Deck 10: Individuals: Determination of Taxable Income and Taxes Payable

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/9

Play

Full screen (f)

Deck 10: Individuals: Determination of Taxable Income and Taxes Payable

1

ABC. Ltd. had unused allowable capital losses of $20,000 during the current fiscal year and an unused business loss of $10,000. ABC Ltd. has a December 31 year-end. Which of the following statements is TRUE?

A)All of the losses will be lost if not used in this fiscal year.

B)The unused business loss will become a non-capital loss and can be carried back 3 years and forward indefinitely.

C)The unused allowable capital loss will become a net-capital loss and can be carried back 3 years and forward indefinitely, and the unused business loss will become a non-capital loss and can be carried back 3 years and forward twenty years.

D)The unused business loss will become a net-capital loss and can be carried back 3 years and forward indefinitely, and the unused allowable capital loss will become a non-capital loss and can be carried back 3 years and forward twenty years.

A)All of the losses will be lost if not used in this fiscal year.

B)The unused business loss will become a non-capital loss and can be carried back 3 years and forward indefinitely.

C)The unused allowable capital loss will become a net-capital loss and can be carried back 3 years and forward indefinitely, and the unused business loss will become a non-capital loss and can be carried back 3 years and forward twenty years.

D)The unused business loss will become a net-capital loss and can be carried back 3 years and forward indefinitely, and the unused allowable capital loss will become a non-capital loss and can be carried back 3 years and forward twenty years.

C

2

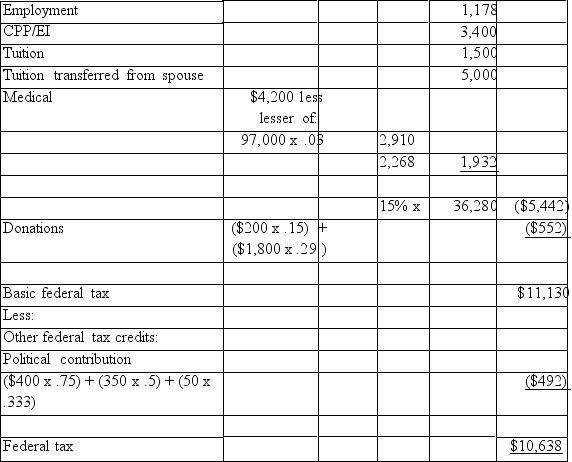

Theodore is 37 years old. He earns $97,000 in 20x7 at his job as a financial analyst. His CPP and EI contributions totaled $3,400. In 20x7 he enrolled in part-time studies at his local university. His

tuition fees totaled $1,500. Theodore donated $2,000 to Ducks Unlimited (a registered charity for tax purposes), and $800 to a federal political party. (Theodore has made annual contributions to

these organizations for the past five years.)He spent a total of $4,200 on eyeglasses, dental care, and prescriptions in 20x7, none of which was reimbursed. Theodore's wife did not work during 20x7, as she was enrolled in university as a nursing student. She had no other income. Her tuition fees were

$8,000. She always transfers as much of her tuition to Theodore as possible. Theodore has a $2,000 loss from 20x6. Theodore and his wife do not have any children.

Required:

A. Calculate Theodore's taxable income for 20x7

B. Calculate Theodore's federal tax liability for 20x7.

tuition fees totaled $1,500. Theodore donated $2,000 to Ducks Unlimited (a registered charity for tax purposes), and $800 to a federal political party. (Theodore has made annual contributions to

these organizations for the past five years.)He spent a total of $4,200 on eyeglasses, dental care, and prescriptions in 20x7, none of which was reimbursed. Theodore's wife did not work during 20x7, as she was enrolled in university as a nursing student. She had no other income. Her tuition fees were

$8,000. She always transfers as much of her tuition to Theodore as possible. Theodore has a $2,000 loss from 20x6. Theodore and his wife do not have any children.

Required:

A. Calculate Theodore's taxable income for 20x7

B. Calculate Theodore's federal tax liability for 20x7.

3

Which of the following is a requirement for a business to qualify as a 'qualified small business corporation'?

A)The shares must not have been owned by another non-related individual in the past 24 months.

B)The shares must not have been owned by another related individual in the past 24 months.

C)The corporation must be a CCPC that uses at least 50% of the fair market value its assets for active business purposes in Canada at the time the shares are sold.

D)More than fifty percent of the fair market value of the assets of the business must have been used for active business in the past 36 months.

A)The shares must not have been owned by another non-related individual in the past 24 months.

B)The shares must not have been owned by another related individual in the past 24 months.

C)The corporation must be a CCPC that uses at least 50% of the fair market value its assets for active business purposes in Canada at the time the shares are sold.

D)More than fifty percent of the fair market value of the assets of the business must have been used for active business in the past 36 months.

A

4

Samantha received an eligible dividend in the amount of $2,000. She is in a 50% tax bracket for regular income. How much is Samantha's dividend tax credit? (Assume a dividend tax credit rate of 15%.)

A)$2,760

B)$2,000

C)$1000

D)$414

A)$2,760

B)$2,000

C)$1000

D)$414

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

5

Stuart Planter is a full-time teacher, and lives in the country with his family. Stuart farms on a part-ti Stuart earned $85,000 in 20x6 at his full-time teaching job. During 20x6 he also incurred farm expen totaling $12,000 and farm revenues totaling $8,000.

Stuart has asked you to help him prepare his 20x6 tax return for the year, and provides you with the f additional information:

· Net capital losses from 20x5 totaled $10,000, and non-capital losses from 20x5 totaled $2,000.

· Stuart had the following amounts deducted from his pay during the year: CPP and EI of $3,400; an tax of $19,000.

· Stuart contributed $5,000 to his TFSA, and $15,000 to a guaranteed investment certificate (GIC)w pays 4% annual interest. His first interest receipt for the GIC will be on June 30th of 20x7.

· Stuart received a $1,000 non-eligible dividend in 20x6.

· Stuart's wife works full-time and earns $68,000 a year.

· Stuart had extensive dental work done in 20x6. The total cost was $7,500 and Stuart did not receive reimbursement for the cost.

Required:

A)Calculate Stuart's net income for tax purposes for 20x6 in accordance with Section 3 of the Incom

Act.

B)Calculate Stuart's taxable income for 20x6.

Calculate Stuart's minimum federal tax liability for 20x6. (Round all numbers to zero decimal places

B)Explain why any items have been omitted.

Stuart has asked you to help him prepare his 20x6 tax return for the year, and provides you with the f additional information:

· Net capital losses from 20x5 totaled $10,000, and non-capital losses from 20x5 totaled $2,000.

· Stuart had the following amounts deducted from his pay during the year: CPP and EI of $3,400; an tax of $19,000.

· Stuart contributed $5,000 to his TFSA, and $15,000 to a guaranteed investment certificate (GIC)w pays 4% annual interest. His first interest receipt for the GIC will be on June 30th of 20x7.

· Stuart received a $1,000 non-eligible dividend in 20x6.

· Stuart's wife works full-time and earns $68,000 a year.

· Stuart had extensive dental work done in 20x6. The total cost was $7,500 and Stuart did not receive reimbursement for the cost.

Required:

A)Calculate Stuart's net income for tax purposes for 20x6 in accordance with Section 3 of the Incom

Act.

B)Calculate Stuart's taxable income for 20x6.

Calculate Stuart's minimum federal tax liability for 20x6. (Round all numbers to zero decimal places

B)Explain why any items have been omitted.

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

6

Archie Smith works full-time as a dentist and is in a 50% tax bracket. He lives on an acreage and he began a part-time farming operation last year (20x1). During 20x1, Archie incurred farm expenses

totaling $38,500 and he received $5,200 in farming revenue. Operations became more profitable this year, however, and in 20x2 Archie's farm revenues were $20,000 and expenses totaled $16,000.

Required:

a)What type of loss was Archie able to recognize in 20x1? Briefly explain your answer.

b)Calculate the loss that Archie was able to apply against his other sources of income in 20x1.

c)What effect will the 20x1 operations have on the 20x2 and future year's taxable income? Show yo calculations.

totaling $38,500 and he received $5,200 in farming revenue. Operations became more profitable this year, however, and in 20x2 Archie's farm revenues were $20,000 and expenses totaled $16,000.

Required:

a)What type of loss was Archie able to recognize in 20x1? Briefly explain your answer.

b)Calculate the loss that Archie was able to apply against his other sources of income in 20x1.

c)What effect will the 20x1 operations have on the 20x2 and future year's taxable income? Show yo calculations.

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is an accurate list of some of the personal federal non-refundable tax credits available to reduce the federal tax liability?

A)Pension credit, volunteer firefighter credit, stock option credit, donation credit

B)Canada caregiver for adult relative credit, Canada employment credit, medical expense credit, disability (mental or physical impairment)credit

C)Tuition credit, adoption expense credit, farm credit, pension credit

D)Dividend tax credit, non-capital loss credit, donation credit, age credit

A)Pension credit, volunteer firefighter credit, stock option credit, donation credit

B)Canada caregiver for adult relative credit, Canada employment credit, medical expense credit, disability (mental or physical impairment)credit

C)Tuition credit, adoption expense credit, farm credit, pension credit

D)Dividend tax credit, non-capital loss credit, donation credit, age credit

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

8

Sally earned $210,000 during 20x4. She also received eligible dividends in the amount of $10,000. S

piece of land during the year and recognized a capital gain of $500,000. Sally is married. Her husban

$100,000 during the year.

Required:

A)Calculate Sally's taxable income and her federal tax liability before the deduction of any allowabl non-refundable tax credits for 1)the normal method, and 2)the alternative minimum tax.

B)Identify which method from A and B above would allow for a deduction of the non-refundable di credit?

C)Which method will Sally be required to use in 20x4, and why? How much will is her federal tax

piece of land during the year and recognized a capital gain of $500,000. Sally is married. Her husban

$100,000 during the year.

Required:

A)Calculate Sally's taxable income and her federal tax liability before the deduction of any allowabl non-refundable tax credits for 1)the normal method, and 2)the alternative minimum tax.

B)Identify which method from A and B above would allow for a deduction of the non-refundable di credit?

C)Which method will Sally be required to use in 20x4, and why? How much will is her federal tax

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is FALSE with respect to the final tax returns of deceased taxpayers?

A)Of the tax returns available for a deceased taxpayer, only the final tax return must be filed.

B)Non-refundable tax credits are prorated to the date of death on the final tax return.

C)A Rights or Things return may be filed in addition to the final tax return.

D)Unused net capital losses less any capital gains deductions previously claimed are deductible against any income.

A)Of the tax returns available for a deceased taxpayer, only the final tax return must be filed.

B)Non-refundable tax credits are prorated to the date of death on the final tax return.

C)A Rights or Things return may be filed in addition to the final tax return.

D)Unused net capital losses less any capital gains deductions previously claimed are deductible against any income.

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck