Deck 9: Business-Type Activities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/79

Play

Full screen (f)

Deck 9: Business-Type Activities

1

Governments may choose whether to account for internal service fund activities on an accrual basis or a modified accrual basis.

False

2

Proprietary fund have two financial statements - the statement of net position and the statement of revenues, expenditures, and changes in net position.

False

3

Governments are required to prepare a statement of cash flows for proprietary funds, but not for governmental funds.

True

4

Governments generally do not have to get formal legislative approval for enterprise fund budgets or incorporate them into their accounting systems.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

5

The costs of cleaning up toxic substances seeping out from an abandoned county dump into the town water supply may be accounted for in either a governmental fund or an enterprise fund.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

6

Internal service funds should be consolidated with other governmental funds in the government-wide statements.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

7

GASB 83 addresses retirement of nuclear reactors and sewage treatment plants.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

8

The government should not recognize a liability for an asset retirement obligation until expenses are incurred.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

9

The proprietary fund operating statement includes ALL changes in net position including capital contributions.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

10

In both the fund statements and the government-wide statements, business-type activities and internal service funds are on a full accrual basis, and their measurement focus is on all economic resources.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

11

The FASB mandates that entities report their cash flows from operations using the direct method.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

12

The appropriate measurement focus for the business-type activities of the Raymond City is

A) Current financial resources.

B) Economic resources.

C) Both (a) and (b).

D) None of the above.

A) Current financial resources.

B) Economic resources.

C) Both (a) and (b).

D) None of the above.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

13

The revenues of an internal service fund are the expenditures and expenses of other funds of that government.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

14

GASB standards require that governments advance fund landfill closure and postclosure costs on an actuarial basis similar to the advance funding of pension plans.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

15

The amounts reported in proprietary fund statements are generally the same as those reported in the government-wide statements because both sets of statements are on a full accrual basis of accounting.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

16

GASB Statement No. 34 mandates that governments report their cash flows from operations using the indirect method.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is not a proprietary fund?

A) City Water Enterprise Fund.

B) City Motor Pool Internal Service Fund.

C) City Hall Capital Projects Fund.

D) None of the above..

A) City Water Enterprise Fund.

B) City Motor Pool Internal Service Fund.

C) City Hall Capital Projects Fund.

D) None of the above..

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

18

In accounting for closure and post-closure landfill costs in an enterprise fund, a government does not necessarily have to "fund" the costs during the landfill's useful life; it merely has to report both an expense and a liability for them.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

19

Governments are not required to incorporate proprietary fund budgets into the accounting system.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

20

Governments must account for an activity in an enterprise fund only if local laws specifically require use of an enterprise fund.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is a key reason for using business-type accounting to account for proprietary fund activities?

A) The modified accrual basis of accounting captures all the resources and obligations associated with an activity.

B) Depreciation is not recognized in business-type accounting in governments and surveys of statement users indicate that information on depreciation is not of high priority to government decision makers.

C) The measurement focus on all economic resources is more consistent with the GASB's objectives that financial reporting should provide information to help determine whether current-year revenues were sufficient to pay for current-year services.

D) Business-type accounting facilitates comparisons with governmental activities.

A) The modified accrual basis of accounting captures all the resources and obligations associated with an activity.

B) Depreciation is not recognized in business-type accounting in governments and surveys of statement users indicate that information on depreciation is not of high priority to government decision makers.

C) The measurement focus on all economic resources is more consistent with the GASB's objectives that financial reporting should provide information to help determine whether current-year revenues were sufficient to pay for current-year services.

D) Business-type accounting facilitates comparisons with governmental activities.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

22

In a statement of net position, the net position of a proprietary fund should be displayed in which of the following categories?

A) Unrestricted fund balance; restricted fund balance; invested in capital assets, net of related debt.

B) Unrestricted net position; restricted net position; invested in capital assets, net of related debt.

C) Unrestricted net assets; restricted net assets

D) Restricted net assets; retained earnings; unrestricted net assets.

A) Unrestricted fund balance; restricted fund balance; invested in capital assets, net of related debt.

B) Unrestricted net position; restricted net position; invested in capital assets, net of related debt.

C) Unrestricted net assets; restricted net assets

D) Restricted net assets; retained earnings; unrestricted net assets.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following is a valid reason for governments to engage in business-type activities?

A) The government does not want control over the activity.

B) The activity competes with general government activities.

C) The government does not want to subsidize the activity.

D) The government can provide the services more cheaply or efficiently than can a private firm.

A) The government does not want control over the activity.

B) The activity competes with general government activities.

C) The government does not want to subsidize the activity.

D) The government can provide the services more cheaply or efficiently than can a private firm.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

24

The appropriate basis of accounting for the proprietary funds of a government is

A) Cash basis.

B) Modified accrual.

C) Full accrual.

D) None of the above.

A) Cash basis.

B) Modified accrual.

C) Full accrual.

D) None of the above.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

25

A government reports the utility services it provides to citizens in a proprietary fund. Which accounting standards must the proprietary fund apply?

A) All FASB pronouncements, unless a FASB pronouncement conflicts with or contradicts a GASB pronouncement.

B) All FASB pronouncements issued prior to November 30, 1989, as well as any post-November 30, 1989 pronouncements specifically adopted by GASB.

C) All GASB pronouncements.

D) All FASB and AICPA standards incorporated into GASB Statement No. 62, as well as any FASB pronouncements issued after November 30, 1989 that have been specifically adopted by the GASB.

A) All FASB pronouncements, unless a FASB pronouncement conflicts with or contradicts a GASB pronouncement.

B) All FASB pronouncements issued prior to November 30, 1989, as well as any post-November 30, 1989 pronouncements specifically adopted by GASB.

C) All GASB pronouncements.

D) All FASB and AICPA standards incorporated into GASB Statement No. 62, as well as any FASB pronouncements issued after November 30, 1989 that have been specifically adopted by the GASB.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following is a valid argument for separate accounting principles for proprietary activities?

A) Two separate measurement focuses and bases for accounting within the same set of financial statements are confusing.

B) There are no clear-cut distinctions between business and non-business activities.

C) The measurement focus on all economic resources is more consistent with the GASB's objectives that financial reporting should provide information to help determine whether current-year revenues were sufficient to pay for current-year services.

D) Surveys of statement users indicate that information on depreciation is not of high priority to government decision makers.

A) Two separate measurement focuses and bases for accounting within the same set of financial statements are confusing.

B) There are no clear-cut distinctions between business and non-business activities.

C) The measurement focus on all economic resources is more consistent with the GASB's objectives that financial reporting should provide information to help determine whether current-year revenues were sufficient to pay for current-year services.

D) Surveys of statement users indicate that information on depreciation is not of high priority to government decision makers.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

27

Flora County issues $6 million of revenue bonds to finance construction of additional physical plant facilities for the county sewer system that is accounted for in an enterprise fund. The bond agreement requires that $0.5 million of the proceeds be invested in U.S. Treasury securities to be used to service the debt if revenues in a particular year are insufficient to do so. When it sells the bonds, the county debits restricted cash and credits revenue bonds payable. What additional entry, if any, is needed?

A) No additional entry is needed at this time.

B) Debit restricted net position $0.5 million; Credit unrestricted net position $0.5 million.

C) Debit unrestricted net position $0.5 million; Credit restricted net position $0.5 million.

D) Debit unrestricted retained earnings $0.5 million; Credit restricted retained earnings $0.5 million.

A) No additional entry is needed at this time.

B) Debit restricted net position $0.5 million; Credit unrestricted net position $0.5 million.

C) Debit unrestricted net position $0.5 million; Credit restricted net position $0.5 million.

D) Debit unrestricted retained earnings $0.5 million; Credit restricted retained earnings $0.5 million.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

28

A statement of revenues, expenses, and changes in net position of a proprietary fund should include which of the following in addition to operating revenues, operating expenses, and ending net position?

A) Nonoperating revenues and expenses.

B) Nonoperating revenues and expenses; other changes in net position.

C) Nonoperating revenues and expenses; capital contributions and other changes in net position; beginning net assets.

D) None of the above.

A) Nonoperating revenues and expenses.

B) Nonoperating revenues and expenses; other changes in net position.

C) Nonoperating revenues and expenses; capital contributions and other changes in net position; beginning net assets.

D) None of the above.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

29

Linden County operates a solid waste landfill that is accounted for in an enterprise fund. The county calculated this year's portion of the total closure and postclosure costs associated with the landfill to be $300,000. The entry(ies) to record this cost should be

A) Debit landfill expense $300,000; Credit liability for landfill costs $300,000

B) Debit landfill expense $300,000; Credit liability for landfill costs $300,000 AND include an addition of $300,000 on the schedule of changes in long-term obligations.

C) Show only an addition of $300,000 on the schedule of changes in long-term obligations.

D) No entry in the fund; No addition on the schedule of changes in long-term obligations.

A) Debit landfill expense $300,000; Credit liability for landfill costs $300,000

B) Debit landfill expense $300,000; Credit liability for landfill costs $300,000 AND include an addition of $300,000 on the schedule of changes in long-term obligations.

C) Show only an addition of $300,000 on the schedule of changes in long-term obligations.

D) No entry in the fund; No addition on the schedule of changes in long-term obligations.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

30

A proprietary fund of a government has some donor-restricted assets. Which of the following best describes where and how those assets will generally be displayed in the fund's financial statements?

A) In a separate restricted asset category on the statement of net position.

B) Intermingled with other assets on the statement of net position.

C) Intermingled with other assets on the statement of net position, but footnoted.

D) In a separate restricted fund.

A) In a separate restricted asset category on the statement of net position.

B) Intermingled with other assets on the statement of net position.

C) Intermingled with other assets on the statement of net position, but footnoted.

D) In a separate restricted fund.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is NOT a budget typically prepared for an activity accounted for in a proprietary fund?

A) Appropriation budget.

B) Cash budget.

C) Capital budget.

D) Flexible budget.

A) Appropriation budget.

B) Cash budget.

C) Capital budget.

D) Flexible budget.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is the best rationale/justification for reporting the business-type activities of a government in a separate fund?

A) Laws or regulations require that the activity's costs of providing services be recovered by fees and charges rather than by general purpose taxes or similar charges.

B) Separate funds facilitate budgeting, planning, and control.

C) Separate funds facilitate an assessment of the activity's performance.

D) Separate funds facilitate an assessment of the activity's fiscal status.

A) Laws or regulations require that the activity's costs of providing services be recovered by fees and charges rather than by general purpose taxes or similar charges.

B) Separate funds facilitate budgeting, planning, and control.

C) Separate funds facilitate an assessment of the activity's performance.

D) Separate funds facilitate an assessment of the activity's fiscal status.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following is NOT true about internal service funds as reported in the fund financial statements?

A) Costs reported by internal service funds are reported twice within the same set of financial statements.

B) Billing rates must be set to cover the full cost of providing the goods or services.

C) Depreciation can be charged to governmental funds through the billing rates established by the internal service fund.

D) Deficits or surpluses in the general fund can be transferred to the internal service fund by adjusting the billing rates.

A) Costs reported by internal service funds are reported twice within the same set of financial statements.

B) Billing rates must be set to cover the full cost of providing the goods or services.

C) Depreciation can be charged to governmental funds through the billing rates established by the internal service fund.

D) Deficits or surpluses in the general fund can be transferred to the internal service fund by adjusting the billing rates.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following are required basic statements of a proprietary fund?

A) Balance sheet and income statement.

B) Balance sheet; statement of revenues, expenses, and changes in retained earnings; and statement of cash flows.

C) Statement of net assets and statement of revenues, expenses, and changes in fund net assets.

D) Statement of net position; statement of revenues, expenses, and changes in net position; and statement of cash flows.

A) Balance sheet and income statement.

B) Balance sheet; statement of revenues, expenses, and changes in retained earnings; and statement of cash flows.

C) Statement of net assets and statement of revenues, expenses, and changes in fund net assets.

D) Statement of net position; statement of revenues, expenses, and changes in net position; and statement of cash flows.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

35

Over the long run, internal service funds are intended to generate sufficient revenues to cover the

A) Full costs of providing services.

B) Full costs of providing services and earn a profit.

C) Current operating costs of providing services.

D) Current operating costs of providing services and earn an operating profit.

A) Full costs of providing services.

B) Full costs of providing services and earn a profit.

C) Current operating costs of providing services.

D) Current operating costs of providing services and earn an operating profit.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

36

Bowdon City voted to establish an internal service fund to account for its printing services. The city transferred $500,000 cash from the general fund to the newly created internal service fund.

-The appropriate entry in the general fund to account for this transfer is a credit to cash for $500,000 and a debit for $500,000 to

A) Due from internal service fund.

B) Nonreciprocal transfer-out.

C) Expenditures.

D) Investment in internal service fund.

-The appropriate entry in the general fund to account for this transfer is a credit to cash for $500,000 and a debit for $500,000 to

A) Due from internal service fund.

B) Nonreciprocal transfer-out.

C) Expenditures.

D) Investment in internal service fund.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

37

Cougar City issued $2 million in general obligation bonds to acquire a fleet of vehicles for the Central Motor Pool Internal Service Fund. At the date of issue, the appropriate entry in the internal service fund is a $ 2 million debit to cash and a $2 million credit to

A) Bonds payable.

B) Capital contribution (revenues).

C) Capital contributed (revenues) AND show $2 million as an addition to the schedule of changes in long-term obligations.

D) No entry in the internal service fund. Show $2 million as an addition to the schedule of changes in long-term obligations.

A) Bonds payable.

B) Capital contribution (revenues).

C) Capital contributed (revenues) AND show $2 million as an addition to the schedule of changes in long-term obligations.

D) No entry in the internal service fund. Show $2 million as an addition to the schedule of changes in long-term obligations.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

38

Bowdon City voted to establish an internal service fund to account for its printing services. The city transferred $500,000 cash from the general fund to the newly created internal service fund.

-The appropriate entry in the internal service fund is a debit to cash for $500,000 and a credit for $500,000 to

A) Due to general fund.

B) Nonreciprocal transfer-in.

C) Capital contribution (Revenues).

D) Investment provided by the general fund.

-The appropriate entry in the internal service fund is a debit to cash for $500,000 and a credit for $500,000 to

A) Due to general fund.

B) Nonreciprocal transfer-in.

C) Capital contribution (Revenues).

D) Investment provided by the general fund.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

39

During the current year, the Adams County Solid Waste Landfill, which is accounted for in an enterprise fund, installed wells designed to assist in the ground water monitoring process after closure of the landfill. The landfill has reached 40 percent of its capacity and is expected to continue to accept waste until 2019. The wells cost $80,000 to acquire and install. The appropriate entry to record the addition is a credit to Cash for $80,000 and an $80,000 debit to

A) Landfill assets.

B) Landfill expenses.

C) Liability for landfill costs.

D) Deferred outflow of resources.

A) Landfill assets.

B) Landfill expenses.

C) Liability for landfill costs.

D) Deferred outflow of resources.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

40

Fennell County operates a solid waste landfill that is accounted for in a governmental fund. The county calculated this year's portion of the total closure and postclosure costs associated with the landfill to be $600,000. The entry to record this cost should be

A) Debit landfill expenditure $600,000; Credit liability for landfill costs $600,000

B) Debit landfill expenditure $600,000; Credit liability for landfill costs $600,000 AND include $600,000 as an addition on the schedule of changes in long-term obligations.

C) No entry in the fund; include $600,000 on the schedule of changes in long-term obligations.

D) No entry in the fund; no addition on the schedule of changes in long-term obligations.

A) Debit landfill expenditure $600,000; Credit liability for landfill costs $600,000

B) Debit landfill expenditure $600,000; Credit liability for landfill costs $600,000 AND include $600,000 as an addition on the schedule of changes in long-term obligations.

C) No entry in the fund; include $600,000 on the schedule of changes in long-term obligations.

D) No entry in the fund; no addition on the schedule of changes in long-term obligations.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

41

On the fund financial statements, internal service activities should be presented

A) In the propriety fund statements, net of interfund eliminations.

B) In the governmental fund statements, net of interfund eliminations.

C) In the proprietary fund statements, without any interfund eliminations.

D) In the governmental fund statements, without any interfund eliminations.

A) In the propriety fund statements, net of interfund eliminations.

B) In the governmental fund statements, net of interfund eliminations.

C) In the proprietary fund statements, without any interfund eliminations.

D) In the governmental fund statements, without any interfund eliminations.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

42

"Cash flows from investing activities" include which of the following as outflows

A) Repayments of short-term borrowing to finance operations.

B) Interest received on investments.

C) Cash transfers to other funds.

D) Purchase of short-term investments.

A) Repayments of short-term borrowing to finance operations.

B) Interest received on investments.

C) Cash transfers to other funds.

D) Purchase of short-term investments.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

43

In which of the following circumstances must an enterprise fund be used to account for the activity?

A) A newly created electric utility fund will finance its operations by a charge to users based on kilowatt hours used.

B) To finance the acquisition of plant facilities, a newly created electric utility issues general obligation debt.

C) To finance the acquisition of plant facilities, a newly created electric utility issues revenue bonds that will be repaid solely from operations of the electric utility.

D) To acquire needed plant facilities, a newly created electric utility enters into long-term lease agreements.

A) A newly created electric utility fund will finance its operations by a charge to users based on kilowatt hours used.

B) To finance the acquisition of plant facilities, a newly created electric utility issues general obligation debt.

C) To finance the acquisition of plant facilities, a newly created electric utility issues revenue bonds that will be repaid solely from operations of the electric utility.

D) To acquire needed plant facilities, a newly created electric utility enters into long-term lease agreements.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following factors do rating agencies take into account when considering revenue bond debt?

A) Tax base.

B) Assessed valuation of property in jurisdiction.

C) History of rates and rate increases.

D) Demographics.

A) Tax base.

B) Assessed valuation of property in jurisdiction.

C) History of rates and rate increases.

D) Demographics.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

45

"Cash flows from capital and related financing activities" include which of the following as cash outflows

A) Grants to other governments for operating activities.

B) Grants to other governments for capital asset acquisitions.

C) Payments for services performed by other funds.

D) Purchases of capital assets.

A) Grants to other governments for operating activities.

B) Grants to other governments for capital asset acquisitions.

C) Payments for services performed by other funds.

D) Purchases of capital assets.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

46

The use of either an enterprise fund or a governmental fund to report a particular activity is most likely optional if

A) Fees are charged to external users for goods or services.

B) The entity's pricing policies set fees and charges to recover costs, including capital costs.

C) The entity is financed solely with revenue debt, as opposed to general obligation debt.

D) The entity's costs are legally required to be recovered from fees and charges rather than general purpose taxes or similar charges.

A) Fees are charged to external users for goods or services.

B) The entity's pricing policies set fees and charges to recover costs, including capital costs.

C) The entity is financed solely with revenue debt, as opposed to general obligation debt.

D) The entity's costs are legally required to be recovered from fees and charges rather than general purpose taxes or similar charges.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

47

Jay County has designated the General Fund as the single fund to account for its self-insurance activities. What is the maximum amount that can be charged to expenditure in the general fund related to the self-insurance activities?

A) The amount of "premium" charged to the other funds.

B) The amount of actual claims expenditures.

C) The actuarially determined amount necessary to cover claims, expenditures, and catastrophic losses.

D) The amount transferred from other funds and activities to the general fund for self-insurance purposes.

A) The amount of "premium" charged to the other funds.

B) The amount of actual claims expenditures.

C) The actuarially determined amount necessary to cover claims, expenditures, and catastrophic losses.

D) The amount transferred from other funds and activities to the general fund for self-insurance purposes.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

48

"Cash flows from capital and related financing activities" include which of the following as inflows

A) Repayment of bonds issued to construct a new city hall building.

B) Interest received on investments.

C) Grant from the state to subsidize the mass transit system.

D) Receipts from the sale of an old backhoe that had been used in general government activities.

A) Repayment of bonds issued to construct a new city hall building.

B) Interest received on investments.

C) Grant from the state to subsidize the mass transit system.

D) Receipts from the sale of an old backhoe that had been used in general government activities.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

49

When a government enterprise fund has restricted assets on its statement of net position, which of the following is a true statement?

A) The total of the restricted assets in the asset section will be equal to the "restricted net position" amount in the equity section.

B) The total of the restricted assets will be offset by a liability of an equal amount.

C) The total of the restricted assets less related liabilities will be equal to the "restricted net assets" amount in the equity section.

D) None of the above statements is true.

A) The total of the restricted assets in the asset section will be equal to the "restricted net position" amount in the equity section.

B) The total of the restricted assets will be offset by a liability of an equal amount.

C) The total of the restricted assets less related liabilities will be equal to the "restricted net assets" amount in the equity section.

D) None of the above statements is true.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following entities is required to use the direct method to report its cash flows?

A) City of Gaston Utility Fund.

B) United Way.

C) General Motors.

D) Oak Grove Water Users Association.

A) City of Gaston Utility Fund.

B) United Way.

C) General Motors.

D) Oak Grove Water Users Association.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

51

"Cash flows from operating activities" include which of the following as inflows

A) Proceeds from short-term borrowing to finance operations.

B) Receipts from property taxes levied to support operations of the activity.

C) Grants from other governments to finance an operating deficit.

D) Any cash receipt that does not meet the definition of investing, capital and related financing, or noncapital financing activities.

A) Proceeds from short-term borrowing to finance operations.

B) Receipts from property taxes levied to support operations of the activity.

C) Grants from other governments to finance an operating deficit.

D) Any cash receipt that does not meet the definition of investing, capital and related financing, or noncapital financing activities.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

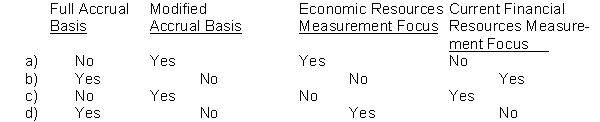

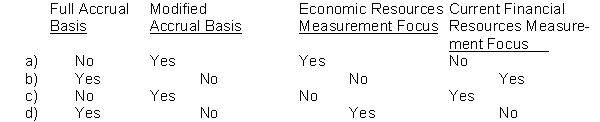

52

The financial statements of a proprietary fund are prepared using the

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

53

"Cash flows from investing activities" do NOT include which of the following as inflows

A) Receipts from the sale of marketable securities.

B) Interest received on bonds held as short-term investments.

C) Interest received on bonds held as long-term investments.

D) Transfers to other funds.

A) Receipts from the sale of marketable securities.

B) Interest received on bonds held as short-term investments.

C) Interest received on bonds held as long-term investments.

D) Transfers to other funds.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

54

"Cash flows from noncapital financing activities" include which of the following as outflows

A) Repayment of bonds issued to finance construction of city hall.

B) Deposits into investment pools.

C) Loans to another fund of the same government .

D) Grants made to other governments to support operating activities.

A) Repayment of bonds issued to finance construction of city hall.

B) Deposits into investment pools.

C) Loans to another fund of the same government .

D) Grants made to other governments to support operating activities.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

55

During the year Endor City’s self-insurance internal service fund billed the general

fund $600,000 for “premiums,” of which $60,000 was for catastrophic losses and the balance was the premium computed on an actuarially determined basis. During the year the city incurred $500,000 in claims losses. The total amount transferred to the self-insurance fund by the general fund was $620,000.

-The amount the city's general fund can recognize as an expenditure is

A) $620,000.

B) $600,000.

C) $540,000.

D) $500,000.

fund $600,000 for “premiums,” of which $60,000 was for catastrophic losses and the balance was the premium computed on an actuarially determined basis. During the year the city incurred $500,000 in claims losses. The total amount transferred to the self-insurance fund by the general fund was $620,000.

-The amount the city's general fund can recognize as an expenditure is

A) $620,000.

B) $600,000.

C) $540,000.

D) $500,000.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

56

Any internal service fund balances that are not eliminated in the consolidation process should generally be presented on the government-wide financial statements

A) In the business-type activities column.

B) In the internal service fund column.

C) In the governmental activities column.

D) These balances should not be presented on the government-wide financial statements.

A) In the business-type activities column.

B) In the internal service fund column.

C) In the governmental activities column.

D) These balances should not be presented on the government-wide financial statements.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

57

During the year Endor City’s self-insurance internal service fund billed the general

fund $600,000 for “premiums,” of which $60,000 was for catastrophic losses and the balance was the premium computed on an actuarially determined basis. During the year the city incurred $500,000 in claims losses. The total amount transferred to the self-insurance fund by the general fund was $620,000.

-The amount the city's self-insurance fund can recognize as revenue is

A) $620,000

B) $600,000.

C) $540,000.

D) $500,000.

fund $600,000 for “premiums,” of which $60,000 was for catastrophic losses and the balance was the premium computed on an actuarially determined basis. During the year the city incurred $500,000 in claims losses. The total amount transferred to the self-insurance fund by the general fund was $620,000.

-The amount the city's self-insurance fund can recognize as revenue is

A) $620,000

B) $600,000.

C) $540,000.

D) $500,000.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

58

A government operates a landfill. In the Landfill Enterprise Fund financial statements, which of the following would be reported as a restricted asset?

A) Cash received from the sale of bonds that must, based on the debt covenant, be spent only on building a new landfill runoff treatment plant.

B) Cash that management has voted to use only for landfill expansion.

C) Cash received from the general fund that will be used only to expand the landfill.

D) None of the above.

A) Cash received from the sale of bonds that must, based on the debt covenant, be spent only on building a new landfill runoff treatment plant.

B) Cash that management has voted to use only for landfill expansion.

C) Cash received from the general fund that will be used only to expand the landfill.

D) None of the above.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

59

Jona City has designated an internal service fund as the single fund to account for its self-insurance activities. Most of the insured activities, such as the police department, fire department, and general government functions, are accounted for in the general fund. What is the maximum amount that can be charged to expenditure in the general fund related to the self-insurance activities?

A) The amount of "premium" charged to the general fund by the internal service fund.

B) The amount of actual losses incurred by the insurance activity.

C) The actuarially determined amount necessary to cover claims, expenditures, and catastrophic losses.

D) The amount transferred from the general fund to the internal service fund for self-insurance purposes.

A) The amount of "premium" charged to the general fund by the internal service fund.

B) The amount of actual losses incurred by the insurance activity.

C) The actuarially determined amount necessary to cover claims, expenditures, and catastrophic losses.

D) The amount transferred from the general fund to the internal service fund for self-insurance purposes.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

60

"Cash flows from investing activities" include which of the following as cash inflows

A) Cash collection of receivables for sales of services.

B) Grants for operating activities.

C) Interest and dividends received.

D) Purchases of investments.

A) Cash collection of receivables for sales of services.

B) Grants for operating activities.

C) Interest and dividends received.

D) Purchases of investments.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

61

A city's comptroller is distraught because depreciation cannot be recorded in a general fund. Moreover, for political reasons the city council never permits the general fund to have a substantial surplus balance. As a consequence the city is unable to "save" resources to replace aging capital assets. The comptroller has heard that it is possible indirectly to charge depreciation in a general fund by transferring capital assets to an internal service fund and correspondingly to build up a cash reserve to replace the capital assets. Is the comptroller correct? If so, explain how an internal service fund can be used to charge depreciation in the general fund and thereby create a cash reserve of what would otherwise be general fund assets.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

62

Many governments use internal service funds to account for activities that provide services to the government itself. What are the ramifications of such an accounting arrangement? What are the effects on the government's financial statements?

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

63

Falmouth City owns and operates a mini-bus system which it accounts for in an enterprise fund. Prepare journal entries to record the following transactions, which occurred in a recent year.

a) The mini-bus system issued $5 million of 8 percent revenue bonds at par and used the proceeds to acquire new mini-buses.

b) As required by the bond covenant, the system set aside 1 percent of the gross bond proceeds for repair contingencies.

c) The system accrued 6 months interest on the revenue bonds at year-end.

d) The system incurred $30,000 of repair costs and paid for them with cash set aside for repair contingencies.

a) The mini-bus system issued $5 million of 8 percent revenue bonds at par and used the proceeds to acquire new mini-buses.

b) As required by the bond covenant, the system set aside 1 percent of the gross bond proceeds for repair contingencies.

c) The system accrued 6 months interest on the revenue bonds at year-end.

d) The system incurred $30,000 of repair costs and paid for them with cash set aside for repair contingencies.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

64

As part of a service concession arrangement with a private firm involving operation of a city car park, a government agrees to incur certain future maintenance costs. If the present value of the consideration paid and to be paid to the government exceeds the present value of the maintenance costs to be incurred by the government, how, if at all, should the government report the "gain"?

A) Immediate recognition of revenue.

B) Deferred inflow of resources, and recognize revenue in a systematic and rational manner over the term of the arrangement.

C) Current liability.

D) A gain should not be reported; only a loss.

A) Immediate recognition of revenue.

B) Deferred inflow of resources, and recognize revenue in a systematic and rational manner over the term of the arrangement.

C) Current liability.

D) A gain should not be reported; only a loss.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following statements about accounting for pollution remediation costs is NOT true?

A) They may be accounted for in either an enterprise fund or a governmental fund.

B) In the government-wide statements, estimates of costs to be incurred in the future should be reported as expenses and offsetting liabilities.

C) Because of the potential effects on public health, liabilities for all estimated remediation costs should be considered and reported as current liabilities.

D) Remediation costs to be accounted for include postremediation monitoring costs as well as actual cleanup costs.

A) They may be accounted for in either an enterprise fund or a governmental fund.

B) In the government-wide statements, estimates of costs to be incurred in the future should be reported as expenses and offsetting liabilities.

C) Because of the potential effects on public health, liabilities for all estimated remediation costs should be considered and reported as current liabilities.

D) Remediation costs to be accounted for include postremediation monitoring costs as well as actual cleanup costs.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

66

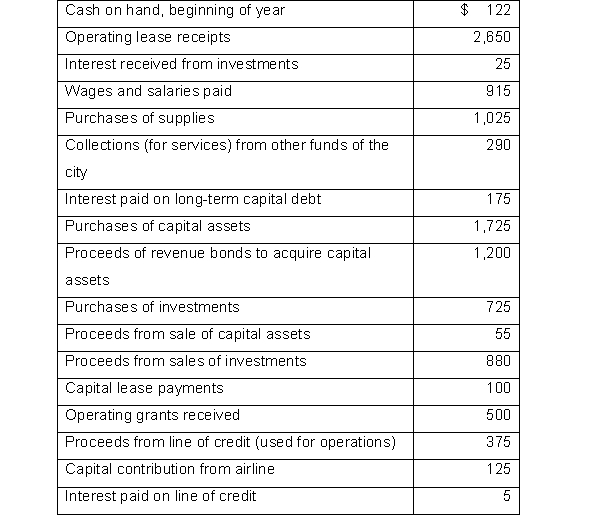

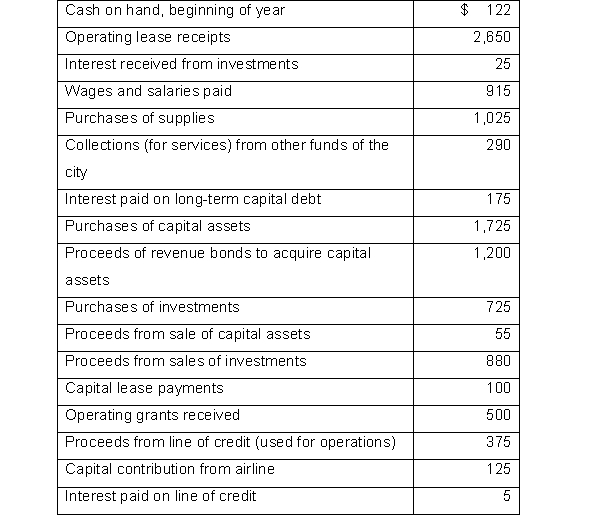

The following list of cash flows was taken from the Camber City airport fund's statement of cash flows. All amounts are in thousands.  REQUIRED:

REQUIRED:

Put these cash flow amounts in the form of a cash flows statement for the airport. Calculate and include a line for cash on hand at the end of the period.

REQUIRED:

REQUIRED:Put these cash flow amounts in the form of a cash flows statement for the airport. Calculate and include a line for cash on hand at the end of the period.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

67

Carlton City has operated a City Utility (Enterprise) Fund for a number of years. The fund accounts for the activities of the city-owned electric, water and sewer systems. During the current year, the city engaged in the following transactions related to the city utility Fund.

REQUIRED:

Prepare the appropriate journal entries. If none is required, write "No entry required."

a) The city billed its customers $1 million for services provided during the year.

b) The city received $260,000 from a developer to connect new houses to the existing utility lines.

c) Depreciation on existing physical plant was $700,000.

d) Revenue bonds in the amount of $2 million were issued at par to finance new construction. The bond agreement requires that the city retain $200,000 of the bond proceeds for purposes of servicing the debt if revenues are not sufficient to do so.

REQUIRED:

Prepare the appropriate journal entries. If none is required, write "No entry required."

a) The city billed its customers $1 million for services provided during the year.

b) The city received $260,000 from a developer to connect new houses to the existing utility lines.

c) Depreciation on existing physical plant was $700,000.

d) Revenue bonds in the amount of $2 million were issued at par to finance new construction. The bond agreement requires that the city retain $200,000 of the bond proceeds for purposes of servicing the debt if revenues are not sufficient to do so.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

68

Altona City opened a landfill that it elects to account for in an enterprise fund.

-At the time the landfill was opened the government estimated total capacity of the landfill to be 5 million cubic feet, useful life to be 20 years, and total closure and postclosure costs to be $18 million.

-At the end of Year 1, the government reestimated total closure costs to be $18.3 million and estimated capacity to be same as the original estimate.

-At the end of Year 2, the government reestimated total capacity to be 4.8 million cubic feet and total closure costs to be $18.5 million.

-At the end of Year 3, the government reestimated useful life to be 17 years but capacity remained unchanged from the preceding year and closure and postclosure costs were estimated to be $18.4 million.

REQUIRED:

Prepare journal entries in the enterprise fund to record the following events.

b) During Year 1, the city estimates that 300,000 cubic feet of capacity were used. Record the landfill expense.

c) During Year 2, the city estimates that 650,000 cubic feet of capacity were used. Record the landfill expense.

d) During Year 3 the city installed equipment at a cost of $130,000. The equipment will be used in monitoring the landfill when it is closed.

e) During Year 3 the city estimates that 1,050,000 cubic feet of capacity were used. Record the landfill expense.

-At the time the landfill was opened the government estimated total capacity of the landfill to be 5 million cubic feet, useful life to be 20 years, and total closure and postclosure costs to be $18 million.

-At the end of Year 1, the government reestimated total closure costs to be $18.3 million and estimated capacity to be same as the original estimate.

-At the end of Year 2, the government reestimated total capacity to be 4.8 million cubic feet and total closure costs to be $18.5 million.

-At the end of Year 3, the government reestimated useful life to be 17 years but capacity remained unchanged from the preceding year and closure and postclosure costs were estimated to be $18.4 million.

REQUIRED:

Prepare journal entries in the enterprise fund to record the following events.

b) During Year 1, the city estimates that 300,000 cubic feet of capacity were used. Record the landfill expense.

c) During Year 2, the city estimates that 650,000 cubic feet of capacity were used. Record the landfill expense.

d) During Year 3 the city installed equipment at a cost of $130,000. The equipment will be used in monitoring the landfill when it is closed.

e) During Year 3 the city estimates that 1,050,000 cubic feet of capacity were used. Record the landfill expense.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

69

An electric utility reports both restricted assets and restricted net position, but the amounts are different from each other. What could account for this difference?

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

70

Garfield County operates a solid waste landfill that is accounted for as an enterprise fund. At the end of 2016, the Landfill Enterprise Fund had a liability for landfill closure and postclosure care costs of $50,000. The county estimated the total costs associated with closing and monitoring the landfill as listed below.

REQUIRED:

(a) Calculate the estimated total current cost of postclosure care as of year-ends 2017 and 2018. (b) Calculate current period expenses for year-ends 2017 and 2018. (c) Prepare the required journal entries at year-ends 2017 and 2018 to recognize the current period expenses. Be sure to show all of your work.

REQUIRED:

(a) Calculate the estimated total current cost of postclosure care as of year-ends 2017 and 2018. (b) Calculate current period expenses for year-ends 2017 and 2018. (c) Prepare the required journal entries at year-ends 2017 and 2018 to recognize the current period expenses. Be sure to show all of your work.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

71

Because of the rising cost of commercial insurance, many governments have elected to be "self-insured." Explain what being "self-insured" means. Explain the difference in the accounting for self-insurance activities between a governmental fund and a proprietary fund.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

72

When insurance premiums went through the roof, Shorte City decided to "self insure." It established an internal service fund (ISF), setting aside resources for potential claims in the new fund. During the year, the following transactions were recorded in the ISF:

-The ISF recognized $1.5 million in claims expense/liabilities in accordance with GASB standards and paid $1.3 million of those claims.

-Based on an actuarial calculation, the ISF billed the other funds of the city for $2.0 million. Of this amount, $1.2 million was billed to the city's general fund and $0.8 million was billed to the city's water and sewer enterprise fund. The actuarial valuation included a reasonable provision for future catastrophe losses of $0.3 million.

REQUIRED:

a) Prepare journal entries to record these transactions in the city's self-insurance ISF.

b) Suppose, instead, that the city reported its self-insurance activities in the general fund. Prepare journal entries to record these transactions in the City's general fund. Assume that any excess was allocated ratably (proportionately) between the general fund and the water and sewer fund.

-The ISF recognized $1.5 million in claims expense/liabilities in accordance with GASB standards and paid $1.3 million of those claims.

-Based on an actuarial calculation, the ISF billed the other funds of the city for $2.0 million. Of this amount, $1.2 million was billed to the city's general fund and $0.8 million was billed to the city's water and sewer enterprise fund. The actuarial valuation included a reasonable provision for future catastrophe losses of $0.3 million.

REQUIRED:

a) Prepare journal entries to record these transactions in the city's self-insurance ISF.

b) Suppose, instead, that the city reported its self-insurance activities in the general fund. Prepare journal entries to record these transactions in the City's general fund. Assume that any excess was allocated ratably (proportionately) between the general fund and the water and sewer fund.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

73

How should a government usually report the activities of an internal service fund in the government-wide financial statements?

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

74

Asset retirement obligations liabilities should be reported at:

A) historical value

B) annually adjusted current value.

C) value estimated by the legislature

D) none of the above.

ANSWERS TO MULTIPLE CHOICE (CHAPTER 9)

A) historical value

B) annually adjusted current value.

C) value estimated by the legislature

D) none of the above.

ANSWERS TO MULTIPLE CHOICE (CHAPTER 9)

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

75

The following transactions were among those reported by Morris City's water utility enterprise fund for the current year.

Proceeds from sales of revenue bonds $3,900,000

Cash received from customer households $1,600,000

Capital contributed by subdivisions $700,000

In the water utility enterprise fund's statement of cash flows for the current year, what amount should be reported as cash flows from capital and related financing activities?

A) $3,900,000

B) $6,200,000

C) $5,500,000

D) $4,600,000

Proceeds from sales of revenue bonds $3,900,000

Cash received from customer households $1,600,000

Capital contributed by subdivisions $700,000

In the water utility enterprise fund's statement of cash flows for the current year, what amount should be reported as cash flows from capital and related financing activities?

A) $3,900,000

B) $6,200,000

C) $5,500,000

D) $4,600,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

76

The City of Santangelo received a $500,000 federal grant to acquire several buses to be used in its public transit system. The city paid $400,000 to acquire several buses. At year-end, $100,000 of the grant had not yet been used. During the year total depreciation on the buses was $40,000. Revenues for the public system were $600,000; operating expenses (other than depreciation) were $470,000.

REQUIRED:

Assuming the Public Transit Enterprise Fund began the year with unrestricted net assets of $420,000, prepare the following for the Public Transit Enterprise Fund.

a) Statement of revenues, expenses, and changes in net position.

b) Net position section of the statement of net position.

REQUIRED:

Assuming the Public Transit Enterprise Fund began the year with unrestricted net assets of $420,000, prepare the following for the Public Transit Enterprise Fund.

a) Statement of revenues, expenses, and changes in net position.

b) Net position section of the statement of net position.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

77

Governments may elect to account for their landfill activities in either a governmental or an enterprise fund. Explain the differences that would result if one government elected to account for its landfill activities in its general fund and another government elected to account for its landfill activities in an enterprise fund.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

78

What are the differences between a cash flows statement prepared for a governmental electric utility versus one prepared for an investor-owned utility?

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

79

Asset retirement obligations are similar to must be recognized under which of the following circumstances:

A) When the facility is constructed.

B) When a contamination event occurs.

C) When new laws require unanticipated dismantling costs

D) All of the above.

A) When the facility is constructed.

B) When a contamination event occurs.

C) When new laws require unanticipated dismantling costs

D) All of the above.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck