Deck 5: Present-Worth Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/8

Play

Full screen (f)

Deck 5: Present-Worth Analysis

1

2

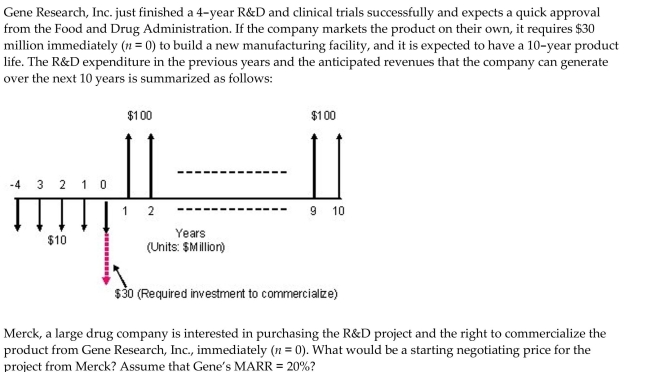

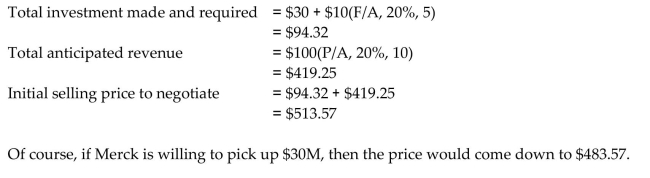

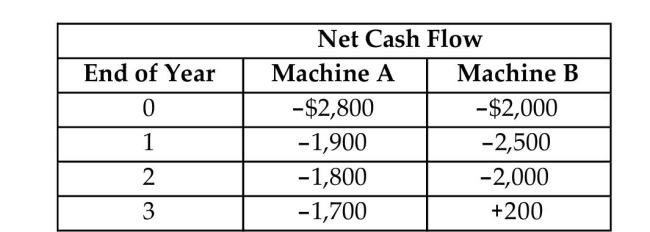

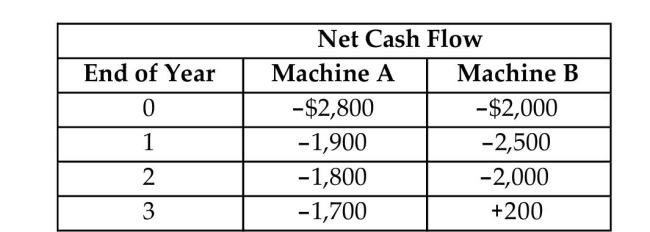

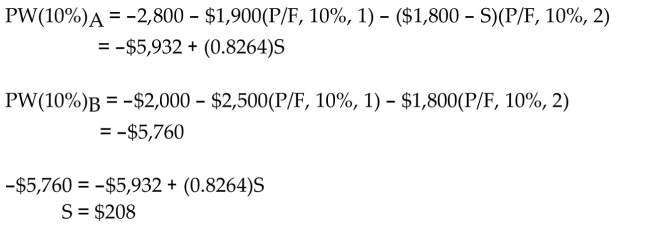

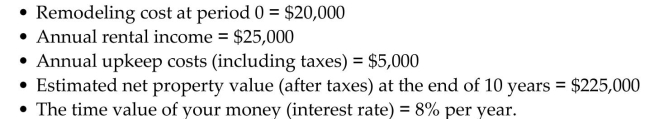

Consider the following two investment alternatives:  Suppose that your firm needs either machine for only 2 years. The net proceeds from the sale of machine B are

Suppose that your firm needs either machine for only 2 years. The net proceeds from the sale of machine B are

estimated to be $200. What should be the required net proceeds from the sale of machine A so that both

machines could be considered economically indifferent at an interest rate of 10%?

Suppose that your firm needs either machine for only 2 years. The net proceeds from the sale of machine B are

Suppose that your firm needs either machine for only 2 years. The net proceeds from the sale of machine B areestimated to be $200. What should be the required net proceeds from the sale of machine A so that both

machines could be considered economically indifferent at an interest rate of 10%?

3

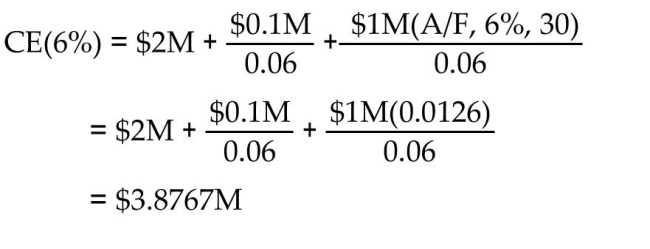

A newly constructed water-treatment facility cost $2 million. It is estimated that the facility will need

revamping to maintain the original design specification every 30 years at a cost of $1 million. Annual repairs

and maintenance costs are estimated to be $100,000. At an interest rate of 6%, determine the capitalized cost of

the facility.

revamping to maintain the original design specification every 30 years at a cost of $1 million. Annual repairs

and maintenance costs are estimated to be $100,000. At an interest rate of 6%, determine the capitalized cost of

the facility.

4

Your R&D group has developed and tested a computer software package that assists engineers to control the

proper chemical mix for the various process manufacturing industries. The total investment in developing the

product was estimated to be $1,500,000. If you decide to market the software, your first year operating net cash

flow is estimated to be $1,000,000. Because of market competition, product life will be about 4 years, and the

product's market share will decrease by 25% each year over the previous year's share. You are approached by a

big software house which wants to purchase the right to manufacture and distribute the product. Assuming that

your interest rate is 15%, for what minimum price would you be willing to sell the software?

proper chemical mix for the various process manufacturing industries. The total investment in developing the

product was estimated to be $1,500,000. If you decide to market the software, your first year operating net cash

flow is estimated to be $1,000,000. Because of market competition, product life will be about 4 years, and the

product's market share will decrease by 25% each year over the previous year's share. You are approached by a

big software house which wants to purchase the right to manufacture and distribute the product. Assuming that

your interest rate is 15%, for what minimum price would you be willing to sell the software?

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

5

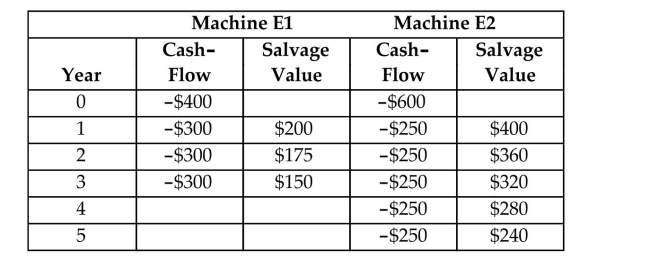

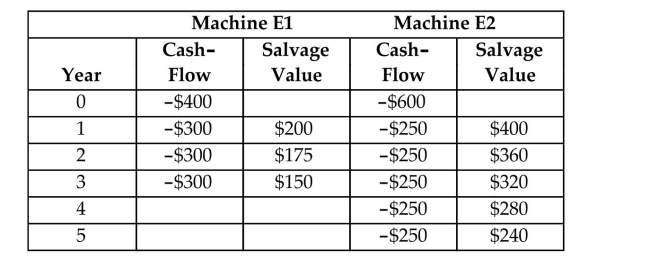

A manufacturing company is considering two mutually exclusive machines E1 and E2 with the following cash

flow information: Which machine would you recommend if the company needs either machine for only 5 years? Assume a MARR

Which machine would you recommend if the company needs either machine for only 5 years? Assume a MARR

of 12% and either machine would be available at the same cost over the next 5 years.

flow information:

Which machine would you recommend if the company needs either machine for only 5 years? Assume a MARR

Which machine would you recommend if the company needs either machine for only 5 years? Assume a MARRof 12% and either machine would be available at the same cost over the next 5 years.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

6

A manufacturing company is considering the purchase of a new CNC lathe, which will cost $60,000 and has an

annual maintenance cost of $8,000. A few parts in the lathe need to be replaced once every 5 years to enable

smooth running of the lathe. This would cost an additional $20,000 (once every 5 years). Assuming that the lathe

would last 15 years under these conditions, what is the total equivalent cost (present value) of this investment at

an interest rate of 12%? (Assume that there will be no appreciable salvage value at the end of 15 years.)

annual maintenance cost of $8,000. A few parts in the lathe need to be replaced once every 5 years to enable

smooth running of the lathe. This would cost an additional $20,000 (once every 5 years). Assuming that the lathe

would last 15 years under these conditions, what is the total equivalent cost (present value) of this investment at

an interest rate of 12%? (Assume that there will be no appreciable salvage value at the end of 15 years.)

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

7

An investment project costs P. It is expected to have an annual net cash flow of 0.125P for 20 years.

(a) What is the project's payback period?

(b) What is the discounted payback period at

(a) What is the project's payback period?

(b) What is the discounted payback period at

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

8

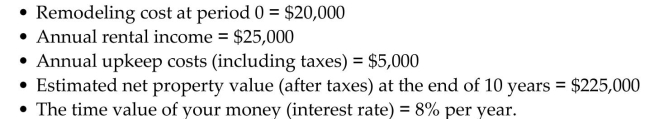

You are considering buying an old house that you will convert into an office building for rental. Assuming that

you will own the property for 10 years, how much (the maximum amount) would you be willing to pay for the

old house now given the following financial data?

you will own the property for 10 years, how much (the maximum amount) would you be willing to pay for the

old house now given the following financial data?

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck