Deck 20: Earnings Per Share

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/153

Play

Full screen (f)

Deck 20: Earnings Per Share

1

At December 31, 2013, BCD had 700 common shares outstanding.On September 1, 2014, an additional 300 common shares were issued.In addition, BCD had $20,000 of 8 percent convertible bonds outstanding December 31, 2013, which are convertible into 400 common shares.No bonds were converted into common shares in 2014.Net income for the year ended December 31, 2014, was $6,000.Assuming the income tax rate was 50 percent, what should be the diluted earnings per share for the year ended December 31, 2014?

A)$4.33

B)$5.67

C)$5.00

D)$7.50

A)$4.33

B)$5.67

C)$5.00

D)$7.50

B

2

Choose the correct statement concerning EPS.

A)EPS can never be negative.

B)If net income is less than zero, all potentially dilutive securities are anti-dilutive.

C)All convertible securities must be incorporated into diluted EPS.

D)Usually, reported EPS is the actual historical income per weighted average share outstanding during the period.

A)EPS can never be negative.

B)If net income is less than zero, all potentially dilutive securities are anti-dilutive.

C)All convertible securities must be incorporated into diluted EPS.

D)Usually, reported EPS is the actual historical income per weighted average share outstanding during the period.

B

3

With respect to the computation of earnings per share, which of the following would be most indicative of a simple capital structure?

A)Ownership interests consisting only of common shares

B)Common shares, preferred shares, and convertible securities outstanding in lots of even thousands

C)Earnings derived from one primary product segment of business

D)Equity represented only by common and convertible preferred shares

A)Ownership interests consisting only of common shares

B)Common shares, preferred shares, and convertible securities outstanding in lots of even thousands

C)Earnings derived from one primary product segment of business

D)Equity represented only by common and convertible preferred shares

A

4

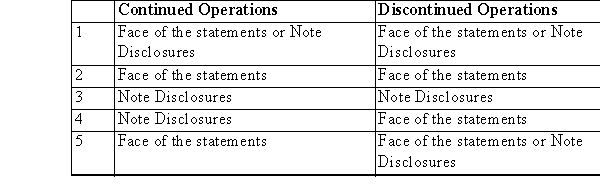

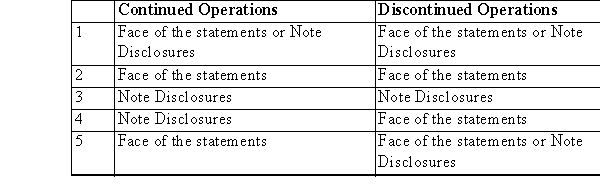

Which of the following choices best describes the location of the required basic and diluted EPS disclosures for public companies?

A)Choice 1

B)Choice 2

C)Choice 3

D)Choice 4

E)Choice 5

A)Choice 1

B)Choice 2

C)Choice 3

D)Choice 4

E)Choice 5

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

5

WEIGHTY Inc.started the current year with 2,000 common shares issued, but only 1,500 were outstanding at that time.The following events took place during the current year: March 30 issued 200 previously unissued shares June 1 sold 400 treasury shares

December 1 purchased 100 treasury shares December 31 issued 500 previously unissued shares

What is WEIGHTY's denominator of earnings per share for the current year? (Do not round intermediate calculations.Round your final answer to nearest whole number.)

A)2,125 shares

B)2,375 shares

C)1,875 shares

D)1,917 shares

December 1 purchased 100 treasury shares December 31 issued 500 previously unissued shares

What is WEIGHTY's denominator of earnings per share for the current year? (Do not round intermediate calculations.Round your final answer to nearest whole number.)

A)2,125 shares

B)2,375 shares

C)1,875 shares

D)1,917 shares

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

6

The annual dividend on nonconvertible cumulative preferred shares is $10,000.At the beginning of the current year, there were 3 years of dividends in arrears.During the current year, $38,000 of dividends on the preferred shares was declared, and $35,000 were paid.What amount of dividends on preferred shares will be subtracted from earnings when computing basic EPS for the current year?

A)$30,000

B)$38,000

C)$10,000

D)$35,000

E)$40,000

A)$30,000

B)$38,000

C)$10,000

D)$35,000

E)$40,000

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

7

FED had 100 common shares issued and outstanding at December 31, 2013.On July 1, 2014, FED issued a 10 percent stock dividend.Unexercised stock options to purchase 20 common shares (adjusted for 2014 stock dividend)at $20 per share were outstanding at the beginning and end of 2014.The average market price of FED'S common shares (which was not affected by the stock dividend)was $25 per share during 2014.The ending market price was $40.FED earned interest at 8% and had a 50% tax rate.Net income for the year ended December 31, 2014, was $2,200.What was FED'S 2014 diluted earnings per share, rounded to the nearest cent?

A)$18.47

B)$18.60

C)$17.17

D)$17.05

A)$18.47

B)$18.60

C)$17.17

D)$17.05

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

8

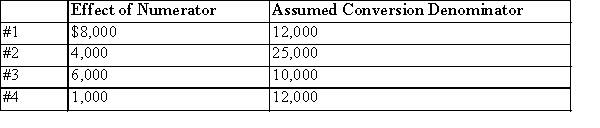

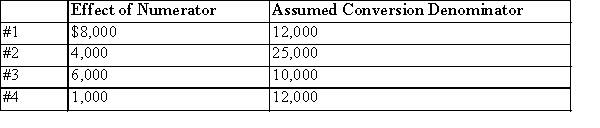

A company earned $20,000 in 2014 and had 20,000 common shares outstanding the entir year.The following four potentially dilutive securities were also outstanding the entire year.The numerator and denominator of the D/A ratios are as indicated.  What is the diluted EPS? (Rounded to the nearest cent)

What is the diluted EPS? (Rounded to the nearest cent)

A)$0.32

B)$1.00

C)$0.81

D)$0.44

What is the diluted EPS? (Rounded to the nearest cent)

What is the diluted EPS? (Rounded to the nearest cent)A)$0.32

B)$1.00

C)$0.81

D)$0.44

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

9

The annual dividend on nonconvertible cumulative preferred shares is $10,000.At the beginning of the current year, there were 3 years of dividends in arrears.During the current year, $38,000 of dividends on the preferred shares were declared, and $35,000 were paid.What amount of dividends on preferred shares will be subtracted from earnings when computing diluted EPS for the current year?

A)$40,000

B)$38,000

C)$10,000

D)$30,000

E)$35,000

A)$40,000

B)$38,000

C)$10,000

D)$30,000

E)$35,000

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

10

Assume basic EPS has been determined.In determining the diluted earnings per share, the annual dividend on convertible noncumulative preferred shares, which are a dilutive convertible security, should be:

A)Disregarded.

B)Deducted from the numerator of basic EPS whether declared or not.

C)Added back to the numerator of basic EPS only if declared.

D)Added back to the numerator of basic EPS whether declared or not.

A)Disregarded.

B)Deducted from the numerator of basic EPS whether declared or not.

C)Added back to the numerator of basic EPS only if declared.

D)Added back to the numerator of basic EPS whether declared or not.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

11

FED had 100 common shares issued and outstanding at December 31, 2013.On July 1, 2014, FED issued a 10 percent stock dividend.Unexercised stock options to purchase 20 common shares (adjusted for 2014 stock dividends)at $20 per share were outstanding at the beginning and end of 2014.The average market price of FED'S common shares (which was not affected by the stock dividend)was $25 per share during 2014.The ending market price was $30.Net income for the year ended December 31, 2014, was $2,200.What was FED'S 2014 basic earnings per share, rounded to the nearest cent?

A)$22.00

B)$20.00

C)$18.33

D)$16.92

A)$22.00

B)$20.00

C)$18.33

D)$16.92

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

12

ABC has 20,000 common shares outstanding throughout the year.It also had 20,000, 6 percent preferred shares, par $20, (cumulative and nonconvertible)outstanding throughout the year.Net income was $300,000.The earnings per share amount would be: (Rounded to the nearest cent.)

A)$15.00

B)$9.20

C)$13.80

D)$10.00

A)$15.00

B)$9.20

C)$13.80

D)$10.00

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

13

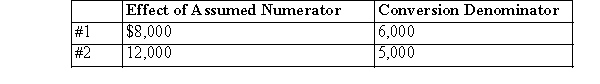

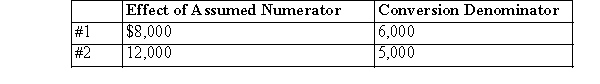

Assume a company had net income of $20,000 and 8,000 common shares were outstanding the entire year.Also assume there were 2 convertible securities outstanding t entire year:  What is the diluted EPS? (Rounded to the nearest cent)

What is the diluted EPS? (Rounded to the nearest cent)

A)$2.00

B)$2.11

C)$2.40

D)$2.50

What is the diluted EPS? (Rounded to the nearest cent)

What is the diluted EPS? (Rounded to the nearest cent)A)$2.00

B)$2.11

C)$2.40

D)$2.50

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

14

LASTEPS Co.had granted 20,000 options to buy one common share at $10 per share several years ago.The company earned $200,000 this year and had 300,000 common shares outstanding the entire year.The company earns interest at 8% and has a 40% tax rate.Given only the above information, what are basic EPS and diluted EPS respectively that should be reported? (Rounded to the nearest cent)

A)Only basic EPS need be reported

B)$0.63; $0.62

C)$0.67; $0.66

D)$0.65; $0.64

E)$0.65; $0.63

A)Only basic EPS need be reported

B)$0.63; $0.62

C)$0.67; $0.66

D)$0.65; $0.64

E)$0.65; $0.63

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

15

ABC experienced the following changes in its capital structure during 2014: Outstanding on January 1, 2014, 90 common stock shares Sold 120 common shares on February 1, 2014

Sold 60 common shares on April 1, 2014

Issued a 2 for 1 split on August 1, 2014

ABC's weighted average number of common shares outstanding for 2014 would be:

A)490.

B)540.

C)245.

D)315.

Sold 60 common shares on April 1, 2014

Issued a 2 for 1 split on August 1, 2014

ABC's weighted average number of common shares outstanding for 2014 would be:

A)490.

B)540.

C)245.

D)315.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

16

A firm that earned $20,000 (after tax)had the following securities outstanding all year during, which the tax rate was 40%: 20,000 common shares

1,000, 6%, $100 par cumulative nonconvertible preferred shares

2,000, 4%, $50 par noncumulative preferred shares, each share convertible into 5 commo shares

100, 8%, $1,000 convertible bonds, each bond convertible into 10 common shares (bonds were issued at face)

No dividends were paid for the year.

The diluted earnings per share for the year should be (rounded to the nearest cent):

A)$0.86

B)$0.47

C)$0.73

D)$0.70

1,000, 6%, $100 par cumulative nonconvertible preferred shares

2,000, 4%, $50 par noncumulative preferred shares, each share convertible into 5 commo shares

100, 8%, $1,000 convertible bonds, each bond convertible into 10 common shares (bonds were issued at face)

No dividends were paid for the year.

The diluted earnings per share for the year should be (rounded to the nearest cent):

A)$0.86

B)$0.47

C)$0.73

D)$0.70

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

17

Basic earnings per share represent the amount of earnings attributable to:

A)Common shares, preferred shares, and all dilutive securities.

B)Each common share outstanding, including dilutive securities.

C)All common shares and dilutive securities.

D)Each common share outstanding.

A)Common shares, preferred shares, and all dilutive securities.

B)Each common share outstanding, including dilutive securities.

C)All common shares and dilutive securities.

D)Each common share outstanding.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

18

If net income is $10,000 and there were 8,000 common shares issued and outstanding the entire year, and $100,000 of noncumulative, nonconvertible 6% $100 par preferred shares outstanding the entire year, what is EPS if no dividends were declared during the year?

A)$0.50

B)$1.25

C)$2.00

D)$1.00

A)$0.50

B)$1.25

C)$2.00

D)$1.00

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

19

For purposes of computing the weighted-average number of shares outstanding during the year, a mid-year event that must be treated as occurring at the beginning of the year is the:

A)Purchase of treasury stock.

B)Sale of additional common shares.

C)Issuance of stock warrants.

D)Stock split.

A)Purchase of treasury stock.

B)Sale of additional common shares.

C)Issuance of stock warrants.

D)Stock split.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following statements is correct?

A)Basic EPS is a historical figure while diluted EPS is a hypothetical figure.

B)Basic EPS is hypothetical figure while diluted EPS is a historical figure.

C)Basic and diluted EPS are both historical figures.

D)Basic and diluted EPS are both hypothetical figures.

A)Basic EPS is a historical figure while diluted EPS is a hypothetical figure.

B)Basic EPS is hypothetical figure while diluted EPS is a historical figure.

C)Basic and diluted EPS are both historical figures.

D)Basic and diluted EPS are both hypothetical figures.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

21

Firm that earned $20,000 (after tax)had the following securities outstanding all year during which the tax rate was 40%: 20,000 common shares

1,000, 6%, $100 par cumulative nonconvertible preferred shares

2,000, 4%, $50 par cumulative preferred shares, each share convertible into 5 common shares

100, 8%, $1,000 convertible bonds, each convertible into 10 common shares (bonds were issued at face)

What is basic EPS? (Rounded to the nearest cent)

A)$0.70

B)$0.50

C)$1.00

D)$0.75

1,000, 6%, $100 par cumulative nonconvertible preferred shares

2,000, 4%, $50 par cumulative preferred shares, each share convertible into 5 common shares

100, 8%, $1,000 convertible bonds, each convertible into 10 common shares (bonds were issued at face)

What is basic EPS? (Rounded to the nearest cent)

A)$0.70

B)$0.50

C)$1.00

D)$0.75

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

22

For purposes of computing the weighted average number of shares outstanding during the year, a midyear event that must be treated as occurring at the beginning of the year is the:

A)Purchase of treasury stock.

B)Declaration and issuance of stock dividend.

C)Issuance of stock warrants.

D)Sale of additional common shares.

A)Purchase of treasury stock.

B)Declaration and issuance of stock dividend.

C)Issuance of stock warrants.

D)Sale of additional common shares.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

23

At December 31, 2013, MNO had 50,000 common shares issued and outstanding.On April 1, 2014, an additional 10,000 common shares were issued.MNO's net income for the year ended December 31, 2014, was $1,035,000.During 2014, MNO declared and paid $600,000 cash dividends on its nonconvertible preferred shares (the full year's requirement).The earnings per common share, rounded to the nearest cent, for the year ended December 31, 2014, should be:

A)$18.00.

B)$18.84.

C)$7.92.

D)$7.57.

A)$18.00.

B)$18.84.

C)$7.92.

D)$7.57.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

24

At December 31, 2013, HIJ had 2,000 common shares outstanding.On January 1, 2014, HIJ issued 1,000 convertible preferred (one share of common for one share of preferred)shares.During 2014, HIJ declared and paid $4,000 cash dividends on the common and $4,000 cash dividends on the preferred (the annual requirement).Net income for the year ended December 31, 2014, was $36,000.Assuming an income tax rate of 50 percent, what should be diluted earnings per share for the year ended December 31, 2014?

A)$12

B)$17

C)$16

D)$18

A)$12

B)$17

C)$16

D)$18

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

25

On January 2, 2014, CBA issued at par $10,000 of 8 percent bonds convertible into 2,000 of CBA's common shares.No bonds were converted during 2014.Throughout 2014, CBA had 2,000 common shares outstanding.CBA's net income after tax was $1,000.CBA's income tax rate is 50 percent.No potentially dilutive securities other than the convertible bonds were outstanding during 2014.CBA's basic EPS and diluted EPS for 2014 would be:

A)Basic EPS $0.50; diluted EPS $0.35.

B)Basic EPS $0.90; diluted EPS $0.15.

C)Basic EPS $0.30; diluted EPS $0.45.

D)Basic EPS $0.70; diluted EPS $0.25.

A)Basic EPS $0.50; diluted EPS $0.35.

B)Basic EPS $0.90; diluted EPS $0.15.

C)Basic EPS $0.30; diluted EPS $0.45.

D)Basic EPS $0.70; diluted EPS $0.25.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

26

Transactions that take place in the period between the end of the fiscal year and the financials statement released must be disclosed and described when which of the following happens:

A)When common shares are issued after the fiscal year end and the proceeds were used to retire preferred shares.

B)When a subsequent event would significantly change the number of common shares or the potential common shares used in basic or diluted EPS.

C)When common shares are issued after the fiscal year end for cash, on the exercise of options.

D)All of these choices are correct.

A)When common shares are issued after the fiscal year end and the proceeds were used to retire preferred shares.

B)When a subsequent event would significantly change the number of common shares or the potential common shares used in basic or diluted EPS.

C)When common shares are issued after the fiscal year end for cash, on the exercise of options.

D)All of these choices are correct.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

27

ABC paid $5,000 in dividends to its preferred shareholders.The 5 percent preferred shares (10,000 shares outstanding)are nonconvertible and noncumulative.The $5,000 dividend:

A)Will be added to the denominator of the EPS calculation.

B)Will be added to the numerator of the EPS calculation.

C)May not affect the EPS calculation, depending on the declaration date of the dividends.

D)Will be subtracted from the numerator of the EPS calculation.

A)Will be added to the denominator of the EPS calculation.

B)Will be added to the numerator of the EPS calculation.

C)May not affect the EPS calculation, depending on the declaration date of the dividends.

D)Will be subtracted from the numerator of the EPS calculation.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

28

A firm has correctly computed the following values: (Its shares are trading on the Vancouver Stock Exchange) Basic EPS = $4.32 Diluted EPS = $4.17

Which of the following correctly states the EPS amounts to be reported?

A)No EPS need be reported

B)Basic and diluted EPS

C)Diluted EPS

D)Basic EPS

Which of the following correctly states the EPS amounts to be reported?

A)No EPS need be reported

B)Basic and diluted EPS

C)Diluted EPS

D)Basic EPS

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

29

JUNK BONDS Inc.began operations Jan.1, 2014.The following events related to common shares took place on the indicated dates during 2014. Jan.1 Issued 25,000 common shares

Apr)1 Purchased 4,000 treasury shares May 1 Split the common shares 4-for-1 Aug.1 Issued 20,000 common shares Dec.1 Issued a 25% stock dividend

Assuming no potentially dilutive securities, what is the weighted average shares for EPS in 2014?(Do not round intermediate calculations.Round your final answer to nearest whole number.)

A)120,416 shares

B)96,333 shares

C)118,345 shares

D)37,917 shares

Apr)1 Purchased 4,000 treasury shares May 1 Split the common shares 4-for-1 Aug.1 Issued 20,000 common shares Dec.1 Issued a 25% stock dividend

Assuming no potentially dilutive securities, what is the weighted average shares for EPS in 2014?(Do not round intermediate calculations.Round your final answer to nearest whole number.)

A)120,416 shares

B)96,333 shares

C)118,345 shares

D)37,917 shares

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

30

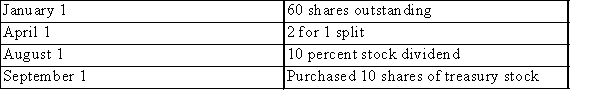

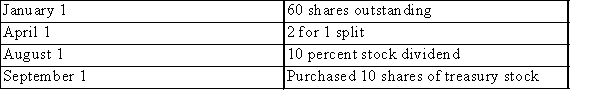

WXY had the following common share transactions:  The weighted average number of shares outstanding for the year was: (Round your answer to nearest whole number.)

The weighted average number of shares outstanding for the year was: (Round your answer to nearest whole number.)

A)129 shares.

B)110 shares.

C)95 shares.

D)115 shares.

The weighted average number of shares outstanding for the year was: (Round your answer to nearest whole number.)

The weighted average number of shares outstanding for the year was: (Round your answer to nearest whole number.)A)129 shares.

B)110 shares.

C)95 shares.

D)115 shares.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

31

A basic earnings per share figure is presented for:

A)Neither simple nor complex structures.

B)A complex capital structure.

C)A simple capital structure.

D)Both simple and complex structures.

A)Neither simple nor complex structures.

B)A complex capital structure.

C)A simple capital structure.

D)Both simple and complex structures.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

32

Last year, TUV had 40,000 $15 par, 7 percent, cumulative, convertible preferred shares outstanding.The Board of Directors did not declare a dividend for the current period because all of these shares were converted to common shares on the first day of the period.What is the effect on the numerator of the EPS calculation for this year due to the preferred shares? (Tax rate is 40%).

A)$0

B)Subtract $25,200

C)Add $42,000

D)Subtract $42,000

E)Not determinable from the information given.

A)$0

B)Subtract $25,200

C)Add $42,000

D)Subtract $42,000

E)Not determinable from the information given.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

33

Concerning earnings per share for a complex capital structure, which of the following statements is incorrect?

A)"Basic earnings per share" is never reported at less than "diluted earnings per share."

B)If the only potentially dilutive security outstanding is an employee stock option plan, then primary and diluted EPS must be equal.

C)Both basic and diluted earnings per share must be presented on the face of the financial statements.

D)A "convertible security" is a security which is not, in form, a common share but which contains provisions to enable its holder to become a common shareholder.

E)Basic earnings per share must be based on the weighted average number of common shares outstanding.

A)"Basic earnings per share" is never reported at less than "diluted earnings per share."

B)If the only potentially dilutive security outstanding is an employee stock option plan, then primary and diluted EPS must be equal.

C)Both basic and diluted earnings per share must be presented on the face of the financial statements.

D)A "convertible security" is a security which is not, in form, a common share but which contains provisions to enable its holder to become a common shareholder.

E)Basic earnings per share must be based on the weighted average number of common shares outstanding.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

34

Given the following sequence of events, determine the weighted average number of share for earnings per share purposes: January 1 100 common shares issued and outstanding April 1 issued 50 previously unissued shares

May 1 split the stock 2-for-1

June 30 purchased 100 shares for the treasury July 30 distributed a 20% stock dividend December 31 Split the stock 3-for-1

A)810

B)475

C)270

D)1,125

May 1 split the stock 2-for-1

June 30 purchased 100 shares for the treasury July 30 distributed a 20% stock dividend December 31 Split the stock 3-for-1

A)810

B)475

C)270

D)1,125

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

35

A simple capital structure could have, in addition to common shares, a security that is a:

A)Convertible preferred shares.

B)Stock right.

C)Nonconvertible preferred shares.

D)Stock warrant.

E)Convertible bond.

A)Convertible preferred shares.

B)Stock right.

C)Nonconvertible preferred shares.

D)Stock warrant.

E)Convertible bond.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

36

When computing diluted earnings per share, convertible securities are:

A)Ignored.

B)Incorporated only if they are anti-dilutive.

C)Incorporated whether they are dilutive or anti-dilutive.

D)Incorporated only if they are dilutive.

A)Ignored.

B)Incorporated only if they are anti-dilutive.

C)Incorporated whether they are dilutive or anti-dilutive.

D)Incorporated only if they are dilutive.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

37

In determining basic earnings per share, the annual dividend on nonconvertible cumulative preferred shares should be:

A)Deducted from net income whether declared or not.

B)Deducted from net income only if declared.

C)Added back to net income whether declared or not.

D)Disregarded.

A)Deducted from net income whether declared or not.

B)Deducted from net income only if declared.

C)Added back to net income whether declared or not.

D)Disregarded.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

38

The reported diluted earnings per share figure may be:

A)More than or less than the basic earnings per share figure.

B)Less than the basic earnings per share figure.

C)More than the basic earnings per share figure.

D)Equal to the basic earnings per share figure.

A)More than or less than the basic earnings per share figure.

B)Less than the basic earnings per share figure.

C)More than the basic earnings per share figure.

D)Equal to the basic earnings per share figure.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

39

At December 31, 2013, the shareholders' equity of LMN reported as outstanding: 100 common shares and 30 nonconvertible preferred shares.On July 1, 2014, LMN issued a 10 percent stock dividend on its common shares and paid a cash dividend of $2.00 per share on its preferred (the full year's requirement).Income for the year ended December 31, 2014 was $1,170.The 2014 EPS, rounded to the nearest cent, for LMN should be:

A)$10.09.

B)$11.70.

C)$10.64.

D)$10.58.

A)$10.09.

B)$11.70.

C)$10.64.

D)$10.58.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

40

The 2014 net income of MNO was $300,000, and 100,000 of its common shares were outstanding during the entire year.In addition, outstanding options existed to purchase 10,000 common shares at $10 per share.These options were granted in 2012 and none had been exercised by December 31, 2014.MNO earned interest at 8% and had a 50% tax rate.The amount, which should be shown as MNO's diluted earnings per share for 2014, is (rounded to the nearest cent).

A)$2.73

B)$2.80

C)$2.69

D)$2.76

A)$2.73

B)$2.80

C)$2.69

D)$2.76

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

41

FGH had 5,000 common shares outstanding on December 31, 2013.An additional 1,000 common shares were issued on April 1, 2014, and 500 more on July 1, 2014.On October 1, 2014, FGH issued 10, $1,000 maturity value, 7 percent convertible bonds.Each bond is convertible into 40 common shares.No bonds were converted into common shares in 2014.What was the number of shares that should be used to compute basic earnings per share and diluted earnings per share, respectively, for the year ended December 31, 2014 (ignore anti-dilution)?

A)5,750 and 5,950 shares

B)6,000 and 6,100 shares

C)5,750 and 6,150 shares

D)6,000 and 6,400 shares

A)5,750 and 5,950 shares

B)6,000 and 6,100 shares

C)5,750 and 6,150 shares

D)6,000 and 6,400 shares

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

42

The classification of a security as a convertible security should be based on information available at the time:

A)The security would be the most anti-dilutive.

B)The security would be the most dilutive.

C)The EPS calculation is made each year.

D)The security is issued.

A)The security would be the most anti-dilutive.

B)The security would be the most dilutive.

C)The EPS calculation is made each year.

D)The security is issued.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

43

At December 31, 2013, GHI had 400 common shares outstanding.On October 1, 2014, an additional 100 common shares were issued.In addition, GHI had $40,000 of 8 percent, convertible bonds outstanding at December 31, 2013, which are convertible into 225 common shares.No bonds were converted into common shares in 2014.Net income for the year ended December 31, 2014, was $14,000.Assuming the income tax rate was 50 percent, the basic earnings per share for the year ended December 31, 2014, should be: (Rounded to the nearest cent)

A)$25.54

B)$36.71

C)$32.94

D)$24.00

A)$25.54

B)$36.71

C)$32.94

D)$24.00

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

44

A firm had 8,000 common shares outstanding at the end of the current period and earned $8,000 that period (net of tax).Also, options to purchase 5,000 shares at $5 each were outstanding all year.For the entire year the firm had $20,000 of 6% debt and $10,000 of 8% debt outstanding.The 8% debt is convertible into 500 common shares.The firm earns interest at 7 percent and has a 50 percent tax rate.The diluted earnings per share for the current year should be (rounded to the nearest cent):

A)$0.72

B)$1.00

C)$0.69

D)$0.65

A)$0.72

B)$1.00

C)$0.69

D)$0.65

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

45

At December 31, 2013, XYZ had 40,000 common shares issued and outstanding and 10,000 nonconvertible preferred shares issued and outstanding.XYZ's net income for the year ended December 31, 2014, was $120,000.During 2014, XYZ declared and paid $50,000 cash dividends on common and $8,000 cash dividends on the nonconvertible preferred (the annual requirement).There were no common share or preferred share transactions during the year.The earnings per common share for the year ended December 31, 2014, should be:

A)$1.75

B)$2.80

C)$3.00

D)$2.40

A)$1.75

B)$2.80

C)$3.00

D)$2.40

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

46

RST's net income for the year ended December 31, 2014, was $30,000.During 2014, RST declared and paid $3,000 cash dividends on preferred shares (the full year's requirement)and $5,250 cash dividends on common shares.At December 31, 2014, 36,000 common shares were issued and outstanding, 30,000 of which had been outstanding throughout the year and 6,000 of which were issued on July 1, 2014.No other common share transactions were completed during the year, and there is no potential dilution of earnings per share.The 2014 earnings per common share of RST, rounded to the nearest cent, should be:

A)$0.91.

B)$0.82.

C)$1.00.

D)$0.75.

A)$0.91.

B)$0.82.

C)$1.00.

D)$0.75.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

47

XYZ reported the following equity accounts on December 31 of this year:  Additional Information: (1)The Board of Directors declared a 10 percent stock dividend on all classes of shares o April 1, and issued these shares on August 1.

Additional Information: (1)The Board of Directors declared a 10 percent stock dividend on all classes of shares o April 1, and issued these shares on August 1.

(2)Income for the period was $88.

(3)There were no share transactions during the year, other than the stock dividend.

The basic earnings per share amount is: (Rounded to the nearest cent.)

A)$2.00.

B)$1.68.

C)$2.20.

D)$1.52.

E)There would not be a basic earnings per share figure for XYZ this year.

Additional Information: (1)The Board of Directors declared a 10 percent stock dividend on all classes of shares o April 1, and issued these shares on August 1.

Additional Information: (1)The Board of Directors declared a 10 percent stock dividend on all classes of shares o April 1, and issued these shares on August 1.(2)Income for the period was $88.

(3)There were no share transactions during the year, other than the stock dividend.

The basic earnings per share amount is: (Rounded to the nearest cent.)

A)$2.00.

B)$1.68.

C)$2.20.

D)$1.52.

E)There would not be a basic earnings per share figure for XYZ this year.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

48

In computing the weighted average number of shares outstanding, the following is considered outstanding only as of the date issued or sold:

A)Stock dividends.

B)Reverse stock splits.

C)Stock splits.

D)Common shares issued.

A)Stock dividends.

B)Reverse stock splits.

C)Stock splits.

D)Common shares issued.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

49

In computing EPS, convertible preferred shares may increase the number of shares outstanding:

A)Only in a complex capital structure, whether or not they have been converted.

B)In a simple capital structure, whether or not they have been converted.

C)In a complex capital structure and a simple capital structure, whether or not they have been.converted.

D)In a complex capital structure only if they have been converted.

A)Only in a complex capital structure, whether or not they have been converted.

B)In a simple capital structure, whether or not they have been converted.

C)In a complex capital structure and a simple capital structure, whether or not they have been.converted.

D)In a complex capital structure only if they have been converted.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

50

At December 31, 2014 and 2013, GHI had 90 common shares and 20 convertible preferred shares outstanding, in addition to 9% convertible bonds payable in the face amount of $4,000.During 2014, GHI paid dividends of $2.50 per share on the preferred shares (the annual requirement).The preferred shares are convertible into 20 common shares.The 9% convertible bonds are convertible into 30 common shares.Net income for 2014 was $1,940.Assume an income tax rate of 40%.The earnings per share amounts would be: (Rounded to the nearest cent)

A)Basic $21.56; diluted $15.40.

B)Basic $21.00; diluted $15.40.

C)Basic $21.56; diluted $15.76.

D)Basic $21.00; diluted $15.76.

A)Basic $21.56; diluted $15.40.

B)Basic $21.00; diluted $15.40.

C)Basic $21.56; diluted $15.76.

D)Basic $21.00; diluted $15.76.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

51

DCE had 900 common shares outstanding on January 1, 2014, issued 600 shares on May 1 and had income applicable to common shares of $5,200 for the year ending December 31, 2014.Earnings per common share for 2014 would be: (Rounded to the nearest cent)

A)$4.00

B)$3.60

C)$5.78

D)$3.46

A)$4.00

B)$3.60

C)$5.78

D)$3.46

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

52

When a company has negative net income and potentially dilutive securities, the calculation of EPS results in:

A)No EPS being reported.

B)Diluted EPS i.e.all potentially dilutive securities are included in the calculation (whether dilutive or anti-dilutive).

C)Diluted EPS being reported and it will be more than basic EPS.

D)None of these choices are correct.

A)No EPS being reported.

B)Diluted EPS i.e.all potentially dilutive securities are included in the calculation (whether dilutive or anti-dilutive).

C)Diluted EPS being reported and it will be more than basic EPS.

D)None of these choices are correct.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

53

Which one of the following organizations are required to disclose EPS?

A)Corporations that do not have share capital

B)Public corporations

C)Companies with few shareholders

D)Government-owned corporations

A)Corporations that do not have share capital

B)Public corporations

C)Companies with few shareholders

D)Government-owned corporations

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

54

Convertible noncumulative preferred stock for which the current year's dividend has not been declared does not affect the EPS figures if it:

A)Is a common convertible security.

B)Has been converted.

C)Is anti-dilutive.

D)None of these choices are correct.

A)Is a common convertible security.

B)Has been converted.

C)Is anti-dilutive.

D)None of these choices are correct.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

55

When computing diluted earnings per share, convertible securities are:

A)Incorporated into diluted EPS whether they are dilutive or anti-dilutive.

B)Incorporated into diluted EPS only if they are anti-dilutive.

C)Incorporated into diluted EPS only if they are dilutive.

D)Ignored for EPS purposes.

A)Incorporated into diluted EPS whether they are dilutive or anti-dilutive.

B)Incorporated into diluted EPS only if they are anti-dilutive.

C)Incorporated into diluted EPS only if they are dilutive.

D)Ignored for EPS purposes.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

56

Earnings per share is computed on the basis of:

A)The number of common and preferred shares outstanding at the end of the year.

B)A weighted average of the number of common shares outstanding during the year.

C)A weighted average of the number of preferred and common shares outstanding during the year.

D)The number of common shares outstanding at the end of the year.

A)The number of common and preferred shares outstanding at the end of the year.

B)A weighted average of the number of common shares outstanding during the year.

C)A weighted average of the number of preferred and common shares outstanding during the year.

D)The number of common shares outstanding at the end of the year.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

57

ABC Inc.began business on January 1, 2014.Due to difficulties in getting the business started, 30 common shares were issued on January 1, 2014 to the organizers and 15 additional shares were sold on that date.The company wanted the market to hear about the shares.Therefore, the following share transactions were implemented during the year 2014: February 1: 2 for 1 stock split

April 1: 10 percent stock dividend

August 1: 5 for 1 stock split

December 1: 2 for 1 reverse stock split

The weighted average number of shares outstanding for 2014 was: (Rounded to the nearest whole number)

A)146 shares.

B)248 shares.

C)180 shares.

D)64 shares.

April 1: 10 percent stock dividend

August 1: 5 for 1 stock split

December 1: 2 for 1 reverse stock split

The weighted average number of shares outstanding for 2014 was: (Rounded to the nearest whole number)

A)146 shares.

B)248 shares.

C)180 shares.

D)64 shares.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

58

In determining basic earnings per share, the annual dividend on convertible cumulative preferred shares, which are not a dilutive convertible security, should be:

A)Deducted from net income whether declared or not.

B)Added back to net income whether declared or not.

C)Disregarded.

D)Deducted from net income only if declared.

A)Deducted from net income whether declared or not.

B)Added back to net income whether declared or not.

C)Disregarded.

D)Deducted from net income only if declared.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

59

Jimbo Co.began operations Jan.1, 2014.The following events related to common stock took place on the indicated dates during 2014. Jan.1 Issued 5,000 common shares

Apr)1 Purchased 400 treasury shares May 1 Split 2-for-1

Aug)1 Issued 2,000 common shares Dec.1 Issued a 20% stock dividend

Assuming no potentially dilutive securities, what are the weighted average shares for EPS in 2014? (Do not round intermediate calculations.Round your final answer to nearest whole number.)

A)10,233 shares

B)6,640 shares

C)12,080 shares

D)12,280 shares

Apr)1 Purchased 400 treasury shares May 1 Split 2-for-1

Aug)1 Issued 2,000 common shares Dec.1 Issued a 20% stock dividend

Assuming no potentially dilutive securities, what are the weighted average shares for EPS in 2014? (Do not round intermediate calculations.Round your final answer to nearest whole number.)

A)10,233 shares

B)6,640 shares

C)12,080 shares

D)12,280 shares

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

60

At December 31, 2014, QRS had 500 common shares issued and outstanding, 400 of which had been issued and outstanding throughout the year and 100 of which were issued on October 1, 2014.Net income for the year ended December 31, 2014, was $4,288.What should be QRS's 2014 earnings per common share, rounded to the nearest cent?

A)$8.58

B)$10.72

C)$9.53

D)$10.09

A)$8.58

B)$10.72

C)$9.53

D)$10.09

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

61

A preferred dividend claim should be subtracted from income to compute basic EPS if the preferred shares are:

A)Participating, nonconvertible, noncumulative, and the dividend has not been declared.

B)Noncumulative, nonconvertible, non-participating, and the dividend has been declared.

C)Noncumulative, nonconvertible, and a dividend has not been declared; however, a dividend was paid this year in fulfillment of the obligation from last year's declaration.

D)Noncumulative, nonconvertible, and the company would like to declare a dividend; however, by law they can't because of a debit balance in the retained earnings account.

A)Participating, nonconvertible, noncumulative, and the dividend has not been declared.

B)Noncumulative, nonconvertible, non-participating, and the dividend has been declared.

C)Noncumulative, nonconvertible, and a dividend has not been declared; however, a dividend was paid this year in fulfillment of the obligation from last year's declaration.

D)Noncumulative, nonconvertible, and the company would like to declare a dividend; however, by law they can't because of a debit balance in the retained earnings account.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

62

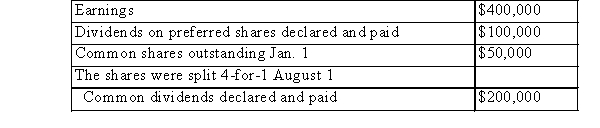

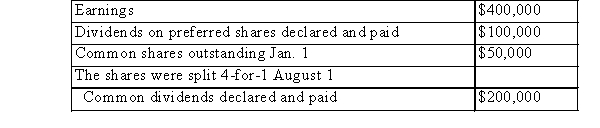

PPO Inc.discloses the following results and information at the end of the current year:  What are PPO's earnings per common share for the current year? (Rounded to the nearest cent.)

What are PPO's earnings per common share for the current year? (Rounded to the nearest cent.)

A)$6.00

B)$1.50

C)$2.00

D)$8.00

What are PPO's earnings per common share for the current year? (Rounded to the nearest cent.)

What are PPO's earnings per common share for the current year? (Rounded to the nearest cent.)A)$6.00

B)$1.50

C)$2.00

D)$8.00

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

63

Steps in calculating diluted EPS include the following except:

A)Determine if the options exercised were in-the-money and thus dilutive.

B)Identify options outstanding at the end of the period

C)Identify any convertible senior debt or shares that actually converted during the period.

D)Rank the items from the least dilutive to the most dilutive.

A)Determine if the options exercised were in-the-money and thus dilutive.

B)Identify options outstanding at the end of the period

C)Identify any convertible senior debt or shares that actually converted during the period.

D)Rank the items from the least dilutive to the most dilutive.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

64

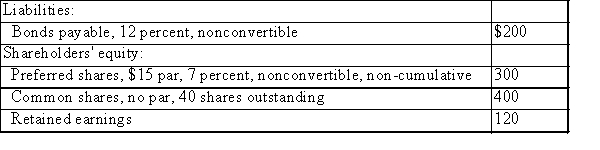

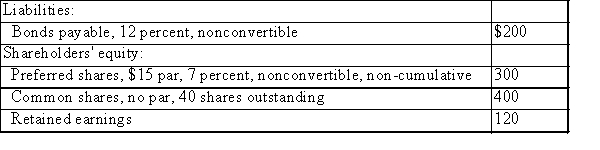

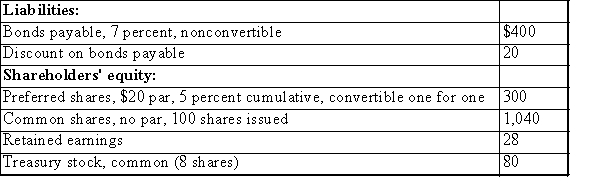

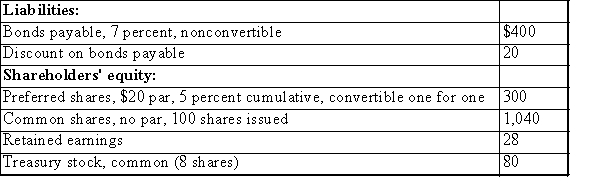

The balance sheet at the beginning of the current year for GHI Inc.reflected the following:  No transactions affecting the denominator of EPS occurred during the year.Assume the preferred shares are dilutive.The number of potential common shares to be included in th denominator of fully diluted EPS is:

No transactions affecting the denominator of EPS occurred during the year.Assume the preferred shares are dilutive.The number of potential common shares to be included in th denominator of fully diluted EPS is:

A)15.

B)14.

C)13.

D)0)

E)10.

No transactions affecting the denominator of EPS occurred during the year.Assume the preferred shares are dilutive.The number of potential common shares to be included in th denominator of fully diluted EPS is:

No transactions affecting the denominator of EPS occurred during the year.Assume the preferred shares are dilutive.The number of potential common shares to be included in th denominator of fully diluted EPS is:A)15.

B)14.

C)13.

D)0)

E)10.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

65

Earnings for a firm for the current year are $20,000 and the weighted average number of common shares before considering potentially dilutive securities is 18,000.The firm has no preferred shares but has 100, 8%, $1,000 convertible bonds which were issued at face value many years ago.Each bond is convertible into 50 common shares.The tax rate is 40%.Compute EPS to be reported for this firm.(Rounded to the nearest cent)

A)Basic EPS $1.11; diluted EPS $1.08.

B)Basic EPS $1.14; diluted EPS $1.11.

C)Basic EPS $1.11; diluted EPS $1.11.

D)Basic EPS $1.08; diluted EPS $1.08.

A)Basic EPS $1.11; diluted EPS $1.08.

B)Basic EPS $1.14; diluted EPS $1.11.

C)Basic EPS $1.11; diluted EPS $1.11.

D)Basic EPS $1.08; diluted EPS $1.08.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

66

Dilutive convertible securities must be used in the computation of:

A)Diluted and basic earnings per share.

B)Basic earnings per share.

C)Diluted earnings per share.

D)Dilutive convertible securities are not used in any computations of earnings per share.

A)Diluted and basic earnings per share.

B)Basic earnings per share.

C)Diluted earnings per share.

D)Dilutive convertible securities are not used in any computations of earnings per share.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

67

If net income is $25,000 and there were 18,000 common shares issued and outstanding the entire year, and 100 cumulative, nonconvertible, 6% $100 par preferred shares outstanding the entire year, what is EPS if no dividends were declared during the year.There are two years' dividends in arrears on the preferred shares.(Rounded to the nearest cent)

A)$1.18

B)$1.16

C)$1.25

D)$1.36

E)$1.39

A)$1.18

B)$1.16

C)$1.25

D)$1.36

E)$1.39

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

68

Anti-dilutive convertible securities would generally be used in the calculation of:

A)diluted earnings per share.

B)Neither basic earnings per share nor diluted earnings per share.

C)Basic earnings per share and diluted earnings per share.

D)Basic earnings per share.

A)diluted earnings per share.

B)Neither basic earnings per share nor diluted earnings per share.

C)Basic earnings per share and diluted earnings per share.

D)Basic earnings per share.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

69

A firm has 10,000 common shares outstanding on January 1 of the current year.The following events take place during the current year: May 1 issued 3,000 new common shares

June 30 purchased 4,000 shares for the treasury October 31 distributed a 20% stock dividend December 1 reissued the June 30 treasury stock

What is the weighted-average number of shares to be used for computing EPS? (Do not round intermediate calculations.Round your final answer to nearest whole number.)

A)14,133 shares

B)12,033 shares

C)10,000 shares

D)8,333 shares

June 30 purchased 4,000 shares for the treasury October 31 distributed a 20% stock dividend December 1 reissued the June 30 treasury stock

What is the weighted-average number of shares to be used for computing EPS? (Do not round intermediate calculations.Round your final answer to nearest whole number.)

A)14,133 shares

B)12,033 shares

C)10,000 shares

D)8,333 shares

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

70

In some cases, diluted earnings per share amounts may be the same as the basic earnings per share amounts.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

71

A company had 50,000 common shares and the following 3 convertible securities outstanding the entire year: 1.6%, $100 par cumulative preferred shares, 200 shares outstanding, each convertible int 5 common shares

2)200, 6% convertible bonds, face $1,000, each bond convertible into 40 common shares

3)2,000 stock options to purchase one common share each at $40.

The company earns interest at 6%.Its net income after tax income was $75,000.The tax rate is 40%.What is the diluted EPS (rounded to the nearest cent)?

A)$1.48

B)$1.40

C)$1.45

D)$1.39

2)200, 6% convertible bonds, face $1,000, each bond convertible into 40 common shares

3)2,000 stock options to purchase one common share each at $40.

The company earns interest at 6%.Its net income after tax income was $75,000.The tax rate is 40%.What is the diluted EPS (rounded to the nearest cent)?

A)$1.48

B)$1.40

C)$1.45

D)$1.39

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

72

The following information relates to the SPE company in 2014. Net income: $50,000

Common shares outstanding on January 1: 30,000

On June 30 issued 2,000 8% cumulative convertible preferred shares

$100 par, each convertible into 10 common shares Issued a 40% stock dividend on Sept.30

What is the diluted EPS? (Rounded to the nearest cent)

A)$1.00

B)$0.76

C)$0.81

D)$0.89

Common shares outstanding on January 1: 30,000

On June 30 issued 2,000 8% cumulative convertible preferred shares

$100 par, each convertible into 10 common shares Issued a 40% stock dividend on Sept.30

What is the diluted EPS? (Rounded to the nearest cent)

A)$1.00

B)$0.76

C)$0.81

D)$0.89

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

73

A company with a simple capital structure would include which of the following in the computation of earnings per share?

A)Dividends on nonconvertible cumulative preferred shares

B)Dividends on common shares

C)Convertible securities

D)Number of shares of nonconvertible cumulative preferred shares

A)Dividends on nonconvertible cumulative preferred shares

B)Dividends on common shares

C)Convertible securities

D)Number of shares of nonconvertible cumulative preferred shares

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

74

The 2014 net income of MNO was $300,000, and 100,000 of its common shares were outstanding during the entire year.In addition, outstanding options existed to purchase 10,000 common shares at $10 per share.These options were granted in 2012 and none had been exercised by December 31, 2014.MNO earned interest at 8% and had a 50% tax rate.The amount, which should be shown as MNO's basic earnings per share for 2014, is (rounded to the nearest cent):

A)$3.08

B)$2.96

C)$3.00

D)$3.04

A)$3.08

B)$2.96

C)$3.00

D)$3.04

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

75

Assume basic EPS has been determined.In determining the diluted earnings per share, the annual dividend on convertible cumulative preferred shares, which are a dilutive convertible security, should be:

A)Added back to the numerator of basic EPS whether declared or not.

B)Added back to the numerator of basic EPS only if declared.

C)Deducted from the numerator of basic EPS whether declared or not.

D)Disregarded.

A)Added back to the numerator of basic EPS whether declared or not.

B)Added back to the numerator of basic EPS only if declared.

C)Deducted from the numerator of basic EPS whether declared or not.

D)Disregarded.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

76

At December 31, 2013, GHI had 400 common shares outstanding.On October 1, 2014, an additional 100 common shares were issued.In addition, GHI had $40,000 of 8 percent, convertible bonds outstanding at December 31, 2013, which are convertible into 225 common shares.No bonds were converted into common shares in 2014.Net income for the year ended December 31, 2014, was $14,000.Assuming the income tax rate was 50 percent, the diluted earnings per share for the year ended December 31, 2014 should be (rounded to the nearest cent):

A)$25.54

B)$36.71

C)$32.94

D)$24.00

A)$25.54

B)$36.71

C)$32.94

D)$24.00

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

77

On January 1, 2014, WXY had stock warrants outstanding to purchase 6,000 shares at an option price of $10.The common shares' market price was $15 the entire year.The firm has 200,000 common shares outstanding at the end of the year.The effect of the warrants on EPS is to:

A)Affect the diluted EPS calculation, but not the basic EPS calculation.

B)Increase the denominator of all EPS calculations by 4,000 shares.

C)Increase the denominator of all EPS calculations by 6,000 shares.

D)Have no potentially dilutive effect on the EPS calculation.

E)Increase the denominator of all EPS calculations by 2,000 shares.

A)Affect the diluted EPS calculation, but not the basic EPS calculation.

B)Increase the denominator of all EPS calculations by 4,000 shares.

C)Increase the denominator of all EPS calculations by 6,000 shares.

D)Have no potentially dilutive effect on the EPS calculation.

E)Increase the denominator of all EPS calculations by 2,000 shares.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

78

What would be the effect on book value per share and earnings per share if the corporation purchased its own shares in the open market at a price greater than book value per share?

A)Decrease both book value per share and earnings per share

B)Decrease book value per share and increase earnings per share

C)Increase both book value per share and earnings per share

D)No effect on book value per share but increase earnings per share

A)Decrease both book value per share and earnings per share

B)Decrease book value per share and increase earnings per share

C)Increase both book value per share and earnings per share

D)No effect on book value per share but increase earnings per share

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

79

At December 31, 2013, BCD had 700 common shares outstanding.On September 1, 2014, an additional 300 common shares were issued.In addition, BCD had $20,000 of 8 percent, convertible bonds outstanding December 31, 2013, which are convertible into 400 common shares.No bonds were converted into common shares in 2014.Net income for the year ended December 31, 2014, was $6,000.Assuming the income tax rate was 50 percent, what should be the basic earnings per share for the year ended December 31, 2014?

A)$7.50

B)$4.33

C)$5.67

D)$5.00

A)$7.50

B)$4.33

C)$5.67

D)$5.00

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

80

When computing diluted earnings per share, convertible securities are:

A)Recognized only if they are anti-dilutive.

B)Recognized only if they are dilutive.

C)Recognized whether they are dilutive or anti-dilutive.

D)Ignored.

A)Recognized only if they are anti-dilutive.

B)Recognized only if they are dilutive.

C)Recognized whether they are dilutive or anti-dilutive.

D)Ignored.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck