Deck 5: Income From Business

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/8

Play

Full screen (f)

Deck 5: Income From Business

1

TriStar Industries was recently denied the deduction of the life insurance premiums on the life insurance policies of its key executives on its annual tax return. Which of the following general limitations to business profit determination best describes the reason for the Canada Revenue Agency's decision?

A)insurance proceeds exemption

B)personal-expense test

C)reserve test

D)exempt-income test

A)insurance proceeds exemption

B)personal-expense test

C)reserve test

D)exempt-income test

D

2

Sam runs a proprietorship that generated $75,000 in profits in 20x0. Included in these profits are: a)$10,000 - amortization expense; b)$5,000 - reasonable bad debt expense;

C)$55,000 - cost of goods sold; and $8,000 - meals and entertainment with clients. Sam's capital cost allowance has been accurately calculated at $8,500 for the year. How much is Sam's business net income for tax purposes?

A)$80,500

B)$75,000

C)$73,500

D)$89,000

C)$55,000 - cost of goods sold; and $8,000 - meals and entertainment with clients. Sam's capital cost allowance has been accurately calculated at $8,500 for the year. How much is Sam's business net income for tax purposes?

A)$80,500

B)$75,000

C)$73,500

D)$89,000

A

3

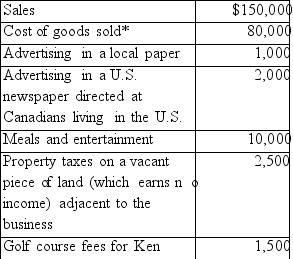

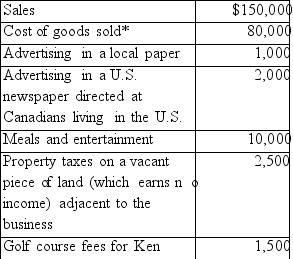

Ken Gray runs a small proprietorship (Ken's Fish)which specializes in fishing gear. He has provided the following information:

(*All inventory is valued at market value.)Required:

(*All inventory is valued at market value.)Required:

A)Calculate the net income for tax purposes for Ken's Fish.

A)would change if Ken had valued his inventory at cost.

B)Explain why any items have been omitted.

C)Briefly discuss how your answer in

(*All inventory is valued at market value.)Required:

(*All inventory is valued at market value.)Required: A)Calculate the net income for tax purposes for Ken's Fish.

A)would change if Ken had valued his inventory at cost.

B)Explain why any items have been omitted.

C)Briefly discuss how your answer in

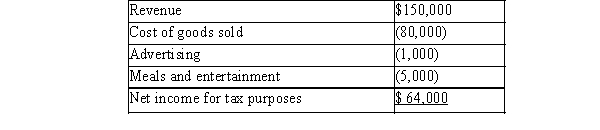

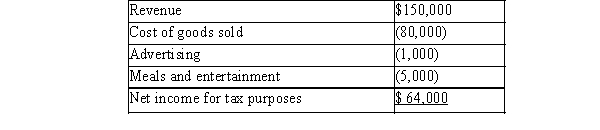

A)  B)Omitted items:

B)Omitted items:

· Advertising in an American newspaper is not deductible when the targeted market is Canadia

· Half of the meals and entertainment are not deductible. S 67.1

· Property taxes on vacant land is only deductible to the extent that income is earned. S.18(2), ( amount can be added to the cost base of the land.

· Recreational fees are not permitted as deductions. S.18(1)(l)

· The convention is not within the territorial scope of the organization hosting the conference, t it is not an allowable deduction. S.20(10)

C)The Income Tax Act requires that inventories be valued at either:

B)Omitted items:

B)Omitted items:· Advertising in an American newspaper is not deductible when the targeted market is Canadia

· Half of the meals and entertainment are not deductible. S 67.1

· Property taxes on vacant land is only deductible to the extent that income is earned. S.18(2), ( amount can be added to the cost base of the land.

· Recreational fees are not permitted as deductions. S.18(1)(l)

· The convention is not within the territorial scope of the organization hosting the conference, t it is not an allowable deduction. S.20(10)

C)The Income Tax Act requires that inventories be valued at either:

4

Which of the following expenses would be denied as a deduction as per the provisions of the Canadian Income Tax Act?

A)Work space in a home used as a taxpayer's principal place of business.

B)Legal and accounting fees incurred during the construction of a building.

C)Maintenance fees on a yacht at Yellow Yacht Leasing Inc.

D)Advertising costs in a non-Canadian newspaper directed at an American market.

A)Work space in a home used as a taxpayer's principal place of business.

B)Legal and accounting fees incurred during the construction of a building.

C)Maintenance fees on a yacht at Yellow Yacht Leasing Inc.

D)Advertising costs in a non-Canadian newspaper directed at an American market.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

5

A taxpayer recognized a $40,000 loss in 20x5 from her small farm (which was a secondary activity to her full-time job as a dentist). What is the maximum deduction that would be allowed from the farm loss for the 20x5 tax year?

A)$21,250.

B)$17,500.

C)$0

D)$40,000.

A)$21,250.

B)$17,500.

C)$0

D)$40,000.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

6

List the six general limitations to business profit determination and give an example for three of the items

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

7

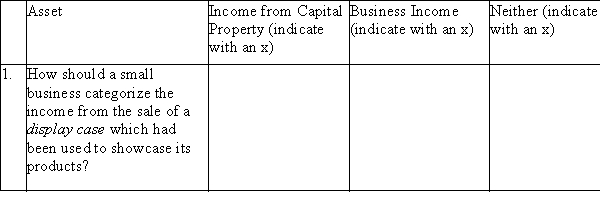

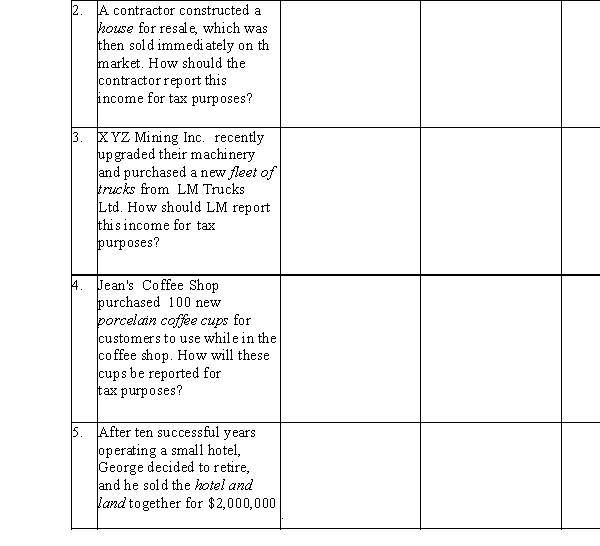

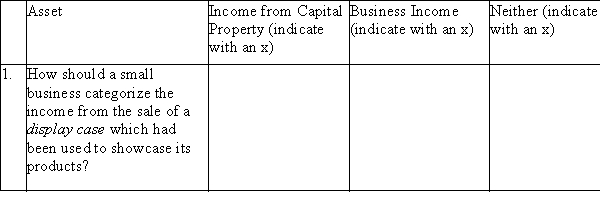

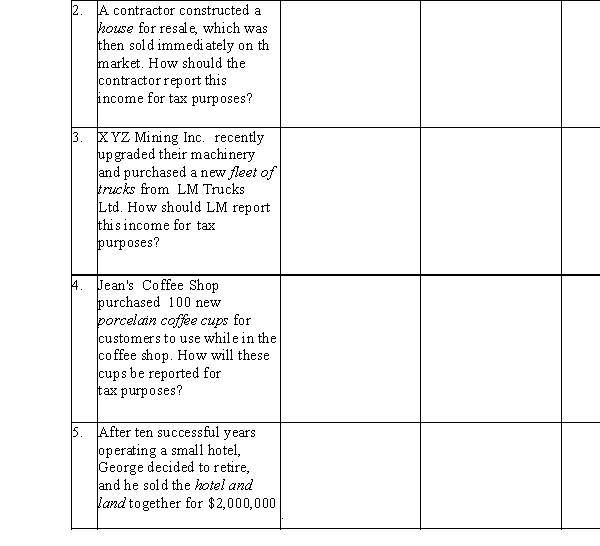

Determine whether the transactions concerning the following assets (shown in italics)would be

classified as a)income from capital for tax purposes, b)business income for tax purposes, or c)neith and briefly explain the reason for your decision. 2. A contractor constructed a

2. A contractor constructed a

classified as a)income from capital for tax purposes, b)business income for tax purposes, or c)neith and briefly explain the reason for your decision.

2. A contractor constructed a

2. A contractor constructed a

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

8

Joe invested in a piece of land seven years ago when real estate prices were rising in his area, and he hoped that the land would double in value within five years. The land remained vacant and was only used in 20x0 when Joe was approached by a businessman to rent the land for two weeks for a local carnival for a fee of $1,000. It is now 20x2 and Joe has been offered a significant sum of money for his land in response to an

Advertisement he placed in a local newspaper. Based on Joe's primary intention for the land, the gain on the sale would be classified as

A)business income.

B)property income.

C)exempt income.

D)a capital gain.

Advertisement he placed in a local newspaper. Based on Joe's primary intention for the land, the gain on the sale would be classified as

A)business income.

B)property income.

C)exempt income.

D)a capital gain.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck