Deck 12: Accounting for Partnerships

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/153

Play

Full screen (f)

Deck 12: Accounting for Partnerships

1

A partner pays income tax on the amount of money he or she withdrew from the partnership during the year.

False

2

All provinces in Canada have a Partnership Act that sets out the basic rules for the forming and operating of partnerships.

True

3

When assets are rolled into a partnership, the value that they are allocated in the partnership is the same as the value in the previous entity.

False

4

In a limited partnership, the amount of debt that a partner is liable for is the amount of capital that they have contributed to the partnership.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

5

A partnership is more difficult to form than a corporation.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

6

A partnership is NOT an accounting entity for financial reporting purposes.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

7

Two proprietorships CANNOT combine and form a partnership.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

8

In a limited liability partnership, all the partners have limited liability for the debts of the partnership.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

9

Because of the unlimited liability of partners in a partnership, it is easier for a partnership to gain large amounts of investment capital.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

10

When a partner exceeds his or her authority and the act looks appropriate for the partnership, the act is NOT binding on the other partners and the partnership.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

11

A partnership is taxed as a single legal entity.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

12

A partnership has unlimited life.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

13

A partnership may be based on a handshake.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

14

When a long-lived asset is contributed to a partnership by a partner, the entry will record the fair value of the asset and the accumulated depreciation which has accumulated on it.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

15

A partnership is a relationship between people who do business with the intention of making a profit.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

16

A partnership must have a legal written agreement.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

17

Mutual agency means that each partner acts for the partnership when he or she does partnership business.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

18

A partnership must make a profit.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

19

Each partner is jointly and severally liable for only their portion of the partnership liabilities.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

20

A corporation is subject to less government restrictions than a partnership.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

21

Salaries to partners and interest on partner's capital balances are expenses of the partnership.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

22

Partnership profit or loss must be divided equally in a partnership.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

23

When accounts receivable are contributed to a partnership, they are valued at their expected realizable value.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

24

A bonus to the departing partner may be paid if the fair value of the partnership assets is less than their carrying amount.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

25

When profit is allocated in a 2:1 ratio, it means that one partner will get 2/3 of the profit.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

26

Partners are NEVER allocated a salary in a partnership.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

27

The admission of a new partner may result in a bonus to the existing partners.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

28

When a partner withdraws from a partnership, asset revaluations should be recorded for the remaining assets in the partnership.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

29

A partner may only withdraw from a partnership on a voluntary basis.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

30

The admission of a new partner may result in a bonus to the new partner from the existing partners.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

31

When profit is allocated in a 3:2:1 ratio, it means that one partner will get 50% of the profit.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

32

The departing partner may have to pay a bonus to the partnership if the remaining partners are anxious to remove the partner.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

33

Partnership profit or loss must be divided according to the formulas which are outlined in the partnership agreement.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

34

If a new partner is purchasing the interests of an existing partner, the purchase price passes directly from the new partner to the old partner and does NOT flow through the partnership.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

35

On the financial statement of a partnership, a separate statement of the division of partnership profit or loss is prepared.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

36

In the withdrawal of a partner, a payment from the partnership assets will affect only the remaining partners' personal assets.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

37

A withdrawal of a partner may result in a payment from remaining partners personal assets.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

38

A profit allocation in a partnership may be allocated in a different ratio than a loss allocation.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

39

A partner may receive interest on their partnership account.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

40

A detailed listing of all the assets invested by a partner in a partnership appears on the Statement of Partners' Equity.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following statements is true regarding the form of a legally binding partnership contract?

A) The partnership contract must be in writing.

B) The partnership contract may be based on a handshake.

C) The partnership contract may be implied.

D) The partnership contract cannot be oral.

A) The partnership contract must be in writing.

B) The partnership contract may be based on a handshake.

C) The partnership contract may be implied.

D) The partnership contract cannot be oral.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

42

The partner in a limited partnership that has unlimited liability is referred to as the

A) lead partner.

B) head partner.

C) general partner.

D) unlimited partner.

A) lead partner.

B) head partner.

C) general partner.

D) unlimited partner.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

43

A partnership

A) is an association of one or more individuals.

B) pays income tax on partnership profit.

C) has a limited life.

D) is not an accounting entity for financial reporting purposes.

A) is an association of one or more individuals.

B) pays income tax on partnership profit.

C) has a limited life.

D) is not an accounting entity for financial reporting purposes.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

44

No capital deficiency means that all partners have credit balances prior to the final distribution of cash.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

45

At the death of a partner, the partnership is dissolved.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

46

A general partner in a limited partnership

A) has unlimited liability for all partnership debts.

B) is always the general manager of the firm.

C) is the partner who lacks a specialization.

D) is liable for partnership liabilities only to the extent of that partner's capital equity.

A) has unlimited liability for all partnership debts.

B) is always the general manager of the firm.

C) is the partner who lacks a specialization.

D) is liable for partnership liabilities only to the extent of that partner's capital equity.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

47

If a partnership is dissolved, an asset does NOT legally return to the partner who originally contributed it.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

48

In a partnership, mutual agency means

A) each partner acts on his own behalf when engaging in partnership business.

B) the act of any partner is binding on all other partners, only if partners act within their scope of authority.

C) an act by a partner is judged as binding on other partners depending on whether the act appears to be appropriate for the partnership.

D) that partners are mutually respectful of each other.

A) each partner acts on his own behalf when engaging in partnership business.

B) the act of any partner is binding on all other partners, only if partners act within their scope of authority.

C) an act by a partner is judged as binding on other partners depending on whether the act appears to be appropriate for the partnership.

D) that partners are mutually respectful of each other.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

49

A bonus to a departing partner maybe paid if there is unrecorded goodwill resulting from the partnership's superior earnings record.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following statements is true regarding a partnership?

A) A partnership is taxed as a separate entity.

B) Only professionals, such as doctors and lawyers may form a partnership.

C) A partnership must file an information return that reports the partnership profit and the partners' share in that profit.

D) A partner's income tax is based on the amount of money the partner withdrew from the partnership during the year.

A) A partnership is taxed as a separate entity.

B) Only professionals, such as doctors and lawyers may form a partnership.

C) A partnership must file an information return that reports the partnership profit and the partners' share in that profit.

D) A partner's income tax is based on the amount of money the partner withdrew from the partnership during the year.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

51

Limited partnerships

A) must have at least one general partner.

B) guarantee that a partner will receive a return.

C) guarantee that a partner will get back his original investment.

D) are only permitted in Ontario.

A) must have at least one general partner.

B) guarantee that a partner will receive a return.

C) guarantee that a partner will get back his original investment.

D) are only permitted in Ontario.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

52

The individual assets invested by a partner in a partnership

A) revert back to that partner if the partnership liquidates.

B) determine that partner's share of profit or loss for the year.

C) are jointly owned by all partners.

D) determine the scope of authority of that partner.

A) revert back to that partner if the partnership liquidates.

B) determine that partner's share of profit or loss for the year.

C) are jointly owned by all partners.

D) determine the scope of authority of that partner.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

53

A bonus to the remaining partners may be paid if the recorded assets are overvalued.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

54

Which one of the following would NOT be considered a disadvantage of the partnership form of organization?

A) limited life

B) unlimited liability

C) mutual agency

D) ease of formation

A) limited life

B) unlimited liability

C) mutual agency

D) ease of formation

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

55

A partnership agreement generally contains all of the following EXCEPT

A) the names and capital contributions of all the partners.

B) the expected life of the partnership.

C) the rights and duties of all partners.

D) the basis for sharing profit or loss among the partners.

A) the names and capital contributions of all the partners.

B) the expected life of the partnership.

C) the rights and duties of all partners.

D) the basis for sharing profit or loss among the partners.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following is NOT a principal characteristic of the partnership form of business organization?

A) mutual agency

B) association of individuals

C) limited liability

D) limited life

A) mutual agency

B) association of individuals

C) limited liability

D) limited life

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

57

The procedures for withdrawal of a partner from a partnership must be specified in the partnership agreement.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following statements about a partnership is correct?

A) The personal assets of a partner are included in the partnership accounting records.

B) A partnership is required to file an income tax return.

C) Each partner's share of profit is taxable to the partnership.

D) A partnership represents an accounting entity for financial reporting purposes.

A) The personal assets of a partner are included in the partnership accounting records.

B) A partnership is required to file an income tax return.

C) Each partner's share of profit is taxable to the partnership.

D) A partnership represents an accounting entity for financial reporting purposes.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

59

A limited liability partnership is designed to

A) protect innocent partners from the negligent acts of employees working on behalf of the partners.

B) ensure all partners get an equal share of partnership earnings.

C) allow partners to enter into several different partnerships simultaneously.

D) protect partners from the negligence claims resulting from the acts of other partners.

A) protect innocent partners from the negligent acts of employees working on behalf of the partners.

B) ensure all partners get an equal share of partnership earnings.

C) allow partners to enter into several different partnerships simultaneously.

D) protect partners from the negligence claims resulting from the acts of other partners.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

60

The liquidation of a partnership is done to ensure that the fair value of the remaining assets is recorded accurately.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

61

The partnership of Ezekiel and Gibbons reports profit of $30,000. The partners share equally in profit and losses. The entry to record the partners' share of profit will include a

A) credit to Income Summary for $30,000.

B) credit to Ezekiel, Capital for $15,000.

C) debit to Gibbons, Capital for $15,000.

D) credit to Ezekiel, Drawings for $15,000.

A) credit to Income Summary for $30,000.

B) credit to Ezekiel, Capital for $15,000.

C) debit to Gibbons, Capital for $15,000.

D) credit to Ezekiel, Drawings for $15,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following is NOT an advantage of the partnership form of business?

A) mutual agency

B) ease of formation

C) ease of decision making

D) freedom from governmental regulations and restrictions

A) mutual agency

B) ease of formation

C) ease of decision making

D) freedom from governmental regulations and restrictions

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following statements is INCORRECT regarding partnership agreements?

A) Common law provinces are governed by the Partnership Act.

B) Oral agreements are preferable to written articles.

C) It should specify the different relationships that are to exist among the partners.

D) It should state procedures for submitting disputes to arbitration.

A) Common law provinces are governed by the Partnership Act.

B) Oral agreements are preferable to written articles.

C) It should specify the different relationships that are to exist among the partners.

D) It should state procedures for submitting disputes to arbitration.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

64

In a limited liability partnership, a partner has unlimited liability

A) for the negligent acts of the other partners.

B) for only his or her share of capital contributed.

C) for the actions of employees whom they directly supervise and control.

D) only during the first 5 years of the partnership.

A) for the negligent acts of the other partners.

B) for only his or her share of capital contributed.

C) for the actions of employees whom they directly supervise and control.

D) only during the first 5 years of the partnership.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

65

The Cliff and Saha partnership agreement stipulates that profits and losses will be shared equally after salary allowances of $80,000 for Cliff and $40,000 for Saha. At the beginning of the year, Cliff's capital account had a balance of $80,000, while Saha's capital account had a balance of $70,000. Profit for the year was $100,000. The balance of Saha's capital account at the end of the year after closing is

A) $70,000.

B) $40,000.

C) $120,000.

D) $100,000.

A) $70,000.

B) $40,000.

C) $120,000.

D) $100,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

66

Partnerships are sometime publicly accountable enterprises and these entities must follow

A) ASPE.

B) IFRS.

C) partnership accounting standards.

D) public sector accounting standards.

A) ASPE.

B) IFRS.

C) partnership accounting standards.

D) public sector accounting standards.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

67

O'Brien is investing in a partnership with Skanes. O'Brien contributes equipment that originally cost $21,000, has a carrying amount of $14,000, and a fair value of $16,000. The entry that the partnership makes to record O'Brien's initial contribution includes a

A) debit to Equipment for $14,000.

B) debit to Equipment for $21,000.

C) debit to Equipment for $16,000.

D) credit to Accumulated Depreciation for $7,000.

A) debit to Equipment for $14,000.

B) debit to Equipment for $21,000.

C) debit to Equipment for $16,000.

D) credit to Accumulated Depreciation for $7,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

68

At the end of December 2013, Rod Clarke, a partner in Boyde-Clarke Company, had a balance in his drawings account of $18,000. Rod's capital account at the beginning of 2013 was $80,000. $5,000 of partnership profit was allocated to Rod in 2013. The entry to close Rod's drawings account at the end of 2013 would include a

A) debit to Income Summary for $18,000.

B) credit to Clarke, Capital for $13,000.

C) debit to Clarke, Capital for $18,000.

D) credit to Clarke, Capital for $5,000.

A) debit to Income Summary for $18,000.

B) credit to Clarke, Capital for $13,000.

C) debit to Clarke, Capital for $18,000.

D) credit to Clarke, Capital for $5,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

69

There are three accounting issues where there are some differences between partnerships and proprietorships. Which one of the following is NOT a difference?

A) private partnerships may follow ASPE

B) formation of a partnership

C) preparing partnership financial statements

D) dividing the partnership profit and loss

A) private partnerships may follow ASPE

B) formation of a partnership

C) preparing partnership financial statements

D) dividing the partnership profit and loss

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

70

Each partner's initial non-cash investment in the partnership should be recorded at the

A) fair value of the assets at the date of their transfer into the business.

B) fair value of the assets at the date the partnership begins operations.

C) original cost of the assets at the time they were purchased by the contributing partner.

D) carrying amount of the assets at the date of their transfer into the partnership.

A) fair value of the assets at the date of their transfer into the business.

B) fair value of the assets at the date the partnership begins operations.

C) original cost of the assets at the time they were purchased by the contributing partner.

D) carrying amount of the assets at the date of their transfer into the partnership.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

71

If division of profits in a partnership is NOT specified, profit (loss) is assumed to be

A) allocated to general partners first.

B) allocated based on capital contribution.

C) held within the partnership.

D) allocated equally.

A) allocated to general partners first.

B) allocated based on capital contribution.

C) held within the partnership.

D) allocated equally.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

72

A partner contributes, as part of her initial investment, accounts receivable with an allowance for doubtful accounts. Which of the following reflects a proper treatment?

A) The allowance for doubtful accounts should be recorded at its fair value.

B) The allowance account may be set up on the books of the partnership because it relates to the existing accounts that are being contributed.

C) The allowance account should not be carried onto the books of the partnership.

D) The accounts receivable and allowance should not be recorded on the books of the partnership because a partner must invest cash in the business.

A) The allowance for doubtful accounts should be recorded at its fair value.

B) The allowance account may be set up on the books of the partnership because it relates to the existing accounts that are being contributed.

C) The allowance account should not be carried onto the books of the partnership.

D) The accounts receivable and allowance should not be recorded on the books of the partnership because a partner must invest cash in the business.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

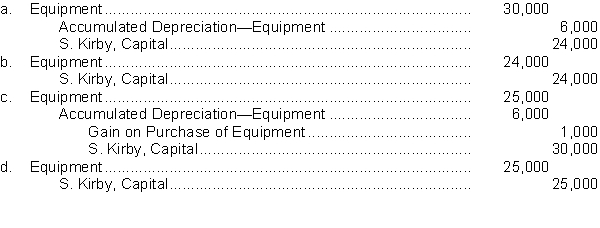

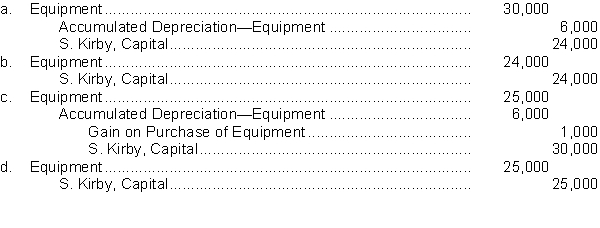

73

Sam Kirby invests personally owned equipment, which originally cost $30,000 and has accumulated depreciation of $6,000 in the Kirby and Gosse partnership. Both partners agree that the fair value of the equipment was $25,000. The entry made by the partnership to record Kirby's investment should be

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following statements about partnerships is INCORRECT?

A) Partnership assets are co-owned by partners.

B) If a partnership is terminated, the assets do not legally revert to the original contributor.

C) If the partnership agreement does not specify the manner in which profit is to be shared, it is distributed according to capital contributions.

D) Each partner has a claim on assets equal to the balance in the partner's capital account.

A) Partnership assets are co-owned by partners.

B) If a partnership is terminated, the assets do not legally revert to the original contributor.

C) If the partnership agreement does not specify the manner in which profit is to be shared, it is distributed according to capital contributions.

D) Each partner has a claim on assets equal to the balance in the partner's capital account.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

75

All of the following are correct EXCEPT

A) a partnership is a legal entity.

B) the partnership can sue or be sued.

C) the personal assets, liability and transactions of the partners are recorded in the partnership.

D) the partnership must file an information tax return.

A) a partnership is a legal entity.

B) the partnership can sue or be sued.

C) the personal assets, liability and transactions of the partners are recorded in the partnership.

D) the partnership must file an information tax return.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

76

A profit ratio based on capital balances might be appropriate when

A) service is a primary consideration.

B) some, but not all, partners plan to work in the business.

C) funds invested in the partnership are considered the critical factor.

D) little profit is expected.

A) service is a primary consideration.

B) some, but not all, partners plan to work in the business.

C) funds invested in the partnership are considered the critical factor.

D) little profit is expected.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

77

Ms. Drew, Mr. Fraser and Ms. Percy had a 1:2:3 partnership split on profit in their partnership. In 2014, the partnership had a profit of $150,000. How much would Ms. Drew receive as her share of the profit?

A) $15,000

B) $50,000

C) $75,000

D) $25,000

A) $15,000

B) $50,000

C) $75,000

D) $25,000

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

78

Use the following information for questions 80-81.

The profit of the Miskell and Leblanc partnership is $30,000. The partnership agreement specifies that Miskell and Leblanc have a salary allowance of $8,000 and $12,000, respectively. The partnership agreement also specifies an interest allowance of 10% on capital balances at the beginning of the year. Each partner had a beginning capital balance of $20,000. Any remaining profit or loss is shared equally.

What is Miskell's share of the $30,000 profit?

A) $8,000

B) $10,000

C) $11,000

D) $13,000

The profit of the Miskell and Leblanc partnership is $30,000. The partnership agreement specifies that Miskell and Leblanc have a salary allowance of $8,000 and $12,000, respectively. The partnership agreement also specifies an interest allowance of 10% on capital balances at the beginning of the year. Each partner had a beginning capital balance of $20,000. Any remaining profit or loss is shared equally.

What is Miskell's share of the $30,000 profit?

A) $8,000

B) $10,000

C) $11,000

D) $13,000

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

79

Ms. Manchester, Mr. Robertson, and Ms. Allison formed a partnership with a 4:2:1 partnership on profit. Mr. Robertson will receive what percentage of the profit at the end of the year?

A) 20%

B) 33%

C) 50%

D) 29%

A) 20%

B) 33%

C) 50%

D) 29%

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

80

Partner A receives $60,000 and Partner B receives $40,000 in a split of $100,000 profit. Which expression does NOT reflect the profit splitting arrangement?

A) 3:2

B) 3/5 and 2/5

C) 6:4

D) 2:1

A) 3:2

B) 3/5 and 2/5

C) 6:4

D) 2:1

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck