Deck 10: Finance, Saving, and Investment

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/151

Play

Full screen (f)

Deck 10: Finance, Saving, and Investment

1

Other things remaining the same, a--------------------in the real interest rate--------------------the quantity saving supplied and-------------------- the quantity of loanable funds supplied.

A)rise; increases; increases

B)rise; increases; decreases

C)fall; increases; increases

D)fall; decreases; increases

E)fall; increases; decreases

A)rise; increases; increases

B)rise; increases; decreases

C)fall; increases; increases

D)fall; decreases; increases

E)fall; increases; decreases

rise; increases; increases

2

If there is no Ricardo-Barro effect, a government budget surplus--------------------

loanable funds and --------------------the real interest rate.

A)decreases; raises

B)increases; lowers

C)increases; raises

D)does not change; does not change

E)decreases; lowers

loanable funds and --------------------the real interest rate.

A)decreases; raises

B)increases; lowers

C)increases; raises

D)does not change; does not change

E)decreases; lowers

increases; lowers

3

The quantity of loanable funds demanded increases if the real interest rate falls, all other things remaining the same, because the real interest rate

A)determines the cost of living.

B)affects the supply of saving which, in turn, determines the quantity of investment.

C)affects the quantity of saving supplied.

D)is not related to the price of bonds and stocks.

E)is the opportunity cost of investment.

A)determines the cost of living.

B)affects the supply of saving which, in turn, determines the quantity of investment.

C)affects the quantity of saving supplied.

D)is not related to the price of bonds and stocks.

E)is the opportunity cost of investment.

E

4

The above table has the private demand for loanable funds and the private supply of loanable funds schedules.

- If the government budget surplus is $200 billion, and there is no Ricardo-Barro effect, the equilibrium real interest rate is --------------------and the equilibrium quantity of loanable funds is --------------------.

A)4 percent; $700 billion

B)6 percent; $600 billion

C)8 percent, $500 billion

D)4 percent; $500 billion

E)8 percent; $700 billion

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following factors does NOT shift the supply of loanable funds curve?

I. change in disposable income

Ii. change in wealth

Iii. change in expected profit

A)ii only

B)i only

C)i and ii

D)iii only

E)ii and iii

I. change in disposable income

Ii. change in wealth

Iii. change in expected profit

A)ii only

B)i only

C)i and ii

D)iii only

E)ii and iii

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following represents ownership of a firm?

A)stocks

B)bonds

C)commodities

D)short-term securities

E)loans

A)stocks

B)bonds

C)commodities

D)short-term securities

E)loans

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

7

In the loanable funds market, which of the following is an example of investment demand?

A)Mary buying stocks for her retirement portfolio

B)Mark buying rare gold coins

C)Brian, owner of Bryan Games, purchasing computers to enhance the production of games

D)George purchasing United States savings bonds for his son's college fund

E)Scott purchasing a rookie-year baseball card for last year's World Series MVP

A)Mary buying stocks for her retirement portfolio

B)Mark buying rare gold coins

C)Brian, owner of Bryan Games, purchasing computers to enhance the production of games

D)George purchasing United States savings bonds for his son's college fund

E)Scott purchasing a rookie-year baseball card for last year's World Series MVP

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

8

If expectations about future income change, there is

A)an increase in saving if people expect income to increase in the future.

B)a decrease saving if people expect income to decrease in the future.

C)a change in the quantity of loanable funds supplied and a movement along the supply of loanable funds curve.

D)no change in saving until income actually changes.

E)a decrease in saving if people expect income to increase in the future.

A)an increase in saving if people expect income to increase in the future.

B)a decrease saving if people expect income to decrease in the future.

C)a change in the quantity of loanable funds supplied and a movement along the supply of loanable funds curve.

D)no change in saving until income actually changes.

E)a decrease in saving if people expect income to increase in the future.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

9

If the real interest rate

A)rises, the supply of loanable funds curve shifts rightward.

B)falls, the supply of loanable funds curve shifts leftward.

C)falls, there is a movement along the supply of loanable funds curve to a higher quantity of saving.

D)falls, there is a movement along the supply curve of loanable funds to a lower quantity of loanable funds .

E)rises, the supply of loanable funds curve shifts leftward.

A)rises, the supply of loanable funds curve shifts rightward.

B)falls, the supply of loanable funds curve shifts leftward.

C)falls, there is a movement along the supply of loanable funds curve to a higher quantity of saving.

D)falls, there is a movement along the supply curve of loanable funds to a lower quantity of loanable funds .

E)rises, the supply of loanable funds curve shifts leftward.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

10

Ford Motor Corporation is considering purchasing new technology that will increase productivity by twenty percent. If Ford Motor Corporation decides to make this investment at the going real interest rate, then

A)the demand for loanable funds increases.

B)the quantity of loanable funds demanded increases.

C)the supply of loanable funds increases.

D)saving increases.

E)Ford's profits will decline.

A)the demand for loanable funds increases.

B)the quantity of loanable funds demanded increases.

C)the supply of loanable funds increases.

D)saving increases.

E)Ford's profits will decline.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

11

The above table has the private demand for loanable funds and the private supply of loanablefunds schedules.

- If the government budget surplus is $200 billion, and there is a Ricardo-Barro effect, the equilibrium real interest rate is-------------------- and the equilibrium quantity of loanable funds is --------------------.

A)6 percent; $600 billion

B)4 percent; $500 billion

C)8 percent; $700 billion

D)8 percent, $500 billion

E)4 percent; $700 billion

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

12

On January 1, Rick's Photo owned $50,000 of equipment. During the year, the value of the equipment fell by $10,000, plus Rick bought $25,000 in new equipment. Rick's company experienced

A)an increase of net investment of $35,000.

B)a change in total financial capital of $15,000.

C)an increase of new capital by $10,000.

D)$40,000 of depreciation.

E)$10,000 of depreciation.

A)an increase of net investment of $35,000.

B)a change in total financial capital of $15,000.

C)an increase of new capital by $10,000.

D)$40,000 of depreciation.

E)$10,000 of depreciation.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

13

The difference between the amount of capital at the beginning of a year and the amount of capital at the end of the year is equal to

A)gross investment.

B)depreciation.

C)net investment.

D)financial consumption.

E)capital consumption.

A)gross investment.

B)depreciation.

C)net investment.

D)financial consumption.

E)capital consumption.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

14

The demand for loanable funds

A)increases when wealth increases.

B)increases in a recession.

C)decreases in an expansion.

D)decreases when wealth increases.

E)increases when firms are optimistic about the profit from investing in capital.

A)increases when wealth increases.

B)increases in a recession.

C)decreases in an expansion.

D)decreases when wealth increases.

E)increases when firms are optimistic about the profit from investing in capital.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

15

The table above gives a nation's investment demand and saving supply schedules. It also has the government's net taxes and expenditures.

-The government has a budget

A)surplus of $20 billion.

B)deficit of $20 billion.

C)deficit of $60 billion.

D)surplus of $60 billion.

E)surplus of $40 billion.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

16

For a government to add to the supply of loanable funds, it must

A)increase its investment demand.

B)have a budget deficit.

C)raise the real interest rate.

D)borrow.

E)have a budget surplus.

A)increase its investment demand.

B)have a budget deficit.

C)raise the real interest rate.

D)borrow.

E)have a budget surplus.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

17

Suppose the government has a budget surplus of $2 billion. If there is no Ricardo-Barro effect, what

Occurs?

A)The supply of loanable funds curve shifts leftward, lowering the interest rate, and increasing investment.

B)The supply of loanable funds curve shifts leftward, raising the interest rate, and decreasing investment.

C)The demand for loanable funds curve shifts rightward, raising the interest rate, and increasing investment.

D)The demand for loanable funds curve shifts leftward, lowering the interest rate, and decreasing investment.

E)The supply of loanable funds curve shifts rightward, lowering the interest rate, and increasing investment.

Occurs?

A)The supply of loanable funds curve shifts leftward, lowering the interest rate, and increasing investment.

B)The supply of loanable funds curve shifts leftward, raising the interest rate, and decreasing investment.

C)The demand for loanable funds curve shifts rightward, raising the interest rate, and increasing investment.

D)The demand for loanable funds curve shifts leftward, lowering the interest rate, and decreasing investment.

E)The supply of loanable funds curve shifts rightward, lowering the interest rate, and increasing investment.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

18

Financial capital

A)is accumulated investment.

B)depreciates each year.

C)is another name for the machines and tools that businesses buy.

D)depends on saving and borrowing decisions.

E)is independent of physical capital.

A)is accumulated investment.

B)depreciates each year.

C)is another name for the machines and tools that businesses buy.

D)depends on saving and borrowing decisions.

E)is independent of physical capital.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

19

The crowding-out effect is the tendency for

A)higher government budget deficits to increase total savings.

B)higher private savings to decrease government budget surpluses.

C)lower private saving to decrease investment.

D)higher government budget deficits to decrease investment.

E)lower private saving to increase the budget deficit.

A)higher government budget deficits to increase total savings.

B)higher private savings to decrease government budget surpluses.

C)lower private saving to decrease investment.

D)higher government budget deficits to decrease investment.

E)lower private saving to increase the budget deficit.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

20

The above table has the private demand for loanable funds and the private supply of loanable funds schedules.

- If the government budget deficit is $200 billion, and there is a Ricardo-Barro effect, the equilibrium real interest rate is and the equilibrium quantity of loanable funds is--------------------.

A)4 percent; $500 billion

B)6 percent; $600 billion

C)8 percent; $700 billion

D)8 percent, $500 billion

E)4 percent; $700 billion

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

21

The above table has the private demand for loanable funds and the private supply of loanable funds schedules

- If the government budget deficit is $200 billion, and there is no Ricardo-Barro effect, the equilibrium real interest rate is-------------------- and the equilibrium quantity of investment is

--------------------.

A)6 percent; $600 billion

B)4 percent; $700 billion

C)4 percent; $500 billion

D)8 percent, $500 billion

E)8 percent; $700 billion

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

22

The total amount spent to buy new physical capital and replace old capital is referred to as

A)gross investment.

B)depreciation.

C)net investment.

D)wealth.

E)savings.

A)gross investment.

B)depreciation.

C)net investment.

D)wealth.

E)savings.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following formulas is correct?

A)Net investment = gross investment - saving

B)Net investment = gross investment - depreciation

C)Net investment = gross investment - wealth

D)Net investment = gross investment + depreciation

E)Net investment = gross investment + capital

A)Net investment = gross investment - saving

B)Net investment = gross investment - depreciation

C)Net investment = gross investment - wealth

D)Net investment = gross investment + depreciation

E)Net investment = gross investment + capital

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

24

When--------------------changes, the supply of loanable funds curve shifts.

A)the price level

B)people's expected future income

C)investment

D)the expected rate of profit

E)"animal spirits"

A)the price level

B)people's expected future income

C)investment

D)the expected rate of profit

E)"animal spirits"

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following are typically financed in the loan market?

I)a mortgage for a house

Iii)credit card balances

Iii)the purchase of a share of stock in a corporation.

A)i and ii

B)i, ii and iii

C)i and iii

D)i only

E)ii and iii

I)a mortgage for a house

Iii)credit card balances

Iii)the purchase of a share of stock in a corporation.

A)i and ii

B)i, ii and iii

C)i and iii

D)i only

E)ii and iii

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

26

Federal Express's purchase of trucks and planes

A)is an example of physical capital.

B)includes depreciation.

C)reflects capital gains.

D)creates wealth.

E)is financial capital.

A)is an example of physical capital.

B)includes depreciation.

C)reflects capital gains.

D)creates wealth.

E)is financial capital.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

27

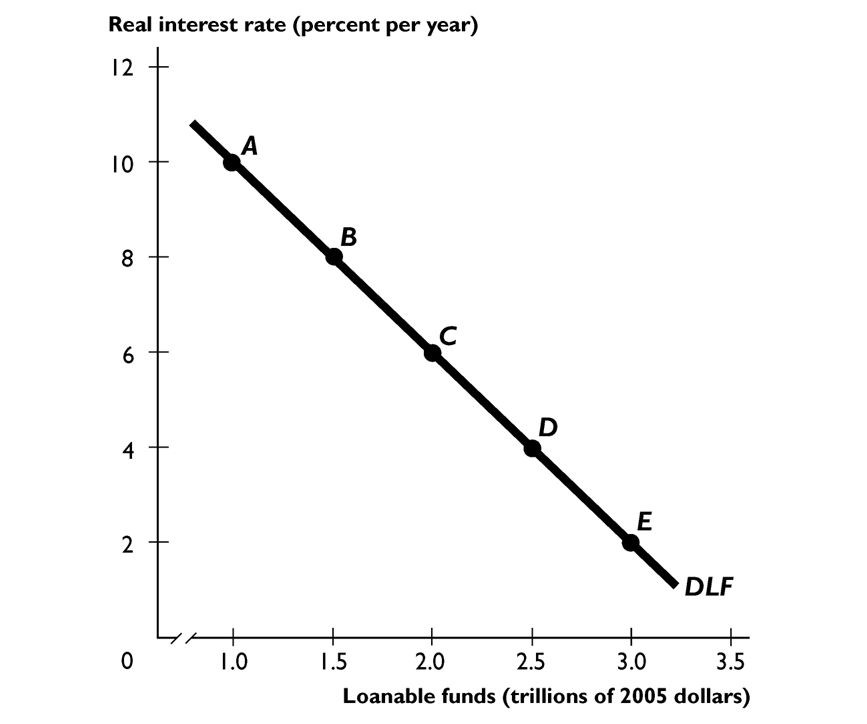

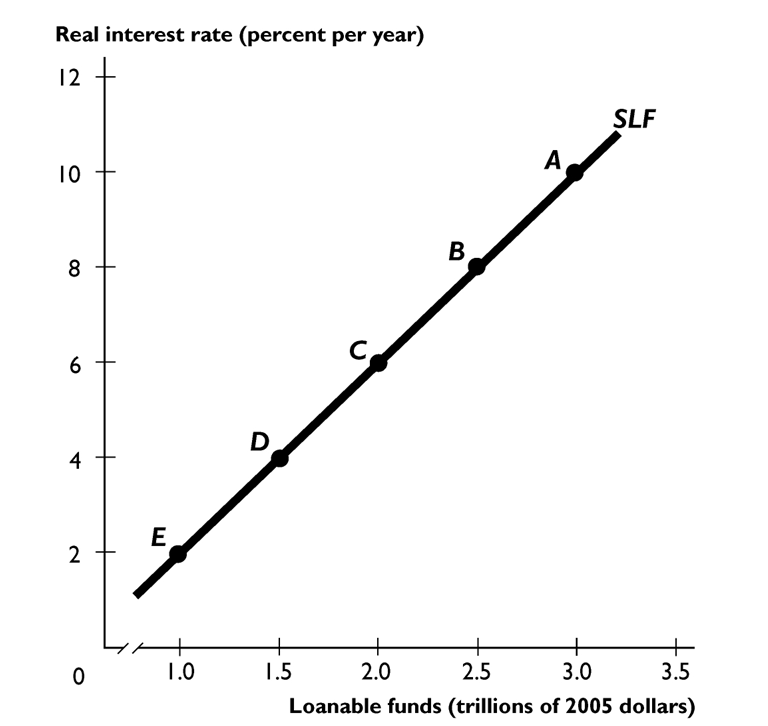

In the figure above, a movement from point A to point C can be the result of

A)a fall in the real interest rate.

B)a decrease in expected profit.

C)a rise in the real interest rate.

D)an increase in expected profit.

E)an increase in the government budget deficit.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

28

The demand for loanable funds increases if

A)technological growth slows.

B)wealth increases.

C)expected profit increases.

D)firms fear a recession.

E)population growth slows.

A)technological growth slows.

B)wealth increases.

C)expected profit increases.

D)firms fear a recession.

E)population growth slows.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

29

The demand for loanable funds curve shows the

A)positive relationship between the demand for loanable funds curve and the supply of loanable funds curve.

B)negative relationship between the interest rate and the quantity of loanable funds demanded.

C)negative relationship between the demand for loanable funds curve and the supply of loanable funds curve.

D)positive relationship between the interest rate and the quantity of loanable funds demanded.

E)U-shaped relationship between the interest rate and the quantity of loanable funds demanded.

A)positive relationship between the demand for loanable funds curve and the supply of loanable funds curve.

B)negative relationship between the interest rate and the quantity of loanable funds demanded.

C)negative relationship between the demand for loanable funds curve and the supply of loanable funds curve.

D)positive relationship between the interest rate and the quantity of loanable funds demanded.

E)U-shaped relationship between the interest rate and the quantity of loanable funds demanded.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

30

Suppose firms become more optimistic about the economy's ability to avoid a recession and hence the expected profit increases. As a result, the demand for loanable funds curve shifts --------------------and the real interest rate --------------------.

A)leftward; falls

B)rightward; falls

C)leftward; rises

D)rightward; does not change

E)rightward; rises

A)leftward; falls

B)rightward; falls

C)leftward; rises

D)rightward; does not change

E)rightward; rises

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

31

Intel's capital at the end of the year equals Intel's capital at the beginning of the year

A)plus net investment.

B)plus depreciation.

C)minus its stock dividends.

D)plus gross investment.

E)minus depreciation.

A)plus net investment.

B)plus depreciation.

C)minus its stock dividends.

D)plus gross investment.

E)minus depreciation.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

32

The change in the quantity of capital from one period to the next is equal to

A)financial investment.

B)depreciation.

C)wealth.

D)gross investment.

E)net investment.

A)financial investment.

B)depreciation.

C)wealth.

D)gross investment.

E)net investment.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

33

A decrease in wealth leads to a

A)rightward shift of the supply of loanable funds curve.

B)downward movement along the supply of loanable funds curve.

C)leftward shift of the supply of loanable funds curve.

D)leftward shift of the demand for loanable funds curve.

E)rightward shift of the demand for loanable funds curve.

A)rightward shift of the supply of loanable funds curve.

B)downward movement along the supply of loanable funds curve.

C)leftward shift of the supply of loanable funds curve.

D)leftward shift of the demand for loanable funds curve.

E)rightward shift of the demand for loanable funds curve.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

34

An example of financial capital is

A)computers.

B)bonds.

C)machines.

D)the talents of a highly paid movie star.

E)buildings.

A)computers.

B)bonds.

C)machines.

D)the talents of a highly paid movie star.

E)buildings.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

35

The local Allied Moving Company begins this year with capital equal to $250,000. During the year the firm depreciates $150,000 worth of its capital and ends the year with capital equal to $250,000. Which statement correctly summarizes Allied Moving Company's investment?

A)Allied Moving Company made no capital investment during the year.

B)Allied Moving Company made net investment of $150,000 during the year.

C)Allied Moving Company made no gross investment during the year.

D)Allied Moving Company made gross investment of $250,000 during the year.

E)Allied Moving Company made no net investment during the year.

A)Allied Moving Company made no capital investment during the year.

B)Allied Moving Company made net investment of $150,000 during the year.

C)Allied Moving Company made no gross investment during the year.

D)Allied Moving Company made gross investment of $250,000 during the year.

E)Allied Moving Company made no net investment during the year.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

36

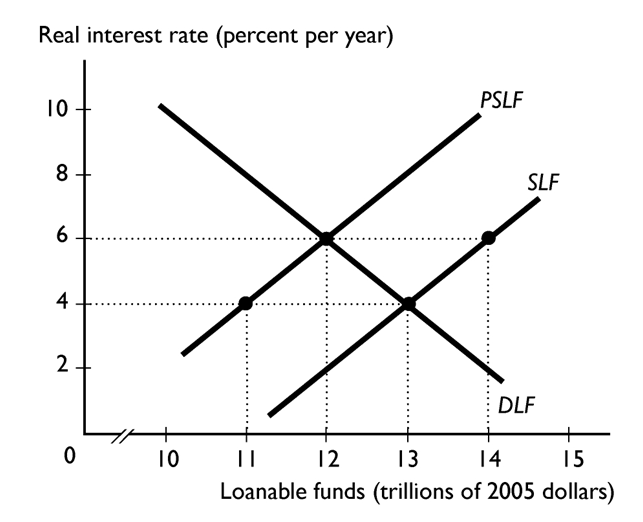

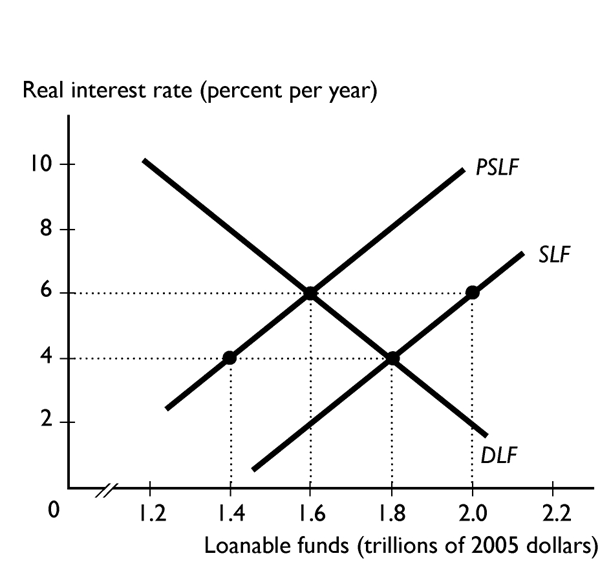

In the figure above, the SLF curve is the supply of loanable funds curve and the PSLF curve is the private supply of loanable funds curve.

-The equilibrium interest rate is-------------------- percent and the equilibrium quantity of loanable funds is --------------------.

A)4; $14 trillion

B)4; $13 trillion

C)4; $11 trillion

D)6; $12 trillion

E)6; $14 trillion

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

37

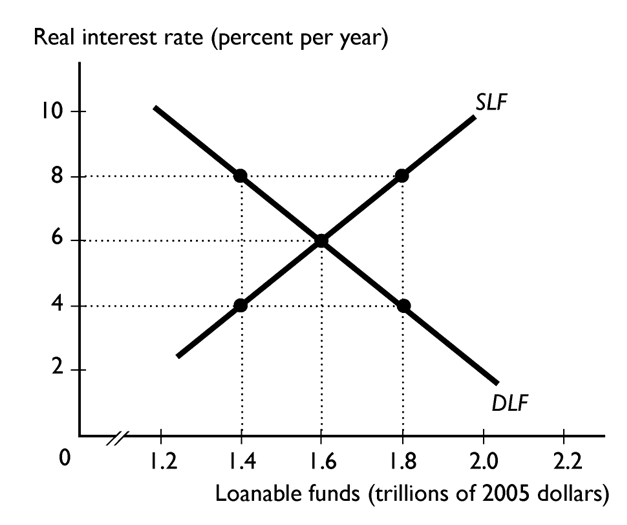

The figure above shows the loanable funds market.

- If the real interest rate is 10 percent, then

A)the government must intervene in order to prevent a credit crisis.

B)savers will exit the market because of the high opportunity cost of saving.

C)there is a surplus in the loanable funds market.

D)there is a shortage in the loanable funds market.

E)the interest rate must increase.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

38

If wealth--------------------, then saving increases, which is shown by a--------------------

A)increases; leftward shift of the supply of loanable funds curve

B)decreases; a movement downward along the supply of loanable funds curve

C)increases; rightward shift of the supply of loanable funds curve

D)increases; movement upward along the supply of loanable funds curve

E)decreases; rightward shift of the supply of loanable funds curve

A)increases; leftward shift of the supply of loanable funds curve

B)decreases; a movement downward along the supply of loanable funds curve

C)increases; rightward shift of the supply of loanable funds curve

D)increases; movement upward along the supply of loanable funds curve

E)decreases; rightward shift of the supply of loanable funds curve

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

39

Gross investment equals

A)net investment financial investment.

B)gross financial capital minus depreciation.

C)net investment plus depreciation.

D)net investment minus depreciation.

E)gross financial capital plus depreciation.

A)net investment financial investment.

B)gross financial capital minus depreciation.

C)net investment plus depreciation.

D)net investment minus depreciation.

E)gross financial capital plus depreciation.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

40

Suppose the government has a budget deficit of $2 billion. If the Ricardo-Barro effect is correct,

Then how much crowding out of investment occurs?

A)exactly equal to $2 billion dollars

B)some crowding out occurs, but less than $2 billion

C)more than $2 billion

D)No crowding out occurs and investment does not change.

E)No crowding out occurs because investment increases by $2 billion.

Then how much crowding out of investment occurs?

A)exactly equal to $2 billion dollars

B)some crowding out occurs, but less than $2 billion

C)more than $2 billion

D)No crowding out occurs and investment does not change.

E)No crowding out occurs because investment increases by $2 billion.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following statements is correct?

A)Net investment plus corporate profits equals gross investment.

B)Gross investment minus financial capital equals net investment.

C)Net investment is greater than gross investment.

D)Net investment minus depreciation equals gross investment.

E)Net investment plus depreciation equals gross investment.

A)Net investment plus corporate profits equals gross investment.

B)Gross investment minus financial capital equals net investment.

C)Net investment is greater than gross investment.

D)Net investment minus depreciation equals gross investment.

E)Net investment plus depreciation equals gross investment.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

42

If the real interest rate is less than the equilibrium real interest rate, there is a --------------------of loanable funds and --------------------.

A)shortage; borrowers have an easy time finding the funds they want

B)surplus; some borrowers cannot find the funds they want

C)surplus; borrowers have an easy time finding the funds they want

D)shortage; savers increase their saving supply to restore the equilibrium

E)shortage; some borrowers cannot find the funds they want

A)shortage; borrowers have an easy time finding the funds they want

B)surplus; some borrowers cannot find the funds they want

C)surplus; borrowers have an easy time finding the funds they want

D)shortage; savers increase their saving supply to restore the equilibrium

E)shortage; some borrowers cannot find the funds they want

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

43

In the figure above, the SLF curve is the supply of loanable funds curve and the PSLF curve is the private supply of loanable funds curve.

- Given these curves, there is a government budget-------------------- and therefore the real interest rate is-------------------- than it would be otherwise.

A)surplus; higher

B)surplus; lower

C)deficit; not different

D)deficit; higher

E)deficit; lower

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

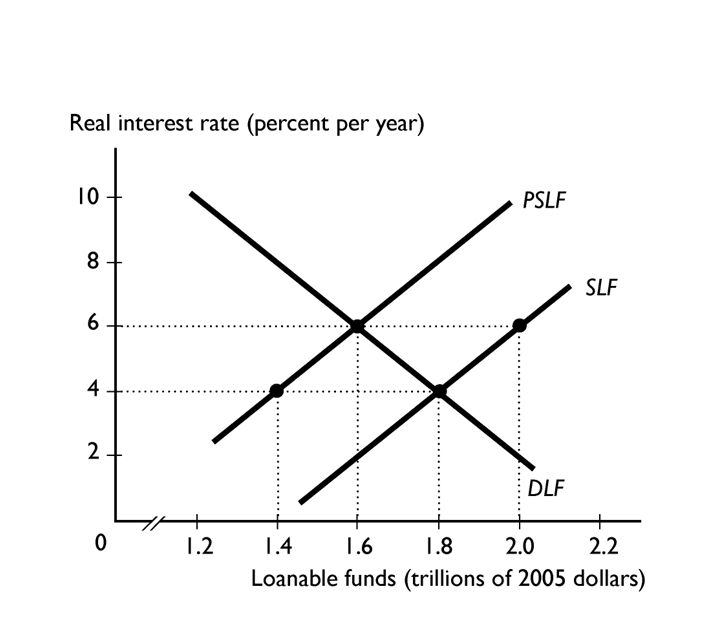

44

In the figure above, the SLF curve is the supply of loanable funds curve and the PSLF curve is the private supply of loanable funds curve.

- The equilibrium interest rate is -------------------- percent and the equilibrium quantity of loanable funds is-------------------- .

A)6; $2.0 trillion

B)6; $1.6 trillion

C)4; $2.0 trillion

D)4; $1.8 trillion

E)4; $1.4 trillion

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following occurs if the expected profit increases?

A)Investment demand decreases and the demand for loanable funds curve shifts leftward.

B)The savings increases and the supply of loanable funds curve shifts rightward.

C)Investment demand increases and the demand for loanable funds curve shifts rightward.

D)The quantity of investment demanded decreases and there is a movement up along the demand for loanable funds curve.

E)The quantity of investment demanded increases and there is a movement down along the demand for loanable funds curve.

A)Investment demand decreases and the demand for loanable funds curve shifts leftward.

B)The savings increases and the supply of loanable funds curve shifts rightward.

C)Investment demand increases and the demand for loanable funds curve shifts rightward.

D)The quantity of investment demanded decreases and there is a movement up along the demand for loanable funds curve.

E)The quantity of investment demanded increases and there is a movement down along the demand for loanable funds curve.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

46

If a surplus of loanable funds exists in the loanable funds market, the real interest rate and the quantity of saving-------------------- .

A)rises; decreases

B)rises; increases

C)falls; decreases

D)falls; does not change

E)falls; increases

A)rises; decreases

B)rises; increases

C)falls; decreases

D)falls; does not change

E)falls; increases

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

47

The demand for loanable funds curve slopes downward because the

A)price of bonds and stocks is not related to the real interest rate.

B)real interest rate is the opportunity cost of investment.

C)expected rate of profit is factor that "rewards" firms for their investment.

D)higher the real interest rate, the lower the cost of investment.

E)expected rate of profit is related positively to the real interest rate.

A)price of bonds and stocks is not related to the real interest rate.

B)real interest rate is the opportunity cost of investment.

C)expected rate of profit is factor that "rewards" firms for their investment.

D)higher the real interest rate, the lower the cost of investment.

E)expected rate of profit is related positively to the real interest rate.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

48

Net investment is

A)the same as depreciation.

B)gross investment plus depreciation.

C)the same as gross investment.

D)gross investment minus depreciation.

E)the same as wealth.

A)the same as depreciation.

B)gross investment plus depreciation.

C)the same as gross investment.

D)gross investment minus depreciation.

E)the same as wealth.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

49

U.S. capital at the end of 2012 equals U.S. capital at the beginning of 2012 plus

A)nothing, because capital can't change in just one year.

B)depreciation during 2012 minus gross investment during 2012.

C)gross investment during 2012.

D)net investment during 2012.

E)gross investment during 2012 minus net investment in 2012.

A)nothing, because capital can't change in just one year.

B)depreciation during 2012 minus gross investment during 2012.

C)gross investment during 2012.

D)net investment during 2012.

E)gross investment during 2012 minus net investment in 2012.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

50

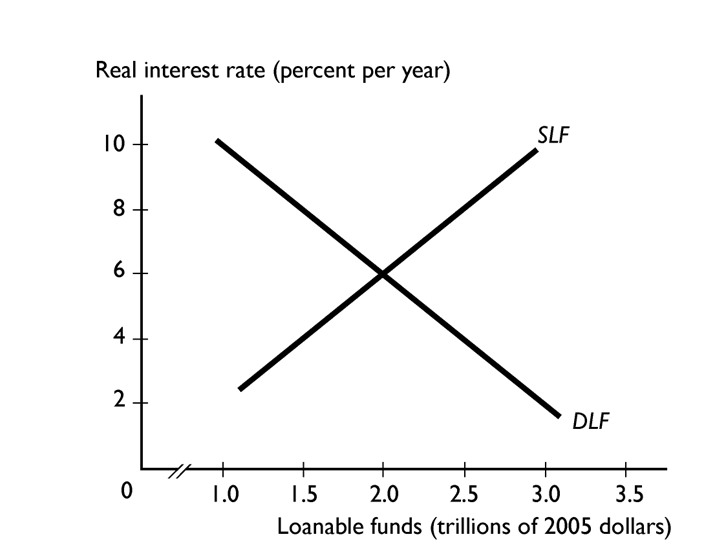

The figure above shows the loanable funds market.

-At an interest rate of

A)8 percent the quantity of loanable funds supplied is $14 trillion.

B)6 percent savers will exit the market because the reward to saving is too low.

C)4 percent there is a surplus of loanable funds.

D)8 percent the quantity demanded of loanable funds is $18 trillion.

E)4 percent there is a shortage of loanable funds.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

51

Bill's Lawn service starts the year with 20 lawn mowers. During the year, 3 mowers break and are not worth fixing. Bill also expands his business and buys 10 more mowers. Bill's net investment is

--------------------Mowers.

A)10

B)20

C)27

D)7

E)13

--------------------Mowers.

A)10

B)20

C)27

D)7

E)13

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

52

Other things remaining the same, the ----------------------------------------the real interest rate, the

A)higher; greater the quantity of loanable funds demanded

B)lower; greater the quantity of loanable funds demanded

C)lower; greater the quantity of loanable funds supplied

D)lower; greater the demand for loanable funds

E)higher; greater the demand for loanable funds

A)higher; greater the quantity of loanable funds demanded

B)lower; greater the quantity of loanable funds demanded

C)lower; greater the quantity of loanable funds supplied

D)lower; greater the demand for loanable funds

E)higher; greater the demand for loanable funds

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

53

Suppose the government's budget deficit increases by $500 billion. If there is no Ricardo-Barro effect, what occurs?

A)The supply of loanable funds curve shifts rightward, the real interest rate falls, and the quantity of loanable funds increases.

B)The supply of loanable funds curve shifts leftward, the real interest rate rises, and the quantity of loanable funds increases.

C)The supply of loanable funds curve shifts leftward, the real interest rate rises, and the quantity of loanable funds decreases.

D)The demand for loanable funds curve shifts rightward, the real interest rate rises, and the quantity of loanable funds increases.

E)The demand for loanable funds curve shifts leftward, the real interest rate falls, and the quantity of loanable funds decreases.

A)The supply of loanable funds curve shifts rightward, the real interest rate falls, and the quantity of loanable funds increases.

B)The supply of loanable funds curve shifts leftward, the real interest rate rises, and the quantity of loanable funds increases.

C)The supply of loanable funds curve shifts leftward, the real interest rate rises, and the quantity of loanable funds decreases.

D)The demand for loanable funds curve shifts rightward, the real interest rate rises, and the quantity of loanable funds increases.

E)The demand for loanable funds curve shifts leftward, the real interest rate falls, and the quantity of loanable funds decreases.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

54

Lulu purchased a security that promises to pay $50 twice a year from January 15, 2012 to January 15, 2016 and then pay $1,000 on January 15, 2016. The security is a debt to the company that issued It. The security is a

A)depreciating asset.

B)bond.

C)net investment to the company that issued it.

D)physical capital.

E)share of stock.

A)depreciating asset.

B)bond.

C)net investment to the company that issued it.

D)physical capital.

E)share of stock.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

55

If there is no Ricardo-Barro effect, an increase in the budget deficit

A)increases the supply of loanable funds.

B)decreases the amount of investment.

C)decreases the demand for loanable funds.

D)increases the amount of investment.

E)lowers the equilibrium real interest rate.

A)increases the supply of loanable funds.

B)decreases the amount of investment.

C)decreases the demand for loanable funds.

D)increases the amount of investment.

E)lowers the equilibrium real interest rate.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

56

--------------------increases the quantity of capital and--------------------decreases the quantity of capital.

A)Net investment; gross investment

B)Investment; saving

C)Gross investment; net investment

D)Depreciation; net investment

E)Investment; depreciation

A)Net investment; gross investment

B)Investment; saving

C)Gross investment; net investment

D)Depreciation; net investment

E)Investment; depreciation

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

57

A document that promises to pay specified sums of money on specified dates and is a debt to the Issuer is called

A)a bond.

B)gross investment.

C)depreciation.

D)a stock.

E)net investment.

A)a bond.

B)gross investment.

C)depreciation.

D)a stock.

E)net investment.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

58

Economists use the word "capital" to mean

A)the funds that firms use to buy and operate their businesses.

B)the tools, instruments, and other produced goods used to produce goods and services.

C)the workers that firms employ to produce goods and services.

D)people's skills and talents.

E)purchases in the market for stocks and bonds.

A)the funds that firms use to buy and operate their businesses.

B)the tools, instruments, and other produced goods used to produce goods and services.

C)the workers that firms employ to produce goods and services.

D)people's skills and talents.

E)purchases in the market for stocks and bonds.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

59

Suppose that there is an increase in disposable income and simultaneously an increase in the expected profitability of investment. As a result, the equilibrium real interest rate --------------------and the

Equilibrium quantity of loanable funds---------------------------------------- .

A)might rise, fall, or remain unchanged; increases

B)might rise, fall, or remain unchanged; decreases

C)rises; increases

D)remains unchanged; increases

E)falls; increases

Equilibrium quantity of loanable funds---------------------------------------- .

A)might rise, fall, or remain unchanged; increases

B)might rise, fall, or remain unchanged; decreases

C)rises; increases

D)remains unchanged; increases

E)falls; increases

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

60

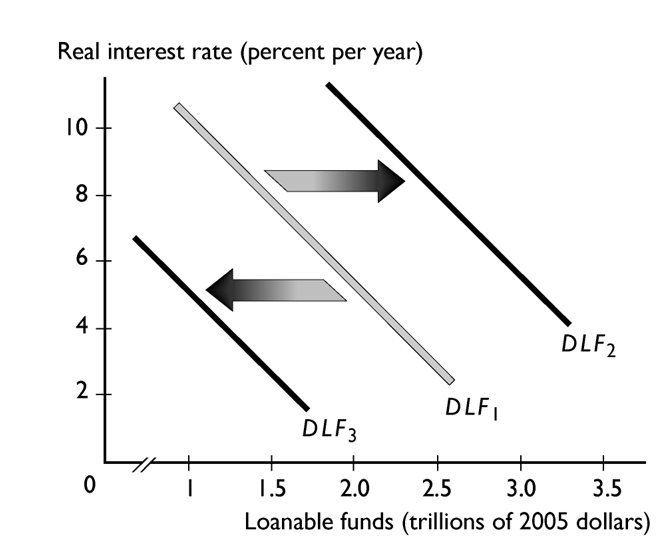

In the figure above, the leftward shift from the demand for loanable funds curve DLF1 to the demand for loanable funds curve DLF3, could be the result of

A)a government budget surplus.

B)the economy entering an expansion.

C)a decrease in interest rates during an economic recession.

D)a increase in interest rates during an economic expansion.

E)the economy entering a recession.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

61

In the figure above, the shift from DLF1 to DLF2 could result from

A)the economy entering a strong expansion.

B)an increase in a government budget surplus.

C)a decrease in the real interest rate.

D)an increase in the nominal interest rate.

E)the economy entering a recession.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

62

A distinction between stocks and bonds is that

A)bonds cannot be sold to anyone other than the company that issued it while stocks can be resold to anyone.

B)bonds can be traded many times in the bond market, while stocks are non-transferable.

C)stocks represent ownership claims to the company and bonds do not.

D)bonds must be held for a fixed number of years whereas stocks can be bought and sold at any time.

E)although the return on a bond is determined by the forces of supply and demand, the return on a stock is set by the stock exchange.

A)bonds cannot be sold to anyone other than the company that issued it while stocks can be resold to anyone.

B)bonds can be traded many times in the bond market, while stocks are non-transferable.

C)stocks represent ownership claims to the company and bonds do not.

D)bonds must be held for a fixed number of years whereas stocks can be bought and sold at any time.

E)although the return on a bond is determined by the forces of supply and demand, the return on a stock is set by the stock exchange.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

63

If the real interest rate rises,

A)the quantity of loanable funds demanded increases.

B)the quantity of loanable funds demanded decreases.

C)the demand for loanable funds curve shifts leftward.

D)the demand for loanable funds curve shifts rightward.

E)there is is movement down along the demand for loanable funds curve.

A)the quantity of loanable funds demanded increases.

B)the quantity of loanable funds demanded decreases.

C)the demand for loanable funds curve shifts leftward.

D)the demand for loanable funds curve shifts rightward.

E)there is is movement down along the demand for loanable funds curve.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

64

If the real interest rate rises, then the

A)supply of saving increases and the supply of loanable funds curve shifts rightward.

B)supply of saving decreases and the supply of loanable funds curve shifts leftward.

C)quantity of saving decreases and there is a movement down along the supply of loanable funds curve.

D)demand for investment decreases and the demand for loanable funds curve shifts leftward.

E)quantity of saving increases and there is a movement up along the supply of loanable funds curve.

A)supply of saving increases and the supply of loanable funds curve shifts rightward.

B)supply of saving decreases and the supply of loanable funds curve shifts leftward.

C)quantity of saving decreases and there is a movement down along the supply of loanable funds curve.

D)demand for investment decreases and the demand for loanable funds curve shifts leftward.

E)quantity of saving increases and there is a movement up along the supply of loanable funds curve.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

65

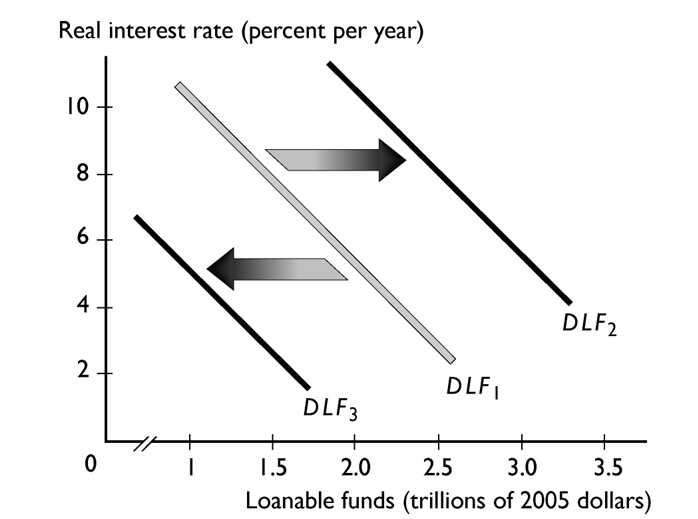

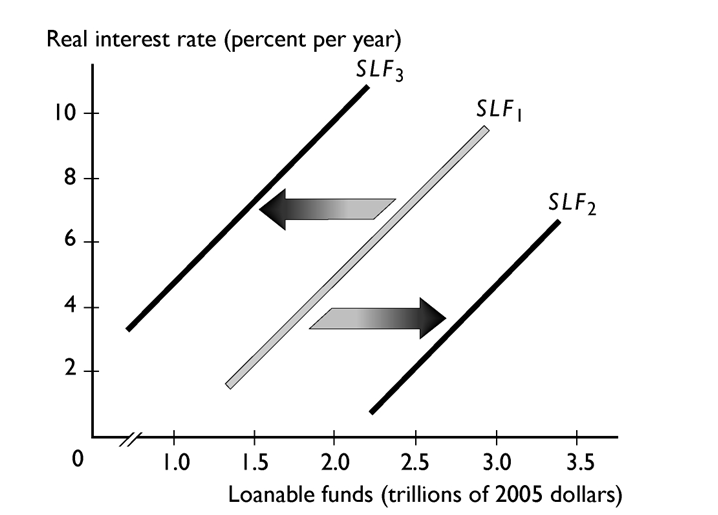

Suppose that the initial supply of loanable funds curve is SLF1. In the figure above, an increase in the real interest rate leads to

I. a shift in the supply of loanable funds curve from SLF1 to SLF2.

Ii. a shift in the supply of loanable funds curve from SLF1 to SLF3.

iii. a movement along the supply of loanable funds curve SLF1.

Iv. no change whatever.

A)i and iii

B)ii only

C)iii only

D)i only

E)iv only

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

66

Net investment equals

A)gross investment minus depreciation.

B)capital plus depreciation.

C)the amount of national wealth.

D)new capital plus old capital.

E)gross investment plus depreciation.

A)gross investment minus depreciation.

B)capital plus depreciation.

C)the amount of national wealth.

D)new capital plus old capital.

E)gross investment plus depreciation.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

67

When a student uses a credit card to buy an iPod, the student is

A)lending in the loan market.

B)lending in the stock market.

C)lending in the bond market.

D)borrowing in the loan market.

E)borrowing in the bond market.

A)lending in the loan market.

B)lending in the stock market.

C)lending in the bond market.

D)borrowing in the loan market.

E)borrowing in the bond market.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

68

If the supply of loanable funds curve shifts rightward from the curve shown in the figure above, the shift could be the result of

A)a rise in expected future income.

B)an increase in disposable income.

C)a decrease in the supply of loanable funds.

D)a decrease in the demand for loanable funds.

E)an increase in wealth.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

69

If a government has a budget deficit, it must

A)increase taxes.

B)borrow in the loanable funds market.

C)decrease taxes.

D)lower the real interest rate.

E)decrease its expenditures.

A)increase taxes.

B)borrow in the loanable funds market.

C)decrease taxes.

D)lower the real interest rate.

E)decrease its expenditures.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

70

In which of the following cases would the supply of loanable funds curve shift rightward?

A)Investment demand increases.

B)The stock market booms so people's wealth increases.

C)The economy moves into a recession.

D)Joe is worried about cutbacks at his firm so his expected future income falls.

E)In June, Sally learns that at year's end she will receive a bonus that will double her current salary.

A)Investment demand increases.

B)The stock market booms so people's wealth increases.

C)The economy moves into a recession.

D)Joe is worried about cutbacks at his firm so his expected future income falls.

E)In June, Sally learns that at year's end she will receive a bonus that will double her current salary.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

71

An increase in wealth leads to--------------------loanable funds.

A)a decrease in the demand for

B)an increase in the supply of

C)a decrease in the supply of

D)an increase in the demand for

E)no change in either the supply of loanable funds or the demand for

A)a decrease in the demand for

B)an increase in the supply of

C)a decrease in the supply of

D)an increase in the demand for

E)no change in either the supply of loanable funds or the demand for

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

72

To acquire financial capital, a firm can

i. obtain a loan from a bank.

Ii. issue stock. iii. issue bonds.

A)ii only

B)i only

C)iii only

D)i and iii

E)i, ii, and iii

i. obtain a loan from a bank.

Ii. issue stock. iii. issue bonds.

A)ii only

B)i only

C)iii only

D)i and iii

E)i, ii, and iii

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

73

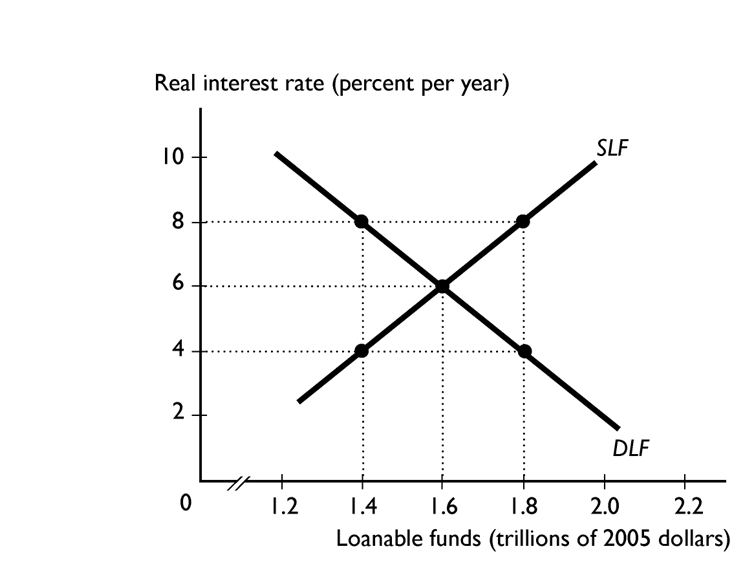

The figure above shows the loanable funds market.

- The equilibrium real interest rate is-------------------- percent and the equilibrium quantity of loanable funds is--------------------.

A)6; $1.6 trillion

B)4; $1.4 trillion

C)4; $1.8 trillion

D)8; $1.4 trillion

E)8; $1.8 trillion

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

74

The demand for loanable funds curve shows that the higher the real interest rate, the

A)more the loanable funds demand curve shifts leftward.

B)smaller the quantity of loanable funds demanded.

C)smaller the demand for loanable funds.

D)larger the demand for loanable funds.

E)larger the quantity of loanable funds demanded.

A)more the loanable funds demand curve shifts leftward.

B)smaller the quantity of loanable funds demanded.

C)smaller the demand for loanable funds.

D)larger the demand for loanable funds.

E)larger the quantity of loanable funds demanded.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

75

In the late 1990s, the U.S. federal government had a budget surplus. If there is no Ricardo-Barro effect, the budget surplus-------------------- the real interest rate and-------------------- the equilibrium quantity of investment.

A)did not change; did not change

B)lowered; increased

C)raised; increased

D)lowered; decreased

E)raised; decreased

A)did not change; did not change

B)lowered; increased

C)raised; increased

D)lowered; decreased

E)raised; decreased

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

76

In the figure above, the SLF curve is the supply of loanable funds curve and the PSLF curve is the private supply of loanable funds curve. If there is no Ricardo-Barro effect, the figure shows a situation in which the government has a budget

A)deficit of $1.6 trillion.

B)surplus of $1.8 trillion.

C)deficit of $0.2 trillion.

D)surplus of $1.4 trillion.

E)surplus of $0.2 trillion.

A)deficit of $1.6 trillion.

B)surplus of $1.8 trillion.

C)deficit of $0.2 trillion.

D)surplus of $1.4 trillion.

E)surplus of $0.2 trillion.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following is correct?

A)The change in the nation's capital stock over a year equals the amount of gross investment.

B)Net investment is the same as capital consumption.

C)Gross investment equals net investment minus depreciation.

D)Gross investment is the total spent on capital.

E)Net investment is the total spent on capital.

A)The change in the nation's capital stock over a year equals the amount of gross investment.

B)Net investment is the same as capital consumption.

C)Gross investment equals net investment minus depreciation.

D)Gross investment is the total spent on capital.

E)Net investment is the total spent on capital.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

78

assuming there are no capital gains, a nation's wealth at the start of a year is equal to the wealth at the start of the previous year plus

A)income minus saving during the year.

B)saving during the year.

C)saving minus depreciation during the year.

D)nothing because wealth does not change from one year to the next.

E)income.

A)income minus saving during the year.

B)saving during the year.

C)saving minus depreciation during the year.

D)nothing because wealth does not change from one year to the next.

E)income.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

79

According to the Ricardo-Barro effect, an increase in the government budget deficit

A)shifts the supply of loanable funds curve leftward.

B)shifts the demand for loanable funds curve leftward.

C)lowers the real interest rate.

D)does not change the real interest rate.

E)has no effect on the nominal interest rate but does change the real interest rate.

A)shifts the supply of loanable funds curve leftward.

B)shifts the demand for loanable funds curve leftward.

C)lowers the real interest rate.

D)does not change the real interest rate.

E)has no effect on the nominal interest rate but does change the real interest rate.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

80

The supply of loanable funds curve has a --------------------slope and the demand for loanable funds curve has a-------------------- slope.

A)negative; negative

B)positive; negative

C)negative; positive

D)positive; positive

E)vertical; horizontal

A)negative; negative

B)positive; negative

C)negative; positive

D)positive; positive

E)vertical; horizontal

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck