Deck 21: Stocks, Bonds, and Mutual Funds

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

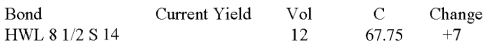

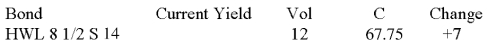

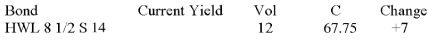

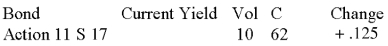

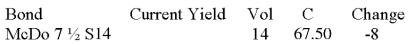

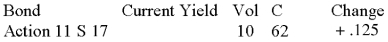

Question

Question

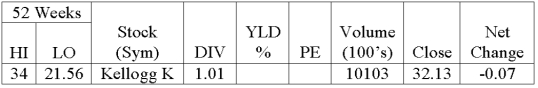

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

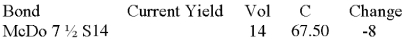

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/65

Play

Full screen (f)

Deck 21: Stocks, Bonds, and Mutual Funds

1

Bonds do not repay the face value in the future.

False

2

A bond quote of 74.375 is $743.50.

False

3

Bond price-earnings ratios are similar to those of stocks.

False

4

Stock represents shares of ownership in a company.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

5

The yearly interest on a bond is the current selling price of the bond times the stated yearly interest rate.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

6

Bond quotes are stated in percents of face value.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

7

Each time the stock of a company trades on the exchange, the company receives additional money.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

8

If someone buys a bond for less than $1,000, that person will receive less annual interest.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

9

A commission is charged only when one is buying a stock.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

10

Cumulative preferred stock is not entitled to dividends in arrears.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

11

A bond yield is the total annual interest of a bond divided by the total current cost of the bond.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

12

The stock yield is the monthly dividend divided by the closing price per share.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

13

A bond selling for more than the face value is selling at a premium.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

14

The previous day's close of a stock is listed in today's transactions.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

15

A company that has no PE ratio has no earnings.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

16

Stocks are quoted in decimals.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

17

The price-earnings ratio of stocks is not standard.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

18

The current yield on a bond is the yearly interest of the bond divided by the cost of the bond at closing.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

19

Stocks are traded over the Internet.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

20

The general public is allowed to trade stock on the floor of the stock exchange.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

21

Bond quotes are stated in:

A) Dollars

B) Fractions of a dollar

C) Percents of face value

D) Percents of purchase price

E) None of these

A) Dollars

B) Fractions of a dollar

C) Percents of face value

D) Percents of purchase price

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

22

A mutual fund is made up of

A) Many stocks

B) 10 stocks

C) 100 stocks

D) 500 stocks

E) None of these

A) Many stocks

B) 10 stocks

C) 100 stocks

D) 500 stocks

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

23

Bonds are usually in denominations of:

A) $100

B) $1,000

C) $10,000

D) $100,000

E) None of these

A) $100

B) $1,000

C) $10,000

D) $100,000

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

24

A mutual fund is an investment company that buys stocks and bonds and then sells shares in those securities to the public.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

25

A bond that closed today at 94 down 2 closed yesterday in dollars at:

A) $960

B) $940

C) $950

D) $930

E) None of these

A) $960

B) $940

C) $950

D) $930

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

26

ARUN stock closed at $8.11 + $.33. Yesterday's closing price was:

A) $8.44

B) $8.40

C) $7.78

D) $7.87

E) None of these

A) $8.44

B) $8.40

C) $7.78

D) $7.87

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

27

The yearly interest of a bond is the face value of the bond:

A) Divided by the stated yearly interest rate

B) Plus the stated yearly interest rate

C) Times the stated yearly interest rate

D) Minus the stated yearly interest rate

E) None of these

A) Divided by the stated yearly interest rate

B) Plus the stated yearly interest rate

C) Times the stated yearly interest rate

D) Minus the stated yearly interest rate

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

28

Stockbrokers:

A) Do not act as middlemen

B) Cannot trade stock

C) Charge a commission for buying and selling

D) Are always right in all their stock recommendations

E) None of these

A) Do not act as middlemen

B) Cannot trade stock

C) Charge a commission for buying and selling

D) Are always right in all their stock recommendations

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

29

Stocks are always quoted in:

A) Percents

B) Quarters of a dollar

C) Decimals

D) Quarter lots

E) None of these

A) Percents

B) Quarters of a dollar

C) Decimals

D) Quarter lots

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

30

A bond quote of 82.25 in dollars is equal to:

A) $82.25

B) $8.25

C) $8,025.50

D) $822.50

E) None of these

A) $82.25

B) $8.25

C) $8,025.50

D) $822.50

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

31

Stock yield is found by the annual dividend divided by the:

A) Opening price per share

B) Closing price per share

C) Price-earnings ratio

D) Net change for the day

E) None of these

A) Opening price per share

B) Closing price per share

C) Price-earnings ratio

D) Net change for the day

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

32

Jangles Co. earned $1.80 per share. Assuming a closing price of $40, the PE ratio is: (Round to the nearest whole percent.)

A) 7

B) 22

C) 72

D) 20

E) None of these

A) 7

B) 22

C) 72

D) 20

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

33

Commissions charged on the trading of stock are:

A) Only on buying of stock

B) On buying and selling of stock

C) Only on sale of stock

D) Fixed

E) None of these

A) Only on buying of stock

B) On buying and selling of stock

C) Only on sale of stock

D) Fixed

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

34

The price-earnings ratio is calculated by the closing price per share of stock divided by:

A) Quarterly earnings per share

B) Dividend per year

C) Annual earnings per share

D) Net change

E) None of these

A) Quarterly earnings per share

B) Dividend per year

C) Annual earnings per share

D) Net change

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

35

The stock of WAL-MAT pays a dividend of $.88. The stock opened at $18.25 and closed at $18.33. The stock yield is:

A) 4.8%

B) 4.2%

C) 4.1%

D) 4.9%

E) None of these

A) 4.8%

B) 4.2%

C) 4.1%

D) 4.9%

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

36

A stock price will rise if:

A) Supply of stock is greater than demand

B) The price-earnings ratio is 10 or greater

C) Stock yield is greater than 8%

D) Demand for stock is greater than supply

E) None of these

A) Supply of stock is greater than demand

B) The price-earnings ratio is 10 or greater

C) Stock yield is greater than 8%

D) Demand for stock is greater than supply

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

37

Dividends in arrears mean:

A) No past dividends have been omitted

B) Preferred has been paid but not holders of common stock

C) Common stock must receive additional dividends not paid

D) A specific amount of dividends has not been paid

E) None of these

A) No past dividends have been omitted

B) Preferred has been paid but not holders of common stock

C) Common stock must receive additional dividends not paid

D) A specific amount of dividends has not been paid

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

38

The NAV is the dollar value of 10 shares of a mutual fund.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

39

The NAV helps an investor keep track of the value of his or her investment.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

40

The offer price of a mutual fund is always the NAV and commission.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

41

Is the bond trading at a premium or a discount?

Is the bond trading at a premium or a discount?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

42

Al Roy bought five bonds of Jort Co. 11 3/4 at 93.25 and four bonds of Inst. System 12x08 for 81.125. If the commission on the bonds is $2.50 per bond, the total cost of all the purchases is:

A) $4,662.50

B) $3,425.00

C) $7,930.00

D) $7,907.50

E) None of these

A) $4,662.50

B) $3,425.00

C) $7,930.00

D) $7,907.50

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

43

Assume $1.19 EPS.

Assume $1.19 EPS.Calculate the yield percent (round to nearest tenth percent)

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

44

What is the bond interest rate?

What is the bond interest rate?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

45

Calculate the bond yield (to the nearest tenth percent) based on the closing price.

Calculate the bond yield (to the nearest tenth percent) based on the closing price.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

46

Loretta Scholten buys nine bonds of Leo Co. 7 ¼ 16 at 103.375. The commission is $3.00 per bond. The current yield to the nearest tenth of a percent is:

A) 7.0%

B) 7.1%

C) 7.2%

D) 7.3%

E) None of these

A) 7.0%

B) 7.1%

C) 7.2%

D) 7.3%

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

47

Exxon sells its bonds at 108.375. The amount of premium or discount the bond is selling for is:

A) $17.35

B) $13.75

C) $13.25

D) $13.57

E) None of these

A) $17.35

B) $13.75

C) $13.25

D) $13.57

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

48

The stock of VIC Corporation is trading at $39.63. The price-earnings ratio is 16 times earnings. The earnings per share for VIC Corporation are:

A) $2.84

B) $2.48

C) $4.96

D) $6.34

E) None of these

A) $2.84

B) $2.48

C) $4.96

D) $6.34

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

49

Ace Corporation pays its cumulative preferred stock $1.95 per share. There are 40,000 shares of preferred and 80,000 shares of common. In 2012, 2013, and 2014, because of slowdowns in the economy, Ace paid no dividends. Now, in 2015, the board of directors has decided to pay out $600,000 in dividends. The common stockholders receive:

A) $312,000

B) $288,000

C) $366,000

D) $444,000

E) None of these

A) $312,000

B) $288,000

C) $366,000

D) $444,000

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

50

In dollars, what was yesterday's close?

In dollars, what was yesterday's close?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

51

What is the total interest for one year on this bond?

What is the total interest for one year on this bond?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

52

Jeff Ryan bought 200 shares of BUI for $19.50. Eight weeks later he sold the stock for $20.75. Assuming a 3% commission, his bottom line was a gain of:

A) $250.00

B) $374.50

C) $8.50

D) $257.50

E) None of these

A) $250.00

B) $374.50

C) $8.50

D) $257.50

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

53

TOX bond 7.55 yields 11%. The bond traded at a low of 71.25 and closed today at 71.625 + .75. The closing price yesterday was:

A) 65.125

B) 72.375

C) 69.875

D) 70.875

E) None of these

A) 65.125

B) 72.375

C) 69.875

D) 70.875

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

54

Royal Co. receives a dividend of $4.88 per share. Today the closing price of the stock is $59.95. The current stock yield to the nearest tenth of a percent is:

A) 8.1%

B) 8.0%

C) 8.2%

D) 8.3%

E) None of these

A) 8.1%

B) 8.0%

C) 8.2%

D) 8.3%

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

55

A bond closed at 102.25. The current yield is 10.4%. The annual interest is:

A) $102.90

B) $106.34

C) $105.80

D) $104.60

E) None of these

A) $102.90

B) $106.34

C) $105.80

D) $104.60

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

56

Bee Sting bought 400 shares of Google at $399.75 per share. Assume a commission of 2% of the purchase price. What is the total to Bee?

A) $159,900

B) $156,702

C) $163,980

D) $163,098

E) None of these

A) $159,900

B) $156,702

C) $163,980

D) $163,098

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

57

Ron bought one bond of Bee Company for 82.25. The original bond was 6 3/4 15. The current yield is (to the nearest tenth of a percent):

A) 8%

B) 8.2%

C) 8.3%

D) 9%

E) None of these

A) 8%

B) 8.2%

C) 8.3%

D) 9%

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

58

Is the bond trading at a premium or a discount?

Is the bond trading at a premium or a discount?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

59

Abby Ring buys five bonds of Moe Co. 12 3/4 15 at 89.375 with a commission of $5.00 per bond. Her total annual interest is:

A) $127.50

B) $637.05

C) $1,275

D) $637.50

E) None of these

A) $127.50

B) $637.05

C) $1,275

D) $637.50

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

60

The bond of Tuckpeck is 8¼ 14. The bond traded for a high of 93.25 and closed at 93. The current yield of the bond to the nearest tenth of a percent is:

A) 8.8%

B) 8.7%

C) 8.9%

D) 8.6%

E) None of these

A) 8.8%

B) 8.7%

C) 8.9%

D) 8.6%

E) None of these

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

61

Is the bond trading at a premium or a discount?

Is the bond trading at a premium or a discount?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

62

Randy Smith bought 180 shares of a mutual fund with an NAV of $14.85. This fund has a load charge of 6%. What is the offer price, and what did Randy pay for the investment?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

63

Tim Sport bought four bonds of ABC 6 1/2 16 at 78.125. Can you help Tim calculate his

(A) total annual interest,

(B) total cost, and

(C) current yield to the nearest tenth percent?

(A) total annual interest,

(B) total cost, and

(C) current yield to the nearest tenth percent?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

64

John invested $150,000, Sally invested $200,000, and Jane invested $50,000 into a partnership. Profits are distributed based on the partner's original investment. First year's profit is $25,000. How is this profit distributed?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

65

Moe Corporation pays its cumulative preferred stock $2.10 per share. There are 30,000 shares of preferred and 80,000 shares of common. In 2014, 2015, and 2016 no dividends were paid. Now, in 2017, $600,000 was declared. How much did each class of stock receive?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck