Deck 10: Installment Buying and Revolving Charge Credit Cards

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

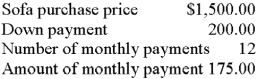

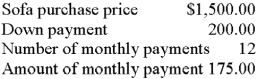

Question

Question

Question

Question

Question

Question

Question

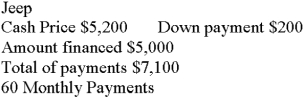

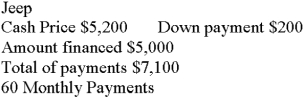

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/60

Play

Full screen (f)

Deck 10: Installment Buying and Revolving Charge Credit Cards

1

Amortization is not a payment process.

False

2

The U.S. Rule can be applied to open credit payments.

True

3

Amount financed is equal to:

A) Cash price times down payment

B) Cash price plus down payment

C) Cash price minus down payment

D) Cash price divided by down payment

E) None of these

A) Cash price times down payment

B) Cash price plus down payment

C) Cash price minus down payment

D) Cash price divided by down payment

E) None of these

Cash price minus down payment

4

The Truth in Lending Act regulates interest charges.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

5

The APR represents the stated interest rate.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

6

Calculating APR requires that the total amount financed be divided by the interest charge and then multiplied by 100.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

7

Finance charge equals total of all monthly payments minus amount financed.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

8

APR cannot be calculated by use a financial calculator.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

9

The amount financed equals the cash price plus the down payment.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

10

The average daily balance is the same as the daily balance.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

11

The cost of credit reports would be included in the amount financed.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

12

The Fair Credit and Charge Card Disclosure Act of 1988 is optional advice to credit card companies.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

13

Revolving charge accounts must be paid off completely by the end of the month.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

14

The monthly payment is calculated by totaling the finance charge and amount financed and dividing that by the number of payments of the loan.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

15

Average daily balance is equal to sum of daily balances divided by number of days in the billing cycle.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

16

A billing cycle is always 30 or 31 days.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

17

The finance charge is equal to the total of all monthly payments:

A) Plus amount financed

B) Minus amount financed

C) Divided by amount financed

D) Multiplied by amount financed

E) None of these

A) Plus amount financed

B) Minus amount financed

C) Divided by amount financed

D) Multiplied by amount financed

E) None of these

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

18

Today most companies calculate the finance charge on their credit card accounts as a percentage of the yearly balance.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

19

The Truth in Lending Act requires that the APR be stated accurately to the nearest 1/4 of 1%.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

20

The daily balance is the previous balance plus cash advances plus purchases minus any payments.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

21

In calculating the daily balance, cash advances are:

A) Added in

B) Subtracted out

C) Sometimes added in

D) Sometimes subtracted out

E) None of these

A) Added in

B) Subtracted out

C) Sometimes added in

D) Sometimes subtracted out

E) None of these

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

22

Most companies calculate the finance charge on credit card accounts as a percentage of the:

A) Daily balance

B) Weekly balance

C) Average daily balance

D) Average weekly balance

E) None of these

A) Daily balance

B) Weekly balance

C) Average daily balance

D) Average weekly balance

E) None of these

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

23

Pete Size read the following partial advertisement: Price $20,999; down payment $1,000; cash or trade; $390.85 per month for 60 months. Calculate (A) the total finance charge and (B) the APR.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

24

The APR represents the:

A) Stated rate of interest

B) True effective quarterly interest rate charged by seller

C) True effective annual rate of interest charged by buyer

D) True effective annual rate of interest charged by seller

E) None of these

A) Stated rate of interest

B) True effective quarterly interest rate charged by seller

C) True effective annual rate of interest charged by buyer

D) True effective annual rate of interest charged by seller

E) None of these

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

25

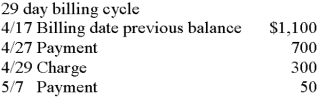

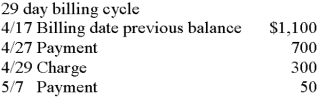

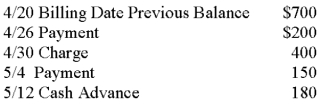

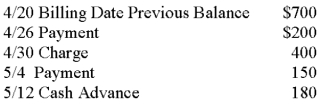

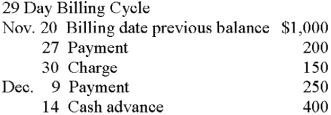

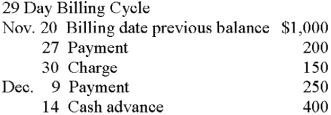

Given the following: The average daily balance is:

A) $910.34

B) $755.17

C) $810.43

D) $755.71

E) None of these

A) $910.34

B) $755.17

C) $810.43

D) $755.71

E) None of these

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

26

The average daily balance is equal to the sum of daily balances:

A) Plus number of days in billing cycle

B) Minus number of days in billing cycle

C) Divided by number of days in billing cycle

D) Multiplied by number of days in billing cycle

E) None of these

A) Plus number of days in billing cycle

B) Minus number of days in billing cycle

C) Divided by number of days in billing cycle

D) Multiplied by number of days in billing cycle

E) None of these

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

27

Given: $140.10 per month; cash price $5,600; down payment $0; 60 payments Cash or trade months with bank-approved credit; amount financed $5,600

Finance charge $2,806

Total payments $8,406

The APR is:

A) 17.30%

B) 17.00 %

C) 16.75 %

D) 16.50 %

E) None of these

Finance charge $2,806

Total payments $8,406

The APR is:

A) 17.30%

B) 17.00 %

C) 16.75 %

D) 16.50 %

E) None of these

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

28

Bill Moore bought a stereo selling for $5,800, putting down $1,200. The payment schedule was for 48 monthly payments of $117.50. What is the APR?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

29

Ed Sloan bought a new Explorer for $22,000. He put down $7,000 and paid $290 for 60 months. The total finance charge to Ed is:

A) $15,000

B) $17,400

C) $2,400

D) $4,200

E) None of these

A) $15,000

B) $17,400

C) $2,400

D) $4,200

E) None of these

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

30

Calculate average daily balance:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

31

Justin Chan bought a Scion car for a price of $8,200, putting down $800 and financing the remainder with 60 monthly payments of $179.99. The APR is:

A) Close to 15%

B) Close to 14%

C) Close to 13 ½%

D) Between 16.00 and 16.25%

E) None of these

A) Close to 15%

B) Close to 14%

C) Close to 13 ½%

D) Between 16.00 and 16.25%

E) None of these

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

32

John Sullivan bought a new Brunswick boat for $17,000. He made a $2,500 down payment on it. The bank's loan was for 60 months. Finance charges totaled $4,900. His monthly payment is:

A) $313.33

B) $323.33

C) $332.33

D) $232.33

E) None of these

A) $313.33

B) $323.33

C) $332.33

D) $232.33

E) None of these

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

33

Which one of the following statements is incorrect?

A) The Truth in Lending Act was passed in 1969

B) APR is the true effective annual interest charged by sellers

C) The Truth in Lending Act regulates interest charges

D) APR represents the true effective rate annual rate of interest

E) None of these

A) The Truth in Lending Act was passed in 1969

B) APR is the true effective annual interest charged by sellers

C) The Truth in Lending Act regulates interest charges

D) APR represents the true effective rate annual rate of interest

E) None of these

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

34

Mia Lane bought a high-definition television for $7,500. Based on her income, she could afford to pay back only $600 per month. There is 1 ½% monthly interest charge on the unpaid balance. The U.S. Rule is used in the calculation. At the end of month 1, the balance outstanding is:

A) $6,012.50

B) $5,012.50

C) $4,012.50

D) $3,012.50

E) None of these

A) $6,012.50

B) $5,012.50

C) $4,012.50

D) $3,012.50

E) None of these

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

35

Calculate the average daily balance (assume a 30-day billing cycle):

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

36

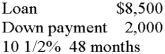

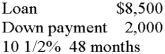

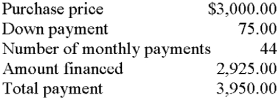

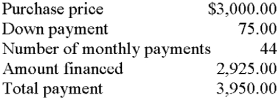

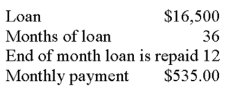

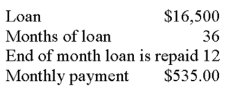

Calculate APR (to nearest hundredth percent):

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

37

Dan Miller bought a new Toyota truck for $28,000. Dan made a down payment of $6,000 and paid $390 monthly for 70 months. The total finance charge was:

A) $13,300

B) $5,300

C) $11,300

D) $27,300

E) None of these

A) $13,300

B) $5,300

C) $11,300

D) $27,300

E) None of these

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

38

Open credit in a revolving charge plan results in:

A) One purchase per month

B) The U.S. Rule being applied to each purchase

C) As many cash purchases till credit limit is reached

D) As many charged purchases till credit limit is reached

E) None of these

A) One purchase per month

B) The U.S. Rule being applied to each purchase

C) As many cash purchases till credit limit is reached

D) As many charged purchases till credit limit is reached

E) None of these

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

39

Pete Sole bought a used car for $8,000. Pete put down $2,000 and financed the balance at 10 1/2% for 60 months. What is his monthly payment?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

40

Marika Katz bought a $7,000 computer. Based on her income, Marika could afford to pay back only $700 per month. The charge on the unpaid balance is 1 1/2%. The U.S. Rule is used in the calculation. Calculate the balance outstanding after the second month.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

41

Able Long buys a new desk for $2,400. Able will pay back $250 per month. Monthly interest is 3% on the unpaid balance. Calculate the balance outstanding after the second payment. (Use the U.S. Rule.)

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

42

Kerry has a $1,973 per month mortgage payment. He decides to refinance his $204,000 balance at 5% over 20 years. What is his new monthly payment?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

43

Pete Frank bought a computer for $4,000. Pete put down $500 and financed the balance at 10 1/2% for 36 months. What is his monthly payment?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

44

Neal Selznick bought a new van for $10,000. Neal put down $1,000 and paid $275 monthly for 40 months. What is the total amount of finance charge that Neal paid at the end of 40 months?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

45

Jamie purchased a condo for $89,900 with a down payment of 20%; her credit terms were 5% for 15 years. What is Jamie's monthly payment?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

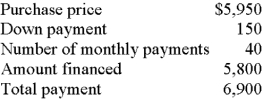

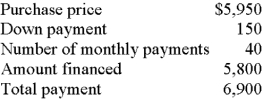

46

Calculate the monthly payment:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

47

Calculate the finance charge:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

48

Jennifer Rick buys a new typewriter for $590. Jennifer puts 20% down and will pay $70 a month for the next 10 months. What is (A) the amount of the loan, (B) the total amount of monthly payments, and (C) the total of the finance charge?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

49

Calculate APR by table from this advertisement:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

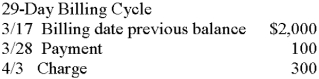

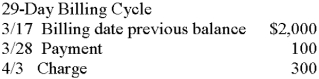

50

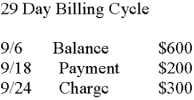

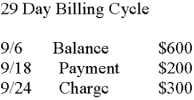

Mary Jones just received the following statement. Can you help her calculate (A) the average daily balance and (B) the finance charge?

Finance charge is 1½% of average daily balance.

Finance charge is 1½% of average daily balance.

Finance charge is 1½% of average daily balance.

Finance charge is 1½% of average daily balance.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

51

Given a mortgage of $100,000 at 7% for 15 years, prepare a one-month amortization schedule. What is the balance after the first month's payment?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

52

Mel Blanc bought a new dining room set for $6,600. Mel put down $1,000 and financed the balance at 12% for 36 months. What will his monthly payment be?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

53

Calculate the monthly payment:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

54

Earl Miller buys a new desk for $2,600. Miller will pay back $270 per month. Monthly interest is 5% on the unpaid balance. Calculate the balance outstanding after the second payment. (Use the U.S. Rule.)

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

55

Jane Ranch bought a tractor for $5,000. Jane has decided that she can afford to pay only $1,000 per month. Can you calculate at the end of month 2 the balance of the loan outstanding? Use the U.S. Rule. The monthly interest charged is 5% on the unpaid balance.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

56

Calculate APR:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

57

Calculate (A) the average daily balance and (B) the finance charge.

Finance charge is 2% of average daily balance.

Finance charge is 2% of average daily balance.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

58

Shelley purchased a home in Maryland Heights, MO, for $204,000. Her down payment was 20% of the cash price, and she obtained a mortgage for 20 years at 7%. What is Shelley's monthly payment and total finance charges?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

59

Calculate APR:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

60

Calculate (A) finance charge, (B) rebate, and (C) payoff.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck