Deck 11: The Monetary System

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/129

Play

Full screen (f)

Deck 11: The Monetary System

1

In response to the financial crisis in 2008, the Fed created which of the following policy tools?

A)the required reserve ratio

B)quantitative easing

C)the federal funds rate

D)open market operations

E)the discount rate

A)the required reserve ratio

B)quantitative easing

C)the federal funds rate

D)open market operations

E)the discount rate

quantitative easing

2

If the Fed buys $10 million of government securities when the desired reserve ratio is 20 percent and the currency drain ratio is 5 percent, the quantity of money

A)increases by $50 million.

B)decreases by $50 million.

C)increases by $42 million.

D)decreases by $42 million.

E)increases by $7.5 million.

A)increases by $50 million.

B)decreases by $50 million.

C)increases by $42 million.

D)decreases by $42 million.

E)increases by $7.5 million.

increases by $42 million.

3

When money is used to compare the relative price of a burrito and a taco, money is being used as a

A)measurement of inflation.

B)token of bartering.

C)store of value.

D)unit of account.

E)medium of exchange.

A)measurement of inflation.

B)token of bartering.

C)store of value.

D)unit of account.

E)medium of exchange.

D

4

A currency drain occurs when the

A)Fed increases the required reserve ratio.

B)Fed buys U.S. government securities.

C)banks reduce the number of loans they create with their excess reserves.

D)non-bank public increases its holdings of currency outside the banking system.

E)Fed sells U.S. government securities.

A)Fed increases the required reserve ratio.

B)Fed buys U.S. government securities.

C)banks reduce the number of loans they create with their excess reserves.

D)non-bank public increases its holdings of currency outside the banking system.

E)Fed sells U.S. government securities.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is NOT held as an asset by banks?

A)securities

B)checkable deposits

C)reserves

D)currency in the banks' vaults

E)loans

A)securities

B)checkable deposits

C)reserves

D)currency in the banks' vaults

E)loans

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

6

The Federal Open Market Committee is

A)comprised of the presidents of the 12 Federal Reserve banks.

B)the main policy making body of the Fed.

C)the government committee charged with determining income tax rates.

D)a seven-member board, each serving a 14-year term.

E)another name for the Board of Governors.

A)comprised of the presidents of the 12 Federal Reserve banks.

B)the main policy making body of the Fed.

C)the government committee charged with determining income tax rates.

D)a seven-member board, each serving a 14-year term.

E)another name for the Board of Governors.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

7

Assume First Central Bank has a desired reserve ratio of 15 percent; $80,000 in total deposits, loans equal to $60,000, and has $20,000 in actual reserves. First Central can make additional loans totaling

A)$12,000.

B)$8,000.

C)$60,000.

D)$80,000.

E)$20,000.

A)$12,000.

B)$8,000.

C)$60,000.

D)$80,000.

E)$20,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

8

The U.S. dollar is called

A)faith money.

B)convertible money because the government stands ready to convert it into gold or silver.

C)fiat money because the law decrees it is money.

D)frail money because wear and tear ruins paper bills.

E)commodity money, because it is convertible into gold.

A)faith money.

B)convertible money because the government stands ready to convert it into gold or silver.

C)fiat money because the law decrees it is money.

D)frail money because wear and tear ruins paper bills.

E)commodity money, because it is convertible into gold.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

9

When the Fed -------------------- securities in an open market operation, banks' reserves-------------------- , and therefore lending --------------------_.

A)sells; increase; increases

B)buys; decrease; decreases

C)buys; do not change; does not change

D)sells; decrease; increases

E)buys; increase; increases

A)sells; increase; increases

B)buys; decrease; decreases

C)buys; do not change; does not change

D)sells; decrease; increases

E)buys; increase; increases

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is NOT among the primary functions of money?

A)indicator of supply

B)medium of exchange

C)an object that is generally accepted in return for goods and services

D)unit of account

E)store of value

A)indicator of supply

B)medium of exchange

C)an object that is generally accepted in return for goods and services

D)unit of account

E)store of value

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

11

Open market operations are when the Fed buys or sells

A)government securities from banks or some other business.

B)government securities from the government.

C)corporate securities from the government.

D)gold.

E)corporate securities from banks or some other business.

A)government securities from banks or some other business.

B)government securities from the government.

C)corporate securities from the government.

D)gold.

E)corporate securities from banks or some other business.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

12

Credit cards are

I. a generally accepted form of payment and therefore part of M1.

Ii. are included in M1 because you write a check to pay your monthly bill.

iii. a means of borrowing money.

A)ii only

B)i and ii

C)i only

D)iii only

E)i and iii

I. a generally accepted form of payment and therefore part of M1.

Ii. are included in M1 because you write a check to pay your monthly bill.

iii. a means of borrowing money.

A)ii only

B)i and ii

C)i only

D)iii only

E)i and iii

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

13

If there is an increase in the amount of currency held outside banks, then the

A)quantity of money will increase.

B)quantity of money will decrease.

C)quantity of money and the monetary base will decrease.

D)quantity of money will not change.

E)monetary base will decrease.

A)quantity of money will increase.

B)quantity of money will decrease.

C)quantity of money and the monetary base will decrease.

D)quantity of money will not change.

E)monetary base will decrease.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

14

The above table gives assets and deposits for a (small)bank.

-The bank's deposits that are part of M2

Are equal to

A)$30.

B)$5,100.

C)$1600.

D)$600.

E)$3,100.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

15

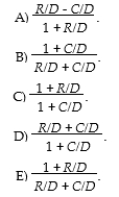

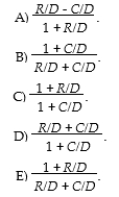

C/D is the currency drain ratio and R/D is the desired reserve ratio. The money multiplier equals

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

16

Suppose the desired reserve ratio is 10 percent. If the Commerce Bank has total deposits of $20,000, total assets of $10,000, and actual reserves of $8000, the amount of excess reserves is

A)$2,000.

B)$6,000.

C)$0.

D)$100.

E)$800.

A)$2,000.

B)$6,000.

C)$0.

D)$100.

E)$800.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

17

An open market purchase of securities by the Fed leads to all of the following EXCEPT

A)an increase in the monetary base.

B)an initial increase in excess reserves.

C)an increase in banks' reserves.

D)a decrease in the quantity of money.

E)an increase in bank lending.

A)an increase in the monetary base.

B)an initial increase in excess reserves.

C)an increase in banks' reserves.

D)a decrease in the quantity of money.

E)an increase in bank lending.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

18

If Federal Reserve notes and coins are $765 billion, and banks' reserves at the Fed are $8 billion, the gold stock is $11 billion, and the Fed owns $725 billion of government securities, what does the

Monetary base equal?

A)$744 billion

B)$1,509 billion

C)$773 billion

D)$765 billion

E)$776 billion

Monetary base equal?

A)$744 billion

B)$1,509 billion

C)$773 billion

D)$765 billion

E)$776 billion

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

19

If someone buries money in a tin can beneath a tree, the money is functioning as a

A)unit of account.

B)medium of exchange.

C)bartering tool.

D)store of value.

E)means of payment.

A)unit of account.

B)medium of exchange.

C)bartering tool.

D)store of value.

E)means of payment.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

20

The unit of account is defined as

A)the exchange of goods and services directly for other goods and services.

B)barter.

C)the medium of exchange.

D)an object that is accepted in return for goods and services.

E)an agreed upon measure for stating prices of goods and services.

A)the exchange of goods and services directly for other goods and services.

B)barter.

C)the medium of exchange.

D)an object that is accepted in return for goods and services.

E)an agreed upon measure for stating prices of goods and services.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

21

For anything to be considered money it must be

A)a mystical token, such as whale teeth.

B)a token, such as a green piece of paper.

C)either a commodity or a token, as long as it is generally accepted as a means of payment.

D)a valuable commodity, such as gold.

E)used in barter transactions.

A)a mystical token, such as whale teeth.

B)a token, such as a green piece of paper.

C)either a commodity or a token, as long as it is generally accepted as a means of payment.

D)a valuable commodity, such as gold.

E)used in barter transactions.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

22

When the First Bank of Townsville makes a loan, it

A)increases its reserves.

B)prints money.

C)decreases the quantity of money.

D)borrows the money from the Fed.

E)creates a checkable deposit.

A)increases its reserves.

B)prints money.

C)decreases the quantity of money.

D)borrows the money from the Fed.

E)creates a checkable deposit.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

23

When the Fed sells $100 million of securities to a commercial bank the

A)required reserve ratio decreases.

B)money supply increases.

C)bank's reserves decrease.

D)monetary base increases.

E)bank's reserves do not change.

A)required reserve ratio decreases.

B)money supply increases.

C)bank's reserves decrease.

D)monetary base increases.

E)bank's reserves do not change.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

24

Suppose the Fed sells $100 of government securities. If the desired reserve ratio is 20 percent and there is no currency drain, then the quantity of money

A)decreases by $80.

B)decreases by $400.

C)decreases by $100.

D)increases by $100.

E)decreases by $500.

A)decreases by $80.

B)decreases by $400.

C)decreases by $100.

D)increases by $100.

E)decreases by $500.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

25

A debit card is

A)not money because it is not officially issued by the government.

B)part of the M2 money supply but not part of the M1 money supply.

C)not money but is used to transfer bank deposits which are money.

D)money because it is generally accepted as a means of payment.

E)money because it is a means of payment.

A)not money because it is not officially issued by the government.

B)part of the M2 money supply but not part of the M1 money supply.

C)not money but is used to transfer bank deposits which are money.

D)money because it is generally accepted as a means of payment.

E)money because it is a means of payment.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

26

If the Fed increases the discount rate,

A)commercial banks pay a lower interest rate if they borrow from the Fed.

B)commercial banks increase their lending to the Fed.

C)commercial banks pay a higher interest rate if they borrow from the Fed.

D)commercial banks' assets increase.

E)commercial banks find it more profitable to increase their loans to businesses.

A)commercial banks pay a lower interest rate if they borrow from the Fed.

B)commercial banks increase their lending to the Fed.

C)commercial banks pay a higher interest rate if they borrow from the Fed.

D)commercial banks' assets increase.

E)commercial banks find it more profitable to increase their loans to businesses.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

27

A commercial bank's reserves are equal to the amount of

A)currency in the bank's vault plus the balance on its reserve account at a Federal Reserve Bank.

B)the bank's loans.

C)only the currency in its vault.

D)the bank's deposits.

E)the bank's government securities.

A)currency in the bank's vault plus the balance on its reserve account at a Federal Reserve Bank.

B)the bank's loans.

C)only the currency in its vault.

D)the bank's deposits.

E)the bank's government securities.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

28

A commercial bank's main goal is to

A)open checking accounts.

B)help the government when it needs money.

C)lend money to the Federal Reserve banks.

D)provide loans to its customers.

E)maximize the wealth of its stockholders.

A)open checking accounts.

B)help the government when it needs money.

C)lend money to the Federal Reserve banks.

D)provide loans to its customers.

E)maximize the wealth of its stockholders.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

29

If the Fed sells government securities to a member of the nonbank public, then the resulting effect on the quantity of money is

A)the same as if the securities were sold to a bank.

B)much smaller than if the securities were sold to a bank.

C)much larger than if the securities were sold to a bank.

D)that there is no change in the quantity of money.

E)None of the above answers are correct.

A)the same as if the securities were sold to a bank.

B)much smaller than if the securities were sold to a bank.

C)much larger than if the securities were sold to a bank.

D)that there is no change in the quantity of money.

E)None of the above answers are correct.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

30

During the 2008 financial crisis, banks restricted--------------------and the M2 money multiplier--------------------

A)lending; increased

B)lending; decreased

C)deposits; decreased

D)deposits; increased

E)buying securities; increased

A)lending; increased

B)lending; decreased

C)deposits; decreased

D)deposits; increased

E)buying securities; increased

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

31

The desired reserve ratio is 3 percent. Robert deposits $3,000 in Bank America. Bank America keeps its minimum desired reserves and lends the excess to Fredrica. How much does Bank America lend to Fredrica?

A)$3,000

B)$2,910

C)$2700

D)$900

E)$300

A)$3,000

B)$2,910

C)$2700

D)$900

E)$300

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

32

The Fed buys $100 million U.S. government securities from Bank of America. Bank of America's balance sheet shows this transaction as --------------------in total assets and --------------------in reserves.

A)a $100 million increase; no change

B)no change; a $100 million decrease

C)a $100 million increase; a $100 million increase

D)a $100 million decrease; a $100 million decrease

E)no change; a $100 million increase

A)a $100 million increase; no change

B)no change; a $100 million decrease

C)a $100 million increase; a $100 million increase

D)a $100 million decrease; a $100 million decrease

E)no change; a $100 million increase

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

33

Checkable deposits are money because

A)only banks and other financial institutions can offer them.

B)they are protected by the Federal Reserve.

C)they are guaranteed by banks.

D)they can be converted into currency on demand and are used directly as a means of payment.

E)checks bounce when there are not enough funds to cash them.

A)only banks and other financial institutions can offer them.

B)they are protected by the Federal Reserve.

C)they are guaranteed by banks.

D)they can be converted into currency on demand and are used directly as a means of payment.

E)checks bounce when there are not enough funds to cash them.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

34

Actual reserves are equal to

A)required reserves plus fractional deposits.

B)minimum balances plus desired reserves.

C)excess reserves plus liabilities.

D)desired reserves plus excess reserves.

E)government securities plus cash in the bank's vault.

A)required reserves plus fractional deposits.

B)minimum balances plus desired reserves.

C)excess reserves plus liabilities.

D)desired reserves plus excess reserves.

E)government securities plus cash in the bank's vault.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

35

Money market mutual funds

A)are included in M1 and M2.

B)are included in M2 but not M1.

C)are included in M1 but not M2.

D)are the largest part of the monetary base.

E)None of the above are correct.

A)are included in M1 and M2.

B)are included in M2 but not M1.

C)are included in M1 but not M2.

D)are the largest part of the monetary base.

E)None of the above are correct.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

36

--------------------like a check and--------------------considered money.

A)E-checks work; are

B)E-cash works; is

C)Debit cards work; are

D)E-cash works; is not

E)Debit cards work; are not

A)E-checks work; are

B)E-cash works; is

C)Debit cards work; are

D)E-cash works; is not

E)Debit cards work; are not

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

37

Suppose the currency drain ratio is 33.33 percent and the desired reserve ratio is 10 percent. The money multiplier equals

A)3.08.

B)6.67.

C)3.00.

D)4.27.

E)2.50.

A)3.08.

B)6.67.

C)3.00.

D)4.27.

E)2.50.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

38

Excess reserves are the

A)same as the required reserves.

B)amount of reserves the Fed requires banks to hold.

C)amount of reserves a bank holds at the Fed.

D)amount of reserves banks keep in their vaults.

E)amount of reserves held over what is desired.

A)same as the required reserves.

B)amount of reserves the Fed requires banks to hold.

C)amount of reserves a bank holds at the Fed.

D)amount of reserves banks keep in their vaults.

E)amount of reserves held over what is desired.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

39

If the Fed purchases securities in the amount of $100,000 from First Union Bank, then the

A)assets of First Union Bank decrease by $100,000.

B)assets of the Fed decrease by $100,000.

C)liabilities of the Fed change in composition but not in amount.

D)assets of First Union Bank change in composition but not in the amount.

E)liabilities of First Union decrease by $100,000.

A)assets of First Union Bank decrease by $100,000.

B)assets of the Fed decrease by $100,000.

C)liabilities of the Fed change in composition but not in amount.

D)assets of First Union Bank change in composition but not in the amount.

E)liabilities of First Union decrease by $100,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

40

When we put a price tag on goods and services, we are using money as a

A)store of value.

B)unit of account.

C)barter token.

D)medium of exchange.

E)means of payment.

A)store of value.

B)unit of account.

C)barter token.

D)medium of exchange.

E)means of payment.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

41

If the desired reserve ratio increases, then

A)banks are able to make more loans.

B)the Fed has supplied banks with more reserves.

C)bank customers become more willing to make deposits in banks.

D)banks' desired reserves increase and their excess reserves decrease.

E)banks can buy more government securities.

A)banks are able to make more loans.

B)the Fed has supplied banks with more reserves.

C)bank customers become more willing to make deposits in banks.

D)banks' desired reserves increase and their excess reserves decrease.

E)banks can buy more government securities.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

42

A bank has $250 in checking deposits, $1,000 in savings deposits, $1,200 in time deposits, $1,000 in loans to businesses, $400 in outstanding credit card balances, $800 in government securities, $25 in currency in its vault, and $25 in deposits at the Fed. Of these,-------------------- are part of M2.

A)$2,600

B)$2,200

C)$2,850

D)$3,450

E)$2,450

A)$2,600

B)$2,200

C)$2,850

D)$3,450

E)$2,450

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following are policy tools used by the Federal Reserve?

I. the federal personal income tax

Ii. open market operations

Iii. changing the required reserve ratio

A)ii only

B)ii and iii

C)i, ii, and iii

D)iii only

E)i only

I. the federal personal income tax

Ii. open market operations

Iii. changing the required reserve ratio

A)ii only

B)ii and iii

C)i, ii, and iii

D)iii only

E)i only

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

44

The monetary base is the

A)sum of government securities and loans to banks held by the Fed.

B)sum of gold and foreign exchange held by the Fed.

C)sum of coins, Federal Reserve notes, and banks' reserves at the Fed.

D)minimum reserve banks must hold to cover any losses from unpaid loans.

E)sum of coins, required reserves, and banks' loans.

A)sum of government securities and loans to banks held by the Fed.

B)sum of gold and foreign exchange held by the Fed.

C)sum of coins, Federal Reserve notes, and banks' reserves at the Fed.

D)minimum reserve banks must hold to cover any losses from unpaid loans.

E)sum of coins, required reserves, and banks' loans.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

45

A currency drain is cash--------------------and has-------------------- effect on the money multiplier.

A)draining into the banks; an

B)draining into the banks; no

C)held outside the banks; an

D)held as reserves; no

E)held at the Fed; an

A)draining into the banks; an

B)draining into the banks; no

C)held outside the banks; an

D)held as reserves; no

E)held at the Fed; an

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

46

If the desired reserve ratio is 7 percent and a bank has $10,000 of deposits, then its desired reserves are

A)$7.

B)$9,300.

C)$700.

D)$930.

E)$7,000.

A)$7.

B)$9,300.

C)$700.

D)$930.

E)$7,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following is NOT a function of money?

I. unit of account

Ii. store of value iii. unit of debt

A)i only

B)ii only

C)iii only

D)Both ii and iii

E)Both i and ii

I. unit of account

Ii. store of value iii. unit of debt

A)i only

B)ii only

C)iii only

D)Both ii and iii

E)Both i and ii

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

48

New money is created in the U.S. economy by

A)U.S. Department of Mint.

B)the U.S. Congress.

C)increased federal government expenditures.

D)the U.S. Treasury.

E)banks that create checkable deposits.

A)U.S. Department of Mint.

B)the U.S. Congress.

C)increased federal government expenditures.

D)the U.S. Treasury.

E)banks that create checkable deposits.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

49

When Maria deposits $100 in currency in her checkable deposit at Bank of America, the immediate effect is that the quantity of M1

A)changes, but the direction of the change depends on whether the deposit was accepted by a thrift institution or a commercial bank.

B)increases.

C)decreases.

D)changes only if Bank of America does not have excess reserves.

E)does not change.

A)changes, but the direction of the change depends on whether the deposit was accepted by a thrift institution or a commercial bank.

B)increases.

C)decreases.

D)changes only if Bank of America does not have excess reserves.

E)does not change.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

50

A barter system of payment is

A)similar to a money system of payment because both use one asset as a unit of account.

B)different from a money system of payment because the barter system is a better unit of account.

C)similar to a money system of payment because both are used as stores of value and units of account.

D)similar to a money system of payment because both require a double coincidence of wants.

E)different from a money system of payment because money does not require a double coincidence of wants.

A)similar to a money system of payment because both use one asset as a unit of account.

B)different from a money system of payment because the barter system is a better unit of account.

C)similar to a money system of payment because both are used as stores of value and units of account.

D)similar to a money system of payment because both require a double coincidence of wants.

E)different from a money system of payment because money does not require a double coincidence of wants.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

51

If the Fed buys government securities from the non-bank public, then

A)deposits at banks decrease and banks' reserves increase.

B)loans at banks decrease.

C)reserves at banks decrease.

D)deposits at banks increase and banks' reserves decrease.

E)deposits at banks increase and banks' reserves increase.

A)deposits at banks decrease and banks' reserves increase.

B)loans at banks decrease.

C)reserves at banks decrease.

D)deposits at banks increase and banks' reserves decrease.

E)deposits at banks increase and banks' reserves increase.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

52

At any point in time, a single bank can loan an amount equal to

A)its required reserves.

B)its excess reserves.

C)its total reserves.

D)the amount of loans the bank made in the past.

E)its government securities.

A)its required reserves.

B)its excess reserves.

C)its total reserves.

D)the amount of loans the bank made in the past.

E)its government securities.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

53

--------------------in the currency drain ratio and --------------------in the desired reserve ratio the money

Multiplier.

A)An increase; a decrease; decrease

B)A decrease; a decrease; increase

C)An increase; a decrease; increase

D)An increase; an increase; increase

E)A decrease; an increase; decrease

Multiplier.

A)An increase; a decrease; decrease

B)A decrease; a decrease; increase

C)An increase; a decrease; increase

D)An increase; an increase; increase

E)A decrease; an increase; decrease

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

54

Assume the desired reserve ratio is 10 percent, banks loan all excess reserves and the currency Drain is zero. If the Fed sells $100 million of U.S. government securities to Boise Bank, the monetary Base increases by

A)$100 million.

B)$10 million.

C)$1,000 million.

D)$1 million.

E)$90 million.

A)$100 million.

B)$10 million.

C)$1,000 million.

D)$1 million.

E)$90 million.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

55

The desired reserve ratio is 10 percent and banks have no excess reserves. Juliet deposits $300 in her bank. What is the maximum that Juliet's bank can now loan?

A)$330

B)$270

C)$300

D)$30

E)$3,000

A)$330

B)$270

C)$300

D)$30

E)$3,000

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

56

The-------------------- the desired reserve ratio, the -------------------- the-------------------- in the quantity of money created from an initial increase of $100,000 in the monetary base.

A)larger; larger; decrease

B)larger; smaller; decrease

C)larger; larger; increase

D)smaller; larger; decrease

E)smaller; larger; increase

A)larger; larger; decrease

B)larger; smaller; decrease

C)larger; larger; increase

D)smaller; larger; decrease

E)smaller; larger; increase

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following best describes a double coincidence of wants?

A)You have what another wants and you want what they have.

B)Neither buyer wants a good.

C)Two buyers want the same good.

D)A buyer and a seller rather than two buyers or two sellers must meet.

E)None of the above answers is correct.

A)You have what another wants and you want what they have.

B)Neither buyer wants a good.

C)Two buyers want the same good.

D)A buyer and a seller rather than two buyers or two sellers must meet.

E)None of the above answers is correct.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following is money?

A)debit cards

B)checkable deposits

C)e-checks

D)checks

E)credit cards

A)debit cards

B)checkable deposits

C)e-checks

D)checks

E)credit cards

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

59

M1 is composed of

A)currency held by individuals and businesses, traveler's checks, and checkable deposits owned by individuals and businesses.

B)traveler's checks, credit cards, and e-cash.

C)currency held by individuals and businesses, traveler's checks, and the credit line on credit cards.

D)checkable deposits owned by individuals and businesses, saving deposits, and certificates of deposit.

E)currency inside of banks, traveler's checks, and government-issued checks.

A)currency held by individuals and businesses, traveler's checks, and checkable deposits owned by individuals and businesses.

B)traveler's checks, credit cards, and e-cash.

C)currency held by individuals and businesses, traveler's checks, and the credit line on credit cards.

D)checkable deposits owned by individuals and businesses, saving deposits, and certificates of deposit.

E)currency inside of banks, traveler's checks, and government-issued checks.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

60

The voting members of the Federal Open Market Committee consists of the

A)six Board of Governor members and six Federal Reserve Bank presidents.

B)12 Board of Governor members and the seven Federal Reserve Bank presidents.

C)12 Board of Governor members and the five Federal Reserve Bank presidents.

D)seven Board of Governor members and the 12 Federal Reserve Bank presidents.

E)seven Board of Governor members and five Federal Reserve Bank presidents.

A)six Board of Governor members and six Federal Reserve Bank presidents.

B)12 Board of Governor members and the seven Federal Reserve Bank presidents.

C)12 Board of Governor members and the five Federal Reserve Bank presidents.

D)seven Board of Governor members and the 12 Federal Reserve Bank presidents.

E)seven Board of Governor members and five Federal Reserve Bank presidents.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

61

The Citizens First Bank sells $100,000 of government securities to the Fed. This sale immediately

A)decreases the bank's checkable deposits.

B)increases the bank's reserves.

C)decreases the quantity of money.

D)decreases the bank's assets.

E)increases the bank's required reserves.

A)decreases the bank's checkable deposits.

B)increases the bank's reserves.

C)decreases the quantity of money.

D)decreases the bank's assets.

E)increases the bank's required reserves.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

62

The discount rate is

A)equal to the nominal interest rate minus the inflation rate.

B)the interest rate that commercial banks have to pay for any reserves that they borrow from the non-bank public.

C)the interest rate that commercial banks receive for the reserves that they have on reserve at the Fed.

D)the interest rate that commercial banks have to pay to the owners of bank deposits.

E)the interest rate that commercial banks pay for reserves that they borrow from the Fed.

A)equal to the nominal interest rate minus the inflation rate.

B)the interest rate that commercial banks have to pay for any reserves that they borrow from the non-bank public.

C)the interest rate that commercial banks receive for the reserves that they have on reserve at the Fed.

D)the interest rate that commercial banks have to pay to the owners of bank deposits.

E)the interest rate that commercial banks pay for reserves that they borrow from the Fed.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

63

Banks can make loans as long as they have

A)reserves.

B)required reserves.

C)excess reserves.

D)excess government securities.

E)deposits.

A)reserves.

B)required reserves.

C)excess reserves.

D)excess government securities.

E)deposits.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

64

The process of money creation by the banking system is limited, in part, by the

A)laws passed each year by the U.S. Congress.

B)Comptroller of the Currency.

C)desired reserve ratio.

D)number of banks.

E)number of depositors.

A)laws passed each year by the U.S. Congress.

B)Comptroller of the Currency.

C)desired reserve ratio.

D)number of banks.

E)number of depositors.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

65

--------------------by the Fed means that the Fed--------------------

A)Credit easing; bought private securities from financial institutions

B)Quantitative easing; required private banks to increase their lending to home buyers

C)Credit easing; made loans directly to home buyers

D)Quantitative easing; decreased in the required reserve ratio

E)Credit easing; tried to lower long-term interest rates

A)Credit easing; bought private securities from financial institutions

B)Quantitative easing; required private banks to increase their lending to home buyers

C)Credit easing; made loans directly to home buyers

D)Quantitative easing; decreased in the required reserve ratio

E)Credit easing; tried to lower long-term interest rates

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

66

A commercial bank is defined as

A)a firm that is chartered to accept deposits and make loans.

B)the institution that sets regulations for commercial activities.

C)any institution that accepts deposits.

D)a firm that obtains funds by selling shares and then buys U.S. Treasury bills.

E)any institution that makes loans.

A)a firm that is chartered to accept deposits and make loans.

B)the institution that sets regulations for commercial activities.

C)any institution that accepts deposits.

D)a firm that obtains funds by selling shares and then buys U.S. Treasury bills.

E)any institution that makes loans.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following is a thrift institution?

I. a credit union

Ii. the Fed

Iii. a savings bank

A)Both i and iii

B)i only

C)ii only

D)i, ii, and iii

E)iii only

I. a credit union

Ii. the Fed

Iii. a savings bank

A)Both i and iii

B)i only

C)ii only

D)i, ii, and iii

E)iii only

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

68

The goal of a commercial bank is to

A)minimize its taxes paid to state governments.

B)maximize its stockholders' wealth.

C)establish good regulations for commercial activities.

D)accept only deposits made in money.

E)make only safe, no-risk loans.

A)minimize its taxes paid to state governments.

B)maximize its stockholders' wealth.

C)establish good regulations for commercial activities.

D)accept only deposits made in money.

E)make only safe, no-risk loans.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

69

If the Fed buys a $100,000 government security from a bank when the desired reserve ratio is 10 percent and the currency drain ratio is 50 percent, the bank can loan a maximum of

A)$100,000.

B)$60,000.

C)$40,000.

D)$90,000.

E)$50,000.

A)$100,000.

B)$60,000.

C)$40,000.

D)$90,000.

E)$50,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

70

If Joe withdraws a $100 bill from his checking account and Jack deposits another $100 bill in his savings account, by how will M1 and M2 change?

A)M1 will increase, and M2 will increase.

B)Both M1 and M2 will remain the same.

C)M1 will decrease, but M2 will remain the same.

D)M1 will remain the same, and M2 will increase.

E)M2 will decrease by $100.

A)M1 will increase, and M2 will increase.

B)Both M1 and M2 will remain the same.

C)M1 will decrease, but M2 will remain the same.

D)M1 will remain the same, and M2 will increase.

E)M2 will decrease by $100.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

71

What is a problem with barter that makes it so difficult to use?

A)Barter requires use of only fiat money.

B)Barter omits the store of value role for money.

C)Individuals have to produce something to trade with.

D)Barter is very efficient but illegal because it avoids taxation.

E)Barter requires a double coincidence of wants.

A)Barter requires use of only fiat money.

B)Barter omits the store of value role for money.

C)Individuals have to produce something to trade with.

D)Barter is very efficient but illegal because it avoids taxation.

E)Barter requires a double coincidence of wants.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

72

If Jose deposits $2,000 in his bank and the desired reserve ratio is 10 percent, what is the amount of new loans that the bank can make?

A)$2,000

B)$2,200

C)$200

D)$1,800

E)$1,900

A)$2,000

B)$2,200

C)$200

D)$1,800

E)$1,900

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

73

A credit card is

A)not money.

B)money.

C)not money but the card's credit line is money.

D)barter money.

E)fiat money.

A)not money.

B)money.

C)not money but the card's credit line is money.

D)barter money.

E)fiat money.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

74

The amount of loans that a bank can create is limited by

A)the bank's excess reserves.

B)the bank's government securities.

C)a directive from the Federal Reserve System, which takes into account the bank's financial stability.

D)a law enacted by Congress.

E)the real interest rate.

A)the bank's excess reserves.

B)the bank's government securities.

C)a directive from the Federal Reserve System, which takes into account the bank's financial stability.

D)a law enacted by Congress.

E)the real interest rate.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

75

If the Fed buys government securities, then

A)banks' excess reserves decrease.

B)the quantity of money is not changed, just its composition.

C)bank reserves are destroyed.

D)the quantity of money decreases.

E)new bank reserves are created.

A)banks' excess reserves decrease.

B)the quantity of money is not changed, just its composition.

C)bank reserves are destroyed.

D)the quantity of money decreases.

E)new bank reserves are created.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

76

If currency outside of banks is $800 billion; traveler's checks are $10 billion; checkable deposits owned by individuals and businesses are $700 billion; savings deposits are $4,000 billion; small time deposits are $1,000 billion; and money market funds and other deposits are $800 billion, then M2 equals-------------------- billion.

A)$5,800

B)$1,510

C)$7,310

D)$710

E)$2,510

A)$5,800

B)$1,510

C)$7,310

D)$710

E)$2,510

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

77

The required reserve ratio is 20 percent and banks have no excess reserves. Katie deposits $300 in her bank. What are the bank's excess reserves immediately after Katie makes her deposit?

A)$30

B)$240

C)$90

D)$300

E)$60

A)$30

B)$240

C)$90

D)$300

E)$60

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

78

The Board of Governors has

A)seven members appointed to 14-year terms.

B)seven members appointed for life.

C)14 members appointed to 10-year terms.

D)four members appointed to seven-year terms.

E)14 members appointed to four-year terms.

A)seven members appointed to 14-year terms.

B)seven members appointed for life.

C)14 members appointed to 10-year terms.

D)four members appointed to seven-year terms.

E)14 members appointed to four-year terms.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

79

Regulating the amount of money in the United States is one of the most important responsibilities of the

A)State Department.

B)U.S. Mint.

C)Treasury Department.

D)Federal Reserve.

E)state governments.

A)State Department.

B)U.S. Mint.

C)Treasury Department.

D)Federal Reserve.

E)state governments.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

80

The monetary base is equal to the sum of coins,

A)and checkable deposits at banks.

B)currency and checkable deposits at banks.

C)U.S. government securities owned by the Federal Reserve and Federal Reserve notes.

D)currency, banks' reserves at the Federal Reserve and checkable deposits at banks.

E)currency and banks' reserves at the Federal Reserve.

A)and checkable deposits at banks.

B)currency and checkable deposits at banks.

C)U.S. government securities owned by the Federal Reserve and Federal Reserve notes.

D)currency, banks' reserves at the Federal Reserve and checkable deposits at banks.

E)currency and banks' reserves at the Federal Reserve.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck