Deck 8: Long-Term Obligations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/60

Play

Full screen (f)

Deck 8: Long-Term Obligations

1

Governments may enter into operating leases, but may not enter into capital leases.

False

2

Overlapping debt refers to the obligations of property owners within a government's boundaries for their proportionate share of the debt of other governments with overlapping geographic boundaries.

True

3

General obligation debt is the obligation of the government at large and is thereby backed by the government's "full faith and credit" and revenue-raising powers.

True

4

A government is prohibited from ever recognizing bond anticipation notes (BANs) as long-term obligations.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

5

When the proceeds of long term debt are reported in governmental fund financial statements

A) They are reported only as an increase in liabilities in the funds.

B) They are reported only as revenues in the funds.

C) They are reported only as an other financing source-debt proceeds.

D) They are reported only as an other financing use-debt proceeds.

A) They are reported only as an increase in liabilities in the funds.

B) They are reported only as revenues in the funds.

C) They are reported only as an other financing source-debt proceeds.

D) They are reported only as an other financing use-debt proceeds.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

6

Per GASB, governments should report resources and actual short-term obligations.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

7

When the proceeds of general long-term debt are received by a governmental fund, the debit to cash is offset by an other financing source on the fund statement.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

8

Financial analysts look at the ratio of assessed value of property to total market value of property as a measure of a government's ability to issue new revenue bonds.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

9

A government that is unable to satisfy claims against it

A) Is prohibited from filing bankruptcy.

B) May seek protection under the Federal Bankruptcy Code, using the same section that is used by businesses.

C) May seek protection under the Federal Bankruptcy Code, using a special section directed to governments.

D) Is automatically placed under the jurisdiction of a higher level of government.

A) Is prohibited from filing bankruptcy.

B) May seek protection under the Federal Bankruptcy Code, using the same section that is used by businesses.

C) May seek protection under the Federal Bankruptcy Code, using a special section directed to governments.

D) Is automatically placed under the jurisdiction of a higher level of government.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

10

Because they are not obligations of the government at large, revenue bonds are usually not subject to voter approvals or other forms of voter oversight.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

11

Revenue debt is secured only by designated revenue streams.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

12

To seek protection under the Federal Bankruptcy Code, a government must

A) Be unable to provide the level of services it has provided in the recent past.

B) Be unable to pay its debts in the current year.

C) Have budgeted expenditures in excess of revenues.

D) Both (b) and (c).

A) Be unable to provide the level of services it has provided in the recent past.

B) Be unable to pay its debts in the current year.

C) Have budgeted expenditures in excess of revenues.

D) Both (b) and (c).

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

13

A government's debt margin is the difference between its authorized debt limit and its outstanding debt.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

14

A high bond rating by a recognized agency guarantees the creditworthiness of a government's debt.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

15

Although governments may elect to report conduit debt in their government-wide and proprietary fund statements, the GASB has ruled that note disclosure is sufficient.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

16

In accounting for operating leases, the rental payments should be recognized as expenditures in a governmental fund and as expenses in the government-wide statement of activities in the periods in which they apply.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

17

Unlike individuals and businesses, governments cannot seek protection under the Federal Bankruptcy Code.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

18

Tax anticipation notes (TANs) must be reported as current liabilities of the governmental funds in which the related revenues will be reported, as well as in the government-wide statements.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

19

In governmental fund financial statements, the assets acquired under a capital lease would be reported at

A) The total of all payments required under the lease.

B) The present value of the required lease payments.

C) The undiscounted total of required lease payments.

D) They are not reported in the fund financial statements.

A) The total of all payments required under the lease.

B) The present value of the required lease payments.

C) The undiscounted total of required lease payments.

D) They are not reported in the fund financial statements.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

20

General long-term debt of a government includes

A) All future financial obligations.

B) All future financial obligations that result from past transactions.

C) All future financial obligations that result from past transactions for which the government has already received a benefit.

D) All future financial obligations that are backed by the government's general credit and revenue raising power and that result from past transactions for which the government has already received a benefit.

A) All future financial obligations.

B) All future financial obligations that result from past transactions.

C) All future financial obligations that result from past transactions for which the government has already received a benefit.

D) All future financial obligations that are backed by the government's general credit and revenue raising power and that result from past transactions for which the government has already received a benefit.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

21

Salvador County issued $25 million of 5 percent demand bonds for construction of a county maintenance building. The county has no take-out agreement related to the bonds. It estimates that 20 percent of the bonds would be demanded (called) by the buyers if interest rates increased by at least one percentage point. At year-end, rates on comparable debt were 7 percent. How should these demand bonds be reported in the government-wide financial statements at year-end?

A) $25 million in the long-term liabilities section of the governmental activities column.

B) $5 million in the current liabilities section of the governmental activities column AND $20 million in the long-term liabilities section of the governmental activities column.

C) $5 million in the governmental activities column AND $20 million would be reported in the schedule of changes in long-term obligations.

D) $25 million in the current liabilities section of the governmental activities column.

A) $25 million in the long-term liabilities section of the governmental activities column.

B) $5 million in the current liabilities section of the governmental activities column AND $20 million in the long-term liabilities section of the governmental activities column.

C) $5 million in the governmental activities column AND $20 million would be reported in the schedule of changes in long-term obligations.

D) $25 million in the current liabilities section of the governmental activities column.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

22

Voters of Valdez School District, a public school district, approved construction of a new high school at a cost not to exceed $20 million. The district will finance the construction by issuing $20 million of 6 percent term bonds payable in 20 years. Because the site had already been prepared, the school district began construction immediately but the bonds would not be issued for nearly a year. Shortly before the fiscal year-end, the school district borrowed $5 million from a local bank due in one year with interest at 6.2 percent. The note will be repaid from bond proceeds. The school district secured a financing agreement with the bank to convert the debt to a 10-year debt if the school district is unable to sell the bonds by the due date. At year-end, how should the $5 million note be displayed in the governmental fund financial statements?

A) Capital projects fund-Notes payable $5 million; Nothing in the schedule of changes in long-term obligations.

B) Capital projects fund-Notes payable $5 million; $15 million in the schedule of changes in long-term obligations.

C) Capital projects fund-Encumbrances of $5 million; $15 million in the schedule of changes in long-term obligations.

D) Nothing in the capital projects fund AND $5 million notes payable in the schedule of Changes in long-term obligations.

A) Capital projects fund-Notes payable $5 million; Nothing in the schedule of changes in long-term obligations.

B) Capital projects fund-Notes payable $5 million; $15 million in the schedule of changes in long-term obligations.

C) Capital projects fund-Encumbrances of $5 million; $15 million in the schedule of changes in long-term obligations.

D) Nothing in the capital projects fund AND $5 million notes payable in the schedule of Changes in long-term obligations.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

23

Dumas County has a December 31 fiscal year-end. In November, the county borrowed $8 million from a local bank, due in six months at 6 percent interest, to finance general government operations. The county pledges property tax revenues to secure the loan. At year-end, how should the county display the bank note in the governmental fund financial statements?

A) Nothing in the General Fund; Nothing in the schedule of changes in long-term obligations.

B) General fund--$8 million in other financing sources; Nothing in the schedule of changes in long-term obligations.

C) General fund--$8 million in other financing sources; $8 million in the schedule of changes in long-term obligations.

D) General fund--$8 million in notes payable; Nothing in the schedule of changes in long-term obligations.

A) Nothing in the General Fund; Nothing in the schedule of changes in long-term obligations.

B) General fund--$8 million in other financing sources; Nothing in the schedule of changes in long-term obligations.

C) General fund--$8 million in other financing sources; $8 million in the schedule of changes in long-term obligations.

D) General fund--$8 million in notes payable; Nothing in the schedule of changes in long-term obligations.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

24

When the government acts as a lessor, which of the following is true? Which of the following is true? i. The lessor is selling the rights to the entire economic life of the asset.

Ii) The lessor is selling a portion of the life economic life of the asset.

Iii) The lessor should offset the receivable with the depreciation of the asset.

Iv) The lessor should offset the receivable with deferred inflow of resources

A) I and II

B) II and IV

C) I and III

D) II and IV

Ii) The lessor is selling a portion of the life economic life of the asset.

Iii) The lessor should offset the receivable with the depreciation of the asset.

Iv) The lessor should offset the receivable with deferred inflow of resources

A) I and II

B) II and IV

C) I and III

D) II and IV

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

25

Olden City entered into a capital lease agreement as a lessee for several new dump trucks to be used in general government activities. The city maintains its books and records in a manner that facilitates the preparation of the fund financial statements. Which of the following is true?

A) The title of the asset is transferred to Olden City.

B) The lease is recorded as a long-term liability at the present value of the lease.

C) The interest expenditure would be recorded on the government-wide financial statements.

D) The term of the lease is specified in the lease contract without consideration of cancellation options.

A) The title of the asset is transferred to Olden City.

B) The lease is recorded as a long-term liability at the present value of the lease.

C) The interest expenditure would be recorded on the government-wide financial statements.

D) The term of the lease is specified in the lease contract without consideration of cancellation options.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

26

GASB Statement No 87 requires specifies which of the following

A) Leases one year or more in length must be accounted for as a financing lease

B) The lessee account for the lease as if it had purchased the rights to the asset and borrowed the purchase price.

C) The treatment of leases of buildings, land and equipment, but excludes the treatment of intangible assets

D) All of the above.

A) Leases one year or more in length must be accounted for as a financing lease

B) The lessee account for the lease as if it had purchased the rights to the asset and borrowed the purchase price.

C) The treatment of leases of buildings, land and equipment, but excludes the treatment of intangible assets

D) All of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

27

Overlapping debt should be reported in which of the following ways?

A) It should be reported in the schedule of changes in long-term obligations.

B) It should be disclosed as a note to the financial statements.

C) It should be reported in a schedule in the statistical section of the annual report.

D) It should not be reported anywhere in the annual report.

A) It should be reported in the schedule of changes in long-term obligations.

B) It should be disclosed as a note to the financial statements.

C) It should be reported in a schedule in the statistical section of the annual report.

D) It should not be reported anywhere in the annual report.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

28

Salvador County issued $25 million of 5 percent demand bonds for construction of a county maintenance building. The county has no take-out agreement related to the debt. It estimates that 20 percent of the bonds would be demanded (called) by the buyers if interest rates increased by at least one percentage point. At year-end, rates on comparable debt were 7 percent. How should these demand bonds be reported in the governmental fund financial statements at year-end?

A) $25 million in the capital projects fund.

B) $5 million in the capital projects fund AND $20 million would be reported in the schedule of changes in long-term obligations.

C) $20 million in the capital projects fund AND $5 million would be reported in the schedule of changes in long-term obligations.

D) $25 million in the schedule of changes in long-term obligations.

A) $25 million in the capital projects fund.

B) $5 million in the capital projects fund AND $20 million would be reported in the schedule of changes in long-term obligations.

C) $20 million in the capital projects fund AND $5 million would be reported in the schedule of changes in long-term obligations.

D) $25 million in the schedule of changes in long-term obligations.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

29

Pacheco City issued $20 million of bonds at par. The city loaned the proceeds to Sharpe Cheese Processors to expand the size of its facility, which would allow Sharpe to hire additional workers. The loan payments from Sharpe to the city are established to match the principal and interest payments on the bond issue. The bonds are payable exclusively from the loan repayments by Sharpe. The bonds are secured by the additional plant facilities built by Sharpe. Where should the city report the bonds in its annual financial report?

A) In the government-wide financial statements.

B) In the notes to the financial statements.

C) In the proprietary fund financial statements.

D) In any of the above ways.

A) In the government-wide financial statements.

B) In the notes to the financial statements.

C) In the proprietary fund financial statements.

D) In any of the above ways.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

30

North City enters into a lease agreement that contains a nonappropriation clause. The clause

A) Has been held by courts in 26 states to effectively cancel the lease.

B) Stipulates that the yearly lease payment must be appropriated by the city council each year.

C) Prohibits the city from replacing leased property with similar property.

D) Permits the city to lease at lower rates than would be possible without the presence of the clause.

A) Has been held by courts in 26 states to effectively cancel the lease.

B) Stipulates that the yearly lease payment must be appropriated by the city council each year.

C) Prohibits the city from replacing leased property with similar property.

D) Permits the city to lease at lower rates than would be possible without the presence of the clause.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

31

Obligations of property owners within a particular government for their proportionate share of debts of other governments with whom their government shares boundaries are called

A) Overlapping debt.

B) Conduit debt.

C) Committed debt.

D) Moral obligation debt.

A) Overlapping debt.

B) Conduit debt.

C) Committed debt.

D) Moral obligation debt.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

32

Bond insurance issued by credit enhancement agencies

A) Assures the holder of the debt that all interest and principal payments will be made.

B) Ensures that the bonds receive the highest possible rating.

C) May seem cost prohibitive to many governments.

D) All of the above.

A) Assures the holder of the debt that all interest and principal payments will be made.

B) Ensures that the bonds receive the highest possible rating.

C) May seem cost prohibitive to many governments.

D) All of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

33

Industrial development bonds are issued in the name of a government with the proceeds used to attract private businesses to a community. Which of the following is a true statement about industrial development bonds?

A) The proceeds are used by the private corporations and principal and interest payments are made by the private corporation. The government backs the bonds in the event of default by the private corporation.

B) The proceeds are used by the private corporations and principal and interest payments are made by the private corporation. The government does not back the bonds in the event of default by the private corporation.

C) The proceeds are used by the government to build infrastructure to service private corporations, with principal and interest payments made by the government out of the additional tax revenues received from the private corporation.

D) The proceeds are used by the government to build infrastructure to service private corporations, with principal and interest payments made by the private corporation in lieu of property taxes.

A) The proceeds are used by the private corporations and principal and interest payments are made by the private corporation. The government backs the bonds in the event of default by the private corporation.

B) The proceeds are used by the private corporations and principal and interest payments are made by the private corporation. The government does not back the bonds in the event of default by the private corporation.

C) The proceeds are used by the government to build infrastructure to service private corporations, with principal and interest payments made by the government out of the additional tax revenues received from the private corporation.

D) The proceeds are used by the government to build infrastructure to service private corporations, with principal and interest payments made by the private corporation in lieu of property taxes.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

34

In the government-wide financial statements, the assets acquired under a capital lease would be reported at

A) The total of all payments required under the lease.

B) The present value of the required lease payments.

C) The undiscounted total of required lease payments.

D) They are not reported in the government-wide financial statements.

A) The total of all payments required under the lease.

B) The present value of the required lease payments.

C) The undiscounted total of required lease payments.

D) They are not reported in the government-wide financial statements.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

35

Salvador County issued $25 million of 5 percent demand bonds for construction of a county maintenance building. Before year-end the county entered into a two-year noncancellable take-out agreement with a local bank with a 10-year payback period. The county estimates that 20 percent of the bonds would be demanded (called) by the buyers if interest rates increased by at least One percentage point. At year-end, rates on comparable debt were 7 percent. How should these demand bonds be reported in the county's government-wide financial statements at year-end?

A) $25 million in the long-term liabilities section of the governmental activities column.

B) $5 million in the current liabilities section of the governmental activities column AND $20 million in the long-term liabilities section of the governmental activities column.

C) $5 million in the governmental activities column AND $20 million would be reported in the schedule of changes in long-term obligations.

D) $25 million in the current liabilities section of the governmental activities column.

A) $25 million in the long-term liabilities section of the governmental activities column.

B) $5 million in the current liabilities section of the governmental activities column AND $20 million in the long-term liabilities section of the governmental activities column.

C) $5 million in the governmental activities column AND $20 million would be reported in the schedule of changes in long-term obligations.

D) $25 million in the current liabilities section of the governmental activities column.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following is likely to be used by a bond rating agency to rate a government's general obligation bonds?

A) A review of the basic financial statements.

B) Consideration of economic statistics such as unemployment rates.

C) Consideration of legal debt margin.

D) All of the above.

A) A review of the basic financial statements.

B) Consideration of economic statistics such as unemployment rates.

C) Consideration of legal debt margin.

D) All of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

37

Why would a government issue revenue bonds (which generally are issued at a higher rate of interest than general obligation bonds) even though the government knows that if revenues from the project are not sufficient to cover principal and interest payments, the government will use resources from general government activities to fund the principal and interest payments?

A) Revenue bonds may not require approval of the voters.

B) Revenue bonds may not be considered in legal debt limitations.

C) Revenue bonds may permit the interest costs to be passed on to the users of the services financed.

D) All of the above.

A) Revenue bonds may not require approval of the voters.

B) Revenue bonds may not be considered in legal debt limitations.

C) Revenue bonds may permit the interest costs to be passed on to the users of the services financed.

D) All of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

38

In a bond covenant, a city agreed to create and maintain a $2 million reserve. These funds can be used

A) Only to make the final year's interest and principal payments on the bonds.

B) Only to make the interest and principal payments on the bonds in a year in which the city is unable to make them from other resources.

C) To make either the final year's interest and principal payments on the bonds or to make the payments in any year that the city is unable to make them from other resources.

D) By the city as it chooses since the funds legally belong to the city.

A) Only to make the final year's interest and principal payments on the bonds.

B) Only to make the interest and principal payments on the bonds in a year in which the city is unable to make them from other resources.

C) To make either the final year's interest and principal payments on the bonds or to make the payments in any year that the city is unable to make them from other resources.

D) By the city as it chooses since the funds legally belong to the city.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

39

Obligations issued in the name of a government on behalf of a nongovernmental entity are called

A) Overlapping debt.

B) Conduit debt.

C) Committed debt.

D) Moral obligation debt.

A) Overlapping debt.

B) Conduit debt.

C) Committed debt.

D) Moral obligation debt.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following funds is most likely to receive the proceeds of revenue bonds?

A) General fund.

B) Capital projects fund.

C) City utility enterprise fund.

D) Highway department special revenue fund.

A) General fund.

B) Capital projects fund.

C) City utility enterprise fund.

D) Highway department special revenue fund.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

41

In November 2017, the Frost City issued $3 million in 6 percent TANs, payable in April 2018. In what fund or fund type should the city report the TANs on its December 31, 2017 financial statements? Explain, indicating any additional information you would need.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

42

What is the distinction between general obligation debt and revenue bond debt? Why might a government issue revenue bond debt instead of general obligation debt?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

43

Identify and define "conduit debt." What are the current reporting standards for conduit debt issued by governments? Do you agree or disagree with the use of conduit debt by governments? Justify your answer. Do you agree or disagree with the current reporting standards related to conduit debt? Why?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

44

Mod City is located in Harper County. Mod Valley School District encompasses all of Mod City and some of Harper County. Property in Mod City is assessed at $400 million; property in Harper County is assessed at $800 million; property in Mod Valley School District is assessed at $600 million. The total debt outstanding for Mod City is $30 million; Harper County is $50 million; Mod Valley School District is $45 million.

REQUIRED: For Mod City, compute (a) the amount of direct debt and (b) the amount of overlapping debt.

REQUIRED: For Mod City, compute (a) the amount of direct debt and (b) the amount of overlapping debt.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

45

During the fiscal year ended 6/30/18, the Harris City engaged in the following transactions.

REQUIRED: Assume that the city maintains its books and records in a manner that facilitates the preparation of its governmental fund financial statements. Prepare all necessary journal entries that the city should make for each transaction. Clearly indicate in which fund the entry is being made. If no entry is required, write "No entry required."

a) In July 2017, the city issued $30 million in 6% general obligation term bonds to finance construction of a new building to house city offices. The bonds were issued at a premium of $300,000.

b) In September 2017, the city transferred $1.5 million from the general fund to cover the $0.9 million principal and $0.6 million interest payments due that month on debt issued in previous years.

c) In September 2017, the city paid the principal and interest due from (b).

d) In June 2018, the city transferred $3 million from the general fund to cover the $1.8 million interest payment and the $1.2 million principal payment due in July 2018 on the bonds issued in (a).

REQUIRED: Assume that the city maintains its books and records in a manner that facilitates the preparation of its governmental fund financial statements. Prepare all necessary journal entries that the city should make for each transaction. Clearly indicate in which fund the entry is being made. If no entry is required, write "No entry required."

a) In July 2017, the city issued $30 million in 6% general obligation term bonds to finance construction of a new building to house city offices. The bonds were issued at a premium of $300,000.

b) In September 2017, the city transferred $1.5 million from the general fund to cover the $0.9 million principal and $0.6 million interest payments due that month on debt issued in previous years.

c) In September 2017, the city paid the principal and interest due from (b).

d) In June 2018, the city transferred $3 million from the general fund to cover the $1.8 million interest payment and the $1.2 million principal payment due in July 2018 on the bonds issued in (a).

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

46

What is "overlapping debt" and why is it important to financial analysts and others who use government financial statements?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

47

On December 31, 2017 Morse City issued $50 million of 8 percent, 20-year, demand bonds that give bondholders the opportunity to "put" (i.e. sell) the securities back to the issuer at face value, beginning on January 1, 2018. On December 31, 2017, prevailing interest rates on comparable bonds were 6.7 percent. Should the city report the bonds as a liability on its December 31, 2017 governmental fund financial statements? Explain, indicating any additional information you would need to make a determination.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

48

In August 2017, the voters of Carp City approved construction of a new public library at the cost of $20 million, to be financed by general obligation bonds. The city put the contracts out to bid and approved the bid of the lowest bidder. In September 2017, the city began the long process of issuing the general obligation bonds. However, so that construction could begin immediately, the city also issued $5 million in bond anticipation notes in September 2017, maturing in March 2018. In December 2017, one of the city's major manufacturers announced that it would be closing its plant in the city, eliminating over half of the jobs currently available in the city.

REQUIRED:

(a) Prepare journal entries to initially record the issuance of the BANs in the city's capital projects fund as well as in its government-wide financial statements.

(b) The city decided to reconsider the scope of the library project in light of the plant closure, prepare any entries necessary to change the reporting of the BANs assuming that the city negotiated a 6-month extension of the initial due date for the BANs and would not issue any general obligation bonds before issuing its June 30, 2018 financial statements.

REQUIRED:

(a) Prepare journal entries to initially record the issuance of the BANs in the city's capital projects fund as well as in its government-wide financial statements.

(b) The city decided to reconsider the scope of the library project in light of the plant closure, prepare any entries necessary to change the reporting of the BANs assuming that the city negotiated a 6-month extension of the initial due date for the BANs and would not issue any general obligation bonds before issuing its June 30, 2018 financial statements.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

49

A major exception to the general rule of expenditure accrual for governmental funds of a state or local government relates to unmatured

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is true about FASB leasing standards?

A) FASB standards are identical to GASB standards.

B) FASB has three type of leases for lessees: sales type, direct financing and operating.

C) FASB distinguishes between capital and operating leases.

D) Governments have the option to follow the FASB standards.

ANSWERS TO MULTIPLE CHOICE (CHAPTER 8)

A) FASB standards are identical to GASB standards.

B) FASB has three type of leases for lessees: sales type, direct financing and operating.

C) FASB distinguishes between capital and operating leases.

D) Governments have the option to follow the FASB standards.

ANSWERS TO MULTIPLE CHOICE (CHAPTER 8)

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is not likely to be a reason why a government might obtain an asset through an operating lease? The government

A) Does not have enough cash or credit to purchase the asset.

B) Wishes to avoid the risk of owning an asset that has become obsolete and cannot be sold.

C) Believes the total value of assets reported in the schedule of changes in capital assets is already too high.

D) Needs the asset for only a small part of its useful life.

A) Does not have enough cash or credit to purchase the asset.

B) Wishes to avoid the risk of owning an asset that has become obsolete and cannot be sold.

C) Believes the total value of assets reported in the schedule of changes in capital assets is already too high.

D) Needs the asset for only a small part of its useful life.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

52

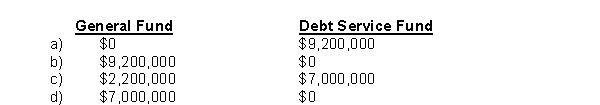

Flora City is accumulating financial resources that are legally restricted to payments of general long-term debt principal and interest maturing in future years. At year-end, $7,000,000 has been accumulated for principal payments, and $2,200,000 has been accumulated for interest payments. These restricted funds should be accounted for in the

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

53

Flora City financed the construction of sidewalks in a newly annexed subdivision by issuing $50 million in special assessment debt. The debt is to be serviced entirely by assessments against the subdivision's property owners. The government does not have any obligation for the debt and has not guaranteed it. Nevertheless, when the property owners in a nearby subdivision were unable to pay their required assessments, the city, fearful of damaging its own credit rating, serviced the debt using its own resources. Should the city report the $50 million in special assessment debt in its government-wide statement of net position? Explain, citing specific GASB provisions.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

54

Clavel County leases an office building with a remaining economic life of 20 years. The fair market value of the building is $6 million. Annual lease payments are agreed at $523,107, based on a 6 percent interest rate. The lease meets the conditions for a capital lease.

1. Record the lease and the first year's interest payment

(a) In a governmental fund

(b) In the government-wide statements

2. Should the office building be depreciated? If so, how and where should depreciation be recorded?

1. Record the lease and the first year's interest payment

(a) In a governmental fund

(b) In the government-wide statements

2. Should the office building be depreciated? If so, how and where should depreciation be recorded?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

55

Midway City engaged in two types of debt transactions in its fiscal year ending December 31, 2017. The city issued its financial statements for 2017 on May 15, 2018.

A. In November 2017, the city issued $4 million in bond anticipation notes (BANs) to finance construction of a new maintenance facility. The proceeds were placed in a capital projects fund and the city began construction immediately. Although the city intended to refinance the BANs with long-term bonds, interest rates were higher than anticipated and as of May 15, 2018 the city had neither issued the bonds nor entered into an agreement to do so. How, if at all, should the debt be reported in the capital projects fund and the government-wide statements? Be specific.

1. Capital projects fund

2. Government-wide statements

B. In October 2017, the city issued $1 million of industrial development bonds to finance the construction of a new fast-food restaurant. The city will construct the facility and lease it to a restaurant chain. The lease satisfies the criteria for a capital lease. The lease payments will be exactly equal to the debt service on the bonds. The bonds are payable exclusively from the lease payments. In the event the restaurant chain defaults on its lease payments, the bondholders have a claim only against the restaurant chain and the leased property, not against the city. In its December 31, 2017 government-wide statement of net position, the city did not report the debt as a liability. Assuming that the amount involved is material, would you as an auditor issue an unqualified opinion on the financial statements? Explain and justify your response.

A. In November 2017, the city issued $4 million in bond anticipation notes (BANs) to finance construction of a new maintenance facility. The proceeds were placed in a capital projects fund and the city began construction immediately. Although the city intended to refinance the BANs with long-term bonds, interest rates were higher than anticipated and as of May 15, 2018 the city had neither issued the bonds nor entered into an agreement to do so. How, if at all, should the debt be reported in the capital projects fund and the government-wide statements? Be specific.

1. Capital projects fund

2. Government-wide statements

B. In October 2017, the city issued $1 million of industrial development bonds to finance the construction of a new fast-food restaurant. The city will construct the facility and lease it to a restaurant chain. The lease satisfies the criteria for a capital lease. The lease payments will be exactly equal to the debt service on the bonds. The bonds are payable exclusively from the lease payments. In the event the restaurant chain defaults on its lease payments, the bondholders have a claim only against the restaurant chain and the leased property, not against the city. In its December 31, 2017 government-wide statement of net position, the city did not report the debt as a liability. Assuming that the amount involved is material, would you as an auditor issue an unqualified opinion on the financial statements? Explain and justify your response.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

56

The work of bond rating agencies is important because

A) They ensure that all principal and interest payments on bonds issued will be made.

B) The rating they assign proves the quality of a particular debt instrument.

C) They affect the debt's marketability and hence its interest rate.

D) Bonds cannot be issued without them.

A) They ensure that all principal and interest payments on bonds issued will be made.

B) The rating they assign proves the quality of a particular debt instrument.

C) They affect the debt's marketability and hence its interest rate.

D) Bonds cannot be issued without them.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

57

Generally accepted accounting principles require governments to report many assets to be reported at market value. However, few liabilities are reported at market value. Present arguments for and against reporting liabilities at market value.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

58

Why is information about long-term debt important to financial statement users?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

59

Rand City entered into the following transactions during the current year. REQUIRED: Assume that the city maintains its books and records in a manner that facilitates the preparation of its fund financial statements. Prepare entries to record the following transactions. Indicate the fund in which the entry is being made.

a) The city issues $5 million of tax anticipation notes, backed by property taxes that will be recorded in the general fund.

b) The city issues $2 million of 90-day bond anticipation notes that it expects to roll over into long-term bonds.

c) The city repays the $5 million in (a) plus $0.125 million in interest.

d) The city successfully issues $20 million in long-term bonds and repays the notes in (b).

a) The city issues $5 million of tax anticipation notes, backed by property taxes that will be recorded in the general fund.

b) The city issues $2 million of 90-day bond anticipation notes that it expects to roll over into long-term bonds.

c) The city repays the $5 million in (a) plus $0.125 million in interest.

d) The city successfully issues $20 million in long-term bonds and repays the notes in (b).

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

60

Terry City is considering issuing $50 million in debt to finance construction of a new sewer system. REQUIRED: Compare the possible financial effects of the city's decision to finance the new system with

(a) General obligation debt

(b) State-issued sewer revolving bond fund debt, which carries the moral obligation of the state in addition to being a primary obligation of the city through its loan payments to the state

(c) The city's own sewer revenue bonds, or

(d) General obligation debt insured by a company specializing in municipal bond insurance.

(a) General obligation debt

(b) State-issued sewer revolving bond fund debt, which carries the moral obligation of the state in addition to being a primary obligation of the city through its loan payments to the state

(c) The city's own sewer revenue bonds, or

(d) General obligation debt insured by a company specializing in municipal bond insurance.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck