Deck 15: Capital-Budgeting Decisions

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/3

Play

Full screen (f)

Deck 15: Capital-Budgeting Decisions

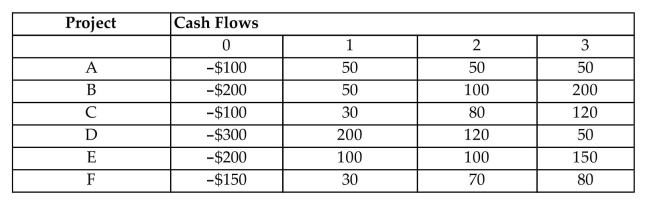

Consider the following investment projects and their interdependencies:  Projects A and B are mutually exclusive.

Projects A and B are mutually exclusive.

Projects C and F are independent projects

Project D is contingent on Project C.

Project E is contingent on project B.

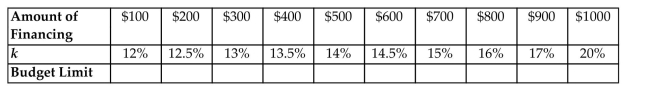

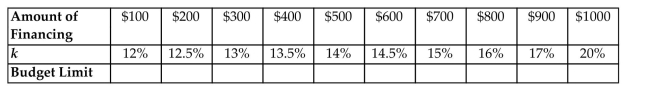

The following indicates the cost of capital as a function of budget: The firm has lending opportunities at 9%.

The firm has lending opportunities at 9%.

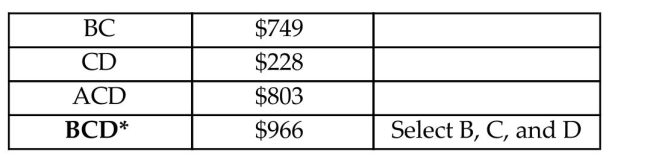

Formulate the entire list of mutually exclusive decision alternatives.

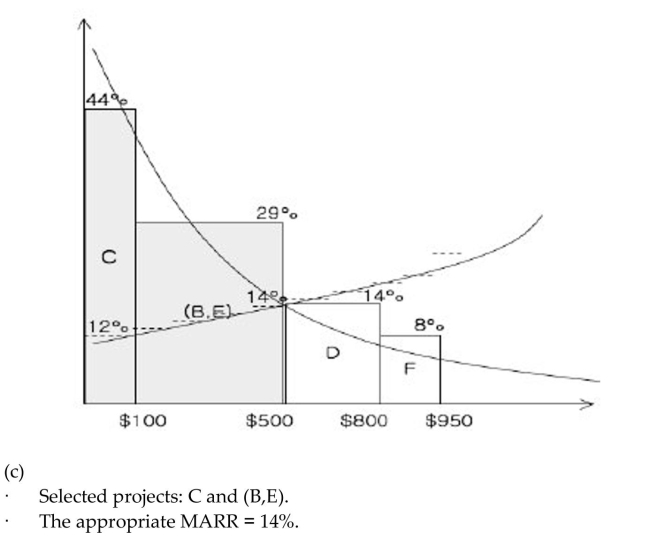

What is the optimal capital budget? Which projects would be funded under the optimal capital budget?

If the firm has a budget limit placed at $600, which projects would be funded? What is the appropriate MARR?

Projects A and B are mutually exclusive.

Projects A and B are mutually exclusive.Projects C and F are independent projects

Project D is contingent on Project C.

Project E is contingent on project B.

The following indicates the cost of capital as a function of budget:

The firm has lending opportunities at 9%.

The firm has lending opportunities at 9%.Formulate the entire list of mutually exclusive decision alternatives.

What is the optimal capital budget? Which projects would be funded under the optimal capital budget?

If the firm has a budget limit placed at $600, which projects would be funded? What is the appropriate MARR?

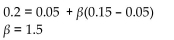

An automobile company is contemplating issuing stock to finance an investment in producing a new

sports-utility vehicle. The annual return to the market portfolio is expected to be 15%, and the current risk-free

interest rate is 5%. The company's analysts further believe that the expected return to the project will be 20%

annually. What is the maximum beta value that would induce the auto maker to issue the stock?

sports-utility vehicle. The annual return to the market portfolio is expected to be 15%, and the current risk-free

interest rate is 5%. The company's analysts further believe that the expected return to the project will be 20%

annually. What is the maximum beta value that would induce the auto maker to issue the stock?

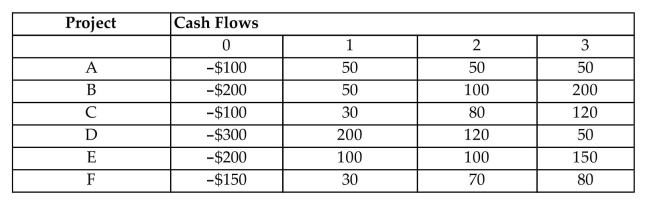

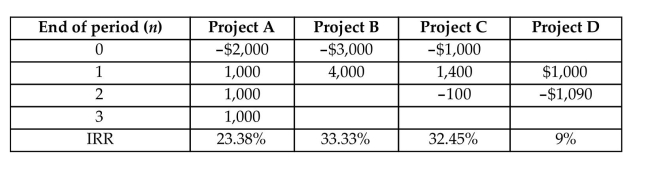

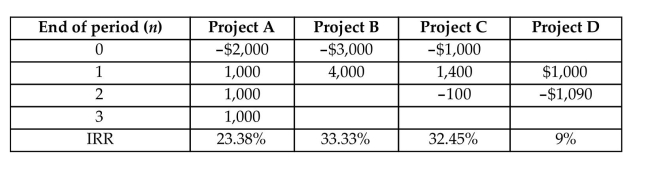

Consider the following four investment projects:  Consider each of the following questions independently:

Consider each of the following questions independently:

a) Suppose that the firm has only $3,500 available at period 0. Neither additional budgets nor borrowing are

allowed in any future budget period. However, you can lend out any left funds (or available funds) at 10%

interest per period. If you want to maximize the amount of cash available at period 3, which project(s) would

you select? What is the total amount of cash available at the end of period 3? No partial projects are allowed.

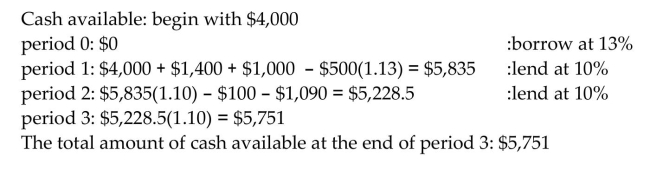

b) Suppose in (a) that, at period 0, you are allowed to borrow $500 at an interest rate of 13%. The loan has to be

repaid at the end of year 1. Which project(s) would you select to maximize the total amount of cash available at

period 3?

Consider each of the following questions independently:

Consider each of the following questions independently:a) Suppose that the firm has only $3,500 available at period 0. Neither additional budgets nor borrowing are

allowed in any future budget period. However, you can lend out any left funds (or available funds) at 10%

interest per period. If you want to maximize the amount of cash available at period 3, which project(s) would

you select? What is the total amount of cash available at the end of period 3? No partial projects are allowed.

b) Suppose in (a) that, at period 0, you are allowed to borrow $500 at an interest rate of 13%. The loan has to be

repaid at the end of year 1. Which project(s) would you select to maximize the total amount of cash available at

period 3?