Deck 20: Accounting for Pensions and Postretirement Benefits

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

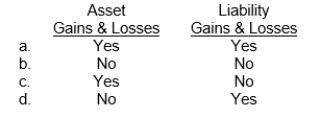

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/82

Play

Full screen (f)

Deck 20: Accounting for Pensions and Postretirement Benefits

1

Regarding the alternatives for measuring the pension liability, the profession adopted the accumulated benefit obligation using the present value of vested and non-vested benefits accrued to date, based on employees' future salary levels.

False

2

Qualified pension plans permit tax-free status of earnings from pension fund assets.

True

3

The employees are the beneficiaries of a defined contribution trust, but the employer is the beneficiary of a defined benefit trust.

True

4

Companies should recognize the entire increase in defined benefit obligation due to a plan initiation or amendment as pension expense in the year of amendment.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

5

Companies report any actuarial gains or losses charged or credited to other comprehensive income in the statement of financial position.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

6

Service cost is the expense caused by the increase in the accumulated benefit obligation because of employees' service during the current year.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

7

A pension plan is contributory when the employer makes payments to a funding agency.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

8

A curtailment occurs when a company enters into a transaction that eliminates all further obligations for part or all of the benefits provided under a defined benefit plan.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

9

Companies compute the vested benefit obligation using only vested benefits, at current salary levels.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

10

In a defined contribution plan, the employer must make up any shortfall in the accumulated assets held by the defined contribution trust.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

11

If a company grants plan amendments, it allocates the past service cost of providing these retroactive benefits to pension expense in the future, specifically to the remaining service-years of the affected employees.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

12

An employer does not have to report a liability on its statement of financial position in a defined-benefit plan.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

13

Qualified pension plans permit deductibility of the employer's contributions to the pension fund.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

14

The interest expense component of pension expense in the current period is computed by multiplying the discount rate by the beginning balance of the defined benefit obligation.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

15

IFRS encourages, but does not require, companies to use actuaries in the measurement of the pension amounts.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

16

For defined benefit plans, IFRS recognizes a pension asset or liability as the funded status of the plan.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

17

The unexpected gains and losses from changes in the defined benefit obligation are called asset gains and losses.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

18

Employers are at risk with defined-benefit plans because they must contribute enough to meet the cost of benefits that the plan defines.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

19

The accumulated benefit obligation bases the deferred compensation amount on both vested and nonvested service using future salary levels.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

20

The difference between the expected return and the actual return is referred to as the asset gain or loss.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is not a characteristic of a defined-contribution pension plan?

A)The employer's contribution each period is based on a formula.

B)The benefits to be received by employees are usually determined by an employee's three highest years of salary defined by the terms of the plan.

C)The accounting for a defined-contribution plan is straightforward and uncomplicated.

D)The benefit of gain or the risk of loss from the assets contributed to the pension fund are borne by the employee.

A)The employer's contribution each period is based on a formula.

B)The benefits to be received by employees are usually determined by an employee's three highest years of salary defined by the terms of the plan.

C)The accounting for a defined-contribution plan is straightforward and uncomplicated.

D)The benefit of gain or the risk of loss from the assets contributed to the pension fund are borne by the employee.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

22

The interest rate used on the defined benefit obligation component of pension expense

A)reflects the incremental borrowing rate of the employer.

B)reflects the rates at which pension benefits could be effectively settled.

C)is the same rate used to compute the interest revenue on plan assets.

D)may be stated implicitly or explicitly when reported.

A)reflects the incremental borrowing rate of the employer.

B)reflects the rates at which pension benefits could be effectively settled.

C)is the same rate used to compute the interest revenue on plan assets.

D)may be stated implicitly or explicitly when reported.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

23

One component of pension expense is interest revenue on plan assets.Plan assets include

A)contributions made by the employer and contributions made by the employee when a contributory plan of some type is involved.

B)plan assets still under the control of the company.

C)only assets reported on the statement of financial position of the employer as pension asset/liability.

D)None of these answer choices are correct.

A)contributions made by the employer and contributions made by the employee when a contributory plan of some type is involved.

B)plan assets still under the control of the company.

C)only assets reported on the statement of financial position of the employer as pension asset/liability.

D)None of these answer choices are correct.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

24

The computation of pension expense includes all the following except

A)service cost component measured using current salary levels.

B)interest on defined benefit obligation.

C)interest revenue on plan assets.

D)All of these answer choices are included in the computation.

A)service cost component measured using current salary levels.

B)interest on defined benefit obligation.

C)interest revenue on plan assets.

D)All of these answer choices are included in the computation.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

25

In accounting for a pension plan, any difference between the pension cost charged to expense and the payments into the fund should be reported as

A)an offset to the liability for past service cost.

B)pension asset/liability.

C)as other comprehensive income (G/L)

D)as accumulated other comprehensive income (PSC).

A)an offset to the liability for past service cost.

B)pension asset/liability.

C)as other comprehensive income (G/L)

D)as accumulated other comprehensive income (PSC).

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

26

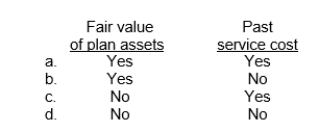

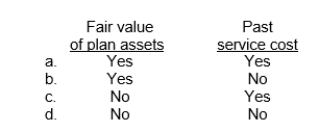

Which of the following items should be included in pension expense calculated by an employer who sponsors a defined-benefit pension plan for its employees?

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

27

In accounting for a defined-benefit pension plan

A)an appropriate funding pattern must be established to ensure that enough monies will be available at retirement to meet the benefits promised.

B)the employer's responsibility is simply to make a contribution each year based on the formula established in the plan.

C)the expense recognized each period is equal to the cash contribution.

D)the liability is determined based upon known variables that reflect future salary levels promised to employees.

A)an appropriate funding pattern must be established to ensure that enough monies will be available at retirement to meet the benefits promised.

B)the employer's responsibility is simply to make a contribution each year based on the formula established in the plan.

C)the expense recognized each period is equal to the cash contribution.

D)the liability is determined based upon known variables that reflect future salary levels promised to employees.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

28

In determining the present value of the prospective benefits (often referred to as the defined benefit obligation), the following are considered by the actuary:

A)retirement and mortality rate.

B)interest rates.

C)benefit provisions of the plan.

D)all of these answer choices are considered.

A)retirement and mortality rate.

B)interest rates.

C)benefit provisions of the plan.

D)all of these answer choices are considered.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

29

The defined benefit obligation is the measure of pension obligation that

A)is required to be used for reporting the service cost component of pension expense.

B)requires pension expense to be determined solely on the basis of the plan formula applied to years of service to date and based on existing salary levels.

C)requires the longest possible period for funding to maximize the tax deduction.

D)is not sanctioned under international financial reporting standards for reporting the service cost component of pension expense.

A)is required to be used for reporting the service cost component of pension expense.

B)requires pension expense to be determined solely on the basis of the plan formula applied to years of service to date and based on existing salary levels.

C)requires the longest possible period for funding to maximize the tax deduction.

D)is not sanctioned under international financial reporting standards for reporting the service cost component of pension expense.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

30

Differing measures of the pension obligation can be based on

A)all years of service-both vested and nonvested-using current salary levels.

B)only the vested benefits using current salary levels.

C)both vested and nonvested service using future salaries.

D)All of these answer choices are correct.

A)all years of service-both vested and nonvested-using current salary levels.

B)only the vested benefits using current salary levels.

C)both vested and nonvested service using future salaries.

D)All of these answer choices are correct.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

31

The relationship between the amount funded and the amount reported for pension expense is as follows:

A)pension expense must equal the amount funded.

B)pension expense will be less than the amount funded.

C)pension expense will be more than the amount funded.

D)pension expense may be greater than, equal to, or less than the amount funded.

A)pension expense must equal the amount funded.

B)pension expense will be less than the amount funded.

C)pension expense will be more than the amount funded.

D)pension expense may be greater than, equal to, or less than the amount funded.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

32

Vested benefits

A)usually require a certain minimum number of years of service.

B)are those that the employee is entitled to receive even if fired.

C)are not contingent upon additional service under the plan.

D)are defined by all of these answer choices.

A)usually require a certain minimum number of years of service.

B)are those that the employee is entitled to receive even if fired.

C)are not contingent upon additional service under the plan.

D)are defined by all of these answer choices.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

33

In a defined-contribution plan, a formula is used that

A)defines the benefits that the employee will receive at the time of retirement.

B)ensures that pension expense and the cash funding amount will be different.

C)requires an employer to contribute a certain sum each period based on the formula.

D)ensures that employers are at risk to make sure funds are available at retirement.

A)defines the benefits that the employee will receive at the time of retirement.

B)ensures that pension expense and the cash funding amount will be different.

C)requires an employer to contribute a certain sum each period based on the formula.

D)ensures that employers are at risk to make sure funds are available at retirement.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

34

In a defined-benefit plan, the process of funding refers to

A)determining the defined benefit obligation.

B)determining the accumulated benefit obligation.

C)making the periodic contributions to a funding agency to ensure that funds are available to meet retirees' claims.

D)determining the amount that might be reported for pension expense.

A)determining the defined benefit obligation.

B)determining the accumulated benefit obligation.

C)making the periodic contributions to a funding agency to ensure that funds are available to meet retirees' claims.

D)determining the amount that might be reported for pension expense.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

35

Alternative methods exist for the measurement of the pension obligation (liability).Which measure requires the use of future salaries in its computation?

A)Vested benefit obligation

B)Accumulated benefit obligation

C)Defined benefit obligation

D)Restructured benefit obligation

A)Vested benefit obligation

B)Accumulated benefit obligation

C)Defined benefit obligation

D)Restructured benefit obligation

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

36

In all pension plans, the accounting problems include all the following except

A)measuring the amount of pension obligation.

B)disclosing the status and effects of the plan in the financial statements.

C)allocating the cost of the plan to the proper periods.

D)determining the level of individual premiums.

A)measuring the amount of pension obligation.

B)disclosing the status and effects of the plan in the financial statements.

C)allocating the cost of the plan to the proper periods.

D)determining the level of individual premiums.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

37

The accumulated benefit obligation measures

A)the pension obligation on the basis of the plan formula applied to years of service to date and based on existing salary levels.

B)the pension obligation on the basis of the plan formula applied to years of service to date and based on future salary levels.

C)an estimated total benefit at retirement and then computes the level cost that will be sufficient, together with interest expected to accumulate at the assumed rate, to provide the total benefits at retirement.

D)the shortest possible period for funding to maximize the tax deduction.

A)the pension obligation on the basis of the plan formula applied to years of service to date and based on existing salary levels.

B)the pension obligation on the basis of the plan formula applied to years of service to date and based on future salary levels.

C)an estimated total benefit at retirement and then computes the level cost that will be sufficient, together with interest expected to accumulate at the assumed rate, to provide the total benefits at retirement.

D)the shortest possible period for funding to maximize the tax deduction.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

38

The actual return on plan assets

A)is equal to the change in the fair value of the plan assets during the year.

B)includes interest, dividends, and changes in the fair value of the fund assets.

C)is equal to the expected rate of return times the fair value of the plan assets at the beginning of the period.

D)All of these answer choices are correct.

A)is equal to the change in the fair value of the plan assets during the year.

B)includes interest, dividends, and changes in the fair value of the fund assets.

C)is equal to the expected rate of return times the fair value of the plan assets at the beginning of the period.

D)All of these answer choices are correct.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

39

In a defined-benefit plan, a formula is used that

A)requires that the benefit of gain or the risk of loss from the assets contributed to the pension plan be borne by the employee.

B)defines the benefits that the employee will receive at the time of retirement.

C)requires that pension expense and the cash funding amount be the same.

D)defines the contribution the employer is to make; no promise is made concerning the ultimate benefits to be paid out to the employees.

A)requires that the benefit of gain or the risk of loss from the assets contributed to the pension plan be borne by the employee.

B)defines the benefits that the employee will receive at the time of retirement.

C)requires that pension expense and the cash funding amount be the same.

D)defines the contribution the employer is to make; no promise is made concerning the ultimate benefits to be paid out to the employees.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

40

In computing the service cost component of pension expense, the IASB concluded that

A)the accumulated benefit obligation provides a more realistic measure of the pension obligation on a going concern basis.

B)a company should employ an actuarial funding method to report pension expense that best reflects the cost of benefits to employees.

C)the defined benefit obligation using future compensation levels provides a realistic measure of present pension obligation and expense.

D)All of these answer choices are correct.

A)the accumulated benefit obligation provides a more realistic measure of the pension obligation on a going concern basis.

B)a company should employ an actuarial funding method to report pension expense that best reflects the cost of benefits to employees.

C)the defined benefit obligation using future compensation levels provides a realistic measure of present pension obligation and expense.

D)All of these answer choices are correct.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

41

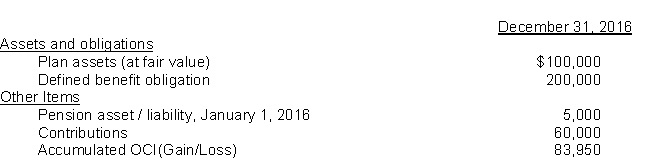

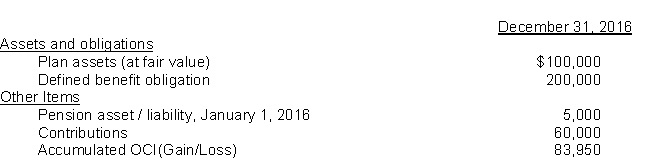

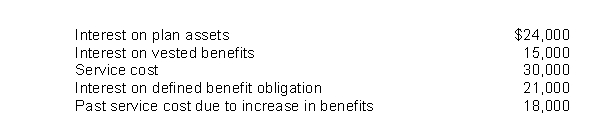

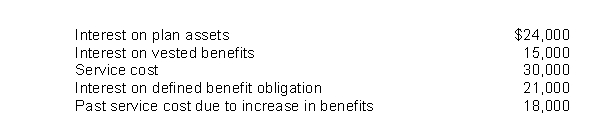

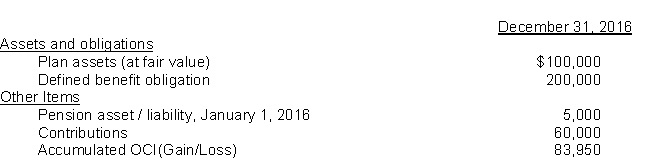

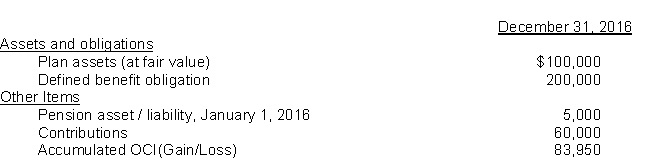

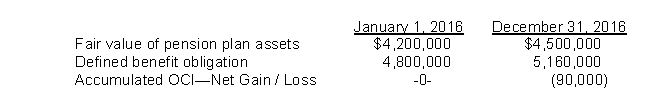

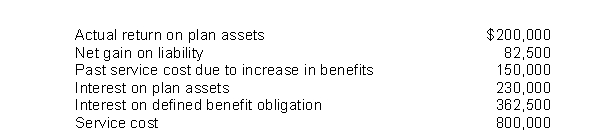

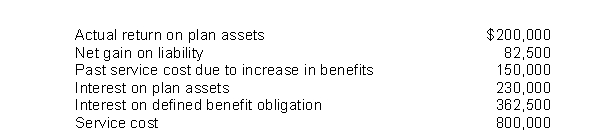

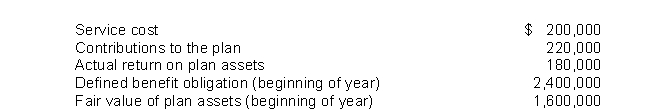

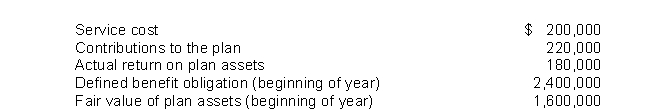

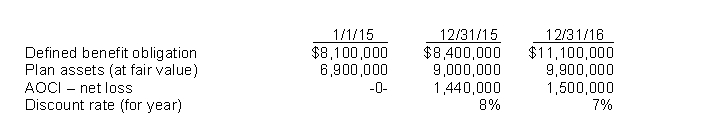

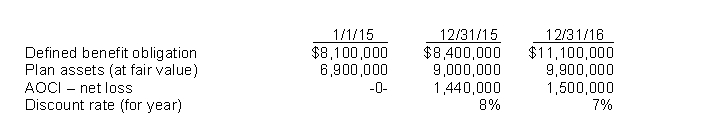

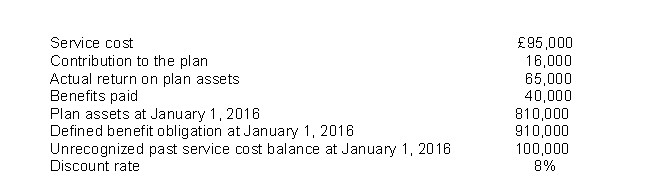

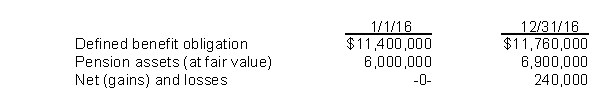

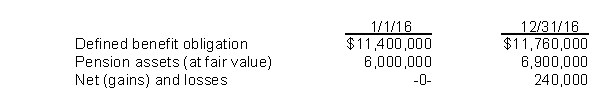

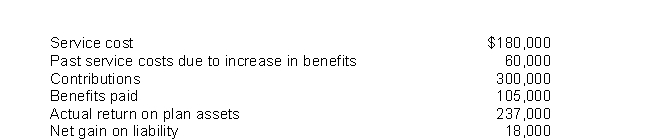

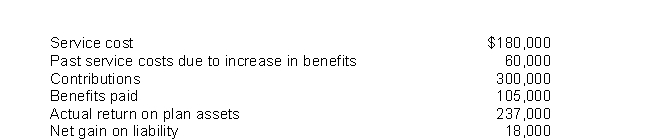

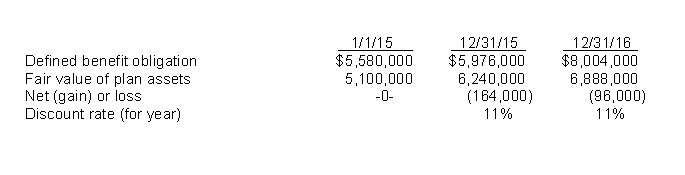

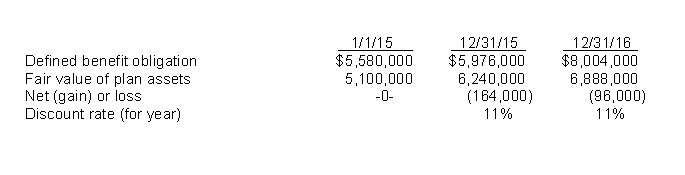

Use the following information for questions

The following information for Cooper Enterprises is given below:

There was no accumulated OCI at January 1, 2016.The average remaining service life of employees is 10 years.

What is the pension expense that Cooper Enterprises should report for 2016?

A)$71,050

B)$110,000

C)$60,000

D)$83,950

The following information for Cooper Enterprises is given below:

There was no accumulated OCI at January 1, 2016.The average remaining service life of employees is 10 years.

What is the pension expense that Cooper Enterprises should report for 2016?

A)$71,050

B)$110,000

C)$60,000

D)$83,950

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

42

Presented below is pension information for Green Company for the year 2016:  The amount of pension expense to be reported for 2016 is

The amount of pension expense to be reported for 2016 is

A)$93,000.

B)$69,000.

C)$60,000.

D)$45,000.

The amount of pension expense to be reported for 2016 is

The amount of pension expense to be reported for 2016 isA)$93,000.

B)$69,000.

C)$60,000.

D)$45,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

43

Presented below is pension information related to Woods, Inc.for the year 2016:  The amount of pension expense to be reported for 2016 is

The amount of pension expense to be reported for 2016 is

A)$120,000.

B)$144,000.

C)$162,000.

D)$108,000.

The amount of pension expense to be reported for 2016 is

The amount of pension expense to be reported for 2016 isA)$120,000.

B)$144,000.

C)$162,000.

D)$108,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following statements is correct?

A)There is an account titled Pension Asset / Liability.

B)There is an account titled Defined Benefit Obligation.

C)Unrecognized net gain or loss should be reported in the liability section of the balance sheet.

D)Other comprehensive income (PSC) should be included in net income.

A)There is an account titled Pension Asset / Liability.

B)There is an account titled Defined Benefit Obligation.

C)Unrecognized net gain or loss should be reported in the liability section of the balance sheet.

D)Other comprehensive income (PSC) should be included in net income.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

45

Whenever a defined-benefit plan is amended and credit is given to employees for years of service provided before the date of amendment

A)both the accumulated benefit obligation and the defined benefit obligation are usually greater than before.

B)both the accumulated benefit obligation and the defined benefit obligation are usually less than before.

C)the expense and the liability should be recognized at the time the benefits are paid.

D)the expense should be recognized immediately, but the liability may be deferred until a reasonable basis for its determination has been identified.

A)both the accumulated benefit obligation and the defined benefit obligation are usually greater than before.

B)both the accumulated benefit obligation and the defined benefit obligation are usually less than before.

C)the expense and the liability should be recognized at the time the benefits are paid.

D)the expense should be recognized immediately, but the liability may be deferred until a reasonable basis for its determination has been identified.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

46

Use the following information for questions

The following information for Cooper Enterprises is given below:

There was no accumulated OCI at January 1, 2016.The average remaining service life of employees is 10 years.

What is the amount that Cooper Enterprises should report as its pension liability on its statement of financial position as of December 31, 2016?

A)$100,000

B)$15,000

C)$105,000

D)$200,000

The following information for Cooper Enterprises is given below:

There was no accumulated OCI at January 1, 2016.The average remaining service life of employees is 10 years.

What is the amount that Cooper Enterprises should report as its pension liability on its statement of financial position as of December 31, 2016?

A)$100,000

B)$15,000

C)$105,000

D)$200,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

47

The unexpected gains or losses that result from changes in the defined benefit obligation are called

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

48

A corporation has a defined-benefit plan.A pension liability will result at the end of the year if the

A)defined benefit obligation exceeds the fair value of the plan assets.

B)fair value of the plan assets exceeds the defined benefit obligation.

C)amount of employer contributions exceeds the pension expense.

D)amount of pension expense exceeds the amount of employer contributions.

A)defined benefit obligation exceeds the fair value of the plan assets.

B)fair value of the plan assets exceeds the defined benefit obligation.

C)amount of employer contributions exceeds the pension expense.

D)amount of pension expense exceeds the amount of employer contributions.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

49

A pension asset is reported when

A)the accumulated benefit obligation exceeds the fair value of pension plan assets.

B)the accumulated benefit obligation exceeds the fair value of pension plan assets, but a past service cost exists.

C)pension plan assets at fair value exceed the accumulated benefit obligation.

D)pension plan assets at fair value exceed the defined benefit obligation.

A)the accumulated benefit obligation exceeds the fair value of pension plan assets.

B)the accumulated benefit obligation exceeds the fair value of pension plan assets, but a past service cost exists.

C)pension plan assets at fair value exceed the accumulated benefit obligation.

D)pension plan assets at fair value exceed the defined benefit obligation.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

50

When a company amends a pension plan, for accounting purposes, past service costs should be

A)treated as a prior period adjustment because no future periods are benefited.

B)amortized in accordance with procedures used for income tax purposes.

C)recorded in other comprehensive income (PSC).

D)reported as an expense in the period the plan is amended.

A)treated as a prior period adjustment because no future periods are benefited.

B)amortized in accordance with procedures used for income tax purposes.

C)recorded in other comprehensive income (PSC).

D)reported as an expense in the period the plan is amended.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following disclosures of pension plan information would not normally be required?

A)The major components of pension expense

B)The amount of past service cost changed or credited in previous years.

C)The funded status of the plan and the amounts recognized in the financial statements

D)The rates used in measuring the benefit amounts

A)The major components of pension expense

B)The amount of past service cost changed or credited in previous years.

C)The funded status of the plan and the amounts recognized in the financial statements

D)The rates used in measuring the benefit amounts

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

52

Barton, Inc.received the following information from its pension plan trustee concerning the operation of the company's defined-benefit pension plan for the year ended December 31, 2016.  The service cost component of pension expense for 2016 is $360,000 and the past service cost due to an increase in benefits is $60,000.The discount rate is 10%.What is the amount of pension expense for 2016?

The service cost component of pension expense for 2016 is $360,000 and the past service cost due to an increase in benefits is $60,000.The discount rate is 10%.What is the amount of pension expense for 2016?

A)$360,000

B)$522,000

C)$531,000

D)$432,000

The service cost component of pension expense for 2016 is $360,000 and the past service cost due to an increase in benefits is $60,000.The discount rate is 10%.What is the amount of pension expense for 2016?

The service cost component of pension expense for 2016 is $360,000 and the past service cost due to an increase in benefits is $60,000.The discount rate is 10%.What is the amount of pension expense for 2016?A)$360,000

B)$522,000

C)$531,000

D)$432,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

53

A pension liability is reported when

A)the defined benefit obligation exceeds the fair value of pension plan assets.

B)the accumulated benefit obligation is less than the fair value of pension plan assets.

C)the pension expense reported for the period is greater than the funding amount for the same period.

D)accumulated other comprehensive income exceeds the fair value of pension plan assets.

A)the defined benefit obligation exceeds the fair value of pension plan assets.

B)the accumulated benefit obligation is less than the fair value of pension plan assets.

C)the pension expense reported for the period is greater than the funding amount for the same period.

D)accumulated other comprehensive income exceeds the fair value of pension plan assets.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

54

Differences between pensions and postretirement benefits include all of the following except

A)Postretirement healthcare benefits are generally uncapped while pensions are generally well-defined.

B)Postretirement healthcare benefits are generally paid as needed and used, whereas pension benefits are generally paid monthly.

C)Postretirement healthcare benefits are generally paid only to the retiree while, pensions are generally paid to the retiree, the spouse, and other dependents.

D)Postretirement healthcare benefits are generally not funded while pensions are generally funded.

A)Postretirement healthcare benefits are generally uncapped while pensions are generally well-defined.

B)Postretirement healthcare benefits are generally paid as needed and used, whereas pension benefits are generally paid monthly.

C)Postretirement healthcare benefits are generally paid only to the retiree while, pensions are generally paid to the retiree, the spouse, and other dependents.

D)Postretirement healthcare benefits are generally not funded while pensions are generally funded.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

55

When a company adopts a pension plan, past service costs should be charged to

A)other comprehensive income (PSC).

B)operations of prior periods.

C)operations of the current period.

D)retained earnings.

A)other comprehensive income (PSC).

B)operations of prior periods.

C)operations of the current period.

D)retained earnings.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

56

Past service cost is amortized on a

A)straight-line basis over the expected future years of service.

B)years-of-service method or on a straight-line basis over the average remaining service life of active employees.

C)straight-line basis over 10 years.

D)past service costs are not amortized.

A)straight-line basis over the expected future years of service.

B)years-of-service method or on a straight-line basis over the average remaining service life of active employees.

C)straight-line basis over 10 years.

D)past service costs are not amortized.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

57

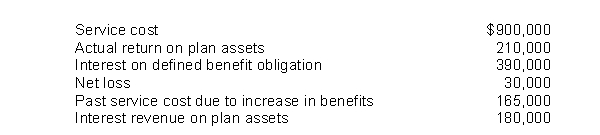

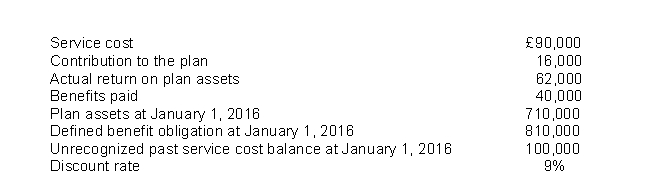

The following information is related to the pension plan of Long, Inc.for 2016.  Pension expense for 2016 is

Pension expense for 2016 is

A)$1,195,000.

B)$1,165,000.

C)$1,000,000.

D)$1,082,500.

Pension expense for 2016 is

Pension expense for 2016 isA)$1,195,000.

B)$1,165,000.

C)$1,000,000.

D)$1,082,500.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

58

Presented below is information related to Jensen Inc.pension plan for 2016.  What amount should be reported for pension expense in 2016?

What amount should be reported for pension expense in 2016?

A)$1,365,000

B)$1,335,000

C)$1,275,000

D)$1,155,000

What amount should be reported for pension expense in 2016?

What amount should be reported for pension expense in 2016?A)$1,365,000

B)$1,335,000

C)$1,275,000

D)$1,155,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

59

Kraft, Inc.sponsors a defined-benefit pension plan.The following data relates to the operation of the plan for the year 2016.  The discount rate was 10%.The amount of pension expense reported for 2016 is

The discount rate was 10%.The amount of pension expense reported for 2016 is

A)$200,000.

B)$260,000.

C)$280,000.

D)$440,000.

The discount rate was 10%.The amount of pension expense reported for 2016 is

The discount rate was 10%.The amount of pension expense reported for 2016 isA)$200,000.

B)$260,000.

C)$280,000.

D)$440,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

60

According to the IASB, recognition of a liability is required when the defined benefit obligation exceeds the fair value of plan assets.Conversely, when the fair value of plan assets exceeds the defined benefit obligation, the Board

A)requires recognition of an asset.

B)requires recognition of an asset if the excess fair value of plan assets exceeds the corridor amount.

C)recommends recognition of an asset but does not require such recognition.

D)does not permit recognition of an asset.

A)requires recognition of an asset.

B)requires recognition of an asset if the excess fair value of plan assets exceeds the corridor amount.

C)recommends recognition of an asset but does not require such recognition.

D)does not permit recognition of an asset.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

61

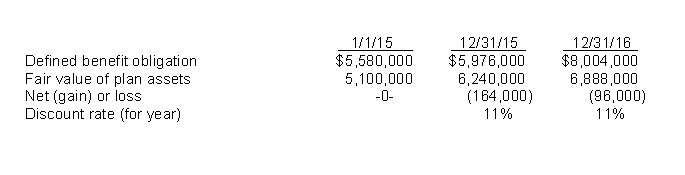

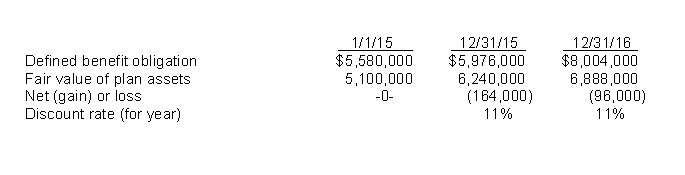

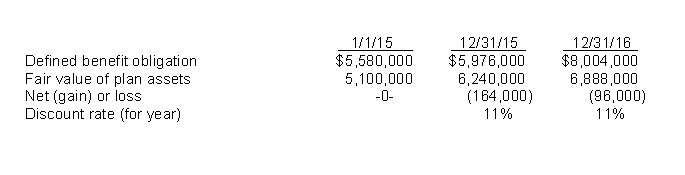

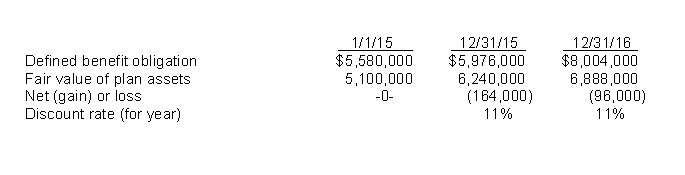

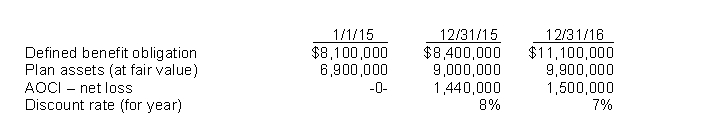

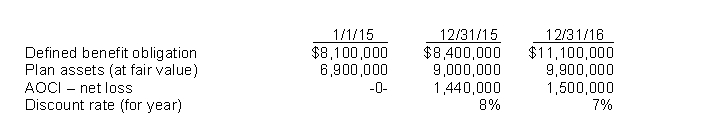

Use the following information for questions

The following information relates to the pension plan for the employees of Turner Co.:

Turner estimates that the average remaining service life is 16 years.Turner's contribution was $756,000 in 2016 and benefits paid were $564,000.

The gain or loss on plan assets in 2016 is

A)$96,000 gain.

B)$201,360 loss.

C)$230,400 loss.

D)$68,000 gain.

The following information relates to the pension plan for the employees of Turner Co.:

Turner estimates that the average remaining service life is 16 years.Turner's contribution was $756,000 in 2016 and benefits paid were $564,000.

The gain or loss on plan assets in 2016 is

A)$96,000 gain.

B)$201,360 loss.

C)$230,400 loss.

D)$68,000 gain.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

62

Dawson plc amends its defined pension plan on January 1, 2016, resulting in £420,000 of past service cost.The company has 400 active employees, of which 100 vest immediately (25%) and the other 300 (75%) vest in four years.The past service cost applicable to the vested employees is £105,000 and vests immediately.The past service cost related to the unvested employees is £315,000 and vests over five years.How much of past service costs would Dawson include in pension expense in 2016?

A)£420,000

B)£126,000

C)£105,000

D)£168,000

A)£420,000

B)£126,000

C)£105,000

D)£168,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

63

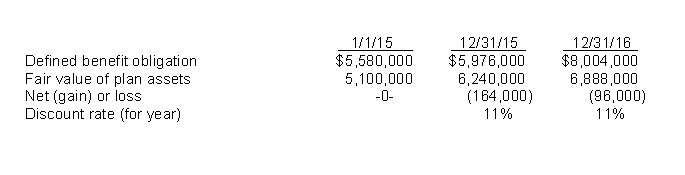

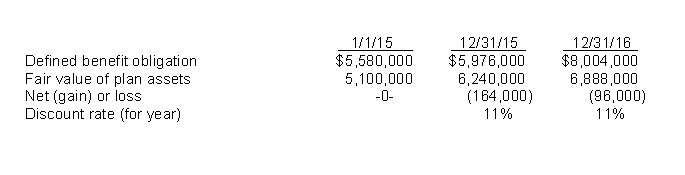

Use the following information for questions

The following data are for the pension plan for the employees of Lockett Company.

Lockett's contribution was $1,260,000 in 2016 and benefits paid were $1,125,000.Lockett

estimates that the average remaining service life is 15 years.

The actual return on plan assets in 2016 was

A)$900,000.

B)$765,000.

C)$600,000.

D)$465,000.

The following data are for the pension plan for the employees of Lockett Company.

Lockett's contribution was $1,260,000 in 2016 and benefits paid were $1,125,000.Lockett

estimates that the average remaining service life is 15 years.

The actual return on plan assets in 2016 was

A)$900,000.

B)$765,000.

C)$600,000.

D)$465,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

64

Use the following information for questions

The following information relates to the pension plan for the employees of Turner Co.:

Turner estimates that the average remaining service life is 16 years.Turner's contribution was $756,000 in 2016 and benefits paid were $564,000.

The net interest amount for 2016 is

A)$122,760 loss.

B)$30,800 gain.

C)$122,766 gain

D)$38,800 loss.

The following information relates to the pension plan for the employees of Turner Co.:

Turner estimates that the average remaining service life is 16 years.Turner's contribution was $756,000 in 2016 and benefits paid were $564,000.

The net interest amount for 2016 is

A)$122,760 loss.

B)$30,800 gain.

C)$122,766 gain

D)$38,800 loss.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

65

Carlton Co.provides the following information about its pension plan for the year 2016.  Based on this information, what is the pension expense for 2016?

Based on this information, what is the pension expense for 2016?

A)£210,800

B)£203,000

C)£72,800 111,000

D)£211,000

Based on this information, what is the pension expense for 2016?

Based on this information, what is the pension expense for 2016?A)£210,800

B)£203,000

C)£72,800 111,000

D)£211,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

66

At the end of the current period, Oxford Ltd.has a defined benefit obligation of £195,000 and pension plan assets with a fair value of £110,000.The amount of the vested benefits for the plan is £105,000.What amount related to its pension plan will be reported on the company's statement of financial position?

A)£5,000

B)£90,000

C)£85,000

D)£20,000

A)£5,000

B)£90,000

C)£85,000

D)£20,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

67

At the end of the current year, Kennedy Co.has a defined benefit obligation of £335,000 and pension plan assets with a fair value of £245,000.The amount of the vested benefits for the plan is £225,000.Kennedy has an accumulated actuarial gain of £8,300.What account and amountrelated to its pension plan will be reported on the company's statement of financial position?

A)Pension liability of £74,300

B)Pension liability of £90,000

C)Pension asset of £233,300

D)Pension asset of £110,000

A)Pension liability of £74,300

B)Pension liability of £90,000

C)Pension asset of £233,300

D)Pension asset of £110,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

68

At January 1, 2016, Trevor Company had plan assets of €215,000 and a defined benefit obligation of the same amount.During 2016, service cost was €22,500, the discount rate was 10% actual and expected return on plan assets were €26,000, contributions were €20,000, and benefits paid were €19,500.Based on this information what would be the Defined benefit obligation for Trevor Company for 2016?

A)€263,500

B)€239,500

C)€22,500

D)€259,000

A)€263,500

B)€239,500

C)€22,500

D)€259,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

69

Use the following information for questions

On January 1, 2016, Newlin Co.has the following balances:

Defined benefit obligation $2,100,000

Fair value of plan assets 1,800,000

The discount rate is 10%.Other data related to the pension plan for 2016 are:

The fair value of plan assets at December 31, 2016 is

A)$2,430,000.

B)$2,250,000.

C)$2,232,000.

D)$2,214,000.

On January 1, 2016, Newlin Co.has the following balances:

Defined benefit obligation $2,100,000

Fair value of plan assets 1,800,000

The discount rate is 10%.Other data related to the pension plan for 2016 are:

The fair value of plan assets at December 31, 2016 is

A)$2,430,000.

B)$2,250,000.

C)$2,232,000.

D)$2,214,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

70

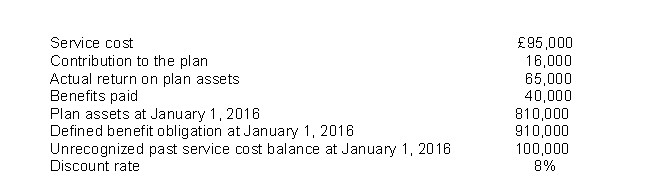

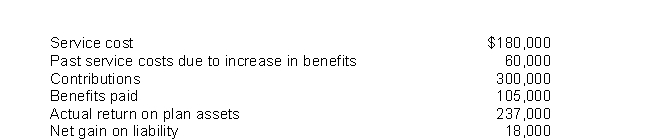

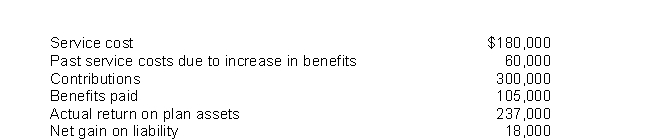

Hubbard, Inc.received the following information from its pension plan trustee concerning the operation of the company's defined-benefit pension plan for the year ended December 31, 2016.  The service cost component of pension expense for 2016 is $840,000 and the past service cost due to an increase in benefits is $180,000 effective January 1, 2016.The discount rate is 10%.What is the amount of pension expense for 2016?

The service cost component of pension expense for 2016 is $840,000 and the past service cost due to an increase in benefits is $180,000 effective January 1, 2016.The discount rate is 10%.What is the amount of pension expense for 2016?

A)$1,800,000

B)$1,578,000

C)$1,506,000

D)$1,380,000

The service cost component of pension expense for 2016 is $840,000 and the past service cost due to an increase in benefits is $180,000 effective January 1, 2016.The discount rate is 10%.What is the amount of pension expense for 2016?

The service cost component of pension expense for 2016 is $840,000 and the past service cost due to an increase in benefits is $180,000 effective January 1, 2016.The discount rate is 10%.What is the amount of pension expense for 2016?A)$1,800,000

B)$1,578,000

C)$1,506,000

D)$1,380,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

71

At the end of the current year, Churchill Industries has a defined obligation of £433,000 and pension plan assets with a fair value of £265,000.The amount of the vested benefits for the plan is £225,000.Churchill has an accumulated actuarial gain of £12,900.What account and amountrelated to its pension plan will be reported on the company's statement of financial position?

A)Pension asset of £168,000

B)Pension liability of £109,100

C)Pension liability of £134,900

D)Pension asset of £115,900

A)Pension asset of £168,000

B)Pension liability of £109,100

C)Pension liability of £134,900

D)Pension asset of £115,900

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

72

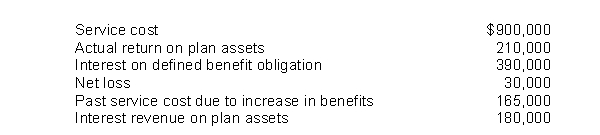

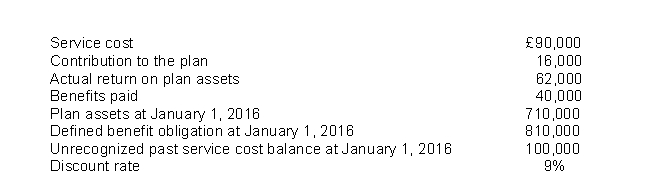

Clarkson Co.provides the following information about its pension plan for the year 2016.  Based on this information, what is the pension expense for 2016?

Based on this information, what is the pension expense for 2016?

A)£108,000

B)£271,900

C)£199,000

D)£208,000

Based on this information, what is the pension expense for 2016?

Based on this information, what is the pension expense for 2016?A)£108,000

B)£271,900

C)£199,000

D)£208,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

73

Use the following information for questions

On January 1, 2016, Newlin Co.has the following balances:

Defined benefit obligation $2,100,000

Fair value of plan assets 1,800,000

The discount rate is 10%.Other data related to the pension plan for 2016 are:

The balance of the defined benefit obligation at December 31, 2016 is

A)$2,433,000.

B)$2,385,000.

C)$2,355,000.

D)$2,337,000.

On January 1, 2016, Newlin Co.has the following balances:

Defined benefit obligation $2,100,000

Fair value of plan assets 1,800,000

The discount rate is 10%.Other data related to the pension plan for 2016 are:

The balance of the defined benefit obligation at December 31, 2016 is

A)$2,433,000.

B)$2,385,000.

C)$2,355,000.

D)$2,337,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

74

Use the following information for questions

The following information relates to the pension plan for the employees of Turner Co.:

Turner estimates that the average remaining service life is 16 years.Turner's contribution was $756,000 in 2016 and benefits paid were $564,000.

The actual return on plan assets in 2016 is

A)$408,000.

B)$456,000.

C)$588,000.

D)$648,000.

The following information relates to the pension plan for the employees of Turner Co.:

Turner estimates that the average remaining service life is 16 years.Turner's contribution was $756,000 in 2016 and benefits paid were $564,000.

The actual return on plan assets in 2016 is

A)$408,000.

B)$456,000.

C)$588,000.

D)$648,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

75

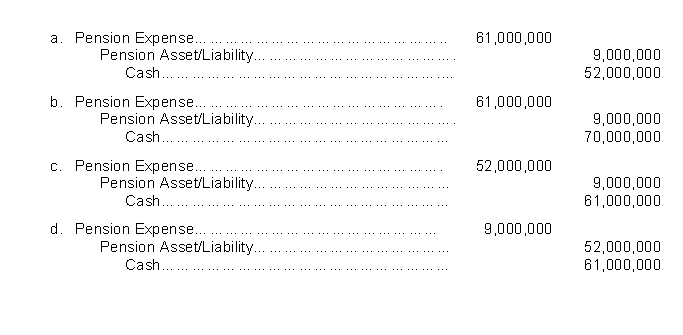

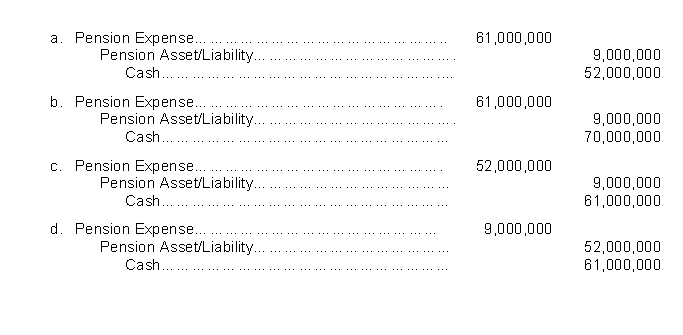

For 2016, Garvey Chambers plc had pension expense of £61 million and contributed £52 million to the pension fund.Which of the following is the journal entry that Garvey Chambers would make to record pension expense and funding?

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

76

Clarkson plc amends its defined pension plan on January 1, 2016, resulting in £520,000 of past service cost.The company has 600 active employees, of which 120 vest immediately (20%) and the other 480 (80%) vest in three years.The past service cost applicable to the vested employees is £104,000 and vests immediately.The past service cost related to the unvested employees is £416,000 and vests over five years.How much of the past service costs would Clarkson include in pension expense in 2016?

A)£332,800

B)£520,000

C)£416,000

D)£436,800

A)£332,800

B)£520,000

C)£416,000

D)£436,800

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

77

Towson Ltd.has experienced tough competition, leading it to seek concessions from its employees in the company's pension plan.In exchange for promises to avoid layoffs and wage cuts, the employees agreed to receive lower pension benefits in the future.As a result, Towson amended its pension plan on January 1, 2016, and recorded past service cost of €225,000.The average period to vesting for the benefits affected by this plan is 6 years.What is the amount of past service cost included in pension expense for 2016?

A)€37,500

B)€112,500

C)€225,000

D)€18,750

A)€37,500

B)€112,500

C)€225,000

D)€18,750

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

78

At January 1, 2016, Wembley Company had plan assets of €250,000 and a defined benefit obligation of the same amount.During 2016, service cost was €27,500, the discount rate was 10%, actual and expected return on plan assets were €25,000, contributions were €20,000, and benefits paid were €17,500.Based on this information what would be the defined benefit obligation for Wembley Company for 2016?

A)€277,500

B)€285,000

C)€27,500

D)€302,500

A)€277,500

B)€285,000

C)€27,500

D)€302,500

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

79

Use the following information for questions

The following data are for the pension plan for the employees of Lockett Company.

Lockett's contribution was $1,260,000 in 2016 and benefits paid were $1,125,000.Lockett

estimates that the average remaining service life is 15 years.

Assume that the actual return on plan assets in 2016 was $800,000.The gain on plan assets in 2016 was

A)$191,000.

B)$170,000.

C)$149,000.

D)$107,000.

The following data are for the pension plan for the employees of Lockett Company.

Lockett's contribution was $1,260,000 in 2016 and benefits paid were $1,125,000.Lockett

estimates that the average remaining service life is 15 years.

Assume that the actual return on plan assets in 2016 was $800,000.The gain on plan assets in 2016 was

A)$191,000.

B)$170,000.

C)$149,000.

D)$107,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

80

Use the following information for questions

The following information relates to the pension plan for the employees of Turner Co.:

Turner estimates that the average remaining service life is 16 years.Turner's contribution was $756,000 in 2016 and benefits paid were $564,000.

The interest expense for 2016 is

A)$537,840.

B)$607,200.

C)$657,360.

D)$880,440.

The following information relates to the pension plan for the employees of Turner Co.:

Turner estimates that the average remaining service life is 16 years.Turner's contribution was $756,000 in 2016 and benefits paid were $564,000.

The interest expense for 2016 is

A)$537,840.

B)$607,200.

C)$657,360.

D)$880,440.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck