Deck 11: Spreadsheet Modeling and Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/60

Play

Full screen (f)

Deck 11: Spreadsheet Modeling and Analysis

1

Which of the following formulas would be used to calculate earnings before taxes?

A) =B15-B16+B6

B) =B15-B5

C) =B15-B16

D) =B17-B10

A) =B15-B16+B6

B) =B15-B5

C) =B15-B16

D) =B17-B10

=B17-B10

2

Use the table below to answer the following questions).

Dresden Pharmaceuticals has decided to go ahead and start clinical trials on a potential new drug. The total R&D costs are estimated to reach around $875,000,000 with clinical trials mounting to

$145,000,000. The current market size is estimated to be around 3,000,000 and is expected to grow at 4 percent every year. The market share Dresden hopes to capture in the first year is 7 percent, and is projected to grow by 25 percent each year for the next 4 years. A monthly

prescription is anticipated to generate revenue of $420 while incurring variable costs of $150. A discount rate of 8 percent is assumed.

-Calculate cumulative net profit at the fourth year.

A) $1,073,538,462

B) $3,189,634,800

C) $1,312,041,240

D) $1,494,838,800

Dresden Pharmaceuticals has decided to go ahead and start clinical trials on a potential new drug. The total R&D costs are estimated to reach around $875,000,000 with clinical trials mounting to

$145,000,000. The current market size is estimated to be around 3,000,000 and is expected to grow at 4 percent every year. The market share Dresden hopes to capture in the first year is 7 percent, and is projected to grow by 25 percent each year for the next 4 years. A monthly

prescription is anticipated to generate revenue of $420 while incurring variable costs of $150. A discount rate of 8 percent is assumed.

-Calculate cumulative net profit at the fourth year.

A) $1,073,538,462

B) $3,189,634,800

C) $1,312,041,240

D) $1,494,838,800

$3,189,634,800

3

Use the table below to answer the following questions).

Dresden Pharmaceuticals has decided to go ahead and start clinical trials on a potential new drug. The total R&D costs are estimated to reach around $875,000,000 with clinical trials mounting to

$145,000,000. The current market size is estimated to be around 3,000,000 and is expected to grow at 4 percent every year. The market share Dresden hopes to capture in the first year is 7 percent, and is projected to grow by 25 percent each year for the next 4 years. A monthly

prescription is anticipated to generate revenue of $420 while incurring variable costs of $150. A discount rate of 8 percent is assumed.

-Calculate the annual cost incurred for the second year.

A) $1,224,120,000

B) $884,520,000

C) $491,400,000

D) $638,820,000

Dresden Pharmaceuticals has decided to go ahead and start clinical trials on a potential new drug. The total R&D costs are estimated to reach around $875,000,000 with clinical trials mounting to

$145,000,000. The current market size is estimated to be around 3,000,000 and is expected to grow at 4 percent every year. The market share Dresden hopes to capture in the first year is 7 percent, and is projected to grow by 25 percent each year for the next 4 years. A monthly

prescription is anticipated to generate revenue of $420 while incurring variable costs of $150. A discount rate of 8 percent is assumed.

-Calculate the annual cost incurred for the second year.

A) $1,224,120,000

B) $884,520,000

C) $491,400,000

D) $638,820,000

$491,400,000

4

Use the table below to answer the following questions).

Dresden Pharmaceuticals has decided to go ahead and start clinical trials on a potential new drug. The total R&D costs are estimated to reach around $875,000,000 with clinical trials mounting to

$145,000,000. The current market size is estimated to be around 3,000,000 and is expected to grow at 4 percent every year. The market share Dresden hopes to capture in the first year is 7 percent, and is projected to grow by 25 percent each year for the next 4 years. A monthly

prescription is anticipated to generate revenue of $420 while incurring variable costs of $150. A discount rate of 8 percent is assumed.

-Calculate the market size for the second year.

A) 3,000,000

B) 273,000

C) 3,244,800

D) 3,120,000

Dresden Pharmaceuticals has decided to go ahead and start clinical trials on a potential new drug. The total R&D costs are estimated to reach around $875,000,000 with clinical trials mounting to

$145,000,000. The current market size is estimated to be around 3,000,000 and is expected to grow at 4 percent every year. The market share Dresden hopes to capture in the first year is 7 percent, and is projected to grow by 25 percent each year for the next 4 years. A monthly

prescription is anticipated to generate revenue of $420 while incurring variable costs of $150. A discount rate of 8 percent is assumed.

-Calculate the market size for the second year.

A) 3,000,000

B) 273,000

C) 3,244,800

D) 3,120,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following formulas would be used to calculate the net income value using only the information in the Model, and not in the Data section?

A) =B5-B17

B) =B6-B15

C) =B15-B16-B17+B18

D) =B18-B11

A) =B5-B17

B) =B6-B15

C) =B15-B16-B17+B18

D) =B18-B11

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

6

Use the table below to answer the following questions).

Dresden Pharmaceuticals has decided to go ahead and start clinical trials on a potential new drug. The total R&D costs are estimated to reach around $875,000,000 with clinical trials mounting to

$145,000,000. The current market size is estimated to be around 3,000,000 and is expected to grow at 4 percent every year. The market share Dresden hopes to capture in the first year is 7 percent, and is projected to grow by 25 percent each year for the next 4 years. A monthly

prescription is anticipated to generate revenue of $420 while incurring variable costs of $150. A discount rate of 8 percent is assumed.

-Calculate the net present value for Dresden's new drug.

A) $1,312,041,240

B) $339,600,000)

C) $3,702,463,939

D) $932,028,690)

Dresden Pharmaceuticals has decided to go ahead and start clinical trials on a potential new drug. The total R&D costs are estimated to reach around $875,000,000 with clinical trials mounting to

$145,000,000. The current market size is estimated to be around 3,000,000 and is expected to grow at 4 percent every year. The market share Dresden hopes to capture in the first year is 7 percent, and is projected to grow by 25 percent each year for the next 4 years. A monthly

prescription is anticipated to generate revenue of $420 while incurring variable costs of $150. A discount rate of 8 percent is assumed.

-Calculate the net present value for Dresden's new drug.

A) $1,312,041,240

B) $339,600,000)

C) $3,702,463,939

D) $932,028,690)

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following would be used to calculate the gross profit?

A) =SUMB7:B11)-B6

B) =B5-B6

C) =B5-B6-B11)

D) =B5-B6+B11-B10)

A) =SUMB7:B11)-B6

B) =B5-B6

C) =B5-B6-B11)

D) =B5-B6+B11-B10)

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

8

Use the table below to answer the following questions).

Dresden Pharmaceuticals has decided to go ahead and start clinical trials on a potential new drug. The total R&D costs are estimated to reach around $875,000,000 with clinical trials mounting to

$145,000,000. The current market size is estimated to be around 3,000,000 and is expected to grow at 4 percent every year. The market share Dresden hopes to capture in the first year is 7 percent, and is projected to grow by 25 percent each year for the next 4 years. A monthly

prescription is anticipated to generate revenue of $420 while incurring variable costs of $150. A discount rate of 8 percent is assumed.

-Calculate the projected profit for the third year.

A) $31,315,200

B) $2,373,996,000

C) $1,149,876,000

D) $1,494,838,800

Dresden Pharmaceuticals has decided to go ahead and start clinical trials on a potential new drug. The total R&D costs are estimated to reach around $875,000,000 with clinical trials mounting to

$145,000,000. The current market size is estimated to be around 3,000,000 and is expected to grow at 4 percent every year. The market share Dresden hopes to capture in the first year is 7 percent, and is projected to grow by 25 percent each year for the next 4 years. A monthly

prescription is anticipated to generate revenue of $420 while incurring variable costs of $150. A discount rate of 8 percent is assumed.

-Calculate the projected profit for the third year.

A) $31,315,200

B) $2,373,996,000

C) $1,149,876,000

D) $1,494,838,800

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

9

Use the table below to answer the following questions).

Dresden Pharmaceuticals has decided to go ahead and start clinical trials on a potential new drug. The total R&D costs are estimated to reach around $875,000,000 with clinical trials mounting to

$145,000,000. The current market size is estimated to be around 3,000,000 and is expected to grow at 4 percent every year. The market share Dresden hopes to capture in the first year is 7 percent, and is projected to grow by 25 percent each year for the next 4 years. A monthly

prescription is anticipated to generate revenue of $420 while incurring variable costs of $150. A discount rate of 8 percent is assumed.

-Calculate the projected sales for the first year.

A) 273,000

B) 210,000

C) 378,000,000

D) 268,230

Dresden Pharmaceuticals has decided to go ahead and start clinical trials on a potential new drug. The total R&D costs are estimated to reach around $875,000,000 with clinical trials mounting to

$145,000,000. The current market size is estimated to be around 3,000,000 and is expected to grow at 4 percent every year. The market share Dresden hopes to capture in the first year is 7 percent, and is projected to grow by 25 percent each year for the next 4 years. A monthly

prescription is anticipated to generate revenue of $420 while incurring variable costs of $150. A discount rate of 8 percent is assumed.

-Calculate the projected sales for the first year.

A) 273,000

B) 210,000

C) 378,000,000

D) 268,230

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

10

Use the table below to answer the following questions).

Dresden Pharmaceuticals has decided to go ahead and start clinical trials on a potential new drug. The total R&D costs are estimated to reach around $875,000,000 with clinical trials mounting to

$145,000,000. The current market size is estimated to be around 3,000,000 and is expected to grow at 4 percent every year. The market share Dresden hopes to capture in the first year is 7 percent, and is projected to grow by 25 percent each year for the next 4 years. A monthly

prescription is anticipated to generate revenue of $420 while incurring variable costs of $150. A discount rate of 8 percent is assumed.

-Calculate the annual revenue for the fourth year.

A) $ 2,325,304,800

B) $830,466,000

C) $1,494,838,800

D) $1,149,876,000

Dresden Pharmaceuticals has decided to go ahead and start clinical trials on a potential new drug. The total R&D costs are estimated to reach around $875,000,000 with clinical trials mounting to

$145,000,000. The current market size is estimated to be around 3,000,000 and is expected to grow at 4 percent every year. The market share Dresden hopes to capture in the first year is 7 percent, and is projected to grow by 25 percent each year for the next 4 years. A monthly

prescription is anticipated to generate revenue of $420 while incurring variable costs of $150. A discount rate of 8 percent is assumed.

-Calculate the annual revenue for the fourth year.

A) $ 2,325,304,800

B) $830,466,000

C) $1,494,838,800

D) $1,149,876,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

11

Use the table below to answer the following questions).

Below is the profit model spreadsheet for the Lazarus Shoe Company producing their latest model of shoes for the month of January.

-Calculate the revenue for units sold.

A) $836,000

B) $1,136,000

C) $600,000

D) $1,786,000

Below is the profit model spreadsheet for the Lazarus Shoe Company producing their latest model of shoes for the month of January.

-Calculate the revenue for units sold.

A) $836,000

B) $1,136,000

C) $600,000

D) $1,786,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is necessary to calculate the variable cost of production for the company to develop a profit model?

A) unit sale price

B) quantity of item produced

C) quantity of item sold

D) fixed cost of production

A) unit sale price

B) quantity of item produced

C) quantity of item sold

D) fixed cost of production

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

13

Troista Mobile Accessories sells mobile apps on their Web site. If a customer spends on average, $12 per visit and visits the Web site 20 times each year, what is the average nondiscounted gross profit during a customer's lifetime? Given that Troista makes a margin of 60 percent on the average bill, with 25 percent of customers not returning each year.

A) $30

B) $75

C) $360

D) $576

A) $30

B) $75

C) $360

D) $576

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following formulas would be used to calculate the operating expenses?

A) =SUMB7:B10)

B) =SUMB7:B9)

C) =SUMB7:B9)-B6

D) =SUMB7:10)-B11

A) =SUMB7:B10)

B) =SUMB7:B9)

C) =SUMB7:B9)-B6

D) =SUMB7:10)-B11

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

15

Use the table below to answer the following questions).

Below is the profit model spreadsheet for the Lazarus Shoe Company producing their latest model of shoes for the month of January.

-Calculate the variable cost of production.

A) $1,786,000

B) $836,000

C) $600,000

D) $1,436,000

Below is the profit model spreadsheet for the Lazarus Shoe Company producing their latest model of shoes for the month of January.

-Calculate the variable cost of production.

A) $1,786,000

B) $836,000

C) $600,000

D) $1,436,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

16

Use the table below to answer the following questions).

Below is the profit model spreadsheet for the Lazarus Shoe Company producing their latest model of shoes for the month of January.

-Calculate the total profit.

A) $600,000

B) $1,436,000

C) $836,000

D) $1,786,000

Below is the profit model spreadsheet for the Lazarus Shoe Company producing their latest model of shoes for the month of January.

-Calculate the total profit.

A) $600,000

B) $1,436,000

C) $836,000

D) $1,786,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

17

Use the table below to answer the following questions).

Dresden Pharmaceuticals has decided to go ahead and start clinical trials on a potential new drug. The total R&D costs are estimated to reach around $875,000,000 with clinical trials mounting to

$145,000,000. The current market size is estimated to be around 3,000,000 and is expected to grow at 4 percent every year. The market share Dresden hopes to capture in the first year is 7 percent, and is projected to grow by 25 percent each year for the next 4 years. A monthly

prescription is anticipated to generate revenue of $420 while incurring variable costs of $150. A discount rate of 8 percent is assumed.

-Calculate the market share percentage in the third year.

A) 25 percent

B) 4 percent

C) 11 percent

D) 7 percent

Dresden Pharmaceuticals has decided to go ahead and start clinical trials on a potential new drug. The total R&D costs are estimated to reach around $875,000,000 with clinical trials mounting to

$145,000,000. The current market size is estimated to be around 3,000,000 and is expected to grow at 4 percent every year. The market share Dresden hopes to capture in the first year is 7 percent, and is projected to grow by 25 percent each year for the next 4 years. A monthly

prescription is anticipated to generate revenue of $420 while incurring variable costs of $150. A discount rate of 8 percent is assumed.

-Calculate the market share percentage in the third year.

A) 25 percent

B) 4 percent

C) 11 percent

D) 7 percent

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following formulas would be used to calculate the net income value using only the data value?

A) =SUMB5:B10)-B11

B) =SUMB5:B11)

C) =B5-SUMB6:B11)

D) =B5-SUMB6:B10)+B11

A) =SUMB5:B10)-B11

B) =SUMB5:B11)

C) =B5-SUMB6:B11)

D) =B5-SUMB6:B10)+B11

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

19

In which of the following ways does demand influence profit?

A) It predicts how many units will be sold.

B) It directly influences the fixed cost of production.

C) It helps in reducing the variable cost of production.

D) It reduces the unit cost of production.

A) It predicts how many units will be sold.

B) It directly influences the fixed cost of production.

C) It helps in reducing the variable cost of production.

D) It reduces the unit cost of production.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following formulas would be used to calculate the net operating income?

A) =B15-B5

B) =B15-B16

C) =SUMB6:B10)-B11

D) =B15-B16+B6

A) =B15-B5

B) =B15-B16

C) =SUMB6:B10)-B11

D) =B15-B16+B6

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

21

Calculate the economic value of a loyal customer for a company given that the customer purchases, on an average, worth $43 per visit and comes three times a year. The company's gross profit margin is 35 per cent with a customer defection rate of 0.4.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

22

Use the table below to answer the following questions).

Sheila joined Simsin Tradings at the age of 36 with a starting salary of $75,000. She expects a salary increase of 5 percent every year. Her retirement plan requires her to pay 9 percent of her salary, while the company matches it at 32 percent. She expects an annual return of 7 percent on her retirement portfolio. Using a predictive model for Sheila's first five years, calculate the following, assuming that the salary increases at the same rate every year, and the return of interest does not change.

-Calculate the employer contribution in Sheila's fourth year at Simsin.

A) $546.98

B) $703.26

C) $2,500.47

D) $2,160

Sheila joined Simsin Tradings at the age of 36 with a starting salary of $75,000. She expects a salary increase of 5 percent every year. Her retirement plan requires her to pay 9 percent of her salary, while the company matches it at 32 percent. She expects an annual return of 7 percent on her retirement portfolio. Using a predictive model for Sheila's first five years, calculate the following, assuming that the salary increases at the same rate every year, and the return of interest does not change.

-Calculate the employer contribution in Sheila's fourth year at Simsin.

A) $546.98

B) $703.26

C) $2,500.47

D) $2,160

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

23

Use the table below to answer the following questions).

Sheila joined Simsin Tradings at the age of 36 with a starting salary of $75,000. She expects a salary increase of 5 percent every year. Her retirement plan requires her to pay 9 percent of her salary, while the company matches it at 32 percent. She expects an annual return of 7 percent on her retirement portfolio. Using a predictive model for Sheila's first five years, calculate the following, assuming that the salary increases at the same rate every year, and the return of interest does not change.

-What will be Sheila's salary in her second year of work at Simsin?

A) $81,750

B) $82,688

C) $78,750

D) $ 75,000

Sheila joined Simsin Tradings at the age of 36 with a starting salary of $75,000. She expects a salary increase of 5 percent every year. Her retirement plan requires her to pay 9 percent of her salary, while the company matches it at 32 percent. She expects an annual return of 7 percent on her retirement portfolio. Using a predictive model for Sheila's first five years, calculate the following, assuming that the salary increases at the same rate every year, and the return of interest does not change.

-What will be Sheila's salary in her second year of work at Simsin?

A) $81,750

B) $82,688

C) $78,750

D) $ 75,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

24

Use the table below to answer the following questions).

Sheila joined Simsin Tradings at the age of 36 with a starting salary of $75,000. She expects a salary increase of 5 percent every year. Her retirement plan requires her to pay 9 percent of her salary, while the company matches it at 32 percent. She expects an annual return of 7 percent on her retirement portfolio. Using a predictive model for Sheila's first five years, calculate the following, assuming that the salary increases at the same rate every year, and the return of interest does not change.

-What's the total retirement balance when Sheila has reached the age of 40 while working with Simsin?

A) $108,374.54

B) $56,253.36

C) $53,627.87

D) $91,163

Sheila joined Simsin Tradings at the age of 36 with a starting salary of $75,000. She expects a salary increase of 5 percent every year. Her retirement plan requires her to pay 9 percent of her salary, while the company matches it at 32 percent. She expects an annual return of 7 percent on her retirement portfolio. Using a predictive model for Sheila's first five years, calculate the following, assuming that the salary increases at the same rate every year, and the return of interest does not change.

-What's the total retirement balance when Sheila has reached the age of 40 while working with Simsin?

A) $108,374.54

B) $56,253.36

C) $53,627.87

D) $91,163

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

25

Use the table below to answer the following questions).

Dresden Pharmaceuticals has decided to go ahead and start clinical trials on a potential new drug. The total R&D costs are estimated to reach around $875,000,000 with clinical trials mounting to

$145,000,000. The current market size is estimated to be around 3,000,000 and is expected to grow at 4 percent every year. The market share Dresden hopes to capture in the first year is 7 percent, and is projected to grow by 25 percent each year for the next 4 years. A monthly

prescription is anticipated to generate revenue of $420 while incurring variable costs of $150. A discount rate of 8 percent is assumed.

-Which of the following years shows the first profit for Dresden's new drug?

A) first year

B) second year

C) third year

D) fourth year

Dresden Pharmaceuticals has decided to go ahead and start clinical trials on a potential new drug. The total R&D costs are estimated to reach around $875,000,000 with clinical trials mounting to

$145,000,000. The current market size is estimated to be around 3,000,000 and is expected to grow at 4 percent every year. The market share Dresden hopes to capture in the first year is 7 percent, and is projected to grow by 25 percent each year for the next 4 years. A monthly

prescription is anticipated to generate revenue of $420 while incurring variable costs of $150. A discount rate of 8 percent is assumed.

-Which of the following years shows the first profit for Dresden's new drug?

A) first year

B) second year

C) third year

D) fourth year

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

26

Use the table below to answer the following questions).

Below is a room overbooking model spreadsheet for the Metza, a hotel chain. The hotel has 425 rooms priced at $180 per day each, and is usually fully booked. Reservations can be cancelled any time before 5:00 p.m. with no penalty. The hotel estimates an average overbooking cost of

$150. Customer demand is set at 400 with an average cancellation of 20.

-Which of the following is the excel formula used to estimate overbooked customers?

A) =MIN0,B5-B15)

B) =MAX0,B15-B5)

C) =MAXB11,B12)

D) =MINB11-B12,B11-B14)

Below is a room overbooking model spreadsheet for the Metza, a hotel chain. The hotel has 425 rooms priced at $180 per day each, and is usually fully booked. Reservations can be cancelled any time before 5:00 p.m. with no penalty. The hotel estimates an average overbooking cost of

$150. Customer demand is set at 400 with an average cancellation of 20.

-Which of the following is the excel formula used to estimate overbooked customers?

A) =MIN0,B5-B15)

B) =MAX0,B15-B5)

C) =MAXB11,B12)

D) =MINB11-B12,B11-B14)

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

27

Use the table below to answer the following questions).

In the spreadsheet below, there is data on the price, cost, demand, and quantity produced for an item. There are also different "what if" values that can help a manager to calculate costs and revenue with variability in demand.

-From the "what if" values, calculate the total cost when demand is 40,000.

A) " 2,000,"00

B) $1,925,000

C) $1,100,000

D) $75,000

In the spreadsheet below, there is data on the price, cost, demand, and quantity produced for an item. There are also different "what if" values that can help a manager to calculate costs and revenue with variability in demand.

-From the "what if" values, calculate the total cost when demand is 40,000.

A) " 2,000,"00

B) $1,925,000

C) $1,100,000

D) $75,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

28

Gruten Retailers sells Mother's Day special greeting cards at their store at $6. They make the cards for a dollar apiece. Most of the cards are sold by Mother's Day, but the actual demand is unknown. They have orders for 120 cards. In the past, they have had sales of at least 100 cards by Mother's Day. The remaining cards are sold at a 40 percent discount. Calculate the net profit, if demand, D, is set at 110 units.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

29

Use the table below to answer the following questions).

Below is a room overbooking model spreadsheet for the Metza, a hotel chain. The hotel has 425 rooms priced at $180 per day each, and is usually fully booked. Reservations can be cancelled any time before 5:00 p.m. with no penalty. The hotel estimates an average overbooking cost of

$150. Customer demand is set at 400 with an average cancellation of 20.

-Calculate the customer arrivals at the Metza.

A) 425

B) 405

C) 400

D) 380

Below is a room overbooking model spreadsheet for the Metza, a hotel chain. The hotel has 425 rooms priced at $180 per day each, and is usually fully booked. Reservations can be cancelled any time before 5:00 p.m. with no penalty. The hotel estimates an average overbooking cost of

$150. Customer demand is set at 400 with an average cancellation of 20.

-Calculate the customer arrivals at the Metza.

A) 425

B) 405

C) 400

D) 380

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

30

Use the table below to answer the following questions).

Sujito Electronix makes headphones for $22 and sells them for $32. Sujito has sold at least 50 headphones on average per week in the past, though the actual demand is unknown. Sujito has also often run short of supply in the past. After three months of release, the headphones are sold at 40 percent discount. The spreadsheet below shows Sujito's sales and demand for the headphones. We take demand at 51, and quantity produced at 55.

-Calculate the net profit for the headphones.

A) $586.8

B) $498.8

C) $1653.8

D) $466.8

Sujito Electronix makes headphones for $22 and sells them for $32. Sujito has sold at least 50 headphones on average per week in the past, though the actual demand is unknown. Sujito has also often run short of supply in the past. After three months of release, the headphones are sold at 40 percent discount. The spreadsheet below shows Sujito's sales and demand for the headphones. We take demand at 51, and quantity produced at 55.

-Calculate the net profit for the headphones.

A) $586.8

B) $498.8

C) $1653.8

D) $466.8

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

31

Use the table below to answer the following questions).

Dresden Pharmaceuticals has decided to go ahead and start clinical trials on a potential new drug. The total R&D costs are estimated to reach around $875,000,000 with clinical trials mounting to

$145,000,000. The current market size is estimated to be around 3,000,000 and is expected to grow at 4 percent every year. The market share Dresden hopes to capture in the first year is 7 percent, and is projected to grow by 25 percent each year for the next 4 years. A monthly

prescription is anticipated to generate revenue of $420 while incurring variable costs of $150. A discount rate of 8 percent is assumed.

-Which of the following conditions is the optimal solution to the newsvendor problem, where Q is the quantity to be purchased, and D is demand?

A) Q > D

B) Q = D

C) D > Q

D) Q / D = 0

Dresden Pharmaceuticals has decided to go ahead and start clinical trials on a potential new drug. The total R&D costs are estimated to reach around $875,000,000 with clinical trials mounting to

$145,000,000. The current market size is estimated to be around 3,000,000 and is expected to grow at 4 percent every year. The market share Dresden hopes to capture in the first year is 7 percent, and is projected to grow by 25 percent each year for the next 4 years. A monthly

prescription is anticipated to generate revenue of $420 while incurring variable costs of $150. A discount rate of 8 percent is assumed.

-Which of the following conditions is the optimal solution to the newsvendor problem, where Q is the quantity to be purchased, and D is demand?

A) Q > D

B) Q = D

C) D > Q

D) Q / D = 0

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

32

Use the table below to answer the following questions).

In the spreadsheet below, there is data on the price, cost, demand, and quantity produced for an item. There are also different "what if" values that can help a manager to calculate costs and revenue with variability in demand.

-Calculate the variable cost when the demand is 60,000 units.

A) $1,430,000

B) $1,375,000

C) $2,750,000

D) $1,320,000

In the spreadsheet below, there is data on the price, cost, demand, and quantity produced for an item. There are also different "what if" values that can help a manager to calculate costs and revenue with variability in demand.

-Calculate the variable cost when the demand is 60,000 units.

A) $1,430,000

B) $1,375,000

C) $2,750,000

D) $1,320,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

33

Use the table below to answer the following questions).

In the spreadsheet below, there is data on the price, cost, demand, and quantity produced for an item. There are also different "what if" values that can help a manager to calculate costs and revenue with variability in demand.

-Calculate the total revenue when the quantity produced is 55,000 and demand is 60,000.

A) $1,375,000

B) $1,320,000)

C) $1,430,000

D) $2,750,000

In the spreadsheet below, there is data on the price, cost, demand, and quantity produced for an item. There are also different "what if" values that can help a manager to calculate costs and revenue with variability in demand.

-Calculate the total revenue when the quantity produced is 55,000 and demand is 60,000.

A) $1,375,000

B) $1,320,000)

C) $1,430,000

D) $2,750,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

34

Use the table below to answer the following questions).

In the spreadsheet below, there is data on the price, cost, demand, and quantity produced for an item. There are also different "what if" values that can help a manager to calculate costs and revenue with variability in demand.

-From the "what if" values, calculate the total profit when the demand is 20,00".

A) $8"5,000

B) $1,000,000

C) $1,100,000

D) $925,000)

In the spreadsheet below, there is data on the price, cost, demand, and quantity produced for an item. There are also different "what if" values that can help a manager to calculate costs and revenue with variability in demand.

-From the "what if" values, calculate the total profit when the demand is 20,00".

A) $8"5,000

B) $1,000,000

C) $1,100,000

D) $925,000)

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

35

Use the table below to answer the following questions).

Below is a room overbooking model spreadsheet for the Metza, a hotel chain. The hotel has 425 rooms priced at $180 per day each, and is usually fully booked. Reservations can be cancelled any time before 5:00 p.m. with no penalty. The hotel estimates an average overbooking cost of

$150. Customer demand is set at 400 with an average cancellation of 20.

-Calculate the net revenue.

A) $72,900

B) $76,500

C) $64,650

D) $68,400

Below is a room overbooking model spreadsheet for the Metza, a hotel chain. The hotel has 425 rooms priced at $180 per day each, and is usually fully booked. Reservations can be cancelled any time before 5:00 p.m. with no penalty. The hotel estimates an average overbooking cost of

$150. Customer demand is set at 400 with an average cancellation of 20.

-Calculate the net revenue.

A) $72,900

B) $76,500

C) $64,650

D) $68,400

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

36

Use the table below to answer the following questions).

Sujito Electronix makes headphones for $22 and sells them for $32. Sujito has sold at least 50 headphones on average per week in the past, though the actual demand is unknown. Sujito has also often run short of supply in the past. After three months of release, the headphones are sold at 40 percent discount. The spreadsheet below shows Sujito's sales and demand for the headphones. We take demand at 51, and quantity produced at 55.

-Which of the following is the value for quantity sold?

A) 51

B) 50

C) 4

D) 55

Sujito Electronix makes headphones for $22 and sells them for $32. Sujito has sold at least 50 headphones on average per week in the past, though the actual demand is unknown. Sujito has also often run short of supply in the past. After three months of release, the headphones are sold at 40 percent discount. The spreadsheet below shows Sujito's sales and demand for the headphones. We take demand at 51, and quantity produced at 55.

-Which of the following is the value for quantity sold?

A) 51

B) 50

C) 4

D) 55

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

37

Use the table below to answer the following questions).

In the spreadsheet below, there is data on the price, cost, demand, and quantity produced for an item. There are also different "what if" values that can help a manager to calculate costs and revenue with variability in demand.

-From the "what if" values, calculate the revenue if the demand is 60,000 units.

A) $2,750,000

B) $825,000

C) $75,000

D) $1,375,000

In the spreadsheet below, there is data on the price, cost, demand, and quantity produced for an item. There are also different "what if" values that can help a manager to calculate costs and revenue with variability in demand.

-From the "what if" values, calculate the revenue if the demand is 60,000 units.

A) $2,750,000

B) $825,000

C) $75,000

D) $1,375,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

38

Use the table below to answer the following questions).

Sheila joined Simsin Tradings at the age of 36 with a starting salary of $75,000. She expects a salary increase of 5 percent every year. Her retirement plan requires her to pay 9 percent of her salary, while the company matches it at 32 percent. She expects an annual return of 7 percent on her retirement portfolio. Using a predictive model for Sheila's first five years, calculate the following, assuming that the salary increases at the same rate every year, and the return of interest does not change.

-What will be the amount of employee contribution to retirement plan when Sheila has reached the age of 38?

A) $7,441.88

B) $7,813.97

C) $24,450

D) $2381.40

Sheila joined Simsin Tradings at the age of 36 with a starting salary of $75,000. She expects a salary increase of 5 percent every year. Her retirement plan requires her to pay 9 percent of her salary, while the company matches it at 32 percent. She expects an annual return of 7 percent on her retirement portfolio. Using a predictive model for Sheila's first five years, calculate the following, assuming that the salary increases at the same rate every year, and the return of interest does not change.

-What will be the amount of employee contribution to retirement plan when Sheila has reached the age of 38?

A) $7,441.88

B) $7,813.97

C) $24,450

D) $2381.40

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

39

Use the table below to answer the following questions).

In the spreadsheet below, there is data on the price, cost, demand, and quantity produced for an item. There are also different "what if" values that can help a manager to calculate costs and revenue with variability in demand.

-From the "what if" values, calculate the net profit when the demand is 65,000.

A) $825,000

B) $1,650,000

C) $800,000

D) $925,000

In the spreadsheet below, there is data on the price, cost, demand, and quantity produced for an item. There are also different "what if" values that can help a manager to calculate costs and revenue with variability in demand.

-From the "what if" values, calculate the net profit when the demand is 65,000.

A) $825,000

B) $1,650,000

C) $800,000

D) $925,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

40

Use the table below to answer the following questions).

Dresden Pharmaceuticals has decided to go ahead and start clinical trials on a potential new drug. The total R&D costs are estimated to reach around $875,000,000 with clinical trials mounting to

$145,000,000. The current market size is estimated to be around 3,000,000 and is expected to grow at 4 percent every year. The market share Dresden hopes to capture in the first year is 7 percent, and is projected to grow by 25 percent each year for the next 4 years. A monthly

prescription is anticipated to generate revenue of $420 while incurring variable costs of $150. A discount rate of 8 percent is assumed.

-Which of the following is the root cause for the newsvendor problem?

A) uncertainty in supply

B) uncertainty in demand

C) high cost per unit sale

D) high total production cost

Dresden Pharmaceuticals has decided to go ahead and start clinical trials on a potential new drug. The total R&D costs are estimated to reach around $875,000,000 with clinical trials mounting to

$145,000,000. The current market size is estimated to be around 3,000,000 and is expected to grow at 4 percent every year. The market share Dresden hopes to capture in the first year is 7 percent, and is projected to grow by 25 percent each year for the next 4 years. A monthly

prescription is anticipated to generate revenue of $420 while incurring variable costs of $150. A discount rate of 8 percent is assumed.

-Which of the following is the root cause for the newsvendor problem?

A) uncertainty in supply

B) uncertainty in demand

C) high cost per unit sale

D) high total production cost

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

41

Brenton joined the Kroos Corporation at a starting salary of $61,500. According to the company's retirement plan, Brenton has to make a retirement contribution of 6 percent of his salary. The company contributes 30 percent of this amount. Brenton is expected to receive a salary increment of 3.5 percent per year for the next three years. Brenton is also expected to receive an annual investment return of 8 percent on the plan. Assuming the same rate of salary increases and investment returns each year, calculate the total balance of the retirement plan in its second year.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

42

Explain how the Data Validation feature in Excel helps in increasing spreadsheet quality.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

43

Profit is computed as the difference between total revenue from sales and total cost of production. Revenue depends on the market share captured by a company and the size of the target market. Various marketing decisions taken by managers are reflected upon the market share. The decisions also have an impact on marketing costs which in turn will affect the total cost of production. Construct an influence diagram that relates these variables.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

44

Which decision model incorporates the uncertainty element?

A) predictive

B) normative

C) prescriptive

D) descriptive

A) predictive

B) normative

C) prescriptive

D) descriptive

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

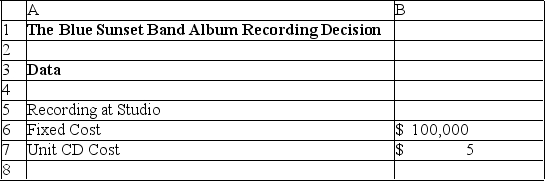

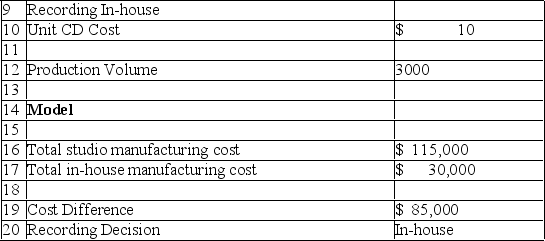

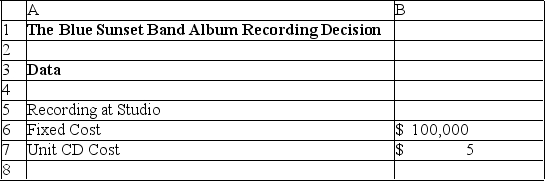

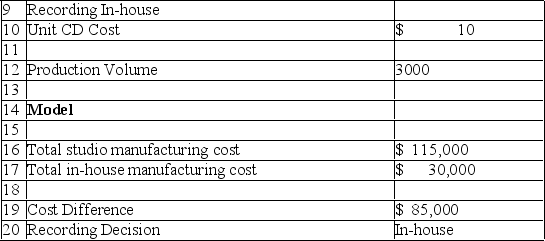

45

Blue Sunset Band is planning to record a new album. A major decision to be made is if the band can record the album on their own, or if they should hire a studio to record it with. The fixed cost for recording at the studio is $100,000, plus the manufacturing cost per CD, which is at $5. If they record the album in-house, the cost per CD is $10. They plan to produce 3000 copies of the album regardless of the place of recording. If the band wished to break even with the cost, how can they achieve this by using the Goal Seek feature in Excel?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

46

Give an account of how data is used in predictive models.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

47

Give an account of how the design and format of spreadsheets can be improved.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following formulas is used to calculate the total studio recording cost?

A) =SUMB6:B12)-B10

B) B6+B7-B16)B12

C) B6+B7*B12

D) B6+B7*B12-B16

A) =SUMB6:B12)-B10

B) B6+B7-B16)B12

C) B6+B7*B12

D) B6+B7*B12-B16

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following formulas are used to calculate the In-house recording cost?

A) B10*B12

B) B10*B12-B17

C) B6+B10*B12

D) =SUMB6:B12)-B7

A) B10*B12

B) B10*B12-B17

C) B6+B10*B12

D) =SUMB6:B12)-B7

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is the mathematical model for deriving total cost of only manufacturing?

A) TC = VC + C × Q)

B) TC = F + C × Q)

C) TC = F + C

D) TC = F + V × Q)

A) TC = VC + C × Q)

B) TC = F + C × Q)

C) TC = F + C

D) TC = F + V × Q)

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

51

The process of developing good, useful, and correct spreadsheet models is known as spreadsheet engineering.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

52

Discuss how overbooking decisions are made by service businesses.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following formula is used to make the recording decision in B20?

A) =IFB19>0,"In-house","Studio")

B) =IFB19<=0,"Studio","In-house")

C) =SUMB19<=0,"Studio")

D) =IFB19>0,"Studio","In-house")

A) =IFB19>0,"In-house","Studio")

B) =IFB19<=0,"Studio","In-house")

C) =SUMB19<=0,"Studio")

D) =IFB19>0,"Studio","In-house")

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

54

Two-way data tables can evaluate only one output variable.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

55

To meet consumer demand, Nib 'N' Ink must produce 800 gel-ink refills. Should the company produce them in-house or outsource them from the supplier? Hint: Use the mathematical descriptive model).

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

56

In predictive modeling, validity refers to how well a model represents reality.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

57

When will a company use a predictive decision model?

A) when it wishes to determine the best product pricing to maximize revenue

B) when it wishes to know how best to use advertising strategies to influence sales

C) when it wishes to know sales patterns to plan inventory levels

D) when it wishes to ensure that a specified level of customer service is achieved

A) when it wishes to determine the best product pricing to maximize revenue

B) when it wishes to know how best to use advertising strategies to influence sales

C) when it wishes to know sales patterns to plan inventory levels

D) when it wishes to ensure that a specified level of customer service is achieved

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

58

Find the range of volumes at which it is more economical for Nib 'N' Ink to produce the refills in-house or outsource them. Hint: Use the break-even decision model).

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

59

Explain how a two-way data table is created.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

60

How can managers judge the validity of a model?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck