Deck 12: Strategic Investment Decisions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/101

Play

Full screen (f)

Deck 12: Strategic Investment Decisions

1

Under the general quantitative rule, a project with a net present value less than zero should not be accepted.

True

2

Cash flows to be considered in capital budgeting decisions generally fall into three major groups: initial investment, incremental operating cash flows, and terminal cash flows.

True

3

The cost of disposing of an old asset is considered irrelevant in capital budgeting decisions.

False

4

The time value of money is important in completing a net present value analysis.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

5

Because of its complex calculation, few managers rely on the payback period as a capital budgeting analysis tool.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

6

In general, the initial project investment does not require discounting in a net present value analysis.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

7

(Appendix 12A) Cash flows for a capital budgeting analysis are often affected by inflation, but not by deflation.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

8

The accrual accounting rate of return method does not consider the time value of money.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

9

The effect of a strategic investment decision on a company's reputation is often difficult to quantify.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

10

Sensitivity analysis is usually performed after applying quantitative analysis techniques in a capital budgeting decision.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

11

A capital investment's expected useful life is inversely correlated with the uncertainty of its cash flows.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

12

Incremental operating cash flows can be associated with changes in capacity or product quality in capital budgeting decisions.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

13

Managers responsible for proposing a project are likely to be favorably biased in their estimates of future project cash flows.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

14

Income taxes have a major effect on capital budgeting decisions.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

15

The internal rate of return method assumes that future cash flows can be reinvested to earn the same return generated by a capital investment project.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

16

Managers should consider qualitative information in making capital budgeting decisions.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

17

Uncertainty is very often a factor when estimating a project's terminal value for an NPV analysis.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

18

In capital budgeting decisions, depreciation shields part of operating income from the effect of income taxes.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

19

Capital budgeting is a process managers use when choosing investments with multi-year cash flows.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

20

The first step in addressing capital budgeting decisions is to identify relevant cash flows.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

21

Phoxco is considering automating its production line. It will cost $40,000 to acquire the necessary equipment. The annual cost savings are expected to be $8,000 per year for 14 years. The firm requires a 20% return. Ignoring income taxes, what is the payback period?

A) 3 years

B) 4.2 years

C) 5 years

D) 6 years

A) 3 years

B) 4.2 years

C) 5 years

D) 6 years

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

22

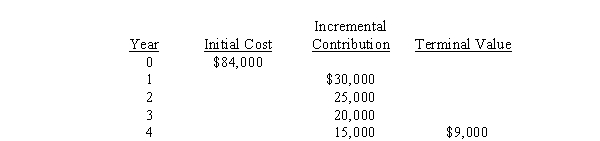

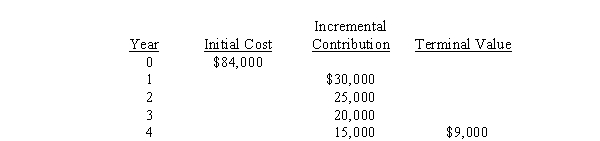

The Bonkers Corp. is contemplating the purchase of a piece of equipment with the following cash flow data:  Ignoring income taxes, what is the payback period?

Ignoring income taxes, what is the payback period?

A) 3.00 years

B) 3.33 years

C) 3.60 years

D) 3.50 years

Ignoring income taxes, what is the payback period?

Ignoring income taxes, what is the payback period?A) 3.00 years

B) 3.33 years

C) 3.60 years

D) 3.50 years

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

23

The time value of money means

A) A dollar received today will be worth more than a dollar received in the future

B) A dollar received today will be worth less than a dollar received in the future

C) Ignoring the profitability of a capital investment

D) The more you invest, the smaller your return is

A) A dollar received today will be worth more than a dollar received in the future

B) A dollar received today will be worth less than a dollar received in the future

C) Ignoring the profitability of a capital investment

D) The more you invest, the smaller your return is

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

24

Walter borrows $10,000 from his mother. He will repay her $2,000 at the end of each of the next four years and the balance at the end of the fifth year. If the interest rate is 12%, what is the amount to be paid at the end of the fifth year?

A) $3,926.00

B) $6,924.16

C) $5,869.65

D) $2,000.00

A) $3,926.00

B) $6,924.16

C) $5,869.65

D) $2,000.00

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

25

The rate of return that results in a zero net present value for a project is called the

A) Average rate of return

B) Internal rate of return

C) Required rate of return

D) Discount rate of return

A) Average rate of return

B) Internal rate of return

C) Required rate of return

D) Discount rate of return

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

26

Alien Corp. is considering the purchase of a new truck which costs $14,340. The truck is expected to save $3,600 in operating costs annually for the next 7 years. How low can the annual cost savings be and still provide a 15% return? Ignore income taxes.

A) $5,967

B) $475

C) $7,458

D) $3,441

A) $5,967

B) $475

C) $7,458

D) $3,441

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

27

You are currently entering college and you want to buy your uncle's Mercedes when you graduate. He has promised to sell it to you for $18,000. How much will you have to deposit now, in an account earning 8%, to have enough money buy the car in 4 years?

A) $6,122

B) $4,500

C) $13,230

D) $3,060

A) $6,122

B) $4,500

C) $13,230

D) $3,060

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

28

(Appendix 12A) The nominal method of NPV analysis adjusts future cash flows for the impact of inflation.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

29

The net present value method is

A) Used to appraise a capital project's qualitative factors.

B) Used to show how long the initial investment will be at risk.

C) The sum of the cash inflows, discounted to time zero.

D) The sum of the projected cash inflows and outflows valued in today's dollars.

A) Used to appraise a capital project's qualitative factors.

B) Used to show how long the initial investment will be at risk.

C) The sum of the cash inflows, discounted to time zero.

D) The sum of the projected cash inflows and outflows valued in today's dollars.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

30

If the internal rate of return exceeds the discount rate, the net present value is

A) Zero

B) Less than one

C) Positive

D) Negative

A) Zero

B) Less than one

C) Positive

D) Negative

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

31

A firm's required rate of return is the rate which makes the

A) Net present value equal to zero.

B) Internal rate of return equal to the average rate of return.

C) Profitability index greater than zero.

D) Determination of the NPV possible.

A) Net present value equal to zero.

B) Internal rate of return equal to the average rate of return.

C) Profitability index greater than zero.

D) Determination of the NPV possible.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

32

For a particular investment project, the present value of the benefits is exactly equal to the present value of the investment. Given this, which of the following statements is true?

A) The net present value is positive.

B) The internal rate of return is less than the required rate of return.

C) The profitability index is less than one.

D) The project is acceptable.

A) The net present value is positive.

B) The internal rate of return is less than the required rate of return.

C) The profitability index is less than one.

D) The project is acceptable.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

33

Uniform cash flows from a capital project are necessary for which of the following calculations? I. Net present value

II) Internal rate of return

III) Profitability index

A) I and II only

B) II and III only

C) I and III only

D) None of the above (not I, II, or III)

II) Internal rate of return

III) Profitability index

A) I and II only

B) II and III only

C) I and III only

D) None of the above (not I, II, or III)

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

34

The process that managers use when they evaluate multi-year investments is called

A) Capital budgeting

B) Activity-based budgeting

C) Short-term decision making

D) Breakeven analysis

A) Capital budgeting

B) Activity-based budgeting

C) Short-term decision making

D) Breakeven analysis

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

35

The Conroy Co. wants to purchase a machine for a new product line that costs $138,750. The company's engineering department estimates the machine will last 10 years and provide an annual contribution margin of $25,000. Ignore income taxes. The internal rate of return to the nearest tenth of a percent is

A) 12.4%

B) 11.6%

C) 13.46%

D) 12.64%

A) 12.4%

B) 11.6%

C) 13.46%

D) 12.64%

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

36

Last semester a class gave a professor $810 to fly to Borneo. However, he decided not to go until he had enough money to fly back, an additional $690. If he invests the $810 at 8%, when can he make the trip, assuming no change in ticket prices?

A) 8 years

B) 6 years

C) 4 years

D) 2 years

A) 8 years

B) 6 years

C) 4 years

D) 2 years

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

37

Phoxco would like to automate its calligraphy operation. The equipment will cost $150,000 plus freight, installation, and testing costs of $5,500. The expected life of the project is 8 years, with annual cost savings of $20,000. The minimum rate of return is 12% and estimated terminal value is $3,000. Ignore income taxes. The profitability index of the project is

A) 1.55

B) 1.57

C) 0.67

D) 0.65

A) 1.55

B) 1.57

C) 0.67

D) 0.65

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

38

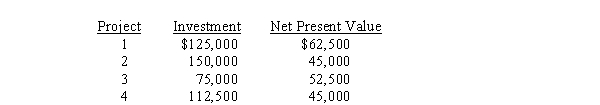

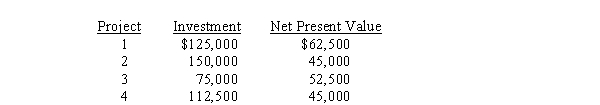

Early, Inc. has chosen four potential investment projects. Listed below are some relevant data on these projects:  Use the profitability index to rank these investments in terms of preference.

Use the profitability index to rank these investments in terms of preference.

A) 1, 3, 2, 4

B) 2, 1, 4, 3

C) 1, 2, 3, 4

D) 3, 1, 4, 2

Use the profitability index to rank these investments in terms of preference.

Use the profitability index to rank these investments in terms of preference.A) 1, 3, 2, 4

B) 2, 1, 4, 3

C) 1, 2, 3, 4

D) 3, 1, 4, 2

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

39

The local school board is considering the purchase of a computer. It will cost $100,000 and will be sold back to the dealer at the end of 6 years for $8,000. If the required rate of return is 14%, what is the minimal annual cost saving required to justify the purchase? Ignore income taxes.

A) $25,714

B) $23,142

C) $24,776

D) $23,656

A) $25,714

B) $23,142

C) $24,776

D) $23,656

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

40

A negative net present value means that the

A) Internal rate of return is less than the required rate of return

B) Project is acceptable

C) Present value of the inflows exceeds the present value of the outflows

D) Company chose the wrong discount rate

A) Internal rate of return is less than the required rate of return

B) Project is acceptable

C) Present value of the inflows exceeds the present value of the outflows

D) Company chose the wrong discount rate

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following is the best example of a tax shield for an asset?

A) Its periodic depreciation

B) Its cost basis

C) Its disposal cost

D) Its trade-in value

A) Its periodic depreciation

B) Its cost basis

C) Its disposal cost

D) Its trade-in value

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

42

In completing a sensitivity analysis for a capital budgeting project, which of the following would typically be varied? I. Discount rate

II) Future cash flows

III) Future accrual-basis revenues and expenses

A) I and III only

B) II and III only

C) I and II only

D) I, II, and III

II) Future cash flows

III) Future accrual-basis revenues and expenses

A) I and III only

B) II and III only

C) I and II only

D) I, II, and III

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

43

(Appendix 12A) Inflation refers to the

A) Exchange rate between two different currencies

B) Decline in general purchasing power of a monetary unit

C) Increase in general purchasing power of a monetary unit

D) Time value of money

A) Exchange rate between two different currencies

B) Decline in general purchasing power of a monetary unit

C) Increase in general purchasing power of a monetary unit

D) Time value of money

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

44

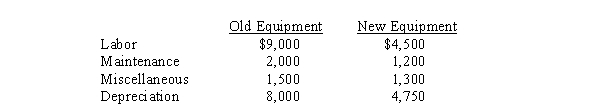

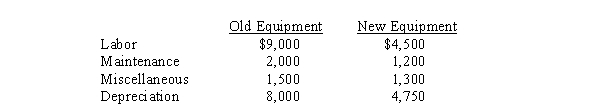

Valley Hospital is considering the purchase of new medical equipment for $25,000. The old equipment has zero salvage value. The costs associated with operating the equipment are:  If the new machine is purchased and ignoring income taxes, the payback period is

If the new machine is purchased and ignoring income taxes, the payback period is

A) 3.57 years

B) 2.13 years

C) 2.86 years

D) 4.55 years

If the new machine is purchased and ignoring income taxes, the payback period is

If the new machine is purchased and ignoring income taxes, the payback period isA) 3.57 years

B) 2.13 years

C) 2.86 years

D) 4.55 years

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

45

The incremental cash tax flow for a capital budgeting project is calculated using which of the following formulas?

A) Annual depreciation × marginal income tax rate

B) Annual depreciation × (1 - marginal income tax rate)

C) (Operating cash flow + annual depreciation) × marginal income tax rate

D) Operating cash flow × marginal income tax rate

A) Annual depreciation × marginal income tax rate

B) Annual depreciation × (1 - marginal income tax rate)

C) (Operating cash flow + annual depreciation) × marginal income tax rate

D) Operating cash flow × marginal income tax rate

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

46

The payback period is deficient as a decision criterion for capital projects because it I. Disregards relative profitability

II) Ignores income beyond the payback period

III) Does not take into account the time value of money

A) I only

B) II only

C) III only

D) I, II, and III

II) Ignores income beyond the payback period

III) Does not take into account the time value of money

A) I only

B) II only

C) III only

D) I, II, and III

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

47

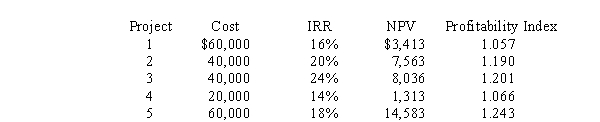

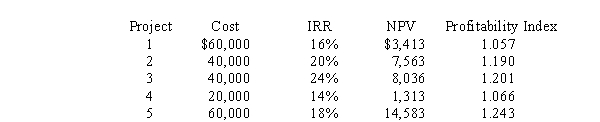

Apex Co. has $100,000 available for long-term investment. Which projects should be selected from the list below?

A) 4 and 5

B) 2, 3, and 4

C) 3 and 5

D) 2 and 5

A) 4 and 5

B) 2, 3, and 4

C) 3 and 5

D) 2 and 5

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

48

(Appendix 12A) Which of the following NPV analysis methods requires adjustment of a project's terminal value for inflation?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

49

Sebastian is presenting a capital budgeting project to Viola, his division manager. Which one of the following is likely to have the least amount of bias when evaluating this project?

A) Sebastian

B) Viola

C) The company's accountant

D) Cannot be determined

A) Sebastian

B) Viola

C) The company's accountant

D) Cannot be determined

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is the best example of a capital budgeting decision?

A) Deciding the price of a product for the next six months

B) Forecasting accrual basis profits for the next five years

C) Purchasing a piece of equipment with an expected life of eight years

D) Deciding which product to emphasize when there are constrained resources

A) Deciding the price of a product for the next six months

B) Forecasting accrual basis profits for the next five years

C) Purchasing a piece of equipment with an expected life of eight years

D) Deciding which product to emphasize when there are constrained resources

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

51

A depreciable asset's taxable basis is calculated as its

A) Cost

B) Net book value on the balance sheet

C) Market value at the time of disposal

D) Cost less accumulated tax depreciation

A) Cost

B) Net book value on the balance sheet

C) Market value at the time of disposal

D) Cost less accumulated tax depreciation

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following factors are subject to uncertainty in an NPV analysis? I. Project life

II) Appropriate discount rate

III) Terminal value

A) I and II only

B) II and III only

C) I and III only

D) I, II, and III

II) Appropriate discount rate

III) Terminal value

A) I and II only

B) II and III only

C) I and III only

D) I, II, and III

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

53

Capital budgeting decisions typically fall into which of the following major categories? I. Developing or expanding products or services

II) Allocating costs to products or services

III) Replacing or reorganizing assets or services

A) I and II only

B) II and III only

C) I and III only

D) I, II, and III

II) Allocating costs to products or services

III) Replacing or reorganizing assets or services

A) I and II only

B) II and III only

C) I and III only

D) I, II, and III

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

54

(Appendix 12A) In a capital budgeting analysis, nominal cash flow is generally calculated as

A) Real cash flow × (1 + inflation rate)t

B) Real cash flow / (1 + inflation rate)t

C) Real cash flow (1 + inflation rate)×t

D) (1 + inflation rate) × t × real cash flow

A) Real cash flow × (1 + inflation rate)t

B) Real cash flow / (1 + inflation rate)t

C) Real cash flow (1 + inflation rate)×t

D) (1 + inflation rate) × t × real cash flow

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following statements regarding NPV analysis is true?

A) Uncertainties increase as the dollar value of an investment increases

B) The discount rate can be calculated with certainty if it is based on the weighted average cost of capital

C) Managers should generally accept projects with an NPV greater than zero

D) The timing of incremental revenues and costs is irrelevant in NPV analysis

A) Uncertainties increase as the dollar value of an investment increases

B) The discount rate can be calculated with certainty if it is based on the weighted average cost of capital

C) Managers should generally accept projects with an NPV greater than zero

D) The timing of incremental revenues and costs is irrelevant in NPV analysis

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

56

Qualitative factors often influence strategic investment decisions. Which of the following is the best example of such a factor?

A) Changes in product prices based on consumer demand

B) Changes in consumer demand based on product prices

C) Increased ability to ship product in a timely manner

D) Discount rate estimates

A) Changes in product prices based on consumer demand

B) Changes in consumer demand based on product prices

C) Increased ability to ship product in a timely manner

D) Discount rate estimates

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following is not a quantitative technique commonly used in capital budgeting decisions?

A) Net present value

B) Activity-based budgeting

C) Internal rate of return

D) Payback

A) Net present value

B) Activity-based budgeting

C) Internal rate of return

D) Payback

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

58

DBR Corporation is considering the purchase and implementation of an enterprise-wide information system. Which of the following would be the least biased source of qualitative information about the project?

A) Information technology staff who would implement the system

B) The software vendor

C) Other companies that have implemented the same system

D) Employees who would use the system

A) Information technology staff who would implement the system

B) The software vendor

C) Other companies that have implemented the same system

D) Employees who would use the system

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following is not a step in the process for addressing capital budgeting decisions?

A) Identify decision alternatives.

B) Identify financial statement effects.

C) Apply quantitative analysis techniques.

D) Perform sensitivity analysis.

A) Identify decision alternatives.

B) Identify financial statement effects.

C) Apply quantitative analysis techniques.

D) Perform sensitivity analysis.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following capital budgeting methods ignores the time value of money?

A) Internal rate of return

B) Net present value

C) Profitability index

D) Payback period

A) Internal rate of return

B) Net present value

C) Profitability index

D) Payback period

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

61

A firm is currently buying a part at a cost of $12 each. It is considering buying a machine that will produce the part at a variable cost of $8. Each unit of input produces the part plus a by-product, which is sold for $1. The machine will cost $40,000 and will have a useful life of 5 years. The firm requires an 8% return. What annual volume is necessary to justify making the investment? Ignore income taxes.

A) 2,558 units

B) 3,198 units

C) 12,792 units

D) 8,000 units

A) 2,558 units

B) 3,198 units

C) 12,792 units

D) 8,000 units

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

62

Allen Co. invested in a machine that has a 3-year useful life. The company's discount rate is 12%, and the net present value of the investment is $(573). Annual cost savings are: year 1 $3,000; year 2 $4,000; and year 3 $5,000. Determine the original cost of the machine. Ignore income taxes.

A) $12,000

B) $8,500

C) $10,000

D) $9,500

A) $12,000

B) $8,500

C) $10,000

D) $9,500

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

63

(Appendix 12A) The real rate of interest is 15%, and inflation is estimated at 5%. What is the nominal rate of interest?

A) 20.00%

B) 15.75%

C) 20.75%

D) 19.25%

A) 20.00%

B) 15.75%

C) 20.75%

D) 19.25%

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

64

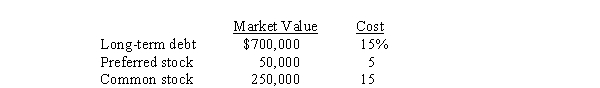

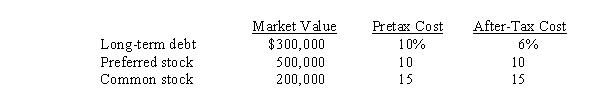

Allen Corporation has the following equity structure:  The weighted average cost of capital is

The weighted average cost of capital is

A) 14.5%

B) 8.2%

C) 8.7%

D) 10.3%

The weighted average cost of capital is

The weighted average cost of capital isA) 14.5%

B) 8.2%

C) 8.7%

D) 10.3%

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

65

Bell Company is considering a project that would provide a single cash inflow eight years from now of $80,000. What is the most that Bell would be willing to spend on this project if the discount rate is 16%?

A) $262,295

B) $24,400

C) $288,400

D) $22,191

A) $262,295

B) $24,400

C) $288,400

D) $22,191

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

66

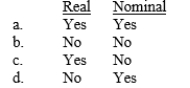

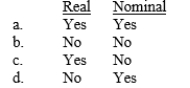

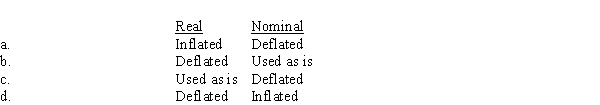

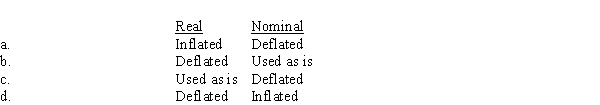

(Appendix 12A) The tax savings cash flows are treated differently under the nominal and real methods. Which of the following reflects this treatment?  More Difficult

More Difficult

More Difficult

More Difficult

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

67

Carri Company is negotiating for the purchase of a new machine. The machine is expected to generate operating cost savings of $225,000 per year for 4 years. Carri uses a 12% discount rate. What is the most Carri would be willing to pay for this machine? Ignore income taxes.

A) $683,325

B) $197,935

C) $540,450

D) $380,250

A) $683,325

B) $197,935

C) $540,450

D) $380,250

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

68

Benjamin Company invested in a 3-year project and expects a 15% rate of return. Annual cash inflows from the project are: year 1 $8,000; year 2 $8,500; and year 3 $9,500. The net present value is $4,000. What was the amount of the original investment? Ignore income taxes.

A) $17,637

B) $15,637

C) $19,637

D) $23,637

A) $17,637

B) $15,637

C) $19,637

D) $23,637

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

69

(Appendix 12A) If nominal cash flow is calculated as real cash flow × (1 + i)t in an NPV analysis, i denotes the

A) Weighted average cost of capital

B) Risk-free interest rate

C) Discount rate

D) Rate of inflation

A) Weighted average cost of capital

B) Risk-free interest rate

C) Discount rate

D) Rate of inflation

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

70

A project has an NPV = 0 and the initial investment is $360,000. If the discount rate is 12%, compute the annual cash inflows, if the project's life is 4 years.

A) $133,080

B) $118,538

C) $82,267

D) $123,682

A) $133,080

B) $118,538

C) $82,267

D) $123,682

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

71

(Appendix 12A) The real and nominal methods are most closely associated with

A) Internal rate of return

B) Payback

C) Net present value

D) Cost of capital

A) Internal rate of return

B) Payback

C) Net present value

D) Cost of capital

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

72

Rams, Inc. has invested in a machine with a cost of $37,164 and annual cost savings of $6,000. The discount rate is 8%, and the machine's internal rate of return is 12%. Ignore income taxes. The estimated life of the machine is

A) 6.2 years

B) 8 years

C) 12 years

D) Cannot be determined

A) 6.2 years

B) 8 years

C) 12 years

D) Cannot be determined

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

73

George Shaw & Co. invested in a project that was to last for 2 years. The project has an internal rate of return of 12%. The project is expected to produce cash inflows of $70,000 in the first year and $80,000 in the second year. The project cost is

A) $143,760

B) $142,510

C) $150,000

D) $126,270

A) $143,760

B) $142,510

C) $150,000

D) $126,270

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

74

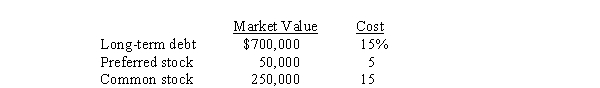

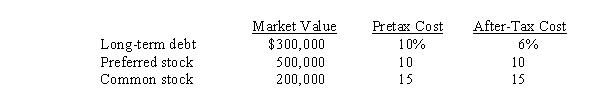

Martin Corporation has the following equity structure:  Martin's weighted average cost of capital is

Martin's weighted average cost of capital is

A) 9.8%

B) 10.3%

C) 11.0%

D) 12.5%

Martin's weighted average cost of capital is

Martin's weighted average cost of capital isA) 9.8%

B) 10.3%

C) 11.0%

D) 12.5%

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

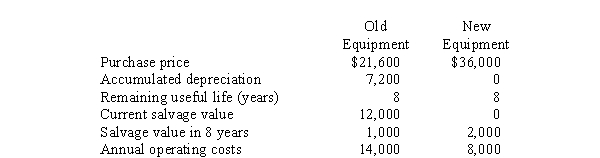

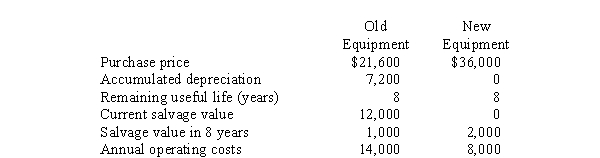

75

What is the net present value of a capital project to buy new equipment for replacing old equipment, given the following data and a minimum return of 12%? Ignore income taxes.

A) $6,616

B) $(5,788)

C) $4,596

D) $7,020

A) $6,616

B) $(5,788)

C) $4,596

D) $7,020

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

76

An organization that provides housing for abused women has limited housing, so it pays rent for several families. The director is considering expanding the housing facilities by purchasing a small triplex that has a useful life of 10 years. The estimated cost is $100,000. Using a discount rate of 15%, the present value of the future savings on rent is $120,000. To yield an internal rate of return that is at least 15%, the actual cost cannot exceed the estimated cost of $100,000 by more than

A) $10,038

B) $3,985

C) $20,000

D) $2,000

A) $10,038

B) $3,985

C) $20,000

D) $2,000

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

77

In January, Wilson Company purchased a new machine for $80,000 that has a useful life of 10 years and a terminal value of $5,000. Annual cash operating savings from the machine are $20,000. The income tax rate is 40%. What is the after-tax payback period?

A) 4.00 years

B) 5.26 years

C) 4.85 years

D) 6.67 years

A) 4.00 years

B) 5.26 years

C) 4.85 years

D) 6.67 years

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

78

Shamus Corp. sold a piece of equipment for $80,000. The asset originally cost $272,000, and accumulated depreciation on the equipment at the date of sale was $174,400. What is the after-tax cash inflow (outflow) from the sale of the equipment, assuming the income tax rate is 40%?

A) $(7,040)

B) $7,040

C) $100,800

D) $87,040

A) $(7,040)

B) $7,040

C) $100,800

D) $87,040

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

79

Bern Company invested in a project that cost $100,000. It had a net present value of $15,975 and a useful life of 8 years. The firm uses a 14% discount rate, and the project has an internal rate of return of 16%. What are the annual cost savings provided by the project?

A) $25,000

B) $26,698

C) $9,263

D) $8,600

A) $25,000

B) $26,698

C) $9,263

D) $8,600

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

80

Which capital budgeting method computes the discount rate that sets the NPV to zero?

A) Accrual accounting rate of return

B) IRR method

C) NPV method

D) Payback method

A) Accrual accounting rate of return

B) IRR method

C) NPV method

D) Payback method

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck