Deck 3: Issues of Budgeting and Control

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/69

Play

Full screen (f)

Deck 3: Issues of Budgeting and Control

1

Capital budgets focus on plans for the acquisition and construction of fixed assets.

True

2

Which of the following is a primary benefit of a performance budget?

A) It facilitates control by establishing rigid spending mandates.

B) It encourages accomplishment of objectives by associating expenditures with outcomes.

C) It encourages planning by requiring management to anticipate every type of expenditure.

D) It provides decision-makers with detailed information.

A) It facilitates control by establishing rigid spending mandates.

B) It encourages accomplishment of objectives by associating expenditures with outcomes.

C) It encourages planning by requiring management to anticipate every type of expenditure.

D) It provides decision-makers with detailed information.

B

3

State and local governments must prepare their GAAP budgetary comparisons on the modified accrual basis of accounting.

False

4

An appropriations budget applies to

A) The general fund.

B) The proprietary fund.

C) The fiduciary fund.

D) The enterprise fund.

A) The general fund.

B) The proprietary fund.

C) The fiduciary fund.

D) The enterprise fund.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

5

For which of the following funds would flexible budgeting be most valuable?

A) Special revenue fund.

B) Capital projects fund.

C) Agency fund.

D) Enterprise fund.

A) Special revenue fund.

B) Capital projects fund.

C) Agency fund.

D) Enterprise fund.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

6

Not-for-profit budgets can rely on levies in addition to fund-raising and donations for revenues.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

7

Most budgets are prepared on a cash or modified cash basis.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

8

Character, in relation to expenditures, represents

A) The morality of the expenditure.

B) The amount of the expenditure.

C) The type of fund in which the expenditure is recorded.

D) The fiscal period the expenditure will benefit.

A) The morality of the expenditure.

B) The amount of the expenditure.

C) The type of fund in which the expenditure is recorded.

D) The fiscal period the expenditure will benefit.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

9

Periodic allocations of funds to departments or agencies are generally called i. Appropriations.

Ii) Allotments.

Iii) Apportionments.

A) III only

B) I and II

C) II and III

D) I, II and III

Ii) Allotments.

Iii) Apportionments.

A) III only

B) I and II

C) II and III

D) I, II and III

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

10

Capital budgets concentrate on long-lived assets.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

11

Encumbrances and expenditures both reduce total fund balances of state and local governments.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

12

Which branch of local (city and county) government most commonly prepares the budget?

A) Executive branch.

B) Legislative branch.

C) Judicial branch.

D) None of the above.

A) Executive branch.

B) Legislative branch.

C) Judicial branch.

D) None of the above.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is NOT a function of a budget in the governmental environment?

A) Planning.

B) Organizing.

C) Controlling.

D) Evaluating.

A) Planning.

B) Organizing.

C) Controlling.

D) Evaluating.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

14

GASB, but not FASB, sets standards for budgetary accounting.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

15

Property taxes levied on the citizens of the Hill County would most appropriately be budgeted in which of the following budgets?

A) Operating budget.

B) Capital budget.

C) Flexible budget.

D) All of the above.

A) Operating budget.

B) Capital budget.

C) Flexible budget.

D) All of the above.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

16

When budgets are integrated into a government's accounting system, estimated revenues are debited.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

17

Cash-basis budgets help governments demonstrate interperiod equity.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

18

The accounting cycle for most governments is two to three years and the budgeting process is less than six months.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

19

Reserve for encumbrances accounts is a balance sheet account.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

20

State and local governments' budget-to-actual comparisons present both original and final budget amounts.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is NOT a reason that legally adopted budgets may not be readily comparable to amounts reported in the GAAP-based financial statements?

A) Differences in basis of accounting.

B) Differences in timing.

C) Differences in reporting entity.

D) Differences in recognition.

A) Differences in basis of accounting.

B) Differences in timing.

C) Differences in reporting entity.

D) Differences in recognition.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

22

A governmental entity has formally integrated the budget into its accounting records and uses encumbrance accounting. During the year the government ordered but had not yet received a new police car. What effect will this event have on the unencumbered balance in the account "Expenditures-capital outlay, police department"?

A) The balance in the account will not be affected until the police car is received.

B) The balance in the account will be increased.

C) The balance in the account will be decreased.

D) Purchase orders never affect any budgetary account balances.

A) The balance in the account will not be affected until the police car is received.

B) The balance in the account will be increased.

C) The balance in the account will be decreased.

D) Purchase orders never affect any budgetary account balances.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

23

To close Encumbrances at the end of the year which of the following entries should be made?

A) Debit Encumbrances; Credit Fund balance.

B) Debit Reserve for encumbrances; Credit Encumbrances.

C) Debit Fund balance; Credit Encumbrances.

D) No closing entry needed.

A) Debit Encumbrances; Credit Fund balance.

B) Debit Reserve for encumbrances; Credit Encumbrances.

C) Debit Fund balance; Credit Encumbrances.

D) No closing entry needed.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is the best reason for preparing budgets for government entities on the cash basis?

A) Cash basis budgeting helps to achieve interperiod equity.

B) Cash basis budgeting helps to ensure that the government will receive no more in revenues than itis required to disburse.

C) Cash basis budgeting helps a government plan to have cash on hand to pay bills

D) Cash basis budgeting more accurately reflects the economic impact of fiscal activities.

A) Cash basis budgeting helps to achieve interperiod equity.

B) Cash basis budgeting helps to ensure that the government will receive no more in revenues than itis required to disburse.

C) Cash basis budgeting helps a government plan to have cash on hand to pay bills

D) Cash basis budgeting more accurately reflects the economic impact of fiscal activities.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

25

A governmental entity has formally integrated the budget into its accounting records. At the end of the third quarter the ledger account "Expenditures--salaries" has a $100,000 debit balance. Which of the following is a true statement?

A) The entity has $100,000 available to spend on salaries.

B) The entity has incurred salaries in the amount of $100,000.

C) The entity had paid salaries in the amount of $100,000.

D) The entity has overspent its budget for salaries by $100,000.

A) The entity has $100,000 available to spend on salaries.

B) The entity has incurred salaries in the amount of $100,000.

C) The entity had paid salaries in the amount of $100,000.

D) The entity has overspent its budget for salaries by $100,000.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

26

A governmental entity has formally integrated the budget into its accounting records. At year-end the ledger account "Estimated Revenues" has a debit balance. Which of the following is the best explanation for the debit balance?

A) The entity overestimated property tax revenue it expected to be recognized.

B) The entity underestimated property tax revenue when preparing its budget.

C) The entity collected more in property taxes than it anticipated.

D) There is no logical explanation; revenue accounts usually do not have debit balances.

A) The entity overestimated property tax revenue it expected to be recognized.

B) The entity underestimated property tax revenue when preparing its budget.

C) The entity collected more in property taxes than it anticipated.

D) There is no logical explanation; revenue accounts usually do not have debit balances.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

27

At year-end Oakland County had $3,000 of outstanding purchase commitments on the books. After the appropriate closing entries are made, what is the effect on the total fund balance of Oakland County?

A) It is $3,000 greater than it would have been if the purchase commitments had been fulfilled by year-end.

B) It is $3,000 less than it would have been if the purchase commitments had been fulfilled by year-end.

C) It is the same as it would have been if the purchase commitments had been fulfilled by year-end; it will be reduced by $3,000 next year.

D) It is the same as it would have been if the purchase commitments had been fulfilled by year-end; it will not change next year.

A) It is $3,000 greater than it would have been if the purchase commitments had been fulfilled by year-end.

B) It is $3,000 less than it would have been if the purchase commitments had been fulfilled by year-end.

C) It is the same as it would have been if the purchase commitments had been fulfilled by year-end; it will be reduced by $3,000 next year.

D) It is the same as it would have been if the purchase commitments had been fulfilled by year-end; it will not change next year.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

28

A university that formally integrates the budget in the accounting system and uses encumbrance accounting orders some new computers that will cost approximately $20,000. To recognize this event the university should make which of the following entries?

A) Debit Expenditures $20,000; Credit Encumbrances $20,000

B) Debit Encumbrances $20,000; Credit Reserve for encumbrances $20,000

C) Debit Encumbrances $20,000; Credit Accounts payable $20,000

D) No entry required when the order is placed.

A) Debit Expenditures $20,000; Credit Encumbrances $20,000

B) Debit Encumbrances $20,000; Credit Reserve for encumbrances $20,000

C) Debit Encumbrances $20,000; Credit Accounts payable $20,000

D) No entry required when the order is placed.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

29

A public school district formally adopted a budget with estimated revenues of $800 and approved expenditures of $780. Which of the following is the appropriate entry to record the budget?

A) Debit Estimated revenues $800; Credit Appropriations $780; Credit Fund balance $20.

B) Debit Appropriations $780; Debit Fund balance $20; Credit Estimated revenues $800.

C) Debit Encumbrances $780; Debit Fund balance $20; Credit Estimated revenues $800.

D) Memorandum entry only.

A) Debit Estimated revenues $800; Credit Appropriations $780; Credit Fund balance $20.

B) Debit Appropriations $780; Debit Fund balance $20; Credit Estimated revenues $800.

C) Debit Encumbrances $780; Debit Fund balance $20; Credit Estimated revenues $800.

D) Memorandum entry only.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

30

A county general fund budget includes budgeted revenues of $900 and budgeted expenditures of $890. Actual revenues for the year were $915. To close the estimated revenues account at the end of the year

A) Debit Estimated revenues $15

B) Credit Estimated revenue $15

C) Debit Estimated revenues $900

D) Credit Estimated revenues $900

A) Debit Estimated revenues $15

B) Credit Estimated revenue $15

C) Debit Estimated revenues $900

D) Credit Estimated revenues $900

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

31

A county previously encumbered $15,000 for the acquisition of supplies. The supplies were received at a total cost of $14,700. To recognize this event the county should make which of the following entries?

A) Debit Reserve for encumbrances $15,000; Credit Encumbrances $15,000.

B) Debit Reserve for encumbrances $14,700; Credit Encumbrances $14,700.

C) Debit Encumbrances $15,000; Credit Reserve for encumbrances $15,000.

D) Debit Encumbrances $14,700; Credit Reserve for encumbrances $14,700.

A) Debit Reserve for encumbrances $15,000; Credit Encumbrances $15,000.

B) Debit Reserve for encumbrances $14,700; Credit Encumbrances $14,700.

C) Debit Encumbrances $15,000; Credit Reserve for encumbrances $15,000.

D) Debit Encumbrances $14,700; Credit Reserve for encumbrances $14,700.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

32

The City of Lakeview adopts its budget on a basis of accounting that permits outstanding purchase commitments to be charged against the budget in the year that the goods are ordered instead of in the year they are received. During 2018, the city received $4,000 of supplies (of which $3,000 had been ordered in 2018 and $1,000 was ordered in 2017) and had $500 of outstanding purchase commitments for supplies at year-end. In the budget-to-actual comparison, the expenditures for supplies would be:

A) $3,000.

B) $3,500.

C) $4,000.

D) $4,500.

A) $3,000.

B) $3,500.

C) $4,000.

D) $4,500.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

33

When Spruce City receives goods at a cost of $9,700 that were encumbered in the prior year for $10,000, which of the following entries are required (assume that encumbrances lapse at year end)?

A) Debit Expenditures $9,700; Credit Accounts payable $9,700; no entry for Encumbrances.

B) Debit Expenditures $9,700 and Reserve for encumbrances $10,000; Credit Accounts payable $9,700 and Encumbrances $10,000.

C) Debit Expenditures $10,000 and Reserve for encumbrances $10,000; Credit Accounts payable $10,000 and Encumbrances $10,000.

D) Debit Reserve for encumbrances $10,000; Credit Encumbrances $10,000; no entry for Expenditures.

A) Debit Expenditures $9,700; Credit Accounts payable $9,700; no entry for Encumbrances.

B) Debit Expenditures $9,700 and Reserve for encumbrances $10,000; Credit Accounts payable $9,700 and Encumbrances $10,000.

C) Debit Expenditures $10,000 and Reserve for encumbrances $10,000; Credit Accounts payable $10,000 and Encumbrances $10,000.

D) Debit Reserve for encumbrances $10,000; Credit Encumbrances $10,000; no entry for Expenditures.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following bases of accounting has been established by GASB for use in the preparation of the general fund budget?

A) Cash basis.

B) Modified accrual basis.

C) Accrual basis.

D) None of the above.

A) Cash basis.

B) Modified accrual basis.

C) Accrual basis.

D) None of the above.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is NOT true about cash basis budgeting?

A) Cash basis budgeting permits a government to balance its budget by delaying cash disbursements.

B) Cash basis budgeting permits a government to balance its budget by advancing the recognition of revenue.

C) Cash basis budgeting encourages interperiod equity.

D) Cash basis budgeting complicates financial accounting and reporting.

A) Cash basis budgeting permits a government to balance its budget by delaying cash disbursements.

B) Cash basis budgeting permits a government to balance its budget by advancing the recognition of revenue.

C) Cash basis budgeting encourages interperiod equity.

D) Cash basis budgeting complicates financial accounting and reporting.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

36

A city received supplies that had been previously encumbered. The supplies were encumbered for $5,000 and had an actual cost of $4,900. To recognize this event the county should make which of the following entries?

A) Debit Reserve for encumbrances $5,000 and Supplies $4,900; Credit Encumbrances $5,000 and Vouchers payable $4,900.

B) Debit Encumbrances $5,000 and Supplies $4,900; Credit Reserve for encumbrances $5,000 and Vouchers payable $4,900.

C) Debit Reserve for encumbrances $4,900 and Supplies $4,900; Credit Encumbrances $4,900 and Vouchers payable $4,900.

D) Debit Encumbrances $4,900 and Supplies $4,900; Credit Reserve for encumbrances $4,900 and Vouchers payable $4,900.

A) Debit Reserve for encumbrances $5,000 and Supplies $4,900; Credit Encumbrances $5,000 and Vouchers payable $4,900.

B) Debit Encumbrances $5,000 and Supplies $4,900; Credit Reserve for encumbrances $5,000 and Vouchers payable $4,900.

C) Debit Reserve for encumbrances $4,900 and Supplies $4,900; Credit Encumbrances $4,900 and Vouchers payable $4,900.

D) Debit Encumbrances $4,900 and Supplies $4,900; Credit Reserve for encumbrances $4,900 and Vouchers payable $4,900.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

37

GASB requires that government entities present their budget-to-actual comparison data on which of the following bases of accounting?

A) Budgetary basis.

B) Cash basis.

C) Modified accrual basis.

D) Accrual basis.

A) Budgetary basis.

B) Cash basis.

C) Modified accrual basis.

D) Accrual basis.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

38

To close Reserve for encumbrances at the end of the year which of the following entries should be made?

A) Debit Reserve for encumbrances; Credit Fund balance.

B) Debit Reserve for encumbrances; Credit Encumbrances.

C) Debit Fund balance; Credit Reserve for encumbrances.

D) No closing entry needed.

A) Debit Reserve for encumbrances; Credit Fund balance.

B) Debit Reserve for encumbrances; Credit Encumbrances.

C) Debit Fund balance; Credit Reserve for encumbrances.

D) No closing entry needed.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

39

A city formally adopted a budget at the beginning of the current year. Budgeted revenues were $500 and budgeted expenditures were $490. During the year actual revenues were $520 and actual expenditures were $480. Fund balance at the end of the current year in comparison to fund balance at the end of the preceding year will be

A) $10 greater.

B) $30 greater.

C) $40 greater.

D) $50 greater.

A) $10 greater.

B) $30 greater.

C) $40 greater.

D) $50 greater.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

40

During the previous year, Bane County closed its Encumbrances account. At the end of the previous year there was $5,000 of outstanding purchase commitments. To restore these commitments to the accounts, which of the following entries would be required?

A) Debit Reserve for encumbrances $5,000; Credit Encumbrances $5,000.

B) Debit Encumbrances $5,000; Credit Reserve for encumbrances $5,000.

C) Debit Encumbrances $5,000; Credit Fund balance $5,000

D) Debit Fund balance $5,000; Credit Reserve for encumbrances $5,000.

A) Debit Reserve for encumbrances $5,000; Credit Encumbrances $5,000.

B) Debit Encumbrances $5,000; Credit Reserve for encumbrances $5,000.

C) Debit Encumbrances $5,000; Credit Fund balance $5,000

D) Debit Fund balance $5,000; Credit Reserve for encumbrances $5,000.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

41

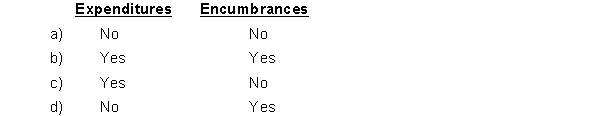

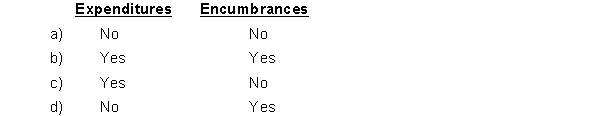

Washington County received goods that had been approved for purchase but for which payment had not yet been made. Should the following accounts be increased?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

42

The City of Denton uses encumbrance accounting to control expenditures. It charges the cost of outstanding purchase commitments to expenditures in the year they are received, not in the year they are ordered. If the city had $11,000 of purchase commitments outstanding at the end of Year 1 and received those goods during Year 2 at a cost of $11,700, what would be the impact on total fund balance for Year 2?

A) Total fund balance at the end of Year 2 would be $11,700 less than at the end of Year 1.

B) Total fund balance at the end of Year 2 would be $700 less than at the end of Year 1.

C) Total fund balance at the end of Year 2 would be $700 greater than at the end of Year 1.

D) Total fund balance at the end of Year 2 would be same as it was at the end of Year 1.

A) Total fund balance at the end of Year 2 would be $11,700 less than at the end of Year 1.

B) Total fund balance at the end of Year 2 would be $700 less than at the end of Year 1.

C) Total fund balance at the end of Year 2 would be $700 greater than at the end of Year 1.

D) Total fund balance at the end of Year 2 would be same as it was at the end of Year 1.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

43

Lincoln County uses encumbrance accounting to control expenditures. It charges the cost of outstanding purchase commitments to expenditures in the year they are ordered, not in the year they are received. If the county had $7,000 of purchase commitments outstanding at the end of Year 1 and received those goods during Year 2 at a cost of $7,800, what would be the impact on total fund balance for Year 2?

A) Total fund balance at the end of Year 2 would be $7,800 less than at the end of Year 1.

B) Total fund balance at the end of Year 2 would be $800 less than at the end of Year 1.

C) Total fund balance at the end of Year 2 would be $800 greater than at the end of Year 1.

D) Total fund balance at the end of Year 2 would be the same as it was at the end of Year 1

A) Total fund balance at the end of Year 2 would be $7,800 less than at the end of Year 1.

B) Total fund balance at the end of Year 2 would be $800 less than at the end of Year 1.

C) Total fund balance at the end of Year 2 would be $800 greater than at the end of Year 1.

D) Total fund balance at the end of Year 2 would be the same as it was at the end of Year 1

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

44

Many governments budget on the cash basis. Explain why a government would budget on a cash basis rather than on a GAAP-basis. Discuss the advantages and disadvantages of cash-basis budgets.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

45

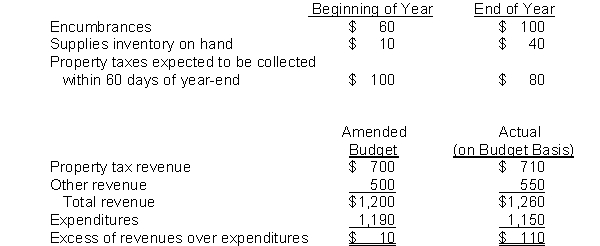

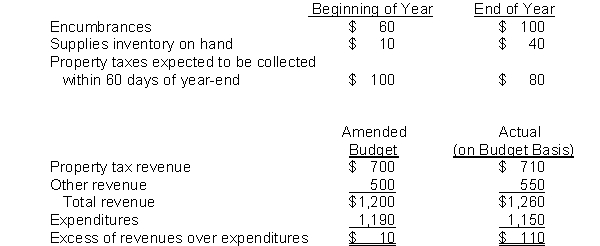

Kayla County prepares its general fund financial reports in accordance with generally accepted accounting principles (GAAP) but its budgetary basis for the general fund differs from GAAP. The budget-to-actual comparison for the general fund is presented below. All numbers are in thousands.

REQUIRED: Prepare the GAAP-basis operating statement for the general fund.

(a) For budgetary purposes, the county recognizes encumbrances as expenditures in the year of the purchase commitment; it recognizes supplies as expenditures when acquired. For budgetary purposes the county recognizes all revenues in the fiscal year collected.

For GAAP-basis financial reporting, the county recognizes supplies as expenditures as consumed. It recognizes property taxes as revenue if they are collected within 60 days of fiscal year-end. All other revenues are recognized on the cash basis for GAAP.

(b) The following additional information is available.

REQUIRED: Prepare the GAAP-basis operating statement for the general fund.

(a) For budgetary purposes, the county recognizes encumbrances as expenditures in the year of the purchase commitment; it recognizes supplies as expenditures when acquired. For budgetary purposes the county recognizes all revenues in the fiscal year collected.

For GAAP-basis financial reporting, the county recognizes supplies as expenditures as consumed. It recognizes property taxes as revenue if they are collected within 60 days of fiscal year-end. All other revenues are recognized on the cash basis for GAAP.

(b) The following additional information is available.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

46

Hill City uses encumbrance accounting to control expenditures. However, it charges the cost of outstanding purchase commitments to expenditures in the year they are received, not in the year they are ordered. If Hill City had $10,000 of purchase commitments outstanding at the end of Year 1 and received those goods during Year 2 at a cost of $9,800, what would be the impact on total fund balance for Year 2?

A) Total fund balance at the end of Year 2 would be $9,800 less than at the end of Year 1.

B) Total fund balance at the end of Year 2 would be $200 less than at the end of Year 1.

C) Total fund balance at the end of Year 2 would be $200 greater than at the end of Year 1.

D) Total fund balance at the end of Year 2 would be same as it was at the end of Year 1.

A) Total fund balance at the end of Year 2 would be $9,800 less than at the end of Year 1.

B) Total fund balance at the end of Year 2 would be $200 less than at the end of Year 1.

C) Total fund balance at the end of Year 2 would be $200 greater than at the end of Year 1.

D) Total fund balance at the end of Year 2 would be same as it was at the end of Year 1.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

47

A review of Park City's books shows the following information: I. $2,500 of outstanding vouchers payable

II) $3,000 of outstanding purchase order amounts

Which of these amounts would you expect to see in the general fund's encumbrances account?

A) $2,500

B) $3,000

C) $5,500

D) $500

II) $3,000 of outstanding purchase order amounts

Which of these amounts would you expect to see in the general fund's encumbrances account?

A) $2,500

B) $3,000

C) $5,500

D) $500

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

48

In which of the following cases would the reserve for encumbrances account be decreased?

A) Budget revisions are made, decreasing appropriations

B) Payment is made for goods received

C) Goods, related to purchase orders, are received

D) Purchase orders are issued

A) Budget revisions are made, decreasing appropriations

B) Payment is made for goods received

C) Goods, related to purchase orders, are received

D) Purchase orders are issued

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

49

Carolina City places an order for a specific item of equipment and encumbers $6,000 for that item. The equipment arrives with an invoice for $5,700. Which of the following entries should the city make upon receipt of the equipment?

A) A debit to expenditures for $5,700, a debit to accounts payable for $300, and a Credit to encumbrances for $6,000.

B) A debit to expenditures for $5,700, a debit to reserve for encumbrances for $6,000, a Credit to accounts payable for $5,700, and a Credit to encumbrances for $6,000.

C) A debit to expenditures for $5,700, a debit to reserve for encumbrances for $300, and a Credit to accounts payable for $6,000.

D) A debit to expenditures for $300, a debit to reserve for encumbrances for $5,700, and a Credit to encumbrances for $6,000.

ANSWERS TO MULTIPLE CHOICE (CHAPTER 3)

A) A debit to expenditures for $5,700, a debit to accounts payable for $300, and a Credit to encumbrances for $6,000.

B) A debit to expenditures for $5,700, a debit to reserve for encumbrances for $6,000, a Credit to accounts payable for $5,700, and a Credit to encumbrances for $6,000.

C) A debit to expenditures for $5,700, a debit to reserve for encumbrances for $300, and a Credit to accounts payable for $6,000.

D) A debit to expenditures for $300, a debit to reserve for encumbrances for $5,700, and a Credit to encumbrances for $6,000.

ANSWERS TO MULTIPLE CHOICE (CHAPTER 3)

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

50

Assume that the County of Katerah maintains its books and records in a manner that facilitates preparation of the fund financial statements. The county formally integrates the budget into the accounting system and uses the encumbrance system. All appropriations lapse at year-end. At the beginning of the fiscal year, the county had the following balances in its accounts. All amounts are in thousands.

REQUIRED: Prepare the necessary entries for the current fiscal year. (a) The county made the appropriate entry to restore the prior-year purchase commitments.

(a) The county made the appropriate entry to restore the prior-year purchase commitments.

(b) The county board approved a budget with revenues estimated to be $800 and expenditures of $750.

(c) The county received the items that had been ordered in the prior year at an actual cost of $135.

(d) The county ordered supplies at an estimated cost of $50 and equipment at an estimated cost of $70.

(e) The county incurred salaries and other operating expenses during the year totaling $600. The county paid these items in cash.

(f) The county received the equipment at an actual cost of $75.

(g) The county earned and collected, in cash, revenues of $810.

REQUIRED: Prepare the necessary entries for the current fiscal year.

(a) The county made the appropriate entry to restore the prior-year purchase commitments.

(a) The county made the appropriate entry to restore the prior-year purchase commitments.(b) The county board approved a budget with revenues estimated to be $800 and expenditures of $750.

(c) The county received the items that had been ordered in the prior year at an actual cost of $135.

(d) The county ordered supplies at an estimated cost of $50 and equipment at an estimated cost of $70.

(e) The county incurred salaries and other operating expenses during the year totaling $600. The county paid these items in cash.

(f) The county received the equipment at an actual cost of $75.

(g) The county earned and collected, in cash, revenues of $810.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

51

Geneva County authorized the issuance of bonds and contracted with the Chessie Construction Company (CCC) to build a new convention center. During 2016, 2017, and 2018, the county engaged in the transactions that follow. All were recorded in the county's capital projects fund.

a. In 2016, the county issued $350 million in bonds (and recorded them as bond proceeds, an account comparable to revenues.)

b. The county approved the contract proposal from CCC for $350 million and encumbered the entire amount.

c. CCC billed the county for $115 for construction to date.

d. The county paid CCC the amount due in full.

e. In 2017, CCC billed the county for additional construction to date of $190 million.

f. The county paid the amount due in full.

g. In 2018, CCC completed construction of the convention center and billed the county an additional $50 million. The county approved the additional costs, even though the total cost of the center was now $355 million, $5 million more than the contract initially provided for.

h. The county transferred $5 million from its general fund to the capital projects fund.

i. The county paid the $50 million in full.

REQUIRED:

1. Prepare the journal entries to record these transactions in the capital projects fund, including closing entries. Assume that amounts originally encumbered are reappropriated each year. Hence the county need not reestablish encumbrances in each year after the first year. Instead, it can close the expenditures of the second and third years to reserve for encumbrances rather than to fund balance.

2. What other funds or schedules would be affected by the transactions listed?

a. In 2016, the county issued $350 million in bonds (and recorded them as bond proceeds, an account comparable to revenues.)

b. The county approved the contract proposal from CCC for $350 million and encumbered the entire amount.

c. CCC billed the county for $115 for construction to date.

d. The county paid CCC the amount due in full.

e. In 2017, CCC billed the county for additional construction to date of $190 million.

f. The county paid the amount due in full.

g. In 2018, CCC completed construction of the convention center and billed the county an additional $50 million. The county approved the additional costs, even though the total cost of the center was now $355 million, $5 million more than the contract initially provided for.

h. The county transferred $5 million from its general fund to the capital projects fund.

i. The county paid the $50 million in full.

REQUIRED:

1. Prepare the journal entries to record these transactions in the capital projects fund, including closing entries. Assume that amounts originally encumbered are reappropriated each year. Hence the county need not reestablish encumbrances in each year after the first year. Instead, it can close the expenditures of the second and third years to reserve for encumbrances rather than to fund balance.

2. What other funds or schedules would be affected by the transactions listed?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

52

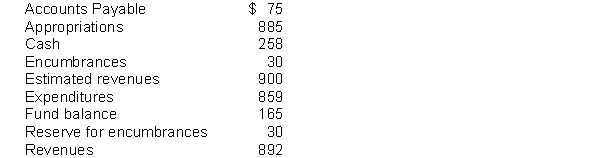

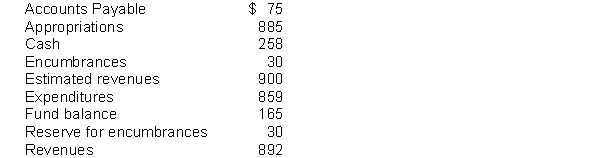

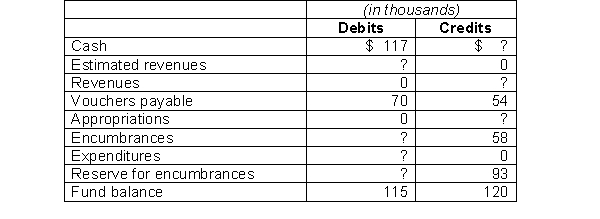

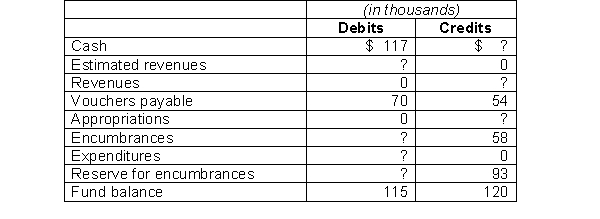

School District #25 formally integrates the budget into the accounting system and uses the encumbrance system. All appropriations lapse at year-end. At year-end, before closing entries, the district had the following balances in its accounts. All accounts had normal balances.

REQUIRED: (a) Prepare the necessary closing entries.

(b) Prepare a balance sheet after closing.

REQUIRED: (a) Prepare the necessary closing entries.

(b) Prepare a balance sheet after closing.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

53

Assume that the City of Pasco maintains its books and records in a manner that facilitates preparation of the fund financial statements. The city engaged in the following transactions related to its general fund during the current fiscal year. The city formally integrates the budget into the accounting records. The city does not maintain an inventory of supplies. All amounts are in thousands.

REQUIRED: Prepare, in summary form, the appropriate journal entries.

(a) The city council approved a budget with revenues estimated to be $800 and expenditures of $785.

(b) The city ordered supplies at an estimated cost of $25 and equipment at an estimated cost of $20.

(c) The city incurred salaries and other operating expenses during the year totaling $730. The city paid for these items in cash.

(d) The city received the supplies at an actual cost of $23.

(e) The city collected revenues of $795.

REQUIRED: Prepare, in summary form, the appropriate journal entries.

(a) The city council approved a budget with revenues estimated to be $800 and expenditures of $785.

(b) The city ordered supplies at an estimated cost of $25 and equipment at an estimated cost of $20.

(c) The city incurred salaries and other operating expenses during the year totaling $730. The city paid for these items in cash.

(d) The city received the supplies at an actual cost of $23.

(e) The city collected revenues of $795.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following is the primary reason why governments formally integrate their legally adopted budget into their accounting systems?

A) It is required by GASB.

B) It allows continuous monitoring of revenues and expenses to compare to budgets.

C) It keeps the government from knowing its budget.

D) It helps a government by letting it know when it is in danger of overspending its budget.

A) It is required by GASB.

B) It allows continuous monitoring of revenues and expenses to compare to budgets.

C) It keeps the government from knowing its budget.

D) It helps a government by letting it know when it is in danger of overspending its budget.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

55

The town of Terry began 2016 with an unreserved balance of $15 million in its street repair fund, a capital projects fund. At the start of the year, the city council appropriated $9 million to reconstruct portions of the roadbed for two of its major roads-Main Street and Koeller Avenue. Shortly after, the town signed contracts with two construction companies to perform the repairs for a total of $9 million. During the year, the town received bills from the construction companies as follows:

a. $4.8 million for the entire cost of repairs to Main Street. This amount is $0.3 higher than expected due to design changes approved by the town. The town did not encumber the additional $0.3 million.

b. $3.0 million, representing a progress billing for repairs to Koeller Avenue, which were not completed at the end of 2016.

At the beginning of 2017, the town reappropriated the remaining $1.5 million for the Koeller Avenue repairs. During the year, the town received this bill:

c. $0.1 million, representing the final billing for the Koeller Avenue repairs. The final cost was $0.5 million less than anticipated.

REQUIRED:

Prepare journal entries to record the events and transactions over the two-year period. Include entries to appropriate, reappropriate, encumber, and re-encumber the required resources, to record the payment of the bills, and to close the accounts at the end of each year.

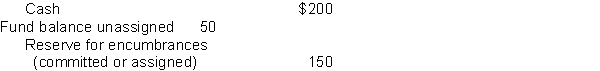

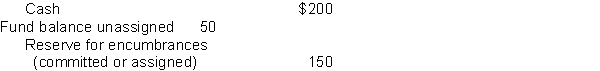

Determine the reserve for encumbrances (committed or assigned) and fund balance-unassigned for the capital projects fund at the end of the second year.

a. $4.8 million for the entire cost of repairs to Main Street. This amount is $0.3 higher than expected due to design changes approved by the town. The town did not encumber the additional $0.3 million.

b. $3.0 million, representing a progress billing for repairs to Koeller Avenue, which were not completed at the end of 2016.

At the beginning of 2017, the town reappropriated the remaining $1.5 million for the Koeller Avenue repairs. During the year, the town received this bill:

c. $0.1 million, representing the final billing for the Koeller Avenue repairs. The final cost was $0.5 million less than anticipated.

REQUIRED:

Prepare journal entries to record the events and transactions over the two-year period. Include entries to appropriate, reappropriate, encumber, and re-encumber the required resources, to record the payment of the bills, and to close the accounts at the end of each year.

Determine the reserve for encumbrances (committed or assigned) and fund balance-unassigned for the capital projects fund at the end of the second year.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

56

Why would a government be more likely than a not-for-profit organization to integrate its budget into its accounting system?

A) Because the amount of expenditures is likely to be greater.

B) Because the penalties for exceeding budgeted expenditures are more severe.

C) Because governments have more sophisticated accounting systems than not-for-profit organizations.

D) Governments are NOT more likely than not-for-profits to formally integrate their budget into their accounting system.

A) Because the amount of expenditures is likely to be greater.

B) Because the penalties for exceeding budgeted expenditures are more severe.

C) Because governments have more sophisticated accounting systems than not-for-profit organizations.

D) Governments are NOT more likely than not-for-profits to formally integrate their budget into their accounting system.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

57

The following schedule shows the amounts related to supplies that the City of Pascal debited and Credited to the indicated accounts during the year (not necessarily year-end balances), before closing entries. The city records its budget, encumbers all of its expenditures, and initially vouchers all payments. All revenue was collected in cash.

REQUIRED:

Some information is missing in the schedule below. Determine the missing data by reconstructing (in summary) the journal entries the city must have made during the year.

REQUIRED:

Some information is missing in the schedule below. Determine the missing data by reconstructing (in summary) the journal entries the city must have made during the year.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

58

The Breast Cancer Fund, a not-for-profit organization, receives its funding primarily from government grants and private contributions. In turn, the Fund provides resources to other organizations and individuals for breast cancer research. Many of the government grants it receives are reimbursement-type. That is, the Fund must incur specific costs to be eligible for grants that reimburse those costs. The Fund makes the following estimates as to its next fiscal year:

a. It will be awarded $7 million in government grants; all but $0.5 million will be received during the fiscal year. The balance will be reimbursed in the first six months after year-end. The Fund will also receive $0.2 million in reimbursement grants related to the previous year.

b. It will receive $600,000 in pledges from private donors. It expects to collect $450,000 during the year and $125,000 in the following year. It estimates that $25,000 will never be received. It also expects to collect $80,000 in pledges made the prior year.

c. It will pay $7 million for outside research.

d. It will purchase new computer equipment costing $100,000. The Fund currently owns its own building, which it had purchased for $800,000, and additional furniture and equipment that it acquired for $250,000. The building has a useful life of twenty years; the furniture and equipment have useful lives of 5 years. It is the Fund's policy to record a full year of depreciation expense in the year that assets are placed in service.

e. Employees will earn wages and salaries of $340,000, of which they will be paid $320,000 during the year and the balance in the next year. The Fund will also pay another $15,000 in payroll costs incurred in the prior year.

f. It will pay the $75,000 insurance deductible on an employee-related lawsuit settled the previous year.

g. It will incur operating costs of $90,000, of which it will pay $70,000 during the year and $20,000 in the following year. It will also pay another $10,000 in costs incurred in the previous year.

REQUIRED:

1. Prepare two budgets, one on the cash basis, the other on the full accrual basis. Show both on the same schedule-the full accrual basis in the first column and the cash basis in the second column.

2. Comment on which budget better shows whether the Breast Cancer Fund is covering the economic cost of the services it provides.

3. Which budget is likely to be more useful to Breast Cancer Fund managers?

a. It will be awarded $7 million in government grants; all but $0.5 million will be received during the fiscal year. The balance will be reimbursed in the first six months after year-end. The Fund will also receive $0.2 million in reimbursement grants related to the previous year.

b. It will receive $600,000 in pledges from private donors. It expects to collect $450,000 during the year and $125,000 in the following year. It estimates that $25,000 will never be received. It also expects to collect $80,000 in pledges made the prior year.

c. It will pay $7 million for outside research.

d. It will purchase new computer equipment costing $100,000. The Fund currently owns its own building, which it had purchased for $800,000, and additional furniture and equipment that it acquired for $250,000. The building has a useful life of twenty years; the furniture and equipment have useful lives of 5 years. It is the Fund's policy to record a full year of depreciation expense in the year that assets are placed in service.

e. Employees will earn wages and salaries of $340,000, of which they will be paid $320,000 during the year and the balance in the next year. The Fund will also pay another $15,000 in payroll costs incurred in the prior year.

f. It will pay the $75,000 insurance deductible on an employee-related lawsuit settled the previous year.

g. It will incur operating costs of $90,000, of which it will pay $70,000 during the year and $20,000 in the following year. It will also pay another $10,000 in costs incurred in the previous year.

REQUIRED:

1. Prepare two budgets, one on the cash basis, the other on the full accrual basis. Show both on the same schedule-the full accrual basis in the first column and the cash basis in the second column.

2. Comment on which budget better shows whether the Breast Cancer Fund is covering the economic cost of the services it provides.

3. Which budget is likely to be more useful to Breast Cancer Fund managers?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

59

Many governments formally integrate the budget into the accounting system. Explain how this is accomplished. Also, explain why a government would formally integrate the budget into the accounting system.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

60

Per GASB standards, a budget-to-actual comparison must include columns for the actual results and

A) The original budget only.

B) The final budget only.

C) Both the original and the final budget.

D) Both the amended and the final budget.

A) The original budget only.

B) The final budget only.

C) Both the original and the final budget.

D) Both the amended and the final budget.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

61

What are the possible differences that may occur between a state or local government's budgetary practices and GAAP?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

62

A government's unassigned general fund balance at year-end may not be indicative of the amount that the government has available for appropriation in future years. Explain and provide an example to support your answer.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

63

Some governments and most not-for-profit entities do not integrate their budgets into their accounting systems or encumber the cost of goods or services for which they are committed. Are such practices justifiable? Explain.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

64

Why may flexible budgets be more appropriate for a government's business-type activities than for its governmental activities?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

65

Why do many governments not consider it necessary to prepare appropriation budgets for, and incorporate budgetary entries into the accounts of, their capital projects funds?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

66

In what way will budgetary entries and encumbrances affect amounts reported in year-end GAAP balance sheets and operating statements of state and local governments?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

67

GAAP require state and local governments to include in their annual financial reports a budget-to-actual comparison showing actual results and original and final appropriated budgets. What are the advantages of requiring both the original and final appropriated budget amounts?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

68

For most governments, the "variance" column on general fund budget-to-actual statements is likely to report relatively small amounts. Do you agree? Explain.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

69

The mayor of the City of Geneva boasts that the budgeted year-end excess of revenues over expenditures for the year just ended was significantly greater than expected. Why is this "favorable" result not necessarily a good thing?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck