Deck 5: Technology and Economic Growth

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/50

Play

Full screen (f)

Deck 5: Technology and Economic Growth

1

The contribution of improved productivity to the rate of growth of the U.S. economy

A) historically dominated the contribution of labor and capital, but never by as much as it has in the 1980s.

B) declined during the 1970s but rebounded during the economic periods of the 1980s and 1990s.

C) had been increasing slowly for 10 years when it suddenly fell below zero in response to the recession of 1981-1982.

D) has never been as important as it is in the rest of the world.

E) none of the above.

A) historically dominated the contribution of labor and capital, but never by as much as it has in the 1980s.

B) declined during the 1970s but rebounded during the economic periods of the 1980s and 1990s.

C) had been increasing slowly for 10 years when it suddenly fell below zero in response to the recession of 1981-1982.

D) has never been as important as it is in the rest of the world.

E) none of the above.

declined during the 1970s but rebounded during the economic periods of the 1980s and 1990s.

2

Let the rate of growth of GDP depend on productivity and the weighted average of the growth rates of capital and labor. According to the growth accounting formula, the weights assigned to the growth rates of capital and labor are

A) the relative income elasticities of the derived demand for capital and labor.

B) the relative shares of GDP devoted to compensating capital and labor.

C) derived demand productivity indices computed from price elasticities.

D) immaterial in computing the rate of growth of potential GDP.

E) none of the above.

A) the relative income elasticities of the derived demand for capital and labor.

B) the relative shares of GDP devoted to compensating capital and labor.

C) derived demand productivity indices computed from price elasticities.

D) immaterial in computing the rate of growth of potential GDP.

E) none of the above.

the relative shares of GDP devoted to compensating capital and labor.

3

The contribution of capital formation to the growth of the U.S. economy

A) was always much smaller than the contribution of labor-input growth.

B) during the 1980s and 1990s, essentially matched the contribution made by capital formation during the 1960s.

C) declined steadily from the mid-1960s to the present.

D) dominated the contribution made by improved productivity throughout the 1980s.

E) b and d.

A) was always much smaller than the contribution of labor-input growth.

B) during the 1980s and 1990s, essentially matched the contribution made by capital formation during the 1960s.

C) declined steadily from the mid-1960s to the present.

D) dominated the contribution made by improved productivity throughout the 1980s.

E) b and d.

b and d.

4

An increase in the saving rate, in Solow's neoclassical growth model,

A) increases the rate of growth of output over the long run.

B) decreases the rate of growth of output over the long run.

C) increases the rate of growth of output temporarily.

D) decreases the rate of growth of output temporarily.

E) none of the above.

A) increases the rate of growth of output over the long run.

B) decreases the rate of growth of output over the long run.

C) increases the rate of growth of output temporarily.

D) decreases the rate of growth of output temporarily.

E) none of the above.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

5

Let GDP = $7,000 billion at the beginning of 1996. To achieve a GDP of

$7,700 billion by December 31 of that year in the absence of growth in either the size of the labor force or productivity and assuming the capital and labor share distribution of the U.S. economy, the capital stock would have to increase by

A) 3 percent.

B) 3.3 percent.

C) 10 percent.

D) 33 percent.

E) none of the above.

$7,700 billion by December 31 of that year in the absence of growth in either the size of the labor force or productivity and assuming the capital and labor share distribution of the U.S. economy, the capital stock would have to increase by

A) 3 percent.

B) 3.3 percent.

C) 10 percent.

D) 33 percent.

E) none of the above.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

6

An important conclusion from Solow's work on long-run growth is that

A) in the steady state, both capital stock and output grow at a slower rate than the labor force.

B) the economy's growth rate does not depend on the savings rate.

C) economies that save more experience a higher growth rate.

D) in the steady state, both capital stock and output grow at the same rate as the labor force.

E) b and d.

A) in the steady state, both capital stock and output grow at a slower rate than the labor force.

B) the economy's growth rate does not depend on the savings rate.

C) economies that save more experience a higher growth rate.

D) in the steady state, both capital stock and output grow at the same rate as the labor force.

E) b and d.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

7

During the 1970s, the two factors primarily responsible for decreased economic growth were decreased

A) labor growth.

B) technological growth.

C) capital stock growth.

D) a and c.

E) b and c.

A) labor growth.

B) technological growth.

C) capital stock growth.

D) a and c.

E) b and c.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

8

Assuming a rate of technology growth within the neoclassical growth model is necessary when technological change is

A) endogenous.

B) heterogeneous.

C) homogeneous.

D) exogeneous.

E) a and d.

A) endogenous.

B) heterogeneous.

C) homogeneous.

D) exogeneous.

E) a and d.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

9

Given the distribution of GDP between capital and labor in the United States, a 2 percent increase in capital stock should produce an increase in GDP of

A) 0.3 percent.

B) 0.6 percent.

C) 1.4 percent.

D) 2 percent.

E) 2.8 percent.

A) 0.3 percent.

B) 0.6 percent.

C) 1.4 percent.

D) 2 percent.

E) 2.8 percent.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

10

If labor input, the capital stock, and real output grow at equal rates, then Solow's formula implies that productivity growth is

A) positive.

B) negative.

C) zero.

D) not uniquely determined.

E) imaginary.

A) positive.

B) negative.

C) zero.

D) not uniquely determined.

E) imaginary.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

11

Suppose that the share of GDP paid to capital always equals 25 percent and the remaining 75 percent goes to labor. If, over the course of 20 years, the capital stock had been growing at 2 percent per year, the labor force had been growing at 3 percent per year, and GDP had been climbing at a 3 percent rate, then labor productivity must have been

A) growing at 7 percent per year.

B) growing at 0.25 percent per year.

C) growing at 5 percent per year.

D) falling at 5 percent per year.

E) falling at 0.75 percent per year.

A) growing at 7 percent per year.

B) growing at 0.25 percent per year.

C) growing at 5 percent per year.

D) falling at 5 percent per year.

E) falling at 0.75 percent per year.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

12

The growth accounting formula DY/Y = DA/A + 0.7DN/N + 0.3DK/K was developed by

A) N. Gregory Mankiw.

B) Charles I. Jones.

C) John B. Taylor.

D) Robert M. Solow.

E) Paul Romer.

A) N. Gregory Mankiw.

B) Charles I. Jones.

C) John B. Taylor.

D) Robert M. Solow.

E) Paul Romer.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

13

According to Solow's growth accounting formula for the United States, a 2 percent annual growth rate in labor, a 4 percent annual growth rate in capital, and a 5 percent annual growth rate in GDP mean that overall productivity must be growing at an annual rate of

A) 1.4 percent.

B) 1.6 percent.

C) 2.4 percent.

D) 3.6 percent.

E) none of the above.

A) 1.4 percent.

B) 1.6 percent.

C) 2.4 percent.

D) 3.6 percent.

E) none of the above.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

14

According to Solow's growth accounting formula, an economy with a steadily growing population and labor force but no change in capital stock or technology will experience

A) steady growth in long-run equilibrium GDP.

B) steady growth in long-run equilibrium per-capita GDP.

C) steady decline in long-run equilibrium per-capita GDP.

D) a and b.

E) a and c.

A) steady growth in long-run equilibrium GDP.

B) steady growth in long-run equilibrium per-capita GDP.

C) steady decline in long-run equilibrium per-capita GDP.

D) a and b.

E) a and c.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

15

According to the Solow growth-accounting equation, a proportionate decline in population and labor force, all else equal, causes

A) an increase in long-run per-capita GDP.

B) a decrease in long-run per-capita GDP.

C) an increase in long-run equilibrium GDP.

D) no significant impact on long-run equilibrium GDP.

E) none of the above.

A) an increase in long-run per-capita GDP.

B) a decrease in long-run per-capita GDP.

C) an increase in long-run equilibrium GDP.

D) no significant impact on long-run equilibrium GDP.

E) none of the above.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

16

According to the growth accounting formula and data for the mid-1970s through the mid-1990s, the most important reason for the slowdown in economic growth has been

A) a decline in the growth rate of capital.

B) an increase in the size of government.

C) a decrease in the growth rate of the labor force.

D) an increase in the number of government regulations.

E) a decline in the rate of technological change.

A) a decline in the growth rate of capital.

B) an increase in the size of government.

C) a decrease in the growth rate of the labor force.

D) an increase in the number of government regulations.

E) a decline in the rate of technological change.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

17

Using the Solow growth accounting formula, in the absence of any technological change, the growth in output along the balanced growth path

A) equals the growth of capital plus the growth of labor.

B) is greater than the growth in the labor force.

C) equals the growth of capital.

D) equals the growth of labor.

E) both c and d.

A) equals the growth of capital plus the growth of labor.

B) is greater than the growth in the labor force.

C) equals the growth of capital.

D) equals the growth of labor.

E) both c and d.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

18

The correct ve rsion of the growth accounting fo rmula for the United States is

A) DK/K = DA/A + 0.7DN/N + 0.3DY/Y.

B) DY/Y = DA/A + 0.7DK/K + 0.3DN/N.

C) DY/Y = DA/A + 0.3DN/N + 0.7DK/K.

D) DY/Y = DA/A + 0.7DN/N + 0.3DK/K.

E) DN/N = DA/A + 0.7DY/Y + 0.3DK/K.

A) DK/K = DA/A + 0.7DN/N + 0.3DY/Y.

B) DY/Y = DA/A + 0.7DK/K + 0.3DN/N.

C) DY/Y = DA/A + 0.3DN/N + 0.7DK/K.

D) DY/Y = DA/A + 0.7DN/N + 0.3DK/K.

E) DN/N = DA/A + 0.7DY/Y + 0.3DK/K.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

19

According to the Solow growth accounting formula, for output per worker to grow, the growth in output along the balanced growth path requires

A) equal growth of capital and labor.

B) no growth in technology.

C) positive technological growth.

D) greater capital growth than labor growth.

E) such growth is not possible.

A) equal growth of capital and labor.

B) no growth in technology.

C) positive technological growth.

D) greater capital growth than labor growth.

E) such growth is not possible.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

20

The primary difference between the endogenous and neoclassical growth theory models consists of the role played by

A) capital stock increments.

B) labor force changes.

C) technological change.

D) government regulations.

E) government subsidies.

A) capital stock increments.

B) labor force changes.

C) technological change.

D) government regulations.

E) government subsidies.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

21

The production of technology is characterized by all of the following except

A) patents

B) nonrivalry

C) excludability

D) consumption rivalry

E) lab managers

A) patents

B) nonrivalry

C) excludability

D) consumption rivalry

E) lab managers

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

22

Government policies to stimulate growth include all of the following forms of support except

A) tax cut legislation.

B) primary, secondary, and higher education.

C) research and development.

D) basic research.

E) additional environmental regulations.

A) tax cut legislation.

B) primary, secondary, and higher education.

C) research and development.

D) basic research.

E) additional environmental regulations.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

23

Relative to the 1960s, federal spending on research and development as a fraction of GDP in 2000 is

A) about the same.

B) twice as much.

C) half as much.

D) on an upward swing.

E) no longer present.

A) about the same.

B) twice as much.

C) half as much.

D) on an upward swing.

E) no longer present.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

24

For a good to be characterized by nonrivalry, it

A) must be shared between friendly parties.

B) cannot be used by more than one person at a time.

C) retain its usability after repeated use.

D) be usable by more than one person at a time.

E) c and d.

A) must be shared between friendly parties.

B) cannot be used by more than one person at a time.

C) retain its usability after repeated use.

D) be usable by more than one person at a time.

E) c and d.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

25

An increase in investment in research, such as in the number of workers doing research, can

A) increase the growth rate of technological change.

B) increase the growth rate of output.

C) permanently increase the growth rate of output.

D) all of the above.

E) a and b only.

A) increase the growth rate of technological change.

B) increase the growth rate of output.

C) permanently increase the growth rate of output.

D) all of the above.

E) a and b only.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following might be a policy designed specifically to stimulate the rate of growth of productivity?

A) A reduction in the Social Security tax

B) An indexing of a progressive income tax to inflation

C) A stimulative monetary policy that eases interest rate pressure

D) An increase in government spending targeted at defense

E) None of the above

A) A reduction in the Social Security tax

B) An indexing of a progressive income tax to inflation

C) A stimulative monetary policy that eases interest rate pressure

D) An increase in government spending targeted at defense

E) None of the above

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

27

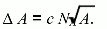

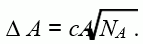

A permanent increase in the long-run growth rate would be possible if the economy's production function took the form of

A)

B)

C)

D) either a, b, or c as long as property rights are protected.

E) neither a, b, nor c, permanent increases are not possible.

A)

B)

C)

D) either a, b, or c as long as property rights are protected.

E) neither a, b, nor c, permanent increases are not possible.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

28

Relative to the 1960s, total spending on research and development as a fraction of GDP in 2000 is

A) about the same.

B) twice as much.

C) half as much.

D) on an upward swing.

E) no longer present.

A) about the same.

B) twice as much.

C) half as much.

D) on an upward swing.

E) no longer present.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

29

Federal spending on research and development currently makes up

_ _ _ _ _ _ _ _ _ _ _ _ of the total amount spent each year.

A) about half

B) almost all

C) about a third

D) about a quarter

E) almost none

_ _ _ _ _ _ _ _ _ _ _ _ of the total amount spent each year.

A) about half

B) almost all

C) about a third

D) about a quarter

E) almost none

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

30

Economic policy may permanently increase the growth rate only

A) during a transition period.

B) if diminishing returns to the production of new technology exist.

C) if diminishing returns to the production of new technology do not exist.

D) if the transition period is followed by decreased government regulations.

E) if accompanied by an increased level of capital stock.

A) during a transition period.

B) if diminishing returns to the production of new technology exist.

C) if diminishing returns to the production of new technology do not exist.

D) if the transition period is followed by decreased government regulations.

E) if accompanied by an increased level of capital stock.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

31

The basic argument behind the funding of research and development by the federal government is that

A) private sector funding is insufficient.

B) private industry does not fund appropriate areas of research.

C) basic research provides social benefits in excess of private benefits.

D) private industry does not perform enough research and development.

E) both c and d.

A) private sector funding is insufficient.

B) private industry does not fund appropriate areas of research.

C) basic research provides social benefits in excess of private benefits.

D) private industry does not perform enough research and development.

E) both c and d.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

32

Each of the following is an important element of endogenous growth theory except

A) technology is characterized by partial excludability.

B) technology is characterized by nonrivalry.

C) technology does not have diminishing returns.

D) technology is subsidized by the government.

E) technology is characterized by a production function.

A) technology is characterized by partial excludability.

B) technology is characterized by nonrivalry.

C) technology does not have diminishing returns.

D) technology is subsidized by the government.

E) technology is characterized by a production function.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

33

In the Solow growth model, technology is treated as a

A) pure public good.

B) pure private good.

C) nonexistent.

D) a necessary annoyance.

E) none of the above.

A) pure public good.

B) pure private good.

C) nonexistent.

D) a necessary annoyance.

E) none of the above.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

34

A major contributor to endogenous growth theory has been

A) Paul Romer.

B) Joseph Stiglitz.

C) John Taylor.

D) Robert Eisner.

E) David Papell.

A) Paul Romer.

B) Joseph Stiglitz.

C) John Taylor.

D) Robert Eisner.

E) David Papell.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

35

In the endogenous growth models, technology is treated as a

A) pure public good.

B) pure private good.

C) nonexistent.

D) a necessary annoyance.

E) a mixed good possessing ch a ra c t e ristics of both public and private go o d s .

A) pure public good.

B) pure private good.

C) nonexistent.

D) a necessary annoyance.

E) a mixed good possessing ch a ra c t e ristics of both public and private go o d s .

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

36

Federal spending on research and development currently 2000) makes up_____________of the total amount spent each year, whereas 40 years ago 1960) it made up about _________

A) about half, two-thirds

B) almost all, a third

C) about a third, a third

D) about a quarter, two-thirds

E) almost none, about half

A) about half, two-thirds

B) almost all, a third

C) about a third, a third

D) about a quarter, two-thirds

E) almost none, about half

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

37

A policy that can increase labor supply is

A) a tax cut.

B) a tax increase.

C) a tax reform that raises marginal tax rates.

D) a tax reform that reduces marginal tax rates.

E) none of the above.

A) a tax cut.

B) a tax increase.

C) a tax reform that raises marginal tax rates.

D) a tax reform that reduces marginal tax rates.

E) none of the above.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

38

Government policies to improve GDP growth

A) focused mainly on capital formation until recently.

B) are welfare improving provided they are aimed at correcting market failures.

C) include spending on education and incentives to research and development.

D) all of the above.

E) a and c.

A) focused mainly on capital formation until recently.

B) are welfare improving provided they are aimed at correcting market failures.

C) include spending on education and incentives to research and development.

D) all of the above.

E) a and c.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

39

Endogenous growth theory allows for which of the following to make a contribution to technological improvement?

A) Assembly line production

B) Increased worker skills

C) Increased capital stock

D) Research and development

E) all of the above

A) Assembly line production

B) Increased worker skills

C) Increased capital stock

D) Research and development

E) all of the above

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

40

Newly developed technology is essentially another form of

A) a public good.

B) nuisance to competing firms.

C) a good with important spillover effects.

D) a and c.

E) c and d.

A) a public good.

B) nuisance to competing firms.

C) a good with important spillover effects.

D) a and c.

E) c and d.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

41

Each of the following is used to examine the sources of improved productivity growth except

A) capital deepening.

B) growth in the labor force.

C) labor quality.

D) total factor productivity.

E) technological change.

A) capital deepening.

B) growth in the labor force.

C) labor quality.

D) total factor productivity.

E) technological change.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

42

The neoclassical growth revival economists argue all of the following except

A) growth rates were fairly steady through the 1920s.

B) growth rates decreased during the Great Depression.

C) growth rates continued their pre-Depression path following World War II.

D) growth rates increased slightly since the beginning of the 1960s.

E) growth rates have remained fairly steady since World War II.

A) growth rates were fairly steady through the 1920s.

B) growth rates decreased during the Great Depression.

C) growth rates continued their pre-Depression path following World War II.

D) growth rates increased slightly since the beginning of the 1960s.

E) growth rates have remained fairly steady since World War II.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

43

The decline in the rate of growth of labor productivity that the United States suffered in the 1970s has been blamed at least partially on

A) the oil price shocks of 1973 and 1979.

B) a reduction in the level of expenditure by business on research and development.

C) a reduction in expenditure by business on fixed, nonresidential investment.

D) the increased expense involved in complying with environmental regulations.

E) a and d.

A) the oil price shocks of 1973 and 1979.

B) a reduction in the level of expenditure by business on research and development.

C) a reduction in expenditure by business on fixed, nonresidential investment.

D) the increased expense involved in complying with environmental regulations.

E) a and d.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

44

The productivity of American workers

A) rose during the 1960s at a rate almost twice that of the 1980s.

B) continued to grow in spite of the oil price shocks of the 1970s.

C) exceeded the 1960s rate of increase since the mid-1990s.

D) all of the above.

E) none of the above, it has remained relatively constant during the past four decades.

A) rose during the 1960s at a rate almost twice that of the 1980s.

B) continued to grow in spite of the oil price shocks of the 1970s.

C) exceeded the 1960s rate of increase since the mid-1990s.

D) all of the above.

E) none of the above, it has remained relatively constant during the past four decades.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

45

The Kennedy round of investment tax credits generated annual increases in the capital stock that peaked in

A) 1966 at 2 percent.

B) 1968 at 5 percent.

C) 1966 at 7 percent.

D) 1963 at 7 percent.

E) 1964 at 5 percent.

A) 1966 at 2 percent.

B) 1968 at 5 percent.

C) 1966 at 7 percent.

D) 1963 at 7 percent.

E) 1964 at 5 percent.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

46

The real wage paid to American labor has

A) been moving steadily higher over the past 20 years despite two energy price shocks in the 1970s.

B) held remarkably steady over the past 20 years, with the 1982 level almost identical to the 1973 level.

C) suffered two energy-related periods of decline over the past 20 years but now is higher than it was in 1973.

D) remained below 1973 levels since the first oil shock in 1973.

E) none of the above.

A) been moving steadily higher over the past 20 years despite two energy price shocks in the 1970s.

B) held remarkably steady over the past 20 years, with the 1982 level almost identical to the 1973 level.

C) suffered two energy-related periods of decline over the past 20 years but now is higher than it was in 1973.

D) remained below 1973 levels since the first oil shock in 1973.

E) none of the above.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

47

Labor productivity in the United States

A) generally increases from one year to the next, but the rate of that increase fell drastically in the 1970s.

B) held stable over the past 50 years and so has maintained labor's share of GDP, at roughly 75 percent.

C) generally falls from one year to the next but particularly when outside shocks create high rates of inflation.

D) has been the source of increasingly inflationary wage settlements since the 1973 oil shock.

E) none of the above.

A) generally increases from one year to the next, but the rate of that increase fell drastically in the 1970s.

B) held stable over the past 50 years and so has maintained labor's share of GDP, at roughly 75 percent.

C) generally falls from one year to the next but particularly when outside shocks create high rates of inflation.

D) has been the source of increasingly inflationary wage settlements since the 1973 oil shock.

E) none of the above.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

48

The real wages earned by American workers

A) has increased steadily ever since 1960.

B) rose during the 1960s and 1970s but remained constant ever since.

C) rose to a peak coinciding with the formation of OPEC in the early 1970s but now has declined to its mid-1960s level.

D) held relatively stable during the years of oil price shocks but now is almost twice what it was at the beginning of the 1960s.

E) remained constant for the past four decades.

A) has increased steadily ever since 1960.

B) rose during the 1960s and 1970s but remained constant ever since.

C) rose to a peak coinciding with the formation of OPEC in the early 1970s but now has declined to its mid-1960s level.

D) held relatively stable during the years of oil price shocks but now is almost twice what it was at the beginning of the 1960s.

E) remained constant for the past four decades.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

49

Of the factors that increase long-run GDP growth, the one that improves welfare the most is

A) growth in labor force participation.

B) growth in average hours worked.

C) growth in the capital stock.

D) growth in productivity.

E) a and b.

A) growth in labor force participation.

B) growth in average hours worked.

C) growth in the capital stock.

D) growth in productivity.

E) a and b.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

50

The largest source of post-1995 productivity derives from

A) information technology capital.

B) labor force contributions.

C) capital contributions other than information technology.

D) total factor productivity.

E) capital deepening.

A) information technology capital.

B) labor force contributions.

C) capital contributions other than information technology.

D) total factor productivity.

E) capital deepening.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck