Deck 7: Long-Term Debt-Paying Ability

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/48

Play

Full screen (f)

Deck 7: Long-Term Debt-Paying Ability

1

Included in the Employee Retirement Income Security Act are the following:

A) provisions requiring minimum funding of pension plans

B) minimum rights to employees upon termination of their employment

C) creation of the Pension Benefit Guaranty Corporation

D) provisions requiring minimum funding of pension plans and minimum rights to employees upon termination of their employment

E) provisions requiring minimum funding of pension plans, minimum rights to employees upon termination of their employment, and creation of the Pension Benefit Guaranty Corporation

A) provisions requiring minimum funding of pension plans

B) minimum rights to employees upon termination of their employment

C) creation of the Pension Benefit Guaranty Corporation

D) provisions requiring minimum funding of pension plans and minimum rights to employees upon termination of their employment

E) provisions requiring minimum funding of pension plans, minimum rights to employees upon termination of their employment, and creation of the Pension Benefit Guaranty Corporation

E

2

If a firm has substantial capital or financing leases disclosed in the notes but not capitalized in the financial statements, then:

A) the times interest earned ratio will be overstated, based upon the financial statements

B) the fixed charge ratio will be overstated, based upon the financial statements

C) the debt ratio will be understated

D) the working capital will be understated

E) none of the answers are correct

A) the times interest earned ratio will be overstated, based upon the financial statements

B) the fixed charge ratio will be overstated, based upon the financial statements

C) the debt ratio will be understated

D) the working capital will be understated

E) none of the answers are correct

C

3

In computing debt to tangible net worth, which of the following is not subtracted in the denominator?

A) Copyrights

B) Goodwill

C) Patents

D) Investments

E) Trademarks

A) Copyrights

B) Goodwill

C) Patents

D) Investments

E) Trademarks

D

4

What significant improvement in the financial reporting of pensions have pension accounting rules provided?

A) determination of the expense for the income statement

B) limited balance sheet recognition of pension liabilities

C) improved disclosure

D) determination of the expense for the income statement and limited balance sheet recognition of pension liabilities

E) determination of the expense for the income statement, limited balance sheet recognition of pension liabilities, and improved disclosure

A) determination of the expense for the income statement

B) limited balance sheet recognition of pension liabilities

C) improved disclosure

D) determination of the expense for the income statement and limited balance sheet recognition of pension liabilities

E) determination of the expense for the income statement, limited balance sheet recognition of pension liabilities, and improved disclosure

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

5

A fixed charge coverage:

A) is a balance sheet indication of debt carrying ability

B) is an income statement indication of debt carrying ability

C) is a liquidity ratio

D) frequently includes research and development

E) computation is standard from firm to firm

A) is a balance sheet indication of debt carrying ability

B) is an income statement indication of debt carrying ability

C) is a liquidity ratio

D) frequently includes research and development

E) computation is standard from firm to firm

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following will not cause times interest earned to drop? Assume no other changes than those listed.

A) An increase in bonds payable with no change in operating income.

B) An increase in interest rates.

C) A rise in preferred stock dividends.

D) A rise in cost of goods sold with no change in interest expense.

E) A drop in sales with no change in interest expense.

A) An increase in bonds payable with no change in operating income.

B) An increase in interest rates.

C) A rise in preferred stock dividends.

D) A rise in cost of goods sold with no change in interest expense.

E) A drop in sales with no change in interest expense.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

7

Under the Employee Retirement Income Security Act, a company can be liable for its pension plan up to:

A) 30 percent of its total assets

B) 30 percent of its net worth

C) 40 percent of its total assets

D) 40 percent of its net worth

E) 50 percent of its total assets

A) 30 percent of its total assets

B) 30 percent of its net worth

C) 40 percent of its total assets

D) 40 percent of its net worth

E) 50 percent of its total assets

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

8

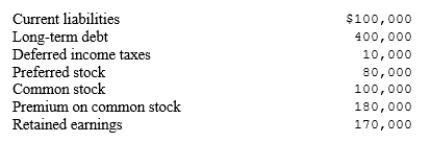

The following financial statement data are taken from Xeron Company's 2010 annual report:  Compute the debt to tangible net worth ratio.

Compute the debt to tangible net worth ratio.

A) 146.8%

B) 135.6%

C) 53.0%

D) 45.7%

E) none of the answers are correct

Compute the debt to tangible net worth ratio.

Compute the debt to tangible net worth ratio.A) 146.8%

B) 135.6%

C) 53.0%

D) 45.7%

E) none of the answers are correct

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements is not correct?

A) A ratio that indicates a firm's long-term, debt-paying ability from the income statement view is the times interest earned.

B) Some of the items on the income statement that are excluded in order to compute times interest earned are interest expense, income taxes, and unusual or infrequent items.

C) Capitalized interest should be included with interest expense when computing times interest earned.

D) Usually, the highest times interest coverage in the most recent five-year period is used as the primary indication of the interest coverage.

E) In the short run, a firm can often meet its interest obligations, even when the times interest earned is less than 1.00.

A) A ratio that indicates a firm's long-term, debt-paying ability from the income statement view is the times interest earned.

B) Some of the items on the income statement that are excluded in order to compute times interest earned are interest expense, income taxes, and unusual or infrequent items.

C) Capitalized interest should be included with interest expense when computing times interest earned.

D) Usually, the highest times interest coverage in the most recent five-year period is used as the primary indication of the interest coverage.

E) In the short run, a firm can often meet its interest obligations, even when the times interest earned is less than 1.00.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

10

A times interest earned ratio indicates that:

A) preferred stock has no maturity date

B) the debt will never become due

C) the firm will be able to repay the principal when due

D) the principal can be refinanced

E) none of the answers are correct

A) preferred stock has no maturity date

B) the debt will never become due

C) the firm will be able to repay the principal when due

D) the principal can be refinanced

E) none of the answers are correct

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

11

The following financial statement data are taken from Xeron Company's 2010 annual report:  Compute the debt ratio.

Compute the debt ratio.

A) 196.9%

B) 113.0%

C) 53.0%

D) 45.7%

E) none of the answers are correct

Compute the debt ratio.

Compute the debt ratio.A) 196.9%

B) 113.0%

C) 53.0%

D) 45.7%

E) none of the answers are correct

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

12

Which of these items represents a definite commitment to pay out funds in the future?

A) bonds payable

B) reserves for rebuilding furnaces

C) deferred taxes

D) minority shareholders' interests

E) redeemable preferred stock

A) bonds payable

B) reserves for rebuilding furnaces

C) deferred taxes

D) minority shareholders' interests

E) redeemable preferred stock

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

13

Jones Company has long-term debt of $1,000,000, while Smith Company, Jones' competitor, has long-term debt of $200,000.Which of the following statements best represents an analysis of the long-term debt position of these two firms?

A) Smith Company's times interest earned should be lower than Jones.

B) Jones obviously has too much debt when compared to its competitor.

C) Jones should sell more stock and use less debt.

D) Smith has five times better long-term borrowing ability than Jones.

E) Not enough information to determine if any of the answers are correct.

A) Smith Company's times interest earned should be lower than Jones.

B) Jones obviously has too much debt when compared to its competitor.

C) Jones should sell more stock and use less debt.

D) Smith has five times better long-term borrowing ability than Jones.

E) Not enough information to determine if any of the answers are correct.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

14

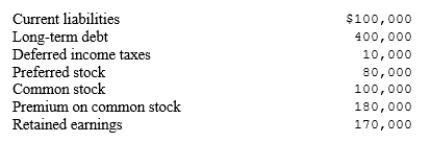

Joseph and John, Inc., had the following balance sheet results for 2010:  Compute the debt-equity ratio.

Compute the debt-equity ratio.

A) 112.1%

B) 87.6%

C) 67.6%

D) 46.7%

E) none of the answers are correct

Compute the debt-equity ratio.

Compute the debt-equity ratio.A) 112.1%

B) 87.6%

C) 67.6%

D) 46.7%

E) none of the answers are correct

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

15

There are a number of assumptions about future events that must be made regarding a defined benefit plan.An assumption that does not need to be made is:

A) interest rates

B) employee turnover

C) mortality rates

D) compensation

E) how long the firm will continue

A) interest rates

B) employee turnover

C) mortality rates

D) compensation

E) how long the firm will continue

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

16

The debt ratio indicates:

A) the ability of the firm to pay its current obligations

B) the efficiency of the use of total assets

C) the magnification of earnings caused by leverage

D) a comparison of liabilities with total assets

E) none of the answers are correct

A) the ability of the firm to pay its current obligations

B) the efficiency of the use of total assets

C) the magnification of earnings caused by leverage

D) a comparison of liabilities with total assets

E) none of the answers are correct

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

17

Ingram Dog Kennels had the following financial statistics for 2010:  What is the times interest earned for 2010?

What is the times interest earned for 2010?

A) 11.4 times

B) 3.3 times

C) 3.1 times

D) 3.7 times

E) none of the answers are correct

What is the times interest earned for 2010?

What is the times interest earned for 2010?A) 11.4 times

B) 3.3 times

C) 3.1 times

D) 3.7 times

E) none of the answers are correct

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

18

Jordan Manufacturing reports the following capital structure:  What is the debt ratio?

What is the debt ratio?

A) 0.48

B) 0.49

C) 0.93

D) 0.96

E) none of the answers are correct

What is the debt ratio?

What is the debt ratio?A) 0.48

B) 0.49

C) 0.93

D) 0.96

E) none of the answers are correct

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following statements best compares long-term borrowing capacity ratios?

A) The debt/equity ratio is more conservative than the debt ratio.

B) The debt ratio is more conservative than the debt/equity ratio.

C) The debt/equity ratio is more conservative than the debt to tangible net worth ratio.

D) The debt to tangible net worth ratio is more conservative than the debt/equity ratio.

E) The debt ratio is more conservative than the debt to tangible net worth ratio.

A) The debt/equity ratio is more conservative than the debt ratio.

B) The debt ratio is more conservative than the debt/equity ratio.

C) The debt/equity ratio is more conservative than the debt to tangible net worth ratio.

D) The debt to tangible net worth ratio is more conservative than the debt/equity ratio.

E) The debt ratio is more conservative than the debt to tangible net worth ratio.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

20

A times interest earned ratio of 0.90 to 1 means:

A) that the firm will default on its interest payment

B) that net income is less than the interest expense

C) that the cash flow is less than the net income

D) that the cash flow exceeds the net income

E) none of the answers are correct

A) that the firm will default on its interest payment

B) that net income is less than the interest expense

C) that the cash flow is less than the net income

D) that the cash flow exceeds the net income

E) none of the answers are correct

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

21

Minority shareholders' interest in earnings of subsidiaries are included in earnings for the times interest earned coverage.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

22

A number of assumptions about future events must be made regarding a defined benefit plan.Which of the following does not represent one of the assumptions?

A) interest rates

B) termination date for the firm

C) employee turnover

D) mortality rates

E) compensation

A) interest rates

B) termination date for the firm

C) employee turnover

D) mortality rates

E) compensation

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

23

A defined benefit plan shifts the risk to the employee as to whether the pension funds will grow to provide for a reasonable pension payment upon retirement.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

24

In general, the profitability of a firm is not considered to be important in determining the short-term, debt-paying ability of the firm.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

25

If an employee is in the pension plan, rights under this plan will be lost if the employee leaves the firm prior to receiving a vested interest.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

26

When analyzing a firm's long-term, debt-paying ability, we only want to determine the firm's ability to pay the principal.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

27

A joint venture can add significant potential liabilities to the parent company that are not on the face of the balance sheet.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

28

A potential significant liability is possible if the company withdraws from a multi-employer pension plan.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

29

Capitalized interest should not be considered as part of interest in the times interest earned computation.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

30

A good times interest earned record would be indicated by a relatively high, stable coverage for the times interest earned coverage.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

31

When a firm is expensing an item faster on the tax return than on the financial statements, a deferred tax liability is the result.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

32

Equity earnings are excluded from earnings for the times interest earned coverage.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

33

To get a better indication of a firm's ability to cover interest payments in the long run, the noncash charges for depreciation, depletion, and amortization can be added back to the times interest earned ratio.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following statements is not true relating to a capitalized (capital) lease?

A) A capital lease is handled as if the lessee bought the asset.

B) The leased asset is in the fixed assets and the related obligation is included in liabilities.

C) On the balance sheet, the capitalized asset amount will not usually agree with the capitalized liability amount because the liability is reduced by payments, and the asset is reduced by depreciation taken.

D) Usually, a company depreciates capitalized leases faster than payments are made.

E) On the balance sheet, the capitalized asset amount will usually be higher than the capitalized liability amount.

A) A capital lease is handled as if the lessee bought the asset.

B) The leased asset is in the fixed assets and the related obligation is included in liabilities.

C) On the balance sheet, the capitalized asset amount will not usually agree with the capitalized liability amount because the liability is reduced by payments, and the asset is reduced by depreciation taken.

D) Usually, a company depreciates capitalized leases faster than payments are made.

E) On the balance sheet, the capitalized asset amount will usually be higher than the capitalized liability amount.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

35

When a portion of operating lease payments is included in fixed charges, it is an effort to recognize the true total interest that the firm is paying.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

36

Under generally accepted accounting principles, an item must clearly represent a commitment to pay out funds in the future in order to be classified as a liability.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

37

The balance sheet pension liability considers the projected benefit obligation.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

38

As with the debt ratio and the debt/equity ratio, from a long-term, debt-paying ability view, the lower the debt to tangible net worth ratio, the better.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

39

The debt to tangible net worth ratio is a more conservative ratio than the debt ratio.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements is not true relating to a defined contribution pension plan?

A) A defined contribution plan defines the contributions of the company to the pension plan.

B) Once the defined contribution is paid, the company has no further obligation to the pension plan.

C) This type of plan shifts the risk to the employee as to whether the pension plan will grow to provide for a reasonable pension payment upon retirement.

D) There is no problem estimating the company's pension expense.

E) This type of plan presents substantial

A) A defined contribution plan defines the contributions of the company to the pension plan.

B) Once the defined contribution is paid, the company has no further obligation to the pension plan.

C) This type of plan shifts the risk to the employee as to whether the pension plan will grow to provide for a reasonable pension payment upon retirement.

D) There is no problem estimating the company's pension expense.

E) This type of plan presents substantial

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

41

Some companies achieve benefits by hundreds of millions of dollars by a pension termination.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

42

In the short run, a firm can often meet its interest obligations even when the times interest earned is less than 1.00.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

43

Some revenue and expense items never go on the tax return, but do go on the income statement.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

44

The tax expense for the financial statements often agrees with the taxes payable.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

45

Increases of profits by cutting the cost of sales would increase the times interest earned.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

46

Times interest earned indicates a firm's long-term, debt-paying ability from the balance sheet view.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

47

Repayment of a long-term bank loan would decrease the debt ratio.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

48

Capitalization of interest results in interest being added to a fixed asset instead of expensed.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck