Deck 9: Depreciation and Corporate Taxes

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/7

Play

Full screen (f)

Deck 9: Depreciation and Corporate Taxes

1

Consider the following two companies:

• Gilbert Corporation had a gross income of $500,000 in tax year 1, $150,000 in salaries, $30,000 in wages,

$20,000 in interest, and $60,000 in depreciation expenses for an asset purchased 3 years ago.

• Ajax Corporation has a gross income of $500,000 in tax year 1, and $150,000 in salaries, $90,000 in wages,

and $20,000 in interest expenses.

Apply the current tax rates and determine which of the following statements is correct.

(a) Both corporations will pay the same amount of income taxes in year 1.

(b) Both corporations will have the same amount of net cash flows in year 1.

(c) Ajax Corporation will have a larger net cash flow than Gilbert in year 1.

(d) Gilbert Corporation will have a larger taxable income than Ajax Corporation in year 1.

• Gilbert Corporation had a gross income of $500,000 in tax year 1, $150,000 in salaries, $30,000 in wages,

$20,000 in interest, and $60,000 in depreciation expenses for an asset purchased 3 years ago.

• Ajax Corporation has a gross income of $500,000 in tax year 1, and $150,000 in salaries, $90,000 in wages,

and $20,000 in interest expenses.

Apply the current tax rates and determine which of the following statements is correct.

(a) Both corporations will pay the same amount of income taxes in year 1.

(b) Both corporations will have the same amount of net cash flows in year 1.

(c) Ajax Corporation will have a larger net cash flow than Gilbert in year 1.

(d) Gilbert Corporation will have a larger taxable income than Ajax Corporation in year 1.

(a)

2

Which of the following statements is most correct? (a) Over a project's life, a typical business will generate a greater amount of total project cash flows

(undiscounted) if a faster depreciation method is adopted.

(b) No matter which depreciation method you adopt, total tax obligations over a project's life remain

Unchanged.

(c) Depreciation recapture equals the cost basis minus an asset's book value at the time of disposal, that is, if

The salvage value is less than the asset's cost basis.

(d) Cash flows must include depreciation expenses since they represent a cost of doing business.

(undiscounted) if a faster depreciation method is adopted.

(b) No matter which depreciation method you adopt, total tax obligations over a project's life remain

Unchanged.

(c) Depreciation recapture equals the cost basis minus an asset's book value at the time of disposal, that is, if

The salvage value is less than the asset's cost basis.

(d) Cash flows must include depreciation expenses since they represent a cost of doing business.

B

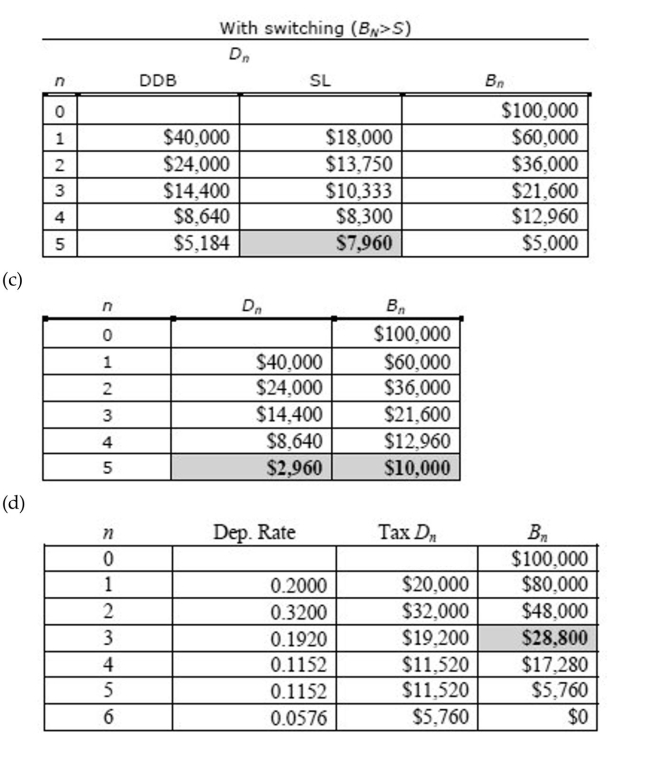

3

An asset with a first cost of $100,000 is depreciated over 5-year period. It is expected to have a $5,000 salvage

value at the end of 5 years.

(a) Using the straight-line method, what is the book value at the end of year 2?

(b) With the double declining balance (200% DB) schedule, what is the depreciation charge for year 5?

(c) In (b) above, suppose the estimated salvage value at the end of year 5 is $10,000, instead of $5,000. If the

200% DB method is used, what is the allowed depreciation charge for year 5?

(d) In (c) above, assume that the asset is classified as a 5-year MACRS property for tax depreciation purpose.

What is the book value of the asset at the end of year 3?

value at the end of 5 years.

(a) Using the straight-line method, what is the book value at the end of year 2?

(b) With the double declining balance (200% DB) schedule, what is the depreciation charge for year 5?

(c) In (b) above, suppose the estimated salvage value at the end of year 5 is $10,000, instead of $5,000. If the

200% DB method is used, what is the allowed depreciation charge for year 5?

(d) In (c) above, assume that the asset is classified as a 5-year MACRS property for tax depreciation purpose.

What is the book value of the asset at the end of year 3?

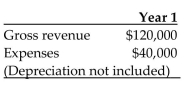

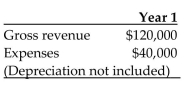

4

A company expects to generate a $300,000 taxable income from its regular business operation in 2010. The

company purchased an industrial fork-lift for $75,000 at the beginning of year 2010. The company expects to

use it for the next 7 years after which it plans to sell it for $10,000. The estimated additional income and

expenses (excluding depreciation) with this purchase of lift-truck for the first year are given below. The fork-lift

will be depreciated according to a 5-year MACRS. (a) Determine the average tax rate applicable in the first year of operation, using the current corporate tax rate

(a) Determine the average tax rate applicable in the first year of operation, using the current corporate tax rate

schedule.

(b) Determine the incremental tax rate that should be applied to the additional taxable income generated from

the purchase of the lift-truck.

company purchased an industrial fork-lift for $75,000 at the beginning of year 2010. The company expects to

use it for the next 7 years after which it plans to sell it for $10,000. The estimated additional income and

expenses (excluding depreciation) with this purchase of lift-truck for the first year are given below. The fork-lift

will be depreciated according to a 5-year MACRS.

(a) Determine the average tax rate applicable in the first year of operation, using the current corporate tax rate

(a) Determine the average tax rate applicable in the first year of operation, using the current corporate tax rateschedule.

(b) Determine the incremental tax rate that should be applied to the additional taxable income generated from

the purchase of the lift-truck.

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck

5

Your accounting records indicate that an asset in use has a book value of $8,640. The asset cost $30,000 when it

was purchased, and it has been depreciated under the 5-year MACRS method. Based on the information

available, determine how many years the asset has been in service.

was purchased, and it has been depreciated under the 5-year MACRS method. Based on the information

available, determine how many years the asset has been in service.

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck

6

You purchased an automated mailing system which cost $50,000 five years ago. At that time, the system was

estimated to have a service life of 5 years with salvage value of $5,000. These estimates are still good. The

property has been depreciated according to a 5-year MACRS property class. Now (five years from purchase)

you are considering selling the system at $10,000.

(a) What book value should you use in determining the taxable gains?

(b) What is the net proceeds from sale, assuming that the tax rate is 35%?

estimated to have a service life of 5 years with salvage value of $5,000. These estimates are still good. The

property has been depreciated according to a 5-year MACRS property class. Now (five years from purchase)

you are considering selling the system at $10,000.

(a) What book value should you use in determining the taxable gains?

(b) What is the net proceeds from sale, assuming that the tax rate is 35%?

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements is most correct?

(a) The reason why the U.S. Congress allows business to use MACRS depreciation as opposed to conventional

methods is to reduce the business tax burden over the project life.

(b) Under the declining balance depreciation system, it is always desirable to switch to straight-line

depreciation.

(c) When determining the cost basis for an asset's depreciation, you must include all the costs that were

incurred to keep the asset in operable condition.

(d) The main reason why a typical firm may use a straight-line depreciation method in reporting an income to

outside investors (as opposed to any other accelerated tax depreciation methods) is to abide by the accounting

principle-that is to report the true cost of doing business.

(a) The reason why the U.S. Congress allows business to use MACRS depreciation as opposed to conventional

methods is to reduce the business tax burden over the project life.

(b) Under the declining balance depreciation system, it is always desirable to switch to straight-line

depreciation.

(c) When determining the cost basis for an asset's depreciation, you must include all the costs that were

incurred to keep the asset in operable condition.

(d) The main reason why a typical firm may use a straight-line depreciation method in reporting an income to

outside investors (as opposed to any other accelerated tax depreciation methods) is to abide by the accounting

principle-that is to report the true cost of doing business.

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck