Deck 10: Property, Plant, and Equipment; Goodwill; and Intangibles

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/109

Play

Full screen (f)

Deck 10: Property, Plant, and Equipment; Goodwill; and Intangibles

1

In a lump-sum purchase of assets, the total cost of the assets is divided among the assets according to their relative market values.

True

2

The cost of removing an old building from acquired land would be a part of the land account.

True

3

If a company constructs its own assets, the cost of the building may include the cost of interest on money borrowed to finance the construction.

True

4

Construction in progress is a current liability if the construction period is less than one year.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

5

The cost of improvements to leased assets appears on the business's balance sheet as leasehold improvements.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

6

Provincial sales taxes (PST)paid on the purchase of property, plant, and equipment is included in the cost of the asset.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

7

Leasehold improvements are not subject to amortization.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

8

The renewal option period is excluded from the amortization period for leasehold improvements.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

9

The relative-fair-value method is the most conservative method of amortizing buildings and equipment.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

10

The cost of land includes fencing, paving, sprinkler systems, and lighting.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

11

Goods and services tax (GST)paid on the purchase of an asset is recoverable only if the asset acquired is used in the business as property, plant, and equipment.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

12

Transportation charges and insurance while in transit are part of the cost of equipment and therefore debited to the equipment account.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

13

Betterments must be expensed as capitalizing the transaction would affect the subsequent calculations of amortization.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

14

Expenditures that increase the asset's capacity or efficiency and/ or extend its useful life are called betterments.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

15

All of the following are property, plant and equipment except:

A)land.

B)prepaid taxes.

C)a building.

D)equipment.

A)land.

B)prepaid taxes.

C)a building.

D)equipment.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

16

The only requirement an asset must meet in order for it to be recorded as property, plant, and equipment is that it have a useful life beyond one year.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

17

Land improvements are not subject to amortization.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

18

The cost of land improvements includes fencing, paving, sprinkler systems, and lighting.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

19

The cost of a property, plant, and equipment asset includes the purchase price, provincial sales taxes, purchase commissions, and all other amounts paid to acquire the asset and to make it ready for its intended use.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

20

Paving, fencing, and exterior lighting should be debited to the land account.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

21

All of the following are characteristics of property, plant and equipment except:

A)tangible.

B)long-lived.

C)held for investment.

D)used in the business.

A)tangible.

B)long-lived.

C)held for investment.

D)used in the business.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

22

The cost of land would include all of the following except:

A)delinquent property taxes paid by the purchaser.

B)net purchase price.

C)grading of the land.

D)paving.

A)delinquent property taxes paid by the purchaser.

B)net purchase price.

C)grading of the land.

D)paving.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

23

A company purchased a used machine for $80,000. The machine required installation costs of $8,000 and insurance while in transit of $500. At which of the following amounts would the equipment be recorded?

A)$80,500

B)$88,500

C)$88,000

D)$80,000

A)$80,500

B)$88,500

C)$88,000

D)$80,000

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

24

Cycle Company Ltd. made a lump-sum purchase of land, buildings, and equipment for $630,000. The appraised market values for the items are respectively, $210,000, $322,000, and $168,000. Cycle Company Ltd. should debit the equipment account for:

A)$289,800.

B)$189,000.

C)$151,200.

D)$168,000.

A)$289,800.

B)$189,000.

C)$151,200.

D)$168,000.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

25

Acme Investments plans to develop a shopping center. In the first quarter, they spent the following amounts: What amount should be recorded as the land cost?

A)$90,000

B)$91,200

C)$103,400

D)$96,200

A)$90,000

B)$91,200

C)$103,400

D)$96,200

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

26

A lump-sum purchase of assets requires an allocation of the purchase price among the assets acquired. This allocation method is called the:

A)book-value method.

B)relative-fair-value method.

C)accumulated method.

D)betterment approach.

A)book-value method.

B)relative-fair-value method.

C)accumulated method.

D)betterment approach.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

27

Jackson Construction Company Ltd. paid $42,000 for equipment with a fair market value of $46,000. Jackson Construction Company Ltd. will record equipment at:

A)$42,000.

B)$46,000.

C)either $42,000 or $46,000.

D)$44,000 (average).

A)$42,000.

B)$46,000.

C)either $42,000 or $46,000.

D)$44,000 (average).

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following assets is never amortized?

A)land

B)land improvements

C)patents

D)leasehold improvements

A)land

B)land improvements

C)patents

D)leasehold improvements

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

29

Utsman Enterprises Ltd. purchased land, buildings, and equipment for $2,400,000. The land has been appraised at $865,000, the buildings at $1,175,000, and the equipment at $510,000. The equipment account will be debited for:

A)$500,000.

B)$525,000.

C)$410,156.

D)$480,000.

A)$500,000.

B)$525,000.

C)$410,156.

D)$480,000.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

30

Lumac Corporation purchased land and a building for $1,500,000. An appraisal indicates that the land's value is $650,000 and the building's value is $975,000. The amount that would be debited to the building account is:

A)$1,056,250.

B)$900,000.

C)$975,000.

D)$995,000.

A)$1,056,250.

B)$900,000.

C)$975,000.

D)$995,000.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

31

Grubbs Company Ltd. acquired land and buildings for $1,350,000. The land is appraised at $475,000 and the buildings are appraised at $775,000. The debit to the buildings account will be:

A)$712,500.

B)$675,000.

C)$837,000.

D)$775,000.

A)$712,500.

B)$675,000.

C)$837,000.

D)$775,000.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

32

The cost of a building would include all of the following except:

A)architectural fees.

B)clearing and grading the land prior to construction of the building.

C)cost of repairs made to an old building to get it ready for occupancy.

D)costs of construction.

A)architectural fees.

B)clearing and grading the land prior to construction of the building.

C)cost of repairs made to an old building to get it ready for occupancy.

D)costs of construction.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

33

Five hundred hectares of land are purchased for $120,000. Additional costs include $5,000 real estate commission, $10,000 for removal of an old building, $6,000 for paving, and $800 delinquent property taxes. What is the cost of the land?

A)$141,800

B)$141,000

C)$135,000

D)$135,800

A)$141,800

B)$141,000

C)$135,000

D)$135,800

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

34

Talbert Company Ltd. purchased land, buildings, and equipment for $3,000,000. The land has been appraised at $865,000, the buildings at $1,175,000, and the equipment at $510,000. The land account will be debited for:

A)$1,382,353.

B)$1,017,647.

C)$600,000.

D)$865,000.

A)$1,382,353.

B)$1,017,647.

C)$600,000.

D)$865,000.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

35

The cost of fencing should be charged to:

A)repairs expense.

B)land improvements.

C)land.

D)improvements expense.

A)repairs expense.

B)land improvements.

C)land.

D)improvements expense.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

36

All amounts paid to acquire an asset and to get it ready for its intended use are referred to as:

A)equity expenditures.

B)salvage expenditures.

C)the cost of an asset.

D)revenue expenditures.

A)equity expenditures.

B)salvage expenditures.

C)the cost of an asset.

D)revenue expenditures.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

37

The cost of paving a parking lot should be charged to:

A)a natural resource.

B)land improvements.

C)land.

D)repairs and maintenance expense.

A)a natural resource.

B)land improvements.

C)land.

D)repairs and maintenance expense.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

38

Jet Tool Company Ltd. paid $184,000 for equipment and a building with fair market values of $100,000 and $150,000, respectively. Jet Tool Company Ltd. should debit the equipment account for:

A)$73,600.

B)$184,000.

C)$110,400.

D)$100,000.

A)$73,600.

B)$184,000.

C)$110,400.

D)$100,000.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following would not be included in the building account?

A)cost of repairing roof that was damaged prior to the purchase of the building

B)cost of demolishing an old building to make room for construction

C)architect fees

D)building permits

A)cost of repairing roof that was damaged prior to the purchase of the building

B)cost of demolishing an old building to make room for construction

C)architect fees

D)building permits

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is included in the cost of a plant asset?

A)amounts paid to ready the asset for its intended use

B)regular maintenance cost

C)normal repair cost

D)wages of workers who use the asset

A)amounts paid to ready the asset for its intended use

B)regular maintenance cost

C)normal repair cost

D)wages of workers who use the asset

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

41

Double-declining-balance amortization computes annual amortization by multiplying the asset's book value by two times the straight-line rate.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

42

A machine acquired on April 1 would be amortized a total of eight months for the year ended December 31.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

43

With respect to amortization, a business should match an asset's expense against the revenue the asset produces.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

44

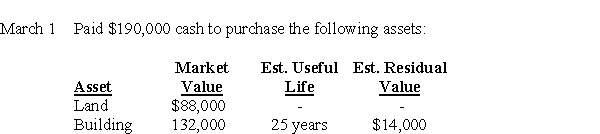

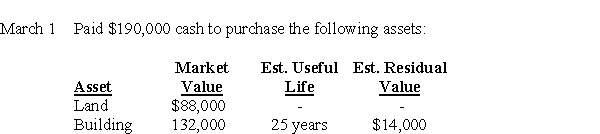

Durham Bike Shop Ltd.'s year end is December 31. Some of the company's transactions are as follows:  Durham Bike Shop Ltd. plans to use the straight-line amortization method for the building.

Durham Bike Shop Ltd. plans to use the straight-line amortization method for the building.

April 15 Purchased a used pickup truck for $10,500 cash. The truck sells for $15,900 when new. The truck is expected to be used for eight years and driven 120,000 km. The estimated salvage value is $3,900. It will be amortized using the units-of-production method.

April 16 Installed heavy-duty racks costing $1,400 that will enable the truck to carry several bicycles.

June 30 Paid John's garage for an oil change ($35)and the replacement of a muffler ($425).

Dec. 31 Recorded amortization on the assets. The truck was driven 9,000 kilometres since it was purchased.

Record the above transactions of Durham Bike Shop Ltd. Round all amounts to the nearest dollar. Explanations are not required.

Durham Bike Shop Ltd. plans to use the straight-line amortization method for the building.

Durham Bike Shop Ltd. plans to use the straight-line amortization method for the building.April 15 Purchased a used pickup truck for $10,500 cash. The truck sells for $15,900 when new. The truck is expected to be used for eight years and driven 120,000 km. The estimated salvage value is $3,900. It will be amortized using the units-of-production method.

April 16 Installed heavy-duty racks costing $1,400 that will enable the truck to carry several bicycles.

June 30 Paid John's garage for an oil change ($35)and the replacement of a muffler ($425).

Dec. 31 Recorded amortization on the assets. The truck was driven 9,000 kilometres since it was purchased.

Record the above transactions of Durham Bike Shop Ltd. Round all amounts to the nearest dollar. Explanations are not required.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

45

Large Construction Ltd. bought land, a building, and equipment for a lump-sum of $1,800,000. Following are the appraised fair market values of the newly acquired assets:

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

46

Record journal entries for the following transactions involving property, plant and equipment for Blankenship Company Ltd.:

a)Purchased equipment costing $100,000.

b)Paid freight to have equipment delivered, $500.

c)Paid $1,000 to have equipment installed.

d)Paid $50,000 to have a similar piece of equipment overhauled.

e)Paid $100 for periodic maintenance to the new equipment.

a)Purchased equipment costing $100,000.

b)Paid freight to have equipment delivered, $500.

c)Paid $1,000 to have equipment installed.

d)Paid $50,000 to have a similar piece of equipment overhauled.

e)Paid $100 for periodic maintenance to the new equipment.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following expenditures would be debited to an expense account?

A)cost to rebuild the company car's engine

B)cost to replace the engine of the company car

C)cost to paint the car after a fender bender

D)cost to replace the transmission of the company car

A)cost to rebuild the company car's engine

B)cost to replace the engine of the company car

C)cost to paint the car after a fender bender

D)cost to replace the transmission of the company car

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

48

A fully amortized asset always has a book value of zero.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

49

Jane Browning purchased a tract of land and contracted with a builder to build an office building on the property. She also engaged other contractors for lighting, fencing, paving, etc.

Based on the following transactions, determine the total costs allocated to the land, building, and land improvements accounts.

a)Purchased land for $125,000.

b)Paid a contractor $150,000 to design and build the office building.

c)Paid a demolition company $20,000 to remove an old structure on the property.

d)Paid $15,000 in delinquent taxes on the property.

e)Paid $20,000 for fencing.

f)Paid $10,000 for paving.

g)Paid an electrical contractor $15,000 for outdoor lighting.

Based on the following transactions, determine the total costs allocated to the land, building, and land improvements accounts.

a)Purchased land for $125,000.

b)Paid a contractor $150,000 to design and build the office building.

c)Paid a demolition company $20,000 to remove an old structure on the property.

d)Paid $15,000 in delinquent taxes on the property.

e)Paid $20,000 for fencing.

f)Paid $10,000 for paving.

g)Paid an electrical contractor $15,000 for outdoor lighting.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

50

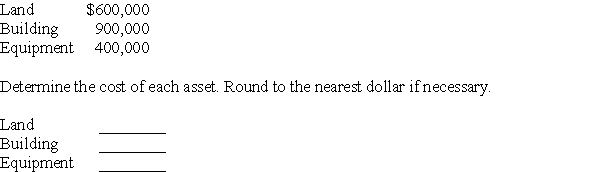

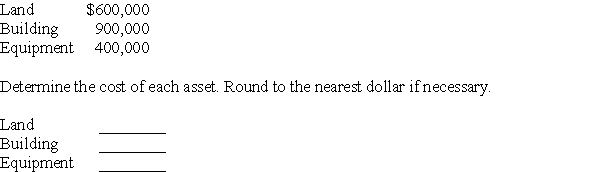

Little Construction Ltd. bought land, a building, and equipment for a lump-sum of $600,000. Following are the appraised fair market values of the newly acquired assets:  Determine the cost of each asset. Round to the nearest dollar if necessary.

Determine the cost of each asset. Round to the nearest dollar if necessary.

Determine the cost of each asset. Round to the nearest dollar if necessary.

Determine the cost of each asset. Round to the nearest dollar if necessary.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

51

Book value is determined by subtracting the residual value from the cost of an asset.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

52

Double-declining-balance amortization computes annual amortization by multiplying the asset's book value less residual value by two times the straight-line rate.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

53

A company's accountant capitalizes a payment that should be recorded as an expense. Which of the following is true?

A)Net income is overstated.

B)Revenues are understated

C)Assets are understated.

D)Liabilities are overstated.

A)Net income is overstated.

B)Revenues are understated

C)Assets are understated.

D)Liabilities are overstated.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

54

Amortization is a process of asset valuation.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

55

For an asset that generates revenue fairly evenly over time, which is the most appropriate method of amortization?

A)units-of-production method

B)double declining balance method

C)straight-line method

D)declining-balance method

A)units-of-production method

B)double declining balance method

C)straight-line method

D)declining-balance method

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

56

An amortizable asset's carrying value is the assets cost less accumulated amortization.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

57

Using the double-declining balance method of amortization means that the book value should not be reduced below the residual value.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

58

A company's accountant capitalizes a payment that should be recorded as an expense. Which of the following is true?

A)Revenue is overstated.

B)Expenses are overstated.

C)Assets are overstated.

D)Liabilities are overstated.

A)Revenue is overstated.

B)Expenses are overstated.

C)Assets are overstated.

D)Liabilities are overstated.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

59

Cost minus salvage value is called amortizable cost.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

60

Amortization is a process of allocating the cost of an asset over its useful life.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

61

A fully amortized asset no longer has value to the business.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

62

Which amortization method generally results in the greatest amortization expense in the first full year of an asset's life?

A)straight-line

B)units-of-production

C)double-declining-balance

D)either straight-line or double-declining-balance

A)straight-line

B)units-of-production

C)double-declining-balance

D)either straight-line or double-declining-balance

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

63

Ronnie's Wings acquired equipment on January 1, 2019, for $300,000. The equipment had an estimated useful life of 10 years and an estimated salvage value of $25,000. On January 1, 2022, Ronnie's Wings revised the total useful life of the equipment to 12 years. Compute amortization expense for the year ended December 31, 2022, if Ronnie's Wings uses straight-line amortization.

A)$21,389

B)$24,167

C)$18,125

D)$16,042

A)$21,389

B)$24,167

C)$18,125

D)$16,042

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

64

If a firm changes its estimate of the useful life of an asset, the firm must recalculate amortization expense for each previous year since the asset was placed in service.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

65

Book value is defined as:

A)cost minus residual value.

B)cost minus accumulated amortization.

C)current market value minus residual value.

D)current market value minus accumulated amortization.

A)cost minus residual value.

B)cost minus accumulated amortization.

C)current market value minus residual value.

D)current market value minus accumulated amortization.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following is false?

A)Amortization is a process of valuation.

B)Amortization expense is the amortized amount for the current period only.

C)Accumulated amortization is that portion of the property, plant, and equipment asset's cost that has already been recorded as an expense.

D)Book value is cost less accumulated amortization.

A)Amortization is a process of valuation.

B)Amortization expense is the amortized amount for the current period only.

C)Accumulated amortization is that portion of the property, plant, and equipment asset's cost that has already been recorded as an expense.

D)Book value is cost less accumulated amortization.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

67

To measure amortization for a property, plant, and equipment asset, all of the following must be known except:

A)estimated useful life.

B)historical cost.

C)current market value.

D)estimated residual value.

A)estimated useful life.

B)historical cost.

C)current market value.

D)estimated residual value.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following is not a recognized amortization method?

A)straight-line method

B)lower-of-cost-or-market method

C)units-of-production method

D)double-declining-balance method

A)straight-line method

B)lower-of-cost-or-market method

C)units-of-production method

D)double-declining-balance method

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

69

The process of allocating a property, plant, and equipment asset's cost to expense over the period the asset is used is called:

A)cash-basis accounting.

B)amortization.

C)accruing.

D)direct write-off.

A)cash-basis accounting.

B)amortization.

C)accruing.

D)direct write-off.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

70

A revision of an estimate that extends the asset's useful life:

A)requires restatement of prior years' financial statements.

B)is ignored until the last year of the asset's life.

C)decreases amortization expense per year for the remaining years of the asset's life.

D)increases amortization expense per year for the remaining years of the asset's life.

A)requires restatement of prior years' financial statements.

B)is ignored until the last year of the asset's life.

C)decreases amortization expense per year for the remaining years of the asset's life.

D)increases amortization expense per year for the remaining years of the asset's life.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

71

Amortizable cost equals cost minus:

A)residual value.

B)book value.

C)accumulated amortization.

D)current year's amortization expense.

A)residual value.

B)book value.

C)accumulated amortization.

D)current year's amortization expense.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

72

If amortization expense for an asset is the same every year, which method is being used?

A)straight-line

B)units-of-production

C)double-declining-balance

D)either units-of-production or double-declining-balance

A)straight-line

B)units-of-production

C)double-declining-balance

D)either units-of-production or double-declining-balance

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

73

Canada Revenue Agency specifies the maximum amortization a taxpayer may deduct for income tax purposes.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

74

On January 1, 2019, Bithe Smarney & Co. purchased $35,500 worth of office equipment with an estimated useful life of seven years and an estimated residual value of $4,000. Bithe Smarney uses the straight-line method of amortization for all office equipment. At the beginning of 2022, Bithe Smarney revised its estimate of the useful life of the office equipment to a total of nine years. The 2022 amortization expense is:

A)$2,000.

B)$3,667.

C)$2,444.

D)$3,000.

A)$2,000.

B)$3,667.

C)$2,444.

D)$3,000.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

75

The entry to record amortization on a building is:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

76

The amortization method that initially ignores residual value in the initial calculation is:

A)double-declining-balance.

B)straight-line.

C)both double-declining-balance and straight-line.

D)units-of-production.

A)double-declining-balance.

B)straight-line.

C)both double-declining-balance and straight-line.

D)units-of-production.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

77

Incorrectly treating a repair expenditure as a betterment:

A)understates expenses and understates owner's equity.

B)understates expenses and understates assets.

C)overstates expenses and understates net income.

D)overstates assets and overstates owner's equity.

A)understates expenses and understates owner's equity.

B)understates expenses and understates assets.

C)overstates expenses and understates net income.

D)overstates assets and overstates owner's equity.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

78

Ronnie's Wings acquired equipment on January 1, 2019, for $300,000. The equipment had an estimated useful life of 10 years and an estimated salvage value of $25,000. On January 1, 2022, Ronnie's Wings revised the total useful life of the equipment to eight years. Compute amortization expense for the year ended December 31, 2022, if Ronnie's Wings uses straight-line amortization.

A)$43,500

B)$38,500

C)$60,000

D)$27,500

A)$43,500

B)$38,500

C)$60,000

D)$27,500

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following statements is true?

A)Accumulated amortization is that portion of a property, plant, and equipment asset's cost that has already been recorded as an expense.

B)Amortization is a process of valuation.

C)Amortization represents the cash a business has set aside to replace assets as they become fully amortized.

D)Accumulated amortization is classified as a liability account on the balance sheet.

A)Accumulated amortization is that portion of a property, plant, and equipment asset's cost that has already been recorded as an expense.

B)Amortization is a process of valuation.

C)Amortization represents the cash a business has set aside to replace assets as they become fully amortized.

D)Accumulated amortization is classified as a liability account on the balance sheet.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

80

Multiplying the asset's book value by a constant percentage is the computation of amortization under:

A)the double-declining-balance method.

B)the units-of-production method.

C)the straight-line method.

D)either double-declining-balance method or straight-line method.

A)the double-declining-balance method.

B)the units-of-production method.

C)the straight-line method.

D)either double-declining-balance method or straight-line method.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck