Ltd.: In addition, the following information related to net changes in working capital is available: Oxford Ltd. also reports that depreciation expense for the year was $ 13,700 and that the deferred tax liability account increased $ 2,600.

Instructions

Prepare a schedule calculating the net cash flow from operating activities that would be shown on a statement of cash flows:

a) using the indirect method.

b) using the direct method.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

66

Use the following information for questions.

Financial statements for Bernard Corp. are presented below: \text{ } \\

BERNARD CORP. Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

-Ophelia Ltd. reported retained earnings at December 31, 2019 of $ 270,000, and at December 31, 2020, $ 218,000. Net income for calendar 2020 was $ 187,500. During 2020, a stock dividend was declared and distributed, which increased the common shares account by $ 116,500. As well, a cash dividend was declared and paid during the year. The amount of the cash dividend declared and paid was

A) $ 93,000.

B) $ 123,000.

C) $ 164,500.

D) $ 239,500.

Financial statements for Bernard Corp. are presented below: \text{ } \\

BERNARD CORP.

Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.-Ophelia Ltd. reported retained earnings at December 31, 2019 of $ 270,000, and at December 31, 2020, $ 218,000. Net income for calendar 2020 was $ 187,500. During 2020, a stock dividend was declared and distributed, which increased the common shares account by $ 116,500. As well, a cash dividend was declared and paid during the year. The amount of the cash dividend declared and paid was

A) $ 93,000.

B) $ 123,000.

C) $ 164,500.

D) $ 239,500.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

67

Oswald Ltd. has recently decided to go public and has hired you as their independent accountant. They wish to adhere to IFRS and know that they must prepare a statement of cash flows. Their financial statements for 2020 and 2019 are provided below:  The following additional data were provided for calendar 2020:

The following additional data were provided for calendar 2020:

1. Dividends declared and paid were $ 24,000.

2. Equipment was sold for $ 30,000. This equipment originally cost $ 44,000, and had a book value of $ 36,000 at the time of sale. The loss on sale was included in "selling and administrative expenses," as was the depreciation expense for the year.

3. Bonds were retired during the year at par.

Instructions

From the information above, prepare a statement of cash flows (direct method) for calendar 2020.

The following additional data were provided for calendar 2020:

The following additional data were provided for calendar 2020:1. Dividends declared and paid were $ 24,000.

2. Equipment was sold for $ 30,000. This equipment originally cost $ 44,000, and had a book value of $ 36,000 at the time of sale. The loss on sale was included in "selling and administrative expenses," as was the depreciation expense for the year.

3. Bonds were retired during the year at par.

Instructions

From the information above, prepare a statement of cash flows (direct method) for calendar 2020.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

68

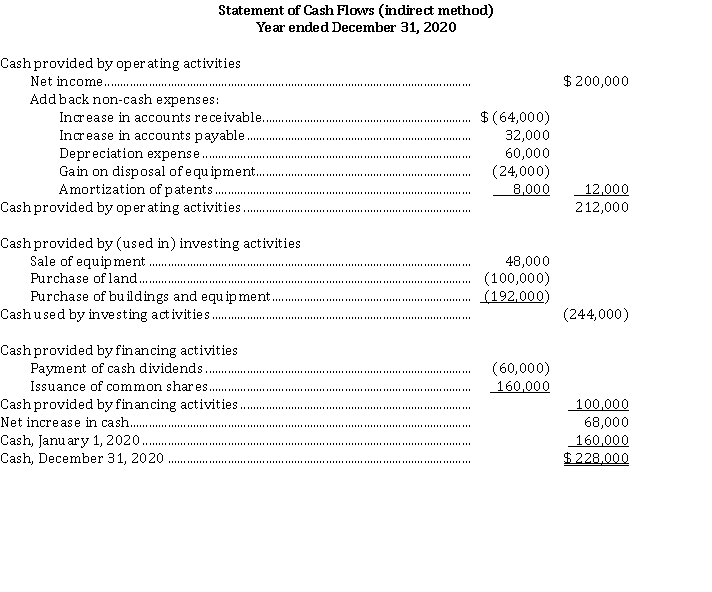

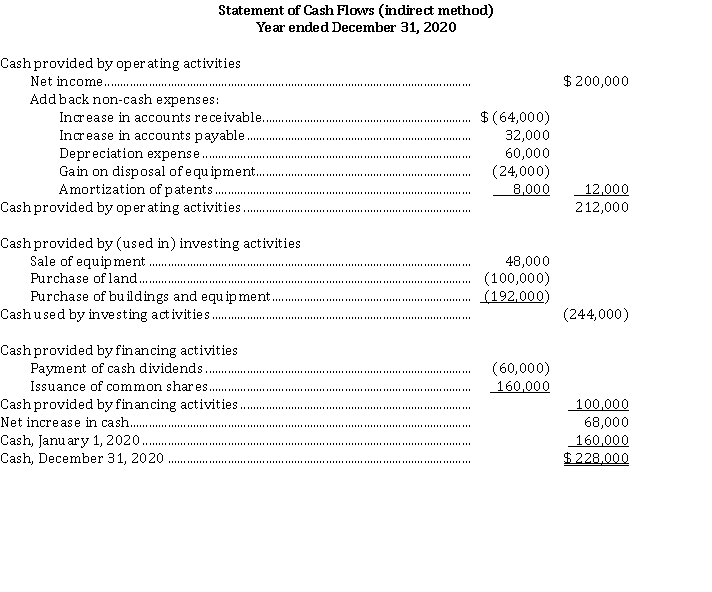

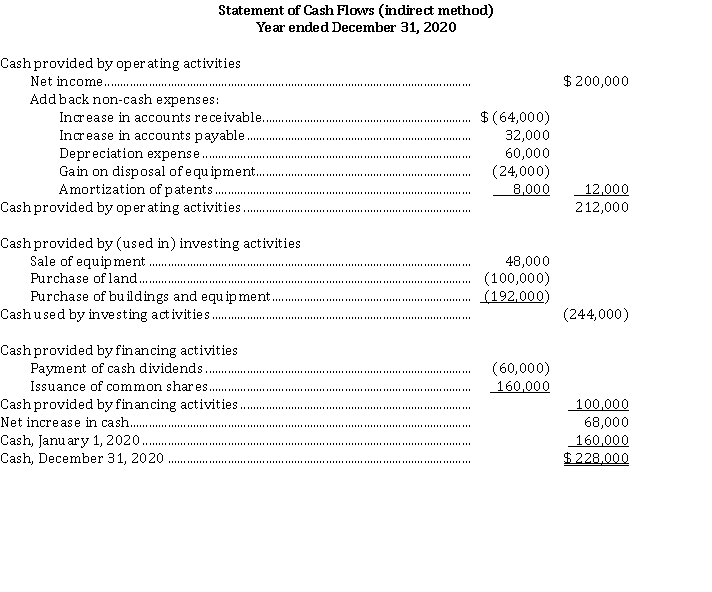

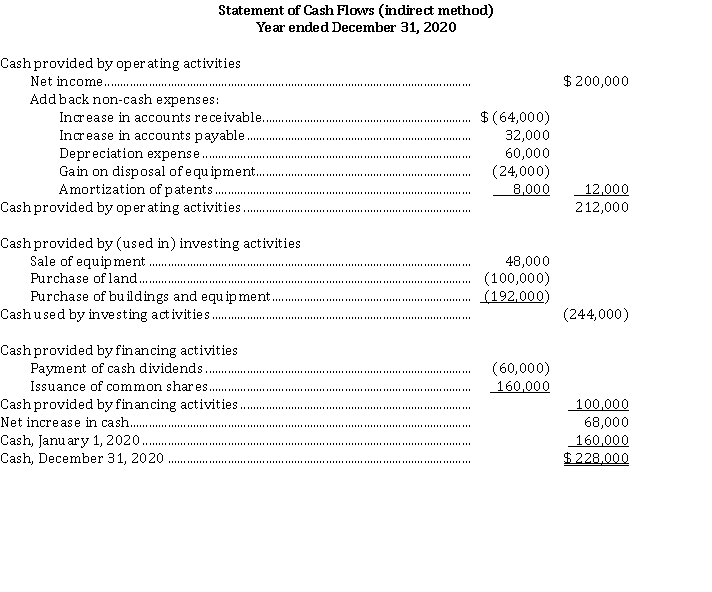

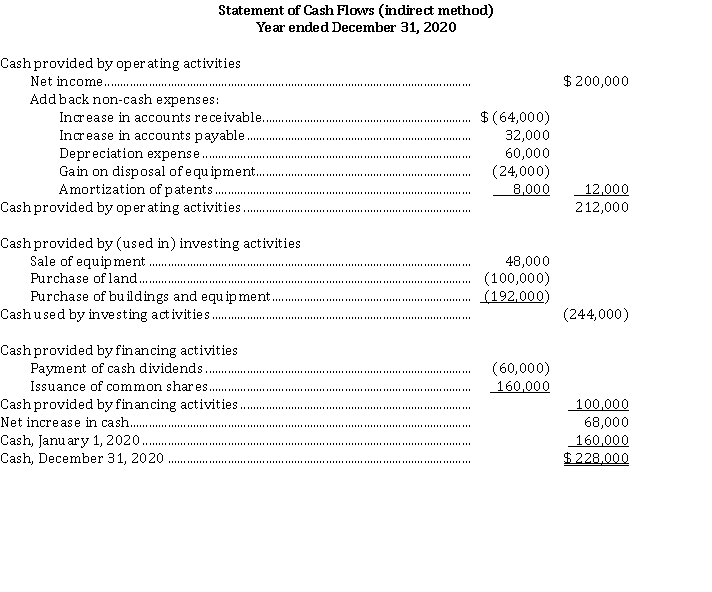

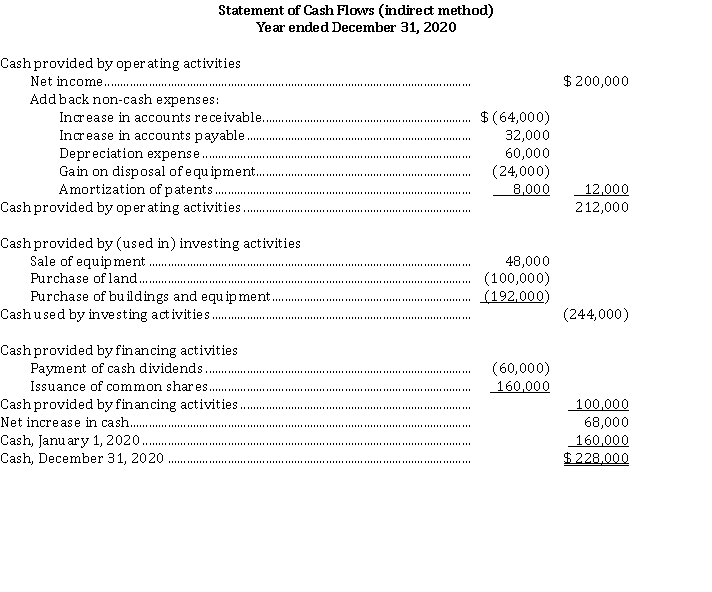

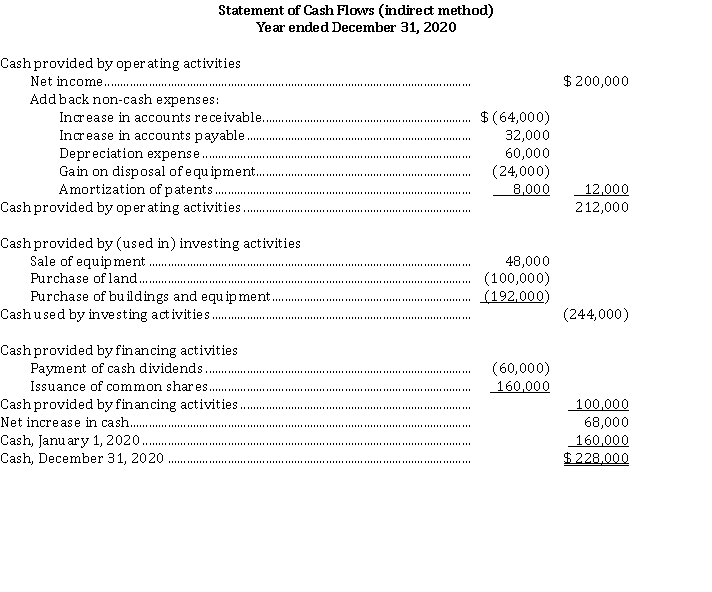

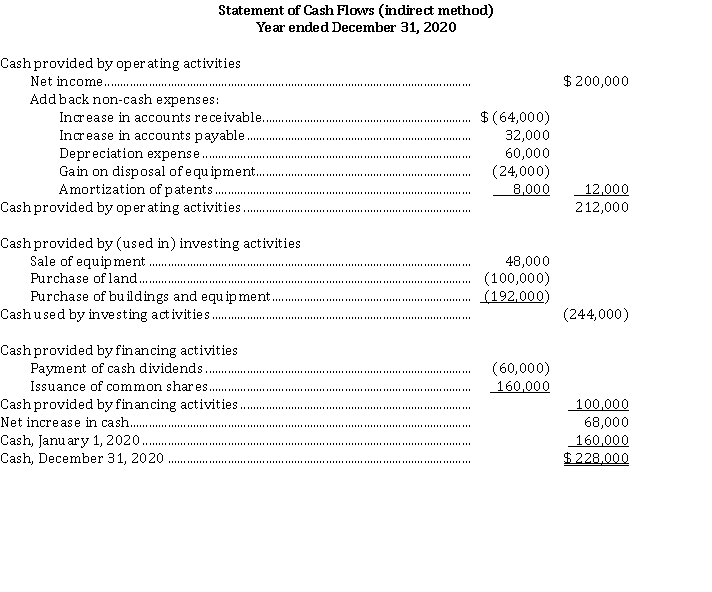

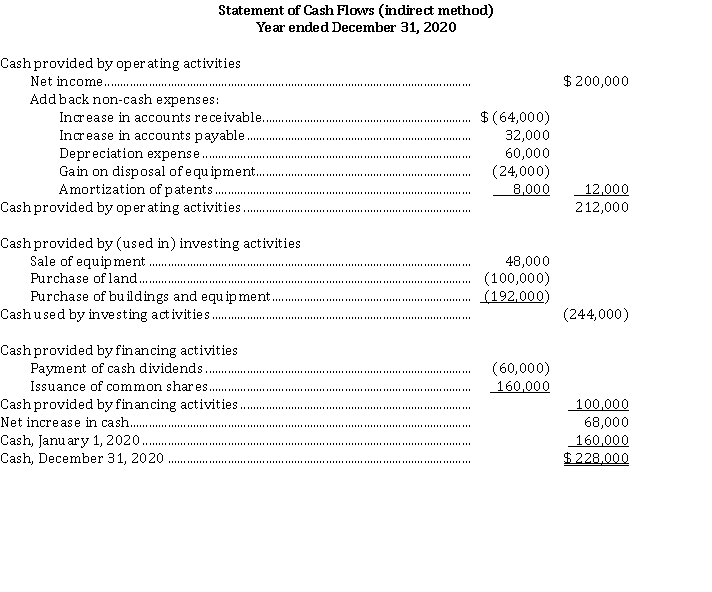

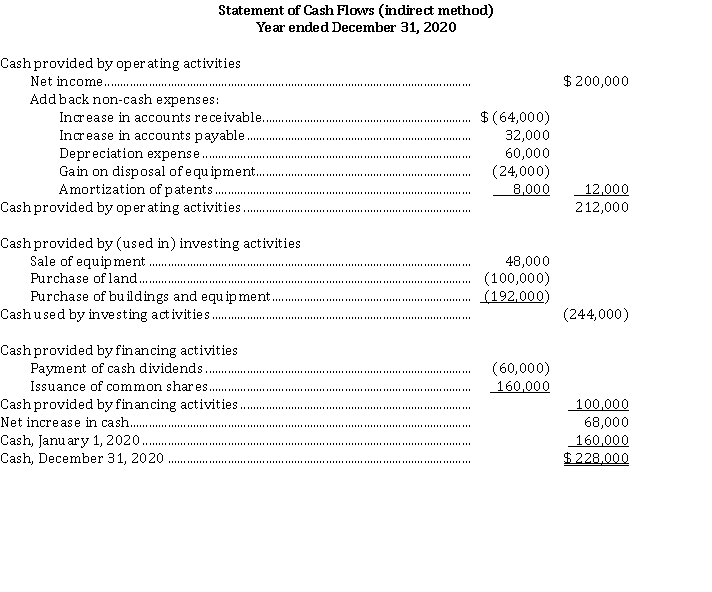

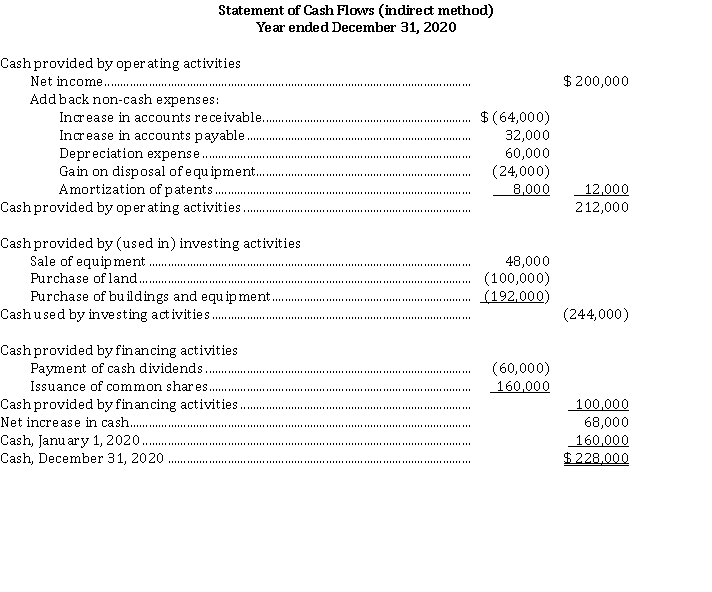

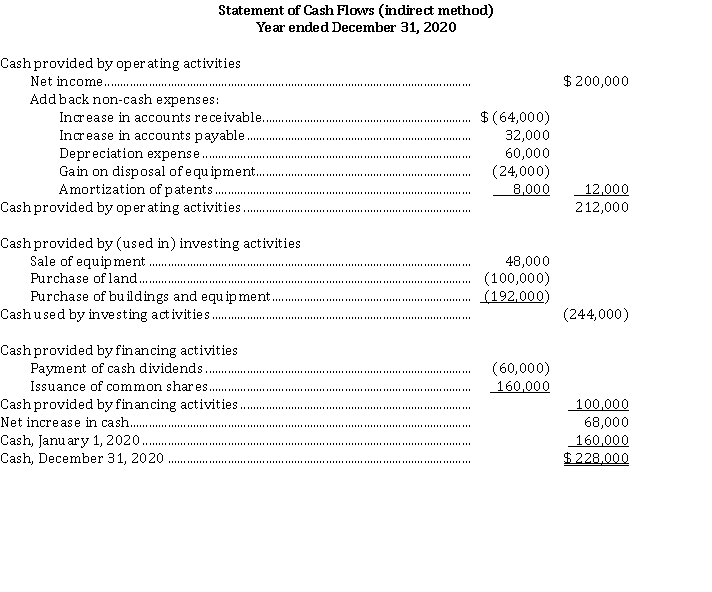

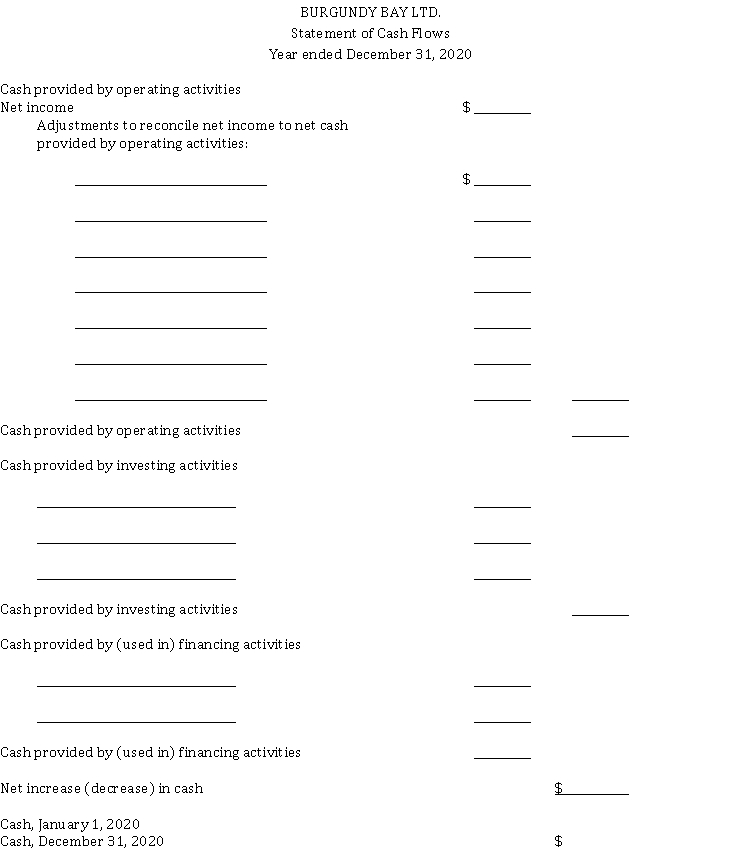

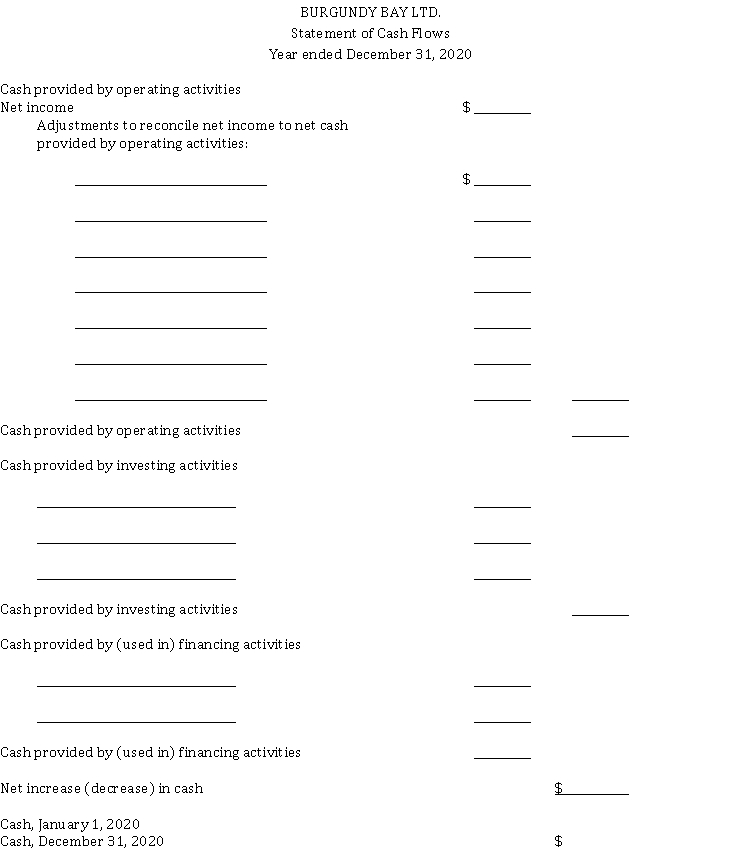

Preparation of statement of cash flows (indirect method)

The following information is taken from Green Lake Corporation's financial statements. Green Lake adheres to ASPE:

Instructions

Prepare a statement of cash flows (indirect method) for Green Lake Corporation for calendar 2020.

The following information is taken from Green Lake Corporation's financial statements. Green Lake adheres to ASPE:

Instructions

Prepare a statement of cash flows (indirect method) for Green Lake Corporation for calendar 2020.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

69

Direct and indirect methods

Explain and compare the direct method and the indirect method of preparing a statement of cash flows.

Explain and compare the direct method and the indirect method of preparing a statement of cash flows.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

70

Classification of cash flows and transactions

Assuming the company follows ASPE, give:

a) three distinct examples of investing activities.

b) three distinct examples of financing activities.

c) three distinct examples of significant non-cash transactions.

d) two examples of transactions not shown on a statement of cash flows.

Assuming the company follows ASPE, give:

a) three distinct examples of investing activities.

b) three distinct examples of financing activities.

c) three distinct examples of significant non-cash transactions.

d) two examples of transactions not shown on a statement of cash flows.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

71

Calculations for statement of cash flows (indirect method)

Cornwall Ltd. sold a machine that cost $ 19,000 and had a book value of $ 11,000 for $ 13,000. Data from the corporation's comparative statements of financial position are: Instructions

Based on the above information, there are four items that need to be shown on a statement of cash flows (indirect method). Calculate these four items. Show your calculations.

Cornwall Ltd. sold a machine that cost $ 19,000 and had a book value of $ 11,000 for $ 13,000. Data from the corporation's comparative statements of financial position are: Instructions

Based on the above information, there are four items that need to be shown on a statement of cash flows (indirect method). Calculate these four items. Show your calculations.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

72

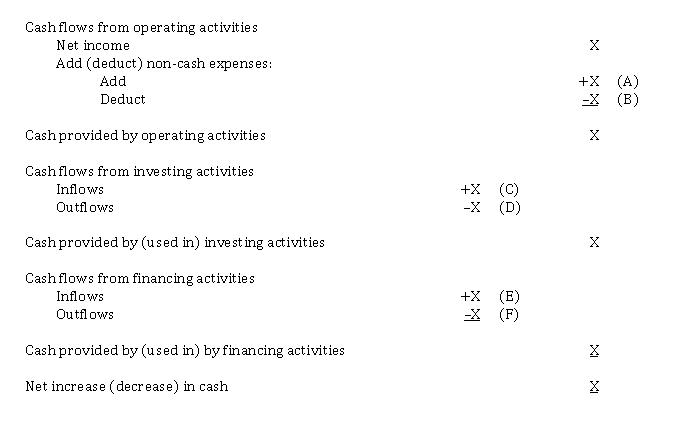

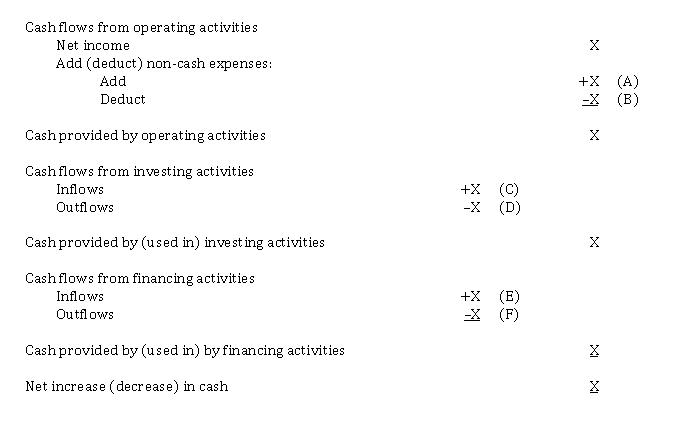

Classification of cash flows (indirect method)

Note that X in the following statement of cash flows identifies a dollar amount and the letters (A) through (F) identify specific items, which appear in the major sections of the statement of cash flows prepared using the indirect method. Instructions

Instructions

For each of the following items, indicate by letter in the blank spaces below, the section or sections where the effect would be reported assuming the company follows ASPE. Use the code (A through F) from above. If the item is not required to be reported on the statement of cash flows, write the word "none" in the blank. Assume that generally accepted accounting principles have been followed in determining net income and that there are no temporary investments which are considered cash equivalents.

1. Issued preferred shares in exchange for equipment.

2. Accounts receivable increased by $ 60,000.

3. Accrued estimated income taxes for the year.

4. Amortization of premium on bonds payable.

5. Purchase of long-term investment.

6. The book value of FV-NI investments was reduced to fair value.

7. Declaration of stock dividends.

8. Bad debts expense recorded (company uses the allowance method).

9. Gain on disposal of old machinery.

10. Declaration and payment of cash dividends.

11. FV-NI investments sold at a loss.

Note that X in the following statement of cash flows identifies a dollar amount and the letters (A) through (F) identify specific items, which appear in the major sections of the statement of cash flows prepared using the indirect method.

Instructions

InstructionsFor each of the following items, indicate by letter in the blank spaces below, the section or sections where the effect would be reported assuming the company follows ASPE. Use the code (A through F) from above. If the item is not required to be reported on the statement of cash flows, write the word "none" in the blank. Assume that generally accepted accounting principles have been followed in determining net income and that there are no temporary investments which are considered cash equivalents.

1. Issued preferred shares in exchange for equipment.

2. Accounts receivable increased by $ 60,000.

3. Accrued estimated income taxes for the year.

4. Amortization of premium on bonds payable.

5. Purchase of long-term investment.

6. The book value of FV-NI investments was reduced to fair value.

7. Declaration of stock dividends.

8. Bad debts expense recorded (company uses the allowance method).

9. Gain on disposal of old machinery.

10. Declaration and payment of cash dividends.

11. FV-NI investments sold at a loss.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

73

below is the latest income statement of Mandolin Ltd.:

In addition, the following information related to net changes in working capital is available: Mandolin Ltd. also reports that depreciation expense for the year was $ 20,550 and that the deferred tax liability account increased $ 3,900.

Instructions

Prepare a schedule calculating the net cash flow from operating activities that would be shown on a statement of cash flows using the direct method.

In addition, the following information related to net changes in working capital is available: Mandolin Ltd. also reports that depreciation expense for the year was $ 20,550 and that the deferred tax liability account increased $ 3,900.

Instructions

Prepare a schedule calculating the net cash flow from operating activities that would be shown on a statement of cash flows using the direct method.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

74

Preparation of statement of cash flows (direct method)

White Horse Ltd. has prepared the following comparative statements of financial position at December 31, 2019 and 2020: White Horse adheres to ASPE.

1. The Accumulated Depreciation account has been credited only for the depreciation expense for the year. There were no disposals of property, plant and equipment, but new equipment was purchased during 2020.

2. Depreciation expense and a charge for impairment of goodwill have both been included in operating expenses.

3. The Retained Earnings account was debited for cash dividends declared and paid of $ 46,000, and credited for the net income for the year.

The condensed income statement for 2020 is as follows: Instructions

From the information above, prepare a statement of cash flows (direct method) for calendar 2020.

White Horse Ltd. has prepared the following comparative statements of financial position at December 31, 2019 and 2020: White Horse adheres to ASPE.

1. The Accumulated Depreciation account has been credited only for the depreciation expense for the year. There were no disposals of property, plant and equipment, but new equipment was purchased during 2020.