Deck 16: Decision Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/49

Play

Full screen (f)

Deck 16: Decision Analysis

1

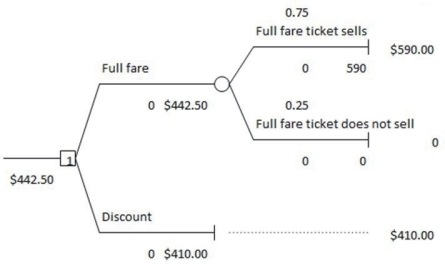

Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. ![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the value of mode obtained from the simulation results? [Hint: Choose the approximate value.]</strong> A) $ 119.0 B) $ 116.1 C) $ 105.7 D) $ 94.1](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951e_be73_bb4e77d4f34a_TB7093_00.jpg) Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

$200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of -

$550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1.![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the value of mode obtained from the simulation results? [Hint: Choose the approximate value.]</strong> A) $ 119.0 B) $ 116.1 C) $ 105.7 D) $ 94.1](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951f_be73_e366b7761335_TB7093_00.jpg)

What is the value of mode obtained from the simulation results? [Hint: Choose the approximate value.]

A) $ 119.0

B) $ 116.1

C) $ 105.7

D) $ 94.1

![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the value of mode obtained from the simulation results? [Hint: Choose the approximate value.]</strong> A) $ 119.0 B) $ 116.1 C) $ 105.7 D) $ 94.1](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951e_be73_bb4e77d4f34a_TB7093_00.jpg) Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of$200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of -

$550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1.

![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the value of mode obtained from the simulation results? [Hint: Choose the approximate value.]</strong> A) $ 119.0 B) $ 116.1 C) $ 105.7 D) $ 94.1](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951f_be73_e366b7761335_TB7093_00.jpg)

What is the value of mode obtained from the simulation results? [Hint: Choose the approximate value.]

A) $ 119.0

B) $ 116.1

C) $ 105.7

D) $ 94.1

$ 94.1

2

Use the information below to answer the following questions). Below is a payoff table that lists four mortgage options:

-What is the average payoff for the 3-year ARM?

A) $ 52,792

B) $ 45,212

C) $ 51,094

D) $ 55,278

-What is the average payoff for the 3-year ARM?

A) $ 52,792

B) $ 45,212

C) $ 51,094

D) $ 55,278

$ 51,094

3

Use the information below to answer the following questions). The payoff table given below lists four mortgage options: The probability of rates rising is 0.6, rates stable is 0.3, and rates falling is 0.1.

-What is the expected payoff for the 1-year ARM?

A) $ 53,082.00

B) $ 16,951.00

C) $ 56,938.00

D) $ 18,979.30

-What is the expected payoff for the 1-year ARM?

A) $ 53,082.00

B) $ 16,951.00

C) $ 56,938.00

D) $ 18,979.30

$ 56,938.00

4

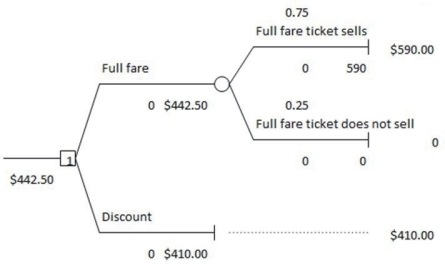

Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. ![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the value of standard deviation obtained from the simulation results? [Hint: Choose the approximate value.]</strong> A) $ 119.1 B) $ 116.1 C) $ 105.7 D) $ 94.4](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951e_be73_bb4e77d4f34a_TB7093_00.jpg) Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

$200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of -

$550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1.![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the value of standard deviation obtained from the simulation results? [Hint: Choose the approximate value.]</strong> A) $ 119.1 B) $ 116.1 C) $ 105.7 D) $ 94.4](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951f_be73_e366b7761335_TB7093_00.jpg)

What is the value of standard deviation obtained from the simulation results? [Hint: Choose the approximate value.]

A) $ 119.1

B) $ 116.1

C) $ 105.7

D) $ 94.4

![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the value of standard deviation obtained from the simulation results? [Hint: Choose the approximate value.]</strong> A) $ 119.1 B) $ 116.1 C) $ 105.7 D) $ 94.4](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951e_be73_bb4e77d4f34a_TB7093_00.jpg) Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of$200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of -

$550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1.

![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the value of standard deviation obtained from the simulation results? [Hint: Choose the approximate value.]</strong> A) $ 119.1 B) $ 116.1 C) $ 105.7 D) $ 94.4](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951f_be73_e366b7761335_TB7093_00.jpg)

What is the value of standard deviation obtained from the simulation results? [Hint: Choose the approximate value.]

A) $ 119.1

B) $ 116.1

C) $ 105.7

D) $ 94.4

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

5

Use the information below to answer the following questions). Below is a payoff table that lists four mortgage options:

-What is the best payoff rate for the 1-year ARM?

A) $ 49,618

B) $ 43,650

C) $ 38,560

D) $ 66,645

-What is the best payoff rate for the 1-year ARM?

A) $ 49,618

B) $ 43,650

C) $ 38,560

D) $ 66,645

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

6

Answer the following questions by creating a decision tree.

Which of the following is considered the worst expected value decision?

A) 1-year ARM

B) 3-year ARM

C) 5-year ARM

D) 30-year fixed

Which of the following is considered the worst expected value decision?

A) 1-year ARM

B) 3-year ARM

C) 5-year ARM

D) 30-year fixed

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

7

Use the information below to answer the following questions). The payoff table given below lists four mortgage options: The probability of rates rising is 0.6, rates stable is 0.3, and rates falling is 0.1.

-What is the expected payoff of the 5-year ARM?

A) $ 17,872.90

B) $ 53,618.60

C) $ 48,805.20

D) $ 20,081.80

-What is the expected payoff of the 5-year ARM?

A) $ 17,872.90

B) $ 53,618.60

C) $ 48,805.20

D) $ 20,081.80

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

8

Use the information given below to answer the following questions). Below is a payoff table that lists three mortgage options:

-What is the maximum opportunity loss incurred for the 2-year ARM?

A) $ 8,626

B) $ 13,716

C) $ 14,369

D) $ 10,581

-What is the maximum opportunity loss incurred for the 2-year ARM?

A) $ 8,626

B) $ 13,716

C) $ 14,369

D) $ 10,581

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

9

Use the information given below to answer the following questions). Below is a payoff table that lists three mortgage options:

-What is the maximum opportunity loss incurred for the 25-year fixed decision?

A) $ 8,626

B) $ 13,716

C) $ 14,369

D) $ 10,581

-What is the maximum opportunity loss incurred for the 25-year fixed decision?

A) $ 8,626

B) $ 13,716

C) $ 14,369

D) $ 10,581

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

10

Use the information given below to answer the following questions). Below is a payoff table that lists three mortgage options:

-What is the maximum opportunity loss incurred for the 5-year ARM?

A) $ 8,626

B) $ 13,716

C) $ 14,369

D) $ 10,581

-What is the maximum opportunity loss incurred for the 5-year ARM?

A) $ 8,626

B) $ 13,716

C) $ 14,369

D) $ 10,581

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

11

Use the information below to answer the following questions). Below is a payoff table that lists four mortgage options:

-An) is also called a minimax regret strategy.

A) opportunity-loss strategy

B) aggressive strategy

C) conservative strategy

D) average payoff strategy

-An) is also called a minimax regret strategy.

A) opportunity-loss strategy

B) aggressive strategy

C) conservative strategy

D) average payoff strategy

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

12

Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. ![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the mean absolute deviation obtained from the simulation results? [Hint: Choose the approximate value.]</strong> A) $ 119.0 B) $ 116.1 C) $ 105.7 D) $ 94.0](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951e_be73_bb4e77d4f34a_TB7093_00.jpg) Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

$200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of -

$550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1.![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the mean absolute deviation obtained from the simulation results? [Hint: Choose the approximate value.]</strong> A) $ 119.0 B) $ 116.1 C) $ 105.7 D) $ 94.0](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951f_be73_e366b7761335_TB7093_00.jpg)

What is the mean absolute deviation obtained from the simulation results? [Hint: Choose the approximate value.]

A) $ 119.0

B) $ 116.1

C) $ 105.7

D) $ 94.0

![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the mean absolute deviation obtained from the simulation results? [Hint: Choose the approximate value.]</strong> A) $ 119.0 B) $ 116.1 C) $ 105.7 D) $ 94.0](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951e_be73_bb4e77d4f34a_TB7093_00.jpg) Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of$200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of -

$550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1.

![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the mean absolute deviation obtained from the simulation results? [Hint: Choose the approximate value.]</strong> A) $ 119.0 B) $ 116.1 C) $ 105.7 D) $ 94.0](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951f_be73_e366b7761335_TB7093_00.jpg)

What is the mean absolute deviation obtained from the simulation results? [Hint: Choose the approximate value.]

A) $ 119.0

B) $ 116.1

C) $ 105.7

D) $ 94.0

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

13

Use the information below to answer the following questions). Below is a payoff table that lists four mortgage options:

-What is the average payoff for the 5-year ARM?

A) $ 49,514

B) $ 52,015

C) $ 53,395

D) $ 51,641

-What is the average payoff for the 5-year ARM?

A) $ 49,514

B) $ 52,015

C) $ 53,395

D) $ 51,641

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

14

Answer the following questions by creating a decision tree.

Which of the following is considered the best expected value decision?

A) 1-year ARM

B) 3-year ARM

C) 5-year ARM

D) 30-year fixed

Which of the following is considered the best expected value decision?

A) 1-year ARM

B) 3-year ARM

C) 5-year ARM

D) 30-year fixed

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

15

Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. ![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the coefficiIIt of variation obtained from the simulation results? [Hint: Choose the approximate value.]</strong> A) 1.587 B) 1.122 C) 2.015 D) 1.890](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951e_be73_bb4e77d4f34a_TB7093_00.jpg) Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

$200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of -

$550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1.![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the coefficiIIt of variation obtained from the simulation results? [Hint: Choose the approximate value.]</strong> A) 1.587 B) 1.122 C) 2.015 D) 1.890](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951f_be73_e366b7761335_TB7093_00.jpg)

What is the coefficiIIt of variation obtained from the simulation results? [Hint: Choose the approximate value.]

A) 1.587

B) 1.122

C) 2.015

D) 1.890

![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the coefficiIIt of variation obtained from the simulation results? [Hint: Choose the approximate value.]</strong> A) 1.587 B) 1.122 C) 2.015 D) 1.890](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951e_be73_bb4e77d4f34a_TB7093_00.jpg) Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of$200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of -

$550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1.

![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the coefficiIIt of variation obtained from the simulation results? [Hint: Choose the approximate value.]</strong> A) 1.587 B) 1.122 C) 2.015 D) 1.890](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951f_be73_e366b7761335_TB7093_00.jpg)

What is the coefficiIIt of variation obtained from the simulation results? [Hint: Choose the approximate value.]

A) 1.587

B) 1.122

C) 2.015

D) 1.890

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

16

Use the information below to answer the following questions). Below is a payoff table that lists four mortgage options:

-Which of the following decisions has the best average payoff?

A) 1-year ARM

B) 3-year ARM

C) 5-year ARM

D) 30-year fixed

-Which of the following decisions has the best average payoff?

A) 1-year ARM

B) 3-year ARM

C) 5-year ARM

D) 30-year fixed

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

17

Use the information below to answer the following questions). The payoff table given below lists four mortgage options: The probability of rates rising is 0.6, rates stable is 0.3, and rates falling is 0.1.

-Which of the following decisions has the largest expected payoff?

A) 1-year ARM

B) 3-year ARM

C) 5-year ARM

D) 30-year fixed

-Which of the following decisions has the largest expected payoff?

A) 1-year ARM

B) 3-year ARM

C) 5-year ARM

D) 30-year fixed

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

18

Use the information below to answer the following questions). Below is a payoff table that lists four mortgage options:

-What is the worst payoff rate for the 5-year ARM?

A) $ 50,894

B) $ 48,134

C) $ 51,641

D) $ 55,895

-What is the worst payoff rate for the 5-year ARM?

A) $ 50,894

B) $ 48,134

C) $ 51,641

D) $ 55,895

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

19

Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. ![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the value of mean obtained from the simulation results? [Hint: Choose the approximate value.]</strong> A) $ 119.0 B) $ 116.1 C) $ 106.2 D) $ 94.4](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951e_be73_bb4e77d4f34a_TB7093_00.jpg) Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

$200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of -

$550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1.![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the value of mean obtained from the simulation results? [Hint: Choose the approximate value.]</strong> A) $ 119.0 B) $ 116.1 C) $ 106.2 D) $ 94.4](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951f_be73_e366b7761335_TB7093_00.jpg)

What is the value of mean obtained from the simulation results? [Hint: Choose the approximate value.]

A) $ 119.0

B) $ 116.1

C) $ 106.2

D) $ 94.4

![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the value of mean obtained from the simulation results? [Hint: Choose the approximate value.]</strong> A) $ 119.0 B) $ 116.1 C) $ 106.2 D) $ 94.4](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951e_be73_bb4e77d4f34a_TB7093_00.jpg) Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of$200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of -

$550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1.

![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the value of mean obtained from the simulation results? [Hint: Choose the approximate value.]</strong> A) $ 119.0 B) $ 116.1 C) $ 106.2 D) $ 94.4](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951f_be73_e366b7761335_TB7093_00.jpg)

What is the value of mean obtained from the simulation results? [Hint: Choose the approximate value.]

A) $ 119.0

B) $ 116.1

C) $ 106.2

D) $ 94.4

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

20

An) is a matrix whose rows correspond to decisions and whose columns correspond to events.

A) decision tree model

B) payoff table

C) utility function table

D) scoring model

A) decision tree model

B) payoff table

C) utility function table

D) scoring model

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

21

If the payoff is $2200 and R is equal to $500, what is the utility function?

A) 0.9877

B) 0.6819

C) 0.7645

D) 0.4502

A) 0.9877

B) 0.6819

C) 0.7645

D) 0.4502

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

22

Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. ![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the probability that the drug will not reach the market? [Hint: Choose the approximate value.]</strong> A) 0.95 B) 0.89 C) 0.77 D) 0.82](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951e_be73_bb4e77d4f34a_TB7093_00.jpg) Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

$200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of -

$550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1.![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the probability that the drug will not reach the market? [Hint: Choose the approximate value.]</strong> A) 0.95 B) 0.89 C) 0.77 D) 0.82](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951f_be73_e366b7761335_TB7093_00.jpg)

What is the probability that the drug will not reach the market? [Hint: Choose the approximate value.]

A) 0.95

B) 0.89

C) 0.77

D) 0.82

![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the probability that the drug will not reach the market? [Hint: Choose the approximate value.]</strong> A) 0.95 B) 0.89 C) 0.77 D) 0.82](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951e_be73_bb4e77d4f34a_TB7093_00.jpg) Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of$200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of -

$550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1.

![<strong>Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. What is the probability that the drug will not reach the market? [Hint: Choose the approximate value.]</strong> A) 0.95 B) 0.89 C) 0.77 D) 0.82](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a5_951f_be73_e366b7761335_TB7093_00.jpg)

What is the probability that the drug will not reach the market? [Hint: Choose the approximate value.]

A) 0.95

B) 0.89

C) 0.77

D) 0.82

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

23

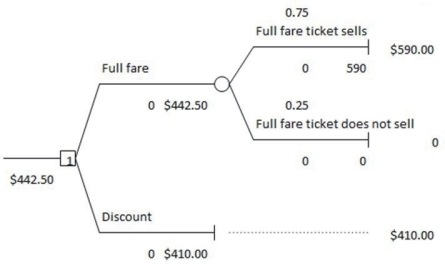

Use the information below to answer the following questions). Below is a decision tree for the airline revenue management.  Create a one-way table and answer the following questions.

Create a one-way table and answer the following questions.

The expected value of perfect information EVPI) is equal to the .

A) Expected Monetary Value EMV) with perfect information minus the EMV without any information

B) EMV with perfect information divided by the EMV without any information

C) sum of the EMV with information and the EMV without any information

D) EMV without any information minus the EMV with perfect information

Create a one-way table and answer the following questions.

Create a one-way table and answer the following questions.The expected value of perfect information EVPI) is equal to the .

A) Expected Monetary Value EMV) with perfect information minus the EMV without any information

B) EMV with perfect information divided by the EMV without any information

C) sum of the EMV with information and the EMV without any information

D) EMV without any information minus the EMV with perfect information

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

24

Use the below information to answer the following questions). Below is a payoff table with three mortgage options:

-What is the expected opportunity loss for the 3-year ARM?

A) $ 7,979.60

B) $ 3,959.40

C) $ 6,853.50

D) $ 8,621.40

-What is the expected opportunity loss for the 3-year ARM?

A) $ 7,979.60

B) $ 3,959.40

C) $ 6,853.50

D) $ 8,621.40

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

25

A payoff table is a matrix whose rows correspond to events and whose columns correspond to decisions.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

26

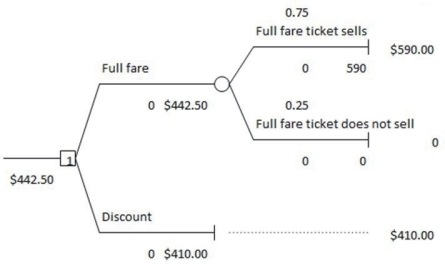

Use the information below to answer the following questions). Below is a decision tree for the airline revenue management. ![<strong>Use the information below to answer the following questions). Below is a decision tree for the airline revenue management. Create a one-way table and answer the following questions. What is the expected value of the ticket when a discount is offered on the full fare? [Hint: Choose the approximate value.]</strong> A) $ 442.50 B) $ 472.00 C) $ 410.00 D) $ 501.50](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a6_0a50_be73_bd441d76536a_TB7093_00.jpg) Create a one-way table and answer the following questions.

Create a one-way table and answer the following questions.

What is the expected value of the ticket when a discount is offered on the full fare? [Hint: Choose the approximate value.]

A) $ 442.50

B) $ 472.00

C) $ 410.00

D) $ 501.50

![<strong>Use the information below to answer the following questions). Below is a decision tree for the airline revenue management. Create a one-way table and answer the following questions. What is the expected value of the ticket when a discount is offered on the full fare? [Hint: Choose the approximate value.]</strong> A) $ 442.50 B) $ 472.00 C) $ 410.00 D) $ 501.50](https://d2lvgg3v3hfg70.cloudfront.net/TB7093/11eb1da5_c3a6_0a50_be73_bd441d76536a_TB7093_00.jpg) Create a one-way table and answer the following questions.

Create a one-way table and answer the following questions.What is the expected value of the ticket when a discount is offered on the full fare? [Hint: Choose the approximate value.]

A) $ 442.50

B) $ 472.00

C) $ 410.00

D) $ 501.50

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following formulas is used to determine the exponential utility function?

A) Ux) = 1 + e-x/R

B) Ux) = 1× ex/R

C) Ux) = 1/ exR

D) Ux) = 1 - e-x/R

A) Ux) = 1 + e-x/R

B) Ux) = 1× ex/R

C) Ux) = 1/ exR

D) Ux) = 1 - e-x/R

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

28

Use the information below to answer the following questions)

Misty Inc. launches a new range of perfumes for men and women. The probability of high consumer demand for the product is 0.6 and low consumer demand is 0.4. The probability of a favorable survey response given high consumer demand is 0.9 and the probability of a favorable survey response given low consumer demand is 0.2.

Greg is indifferent between receiving $2,000, and taking a chance at $2,500 with probability 0.7 and losing $1200 with probability 0.5. What is the expected value of this gamble?

A) $ 1,150

B) $ 1,800

C) $ 1,460

D) $ 2,045

Misty Inc. launches a new range of perfumes for men and women. The probability of high consumer demand for the product is 0.6 and low consumer demand is 0.4. The probability of a favorable survey response given high consumer demand is 0.9 and the probability of a favorable survey response given low consumer demand is 0.2.

Greg is indifferent between receiving $2,000, and taking a chance at $2,500 with probability 0.7 and losing $1200 with probability 0.5. What is the expected value of this gamble?

A) $ 1,150

B) $ 1,800

C) $ 1,460

D) $ 2,045

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

29

Use the information below to answer the following questions)

Misty Inc. launches a new range of perfumes for men and women. The probability of high consumer demand for the product is 0.6 and low consumer demand is 0.4. The probability of a favorable survey response given high consumer demand is 0.9 and the probability of a favorable survey response given low consumer demand is 0.2.

What is the likelihood for high demand knowing that the market report is favorable?

A) 84%

B) 90%

C) 87%

D) 80%

Misty Inc. launches a new range of perfumes for men and women. The probability of high consumer demand for the product is 0.6 and low consumer demand is 0.4. The probability of a favorable survey response given high consumer demand is 0.9 and the probability of a favorable survey response given low consumer demand is 0.2.

What is the likelihood for high demand knowing that the market report is favorable?

A) 84%

B) 90%

C) 87%

D) 80%

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

30

Use the information below to answer the following questions). Below are four options for an investment decision.

-Which of the following is the average utility for the bond fund decision?

A) 1.18

B) 0.38

C) 0.54

D) 0.43

-Which of the following is the average utility for the bond fund decision?

A) 1.18

B) 0.38

C) 0.54

D) 0.43

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

31

Use the information below to answer the following questions). Below are four options for an investment decision.

-Based on the average utility, which of the following is considered the worst decision?

A) Bank CD

B) Bond fund

C) Index fund

D) Growth fund

-Based on the average utility, which of the following is considered the worst decision?

A) Bank CD

B) Bond fund

C) Index fund

D) Growth fund

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

32

Use the information below to answer the following questions). Below are four options for an investment decision.

-Which of the following is the average utility for the index fund decision?

A) 1.05

B) 0.70

C) 0.60

D) 0.45

-Which of the following is the average utility for the index fund decision?

A) 1.05

B) 0.70

C) 0.60

D) 0.45

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

33

Use the information below to answer the following questions)

Misty Inc. launches a new range of perfumes for men and women. The probability of high consumer demand for the product is 0.6 and low consumer demand is 0.4. The probability of a favorable survey response given high consumer demand is 0.9 and the probability of a favorable survey response given low consumer demand is 0.2.

A children's welfare fundrai'er involves selling one thousand $70 tickets to win a $20,000'grand prize. If the probability of winning is only 0.005, what is the expected payoff?

A) -$40

B) -$50

C) $30

D) $60

Misty Inc. launches a new range of perfumes for men and women. The probability of high consumer demand for the product is 0.6 and low consumer demand is 0.4. The probability of a favorable survey response given high consumer demand is 0.9 and the probability of a favorable survey response given low consumer demand is 0.2.

A children's welfare fundrai'er involves selling one thousand $70 tickets to win a $20,000'grand prize. If the probability of winning is only 0.005, what is the expected payoff?

A) -$40

B) -$50

C) $30

D) $60

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

34

Use the below information to answer the following questions). Below is a payoff table with three mortgage options:

-The expected value of sample information EVSI) is equal to the .

A) Expected Monetary Value EMV) without sample information divided by the EMV with sample information

B) EMV without sample information minus the EMV with sample information

C) sum of the EMV with sample information and the EMV without sample information

D) EMV with sample information minus the EMV without sample information

-The expected value of sample information EVSI) is equal to the .

A) Expected Monetary Value EMV) without sample information divided by the EMV with sample information

B) EMV without sample information minus the EMV with sample information

C) sum of the EMV with sample information and the EMV without sample information

D) EMV with sample information minus the EMV without sample information

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

35

Use the below information to answer the following questions). Below is a payoff table with three mortgage options:

-What is the expected opportunity loss for the 1-year ARM?

A) $ 7,979.60

B) $ 3,959.40

C) $ 6,853.50

D) $ 8,621.40

-What is the expected opportunity loss for the 1-year ARM?

A) $ 7,979.60

B) $ 3,959.40

C) $ 6,853.50

D) $ 8,621.40

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

36

Use the information below to answer the following questions). Below are four options for an investment decision.

-Based on the average utility, which of the following is considered the best decision?

A) Bank CD

B) Bond fund

C) Index fund

D) Growth fund

-Based on the average utility, which of the following is considered the best decision?

A) Bank CD

B) Bond fund

C) Index fund

D) Growth fund

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

37

Use the below information to answer the following questions). Below is a payoff table with three mortgage options:

-What is the expected opportunity loss for the 30-year fixed decision?

A) $ 7,979.60

B) $ 3,959.40

C) $ 6,853.50

D) $ 8,621.40

-What is the expected opportunity loss for the 30-year fixed decision?

A) $ 7,979.60

B) $ 3,959.40

C) $ 6,853.50

D) $ 8,621.40

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

38

Use the information below to answer the following questions)

Misty Inc. launches a new range of perfumes for men and women. The probability of high consumer demand for the product is 0.6 and low consumer demand is 0.4. The probability of a favorable survey response given high consumer demand is 0.9 and the probability of a favorable survey response given low consumer demand is 0.2.

If the marketing report is u'favorable, what is the probability of low demand?

A) 84%

B) 90%

C) 87%

D) 80%

Misty Inc. launches a new range of perfumes for men and women. The probability of high consumer demand for the product is 0.6 and low consumer demand is 0.4. The probability of a favorable survey response given high consumer demand is 0.9 and the probability of a favorable survey response given low consumer demand is 0.2.

If the marketing report is u'favorable, what is the probability of low demand?

A) 84%

B) 90%

C) 87%

D) 80%

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

39

Use the information below to answer the following questions). Below is a decision tree for the airline revenue management.  Create a one-way table and answer the following questions.

Create a one-way table and answer the following questions.

If the probability of selling the full-fare ticket is 0.80, what is the expected value of the ticket?

A) $ 442.50

B) $ 472.00

C) $ 501.50

D) $ 531.00

Create a one-way table and answer the following questions.

Create a one-way table and answer the following questions.If the probability of selling the full-fare ticket is 0.80, what is the expected value of the ticket?

A) $ 442.50

B) $ 472.00

C) $ 501.50

D) $ 531.00

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

40

Use the information below to answer the following questions). Below are four options for an investment decision.

-Identify the average utility for the growth fund decision.

A) 1.05

B) 0.70

C) 0.20

D) 0.60

-Identify the average utility for the growth fund decision.

A) 1.05

B) 0.70

C) 0.20

D) 0.60

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

41

An outcome over which the decision maker has complete control is called an event node.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

42

What are the three elements required to characterize decisions with uncertain consequences?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

43

Describe the steps involved in the construction of a decision tree.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

44

In a minimin strategy, the decision which minimizes the minimum payoff is chosen.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

45

What are the differences between an aggressive strategy and a conservative strategy?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

46

What is the expected value of sample information?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

47

The average payoff strategy weights the likelihood that the actual outcomes can occur.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

48

What is the expected value of perfect information?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

49

For the average payoff strategy, the decision with the best average payoff is chosen.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck