Deck 4: Recognizing Revenues in Governmental Funds

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/73

Play

Full screen (f)

Deck 4: Recognizing Revenues in Governmental Funds

1

As used in defining the modified accrual basis of accounting, the term "available" means

A) received in cash.

B) will be received in person within 60 days after year-end.

C) collection in cash is reasonably assured.

D) collected within the current period or expected to be collected soon enough thereafter to be used to pay liabilities of the current period.

A) received in cash.

B) will be received in person within 60 days after year-end.

C) collection in cash is reasonably assured.

D) collected within the current period or expected to be collected soon enough thereafter to be used to pay liabilities of the current period.

D

2

Under the modified accrual basis of accounting, investment revenues for the current period should include

A) only interest and dividends received.

B) all interest and dividends received during the period plus all accruals of interest and dividends earned.

C) all interest and dividends received plus gains and losses on securities that were sold during the period.

D) all interest and dividends received, all gains and losses on securities sold, and all changes in market values on securities held in the portfolio at year-end.

A) only interest and dividends received.

B) all interest and dividends received during the period plus all accruals of interest and dividends earned.

C) all interest and dividends received plus gains and losses on securities that were sold during the period.

D) all interest and dividends received, all gains and losses on securities sold, and all changes in market values on securities held in the portfolio at year-end.

D

3

The modified accrual basis of accounting is used in presenting the fund financial statements of the governmental funds because

A) it is the superior method of accounting for the economic resources of any entity.

B) it ensures the entity achieved interperiod equity.

C) facilitates comparisons among entities by standardizing reporting for all non-Federal governments

D) it results in accounting measurements based on the substance of transactions.

A) it is the superior method of accounting for the economic resources of any entity.

B) it ensures the entity achieved interperiod equity.

C) facilitates comparisons among entities by standardizing reporting for all non-Federal governments

D) it results in accounting measurements based on the substance of transactions.

C

4

Governmental activities tend to derive most of their revenues from foreign exchange transactions.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

5

In accounting for property taxes, under the modified accrual basis, existing standards provide that, except in unusual circumstances, revenues should be recognized only if cash is expected to be collected by year-end.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

6

As used in governmental accounting, interperiod equity refers to a concept of

A) providing the same level of services to citizens each year.

B) measuring whether current year revenues are sufficient to pay for current year services.

C) levying property taxes at the same rate each year.

D) requiring that general fund budgets be balanced each year.

A) providing the same level of services to citizens each year.

B) measuring whether current year revenues are sufficient to pay for current year services.

C) levying property taxes at the same rate each year.

D) requiring that general fund budgets be balanced each year.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

7

Taxes that are imposed on the reporting government's citizens are considered general revenues, even if they are restricted to specific programs.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

8

Under the modified accrual basis, revenues are "available" if they are collected within the current period or are expected to be collected soon enough after the end of the period to be used to pay liabilities of the current period.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

9

Under the accrual basis of accounting, property tax revenues are recognized

A) when they are received in cash.

B) in the year for which they were levied.

C) in the year for which they were levied and when collection in cash is reasonably assured.

D) when they are available to finance expenditures of the fiscal period.

A) when they are received in cash.

B) in the year for which they were levied.

C) in the year for which they were levied and when collection in cash is reasonably assured.

D) when they are available to finance expenditures of the fiscal period.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

10

Current financial resources include cash and receivables but not investments.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

11

Under the modified accrual basis of accounting, the amount of property tax revenues that should be recognized by a government in the current year related to the current-year levy will be

A) the total amount of the levy.

B) the expected collectible portion of the levy.

C) the portion of the levy collected.

D) the portion of the levy collected in the current year or within sixty days after the end of the fiscal period.

A) the total amount of the levy.

B) the expected collectible portion of the levy.

C) the portion of the levy collected.

D) the portion of the levy collected in the current year or within sixty days after the end of the fiscal period.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

12

For fund financial statements, the measurement focus and basis of accounting used by governmental fund types are

A) current financial resources and modified accrual accounting.

B) economic resources and modified accrual accounting.

C) current financial resources and full accrual accounting.

D) economic resources and full accrual accounting.

A) current financial resources and modified accrual accounting.

B) economic resources and modified accrual accounting.

C) current financial resources and full accrual accounting.

D) economic resources and full accrual accounting.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

13

The revenue-recognition issues facing governments are generally focused on the exchange transaction earning process, like those of businesses.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

14

Revenues that cannot be classified as general revenues are by default considered program revenues.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

15

Under the modified accrual basis of accounting, derived nonexchange revenues are recognized when

A) they are anticipated to be paid.

B) they are measurable and available to finance the expenditures of the current period.

C) the underlying transaction occurs.

D) the underlying transaction occurs and they are measurable and available to finance the expenditures of the current period.

A) they are anticipated to be paid.

B) they are measurable and available to finance the expenditures of the current period.

C) the underlying transaction occurs.

D) the underlying transaction occurs and they are measurable and available to finance the expenditures of the current period.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

16

Ad valorem taxes are taxes that are based on value.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

17

Income taxes are classified as ad valorem taxes.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

18

Sales taxes are derived taxes on exchange transactions carried on by taxpayers.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

19

If an entity elects to focus on all economic resources, then it should adopt a modified accrual basis of accounting.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

20

The budgetary measurement focus of governments is determined by applicable state or local laws.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

21

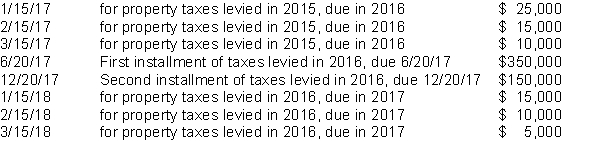

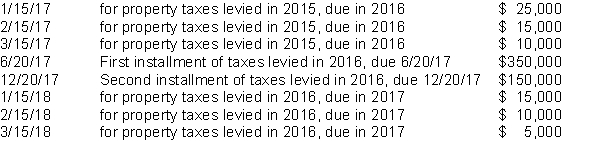

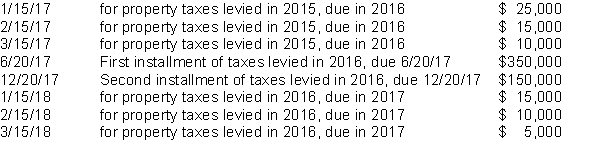

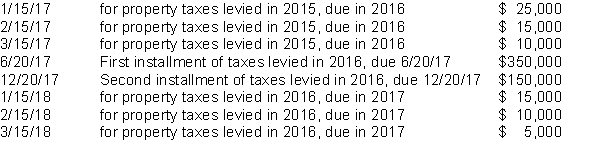

A city that has a 12/31 fiscal year end has adopted a policy of recognizing property tax revenue consistent with the 60-day rule allowable period under GAAP. Property taxes of $600,000 (of which none are estimated to be uncollectible) are levied in October 2016 to finance the activities of fiscal year 2017. Property taxes are due in two installments June 20 and December 20. Cash collections related to property taxes are as follows:  The total amount of property tax revenue that should be recognized in the governmental fund financial statements in 2017 is:

The total amount of property tax revenue that should be recognized in the governmental fund financial statements in 2017 is:

A) $600,000.

B) $575,000.

C) $535,000.

D) $525,000.

The total amount of property tax revenue that should be recognized in the governmental fund financial statements in 2017 is:

The total amount of property tax revenue that should be recognized in the governmental fund financial statements in 2017 is:A) $600,000.

B) $575,000.

C) $535,000.

D) $525,000.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

22

A city that has a 12/31 fiscal year end has adopted a policy of recognizing property tax revenue consistent with the 60-day rule allowable period under GAAP. Property taxes of $600,000 (of which none are estimated to be uncollectible) are levied in October 2016 to finance the activities of fiscal year 2017. Property taxes are due in two installments June 20 and December 20. Cash collections related to property taxes are as follows:  The total amount of property tax revenue that will be recognized in the government-wide financial statements in 2017 is:

The total amount of property tax revenue that will be recognized in the government-wide financial statements in 2017 is:

A) $600,000.

B) $575,000.

C) $535,000.

D) $525,000.

The total amount of property tax revenue that will be recognized in the government-wide financial statements in 2017 is:

The total amount of property tax revenue that will be recognized in the government-wide financial statements in 2017 is:A) $600,000.

B) $575,000.

C) $535,000.

D) $525,000.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

23

Under the modified accrual basis of accounting used by governments, transactions that result in long-term liabilities

A) are included on the fund statements as an expenditure.

B) are included as a contra-account to revenue.

C) are not recorded as expenditures.

D) hidden for 10 years from the taxpayers.

A) are included on the fund statements as an expenditure.

B) are included as a contra-account to revenue.

C) are not recorded as expenditures.

D) hidden for 10 years from the taxpayers.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

24

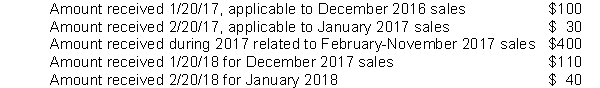

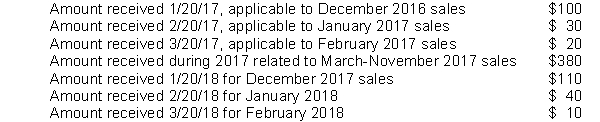

A city levies a 2 percent sales tax. Sales taxes must be remitted by the merchants to the city by the twentieth day of the month following the month in which the sale occurred. Cash received by the city related to sales taxes is as follows:  Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize in the government-wide financial statements as sales tax revenue for the fiscal year ended 12/31/17?

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize in the government-wide financial statements as sales tax revenue for the fiscal year ended 12/31/17?

A) $430.

B) $530.

C) $540.

D) $550.

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize in the government-wide financial statements as sales tax revenue for the fiscal year ended 12/31/17?

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize in the government-wide financial statements as sales tax revenue for the fiscal year ended 12/31/17?A) $430.

B) $530.

C) $540.

D) $550.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

25

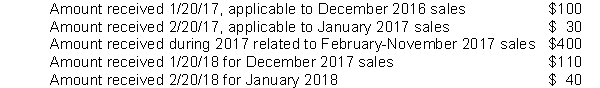

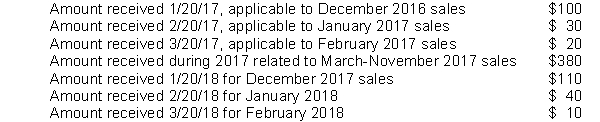

A city levies a 2 percent sales tax that is collected for them by the state. Sales taxes must be remitted by the merchants to the state by the 20th day of the month following the month in which the sale occurred. The state has a policy of remitting sales taxes to the city within 30 days of collection by the state. Cash received by the state related to sales taxes is as follows:  Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its governmental fund financial statements for the fiscal year ended 12/31/17?

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its governmental fund financial statements for the fiscal year ended 12/31/17?

A) $430.

B) $530.

C) $540.

D) $550.

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its governmental fund financial statements for the fiscal year ended 12/31/17?

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its governmental fund financial statements for the fiscal year ended 12/31/17?A) $430.

B) $530.

C) $540.

D) $550.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

26

Under GAAP, property taxes levied in one fiscal period to finance the activities of the following fiscal period are recognized as revenue in the governmental fund financial statements

A) in the year levied.

B) in the year for which they are intended to finance the activities.

C) when collected, regardless of when levied.

D) in the year for which they are intended to finance the activities, if collected within that period or within a period no greater than 60 days after the close of the fiscal year.

A) in the year levied.

B) in the year for which they are intended to finance the activities.

C) when collected, regardless of when levied.

D) in the year for which they are intended to finance the activities, if collected within that period or within a period no greater than 60 days after the close of the fiscal year.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

27

GASB suggests that income tax revenues should be recognized in the governmental fund financial statements in the accounting period

A) when collected in cash by the taxing authority.

B) in which the underlying income was earned, regardless of when collected.

C) governments base the amount of income to be recognized on the amount of withholding and estimated tax payments received during the year, adjusted for settlements and refunds when tax returns are actually filed

D) when earned.

A) when collected in cash by the taxing authority.

B) in which the underlying income was earned, regardless of when collected.

C) governments base the amount of income to be recognized on the amount of withholding and estimated tax payments received during the year, adjusted for settlements and refunds when tax returns are actually filed

D) when earned.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

28

Under GAAP, property taxes levied in one fiscal period to finance the activities of the following fiscal period are recognized as revenue in the government-wide financial statements

A) in the year levied.

B) in the year for which they are intended to finance the activities.

C) when collected, regardless of when levied.

D) in the year for which they are intended to finance the activities, if collected within that period or within a period no greater than 60 days after the close of the fiscal year.

A) in the year levied.

B) in the year for which they are intended to finance the activities.

C) when collected, regardless of when levied.

D) in the year for which they are intended to finance the activities, if collected within that period or within a period no greater than 60 days after the close of the fiscal year.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

29

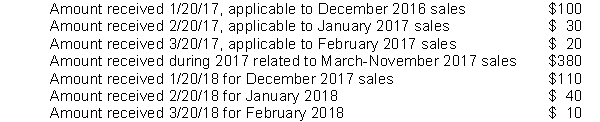

A city levies a 2 percent sales tax that is collected for them by the state. Sales taxes must be remitted by the merchants to the state by the twentieth day of the month following the month in which the sale occurred. The state has a policy of remitting sales taxes to the city within 30 days of collection by the state. Cash received by the state related to sales taxes is as follows:  Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its government-wide financial statements for the fiscal year ended 12/31/17?

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its government-wide financial statements for the fiscal year ended 12/31/17?

A) $430.

B) $530.

C) $540.

D) $550.

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its government-wide financial statements for the fiscal year ended 12/31/17?

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its government-wide financial statements for the fiscal year ended 12/31/17?A) $430.

B) $530.

C) $540.

D) $550.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

30

Under the accrual basis of accounting, gains and losses on disposal of capital assets

A) are not recognized.

B) are recognized when the proceeds (cash) of the sale are received (on the installment basis).

C) are recognized only if there is a gain.

D) are recognized when the sale occurs, regardless of when the cash is collected.

A) are not recognized.

B) are recognized when the proceeds (cash) of the sale are received (on the installment basis).

C) are recognized only if there is a gain.

D) are recognized when the sale occurs, regardless of when the cash is collected.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

31

A city levies a 2 percent sales tax. Sales taxes must be remitted by the merchants to the City by the twentieth day of the month following the month in which the sale occurred. Cash received by the city related to sales taxes is as follows:  Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize in the governmental fund financial statements as sales tax revenue for the fiscal year ended 12/31/17?

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize in the governmental fund financial statements as sales tax revenue for the fiscal year ended 12/31/17?

A) $430.

B) $530.

C) $540.

D) $550.

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize in the governmental fund financial statements as sales tax revenue for the fiscal year ended 12/31/17?

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize in the governmental fund financial statements as sales tax revenue for the fiscal year ended 12/31/17?A) $430.

B) $530.

C) $540.

D) $550.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

32

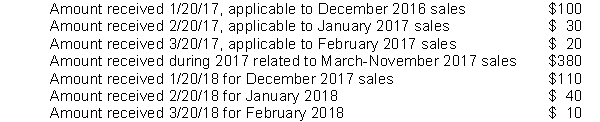

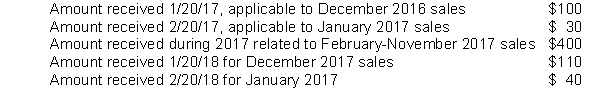

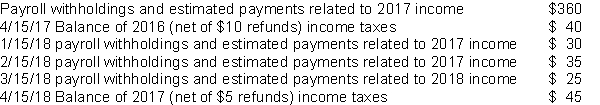

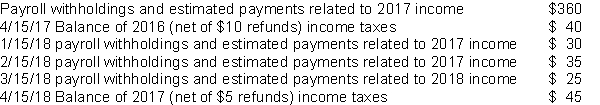

During 2017, a state has the following cash collections related to state income taxes  Assuming that the state defines "available" as the maximum period allowable for property taxes, what is the amount of revenue that will be recognized in the 2017 governmental fund financial statements related to state income taxes?

Assuming that the state defines "available" as the maximum period allowable for property taxes, what is the amount of revenue that will be recognized in the 2017 governmental fund financial statements related to state income taxes?

A) $400.

B) $430.

C) $465.

D) $490.

Assuming that the state defines "available" as the maximum period allowable for property taxes, what is the amount of revenue that will be recognized in the 2017 governmental fund financial statements related to state income taxes?

Assuming that the state defines "available" as the maximum period allowable for property taxes, what is the amount of revenue that will be recognized in the 2017 governmental fund financial statements related to state income taxes?A) $400.

B) $430.

C) $465.

D) $490.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

33

Under the modified accrual basis of accounting, imposed nonexchange revenues (such as fines) should be recognized

A) when assessed.

B) when the government has an enforceable legal claim.

C) when collected.

D) when the government has an enforceable legal claim and when collected within the current period or soon enough thereafter to be used to pay the liabilities of the current period.

A) when assessed.

B) when the government has an enforceable legal claim.

C) when collected.

D) when the government has an enforceable legal claim and when collected within the current period or soon enough thereafter to be used to pay the liabilities of the current period.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

34

Gifts of capital assets are recorded in i. proprietary fund, if use is related to the purpose of that fund

Ii) general fund, if use is related to the overall general government function and is planned to be held (not sold)

Iii) capital assets, if use is related to the overall general government function and is planned to be held (not sold)

A) I

B) II

C) III

D) I and III

Ii) general fund, if use is related to the overall general government function and is planned to be held (not sold)

Iii) capital assets, if use is related to the overall general government function and is planned to be held (not sold)

A) I

B) II

C) III

D) I and III

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

35

A city that has property taxes of $720,000 (of which 10 percent are estimated to be uncollectible) which are levied in October 2016 to finance the activities of the fiscal year 2017. During 2017, cash collections related to property taxes levied in October 2016 were $600,000. In 2018 the following amounts related to the property taxes levied in October 2016 were collected: January $30,000; March, $6,000. For the fiscal year ended 12/31/17, what amount should be recognized as property tax revenues related to the 2016 levy on the governmental fund financial statements?

A) $720,000.

B) $648,000.

C) $630,000.

E) $600,000.

A) $720,000.

B) $648,000.

C) $630,000.

E) $600,000.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

36

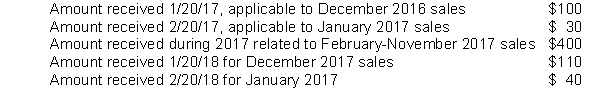

During 2017, a state has the following cash collections related to state income taxes  1/15/18 payroll withholdings and estimated payments related to 2017 income $ 30

1/15/18 payroll withholdings and estimated payments related to 2017 income $ 30

2/15/18 payroll withholdings and estimated payments related to 2017 income $ 35

3/15/18 payroll withholdings and estimated payments related to 2017 income $ 25

4/15/18 Balance of 2017 (net of $5 refunds) income taxes $ 45

Assuming that the state defines "available" as the maximum period allowable for property taxes, what is the amount of revenue that will be recognized in the 2017 government-wide financial statements related to state income taxes?

A) $400.

B) $475.

C) $430.

D) $465.

1/15/18 payroll withholdings and estimated payments related to 2017 income $ 30

1/15/18 payroll withholdings and estimated payments related to 2017 income $ 302/15/18 payroll withholdings and estimated payments related to 2017 income $ 35

3/15/18 payroll withholdings and estimated payments related to 2017 income $ 25

4/15/18 Balance of 2017 (net of $5 refunds) income taxes $ 45

Assuming that the state defines "available" as the maximum period allowable for property taxes, what is the amount of revenue that will be recognized in the 2017 government-wide financial statements related to state income taxes?

A) $400.

B) $475.

C) $430.

D) $465.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

37

A city that has property taxes of $720,000 (of which 10 percent are estimated to be uncollectible) which are levied in October 2016 to finance the activities of the fiscal year 2017. During 2017, cash collections related to property taxes levied in October 2016 were $600,000. In 2018 the following amounts related to the property taxes levied in October 2016 were collected: January $30,000; March $6,000. For the fiscal year ended 12/31/17, what amount should be recognized as property tax revenues related to the 2016 levy on the government-wide financial statements?

A) $720,000.

B) $648,000.

C) $630,000.

D) $600,000.

A) $720,000.

B) $648,000.

C) $630,000.

D) $600,000.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

38

Under the modified accrual basis of accounting, license fees, permits, and other miscellaneous revenue are generally recognized for practical purposes

A) when cash is received.

B) when the exchange takes place.

C) over the period during which the government obtains an enforceable legal claim.

D) when related expenditures are incurred.

A) when cash is received.

B) when the exchange takes place.

C) over the period during which the government obtains an enforceable legal claim.

D) when related expenditures are incurred.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

39

Under the accrual basis of accounting, imposed nonexchange revenues (such as fines) should be recognized

A) when assessed.

B) when the government has an enforceable legal claim.

C) when collected.

D) when the government has an enforceable legal claim and when collected within the current period or soon enough thereafter to be used to pay the liabilities of the current period

A) when assessed.

B) when the government has an enforceable legal claim.

C) when collected.

D) when the government has an enforceable legal claim and when collected within the current period or soon enough thereafter to be used to pay the liabilities of the current period

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

40

In government-wide statements of activities are reported in ___ separate columns

A) two

B) three

C) five

D) one column for each function.

A) two

B) three

C) five

D) one column for each function.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

41

Under GAAP, income tax revenues should be recognized in the government-wide financial statements in the accounting period

A) when collected in cash by the taxing authority.

B) in which the underlying income was earned, regardless of when collected.

C) in which the underlying income was earned, if collected in the current period or soon enough thereafter to pay liabilities of the current period.

D) when earned.

A) when collected in cash by the taxing authority.

B) in which the underlying income was earned, regardless of when collected.

C) in which the underlying income was earned, if collected in the current period or soon enough thereafter to pay liabilities of the current period.

D) when earned.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

42

State governments should recognize food stamp revenue

A) when they receive the food stamps.

B) with an offsetting expenditure.

C) when the recipient uses the food stamps

D) never. Food stamps are not financial resources.

A) when they receive the food stamps.

B) with an offsetting expenditure.

C) when the recipient uses the food stamps

D) never. Food stamps are not financial resources.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

43

During 2017, the city issued $300 in fines for failure to keep real property in 'acceptable' condition. During that period the city spent $200 to mow and clean up the unoccupied properties for which the fines were assessed. The city estimates that $30 of the fines issued in 2017 will be uncollectible. During 2017 the city collected $230 related to 2017 fines and $20 related to 2016 fines. The amount of revenue that the city should recognize in its 2017 governmental fund financial statements related to fines is

A) $230.

B) $250.

C) $270.

D) $300.

A) $230.

B) $250.

C) $270.

D) $300.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

44

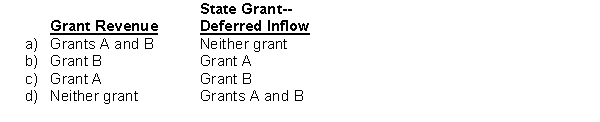

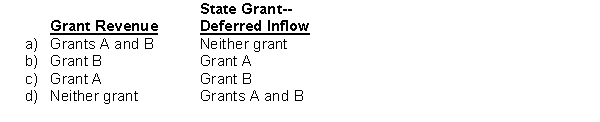

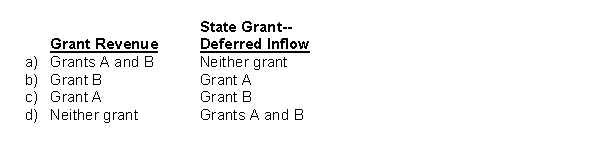

Paul City received payment of two grants from the state during its fiscal year ending September 30, 2016. Grant A can be used to cover any operating expenses incurred during fiscal 2017. Grant B can be used at any time to acquire equipment for the city's fire department. Should the city report these grants as grant revenues or deferred inflows in its governmental fund financial statements for fiscal 2016?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

45

A government is the recipient of a bequest of a multi-story office building that the government intends to use as a new city hall. The building has a historical cost of $850,000; a book value in the hands of the benefactor of $700,000; and a fair value of $1,050,000. The city should recognize on its government-wide financial statements donations revenue of

A) $-0-.

B) $700,000.

C) $850,000.

D) $1,050,000.

A) $-0-.

B) $700,000.

C) $850,000.

D) $1,050,000.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

46

A city with a 12/31 fiscal year-end requires that restaurants buy a license, renewable yearly. Proceeds of the license fees are intended to pay the salaries of inspectors in the health department. Licenses are issued for a fiscal year from October 1 to September 30. During 2017, cash collections related to licenses were as follows Licenses issued during 2016 for the 10/1/16-9/30/17 fiscal year $ 30

Licenses issued during 2017 for the 10/1/17-9/30/18 fiscal year $180

It is anticipated that during 2018 the amount collected on licenses for the 10/1/17-9/30/18 fiscal year will be $45. In September 2016 the amount collected related to 10/1/16-9/30/17 licenses was $144. What amount should be recognized as revenue in the fund financial statements for the fiscal year ended 12/31/17?

A) $180.

B) $183.

C) $210.

D) $225.

Licenses issued during 2017 for the 10/1/17-9/30/18 fiscal year $180

It is anticipated that during 2018 the amount collected on licenses for the 10/1/17-9/30/18 fiscal year will be $45. In September 2016 the amount collected related to 10/1/16-9/30/17 licenses was $144. What amount should be recognized as revenue in the fund financial statements for the fiscal year ended 12/31/17?

A) $180.

B) $183.

C) $210.

D) $225.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

47

Under GAAP, investment income for governments must include

A) only dividends and interest received during the period.

B) only dividends and interest earned during the period.

C) only realized gains and losses.

D) dividends and interest received during the period and both realized and unrealized gains and losses

A) only dividends and interest received during the period.

B) only dividends and interest earned during the period.

C) only realized gains and losses.

D) dividends and interest received during the period and both realized and unrealized gains and losses

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

48

For purposes of recognizing property tax revenues in governmental funds, "available" is defined as

A) revenues received within 90 days after year-end.

B) revenues received within 60 days after year-end.

C) revenues received within 120 days after year-end.

D) being up to the judgment of the preparer.

A) revenues received within 90 days after year-end.

B) revenues received within 60 days after year-end.

C) revenues received within 120 days after year-end.

D) being up to the judgment of the preparer.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

49

At the beginning of its fiscal year, a local government was given 100 acres that the town council voted to use as a central park and business center. The land had an historical cost of $100 but was appraised at the time of donation at $500. The amount that should be recognized on the governmental fund financial statements for the year as revenue is

A) $-0-.

B) $100

C) $400

D) $500

A) $-0-.

B) $100

C) $400

D) $500

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following are derived tax revenues?

A) Income taxes.

B) Sales taxes.

C) Both of the above.

D) Neither of the above

A) Income taxes.

B) Sales taxes.

C) Both of the above.

D) Neither of the above

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

51

A city receives notice of a $150,000 grant from the state to purchase vans to transport physically challenged individuals. Although the city did not receive any of the grant funds during the current year, the city purchased a bus for $65,000 and issued a purchase order for a van for $60,000. The grant revenue that the city should recognize in the government-wide financial statements in the current year is

A) $-0-.

B) $ 65,000.

C) $125,000.

D) $150,000.

A) $-0-.

B) $ 65,000.

C) $125,000.

D) $150,000.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

52

An anonymous benefactor has pledged to give the state a gift of $100,000 without criteria for the state to meet. There is no reason to believe that the benefactor will not honor their pledge. The government should recognize revenue as

A) immediately as cash

B) deferred inflow of resources until "available" to meet current liabilities

C) ratably over 30 years.

D) never. The contributions themselves cannot be used to support the government's programs.

A) immediately as cash

B) deferred inflow of resources until "available" to meet current liabilities

C) ratably over 30 years.

D) never. The contributions themselves cannot be used to support the government's programs.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

53

Reimbursement-type grant revenues are recognized in the accounting period in which

A) the award is made.

B) the cash is received.

C) the grantee is notified of the award.

D) expenditures are recorded on grant-related activities.

A) the award is made.

B) the cash is received.

C) the grantee is notified of the award.

D) expenditures are recorded on grant-related activities.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

54

Payments made to a state pension plan by the state government on behalf of a local government should

A) not be displayed or disclosed in the local government financial statements.

B) be displayed as a revenue in the local government financial statements.

C) be displayed as both a revenue and an expenditure in the local government financial statements.

D) be disclosed, but not displayed, in the local government financial statements.

A) not be displayed or disclosed in the local government financial statements.

B) be displayed as a revenue in the local government financial statements.

C) be displayed as both a revenue and an expenditure in the local government financial statements.

D) be disclosed, but not displayed, in the local government financial statements.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

55

Last year a city received notice of a $150,000 grant from the state to purchase vehicles to transport physically challenged individuals. During the current year the city received the entire $150,000, purchased a bus for $65,000, and issued a purchase order for a van for $60,000. The grant revenue that the city should recognize on the government-wide financial statements in the current year is

A) $-0-.

B) $ 65,000.

C) $125,000.

D) $150,000.

A) $-0-.

B) $ 65,000.

C) $125,000.

D) $150,000.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

56

A city is the recipient of a cash bequest of $500,000 that must be used to plant flowers and shrubs in the city parks. During the year only $200,000 is actually received from the bequest and $150,000 is spent on shrubs. The amount that should be recognized as revenue by the city in its government-wide financial statements in the current year is

A) $-0-.

B) $150,000.

C) $200,000.

D) $500,000.

A) $-0-.

B) $150,000.

C) $200,000.

D) $500,000.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

57

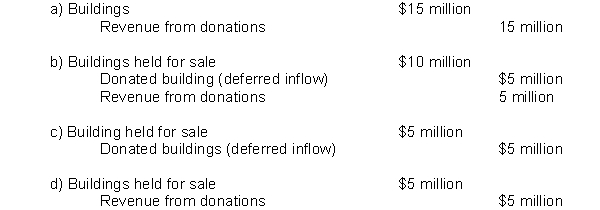

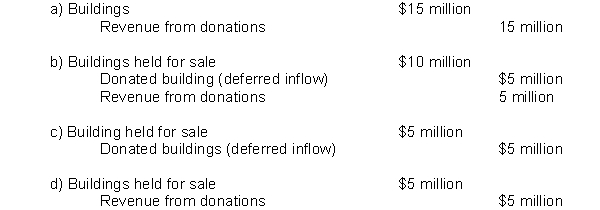

A wealthy philanthropist donates three buildings to H-Town. Each building has a fair market value of $5 million. The town plans to use Building 1 as a new fire station and sell Buildings 2 and 3. Building 2 is sold after year-end, but within the availability period. Building 3 fails to sell by the time the town issues the financial statements. Which of the following correctly records revenue from these donations in the governmental fund financial statements?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

58

Unrestricted grant revenues with a time requirement should be recognized

A) when the award is announced.

B) when the cash is received.

C) in the period in which the grant is required to be used.

D) when expenditures are recognized on grant-related activities.

A) when the award is announced.

B) when the cash is received.

C) in the period in which the grant is required to be used.

D) when expenditures are recognized on grant-related activities.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following are not characterized as non-exchange revenues?

A) Sales taxes

B) Property taxes.

C) Fines and forfeits.

D) Charges for services.

A) Sales taxes

B) Property taxes.

C) Fines and forfeits.

D) Charges for services.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

60

A government is the recipient of a bequest of a multi-story office building that the government intends to sell to support program activities. The building has a historical cost of $850,000, a book value in the hands of the benefactor of $700,000, and a fair value of $1,050,000. The city had not yet begun to try to sell the building when its annual financial statements were issued. The city should recognize on its governmental fund financial statements, donations revenue of

A) $-0-.

B) $700,000.

C) $850,000.

D) $1,050,000.

A) $-0-.

B) $700,000.

C) $850,000.

D) $1,050,000.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

61

The City of Kayla levies a local sales tax that is collected by the merchants and remitted to the city by the twentieth day of the month following the month of sale. The city maintains its books and records in a manner that facilitates the preparation of fund financial statements. The city has adopted a 60-day rule for sales tax revenue recognition, where appropriate. Prepare all necessary journal entries to record the following transactions related to sales tax revenues for the year ended December 31, 2014.

a.) On January 20, the city receives sales tax returns and related payments of $7,000 from the merchants of the city for the month of December 2013.

b.) On February 20, the City receives sales tax returns and related payments of $3,000 from the merchants of the City for the month of January 2014.

c.) During 2014 the City receives sales tax returns and related payments of $40,000 from the merchants for the months of February-November 2014.

d.) On January 20, 2015 the city receives sales tax returns and related payments of $7,500 from the merchants of the city for the month of December 2014.

a.) On January 20, the city receives sales tax returns and related payments of $7,000 from the merchants of the city for the month of December 2013.

b.) On February 20, the City receives sales tax returns and related payments of $3,000 from the merchants of the City for the month of January 2014.

c.) During 2014 the City receives sales tax returns and related payments of $40,000 from the merchants for the months of February-November 2014.

d.) On January 20, 2015 the city receives sales tax returns and related payments of $7,500 from the merchants of the city for the month of December 2014.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

62

Ben City maintains its books and records in a manner that facilitates the preparation of fund financial statements. Prepare all necessary journal entries to record the following events related to property tax revenues for the year ended December 31, 2017. The city has adopted the 60-day rule for property tax revenue recognition.

a. On January 3, 2017 the city council levied property taxes of $2 million to support general government operations, due in two equal installments on June 20 and December 20, 2017. The property taxes were levied to finance the 2017 budget, which had been adopted on November 3, 2016. Historically 2 percent of property taxes are uncollectible.

b. The city collected the following amounts related to property taxes

Delinquent 2016 taxes collected in January 2017 $ 22,000

Delinquent 2016 taxes collected in March 2017 $ 25,000

2017 taxes collected in June 2017 $ 1,080

2017 taxes collected in December 2017 $ 800,000

Delinquent 2017 taxes collected in January 2018 $ 20,000

Delinquent 2017 taxes collected in March 2018 $ 30,000

c. Property taxes due in 2017 but uncollected by the December due date were reclassified as delinquent.

d. $4,000 of 2015 taxes were written off during 2017.

a. On January 3, 2017 the city council levied property taxes of $2 million to support general government operations, due in two equal installments on June 20 and December 20, 2017. The property taxes were levied to finance the 2017 budget, which had been adopted on November 3, 2016. Historically 2 percent of property taxes are uncollectible.

b. The city collected the following amounts related to property taxes

Delinquent 2016 taxes collected in January 2017 $ 22,000

Delinquent 2016 taxes collected in March 2017 $ 25,000

2017 taxes collected in June 2017 $ 1,080

2017 taxes collected in December 2017 $ 800,000

Delinquent 2017 taxes collected in January 2018 $ 20,000

Delinquent 2017 taxes collected in March 2018 $ 30,000

c. Property taxes due in 2017 but uncollected by the December due date were reclassified as delinquent.

d. $4,000 of 2015 taxes were written off during 2017.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

63

Governments use modified accrual accounting to determine when transactions and events will be recognized in the financial statements of the governmental fund types.

a.) What is modified accrual accounting and how does it affect revenue recognition for the following types of revenue: property taxes; sales and income taxes; fines; grants of all types; and investment income.

b.) In your opinion is modified accrual accounting the best basis of accounting for governments? Why or why not?

a.) What is modified accrual accounting and how does it affect revenue recognition for the following types of revenue: property taxes; sales and income taxes; fines; grants of all types; and investment income.

b.) In your opinion is modified accrual accounting the best basis of accounting for governments? Why or why not?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

64

On December 30, 2016, a county purchases a new snow plow for $100,000. On January 2, 2017, the snow plow is seriously damaged in an accident. The plow is uninsured. Soon after the accident, the county is able to sell the snow plow for $10,000.

(a) Record the purchase of the snow plow in the county's general fund.

(b) Record the sale of the snow plow.

(c) How would the sale of the snow plow affect the general fund's operating statement?

(d) How would the sale of the snow plow affect the governmental activities column of the government-wide statement of activities?

(e) Explain the rationale for the difference between the information conveyed in the fund operating statement vs. the government-wide statement of activities in relation to the snow plow.

(a) Record the purchase of the snow plow in the county's general fund.

(b) Record the sale of the snow plow.

(c) How would the sale of the snow plow affect the general fund's operating statement?

(d) How would the sale of the snow plow affect the governmental activities column of the government-wide statement of activities?

(e) Explain the rationale for the difference between the information conveyed in the fund operating statement vs. the government-wide statement of activities in relation to the snow plow.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

65

A city receives a federal grant which the city must pass through to smaller units of government who meet the eligibility requirements. The city must monitor these smaller units of government for compliance with grant requirements.

a.) How should the city recognize this grant in its fund financial statements?

b.) Would your answer be different if the city were not required to monitor the other governments for compliance with grant requirements? Explain.

a.) How should the city recognize this grant in its fund financial statements?

b.) Would your answer be different if the city were not required to monitor the other governments for compliance with grant requirements? Explain.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

66

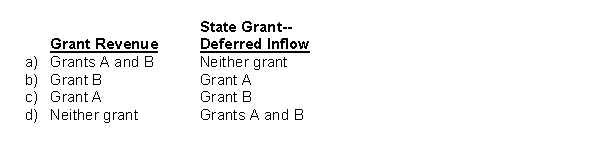

Paul City received payment of two grants from the state during its fiscal year ending September 30, 2016. Grant A can be used to cover any operating expenses incurred during fiscal 2017. Grant B can be used at any time to acquire equipment for the city's fire department. Should the city report these grants as grant revenues or deferred inflows in its government-wide financial statements for fiscal 2016?  ANSWERS TO MULTIPLE CHOICE (CHAPTER 4)

ANSWERS TO MULTIPLE CHOICE (CHAPTER 4)

ANSWERS TO MULTIPLE CHOICE (CHAPTER 4)

ANSWERS TO MULTIPLE CHOICE (CHAPTER 4)

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

67

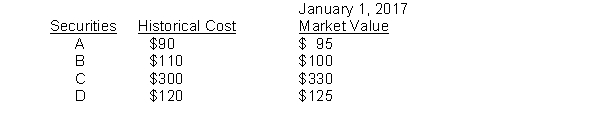

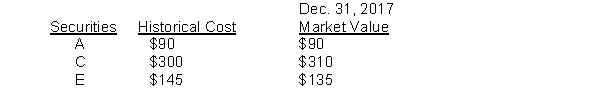

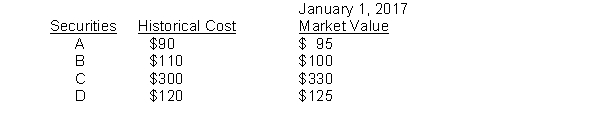

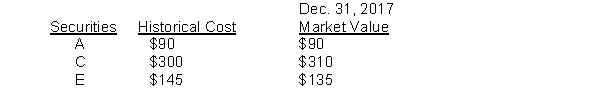

The City of Jolie maintains its books and records in a manner that facilitates the preparation of fund financial statements. Prepare all necessary journal entries to record the city's investment income and related transactions for the year 2017. The city has a 12/31 fiscal year-end. All of the City's investments are required to be reported at fair value. The beginning securities portfolio held by the general fund was as follows:  a.) Dividends received related to investments held in the general fund, $75.

a.) Dividends received related to investments held in the general fund, $75.

b.) On March 1, Security B is sold for $105.

c.) On April 1, Security E is purchased for $145

d.) On May 1 Security D is sold for $140.

e.) On December 31, necessary adjusting entries are made to recognize appropriate amounts of gains/losses associated with the securities. The market values of the securities at year-end were as follows:

a.) Dividends received related to investments held in the general fund, $75.

a.) Dividends received related to investments held in the general fund, $75.b.) On March 1, Security B is sold for $105.

c.) On April 1, Security E is purchased for $145

d.) On May 1 Security D is sold for $140.

e.) On December 31, necessary adjusting entries are made to recognize appropriate amounts of gains/losses associated with the securities. The market values of the securities at year-end were as follows:

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

68

Castle County reported the following transactions during its fiscal year ended December 31, 2017:

-On February 16, 2017, the county purchased a 15-year $100,000 bond for $99,800 with cash held in a debt sinking fund. During the year, the county received $3,000 in interest. At year-end, the market value of the bond was $99,950.

-In December 2016, the Kiplinger foundation pledged up to $3 million to support the county's Art Museum. The foundation will contribute $1 for every $2 in admissions revenue generated by the Art Museum. During 2017, the Art Museum reported $4.0 million in admissions revenue. During January and February 2018, it reported an additional $1.0 million. The county received the matching contributions for both admissions amounts.

-During the year, the county agreed to impose a license fee on all tanning salons operated in the county. Licenses cover the period July 1, 2017 to June 30, 2018. The county received license revenues of $150,000.

-The county sold two police cars for salvage totaling $7,500. It had purchased the cars five years earlier at $30,000 each. The county had fully depreciated the police cars in its government-wide financial statements and a total salvage value of $5,000 had been anticipated.

-The county received a $1.5 million grant from the state to reimburse the cost of its DARE program. The county incurred DARE program costs of $1.0 million during 2017 and an additional $500,000 in January and February 2018.

-On February 16, 2017, the county purchased a 15-year $100,000 bond for $99,800 with cash held in a debt sinking fund. During the year, the county received $3,000 in interest. At year-end, the market value of the bond was $99,950.

-In December 2016, the Kiplinger foundation pledged up to $3 million to support the county's Art Museum. The foundation will contribute $1 for every $2 in admissions revenue generated by the Art Museum. During 2017, the Art Museum reported $4.0 million in admissions revenue. During January and February 2018, it reported an additional $1.0 million. The county received the matching contributions for both admissions amounts.

-During the year, the county agreed to impose a license fee on all tanning salons operated in the county. Licenses cover the period July 1, 2017 to June 30, 2018. The county received license revenues of $150,000.

-The county sold two police cars for salvage totaling $7,500. It had purchased the cars five years earlier at $30,000 each. The county had fully depreciated the police cars in its government-wide financial statements and a total salvage value of $5,000 had been anticipated.

-The county received a $1.5 million grant from the state to reimburse the cost of its DARE program. The county incurred DARE program costs of $1.0 million during 2017 and an additional $500,000 in January and February 2018.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

69

In addition to exchange revenues, GASB standards discuss four categories of nonexchange revenues. For each of the following revenues recognized by a city indicate the category into which it best fits.

A. A state grant that the city must accept and use to hire air pollution inspectors

________________________

B. Revenue from fees charged by the police department to monitor a charity bicycle ride

_______________________

C. Fines for traffic violations

_______________________

D. A federal grant to support general education services.

_______________________

E. Investments in the state's investment pool.

________________________

F. Hotel occupancy tax.

________________________

G. Local option sales tax

________________________

H. City library late fees

________________________

A. A state grant that the city must accept and use to hire air pollution inspectors

________________________

B. Revenue from fees charged by the police department to monitor a charity bicycle ride

_______________________

C. Fines for traffic violations

_______________________

D. A federal grant to support general education services.

_______________________

E. Investments in the state's investment pool.

________________________

F. Hotel occupancy tax.

________________________

G. Local option sales tax

________________________

H. City library late fees

________________________

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

70

Answer the following questions with regard to the preparation of fund financial statements. At fiscal year-end, a city holds an investment portfolio in its general fund that has a fair market value of $15 million and a historical cost of $28 million. The portfolio had a fair value of $18 million at the beginning of the current fiscal year. The portfolio is composed of a variety of bonds with a face value $29 and a due date five years in the future. The bonds were acquired to meet a $29 million debt due five years in the future.

a.) At what amount should the portfolio be valued on the balance sheet?

b.) What amount, if any, should appear on the operating statement?

c.) Defend the valuation method required by GAAP.

d.) Argue against the valuation method required by GAAP.

e.) At what amount would the city want to record these investments on its financial statements for the current year? Why?

a.) At what amount should the portfolio be valued on the balance sheet?

b.) What amount, if any, should appear on the operating statement?

c.) Defend the valuation method required by GAAP.

d.) Argue against the valuation method required by GAAP.

e.) At what amount would the city want to record these investments on its financial statements for the current year? Why?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

71

Answer the following questions with regard to the preparation of fund financial statements. A city receives three grants from the state. One grant is received in cash but must be used only for the acquisition of two vans specifically equipped to transport physically challenged citizens who use wheelchairs as a means of mobility. The second grant provides for reimbursement of costs incurred in operating a public transit system. The third grant is a distribution of state general fund revenues allocated to each city in the state based on the population of the city. This grant is to be used in general government operations.

a.) Discuss the various methods of revenue recognition for grants and other similar revenues.

b.) What is the appropriate basis for revenue recognition for each of the three state grants?

c.) What is the rationale for each of these methods of revenue recognition?

a.) Discuss the various methods of revenue recognition for grants and other similar revenues.

b.) What is the appropriate basis for revenue recognition for each of the three state grants?

c.) What is the rationale for each of these methods of revenue recognition?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

72

The City of Chessie received two contributions during its current fiscal year:

-A developer contributed 10 acres of land as part of an agreement with the city to allow more houses to be built per acre than current zoning laws permit. The city will use the land to build a park. The developer purchased the land for $1.5 million. The fair value of the land at the time of the contribution was $1.9 million.

-A local resident contributed 30 acres of land to the city. The city agreed that it would sell the land and use the proceeds to add a new wing to the city's senior center. The resident paid $500,000 for the land. When it was contributed, it had a fair value of $1.5 million. The city sold the land to several developers a month after its fiscal year-end for $1.7 million.

a. Prepare journal entries to record each of these contributions in the city's general fund.

b. Comment on and justify any differences in the way you recognized each of these transactions.

c. Would your answer on the contribution for the senior center be different if the city had been unable to sell the land before its financial statements were issued?

d. How would each of these transactions be reported in the city's government-wide financial statements?

-A developer contributed 10 acres of land as part of an agreement with the city to allow more houses to be built per acre than current zoning laws permit. The city will use the land to build a park. The developer purchased the land for $1.5 million. The fair value of the land at the time of the contribution was $1.9 million.

-A local resident contributed 30 acres of land to the city. The city agreed that it would sell the land and use the proceeds to add a new wing to the city's senior center. The resident paid $500,000 for the land. When it was contributed, it had a fair value of $1.5 million. The city sold the land to several developers a month after its fiscal year-end for $1.7 million.

a. Prepare journal entries to record each of these contributions in the city's general fund.

b. Comment on and justify any differences in the way you recognized each of these transactions.

c. Would your answer on the contribution for the senior center be different if the city had been unable to sell the land before its financial statements were issued?

d. How would each of these transactions be reported in the city's government-wide financial statements?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

73

The City of Katerah maintains its books and records in a manner that facilitates the preparation of fund financial statements. Prepare all necessary journal entries to record the city's revenues from the following transactions for the year ended December 31, 2017.

a.) On January 15, the city received notification that it had been awarded a $300,000 federal grant to assist in the operation of its "Meals on Wheels" program. The federal government expects to send the cash in about three months. This is not a reimbursement type grant and all eligibility requirements have been met.

b.) In February the city spent $31,000 on "Meals on Wheels."

c.) In March, fines of $1,800 were issued for parking tickets. Payment must be made within 30 days, when the city has an enforceable legal claim to the amounts.

d.) In April, the city received the $300,000 grant from the federal government.

e.) In April, the city received $1,200 cash in payment of parking tickets issued in March. In addition, $100 of tickets was contested and court dates have been set. Also, the city expects another that $100 of tickets will be uncollectible but the remaining amounts will be paid eventually.

f.) Restaurant licenses are issued for a one-year period, from July 1 to June 30. The license fees are used to pay restaurant inspectors. In June, the city received $11,000 in restaurant license fees.

a.) On January 15, the city received notification that it had been awarded a $300,000 federal grant to assist in the operation of its "Meals on Wheels" program. The federal government expects to send the cash in about three months. This is not a reimbursement type grant and all eligibility requirements have been met.

b.) In February the city spent $31,000 on "Meals on Wheels."

c.) In March, fines of $1,800 were issued for parking tickets. Payment must be made within 30 days, when the city has an enforceable legal claim to the amounts.

d.) In April, the city received the $300,000 grant from the federal government.

e.) In April, the city received $1,200 cash in payment of parking tickets issued in March. In addition, $100 of tickets was contested and court dates have been set. Also, the city expects another that $100 of tickets will be uncollectible but the remaining amounts will be paid eventually.

f.) Restaurant licenses are issued for a one-year period, from July 1 to June 30. The license fees are used to pay restaurant inspectors. In June, the city received $11,000 in restaurant license fees.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck