Deck 6: Pensions and Other Employee Future Benefits

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/69

Play

Full screen (f)

Deck 6: Pensions and Other Employee Future Benefits

1

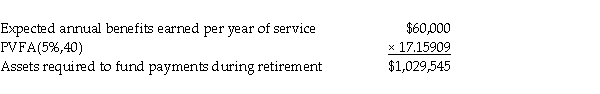

Saul is currently 30 years old and he plans to retire early, in 20 years' time. He would like to have an income of $60,000 per year during his retirement, which he anticipates will last for another 40 years. Assume that he receives the retirement income at the end of each of the 40 years.

Required:

Determine the amount of money he will need to have accumulated by the time he starts his retirement. Assume a discount rate of 5%.

Required:

Determine the amount of money he will need to have accumulated by the time he starts his retirement. Assume a discount rate of 5%.

Using BAII Plus financial calculator:

Using BAII Plus financial calculator:40N, 5 I/Y, 60000 PMT, CPT PV

2

What is true about actuarial gains and losses?

A)These gains and losses are caused by actuarial miscalculations.

B)IFRS requires actuarial gains and losses to be recorded through the income statement.

C)IFRS requires actuarial gains and losses to be recorded through OCI without recycling through the income statement.

D)IFRS requires actuarial gains and losses not to be reported as they will reverse themselves over such a long time horizon.

A)These gains and losses are caused by actuarial miscalculations.

B)IFRS requires actuarial gains and losses to be recorded through the income statement.

C)IFRS requires actuarial gains and losses to be recorded through OCI without recycling through the income statement.

D)IFRS requires actuarial gains and losses not to be reported as they will reverse themselves over such a long time horizon.

C

3

Which of the following best describes a "defined contribution plan"?

A)A pension plan where the employer can reduce its contributions if it is overfunded.

B)A pension plan that place investment risk on the employees.

C)A pension plan that place investment risk on the employers.

D)A pension plan where the employee can decrease its contributions if it is overfunded.

A)A pension plan where the employer can reduce its contributions if it is overfunded.

B)A pension plan that place investment risk on the employees.

C)A pension plan that place investment risk on the employers.

D)A pension plan where the employee can decrease its contributions if it is overfunded.

B

4

If a company provides a non-contributory pension plan, who makes the contributions?

A)Both the employer and employee.

B)Only the employee.

C)Only the employer.

D)No one.

A)Both the employer and employee.

B)Only the employee.

C)Only the employer.

D)No one.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

5

KitKat Singh is currently 30 years old and he plans to retire early, in 25 years' time. He would like to have an income of $50,000 per year during his retirement, which he anticipates will last for another 30 years. Assume that he receives the retirement income at the end of each of the 30 years.

Required:

Determine the amount of money he will need to have accumulated by the time he starts his retirement. Assume a discount rate of 5%.

Required:

Determine the amount of money he will need to have accumulated by the time he starts his retirement. Assume a discount rate of 5%.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

6

Peter is currently 30 years old and he plans to retire early, in 20 years' time. He would like to have an income of $50,000 per year during his retirement, which he anticipates will last for another 40 years. Assume that Peter receives the retirement income at the end of each of the 40 years.

Required:

Determine the amount of money Peter will need to have accumulated by the time he starts his retirement. Assume a discount rate of 9%.

Required:

Determine the amount of money Peter will need to have accumulated by the time he starts his retirement. Assume a discount rate of 9%.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

7

A pension plan promises to pay $70,000 at the end of each year for 10 years of the retirement period.

Required:

Compute the funds required to fund this pension plan at the start of the retirement period assuming:

a. discount rate of 12%; or

b. discount rate of 9%.

Required:

Compute the funds required to fund this pension plan at the start of the retirement period assuming:

a. discount rate of 12%; or

b. discount rate of 9%.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

8

A pension plan promises to pay $75,000 at the end of each year of the retirement period.

Required:

Compute the funds required to fund this pension plan at the start of the retirement period assuming:

a. discount rate of 9% and a retirement period of 30 years; or

b. discount rate of 9% and a retirement period of 40 years.

Required:

Compute the funds required to fund this pension plan at the start of the retirement period assuming:

a. discount rate of 9% and a retirement period of 30 years; or

b. discount rate of 9% and a retirement period of 40 years.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

9

Which statement explains the risk involved in "defined contribution plans"?

A)Poor returns on the pension investments reduce the benefits for future retirees.

B)High returns on the pension investments increase the benefit payments for the employer.

C)The plan specifies the fixed benefits that future retirees will receive.

D)The plan provides benefits to future retirees depending on their years of service.

A)Poor returns on the pension investments reduce the benefits for future retirees.

B)High returns on the pension investments increase the benefit payments for the employer.

C)The plan specifies the fixed benefits that future retirees will receive.

D)The plan provides benefits to future retirees depending on their years of service.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

10

Which statement is correct?

A)The plan sponsor of a defined benefit plan never needs to increase its contributions to the pension trust.

B)A defined contribution plan is a pension plan that places investment risk on the employers.

C)Inadequate contributions to a defined benefit plan by the plan sponsor or poor investment returns will result in an underfunded pension.

D)A defined contribution plan specifies the fixed benefits that future retirees will receive.

A)The plan sponsor of a defined benefit plan never needs to increase its contributions to the pension trust.

B)A defined contribution plan is a pension plan that places investment risk on the employers.

C)Inadequate contributions to a defined benefit plan by the plan sponsor or poor investment returns will result in an underfunded pension.

D)A defined contribution plan specifies the fixed benefits that future retirees will receive.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

11

What is the fundamental difference between a defined contribution and a defined benefit pension plan?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

12

Phil works for the Government of Alberta. Phil is covered by a defined benefit pension plan. Phil just turned 45 years old, and expects to retire at age 65. At that time, the pension plan will pay Phil annual pension payments equal to 2% of his final year's salary for each year of services rendered. The pension payments will continue until Phil's death, which actuaries expect to be when he turns 80 years old. For the current year, Phil will earn $55,000, and this rate is expected to increase by 5% per year. Assume that the Alberta Government uses a 10% interest rate for its pension obligations.

Required:

Determine the current service cost for Phil Jackson's pension for the past year (the year just before he turned 45).

Required:

Determine the current service cost for Phil Jackson's pension for the past year (the year just before he turned 45).

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

13

What is the key objective in the accounting for defined benefit plans that is achieved by estimating and recording current service cost?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following best describes a "defined benefit plan"?

A)High returns in the pension plan result in higher benefit payments to the employees in the future.

B)A pension plan that specifies how much funds the employee needs to contribute.

C)A plan that requires the employer to contribute $10 per hour worked by an employee.

D)A plan that specifies how much in pension payments employees will receive in their retirement.

A)High returns in the pension plan result in higher benefit payments to the employees in the future.

B)A pension plan that specifies how much funds the employee needs to contribute.

C)A plan that requires the employer to contribute $10 per hour worked by an employee.

D)A plan that specifies how much in pension payments employees will receive in their retirement.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

15

Which statement explains the risk involved in "defined benefit plans"?

A)The plan places investment risk on employees since the future benefits are pre-specified.

B)The plan sponsor never needs to increase its contributions to the pension trust.

C)The plan may require the employee to pay $200 per month for each year of service.

D)The plan specifies the eventual outflows from the pension trust to future retirees.

A)The plan places investment risk on employees since the future benefits are pre-specified.

B)The plan sponsor never needs to increase its contributions to the pension trust.

C)The plan may require the employee to pay $200 per month for each year of service.

D)The plan specifies the eventual outflows from the pension trust to future retirees.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

16

Othello Steel provides a defined benefit pension plan for its employees. One of its employees, Ginger Philips, who just turned 45 years old, expects to retire at age 70. At that time, the pension plan will pay Ginger annual pension payments equal to 10% of her final year's salary for each year of services rendered. The pension payments will continue until Ginger's death, which actuaries expect to be when she turns 95 years old. Ginger is currently earning $75,000 per year, and this rate is not expected to increase due to the poor state of the steel industry. Orion Steel uses a 6 % interest rate for its pension obligations.

Required:

Determine the current service cost for Ginger Philips's pension for the past year (the year just before she turned 45).

Required:

Determine the current service cost for Ginger Philips's pension for the past year (the year just before she turned 45).

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

17

Katherina is currently 30 years old and plans to retire later in life. She would like to have an income of $35,000 per year during her retirement, which she anticipates will last for another 25 years. Assume that she receives the retirement income at the end of each of the 25 years.

Required:

Determine the amount of money Katherina will need to have accumulated by the time she starts her retirement. Assume a discount rate of 5%.

Required:

Determine the amount of money Katherina will need to have accumulated by the time she starts her retirement. Assume a discount rate of 5%.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

18

Orion Steel provides a defined benefit pension plan for its employees. One of its employees, Gail Camden, who just turned 45 years old, expects to retire at age 65. At that time, the pension plan will pay Gail annual pension payments equal to 5% of her final year's salary for each year of services rendered by Gail. The pension payments will continue until Gail's death, which actuaries expect to be when she turns 95 years old. Gail is currently earning $35,000 per year, and this rate is not expected to increase due to the poor state of the steel industry. Orion Steel uses an 8 % interest rate for its pension obligations.

Required:

Determine the current service cost for Gail Camden's pension for the past year (the year just before she turned 45).

Required:

Determine the current service cost for Gail Camden's pension for the past year (the year just before she turned 45).

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

19

Sally is currently 30 years old and is planning for her retirement. She would like to have an income of $55,000 per year during her retirement, which she anticipates will last for another 25 years. Assume that she receives the retirement income at the end of each of the 25 years.

Required:

Determine the amount of money Sally will need to have accumulated by the time she starts her retirement. Assume a discount rate of 4%.

Required:

Determine the amount of money Sally will need to have accumulated by the time she starts her retirement. Assume a discount rate of 4%.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

20

A pension plan promises to pay $75,000 at the end of each year for 25 years of the retirement period.

Required:

Compute the funds required to fund this pension plan at the start of the retirement period assuming:

a. discount rate of 5%; or

b. discount rate of 4%.

Required:

Compute the funds required to fund this pension plan at the start of the retirement period assuming:

a. discount rate of 5%; or

b. discount rate of 4%.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

21

What is the total pension expense for the following plan after 5 years? "The plan requires the company to contribute $500 for each of its 1,000 employees. The plan hopes to accumulate enough funds so that each retiree receives $20,000 in the future; the company has no obligation to guarantee the investment returns."

A)$2,500

B)$100,000

C)$2,500,000

D)$20,000,000

A)$2,500

B)$100,000

C)$2,500,000

D)$20,000,000

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

22

What is the pension expense for the following plan? "The plan requires the company to contribute $500 for each of its 1,000 employees. The plan hopes to accumulate enough funds so that each retiree receives $20,000 in the future; the company has no obligation to guarantee the investment returns."

A)$500

B)$20,000

C)$500,000

D)$20,000,000

A)$500

B)$20,000

C)$500,000

D)$20,000,000

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

23

What is the total pension expense for the following plan after 10 years? "The company must contribute $100/year for each of its 500 employees. The plan hopes to accumulate enough funds so that each retiree receives $10,000 in the future; the plan does not guarantee the investment returns to the employees."

A)$1,000

B)$100,000

C)$500,000

D)$5,000,000

A)$1,000

B)$100,000

C)$500,000

D)$5,000,000

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

24

What is the key distinction between amounts recorded through income as pension expense versus amounts recorded through OCI?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

25

In pension accounting, how are past service costs accounted for under ASPE?

A)Recognized in the balance sheet as a liability for the full amount.

B)Recognized in the income statement as an expense for the full amount.

C)Not recognized, but disclosed in a note.

D)Included as part of pension expense and may be amortized over a specified period.

A)Recognized in the balance sheet as a liability for the full amount.

B)Recognized in the income statement as an expense for the full amount.

C)Not recognized, but disclosed in a note.

D)Included as part of pension expense and may be amortized over a specified period.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

26

Dunder Mae Products has a defined contribution pension plan for its employees. The plan requires the company to contribute 8% of these employees' salaries to the pension. In 2019, total salary for employees covered by the pension plan totalled $70 million, of which 85% is attributable to employees involved in manufacturing while the remaining 15% of salaries relate to administrative staff. The company contributed $3 million to the pension during the year.

Required:

Provide the summary journal entry for Dunder Mae's pension plan for 2019.

Required:

Provide the summary journal entry for Dunder Mae's pension plan for 2019.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

27

Which statement best explains the meaning of "current service cost"?

A)The present value of pension benefits that employees have earned.

B)The increase in the present value of a defined benefit obligation resulting from employee service in the current period.

C)The amount of funds deposited with the pension trust in the year.

D)The annual contribution required by the employer as specified in the pension plan agreement.

A)The present value of pension benefits that employees have earned.

B)The increase in the present value of a defined benefit obligation resulting from employee service in the current period.

C)The amount of funds deposited with the pension trust in the year.

D)The annual contribution required by the employer as specified in the pension plan agreement.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

28

Tener Company sponsors a defined contribution pension plan for its employees. The plan specifies that the company will contribute $2 for every dollar that an employee contributes to the plan. Employees are eligible to contribute up to 7% of their salary to the pension plan. During 2020, employees covered by the pension plan earned salaries totalling $42 million. Employee contributions to the pension totalled $2.1 million. Tener contributed $3 million to the plan during the year.

Required:

Provide the summary journal entry for Tener's pension plan for 2020.

Required:

Provide the summary journal entry for Tener's pension plan for 2020.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

29

A company reported $430,000 of pension expense in its income statement. The balance sheet showed that the pension liability increased by $29,000 over the year.

Required:

How much cash was paid to the pension trustee during the period?

Required:

How much cash was paid to the pension trustee during the period?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

30

In a recent flood some company records have been partially destroyed and it is your job to help reconstruct the missing data. For one of the company employees, Piper Jones, you have managed to gather some information regarding her pension. She currently earns $78,000 per year and expects to be paid through the company's defined benefits pension plan 7% of her final salary for each year of service. Given the state of the company, salaries are not expected to increase. You know that the pension payments should continue until her death, which actuaries expect to be when she turns 90 years old. You also know that the value of the future annuities at date of retirement should be $71,870 fulfill this commitment. Piper has just turn 55, however, you do not know her planned retirement age.

Required:

a. Determine Piper Jones planned retirement age assuming the company uses 5% interest rate for its pension plans.

b. Determine the current service cost for Piper Jones' pension for the past year (the year just before she turned 45).

Required:

a. Determine Piper Jones planned retirement age assuming the company uses 5% interest rate for its pension plans.

b. Determine the current service cost for Piper Jones' pension for the past year (the year just before she turned 45).

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

31

Which best explains a "curtailment'?

A)A reduction in the number of employees or the amount of benefits they will receive in the future.

B)The employer puts an end to the plan using company lawyers.

C)The employer stops contributing to the plan.

D)The employees stop contributing to the plan.

A)A reduction in the number of employees or the amount of benefits they will receive in the future.

B)The employer puts an end to the plan using company lawyers.

C)The employer stops contributing to the plan.

D)The employees stop contributing to the plan.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

32

What is true of the interest cost component of the pension expense?

A)ASPE specifies that enterprises should use the yields on high-quality corporate bonds.

B)IFRS specifies that enterprises should use the yields on high-quality short-term corporate bonds.

C)It represents the increase in the pension obligation due to the passage of time.

D)IFRS specifies that enterprises should use the yields on medium-quality corporate bonds.

A)ASPE specifies that enterprises should use the yields on high-quality corporate bonds.

B)IFRS specifies that enterprises should use the yields on high-quality short-term corporate bonds.

C)It represents the increase in the pension obligation due to the passage of time.

D)IFRS specifies that enterprises should use the yields on medium-quality corporate bonds.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

33

Gander Products has a defined contribution pension plan for its employees. The plan requires the company to contribute 6% of these employees' salaries to the pension. In 2019, total salary for employees covered by the pension plan totalled $40 million, of which 75% is attributable to employees involved in manufacturing while the remaining 25% of salaries relate to administrative staff. The company contributed $500,000 to the pension during the year.

Required:

Provide the summary journal entry for Gander's pension plan for 2019.

Required:

Provide the summary journal entry for Gander's pension plan for 2019.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

34

In a recent flood some company records have been partially destroyed and it is your job to help reconstruct the missing data. For one of the company employees, Piper Jones, you have managed to gather some information regarding her pension. She currently earns $65,000 per year and expects to be paid through the company's defined benefits pension plan 10% of her final salary for each year of service. Given the state of the company, salaries are not expected to increase. You know that the pension payments should continue until her death, which actuaries expect to be when she turns 85 years old. You also know that the value of the future annuities at date of retirement should be $85,560 to fulfill this commitment. Piper has just turn 45, however, you do not know her planned retirement age.

Required:

a. Determine Piper Jones planned retirement age assuming the company uses 5% interest rate for its pension plans.

b. Determine the current service cost for Piper Jones' pension for the past year (the year just before she turned 45).

Required:

a. Determine Piper Jones planned retirement age assuming the company uses 5% interest rate for its pension plans.

b. Determine the current service cost for Piper Jones' pension for the past year (the year just before she turned 45).

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

35

Wags Inc Company sponsors a defined contribution pension plan for its employees. The plan specifies that the company will match the amount each employee contributes to the plan. Employees are eligible to contribute up to 10% of their salary to the pension plan. During 2020, employees covered by the pension plan earned salaries totalling $30 million. Employee contributions to the pension totalled $3 million. Wags Inc contributed $2 million to the plan during the year.

Required:

Provide the summary journal entry for Wags Inc's pension plan for 2020.

Required:

Provide the summary journal entry for Wags Inc's pension plan for 2020.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

36

What is the pension expense for the following plan? "The company must contribute $100/year for each of its 500 employees. The plan hopes to accumulate enough funds so that each retiree receives $10,000 in the future; the plan does not guarantee the investment returns to the employees."

A)$100

B)$10,000

C)$50,000

D)$5,000,000

A)$100

B)$10,000

C)$50,000

D)$5,000,000

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

37

Which statement about "defined contribution plans" is correct?

A)Pension expense equals the contributions made based on the plan formula.

B)Pension expense equals the present value of the future benefits to be paid to the retiree.

C)Pension cost cannot be capitalized to the cost of inventory.

D)Pension cost may not be capitalized to the construction cost of property, plant and equipment.

A)Pension expense equals the contributions made based on the plan formula.

B)Pension expense equals the present value of the future benefits to be paid to the retiree.

C)Pension cost cannot be capitalized to the cost of inventory.

D)Pension cost may not be capitalized to the construction cost of property, plant and equipment.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

38

What are actuarial losses or gains in a defined benefit plan?

A)Difference arising between the actual and the expected value of plan contributions.

B)Expected income earned on the pension plan assets.

C)Plan amendments that retrospectively improve pension plan benefits.

D)Differences arising between the actual and expected values of the obligation.

A)Difference arising between the actual and the expected value of plan contributions.

B)Expected income earned on the pension plan assets.

C)Plan amendments that retrospectively improve pension plan benefits.

D)Differences arising between the actual and expected values of the obligation.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

39

A company reported $350,000 of pension expense in its income statement. The balance sheet showed that the pension liability increased by $20,000 over the year. How much cash was paid to the pension trustee during the period?

A)$320,000

B)$330,000

C)$350,000

D)$370,000

A)$320,000

B)$330,000

C)$350,000

D)$370,000

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

40

Explain the accounting for defined contribution plans and also discuss why it is straightforward.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

41

A company has a defined benefit pension liability of $1,050,000 at the beginning of the year. The company contributes $5,500,000 to the pension during the year and records a pension expense of $8,200,000.

Required:

Determine the value of the defined benefit pension liability at year-end.

Required:

Determine the value of the defined benefit pension liability at year-end.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

42

A company has a defined benefit pension liability of $3,750,000 at the end of the year. The company contributes $5,500,000 to the pension during the year and records a pension expense of $8,200,000.

Required:

Determine the value of the defined benefit pension liability at the beginning of the year.

Required:

Determine the value of the defined benefit pension liability at the beginning of the year.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following component does not relate to the assets/liabilities held in the pension trust for a defined benefit plan?

A)Interest cost on pension obligations.

B)Current service cost.

C)Income from plan assets.

D)Amortization of actuarial gains and losses.

A)Interest cost on pension obligations.

B)Current service cost.

C)Income from plan assets.

D)Amortization of actuarial gains and losses.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

44

What is an actuarial gain?

A)An unfavourable difference between actual and expected amounts for pension obligations.

B)A favourable difference between actual and expected amounts for pension plan obligations.

C)An unfavourable difference between actual and expected amounts for pension contributions.

D)A favourable difference between actual and expected amounts for pension contributions.

A)An unfavourable difference between actual and expected amounts for pension obligations.

B)A favourable difference between actual and expected amounts for pension plan obligations.

C)An unfavourable difference between actual and expected amounts for pension contributions.

D)A favourable difference between actual and expected amounts for pension contributions.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

45

A company's defined benefit pension plan incurs current service cost of $4,000,000. This pension plan's assets generated $2,500,000 of income, which exceeded expectations by $500,000. Pension obligations incurred interest cost of $1,500,000, which were $700,000 below expectations. During the year, the company increased benefits in the pension plan and incurred $800,000 for past service cost.

A)$5,000,000

B)$3,800,000

C)$4,600,000

D)$5,600,000

A)$5,000,000

B)$3,800,000

C)$4,600,000

D)$5,600,000

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

46

What four accounts are affected by the accounting for a defined benefit pension plan?

A)Cash, pension expense, OCI, and the defined benefit asset or liability.

B)Expected gains and losses, cash, income, pension expense.

C)Pension liability, pension expense, cash, income.

D)Pension expense, pension assets, pension liability, cash.

A)Cash, pension expense, OCI, and the defined benefit asset or liability.

B)Expected gains and losses, cash, income, pension expense.

C)Pension liability, pension expense, cash, income.

D)Pension expense, pension assets, pension liability, cash.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

47

A company has a defined benefit pension liability of $750,000 at the beginning of the year. The company contributes $2,500,000 to the pension during the year and records a pension expense of $2,200,000.

Required:

Determine the value of the defined benefit pension liability at year-end.

Required:

Determine the value of the defined benefit pension liability at year-end.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

48

A company reported $430,000 of pension expense in its income statement. The company fully paid the amount of pension expense owed to the trustee. The balance sheet showed that the pension asset increased by $29,000 over the year.

Required:

How much cash was paid to the pension trustee during the period?

Required:

How much cash was paid to the pension trustee during the period?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

49

A company has a defined benefit pension asset of $1,300,000 at the beginning of the year. The company contributes $4,000,000 to the pension during the year and records a pension expense of $6,200,000. The closing balance of the defined benefit pension plan at year-end is therefore a:

A)$900,000 asset

B)$900,000 liability

C)$5,300,000 asset

D)$3,500,000 asset

A)$900,000 asset

B)$900,000 liability

C)$5,300,000 asset

D)$3,500,000 asset

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

50

Current service cost for a defined benefit pension plan amounted to $1,000,000. Expected income on the pension plan's assets amounted to $7,500,000, while actual income was $7,800,000. The interest on the pension obligation was $9,000,000, which matched the actuarial estimates. No past service costs arose during the year. Given this information the pension expense for the year was:

A)$500,000

B)$2,200,000

C)$2,500,000

D)$1,000,000

A)$500,000

B)$2,200,000

C)$2,500,000

D)$1,000,000

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

51

A company has a defined benefit pension asset of $1,050,000 at the beginning of the year. The company contributes $5,500,000 to the pension during the year and records a pension expense of $8,200,000.

Required:

Determine the value of the defined benefit pension liability at year-end.

Required:

Determine the value of the defined benefit pension liability at year-end.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following component refers to the services provided by the employees in the current period in a defined benefit plan?

A)Current service cost.

B)Interest cost on pension obligations.

C)Income from plan assets.

D)Amortization of actuarial gains and losses.

A)Current service cost.

B)Interest cost on pension obligations.

C)Income from plan assets.

D)Amortization of actuarial gains and losses.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

53

A company has a defined benefit pension liability of $4,700,000 at the beginning of the year. The company contributes $7,000,000 to the pension during the year and records a pension expense of $10,200,000. The closing balance of the defined benefit pension plan at year-end is therefore a:

A)$7,900,000 liability

B)$7,900,000 asset

C)$11,700,000 liability

D)$1,500,000 asset

A)$7,900,000 liability

B)$7,900,000 asset

C)$11,700,000 liability

D)$1,500,000 asset

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

54

A company has a defined benefit pension asset of $1,050,000 at the end of the year. The company contributes $2,500,000 to the pension during the year and records a pension expense of $2,200,000.

Required:

Determine the value of the defined benefit pension liability at the beginning of the year.

Required:

Determine the value of the defined benefit pension liability at the beginning of the year.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

55

What are past service costs in a defined benefit plan?

A)Plan amendments that retrospectively improve pension plan benefits.

B)Difference arising between the actual and the expected value of plan assets.

C)Expected interest, dividend or income earned on the pension plan assets.

D)Differences arising between the actual and expected values of the pension obligations.

A)Plan amendments that retrospectively improve pension plan benefits.

B)Difference arising between the actual and the expected value of plan assets.

C)Expected interest, dividend or income earned on the pension plan assets.

D)Differences arising between the actual and expected values of the pension obligations.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following component refers to the benefits earned by employees in a defined benefit plan?

A)Interest cost on pension obligations.

B)Income from plan assets.

C)Amortization of past service cost.

D)Amortization of actuarial gains and losses.

A)Interest cost on pension obligations.

B)Income from plan assets.

C)Amortization of past service cost.

D)Amortization of actuarial gains and losses.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

57

A company has a defined benefit pension asset of $750,000 at the beginning of the year. The company contributes $2,500,000 to the pension during the year and records a pension expense of $2,200,000.

Required:

Determine the value of the defined benefit pension liability at year-end.

Required:

Determine the value of the defined benefit pension liability at year-end.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following components does not relate to the assets/liabilities held in the pension trust for a defined benefit plan?

A)Interest cost on pension obligations.

B)Income from plan assets.

C)Amortization of actuarial gains and losses.

D)Amortization of past service cost.

A)Interest cost on pension obligations.

B)Income from plan assets.

C)Amortization of actuarial gains and losses.

D)Amortization of past service cost.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

59

Summarize the three steps in the accounting for defined benefit pension plans.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

60

What are actuarial losses or gains in a defined benefit plan?

A)Plan amendments that retrospectively improve pension plan benefits.

B)Expected income earned on the pension plan assets.

C)Difference arising between the actual and the expected value of plan obligations.

D)Differences arising between the actual and expected values of the pension contributions.

A)Plan amendments that retrospectively improve pension plan benefits.

B)Expected income earned on the pension plan assets.

C)Difference arising between the actual and the expected value of plan obligations.

D)Differences arising between the actual and expected values of the pension contributions.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

61

Why does IAS 19 require Recognizing changes in the fair value of pension assets and liabilities to flow through OCI and not through the income statement?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

62

What is the key distinction between amounts recorded through income as pension expense versus amounts recorded through OCI?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

63

What are the two components of OCI related to pensions? What is the conceptual reason for recognizing these two components through OCI rather than net income?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

64

Which statement is correct?

A)An unexpected gain on plan assets represents an unfavourable difference between actual and expected amounts of income from pension assets.

B)Actuarial gains and losses arising from the obligations of a pension plan derive from differences between the actual and expected values of the obligation.

C)IFRS requires actuarial gains and losses to be recorded the income statement.

D)An unexpected loss on plan assets represents a favourable difference between actual and expected amounts of income from pension assets.

A)An unexpected gain on plan assets represents an unfavourable difference between actual and expected amounts of income from pension assets.

B)Actuarial gains and losses arising from the obligations of a pension plan derive from differences between the actual and expected values of the obligation.

C)IFRS requires actuarial gains and losses to be recorded the income statement.

D)An unexpected loss on plan assets represents a favourable difference between actual and expected amounts of income from pension assets.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

65

What is an actuarial loss?

A)An unfavourable difference between actual and expected amounts for pension plan obligations.

B)A favourable difference between actual and expected amounts for pension assets.

C)An unfavourable difference between actual and expected amounts for pension contributions.

D)A favourable difference between actual and expected amounts for pension obligations.

A)An unfavourable difference between actual and expected amounts for pension plan obligations.

B)A favourable difference between actual and expected amounts for pension assets.

C)An unfavourable difference between actual and expected amounts for pension contributions.

D)A favourable difference between actual and expected amounts for pension obligations.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

66

What amount is included in the pension reconciliation for the balance sheet?

A)Current service cost.

B)Pension plan assets.

C)Benefit paid.

D)Contributions paid.

A)Current service cost.

B)Pension plan assets.

C)Benefit paid.

D)Contributions paid.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

67

Which statement is correct?

A)The defined benefit liability or asset must be separately identified on the income statement.

B)The components of pension expense must be disclosed in the notes to the statements.

C)The defined benefit liability or asset must be separately identified on the balance sheet.

D)Pension asset/liability amounts can be offset if a company has more than one benefit plan.

A)The defined benefit liability or asset must be separately identified on the income statement.

B)The components of pension expense must be disclosed in the notes to the statements.

C)The defined benefit liability or asset must be separately identified on the balance sheet.

D)Pension asset/liability amounts can be offset if a company has more than one benefit plan.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

68

What amount is included in the pension reconciliation for the income statement?

A)Fair value of plan assets.

B)Pension expense.

C)Benefit paid.

D)Contributions paid.

A)Fair value of plan assets.

B)Pension expense.

C)Benefit paid.

D)Contributions paid.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

69

Regarding the presentation and disclosure of pension plans, which statement is true?

A)Enterprises must disclose the components of pension gains.

B)If the pension expense, OCI, and the defined benefit asset or liability are not separately identified on the face of the financial statements, they must be disclosed in the notes.

C)When a company has more than one defined benefit plan, IFRS usually permits the company to offset pension asset and pension liability amounts.

D)Two plans that both have net liability positions cannot be added together.

A)Enterprises must disclose the components of pension gains.

B)If the pension expense, OCI, and the defined benefit asset or liability are not separately identified on the face of the financial statements, they must be disclosed in the notes.

C)When a company has more than one defined benefit plan, IFRS usually permits the company to offset pension asset and pension liability amounts.

D)Two plans that both have net liability positions cannot be added together.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck