Deck 15: Auditing the Expenditure Cycle

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

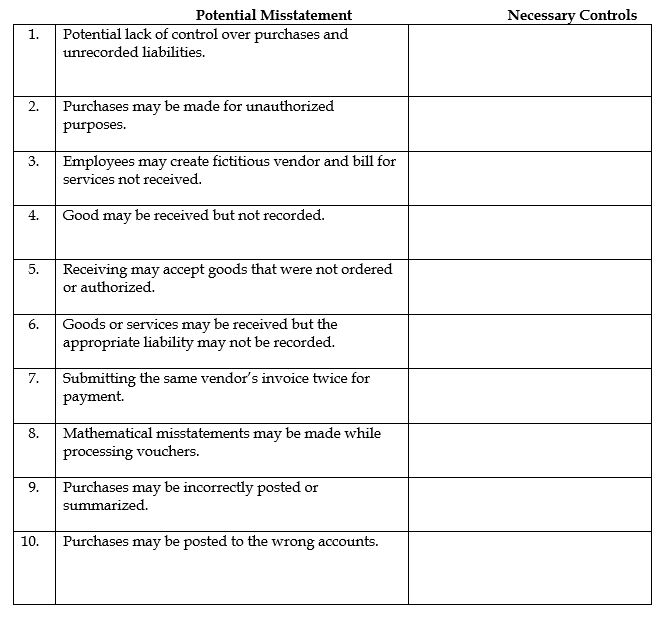

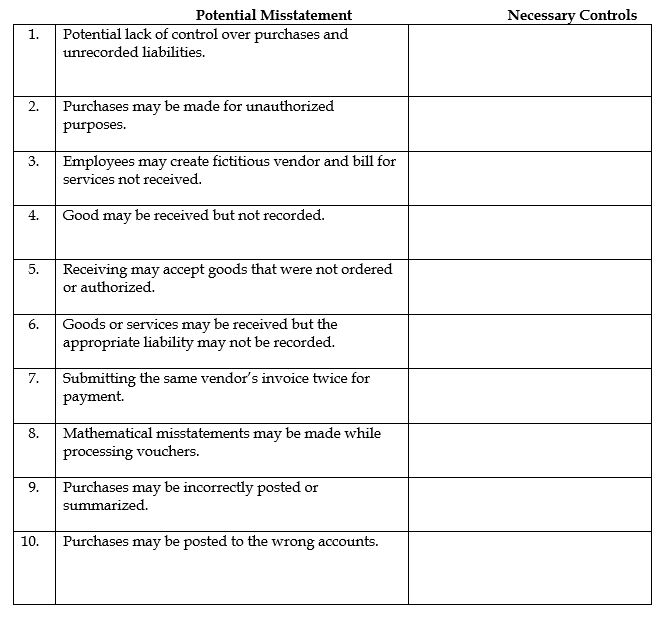

Question

Question

Question

Question

Question

Question

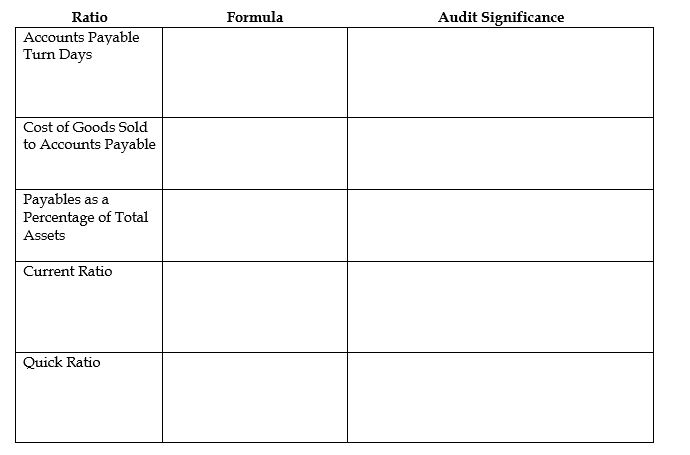

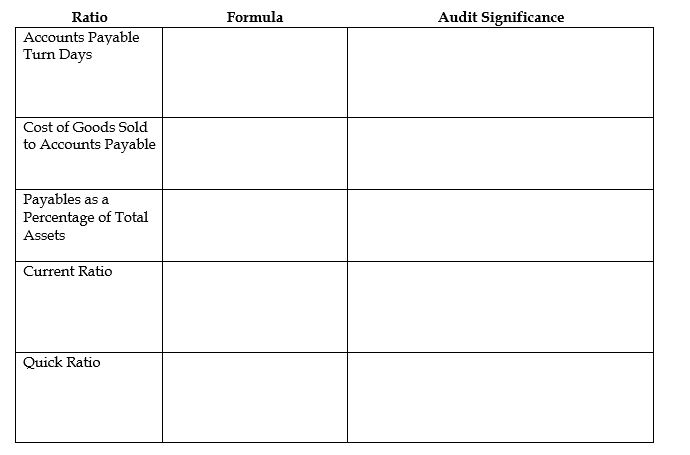

Question

Question

Question

Question

Question

Question

Question

Question

Question

Match between columns

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/79

Play

Full screen (f)

Deck 15: Auditing the Expenditure Cycle

1

Suspense files are hard copy files that hold transactions that have not been processed because they have been rejected by computer application controls.

False

2

The expenditure cycle includes payroll transactions.

False

3

Because many purchasing agents are involved in their preparation, purchase orders are

rarely prenumbered.

rarely prenumbered.

False

4

Upon receipt of an invoice from a vendor, it is common for personnel in the accounts receivable department to enter the transaction data via terminals.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

5

All purchase cycle disclosures that should have been included in the financial statements have been included is a balance objective.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

6

Vendors tardy in sending invoices resulting in cutoff problems in recording payables lead to overstatement of expenditures and payables.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

7

The expenditure cycle is especially prone to a risk of employee fraud through unauthorized disbursement of cash.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

8

A valid purchase requisition represents the authorization for the receiving department to accept goods delivered by vendors.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

9

A purchasing function is usually responsible for determining that unpaid vouchers are processed for payment on their due dates.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

10

Department managers should regularly be asked to review the transactions that have been charged to their accounts.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

11

Purchase orders should be prenumbered.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

12

Monitoring activities about which the auditor should obtain knowledge include feedback from suppliers concerning future delivery problems.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

13

To reduce the risk of theft or alternations, the department controlling the production of checks should control the mailing of the checks.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

14

The net operating cycle represents the time from using cash to purchase goods or services to collecting cash from the sale of goods or services.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

15

The accounts payable turn days is the mean number of days it takes to retire payables.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

16

The accounts payable department is usually responsible for ensuring that purchases are accurately recorded.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

17

Unlike accounts receivable, in accounts payable it is not necessary to segregate transaction duties.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

18

A copy of the receiving report should be forwarded to accounts payable.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

19

A control to overcome submitting an invoice twice for payment requires that a voucher cannot be issued without original supporting documents.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

20

The cash disbursement function usually involves simultaneously accruing the liability and recording the cash disbursement.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

21

Examining subsequent payments consists of examining the documentation for checks issued or vouchers paid before the balance sheet date.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

22

Goods shipped FOB shipping point should remain in the inventory of the seller and be excluded from the buyer's inventory and accounts payable until arrival at the buyer's receiving department.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

23

Disbursement checks generally include a stub, similar to a payroll check stub, which identifies the vendor invoice number and the invoice(s) being paid.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

24

The specific audit objective that all purchase transactions and cash disbursements are valued using GAAP and correctly journalized, summarized, and posted relates to:

A) rights and obligations.

B) completeness.

C) existence or occurrence.

D) presentation and disclosure.

E) valuation or allocation.

A) rights and obligations.

B) completeness.

C) existence or occurrence.

D) presentation and disclosure.

E) valuation or allocation.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

25

The expenditure cycle would include:

A) the purchase of another entity's stocks.

B) the purchase of treasury stock.

C) payroll transactions.

D) payments by check.

E) the purchase of another entity's bonds.

A) the purchase of another entity's stocks.

B) the purchase of treasury stock.

C) payroll transactions.

D) payments by check.

E) the purchase of another entity's bonds.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

26

The specific audit objective that recorded purchases represent goods, services, and productive assets received during the period relates to:

A) rights and obligations.

B) completeness.

C) existence or occurrence.

D) presentation and disclosure.

E) valuation or allocation.

A) rights and obligations.

B) completeness.

C) existence or occurrence.

D) presentation and disclosure.

E) valuation or allocation.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

27

The specific audit objective that the entity is liable for the payables resulting from the recorded purchase transactions relates to:

A) rights and obligations.

B) completeness.

C) existence or occurrence.

D) presentation and disclosure.

E) valuation or allocation.

A) rights and obligations.

B) completeness.

C) existence or occurrence.

D) presentation and disclosure.

E) valuation or allocation.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

28

Vendors usually provide monthly statements that are available in client files.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

29

Documentation supporting payables recorded but remaining unpaid through the end of fieldwork should also be examined on a test basis.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

30

When auditors complete an audit they are usually very knowledgeable about the client's business and business practices.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

31

Evidence for the cash disbursement cutoff test may be obtained by personal observation and review of external documentation.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

32

An abnormal decrease in the accounts payable turnover ratio or unexpected increases in the current ratio may provide indicators of overstated liabilities.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

33

Accounts payable is normally the largest current liability in a balance sheet.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

34

There are three major substantive tests of details of accounts payable transactions.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

35

Like the confirmation of accounts receivable, confirmation of accounts payable is required.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

36

Accounts payable confirmations do not normally specify the amount due.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

37

The search for unrecorded accounts payable relates to the completeness assertion for accounts payable.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

38

The specific audit objective that all purchases and cash disbursements made during the period were recorded relates to:

A) rights and obligations.

B) completeness.

C) existence or occurrence.

D) presentation and disclosure.

E) valuation or allocation.

A) rights and obligations.

B) completeness.

C) existence or occurrence.

D) presentation and disclosure.

E) valuation or allocation.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

39

The primary account balance in the expenditure cycle is accounts payable.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

40

An auditor might use a generalized audit software to perform sequence checks and print a list of purchase orders whose numbers are missing in a designated computer file.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

41

Which one of the following financial ratios has a numerator and denominator whose amounts should change by approximately the percentage from year to year?

A) quick ratio.

B) current ratio.

C) accounts payable turn days.

D) payables as a percentage of total assets.

E) cost of goods sold to accounts payable

A) quick ratio.

B) current ratio.

C) accounts payable turn days.

D) payables as a percentage of total assets.

E) cost of goods sold to accounts payable

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

42

The processing of purchases transactions involves all of the following purchases functions except:

A) preparing purchase invoices.

B) requisitioning goods and services.

C) receiving the goods.

D) preparing the payment voucher.

E) recording the liability.

A) preparing purchase invoices.

B) requisitioning goods and services.

C) receiving the goods.

D) preparing the payment voucher.

E) recording the liability.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

43

The computer file that contains data for approved vouchers for purchases that have been received is the:

A) open purchase order file.

B) approved vendor master file.

C) suspense file.

D) accounts payable master file.

E) purchase transactions file.

A) open purchase order file.

B) approved vendor master file.

C) suspense file.

D) accounts payable master file.

E) purchase transactions file.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

44

The auditor is concerned that individuals in the purchasing department are initiating purchases on their own to companies in which they have a vested interest. The document the auditor would be most interested in reviewing under these circumstances would be the:

A) purchase order.

B) receiving report.

C) voucher.

D) purchase requisition.

E) bill of lading.

A) purchase order.

B) receiving report.

C) voucher.

D) purchase requisition.

E) bill of lading.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

45

The employee most likely to be involved in a "kickback" scheme is the:

A) purchasing agent.

B) accounts payable clerk.

C) authorized check signer.

D) petty cash custodian.

E) accounts receivable clerk.

A) purchasing agent.

B) accounts payable clerk.

C) authorized check signer.

D) petty cash custodian.

E) accounts receivable clerk.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

46

Accounts payable turnover is a substantive test for:

A) initial procedures.

B) analytical procedures.

C) test of details of transactions.

D) tests of details of balances.

E) presentation and disclosure.

A) initial procedures.

B) analytical procedures.

C) test of details of transactions.

D) tests of details of balances.

E) presentation and disclosure.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

47

Controls over the recording of a liability and the specific audit objectives to which they can relate, include all of the following except:

A) computer prepares a report of all goods received that have resulted in a voucher.

B) computer agreement of the details of the voucher with the vendors' invoices and the related receiving reports and purchase orders.

C) computer comparison of the receiving report date with the accounting period when the voucher is recorded.

D) computer check of the mathematical accuracy of each voucher and supporting vendors' invoices.

E) the supporting documents should be stamped, perforated, or otherwise canceled to prevent resubmission for duplicate payment.

A) computer prepares a report of all goods received that have resulted in a voucher.

B) computer agreement of the details of the voucher with the vendors' invoices and the related receiving reports and purchase orders.

C) computer comparison of the receiving report date with the accounting period when the voucher is recorded.

D) computer check of the mathematical accuracy of each voucher and supporting vendors' invoices.

E) the supporting documents should be stamped, perforated, or otherwise canceled to prevent resubmission for duplicate payment.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

48

The computer file that holds transactions that have not been processed because they have been rejected by computer application controls is the:

A) open purchase order file.

B) approved vendor master file.

C) suspense file.

D) accounts payable master file.

E) purchase transactions file.

A) open purchase order file.

B) approved vendor master file.

C) suspense file.

D) accounts payable master file.

E) purchase transactions file.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

49

Recent trends in accounts payable include all of the following except:

A) increasing use of electronic invoicing.

B) improving efficiency, timeliness, and processes.

C) decreased use of imaging.

D) installing electronic payments.

E) cleaning up vendor files.

A) increasing use of electronic invoicing.

B) improving efficiency, timeliness, and processes.

C) decreased use of imaging.

D) installing electronic payments.

E) cleaning up vendor files.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

50

The computer file of purchase orders submitted to vendors for which the goods or services have not been received is the:

A) open purchase order file.

B) approved vendor master file.

C) suspense file.

D) accounts payable master file.

E) purchase transactions file.

A) open purchase order file.

B) approved vendor master file.

C) suspense file.

D) accounts payable master file.

E) purchase transactions file.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

51

Management's commitment to competence should be reflected in:

A) hiring assignment.

B) training of personnel.

C) maintaining custody of purchased assets

D) reporting on expenditure cycle activities.

E) all of the above

A) hiring assignment.

B) training of personnel.

C) maintaining custody of purchased assets

D) reporting on expenditure cycle activities.

E) all of the above

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

52

Factors that may contribute to misstatements in the expenditure cycle assertions include all of the following except:

A) there is usually a high volume of transactions.

B) unauthorized purchases and cash disbursements may be made.

C) purchased assets may be appropriated.

D) there may be duplicate payment of vendor's invoices.

E) contentious accounting issues may arise concerning whether a cost should be capitalized or expensed.

A) there is usually a high volume of transactions.

B) unauthorized purchases and cash disbursements may be made.

C) purchased assets may be appropriated.

D) there may be duplicate payment of vendor's invoices.

E) contentious accounting issues may arise concerning whether a cost should be capitalized or expensed.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

53

The computer file that contains pertinent information on vendors and suppliers that have been approved to purchase services from and make payments to is the:

A) open purchase order file.

B) approved vendor master file.

C) suspense file.

D) accounts payable master file.

E) purchase transactions file.

A) open purchase order file.

B) approved vendor master file.

C) suspense file.

D) accounts payable master file.

E) purchase transactions file.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

54

In regard to the valuation or allocation of accounts payable, inherent risk is:

A) high.

B) very high.

C) very low.

D) low.

E) moderate.

A) high.

B) very high.

C) very low.

D) low.

E) moderate.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

55

The computer file that contains data on approved unpaid vouchers is the:

A) open purchase order file.

B) approved vendor master file.

C) suspense file.

D) accounts payable master file.

E) purchase transactions file.

A) open purchase order file.

B) approved vendor master file.

C) suspense file.

D) accounts payable master file.

E) purchase transactions file.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

56

In assessing the risk of material misstatement the vendor who often offers price concessions or terms such that goods do not have to be paid for until the manufactured product is resold is the:

A) manufacturing of construction machinery and equipment.

B) computer manufacturing.

C) retail grocer.

D) hotel.

E) local school district.

A) manufacturing of construction machinery and equipment.

B) computer manufacturing.

C) retail grocer.

D) hotel.

E) local school district.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

57

Cost of Goods Sold divided by Accounts Receivable is the formula for:

A) accounts payable turn days.

B) cost of goods sold to accounts payable.

C) payables as a percentage of total assets.

D) current ratio.

E) quick ratio.

A) accounts payable turn days.

B) cost of goods sold to accounts payable.

C) payables as a percentage of total assets.

D) current ratio.

E) quick ratio.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

58

A trace of the beginning balance for accounts payable to prior year's working papers is a substantive test for:

A) initial procedures.

B) analytical procedures.

C) test of details of transactions.

D) tests of details of balances.

E) presentation and disclosure.

A) initial procedures.

B) analytical procedures.

C) test of details of transactions.

D) tests of details of balances.

E) presentation and disclosure.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

59

Regarding purchase returns and allowances, control activities useful in reducing the risk of misstatements include all of the following except:

A) all purchase returns should be authorized by the vendor.

B) goods should be returned only with a proper purchase return authorization.

C) the computer should match debit memo information with the authorization for purchase return and the shipping documents.

D) the computer generates a report of all authorized purchase returns that have not been shipped or have not resulted in a debit memo.

E) all of the above

A) all purchase returns should be authorized by the vendor.

B) goods should be returned only with a proper purchase return authorization.

C) the computer should match debit memo information with the authorization for purchase return and the shipping documents.

D) the computer generates a report of all authorized purchase returns that have not been shipped or have not resulted in a debit memo.

E) all of the above

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

60

The specific objective accounts payable are legal obligations of the entity at the balance sheet date is derived from the:

A) existence or occurrence.

B) completeness.

C) rights and obligations.

D) presentation and disclosure.

E) valuation or allocation.

A) existence or occurrence.

B) completeness.

C) rights and obligations.

D) presentation and disclosure.

E) valuation or allocation.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

61

Consider the following procedures for the verification of accounts payable:

-A number of open vouchers were accidentally omitted from the list given to the auditor.

_____

A)Verify the accuracy of schedules and agreement with accounts payable balances.

B)Apply analytical procedures.

C)Vouch recorded payables.

D)Confirm accounts payablE.

E)Perform purchases cutoff test.

F)Perform cash disbursements cutoff test.

G)Examine subsequent payments.

H)Search for unrecorded accounts payablE.

I)Compare statement presentation with GAAP.

-A number of open vouchers were accidentally omitted from the list given to the auditor.

_____

A)Verify the accuracy of schedules and agreement with accounts payable balances.

B)Apply analytical procedures.

C)Vouch recorded payables.

D)Confirm accounts payablE.

E)Perform purchases cutoff test.

F)Perform cash disbursements cutoff test.

G)Examine subsequent payments.

H)Search for unrecorded accounts payablE.

I)Compare statement presentation with GAAP.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

62

Consider the following procedures for the verification of accounts payable:

A:Verify the accuracy of schedules and agreement with accounts payable balances.

B:Apply analytical procedures.

C:Vouch recorded payables.

D:Confirm accounts payablE.

E:Perform purchases cutoff test.

F:Perform cash disbursements cutoff test.

G:Examine subsequent payments.

H:Search for unrecorded accounts payablE.I:

Compare statement presentation with GAAP.

Required: For each of the following independent exceptions, indicate the most likely and efficient audit procedure that would have detected the error. Use a letter from above to indicate your choicE.REQUIRED: For each of the following independent exceptions, indicate the most likely and effic

_____

Utility bills are never accrued. Instead, they are simply recorded and paid

immediately upon receipt the first week of the next period.

_____

A:Verify the accuracy of schedules and agreement with accounts payable balances.

B:Apply analytical procedures.

C:Vouch recorded payables.

D:Confirm accounts payablE.

E:Perform purchases cutoff test.

F:Perform cash disbursements cutoff test.

G:Examine subsequent payments.

H:Search for unrecorded accounts payablE.I:

Compare statement presentation with GAAP.

Required: For each of the following independent exceptions, indicate the most likely and efficient audit procedure that would have detected the error. Use a letter from above to indicate your choicE.REQUIRED: For each of the following independent exceptions, indicate the most likely and effic

_____

Utility bills are never accrued. Instead, they are simply recorded and paid

immediately upon receipt the first week of the next period.

_____

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

63

In the confirmation of accounts payable, which of the following accounts would be least likely to be selected by the auditor for confirmation?

A) an account with high activity during the year, but a low balance at year end.

B) an account with a vendor who sends a monthly statement.

C) an account with a zero balance.

D) a major vendor used in the prior year, but not in the current year.

E) an account with a debit balance.

A) an account with high activity during the year, but a low balance at year end.

B) an account with a vendor who sends a monthly statement.

C) an account with a zero balance.

D) a major vendor used in the prior year, but not in the current year.

E) an account with a debit balance.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

64

Consider the following procedures for the verification of accounts payable:

-Construction work is underway on a new wing of the warehouse. The work is about 10% complete. The contract calls for the first progress billing at 25% completion.

_____

A)Verify the accuracy of schedules and agreement with accounts payable balances.

B)Apply analytical procedures.

C)Vouch recorded payables.

D)Confirm accounts payablE.

E)Perform purchases cutoff test.

F)Perform cash disbursements cutoff test.

G)Examine subsequent payments.

H)Search for unrecorded accounts payablE.

I)Compare statement presentation with GAAP.

-Construction work is underway on a new wing of the warehouse. The work is about 10% complete. The contract calls for the first progress billing at 25% completion.

_____

A)Verify the accuracy of schedules and agreement with accounts payable balances.

B)Apply analytical procedures.

C)Vouch recorded payables.

D)Confirm accounts payablE.

E)Perform purchases cutoff test.

F)Perform cash disbursements cutoff test.

G)Examine subsequent payments.

H)Search for unrecorded accounts payablE.

I)Compare statement presentation with GAAP.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

65

For each of the following potential expenditure cycle misstatements below, indicate the necessary control, which would most likely prevent or detect the misstatement.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

66

Consider the following procedures for the verification of accounts payable:

-Invoices on disputed orders are routinely held in a "pending" file in vouchers payable until the dispute is resolved.

_____

A)Verify the accuracy of schedules and agreement with accounts payable balances.

B)Apply analytical procedures.

C)Vouch recorded payables.

D)Confirm accounts payablE.

E)Perform purchases cutoff test.

F)Perform cash disbursements cutoff test.

G)Examine subsequent payments.

H)Search for unrecorded accounts payablE.

I)Compare statement presentation with GAAP.

-Invoices on disputed orders are routinely held in a "pending" file in vouchers payable until the dispute is resolved.

_____

A)Verify the accuracy of schedules and agreement with accounts payable balances.

B)Apply analytical procedures.

C)Vouch recorded payables.

D)Confirm accounts payablE.

E)Perform purchases cutoff test.

F)Perform cash disbursements cutoff test.

G)Examine subsequent payments.

H)Search for unrecorded accounts payablE.

I)Compare statement presentation with GAAP.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

67

Discuss the confirmation of accounts payable in terms of:

1.requirements under GAAS;

2.accounts selected for confirmation; and

3.the difference in the form for accounts payable versus accounts receivable confirmations.

1.requirements under GAAS;

2.accounts selected for confirmation; and

3.the difference in the form for accounts payable versus accounts receivable confirmations.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

68

Consider the following procedures for the verification of accounts payable:

-The client has conspired to prevent the auditor from confirming or otherwise testing vendor accounts that are materially understated at year.

_____

A)Verify the accuracy of schedules and agreement with accounts payable balances.

B)Apply analytical procedures.

C)Vouch recorded payables.

D)Confirm accounts payablE.

E)Perform purchases cutoff test.

F)Perform cash disbursements cutoff test.

G)Examine subsequent payments.

H)Search for unrecorded accounts payablE.

I)Compare statement presentation with GAAP.

-The client has conspired to prevent the auditor from confirming or otherwise testing vendor accounts that are materially understated at year.

_____

A)Verify the accuracy of schedules and agreement with accounts payable balances.

B)Apply analytical procedures.

C)Vouch recorded payables.

D)Confirm accounts payablE.

E)Perform purchases cutoff test.

F)Perform cash disbursements cutoff test.

G)Examine subsequent payments.

H)Search for unrecorded accounts payablE.

I)Compare statement presentation with GAAP.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

69

Consider the following procedures for the verification of accounts payable:

A:Verify the accuracy of schedules and agreement with accounts payable balances.

B:Apply analytical procedures.

C:Vouch recorded payables.

D:Confirm accounts payablE.

E:Perform purchases cutoff test.

F:Perform cash disbursements cutoff test.

G:Examine subsequent payments.

H:Search for unrecorded accounts payablE.I:

Compare statement presentation with GAAP.

Required: For each of the following independent exceptions, indicate the most likely and efficient audit procedure that would have detected the error. Use a letter from above to indicate your choicE.REQUIRED: For each of the following independent exceptions, indicate the most likely and effic

_____

Purchases are often recorded for goods that are never received.

A:Verify the accuracy of schedules and agreement with accounts payable balances.

B:Apply analytical procedures.

C:Vouch recorded payables.

D:Confirm accounts payablE.

E:Perform purchases cutoff test.

F:Perform cash disbursements cutoff test.

G:Examine subsequent payments.

H:Search for unrecorded accounts payablE.I:

Compare statement presentation with GAAP.

Required: For each of the following independent exceptions, indicate the most likely and efficient audit procedure that would have detected the error. Use a letter from above to indicate your choicE.REQUIRED: For each of the following independent exceptions, indicate the most likely and effic

_____

Purchases are often recorded for goods that are never received.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

70

Consider the following procedures for the verification of accounts payable:

A:Verify the accuracy of schedules and agreement with accounts payable balances.

B:Apply analytical procedures.

C:Vouch recorded payables.

D:Confirm accounts payablE.

E:Perform purchases cutoff test.

F:Perform cash disbursements cutoff test.

G:Examine subsequent payments.

H:Search for unrecorded accounts payablE.I:

Compare statement presentation with GAAP.

Required: For each of the following independent exceptions, indicate the most likely and efficient audit procedure that would have detected the error. Use a letter from above to indicate your choicE.REQUIRED: For each of the following independent exceptions, indicate the most likely and effic

_____

Numerous debit balances exist in vendor accounts from multiple payments on

invoices.

_____

A:Verify the accuracy of schedules and agreement with accounts payable balances.

B:Apply analytical procedures.

C:Vouch recorded payables.

D:Confirm accounts payablE.

E:Perform purchases cutoff test.

F:Perform cash disbursements cutoff test.

G:Examine subsequent payments.

H:Search for unrecorded accounts payablE.I:

Compare statement presentation with GAAP.

Required: For each of the following independent exceptions, indicate the most likely and efficient audit procedure that would have detected the error. Use a letter from above to indicate your choicE.REQUIRED: For each of the following independent exceptions, indicate the most likely and effic

_____

Numerous debit balances exist in vendor accounts from multiple payments on

invoices.

_____

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

71

For each one of the following financial ratios, indicate the formula and identify the audit significance.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

72

Consider the following procedures for the verification of accounts payable:

-A number of checks were written and recorded on the last day of the year, but were not mailed until several days later.

_____

A)Verify the accuracy of schedules and agreement with accounts payable balances.

B)Apply analytical procedures.

C)Vouch recorded payables.

D)Confirm accounts payablE.

E)Perform purchases cutoff test.

F)Perform cash disbursements cutoff test.

G)Examine subsequent payments.

H)Search for unrecorded accounts payablE.

I)Compare statement presentation with GAAP.

-A number of checks were written and recorded on the last day of the year, but were not mailed until several days later.

_____

A)Verify the accuracy of schedules and agreement with accounts payable balances.

B)Apply analytical procedures.

C)Vouch recorded payables.

D)Confirm accounts payablE.

E)Perform purchases cutoff test.

F)Perform cash disbursements cutoff test.

G)Examine subsequent payments.

H)Search for unrecorded accounts payablE.

I)Compare statement presentation with GAAP.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

73

Central Meat Inc. buys and processes livestock for sales to supermarkets. In connection with your examination of the company's financial statements, you accumulate the following information about purchases and cash disbursements transactions in the expenditure cycle.

1.Each livestock buyer submits a daily report of purchases to the plant superintendent. This report shows the dates of purchase and expected delivery, the vendor and the number, weights, and type of livestock purchased. As shipments are received, any available plant employee counts the number of each type received and places a check mark beside this quantity on the buyer's report. When all shipments listed on the report have been received, the report is returned to the buyer.

2.Vendor's invoices, after a clerical check, are sent to the buyer for approval and returned to the accounting department. A disbursement voucher and a check for the approved amount are prepared in the accounting department. Checks are forwarded to the treasurer for signing. The treasurer's office sends signed checks directly to the buyer for delivery to the vendor.

REQUIRED: For each of the numbered notes identify three specific weaknesses. Give your recommended improvement for each weakness. Use a tabular format for your answer with columns for weaknesses and recommended improvements.

1.Each livestock buyer submits a daily report of purchases to the plant superintendent. This report shows the dates of purchase and expected delivery, the vendor and the number, weights, and type of livestock purchased. As shipments are received, any available plant employee counts the number of each type received and places a check mark beside this quantity on the buyer's report. When all shipments listed on the report have been received, the report is returned to the buyer.

2.Vendor's invoices, after a clerical check, are sent to the buyer for approval and returned to the accounting department. A disbursement voucher and a check for the approved amount are prepared in the accounting department. Checks are forwarded to the treasurer for signing. The treasurer's office sends signed checks directly to the buyer for delivery to the vendor.

REQUIRED: For each of the numbered notes identify three specific weaknesses. Give your recommended improvement for each weakness. Use a tabular format for your answer with columns for weaknesses and recommended improvements.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

74

Consider the following procedures for the verification of accounts payable:

-Goods in transit shipped FOB-shipping point were not recorded as purchases in the current period.

_____

A)Verify the accuracy of schedules and agreement with accounts payable balances.

B)Apply analytical procedures.

C)Vouch recorded payables.

D)Confirm accounts payablE.

E)Perform purchases cutoff test.

F)Perform cash disbursements cutoff test.

G)Examine subsequent payments.

H)Search for unrecorded accounts payablE.

I)Compare statement presentation with GAAP.

-Goods in transit shipped FOB-shipping point were not recorded as purchases in the current period.

_____

A)Verify the accuracy of schedules and agreement with accounts payable balances.

B)Apply analytical procedures.

C)Vouch recorded payables.

D)Confirm accounts payablE.

E)Perform purchases cutoff test.

F)Perform cash disbursements cutoff test.

G)Examine subsequent payments.

H)Search for unrecorded accounts payablE.

I)Compare statement presentation with GAAP.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

75

In understanding the client's business and industry, briefly describe the expenditure cycle characteristics of a (1) large retail grocer and (2) public school district.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

76

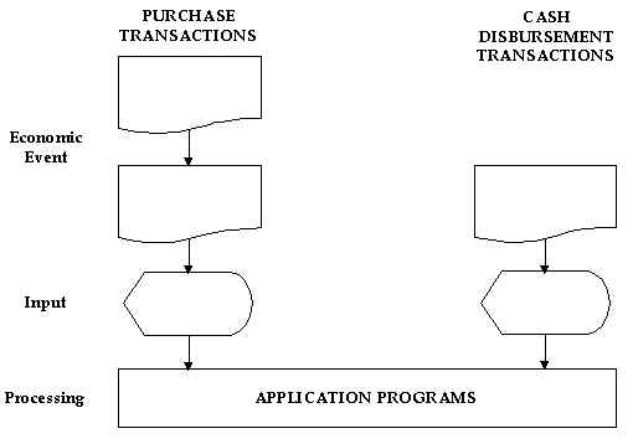

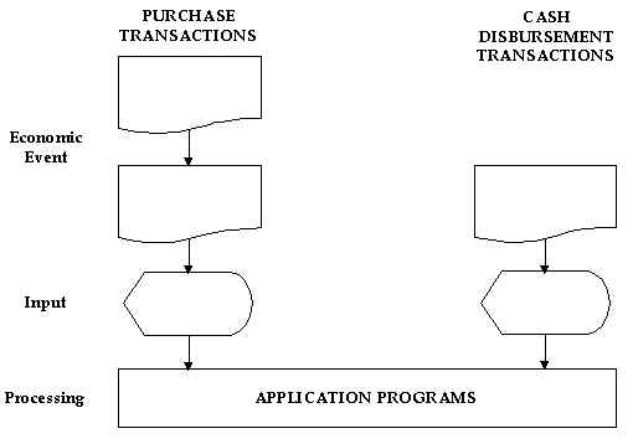

Shown below is a partial flowchart of the overview of a computerized system for purchases transactions and cash disbursements in the expenditure cycle.

REQUIRED: Label the symbols in the partial flowchart.

REQUIRED: Label the symbols in the partial flowchart.

REQUIRED: Label the symbols in the partial flowchart.

REQUIRED: Label the symbols in the partial flowchart.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

77

Consider the following procedures for the verification of accounts payable:

-Goods are sometimes ordered by purchasing agents on their own initiative to fill secret agreements with certain vendors.

_____

A)Verify the accuracy of schedules and agreement with accounts payable balances.

B)Apply analytical procedures.

C)Vouch recorded payables.

D)Confirm accounts payablE.

E)Perform purchases cutoff test.

F)Perform cash disbursements cutoff test.

G)Examine subsequent payments.

H)Search for unrecorded accounts payablE.

I)Compare statement presentation with GAAP.

-Goods are sometimes ordered by purchasing agents on their own initiative to fill secret agreements with certain vendors.

_____

A)Verify the accuracy of schedules and agreement with accounts payable balances.

B)Apply analytical procedures.

C)Vouch recorded payables.

D)Confirm accounts payablE.

E)Perform purchases cutoff test.

F)Perform cash disbursements cutoff test.

G)Examine subsequent payments.

H)Search for unrecorded accounts payablE.

I)Compare statement presentation with GAAP.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

78

Consider the following procedures for the verification of accounts payable:

-Liquidity problems in the current year have caused the client to miss a large number of cash discounts. Further, many invoices were not paid until they became "past due."

_____

A)Verify the accuracy of schedules and agreement with accounts payable balances.

B)Apply analytical procedures.

C)Vouch recorded payables.

D)Confirm accounts payablE.

E)Perform purchases cutoff test.

F)Perform cash disbursements cutoff test.

G)Examine subsequent payments.

H)Search for unrecorded accounts payablE.

I)Compare statement presentation with GAAP.

-Liquidity problems in the current year have caused the client to miss a large number of cash discounts. Further, many invoices were not paid until they became "past due."

_____

A)Verify the accuracy of schedules and agreement with accounts payable balances.

B)Apply analytical procedures.

C)Vouch recorded payables.

D)Confirm accounts payablE.

E)Perform purchases cutoff test.

F)Perform cash disbursements cutoff test.

G)Examine subsequent payments.

H)Search for unrecorded accounts payablE.

I)Compare statement presentation with GAAP.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

80

Match between columns

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck